An Electricity Price Forecasting Model by Hybrid Structured Deep Neural Networks

Abstract

:1. Introduction

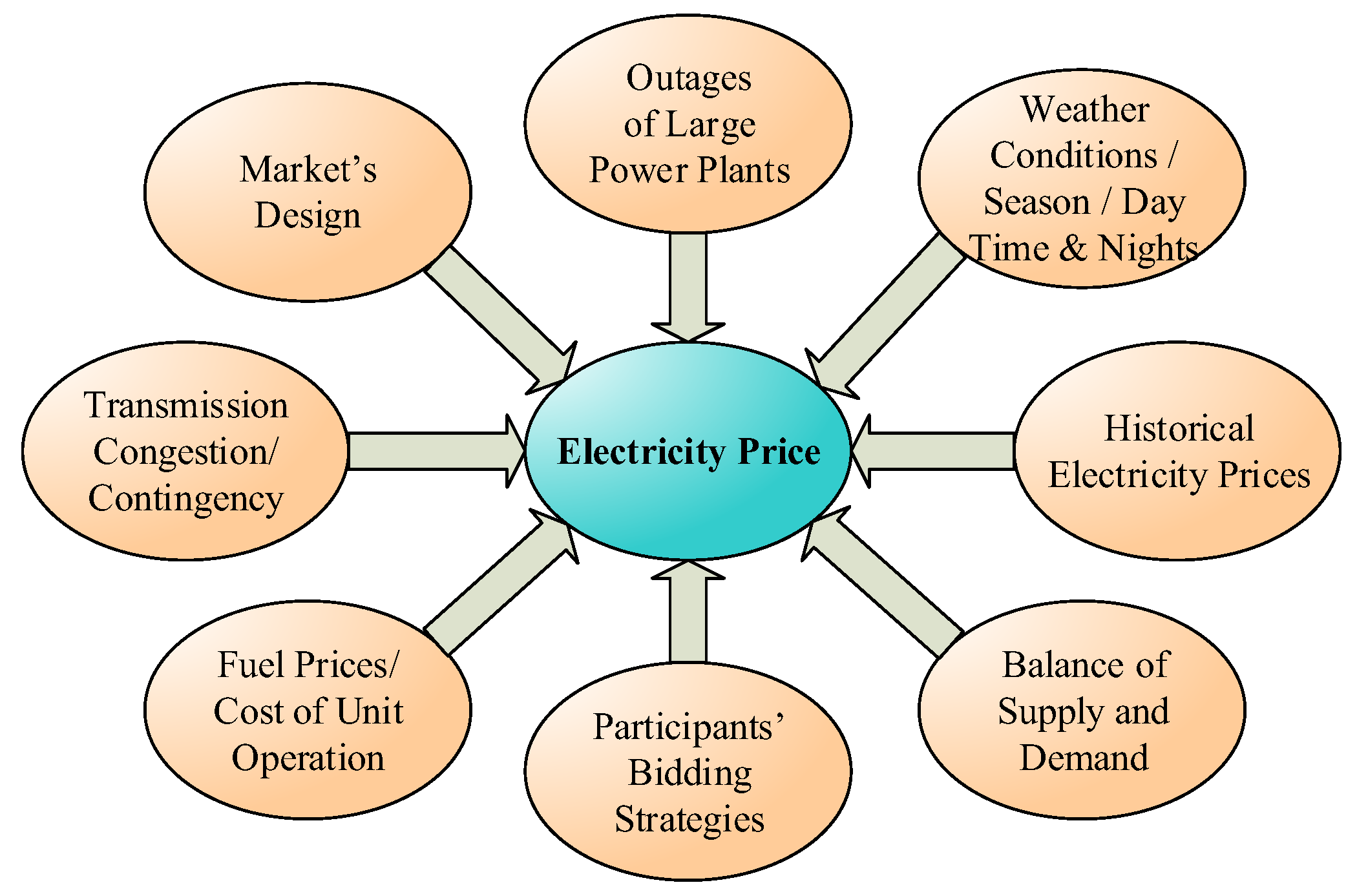

2. Electricity Price Forecasting

3. Artificial Neural Network Model

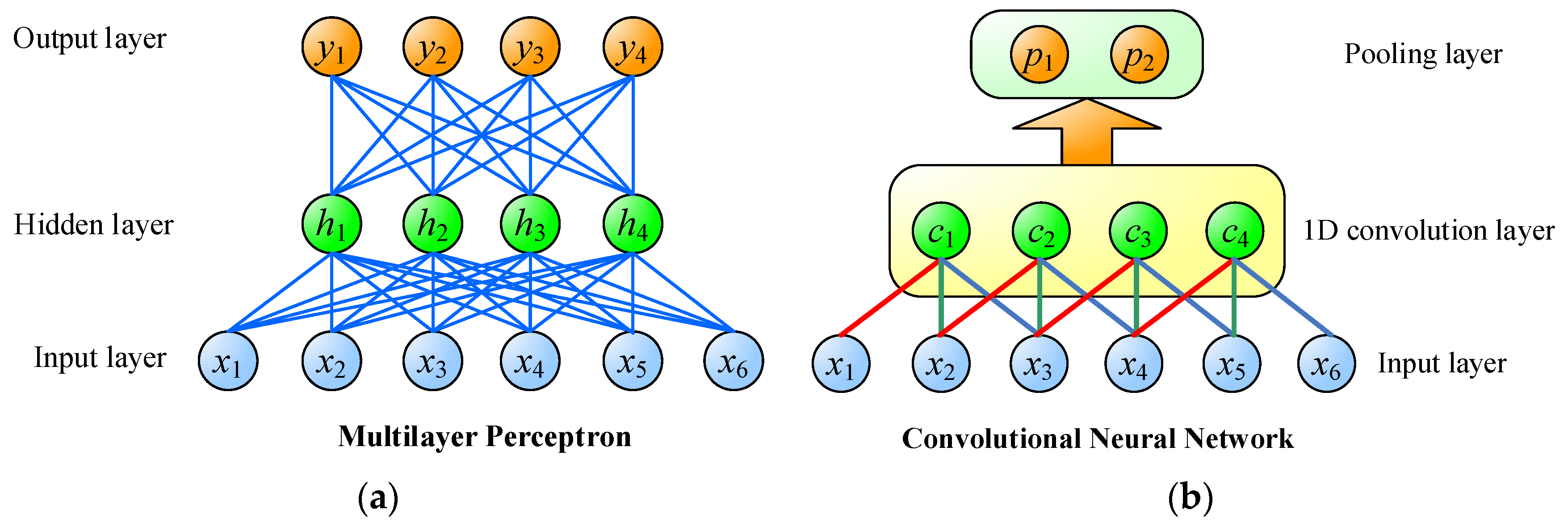

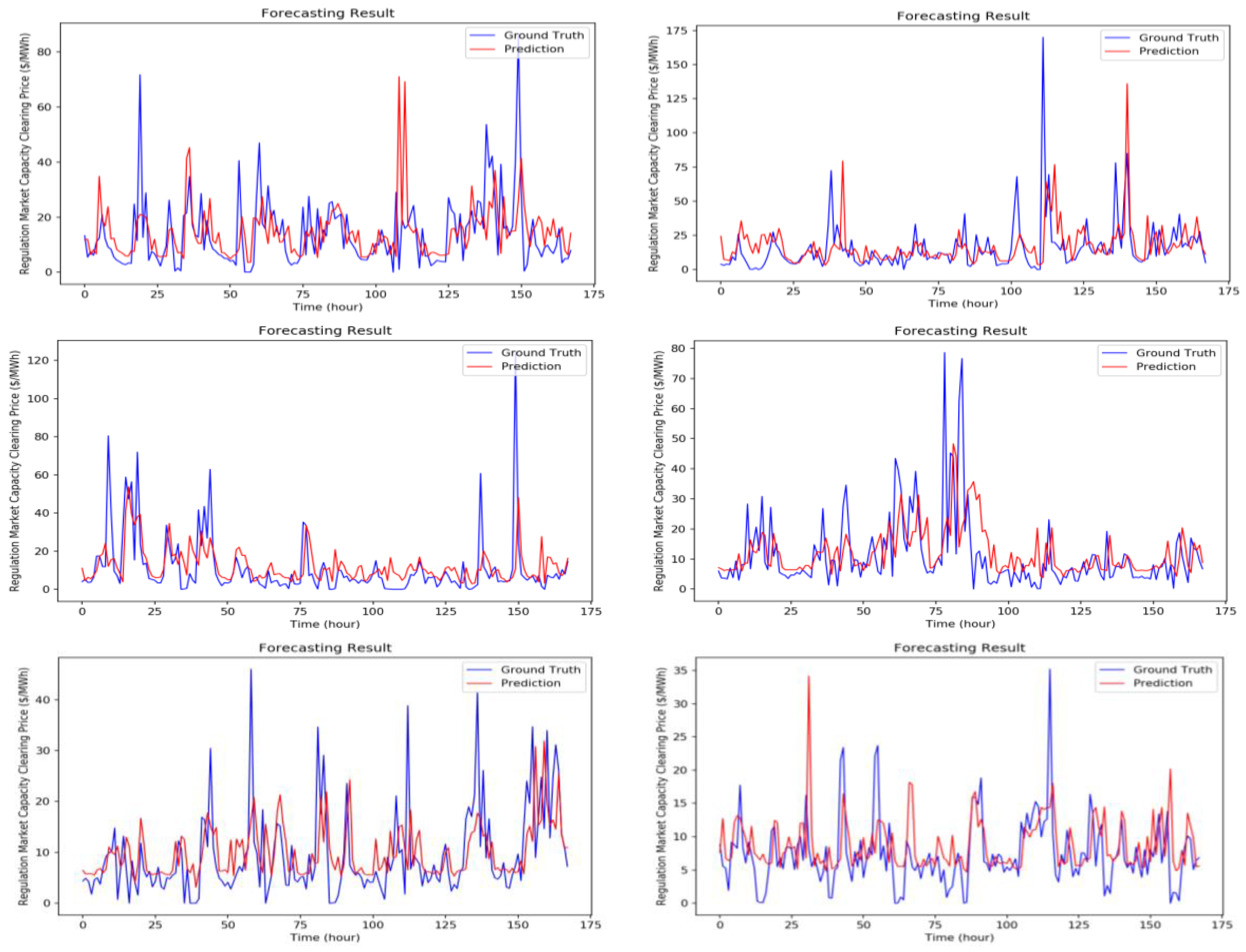

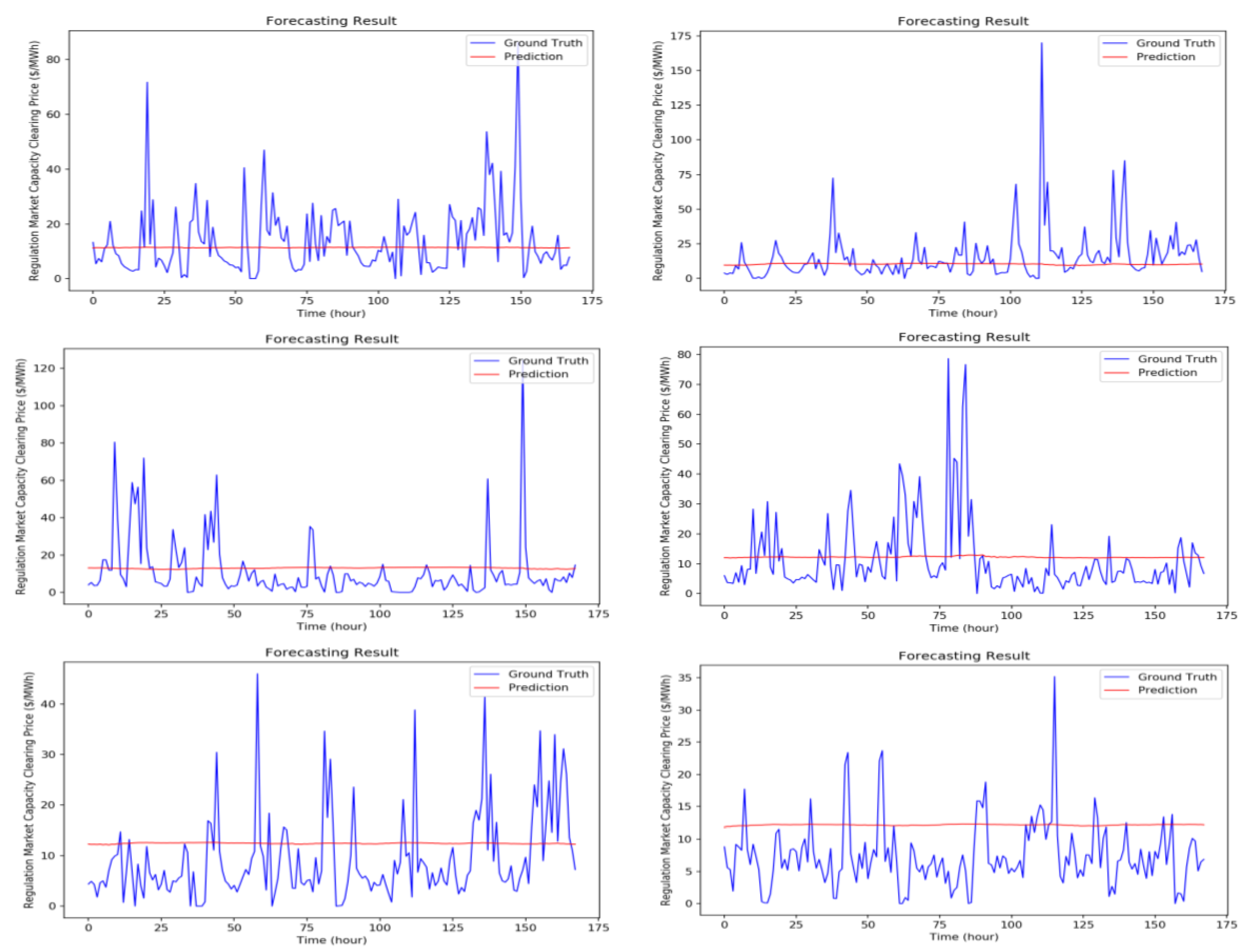

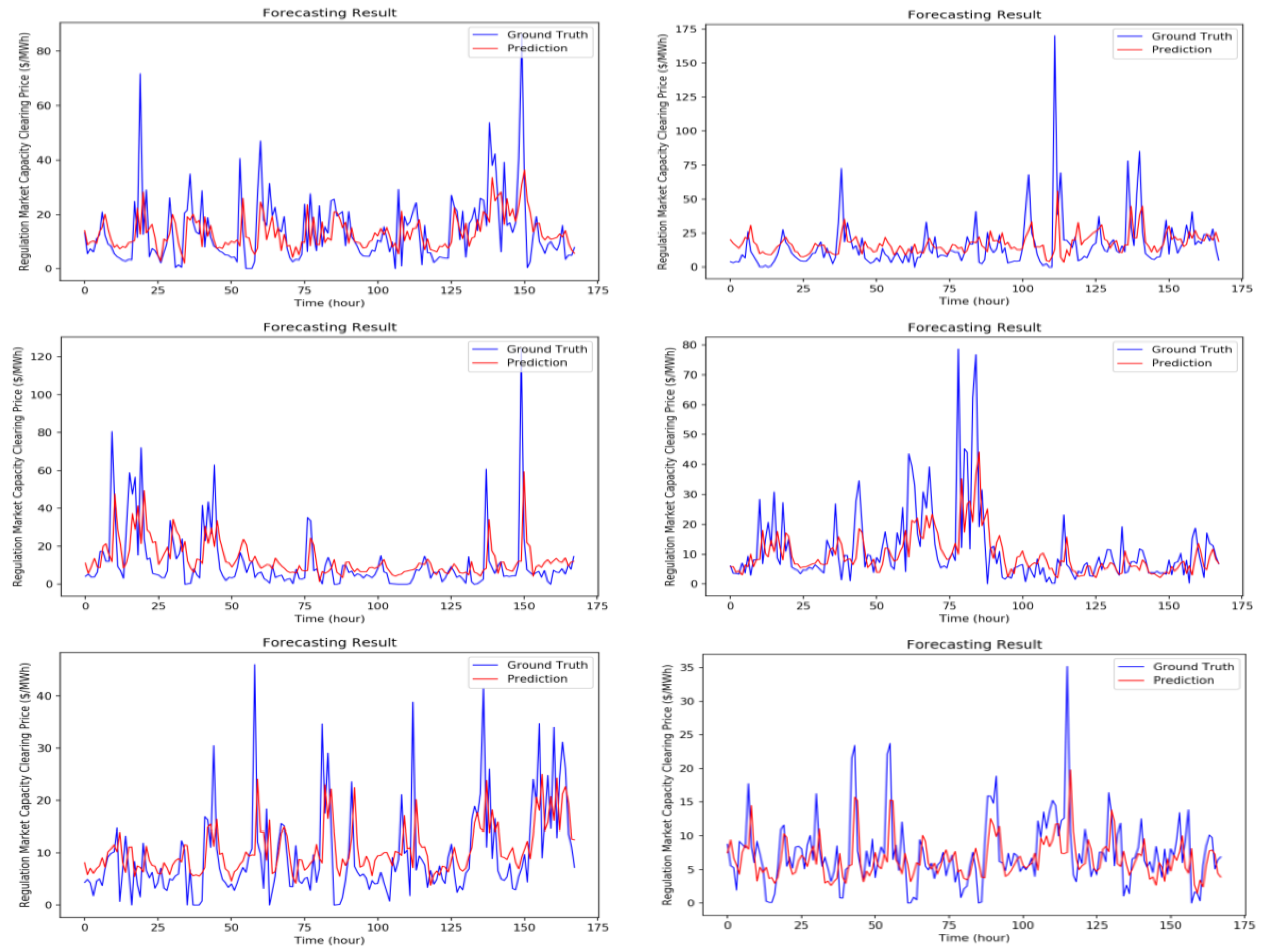

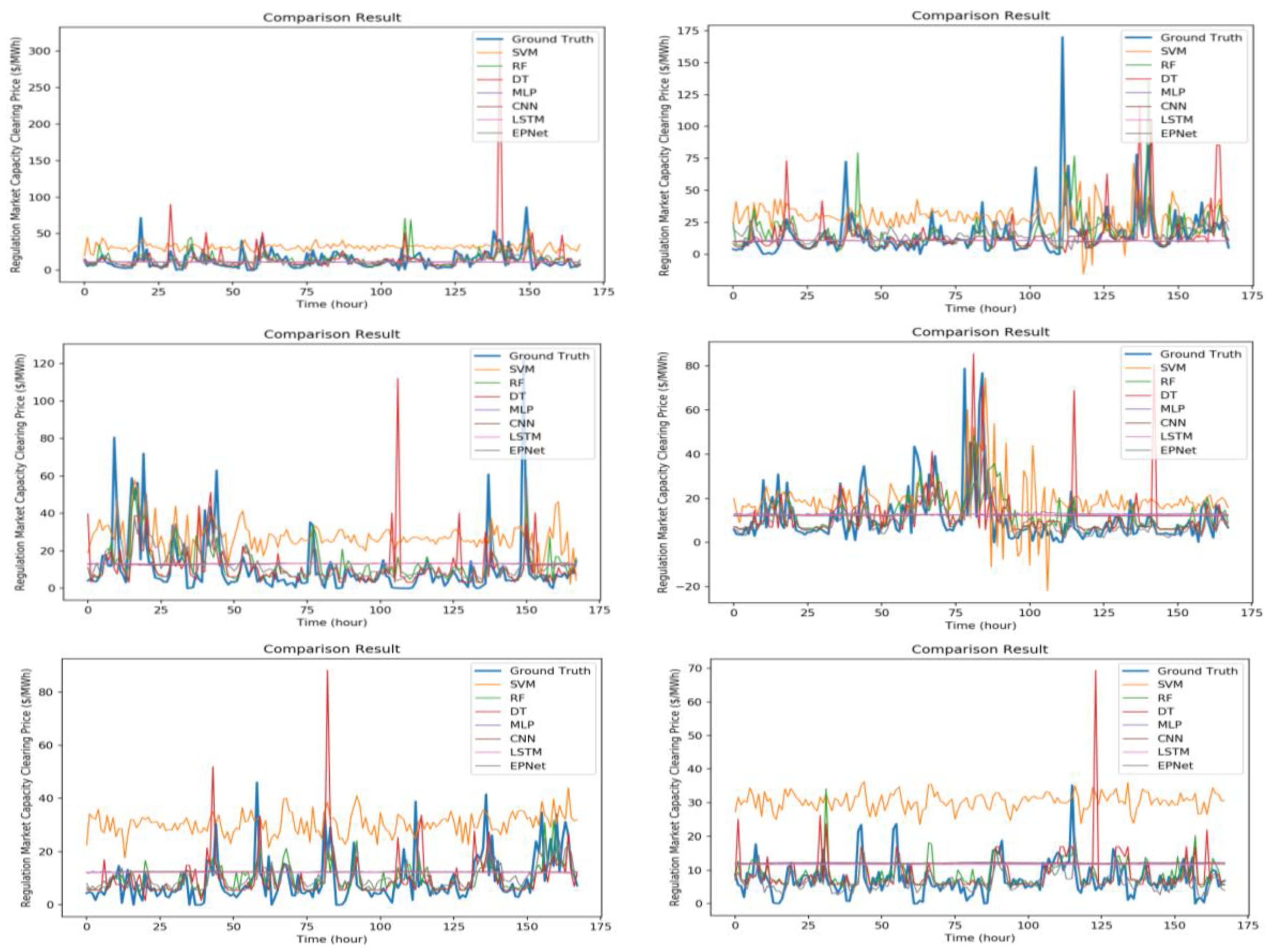

3.1. Multilayer Perceptron and Convolutional Neural Network

3.2. Long Short-Term Memory

3.3. Batch Normalization

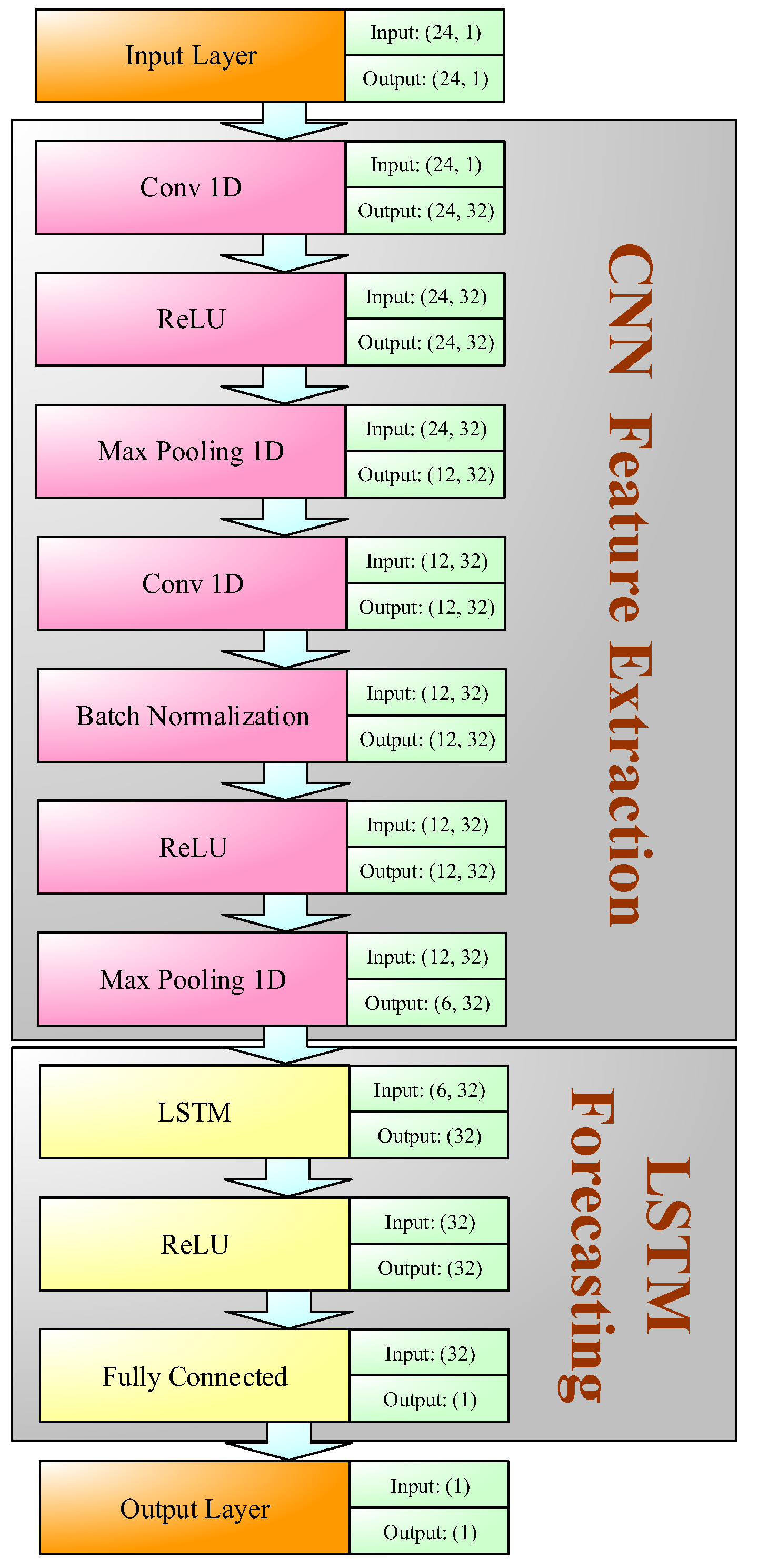

4. Hybrid Structured Deep Neural Network

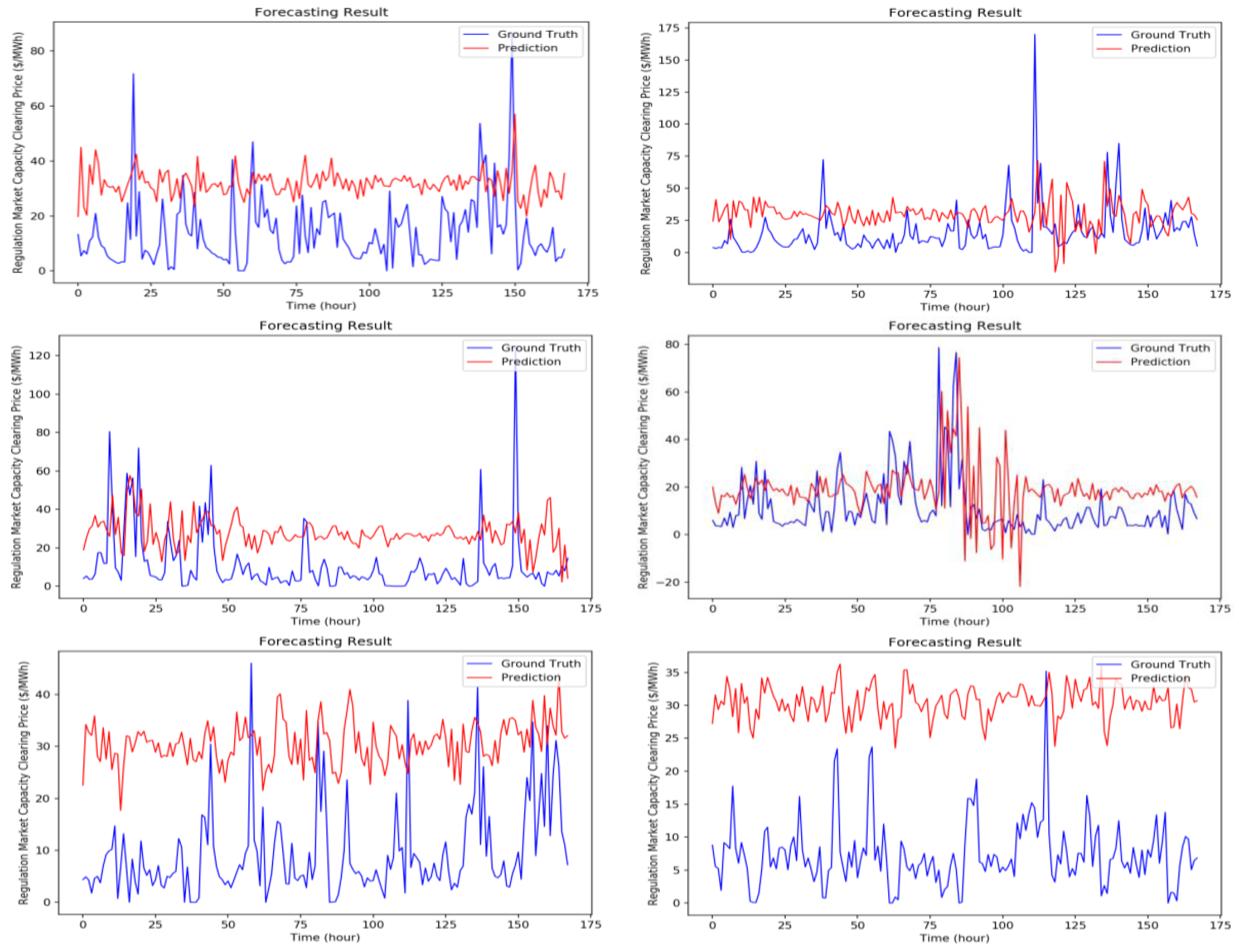

5. Experimental Results

6. Conclusions

Acknowledgments

Author Contributions

Conflicts of Interest

References

- Nowotarski, J.; Weron, R. Recent advances in electricity price forecasting: A review of probabilistic forecasting. Renew. Sustain. Energy Rev. 2018, 81, 1548–1568. [Google Scholar] [CrossRef]

- Ziel, F.; Weron, R. Day-ahead electricity price forecasting with high-dimensional structures: Univariate vs. multivariate modeling frameworks. Energy Econ. 2018, 70, 396–420. [Google Scholar] [CrossRef]

- Nowotarski, J.; Weron, R. On the importance of the long-term seasonal component in day-ahead electricity price forecasting. Energy Econ. 2016, 57, 228–235. [Google Scholar] [CrossRef]

- Gollou, A.R.; Ghadimi, N. A new feature selection and hybrid forecast engine for day-ahead price forecasting of electricity markets. J. Intell. Fuzzy Syst. 2017, 32, 4031–4045. [Google Scholar] [CrossRef]

- Abedinia, O.; Amjady, N.; Zareipour, H. A New Feature Selection Technique for Load and Price Forecast of Electrical Power Systems. IEEE Trans. Power Syst. 2017, 32, 62–74. [Google Scholar] [CrossRef]

- Bello, A.; Bunn, D.W.; Reneses, J.; Munoz, A. Medium-Term Probabilistic Forecasting of Electricity Prices: A Hybrid Approach. IEEE Trans. Power Syst. 2017, 32, 334–343. [Google Scholar] [CrossRef]

- Lin, W.M.; Gow, H.J.; Tsai, M.T. Electricity price forecasting using enhanced probability neural network. Energy Convers. Manag. 2010, 51, 2707–2714. [Google Scholar] [CrossRef]

- Amjady, N.; Daraeepour, A.; Keynia, F. Day-ahead electricity price forecasting by modified relief algorithm and hybrid neural network. IET Gener. Transm. Distrib. 2010, 4, 432. [Google Scholar] [CrossRef]

- Neupane, B.; Woon, W.; Aung, Z. Ensemble Prediction Model with Expert Selection for Electricity Price Forecasting. Energies 2017, 10, 77. [Google Scholar] [CrossRef]

- Lahmiri, S. Comparing variational and empirical mode decomposition in forecasting day-ahead energy prices. IEEE Syst. J. 2017, 11, 1907–1910. [Google Scholar] [CrossRef]

- González, J.P.; San Roque, A.M.; Pérez, E.A. Forecasting functional time series with a new Hilbertian ARMAX model: Application to electricity price forecasting. IEEE Trans. Power Syst. 2018, 33, 545–556. [Google Scholar] [CrossRef]

- Rafiei, M.; Niknam, T.; Khooban, M.H. Probabilistic Forecasting of Hourly Electricity Price by Generalization of ELM for Usage in Improved Wavelet Neural Network. IEEE Trans. Ind. Inform. 2017, 13, 71–79. [Google Scholar] [CrossRef]

- Benth, F.E.; Benth, J.Š.; Koekebakker, S. Stochastic Modeling of Electricity and Related Markets, 1st ed.; World Scientific: Trenton, NJ, USA, 2010; ISBN 978-981-281-230-8. [Google Scholar]

- An Introduction to Electricity Price Forecasting. Available online: http://energyanalyst.co.uk/an-introduction-to-electricity-price-forecasting/ (accessed on 15 February 2018).

- Hu, L.; Taylor, G.; Wan, H.-B.; Irving, M. A review of short-term electricity price forecasting techniques in deregulated electricity markets. In Proceedings of the 2009 44th International Universities Power Engineering Conference (UPEC 2009), Glasgow, UK, 1–4 September 2009. [Google Scholar]

- White, B.W.; Rosenblatt, F. Principles of Neurodynamics: Perceptrons and the Theory of Brain Mechanisms. Am. J. Psychol. 1963, 76, 705. [Google Scholar] [CrossRef]

- Krizhevsky, A.; Sutskever, I.; Hinton, G.E. ImageNet Classification with Deep Convolutional Neural Networks. Adv. Neural Inf. Process. Syst. 2012, 1–9. [Google Scholar] [CrossRef]

- Qiu, Z.; Chen, J.; Zhao, Y.; Zhu, S.; He, Y.; Zhang, C. Variety Identification of Single Rice Seed Using Hyperspectral Imaging Combined with Convolutional Neural Network. Appl. Sci. 2018, 8, 212. [Google Scholar] [CrossRef]

- Li, C.; Zhou, H. Enhancing the Efficiency of Massive Online Learning by Integrating Intelligent Analysis into MOOCs with an Application to Education of Sustainability. Sustainability 2018, 10, 468. [Google Scholar] [CrossRef]

- Lopez-Martin, M.; Carro, B.; Sanchez-Esguevillas, A.; Lloret, J. Network Traffic Classifier with Convolutional and Recurrent Neural Networks for Internet of Things. IEEE Access 2017, 5, 18042–18050. [Google Scholar] [CrossRef]

- Nam, S.; Park, H.; Seo, C.; Choi, D. Forged Signature Distinction Using Convolutional Neural Network for Feature Extraction. Appl. Sci. 2018, 8, 153. [Google Scholar] [CrossRef]

- An, Q.; Pan, Z.; You, H. Ship Detection in Gaofen-3 SAR Images Based on Sea Clutter Distribution Analysis and Deep Convolutional Neural Network. Sensors 2018, 18, 334. [Google Scholar] [CrossRef] [PubMed]

- Hochreiter, S.; Schmidhuber, J. Long Short-Term Memory. Neural Comput. 1997, 9, 1735–1780. [Google Scholar] [CrossRef] [PubMed]

- Ioffe, S.; Szegedy, C. Batch Normalization: Accelerating Deep Network Training by Reducing Internal Covariate Shift. In Proceedings of the 32nd International Conference on International Conference on Machine Learning (ICML’15), Lile, France, 6–11 July 2015; Volume 37, pp. 448–456. [Google Scholar]

- Suykens, J.A.K.; Vandewalle, J. Least squares support vector machine classifiers. Neural Process. Lett. 1999, 9, 293–300. [Google Scholar] [CrossRef]

- Liu, J.P.; Li, C.L. The short-term power load forecasting based on sperm whale algorithm and wavelet least square support vector machine with DWT-IR for feature selection. Sustainability 2017, 9, 1188. [Google Scholar] [CrossRef]

- Wang, J.; Niu, T.; Wang, R. Research and application of an air quality early warning system based on a modified least squares support vector machine and a cloud model. Int. J. Environ. Res. Public Health 2017, 14, 249. [Google Scholar] [CrossRef] [PubMed]

- Niu, D.; Li, Y.; Dai, S.; Kang, H.; Xue, Z.; Jin, X.; Song, Y. Sustainability Evaluation of Power Grid Construction Projects Using Improved TOPSIS and Least Square Support Vector Machine with Modified Fly Optimization Algorithm. Sustainability 2018, 10, 231. [Google Scholar] [CrossRef]

- Wang, S.; Hae, H.; Kim, J. Development of easily accessible electricity consumption model using open data and GA-SVR. Energies 2018, 11, 373. [Google Scholar] [CrossRef]

- Das, M.; Akpinar, E. Investigation of Pear Drying Performance by Different Methods and Regression of Convective Heat Transfer Coefficient with Support Vector Machine. Appl. Sci. 2018, 8, 215. [Google Scholar] [CrossRef]

- Liaw, A.; Wiener, M. Classification and Regression by randomForest. R News 2002, 2, 18–22. [Google Scholar] [CrossRef]

- Quintana, D.; Sáez, Y.; Isasi, P. Random Forest Prediction of IPO Underpricing. Appl. Sci. 2017, 7, 636. [Google Scholar] [CrossRef]

- MA, J.; Qiao, Y.; Hu, G.; Huang, Y.; Sangaiah, A.K.; Zhang, C.; Wang, Y.; Zhang, R. De-Anonymizing Social Networks With Random Forest Classifier. IEEE Access 2018, 6, 10139–10150. [Google Scholar] [CrossRef]

- Zhu, M.; Xia, J.; Jin, X.; Yan, M.; Cai, G.; Yan, J.; Ning, G. Class Weights Random Forest Algorithm for Processing Class Imbalanced Medical Data. IEEE Access 2018, 6, 4641–4652. [Google Scholar] [CrossRef]

- Hassan, M.; Southworth, J. Analyzing Land Cover Change and Urban Growth Trajectories of the Mega-Urban Region of Dhaka Using Remotely Sensed Data and an Ensemble Classifier. Sustainability 2017, 10, 10. [Google Scholar] [CrossRef]

- Huang, N.; Lu, G.; Xu, D. A permutation importance-based feature selection method for short-term electricity load forecasting using random forest. Energies 2016, 9, 767. [Google Scholar] [CrossRef]

- Safavian, S.R.; Landgrebe, D. A Survey of Decision Tree Classifier Methodology. IEEE Trans. Syst. Man Cybern. 1991, 21, 660–674. [Google Scholar] [CrossRef]

- Rosli, N.; Rahman, M.; Balakrishnan, M.; Komeda, T.; Mazlan, S.; Zamzuri, H. Improved Gender Recognition during Stepping Activity for Rehab Application Using the Combinatorial Fusion Approach of EMG and HRV. Appl. Sci. 2017, 7, 348. [Google Scholar] [CrossRef]

- Huang, N.; Peng, H.; Cai, G.; Chen, J. Power quality disturbances feature selection and recognition using optimal multi-resolution fast S-transform and CART algorithm. Energies 2016, 9, 927. [Google Scholar] [CrossRef]

- Alani, A.Y.; Osunmakinde, I.O. Short-term multiple forecasting of electric energy loads for sustainable demand planning in smart grids for smart homes. Sustainability 2017, 9, 1972. [Google Scholar] [CrossRef]

- Rau, C.-S.; Wu, S.-C.; Chien, P.-C.; Kuo, P.-J.; Chen, Y.-C.; Hsieh, H.-Y.; Hsieh, C.-H.; Liu, H.-T. Identification of Pancreatic Injury in Patients with Elevated Amylase or Lipase Level Using a Decision Tree Classifier: A Cross-Sectional Retrospective Analysis in a Level I Trauma Center. Int. J. Environ. Res. Public Health 2018, 15, 277. [Google Scholar] [CrossRef] [PubMed]

- Rau, C.-S.; Wu, S.-C.; Chien, P.-C.; Kuo, P.-J.; Chen, Y.-C.; Hsieh, H.-Y.; Hsieh, C.-H. Prediction of Mortality in Patients with Isolated Traumatic Subarachnoid Hemorrhage Using a Decision Tree Classifier: A Retrospective Analysis Based on a Trauma Registry System. Int. J. Environ. Res. Public Health 2017, 14, 1420. [Google Scholar] [CrossRef] [PubMed]

- The Electric Power Markets (PJM) Regulation Zone Preliminary Billing Data. Available online: http://www.pjm.com/ (accessed on 15 February 2018).

| Test | SVM | RF | DT | MLP | CNN | LSTM | EPNet |

|---|---|---|---|---|---|---|---|

| #1 | 21.39033 | 7.235430 | 7.804850 | 7.43424 | 7.48507 | 7.50518 | 6.64578 |

| #2 | 20.50628 | 10.90374 | 11.26161 | 10.5093 | 10.5437 | 10.4989 | 10.5628 |

| #3 | 19.18263 | 7.668554 | 8.438150 | 9.21527 | 9.19676 | 9.25378 | 7.84723 |

| #4 | 11.67179 | 6.385481 | 7.093340 | 8.06167 | 7.60692 | 7.81942 | 5.58958 |

| #5 | 23.73414 | 7.751149 | 8.375909 | 9.80112 | 9.76736 | 9.72057 | 8.03916 |

| #6 | 22.00405 | 6.055857 | 6.686256 | 7.25569 | 7.28988 | 7.10398 | 5.56724 |

| #7 | 41.34432 | 14.47317 | 15.51438 | 13.6297 | 13.5379 | 13.5496 | 13.7261 |

| #8 | 34.27010 | 10.69618 | 11.52254 | 10.0386 | 9.95490 | 9.94837 | 10.2118 |

| #9 | 42.91338 | 12.00563 | 12.81033 | 11.6585 | 11.6476 | 11.6245 | 11.3043 |

| #10 | 52.78504 | 8.842888 | 7.924259 | 11.0058 | 11.0646 | 11.1863 | 8.96979 |

| Average | 28.98021 | 9.201808 | 9.743163 | 9.860989 | 9.809469 | 9.82106 | 8.846378 |

| Test | SVM | RF | DT | MLP | CNN | LSTM | EPNet |

|---|---|---|---|---|---|---|---|

| #1 | 22.79050 | 12.33350 | 19.34582 | 11.82432 | 11.76039 | 11.75441 | 10.50514 |

| #2 | 25.06868 | 20.31479 | 20.69246 | 19.61244 | 19.66396 | 19.63171 | 17.22459 |

| #3 | 21.06832 | 12.58604 | 16.24223 | 13.40199 | 13.40107 | 13.39795 | 12.45311 |

| #4 | 14.08044 | 10.81497 | 13.36911 | 11.43035 | 11.19074 | 11.28681 | 10.05318 |

| #5 | 30.12712 | 17.78671 | 20.01475 | 19.25388 | 19.25511 | 19.23331 | 18.23270 |

| #6 | 23.41642 | 10.66788 | 12.99470 | 11.04037 | 11.05200 | 10.98134 | 10.56639 |

| #7 | 66.32881 | 40.86279 | 47.05901 | 42.13376 | 42.24259 | 42.18803 | 39.87986 |

| #8 | 38.79443 | 24.88408 | 42.61376 | 19.51944 | 19.54175 | 19.53222 | 19.06935 |

| #9 | 47.15740 | 25.03586 | 36.95668 | 24.40165 | 24.49525 | 24.41055 | 24.17560 |

| #10 | 53.98195 | 19.46185 | 19.53967 | 17.27284 | 17.30463 | 17.35654 | 16.89385 |

| Average | 34.28141 | 19.47485 | 24.88282 | 18.9891 | 18.99075 | 18.97729 | 17.90538 |

© 2018 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (http://creativecommons.org/licenses/by/4.0/).

Share and Cite

Kuo, P.-H.; Huang, C.-J. An Electricity Price Forecasting Model by Hybrid Structured Deep Neural Networks. Sustainability 2018, 10, 1280. https://doi.org/10.3390/su10041280

Kuo P-H, Huang C-J. An Electricity Price Forecasting Model by Hybrid Structured Deep Neural Networks. Sustainability. 2018; 10(4):1280. https://doi.org/10.3390/su10041280

Chicago/Turabian StyleKuo, Ping-Huan, and Chiou-Jye Huang. 2018. "An Electricity Price Forecasting Model by Hybrid Structured Deep Neural Networks" Sustainability 10, no. 4: 1280. https://doi.org/10.3390/su10041280