How Will Policies of China’s CO2 ETS Affect its Carbon Price: Evidence from Chinese Pilot Regions

Abstract

:1. Introduction

2. Literature Review

2.1. Relevant Studies on Policy Designs in C-CETPs

2.2. The Determinants of the Carbon Price

2.3. Literature Gap

3. Variables and Data

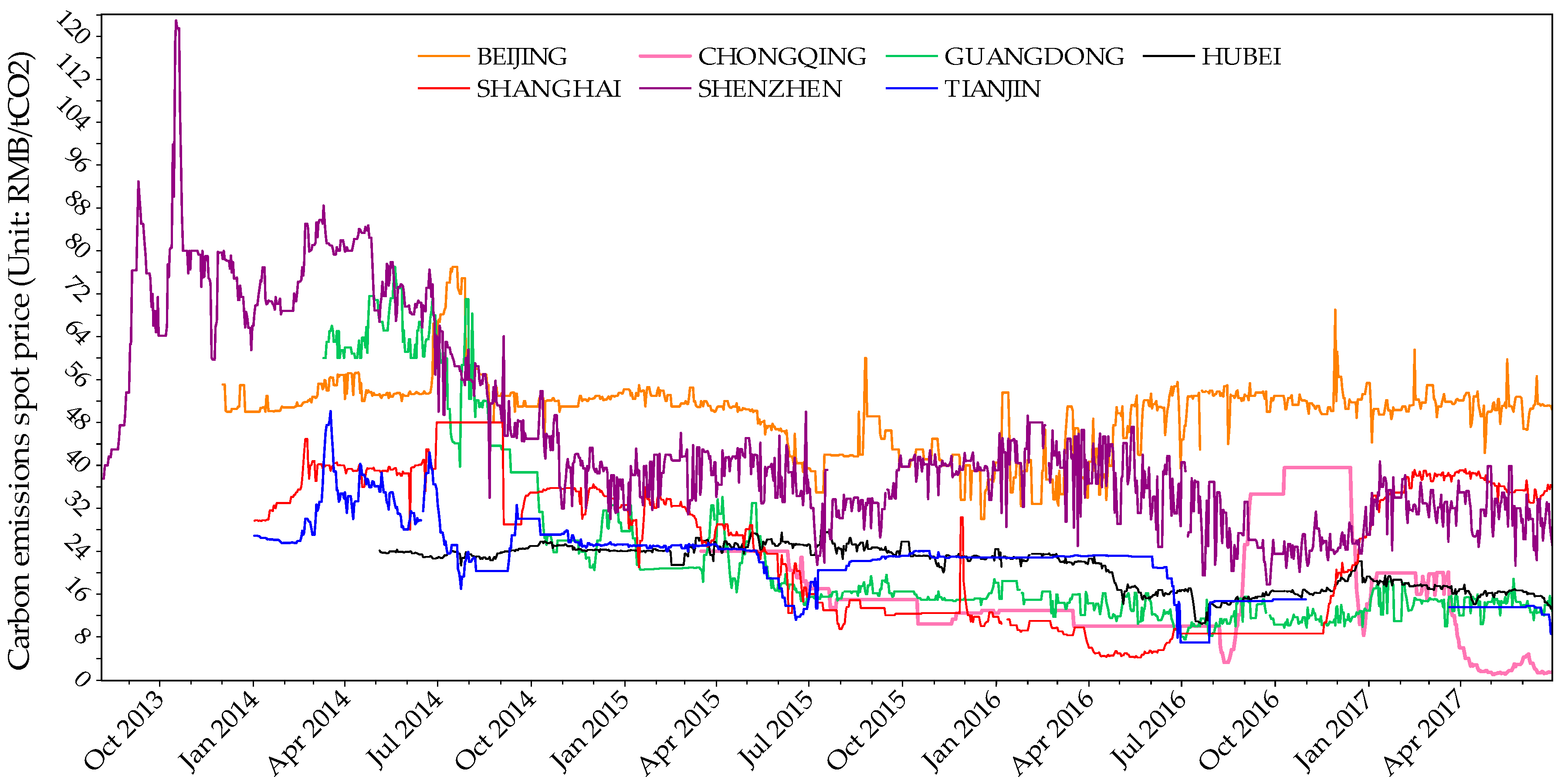

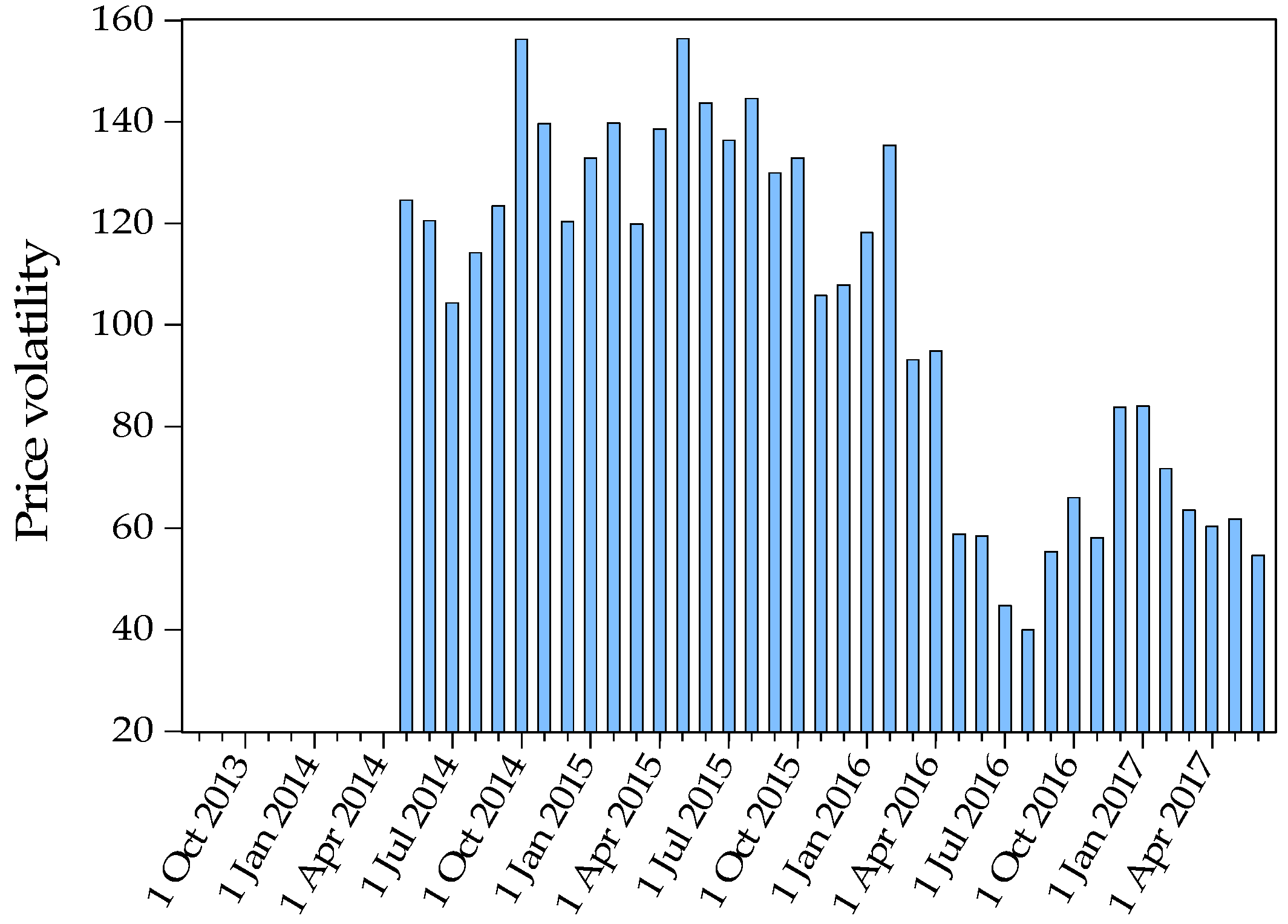

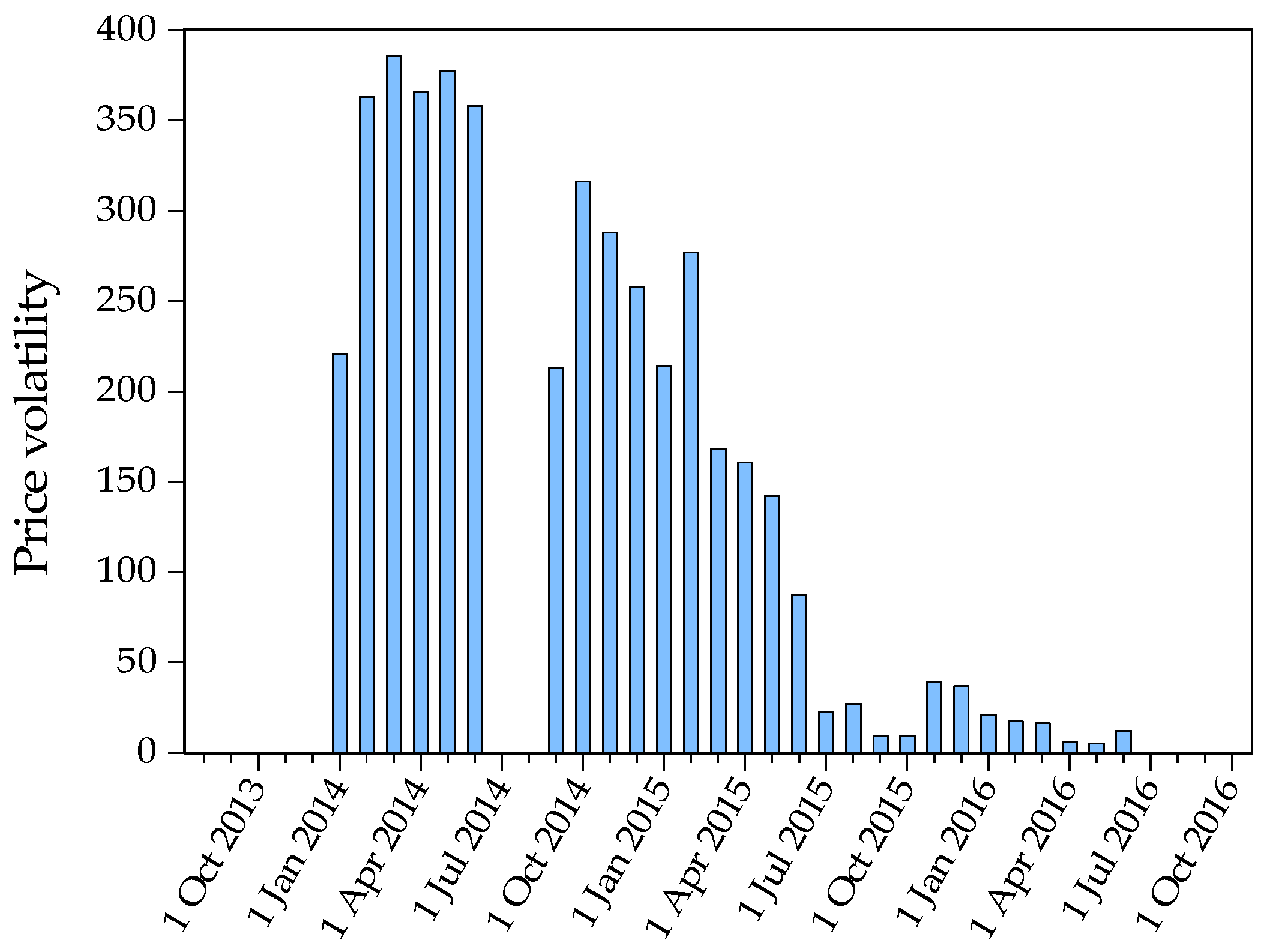

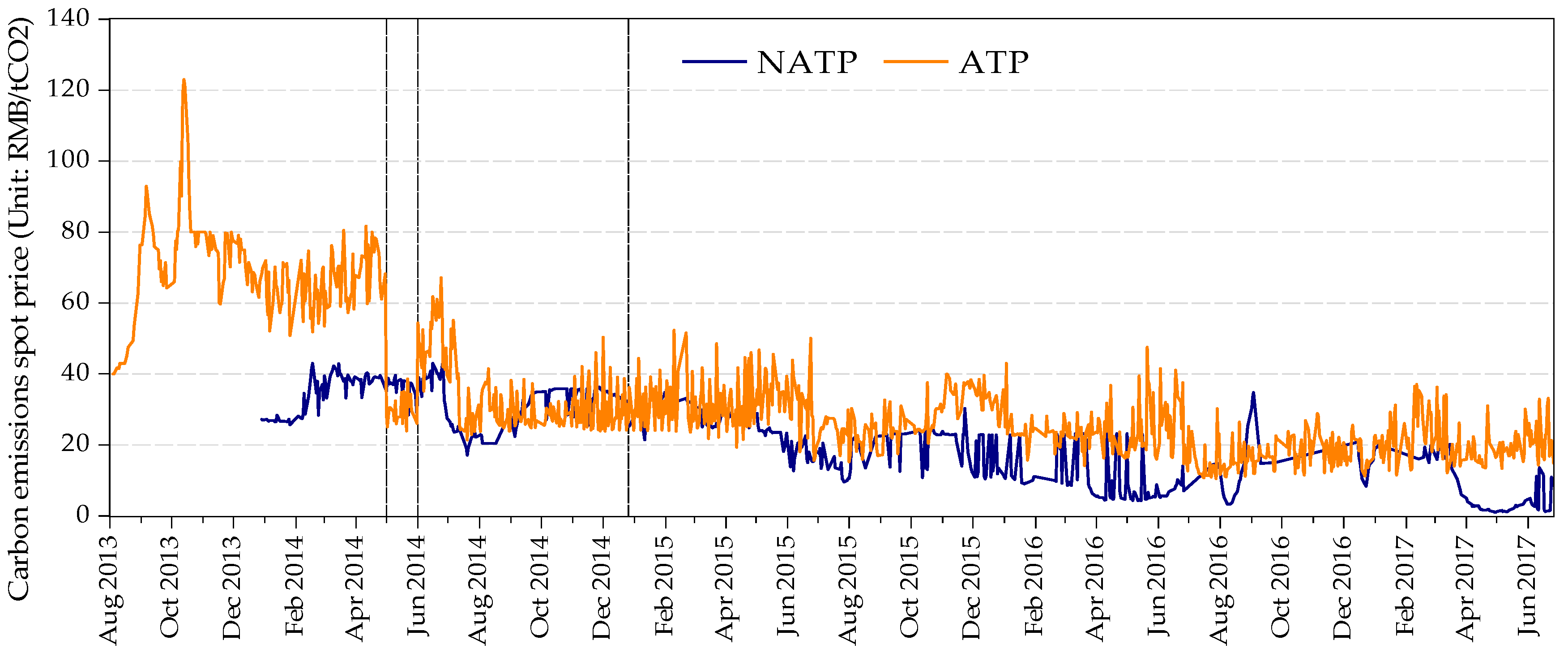

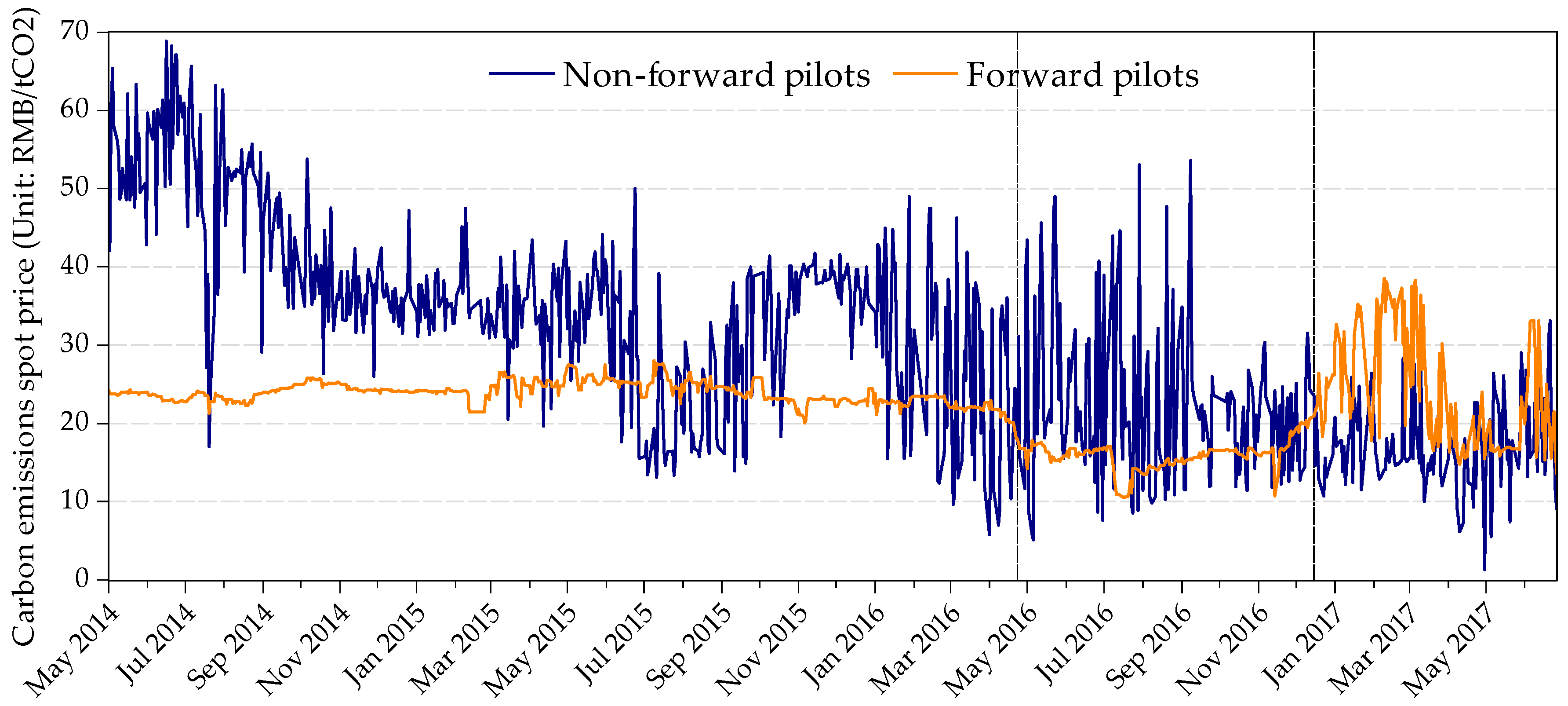

3.1. The Carbon Price

3.2. Control Variables

- (1)

- Economic variables: CPI (last month equals 100), Industrial added value (IAV in 100 million RMB), Industrial added value month-on-month growth rate (IAV_YOY in %). These original data are of monthly frequency. We have processed these data for our regression model. Data of CPI and IAV_YOY are collected from National Bureau of Statistics. Data of IAV is collected from local bureau of statistics websites (Beijing Statistical Information Net: http://www.bjstats.gov.cn. Tianjin Statistical Information Net: http://www.stats-tj.gov.cn. Shanghai Statistical: http://www.stats-sh.gov.cn. Hubei Statistical Bureau Net: http://www.stats-hb.gov.cn. Chongqing Data Net: http://www.cqdata.gov.cn/. Guangdong Statistical Information Net: http://www.gdstats.gov.cn).

- (2)

- Energy variables: Coal price index (COAL_PRICE, index on 1 January 2006 equals 100) reflects the level of coal price; Electricity-coal price (ELE_COAL_PRICE in RMB/ton) represents the price of coal which is used to generate electricity; Industrial natural gas market price (NG_PRICE in RMB/cubic meter) is the market selling price of natural gas which is used for industrial production. Variables about electricity are also included because the power sector was endowed with almost 50% of carbon allowance, which means it is undoubtedly the important subject of carbon trading market. Most electric power in China is generated by firing coal. Coal benchmark on-grid prices (ELEC_PRICE in RMB/MWh) are respectively made by NDRC and the provincial Price Bureau according to limits on the authority of price control. Each province in China executes a unified price for all the newly constructed coal-fired units. The NDRC adjusts the Coal benchmark on-grid price periodically, which affects the profits of coal-fired power plants. These original data are of daily frequency. Power plants in the European Union pay close attention to the profits from producing electricity depending on whether the input is coal (profits are referred to as dark spread) or gas (profits are referred to as spark spread) and to the difference between them, because carbon price is sensitive to them. This logic is described by Kanen [31]. However, things are different in China. Most of China’s power plants are coal-fired power plants now. The natural gas-fired power plant’s proportion is so small that they cannot influence the electric power market. We only consider one similar processed variable in China: Chinese Dark Spread (CHINESE_DS in RMB/MWh). The Chinese Dark Spread represents the theoretical profit that coal-fired power plants in China make from selling a unit of electricity. Their costs come from purchasing fuel which is required to produce that unit of electricity. The calculation method of dark spread in China is different from Europe. We use Coal benchmark on-grid price (In Europe, they use peak electricity price. In China, only on-grid price influences the interests of the power plant.) minus the Coal price for generating a thousand kilowatt hour electricity (According to Chinese present coal-fired power generation efficiency, generating one thousand kilowatt hour electricity consumes about 360 kg standard coal). All the data in this section are provided by Wind database (a professional database in China).

- (3)

- Climate condition variables: According to previous literature, our investigation focuses on the most important dimension of weather: extremely hot and cold degree-days. If the intraday highest temperature is higher than 30-degree centigrade, we call it extremely high temperature (T_H). The corresponding variable, T_H, takes 1; otherwise, T_H takes 0. If the intraday lowest temperature is lower than 0-degree centigrade, we call it extremely low temperature (T_L). The corresponding variable, T_L, takes 1; otherwise, T_L takes 0. Temperature data in Guangdong Province and Hubei Province are calculated by the key city samples’ average temperature weighted by population. We only examine the temperature factor, because China’s hydropower, wind power and solar power’s proportion are very small. We do not consider precipitation and wind scale. Temperature records are collected from a Weather Net (The website is http://www.tianqi.com).

- (4)

- C-CETP’s characteristic variables: Free carbon allowance amount (ALLOWANCE in a million ton), Covered enterprise number (E_NO). Each pilot region has distinct characteristic about regulated enterprise and is computed free quota depending on its covered enterprise and industry. Theoretically speaking, these characteristics can affect their carbon price. These data are shown in Table 1. Data sources include some papers, research reports and all the seven carbon exchange websites [40,41].

3.3. Policy Variables

- (1)

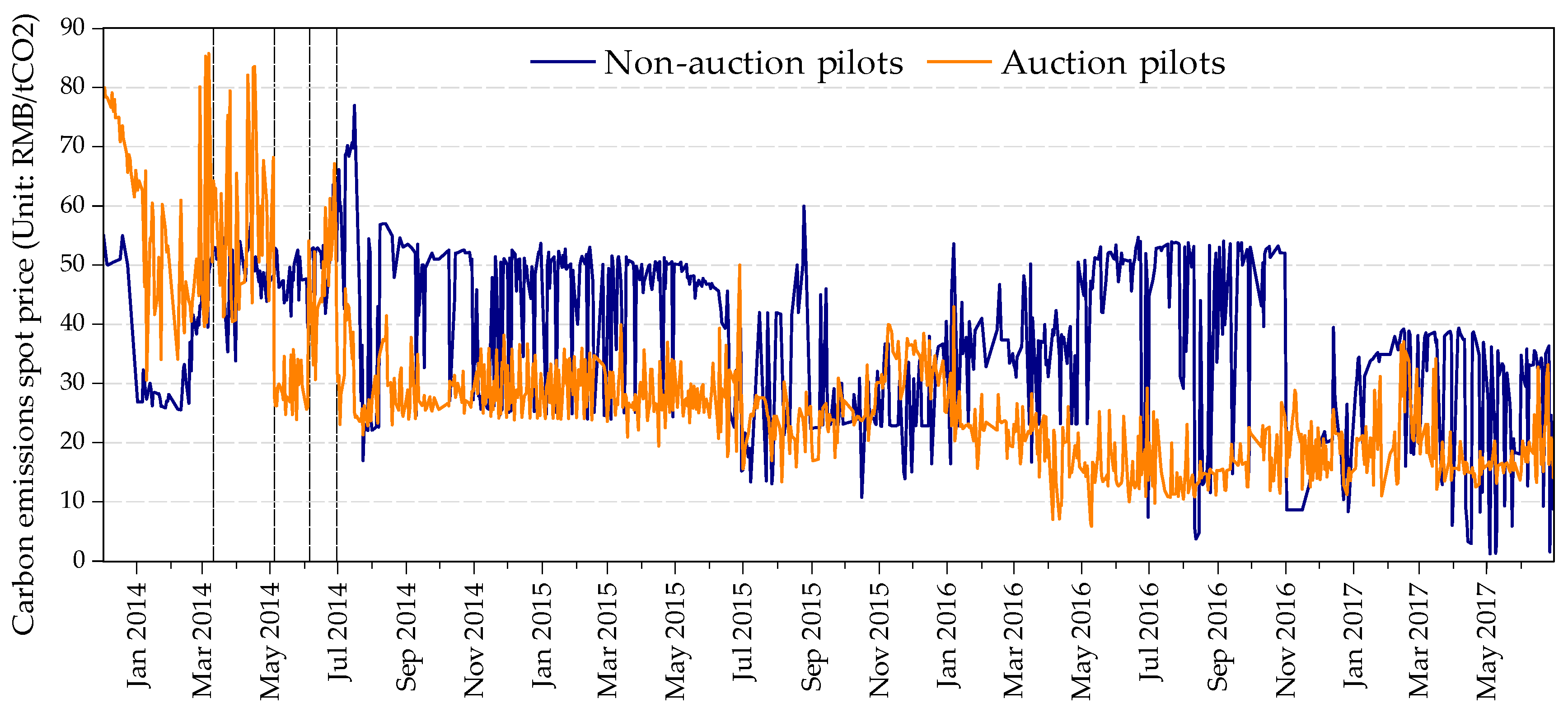

- Auction (AUCTION): It is a virtual variable, where the values of Shanghai, Shenzhen, Guangdong and Hubei are 1. But we assign no value to the other pilot regions. At the same time, the variable of auction price (AUCTION_PRICE) is introduced. It is used to test whether carbon price is driven by auction price.

- (2)

- Investment access of individual and institutional traders in the carbon market (INV_ACC_IIT): It is a virtual variable. The degree of market participation is not the same in C-CETPs, for there exists thresholds for institutional investors and individuals to participate in carbon trading, such as enterprise net assets limit and personal financial assets limit. Account opening fee and transaction fee also have a huge distinction among different pilot regions. It is extremely difficult to judge actual transaction situation only by policy documents, so we did a market participation survey to collect data from the exchanges. If individual investors and institutional investors in certain pilots trade actively, we assign INV_ACC_IIT values to 1; otherwise, this variable takes 0.

- (3)

- Introduction of carbon forward (FORWARD): It is a virtual variable, where the value of Hubei is 1 and the values of the other pilot regions are 0. The reason is that only Hubei Exchange makes standardized contracts similar as futures, which has the function of hedging and price discovery. Carbon forward of Guangdong can only lock price in the future. They have essential differences in the trading rules. A mature carbon market should have transactions of derivatives in addition to spot trading. So, we assume that the carbon price trend will change because of the introduction of carbon forward transaction.

3.4. Variables Used for Policy Effects’ Test

- (1)

- Verification period (VER_PERIOD): It is a virtual variable, where the values of all the seven pilots during mandatory verification periods are 1. All the carbon pilots have a verification period every year at about June to July. Values of the other days are 0.

- (2)

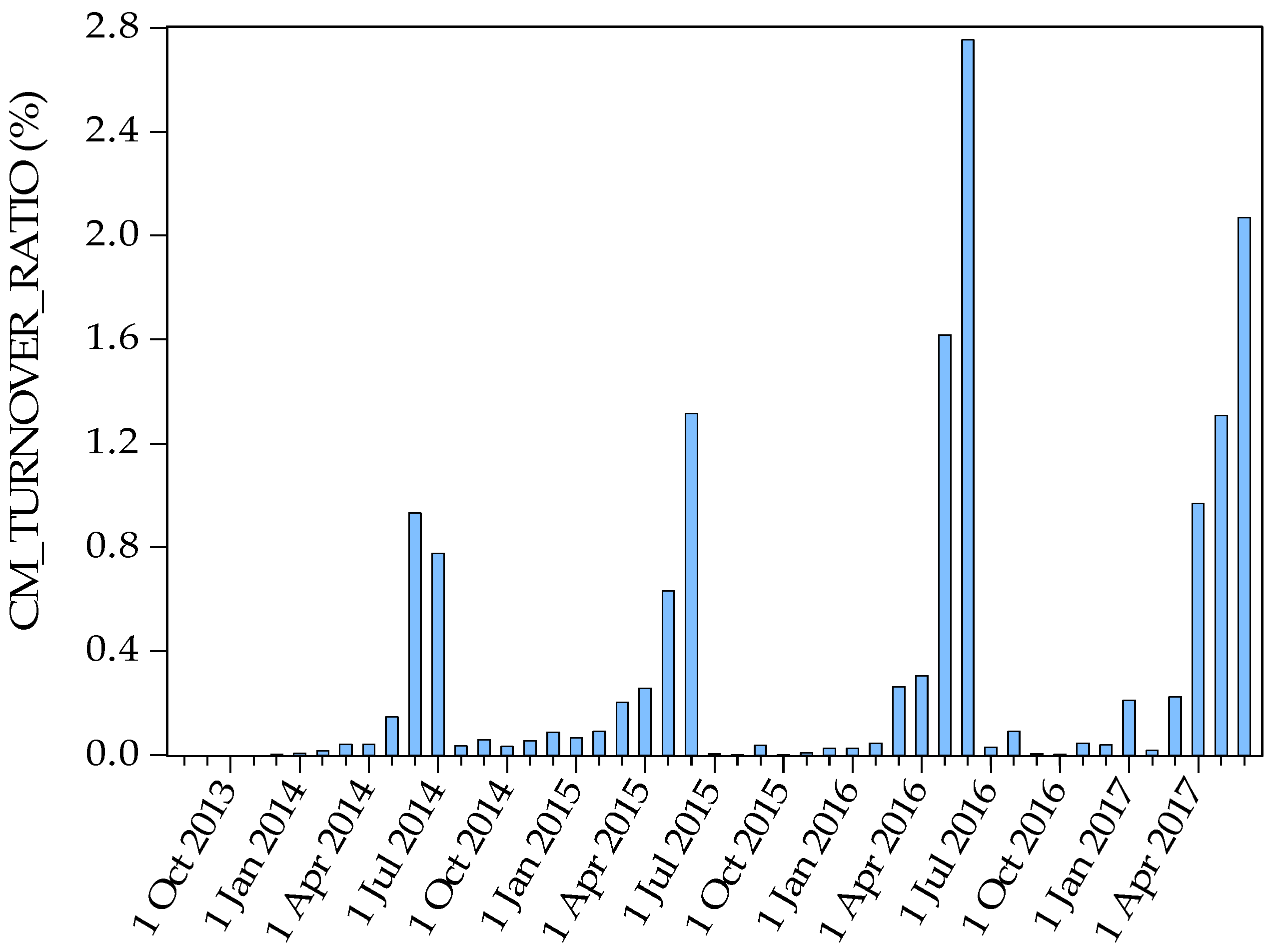

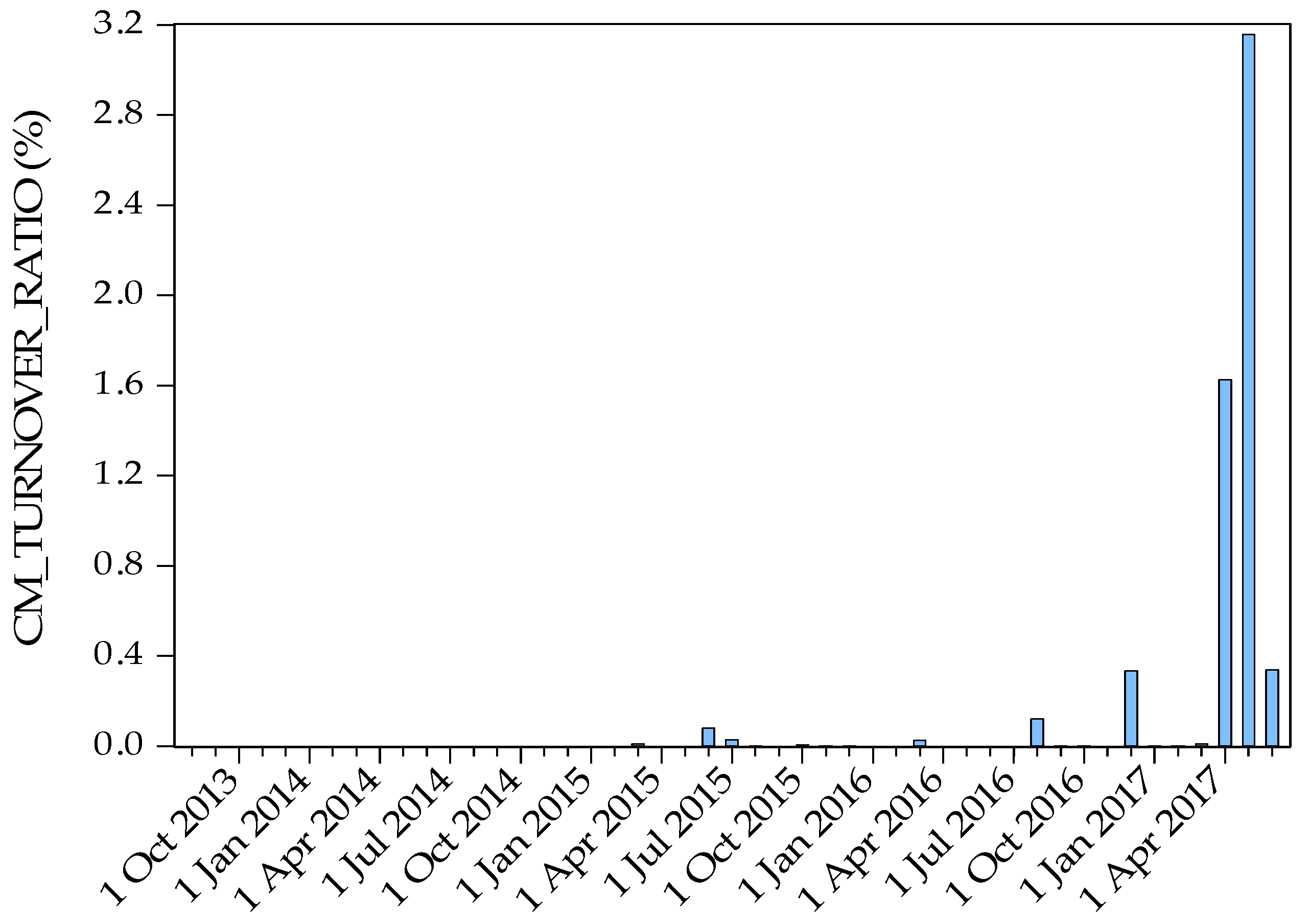

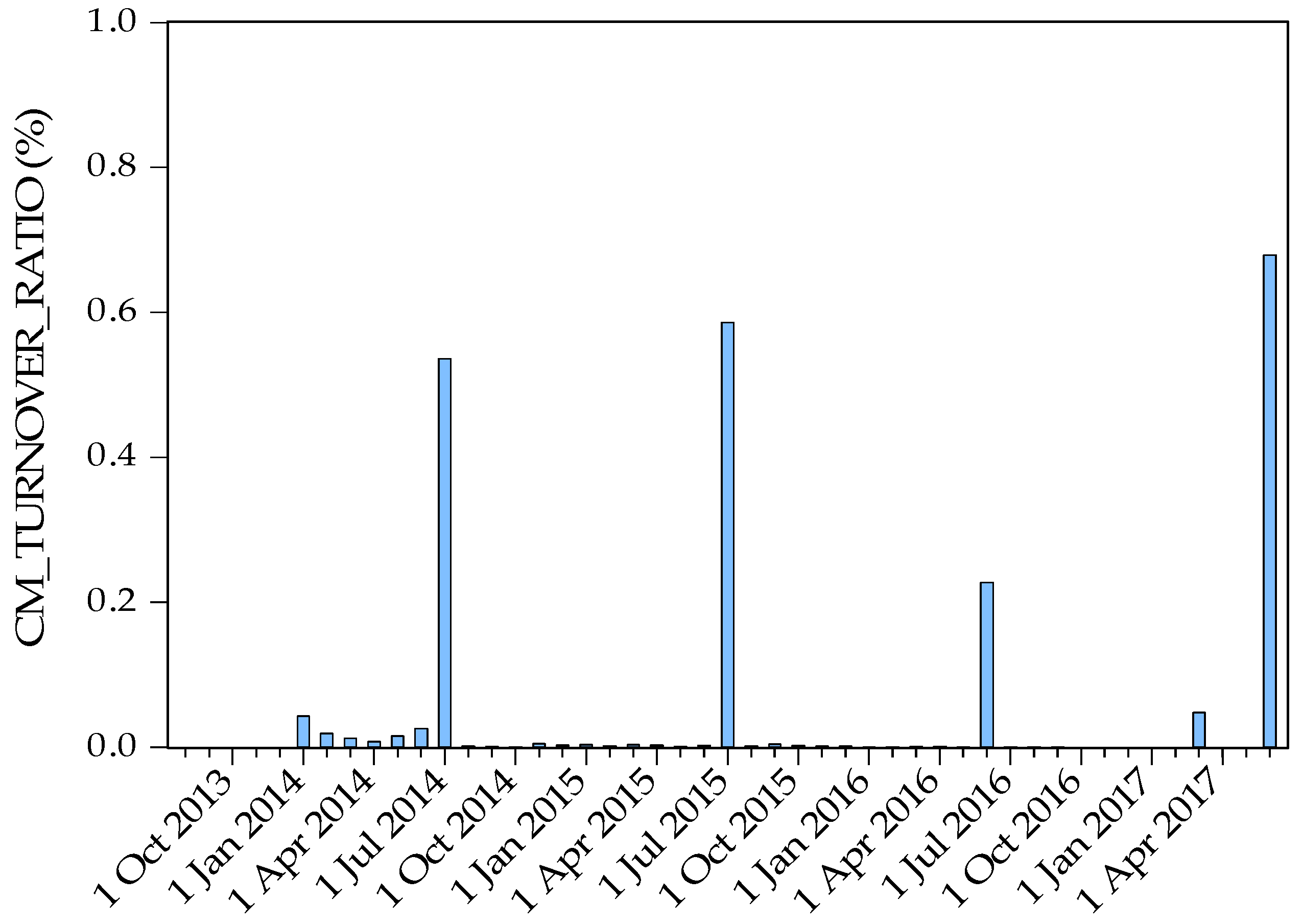

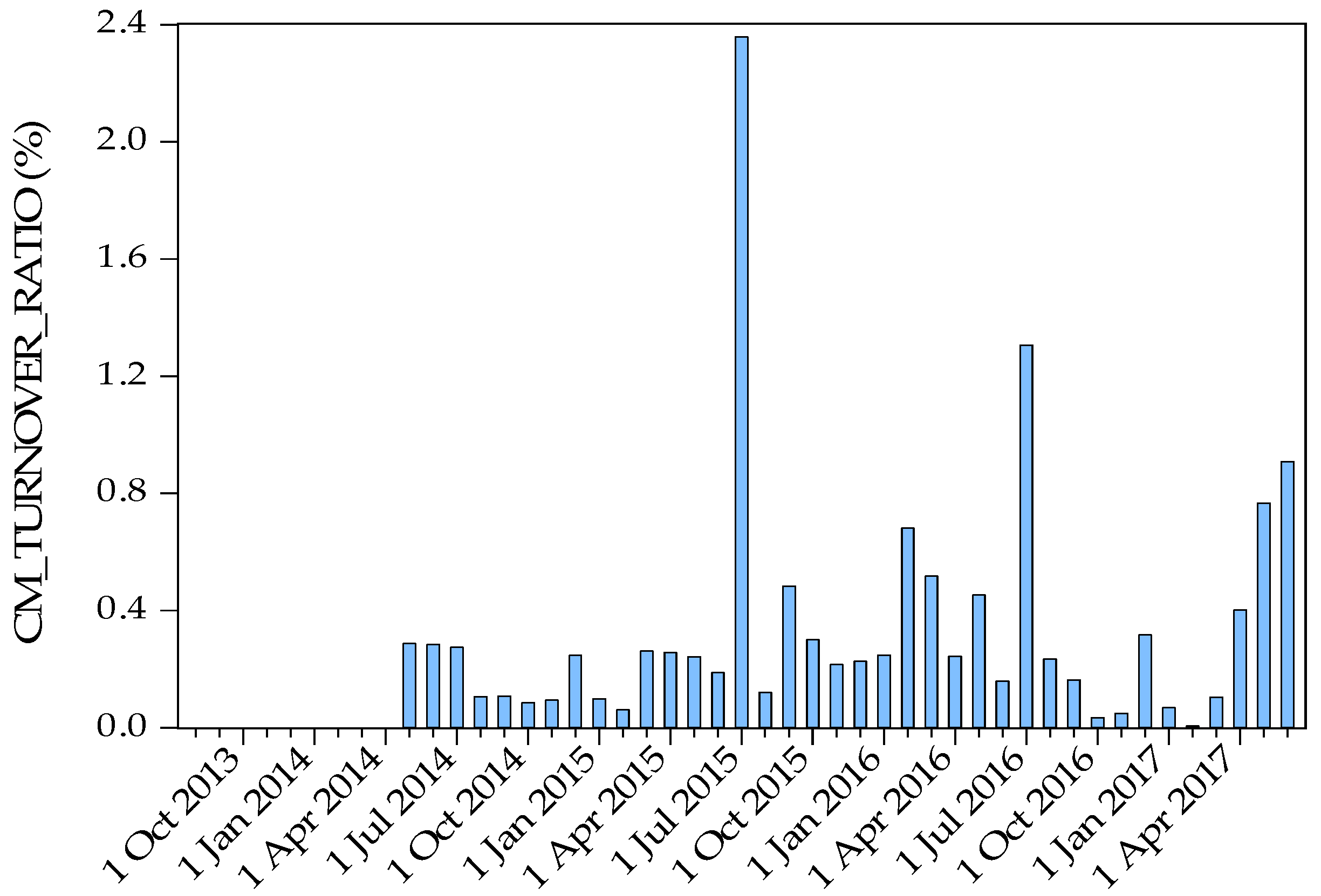

- Carbon market turnover ratio (CM_TURNOVER_RATIO): This variable is used to measure the pilot regions’ market activity level, which is calculated as follows:Volumeit represents the total amount of CO2 allowance that is traded at the pilot i on month t. Allowanceit represents the total free carbon allowance amount at the pilot i for certain compliance year T.

3.5. Summary Statistics

4. Empirical Framework

4.1. Basic Specification

4.2. Validity of the Identification Assumptions

5. Empirical Results and Discussion

5.1. Main Results about Alternative Variables and Principal Components

5.2. Main Results about Policy Effects

5.3. Policy Effects Test: Periodic Test of Each Pilot’s Carbon Price

5.4. Heterogeneity in the Policies Effect

5.5. Additional Robustness Checks

6. Conclusions and Policy Implications

6.1. Adjust the Allowance Allocation Methods to Coordinate with Regional Characteristics

6.2. Introduce Autonomic-Adjusting Measures to the Market in the Short Term, Build Open-to-Public Information Platform in the Long Term

6.3. Gradually Broaden the Scope of Covered Entities and Gradually Extend to Industries with Lower Emission Intensity

6.4. Government Should Have a Long-Term Industry Development Plan and Provide Technology Support for Backward Areas to Improve Their Energy Structure

Acknowledgments

Author Contributions

Conflicts of Interest

Appendix A

| Variable | CPI | IAV | IAV_YOY | COAL_PRICE | ELE_COAL_PRICE |

| R2 | 0.04 | 0.1875 | 0.0372 | 0.0445 | 0.1986 |

| Variable | NG_PRICE | ELEC_PRICE | CHINESE_DS | T_L | ALLOWANCE |

| R2 | 0.0170 | 0.1152 | 0.0615 | 0.0073 | 0.2873 |

| Variable | E_NO | AUCTION | INV_ACC_IIT | FORWARD | VER_PERIOD |

| R2 | 0.3578 | 0.0613 | 0.0031 | 0.0336 | 0.0020 |

| Impact on Liquidity | |||

| AUCTION | INV_ACC_IIT | FORWARD | |

| Coefficient | 0.1677 (2.9879) *** | 0.0484 (6.4173) *** | — |

| Impact on Price Volatility | |||

| AUCTION | INV_ACC_IIT | FORWARD | |

| Coefficient | — | 0.0583 (1.7335) * | — |

Appendix B

References

- Böhringer, C.; Dijkstra, B.; Rosendahl, K.E. Sectoral and regional expansion of emissions trading. Resour. Energy Econ. 2014, 37, 201–225. [Google Scholar] [CrossRef]

- Perdan, S.; Azapagic, A. Carbon trading: Current schemes and future developments. Energy Policy 2011, 39, 6040–6054. [Google Scholar] [CrossRef]

- Jiang, J.; Xie, D.; Ye, B.; Shen, B.; Chen, Z. Research on China’s cap-and-trade carbon emission trading scheme: Overview and outlook. Appl. Energy 2016, 178, 902–917. [Google Scholar] [CrossRef]

- Chang, Y.-C.; Wang, N. Environmental regulations and emissions trading in China. Energy Policy 2010, 38, 3356–3364. [Google Scholar] [CrossRef]

- Hancheng, D.; Masui, T. Assessing the contribution of carbon emissions trading in China to carbon intensity reduction. Energy Sci. Technol. 2012, 4, 19–26. [Google Scholar]

- Chen, B. The establishment of China’s national carbon emission trading market and its macro-control strategy. China Popul. Resour. Environ. 2013, 23, 9–15, [in Chinese]. [Google Scholar]

- Zhang, C.; Wang, Q.; Shi, D.; Li, P.; Cai, W. Scenario-based potential effects of carbon trading in China: An integrated approach. Appl. Energy 2016, 182, 177–190. [Google Scholar] [CrossRef]

- Tanaka, S. Environmental regulations on air pollution in China and their impact on infant mortality. J. Health Econ. 2015, 42, 90–103. [Google Scholar] [CrossRef] [PubMed]

- Zhang, D.; Karplus, V.J.; Cassisa, C.; Zhang, X. Emissions trading in China: Progress and prospects. Energy Policy 2014, 75, 9–16. [Google Scholar] [CrossRef]

- Jiang, J.J.; Ye, B.; Ma, X.M. The construction of Shenzhen’s carbon emission trading scheme. Energy Policy 2014, 75, 17–21. [Google Scholar] [CrossRef]

- Wu, L.; Qian, H.; Li, J. Advancing the experiment to reality: Perspectives on Shanghai pilot carbon emissions trading scheme. Energy Policy 2014, 75, 22–30. [Google Scholar] [CrossRef]

- Qi, S.; Wang, B.; Zhang, J. Policy design of the Hubei ETS pilot in China. Energy Policy 2014, 75, 31–38. [Google Scholar] [CrossRef]

- Shen, B.; Dai, F.; Price, L.; Lu, H. California’s Cap-and-Trade Programme and Insights for China’s Pilot Schemes. Energy Environ. 2014, 25, 551–575. [Google Scholar] [CrossRef]

- Xiong, L.; Shen, B.; Qi, S.; Price, L. Assessment of allowance mechanism in China’s carbon trading pilots. Energy Procedia 2015, 75, 2510–2515. [Google Scholar] [CrossRef]

- Pezzey, J.C.; Park, A. Reflections on the double dividend debate. Environ. Resour. Econ. 1998, 11, 539–555. [Google Scholar] [CrossRef]

- Cramton, P.; Kerr, S. Tradeable carbon permit auctions: How and why to auction not grandfather. Energy Policy 2002, 30, 333–345. [Google Scholar] [CrossRef]

- Böhringer, C.; Lange, A. On the design of optimal grandfathering schemes for emission allowances. Eur. Econ. Rev. 2005, 49, 2041–2055. [Google Scholar] [CrossRef]

- Cong, R.; Wei, Y.-M. Auction design for the allocation of carbon emission allowances: Uniform or discriminatory price? Int. J. Energy Environ. 2010, 1, 533–546. [Google Scholar]

- Cong, R.-G.; Wei, Y.-M. Experimental comparison of impact of auction format on carbon allowance market. Renew. Sustain. Energy Rev. 2012, 16, 4148–4156. [Google Scholar] [CrossRef]

- Liu, L.; Chen, C.; Zhao, Y.; Zhao, E. China’s carbon-emissions trading: Overview, challenges and future. Renew. Sustain. Energy Rev. 2015, 49, 254–266. [Google Scholar] [CrossRef]

- Munnings, C.; Morgenstern, R.; Wang, Z.; Liu, X. Assessing the design of three pilot programs for carbon trading in China. Resour. Future 2014, 14–36. Available online: https://ideas.repec.org/p/rff/dpaper/dp-14-36.html (accessed on 25 January 2018). [CrossRef]

- Fan, J.; Li, Y.; Wu, Y.; Wang, S.; Zhao, D. Allowance trading and energy consumption under a personal carbon trading scheme: A dynamic programming approach. J. Clean. Prod. 2016, 112, 3875–3883. [Google Scholar] [CrossRef]

- Fan, J.; Wang, S.; Wu, Y.; Li, J.; Zhao, D. Buffer effect and price effect of a personal carbon trading scheme. Energy 2015, 82, 601–610. [Google Scholar] [CrossRef]

- Fan, J.; Wang, S.; Wu, Y.; Li, J.; Zhao, D. Energy-use choices and allowance trading under the personal carbon trading scheme. Nat. Resour. Model. 2015, 28, 1–17. [Google Scholar] [CrossRef]

- Li, J.; Fan, J.; Zhao, D.; Wang, S. Allowance price and distributional effects under a personal carbon trading scheme. J. Clean. Prod. 2015, 103, 319–329. [Google Scholar] [CrossRef]

- Hu, G.; Rong, K.; Shi, Y.; Yu, J. Sustaining the emerging carbon trading industry development: A business ecosystem approach of carbon traders. Energy Policy 2014, 73, 587–597. [Google Scholar] [CrossRef]

- Lo, A.Y.; Howes, M. Powered by the state or finance? The organization of China’s carbon markets. Eurasian Geogr. Econ. 2013, 54, 386–408. [Google Scholar]

- Shen, W. Chinese business at the dawn of its domestic emissions trading scheme: Incentives and barriers to participation in carbon trading. Clim. Policy 2015, 15, 339–354. [Google Scholar] [CrossRef]

- Springer, U. The market for tradable GHG permits under the Kyoto protocol: A survey of model studies. Energy Econ. 2003, 25, 527–551. [Google Scholar] [CrossRef]

- Christiansen, A.C.; Arvanitakis, A.; Tangen, K.; Hasselknippe, H. Price determinants in the EU emissions trading scheme. Clim. Policy 2005, 5, 15–30. [Google Scholar] [CrossRef]

- Kanen, J.L. Carbon Trading and Pricing; Environmental Finance Publications: London, UK, 2006. [Google Scholar]

- Bunn, D.W.; Fezzi, C. Interaction of European Carbon Trading and Energy Prices; Social Science Electronic Publishing: Rochester, NY, USA, 2007. [Google Scholar]

- Convery, F.J.; Redmond, L. Market and price developments in the European Union emissions trading scheme. Rev. Environ. Econ. Policy 2007, 1, 88–111. [Google Scholar] [CrossRef]

- Mansanet-Bataller, M.; Pardo, A.; Valor, E. CO2 prices, energy and weather. Energy J. 2007, 73–92. [Google Scholar] [CrossRef]

- Alberola, E.; Chevallier, J.; Chèze, B.T. Price drivers and structural breaks in European carbon prices 2005–2007. Energy Policy 2008, 36, 787–797. [Google Scholar] [CrossRef]

- Creti, A.; Jouvet, P.-A.; Mignon, V. Carbon price drivers: Phase I versus phase II equilibrium? Energy Econ. 2012, 34, 327–334. [Google Scholar] [CrossRef]

- Aatola, P.; Ollikainen, M.; Toppinen, A. Price determination in the EU ETS market: Theory and econometric analysis with market fundamentals. Energy Econ. 2013, 36, 380–395. [Google Scholar] [CrossRef]

- Doytch, N.; Uctum, M. Globalization and the environmental impact of sectoral FDI. Econ. Syst. 2016, 40, 582–594. [Google Scholar] [CrossRef]

- Yang, B.; Liu, C.; Su, Y.; Jing, X. The allocation of carbon intensity reduction target by 2020 among industrial sectors in China. Sustainability 2017, 9, 148. [Google Scholar] [CrossRef]

- Zhang, X. Analysis of carbon market volume and coverage in pilot regions. China Econ. Trade Herald 2014, 29, 4–6. (In Chinese) [Google Scholar]

- Environomist China Carbon Market Reasearch Report 2017. Available online: http://www.environomist.com/upload/file/20170216171434_40.pdf (accessed on 15 March 2017).

- Wang, X.; Fan, G.; Yu, J. China Provinces Marketization Index Report; Social Science Literature Press: Beijing, China, 2016; pp. 214–218. ISBN 978-7-5201-0022-9. (In Chinese) [Google Scholar]

| 2013–2014 | 2014–2015 | 2015–2016 | 2016–2017 | 2017–2018 | ||

|---|---|---|---|---|---|---|

| Beijing | ALLOWANCE | 55 | 47 | 47 | 46 | unpublished |

| E_NO | 415 | 543 | 543 | 947 | ||

| Tianjin | ALLOWANCE | 100 | 160 | 160 | 160 | |

| E_NO | 114 | 112 | 109 | 109 | ||

| Shanghai | ALLOWANCE | 160 | 160 | 160 | 155 | |

| E_NO | 191 | 191 | 191 | 310 | ||

| Hubei | ALLOWANCE | - | 324 | 281 | 253 | |

| E_NO | - | 138 | 138 | 236 | ||

| Chongqing | ALLOWANCE | - | 125 | 105 | 96 | |

| E_NO | - | 242 | 254 | 254 | ||

| Guangdong | ALLOWANCE | 388 | 408 | 408 | 422 | 422 |

| E_NO | 242 | 193 | 189 | 244 | 246 | |

| Shenzhen | ALLOWANCE | 33 | 33 | 33 | 33 | unpublished |

| E_NO | 832 | 833 | 832 | 824 |

| Mean | Std. Dev. | Min. | Max. | Obs. | |

|---|---|---|---|---|---|

| P (RMB/tCO2) | 32.29 | 17.55 | 1.00 | 122.97 | 4011 |

| CPI (last month equals 100) | 101.94 | 0.75 | 99.84 | 103.80 | 4011 |

| IAV (100 million RMB) | 55.12 | 27.72 | 12.89 | 110.04 | 3860 |

| IAV_YOY (%) | 7.59 | 4.72 | −7.00 | 21.82 | 3622 |

| COAL_PRICE | 142.99 | 10.25 | 118.60 | 168.30 | 4011 |

| ELE_COAL_PRICE (RMB/ton) | 468.57 | 90.44 | 300.92 | 669.03 | 3857 |

| NG_PRICE (RMB/m3) | 3.77 | 0.59 | 2.86 | 4.54 | 4011 |

| ELEC_PRICE (RMB/MWh) | 459.84 | 90.44 | 351.40 | 658.00 | 4011 |

| CHINESE_DS (RMB/MWh) | 298.12 | 103.65 | 148.69 | 587.50 | 3857 |

| ALLOWANCE (million ton) | 173.10 | 136.63 | 33.00 | 422.00 | 4011 |

| E_NO (number) | 418 | 320 | 109 | 1100 | 4011 |

| AUCTION_PRICE (RMB/tCO2) | 30.72 | 12.93 | 9.88 | 60.00 | 2512 |

| Time | Average Price | |

|---|---|---|

| Beijing | No auction | |

| Tianjin | No auction | |

| Shanghai | 30 June 2014 | 48 RMB/tCO2 |

| 30 June 2017 | 38.77 RMB/tCO2 | |

| Hubei | 31 March 2014 | 20 RMB/tCO2 |

| Chongqing | No auction | |

| Guangdong | 16 December 2013 | 60 RMB/tCO2 |

| 6 January 2014 | 60 RMB/tCO2 | |

| 28 February 2014 | 60 RMB/tCO2 | |

| 3 April 2014 & 17 April 2014 & 5 May 2014 | 60 RMB/tCO2 | |

| 25 June 2014 | 60 RMB/tCO2 | |

| 26 September 2014 | 26 RMB/tCO2 | |

| 22 December 2014 | 30 RMB/tCO2 | |

| 27 March 2015 | 35 RMB/tCO2 | |

| 10 June 2015 | 40 RMB/tCO2 | |

| 21 September 2015 | 16.1 RMB/tCO2 | |

| 21 December 2015 | 15 RMB/tCO2 | |

| 29 March 2016 | 12.69 RMB/tCO2 | |

| 28 June 2016 | Auction closed | |

| 21 September 2016 | 9.88 RMB/tCO2 | |

| 4 January 2017 | 15 RMB/tCO2 | |

| 27 March 2017 | 16.5 RMB/tCO2 | |

| 5 June 2017 | Auction closed | |

| Shenzhen | 6 June 2014 | 35.43 RMB/tCO2 |

| Coefficient | t-Values | R2 | ||

|---|---|---|---|---|

| Economic variable | CPI | 0.2042 *** | (13.2064) | 0.0400 |

| IAV | −0.4388 *** | (−29.8800) | 0.1875 | |

| IAV_YOY | 0.1992 *** | (11.8996) | 0.0372 | |

| Energy variable | COAL_PRICE | 0.2109 *** | (13.6641) | 0.0445 |

| ELE_COAL_PRICE | 0.0692 *** | (5.7866) | 0.4986 | |

| NG_PRICE | 0.1305 *** | (8.3358) | 0.0170 | |

| ELEC_PRICE | 0.3395 *** | (22.8545) | 0.1152 | |

| CHINESE_DS | 0.2420 *** | (16.6604) | 0.0615 | |

| Climate condition variables | T_H | 0.0195 | (0.6005) | — |

| T_L | 0.2949 *** | (5.4257) | 0.0073 | |

| C-CETP’s characteristic variables | ALLOWANCE | −0.5360 *** | (−40.2058) | 0.2873 |

| E_NO | 0.5982 *** | (47.2654) | 0.3578 |

| Principal Component | Original Variables | Cumulative | Coefficient | R2 on Carbon Price | |

|---|---|---|---|---|---|

| Category 1: Economic and industrial development level | F1: ECON1 | CPI, IAV, IAV_YOY | 38.0% | 0.1671 *** (9.92) | 0.03 |

| F2: ECON2 | 37.6% | −0.4955 *** (−33.16) | 0.23 | ||

| Category 2: Energy and power | F3: ENERGY1 | COAL_PRICE, ELE_COAL_PRICE, NG_PRICE, ELEC_PRICE, CHINESE_DS | 51.8% | 0.2186 *** (14.95) | 0.05 |

| F4: ENERGY2 | 37.2% | 0.0102 (0.68) | — | ||

| Category 3: Climate condition | F5: CLIMATE | T_L | 100% | 0.2949 *** (5.43) | 0.0073 |

| Category 4: C-CETP’s characteristic | F6: CHARACTERISTIC | ALLOWANCE, E_NO | 85.2% | −0.6142 *** (−49.29) | 0.38 |

| (1) | (2) | (3) | (4) | (5) | |

|---|---|---|---|---|---|

| AUCTION × TIME | −0.7567 *** (−15.1592) | −0.8941 *** (−18.1354) | −0.8911 *** (−17.7894) | −0.8903 *** (−17.7635) | −0.7998 *** (−16.4333) |

| Observations | 4011 | 3622 | 3468 | 3468 | 3468 |

| R2 | 0.8130 | 0.8613 | 0.8392 | 0.8392 | 0.8510 |

| Time fixed effects | Y | Y | Y | Y | Y |

| Region fixed effects | Y | Y | Y | Y | Y |

| F2 | N | Y | Y | Y | Y |

| F3 | N | N | Y | Y | Y |

| F5 | N | N | N | Y | Y |

| F6 | N | N | N | N | Y |

| (1) | (2) | (3) | (4) | (5) | |

|---|---|---|---|---|---|

| AUCTION_PRICE | 0.3565 *** (19.9480) | 0.2725 *** (14.5789) | 0.2860 *** (16.1906) | 0.2838 *** (16.0522) | 0.2226 *** (11.2830) |

| Observations | 2512 | 2292 | 2292 | 2292 | 2292 |

| R2 | 0.7837 | 0.8180 | 0.8381 | 0.8386 | 0.8433 |

| Time fixed effects | Y | Y | Y | Y | Y |

| Region fixed effects | Y | Y | Y | Y | Y |

| F2 | N | Y | Y | Y | Y |

| F3 | N | N | Y | Y | Y |

| F5 | N | N | N | Y | Y |

| F6 | N | N | N | N | Y |

| (1) | (2) | (3) | (4) | (5) | |

|---|---|---|---|---|---|

| INV_ACC_IIT × TIME | 0.6739 *** (18.2847) | 0.4182 *** (10.8077) | 0.3526 *** (8.9237) | 0.3554 *** (8.9852) | 0.1047 *** (2.4416) |

| Observations | 4011 | 3622 | 3468 | 3468 | 3468 |

| R2 | 0.8188 | 0.8507 | 0.8249 | 0.8250 | 0.8358 |

| Time fixed effects | Y | Y | Y | Y | Y |

| Region fixed effects | Y | Y | Y | Y | Y |

| F2 | N | Y | Y | Y | Y |

| F3 | N | N | Y | Y | Y |

| F5 | N | N | N | Y | Y |

| F6 | N | N | N | N | Y |

| (1) | (2) | (3) | (4) | (5) | |

|---|---|---|---|---|---|

| FORWARD × TIME | 0.4875 *** (12.7380) | 0.3314 *** (8.4487) | 0.3175 *** (7.0799) | 0.3184 *** (7.0991) | 0.1923 *** (4.3752) |

| Observations | 4011 | 3622 | 3468 | 3468 | 3468 |

| R2 | 0.8091 | 0.8482 | 0.8229 | 0.8230 | 0.8366 |

| Time fixed effects | Y | Y | Y | Y | Y |

| Region fixed effects | Y | Y | Y | Y | Y |

| F2 | N | Y | Y | Y | Y |

| F3 | N | N | Y | Y | Y |

| F5 | N | N | N | Y | Y |

| F6 | N | N | N | N | Y |

| 2013–2014 | 2014–2015 | 2015–2016 | 2016–2017 | |

|---|---|---|---|---|

| Beijing | original provision: before 15 June 2014; actually: 4 July 2014 | original provision: 15 June 2015; actually: 30 June 2015 | 15–25 June 2016 | original provision: 15 June 2017; actually: 5 July 2017 |

| Tianjin | 10 June–10 July 2014 | before 10 July 2015 | Before 30 June 2016 | Before 30 June 2017 |

| Shanghai | 1–30 June 2014 | before 30 June 2015 | Before 30 June 2016 | Before 30 June 2017 |

| Hubei | — | Before 31 July 2015 | Before 25 July 2016 | original provision: 31 May 2017; actually: 31 July 2017 |

| Chongqing | — | Before 23 July 2015 | 17 October–18 November 2016 | 15 September–31 October 2017 |

| Guangdong | original provision: before 20 June 2014; actually: 15 July 2014 | original provision: before 23 June 2015; actually: 4 July 2015 | Before 20 June 2016 | Before 20 June 2017 |

| Shenzhen | Before 30 June 2014 | Before 30 June 2015 | Before 1 July 2016 | Before 30 June 2017 |

| Beijing | Tianjin | Shanghai | Hubei | Chongqing | Guangdong | Shenzhen | |

|---|---|---|---|---|---|---|---|

| VER_PERIOD | 0.3413 *** (9.3071) | −0.3533 *** (−11.8419) | −0.1387 ** (−2.1180) | −0.1464 (−7.8612) | 2.1647 *** (3.0021) | 3.7516 *** (3.1222) | 7.0732(1.6610) |

| Observations | 487 | 385 | 417 | 651 | 134 | 580 | 814 |

| F2 | Y | Y | Y | Y | Y | Y | Y |

| F3 | Y | Y | Y | Y | Y | Y | Y |

| F5 | Y | Y | Y | Y | Y | Y | Y |

| F6 | Y | Y | Y | Y | Y | Y | Y |

| Policy Variable | |||

|---|---|---|---|

| AUCTION | INV_ACC_IIT | FORWARD | |

| Energy-intensive industry concentrated pilots | −1.1705 *** | −1.3850 *** | −0.6481 *** |

| (0.0636) | (0.0622) | (0.0474) | |

| The third industry concentrated pilots | −1.5498 *** | 0.1071 | 0.7588 *** (0.1059) |

| (0.0450) | (0.0783) | ||

| High marketization degree pilots | −1.3390 *** | −0.4199 *** | 0.6248 *** (0.0873) |

| (0.0446) | (0.0532) | ||

| Low marketization degree pilots | −1.7066 ** | −1.7066 ** | −0.5651 ** |

| (0.8076) | (0.8076) | (0.2413) | |

| Specifications | AUCTION | INV_ACC_IIT | FORWARD |

|---|---|---|---|

| Eliminate outliers | −1.1920 *** | 0.4032 *** | 0.1408 *** |

| (0.0434) | (0.0417) | (0.0467) | |

| Only northern China | — | 0.2457 *** | — |

| (0.0480) | |||

| Only southern China | −1.3487 *** | 1.8333 *** | 0.2925 *** |

| (0.0428) | (0.0951) | (0.0714) |

© 2018 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (http://creativecommons.org/licenses/by/4.0/).

Share and Cite

Yang, B.; Liu, C.; Gou, Z.; Man, J.; Su, Y. How Will Policies of China’s CO2 ETS Affect its Carbon Price: Evidence from Chinese Pilot Regions. Sustainability 2018, 10, 605. https://doi.org/10.3390/su10030605

Yang B, Liu C, Gou Z, Man J, Su Y. How Will Policies of China’s CO2 ETS Affect its Carbon Price: Evidence from Chinese Pilot Regions. Sustainability. 2018; 10(3):605. https://doi.org/10.3390/su10030605

Chicago/Turabian StyleYang, Baochen, Chuanze Liu, Zehao Gou, Jiacheng Man, and Yunpeng Su. 2018. "How Will Policies of China’s CO2 ETS Affect its Carbon Price: Evidence from Chinese Pilot Regions" Sustainability 10, no. 3: 605. https://doi.org/10.3390/su10030605