1. Introduction

In recent years, there have been many examples of the undesirable effects of the neglect of corporate social responsibility around the world, such as the BP oil spill in the Gulf of Mexico, and the fraud scandals created by some of the world’s largest automakers, such as Volkswagen, and Mitsubishi Motors, involving the falsification of diesel vehicle emissions data and fuel consumption tests. These events not only caused major financial loss to the companies, but also affected the interests of other interested parties, and even caused damage to the company’s goodwill and corporate image, as well as seriously endangering sustainable development. Clearly, attaching importance to corporate social responsibility is an important issue that cannot be ignored in current business operations. In addition to requiring the company to actively implement relevant internal controls to prevent similar incidents from happening again, society also requires the company’s stakeholders to take responsibility and perform corporate social responsibility work to meet the expectations of stakeholders.

The purpose of internal control is to promote sound company operations, to ensure reasonable effectiveness and efficiency of these operations, and reporting on the reliability, timeliness, transparency and compliance with the relevant laws and regulations as well as other goals [

1]. Sound internal controls will not only improve the company’s operating efficiency, but also reduce the risk. If the company incorporates corporate social responsibility principles into its internal control objectives, effective implementation of the internal control system will be able to meet the expectations of stakeholders and avoid major incidents of neglect of corporate social responsibility, resulting in significant company losses [

2]. Therefore, strengthening the internal control to cope with various issues and leading companies to attach importance to social responsibility is the most important problem encountered by the current society.

In the past, the focus in the stakeholders’ analysis of company performance has been on the financial performance aspect, neglecting non-financial information. The current objectives of the Committee of Sponsoring Organizations (COSO) are focused only on the achievement of operational effectiveness and efficiency, reporting reliability, and compliance with relevant laws and regulations. In other words, the COSO framework lacks the relevant connotations of corporate social responsibility [

3,

4,

5,

6,

7]. Finally, although the company’s internal control objectives may be immediately achieved, the results may not necessarily meet societal expectations or those of stakeholders. Therefore, given the current trend of attaching greater importance to corporate social responsibility, the three major objectives of COSO have been unable to meet the needs of stakeholders. It can be seen that the company must first make a good assessment of risks. They must also establish a sound internal control system, in which corporate social responsibility-oriented internal control is an important key to societal sustainability.

Moreover, the success of social sustainability is largely dependent on successful implementation of an internal control system which integrates all aspects of the organization into a series of activities aimed at reaching sustainable objectives [

8,

9]. Therefore, based on the existing two areas of internal control and corporate social responsibility, this paper will introduce the internal control system of corporate social responsibility orientation with the concept of balanced scorecard. Finally, the multi-criteria decision-making model is used to analyze the performance of this sustainable internal control system. The main purpose of combining the decision-making trial and evaluation laboratory (DEMATEL) and the analytical network process (ANP) methods is to determine the importance of each criterion and the interrelation among them. The VlseKriterijumska Optimizacija I Kompromisno Resenje (VIKOR) method is used to evaluate the overall performance gap in the sustainability performance for the empirical cases and identify and prioritize improvement strategies [

10]. Based on this framework, senior management can further not only understand the priority and relationship of the company’s corporate social responsibility (CSR)-oriented internal control objectives, but can also reduce performance gaps between current levels of social sustainability and the expectations of stakeholders.

2. Literature Review

2.1. The Importance of Corporate Social Responsibility

The topic of corporate social responsibility (CSR) continues to be of interest to researchers. It has been debated in the management literature for more than 50 years (e.g., [

11,

12,

13]). Although consensus on a precise definition has yet to be found, it is widely accepted that CSR refers to the responsibility of an enterprise for the environment, social mores and quality of governance of its operations [

14,

15,

16]. That is, while the company is producing profits, it also has to assume social responsibility for all stakeholders to achieve the ideals of economic prosperity, social welfare and sustainable environmental protection.

In recent decades, firms engaging in CSR have thus exhibited philanthropic and socially responsible business practices beyond the pursuit of economic self-interest and compliance with the law [

17,

18]. According to the World Business Council for Sustainable Development (WBCSD), corporate social responsibility requires a company’s continued commitment to comply with ethical norms in its operations, while contributing to economic development, as well as improving the quality of life of employees, their families, local communities and society as a whole. A growing body of literature suggests that an organization’s involvement in CSR policies and practices tends to contribute not only to improvement of financial outcomes at the organizational level, but also to nonfinancial outcomes such as the firm’s reputation in the eyes of its consumers and its attractiveness to investors by satisfying external stakeholders’ expectations [

19,

20,

21,

22].

Recalling the evolution of corporate social responsibility suggests its importance. Modern companies are also actively making CSR efforts for the benefit of various stakeholders [

23,

24,

25]. However, the company must somehow consider the interests of various stakeholders and implement actions into the management of the company to meet stakeholder expectations. Wood [

26] (1991) has pointed out that managers have some discretion into which projects to devote their energy to. Information about the direction the manager takes can tell us much about the company’s goals, the company’s vision, and whether the company’s responsibilities can be realized [

27,

28]. It can be seen from this that whether corporate social responsibility can be concretely realized requires the design, planning, and management of related systems. The goal is not simply to engage in empty talk, but also to have the opportunity to achieve concrete realization.

2.2. Improving Internal Control and Strengthening Corporate Social Responsibility

Modern concepts of internal control emerged in the 1940s. After more than half a century of theoretical research and practical exploration, efforts have gradually consolidated to form a series of relatively systematic and feasible internal control frameworks and guidelines. According to the internal control framework of the international COSO organization, the objectives of internal control are nothing more than business objectives, reporting goals, compliance goals, and strategic objectives [

29,

30]. The different definitions of “internal control” can include the elements for the control of the internal environment, risk assessment, control activities, information and communication, and internal supervision [

31,

32]. The latest enterprise risk management integration framework further refines the monitoring of risks. From this we can realize that internal control theory has undergone five stages of internal control, internal control, internal control structure, internal control integration framework, and enterprise risk management integration framework [

33,

34]. The overall internal control development process is not a big bang, but a gradual process of theoretical development. It constantly absorbs new content in accordance with changes of the control environment over time.

In the past, internal control focused on the internal elements of the company, only emphasizing the interests of internal relations, and often neglecting the common interests of people outside the company [

35,

36]. As a consequence, the benefits of internal control were often limited to the interests of internal stakeholders. The results might not only fail to meet societal expectations, but could trigger a crisis because of differences in internal and external control for the company and sustainable development of corporate society. Therefore, a single, static internal control architecture appears to no longer be sufficient, but rather a more complex and dynamic internal control integration framework incorporating a multitude of stakeholder expectations need to be embedded in the enterprise’s overall strategic risk management architecture.

From the above, we can see that, due to the increasingly complex control environment, in order for companies to meet the expectations of both internal and external stakeholders, internal control objectives need to consider the interests of both internal and external stakeholders. A more macroscopic perspective is required to meet the goal of corporate social responsibility as a social institution. Such development would not only promote changes in the values of society and stakeholders, but would also further improve internal control theory and control objectives [

35]. The overall framework for internal control and enterprise risk management integration should not only consider changes in the external environment of the company’s internal control, but also the risks of incorporating corporate social responsibility [

37,

38]. It should also actively strengthen the integration of corporate social responsibility and internal control objectives. Based on the perspective of corporate social responsibility, inspecting corporate internal control issues and establishing a CSR-oriented internal control system are the fundamental guarantees for long-term corporate stability.

2.3. Practical Application of the Balanced Scorecard and Its Extension in Corporate Sustainability

The balanced scorecard, as conceived by Kaplan and Norton [

39], is a systematic strategic management system which provides a comprehensive framework for the evaluation of financial and non-financial performance measures from finance, customer, internal business process, and learning and growth perspectives. To reach a consensus on the overall strategy for development of a company, the balanced scorecard approach can effectively integrate the four objectives, targets, and initial action plans for design and implementation. The main purpose is to transform the company’s strategy into concrete action plans to create a competitive advantage [

40,

41].

The balanced scorecard is also an advanced tool for performance measurement which divides the strategy into four different perspectives on operational objectives. Appropriate performance measures can be designed based on these four perspectives. Therefore, it not only provides enterprises with all kinds of information necessary for effective operation, but also overcomes the complexity and asymmetry of that information. More importantly, the indicators it provides to enterprises are quantifiable, measurable, and assessable, which is conducive to comprehensive and systematic monitoring and promotion of the company’s strategic and long-term goals.

Aside from being a performance evaluation framework, the balanced scorecard can also help illuminate the driving forces of performance after a systematic analysis of the relevant factors required to meet the intended strategy [

39,

42,

43,

44]. Furthermore, some extended balanced scorecard designs have been developed to integrate the measurements of economic, social, and environmental factors in order to evaluate corporate sustainability performance (e.g., [

45,

46,

47,

48,

49]). Scholars and practitioners therefore believe that the balanced scorecard is an appropriate tool for assessing the corporate sustainability performance because it can integrate the economic, environmental, and social needs of key stakeholders (e.g., [

45,

50,

51,

52,

53]).

In addition, the balanced scorecard (BSC) is also an effective communication tool connecting strategy and practice. The goals and assessment indicators used in the balanced scorecard are derived from organizational strategy. It can translate the abstract vision of the organizational mission into tangible, concrete, practical, clear and effective goals and measurement indicators. Among them, in terms of the customer aspect, the BSC may need to consider all the various stakeholders that need to be satisfied to attain corporate social responsibility, by consideration of the expectations and vision of each stakeholder. The internal business process of the BSC is related to the organization’s internal operational processes which the company needs to focus on and achieve in order to meet the expectations of various stakeholders. In this regard, the BSC is not concerned with the mere improvement of existing business processes, but with developing new internal business processes based on the vision and expectations of stakeholders. Moreover, the aspect of learning and growth in the BSC is related to the organization’s investment in the future which is needed in order to realize the long-term interests and expectations of the various stakeholders, including measurement of employee abilities, the organization’s value system and so on. Finally, the success of the organization in all these aspects must be translated into financial success and the efficient use of resources. Therefore, the BSC lists the financial goals of the organization and measures and whether the implementation and execution of the strategy is contributing to the improvement of the final operating results.

The goals and measurement metrics in the BSC are interconnected. This link not only includes causality, but also a combination of measurement of outcomes and measurement of the process leading to the results, which ultimately reflects the success of the organization’s strategy. Compared with traditional and short-term oriented performance evaluation models, the BSC can assist in performance evaluation of the CSR-oriented internal control, because it focuses more on the various stakeholders’ interests, reflecting the need for sustainable corporate development [

53,

54] and the links between the main sources of value and corporate strategy [

43].

2.4. A Discussion of Prior Literature

Internal control objectives are reflected by maximization of shareholder value as the axis. The emphasis is on increasing the value of assets, to enhance the effect of economic efficiency and other economic goals. At the same time, internal controls also need to take into account social goals such as legal compliance and external stakeholder information needs, although consideration of the interests of other stakeholders is not comprehensive.

Modern companies have recognized that common corporate and social trends are critical in today’s business environment. In this regard, companies must incorporate the implications of CSR into the goals and scope of the internal company control. At the same time, they must also combine internal control with corporate social responsibility as a way to bring about mutual progress. For this purpose, the goal of corporate internal control is expanded from the original three COSO goals to four major goals with the inclusion of corporate social responsibility. The goal of corporate social sustainable development can be considered complete, and the goals of internal control can be achieved under the guidance of social responsibility.

When an organization commits itself to the development and implementation of activities related to social responsibility, the company’s stakeholders perceive that the organization is fulfilling its social responsibilities and is aligned with the common interests of stakeholders. Society is satisfied with the performance of the organization. Employee recognition of the organization’s socially responsible behavior indirectly impacts future performance and pursuit of excellence. The purpose of investment in CSR is not only to improve the internal efficiency of the company, to achieve reliability, but also to comply with related laws and regulations [

55]. At the same time, social returns can also be expected from corporate socially responsible behavior.

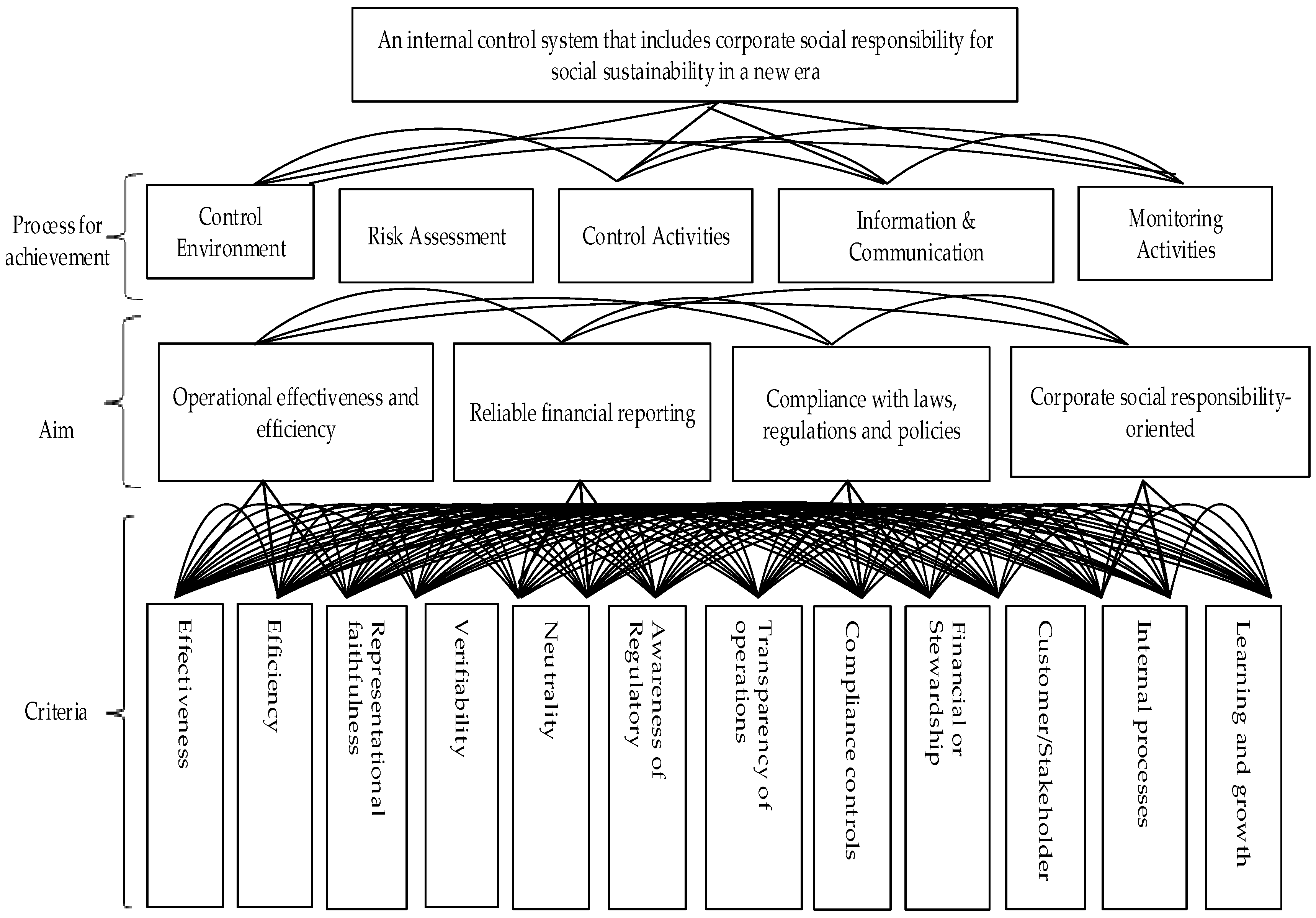

A study of the impact of the interaction of internal control coupled with CSR on corporate performance by Zhu and Sun [

56] showed that the main advantages of implementing CSR practices for internal or external stakeholders affect the company itself, suppliers, government, employees, and customers/stakeholders. Based on a review of the extant literature, we prepared and pre-tested a questionnaire in consultation with domain experts. The questionnaire includes 4 dimensions and 12 important criteria. The integrated framework for an internal control system with innovative and practical guiding CSR values is shown in

Figure 1 and

Table 1. It is hoped that a win-win relationship between the enterprise and society will be realized.

3. Methodology

3.1. Data Collection and Empirical Case

The dimensions and criteria of an internal control system that includes corporate social responsibility for social sustainability are often not independent but rather affect and interact with one another. As shown in

Figure 1 and

Table 1, we have collected a series of factors that can improve the effectiveness of internal control with innovative and practical guiding values for CSR obtained from the literature review and expert opinion. The four aspects having significant impact on the implementation of this new CSR-oriented internal control socially sustainable system, four aspects have a potentially significant impact are:

Accordingly, the research process described in the paper is designed to include three phases: the pre-test questionnaire, the official questionnaire and the application of the survey to empirical cases. In the first phase, a pre-test questionnaire was designed to find a limited number of criteria from a single perspective in order to ensure the validity of the pairwise comparison [

57,

58]. The eighteen domain experts included 7 auditors of local CPA firms, 3 officials from the Financial Supervisory Commission in Taiwan, 4 members of CSR policy committees in listed companies and 4 academicians that specialize in internal control.

These domain experts all had a profound theoretical or practical understanding of the sustainability of internal control or corporate social responsibility. Among the participants, the 7 accountants had not only been involved in the actual case review of an internal control system project for the past three years, but also had relevant experience in the preparation of corporate social responsibility reports. They answered the pre-test questionnaire face-to-face in order to identify the most important criteria from a pool of criteria drawn from prior studies.

The pre-test questionnaire responses were rated in the range from 0 to 10 with a high score representing greater importance. The important criteria were selected based on triangular fuzzy numbers (with a mean of 8 or above). The evaluation criteria for a corporate social responsibility-oriented internal control system are shown in

Table 1. The operational performance aspect is affected by two criteria: effectiveness, and efficiency; the financial reporting aspect is affected by three criteria: representational faithfulness, verifiability, and neutrality; the regulatory compliance aspect is affected by three criteria: awareness of regulations, transparency of operations, and compliance controls; the corporate social responsibility aspect is affected by four criteria: finances or stewardship, customers/stakeholders, internal processes, and learning and growth.

In the second phase, the official questionnaire was formulated according to

Table 1. Respondents received instructions on how to complete the questionnaire before answering the questions. Each subject spent 20–30 min completing the questionnaire. The respondents were either chief executive officers or senior managers in Internal Control departments. A total of 178 survey responses were retrieved: among the respondents, 59.6% were male and 84.3% had over 9 years’ work experience. All of the respondents were based in Taiwan.

Table 2 presents detailed information about the survey participants.

In the third phase, we invited each of the aforementioned dual-experienced CPAs to provide a case as an example for empirical analysis; which provided us with, in total, seven cases. The seven case companies are listed companies that have been selected as Excellence in CSR in Taiwan. Next, the CPAs were asked to assign linguistic values to the seven different cases for the twelve criteria for the CSR-oriented internal control social sustainable system proposed in this study. The questionnaire was designed to obtain performance values, which were very good, good, median, poor, and very poor, which were transformed by scaling into the numbers: 100, 75, 50, 25, 0, respectively. Finally, we use the weighted average method to calculate the individual scores of each company in different indicators. In the meanwhile, the final values obtained can be applied by VIKOR to evaluate the overall performance gap in empirical cases’ sustainability performance of CSR-oriented internal control system.

3.2. Research Design and Operational Procedure of the Decision-Making Model

In prior studies, most hypothetical performance evaluation models consider the evaluation dimensions and criteria to be independent. However, there are mutual interactions between the evaluation dimensions and criteria [

65,

68]. Hwang and Yoon [

69] noted that the MADM is able to simultaneously consider multiple attributes of the research topic to help decision-makers evaluate each alternative, to set priorities according to specific characteristics, and to finally select the best solution. Nekhili et al. [

70] also pointed out that the relationships between CSR and internal control variables are more complex and less linear than many scholars have assumed. Therefore, MADM is a very suitable technique that can be used to solve the dynamic problems that arise in the evaluation of the social sustainability internal control performance in the real world.

In this approach, the DEMATEL (Decision Making Trial and Evaluation Laboratory) technique, the DEMATEL-based Analytic Network Process (DANP), and the modified VlseKriterijumska Optimizacija I Kompromisno Resenje (VIKOR) method are included. The multiple attribute decision making (MADM) method combined with these three analytical techniques can not only prioritize the criteria based on the intensity of their interrelations but also identify the root of the problem to help formulate optimal improvement strategies, in turn facilitating effective resource allocation and continuous, dynamic improvement targeting the needs of the sustainability objective of internal control conditions.

The detailed operational procedure of the decision-making model is divided into three phases based on the three analytical techniques. The calculations involved in each phase are illustrated in

Figure 2. First, the DEMATEL technique is used to construct an influential network relation map (INRM) to show the relationships among these evaluation dimensions and criteria.

The DEMATEL technique was developed for the purpose of explaining specific societal problems based on a network relation diagram and a structural model. The DEMATEL can clarify the interrelations among criteria, thereby lifting the restriction imposed by the assumption in conventional analytical techniques that the assessment criteria are independent of one another [

71]. In addition, DEMATEL can perform prioritization and standard selection despite conflicts among the attributes. It can also use the ideal standard as a benchmark rather than a relative standard to avoid having to select the best option out of a bad batch. Last, but not least, from the results obtained by executing the DEMATEL one can propose improvement strategies systemically at the source of the impacts. Therefore, these basic concepts are used to create a series of new hybrid MCDM models to solve complex and dynamic real-world problems [

72,

73,

74,

75]. The details of DEMATEL are shown in

Appendix A.

After building an influential network relation map with DEMATEL, the DANP technique is used to obtain the influential weights. First, the total influence matrix

T was vertically partitioned according to different dimensions. The criteria under each dimension are added up horizontally. Afterward, each criterion in the partitioned matrix is divided by the horizontal sum of the dimension to which it belongs to obtain the normalized matrix

. Eventually, the limit supermatrix is computed by multiplying the weighted supermatrix

W by itself to achieve a convergent and stable matrix

. The ANP combined with the DEMATEL can provide the DANP influential weights (also call the “global weights”), thereby resolving the interdependence issue, making this technique more appropriate for real world applications. The DANP is described in detail in

Appendix B.

Finally, a modified VIKOR approach is adopted to evaluate the socially sustainable internal control performance for continuous improvement. Opricovic and Tzeng [

10] developed the VIKOR approach, which solves MADM problems when conflicting criteria are present. The VIKOR method uses the class distance function based on the idea of an aspired level to a worst level to rank all the solutions [

76,

77]. The modified VIKOR is not only applied to rank and select optimal alternatives but is also used for performance gap improvement among the criteria and their dimensions, even for the overall performance gap. Thus, this new model provides more accurate information about the gap between the current sustainability performance in the empirical cases and the target level. This information can help decision makers understand the sustainability performance in empirical situations covering the range from the target level to the tolerable level for all dimensions and criteria. The details of the modified VIKOR are presented in

Appendix C.

A diagram of the socially sustainable internal control performance evaluation method is illustrated in

Figure 2.

4. Empirical Analysis of Sustainable Internal Control Performance

This paper first discusses the relationship between the dimensions and criteria for sustainable internal control performance obtained by using the DEMATEL technique, based on the questionnaire results from domain experts. Second, the DANP method is used to determine the weights of these evaluation criteria. Lastly, the author applies the influential weights calculated above for empirical analysis of case studies and employs the modified VIKOR method to evaluate the overall performance gap of the case companies’ sustainability performance and to identify priorities for improvement strategies based on INRM. The results of DEMATEL for Analyzing the Relationships Between Dimensions and Criteria are obtained as shown in

Appendix D.

Zhu and Sun [

56] concluded that there are several advantages to using a mixed multi-criterial decision analysis model: DEMATEL can clarify the interrelations among criteria, thereby lifting the restriction imposed by the assumption in conventional analytical techniques that the assessment criteria are independent of one another; prioritization and selection of criteria can be carried out despite any conflicts among the attributes; using the ideal standard as the benchmark instead of a relative standards one can avoid selecting the best option out of a bad batch; this model can be used to systematically propose improvement strategies at the source of the impacts.

As shown in

Table 3, the sum of the influence of each dimension and criterion can be derived by applying Equations (A5) and (A6) in DEMATEL’s step 3. INRM in

Figure 3 illustrates the influential network-relationship from the 4 dimensions and the subsystem of the CSR-oriented internal control system. According to the value of influence given

, operational performance (A) is influenced by reliable financial reporting (B), compliance with laws, regulations and policies (C), and corporate social responsibility-oriented (D), because the

value of operational performance (A) is negative and a minimum (−1.263). The dimensions with positive values of

have great influence on the other dimensions. Meanwhile, the sum of the compliance with laws, regulations and policies (C) has the highest value with

(3.086) while the sum of operational performance has the lowest value with

(2.112).

The criteria with negative values of

are greatly influenced by the other criteria. A significantly positive value of

represents that this criterion affects the other criteria much more than the other criteria affect it, which means it should be given priority for improvement. In turn, reliable financial reporting (B) is influenced by compliance with laws, regulations and policies (C) and corporate social responsibility-oriented (D), whereas compliance with laws, regulations and policies (C) is influenced by corporate social responsibility-oriented (D). Thus, to improve the dimension of operational performance (A), improvements to reliable financial reporting (B), compliance with laws, regulations and policies (C), and corporate social responsibility-oriented (D) should be emphasized. In turn, to improve the dimension of reliable financial reporting (B), improvements to compliance with laws, regulations and policies (C) and corporate social responsibility-oriented (D) should be emphasized. Finally, it should be noted that corporate social responsibility-oriented (D) with a maximum value of

(1.309) has the most influence on the other dimensions. Therefore,

Figure 3 illustrates the priority of influence of the four dimensions from four perspectives which are, in order corporate social responsibility-oriented (D), compliance with laws, regulations and policies (C), reliable financial reporting (B), and operational performance (A).

Table 3 and

Figure 3 show the results of the analysis of each criterion. It can be seen that in the dimension of operational performance (A), effectiveness (a1) is the most important criterion (

= −1.442), whereas efficiency (a2) is the least influential (

= −1.519). Management that pursues efficiency will attach greater importance to maintaining internal stability and the status quo; while management that pursues effects will attach more importance to external changes and pursues innovation. However, it is often difficult for companies to maintain a balance between the two. In terms of the difference between “efficiency” and “effectiveness”, the former refers to “do things right” while the latter refers to “do the right thing.” Now management is paying more attention to effectiveness. The pursuit of effectiveness must be concerned with change. For corporate social responsibility, companies can not only increase economic effects, but also attract additional external benefits to the company. Thus, effectiveness is the most important criterion in the dimension of operational performance.

In the dimension of reliable financial reporting (B), verifiability (b2) is the most important criterion ( = −0.267), whereas representational faithfulness (b1) is the least influential ( = −0.713). With consideration of cost-effectiveness and importance, for information to be faithfully expressed or reasonably presented, it must be considered reliable. Whether or not it is reliable is determined as follows: first of all, information must be verifiable, and accounting information must not be affected by the personal biases of the measurer. Second, for the selection or disclosure of accounting principles or policies, the accounting information generated should be crucial in nature. It should faithfully express the economic reality rather than merely focusing on economic consequences. Accounting-related information should not be manipulated. In this way, the information required by the internal control system for planning, supervision, etc. can be obtained or revealed in a timely manner and provided to all stakeholders. The effectiveness of the information and communication systems will affect the effectiveness of the internal control systems.

In the dimension of compliance with laws, regulations and policies (C), awareness of regulations (c1) is the most important criterion ( = 0.294), whereas transparency of operations (c2) is the least influential criterion ( = −0.213). As part of a social organization, a company’s operations should comply with the laws and regulations of the state and there is a basic obligation for the company to fulfill its social responsibilities. Internal control, from the perspective of auditing, is meant to ensure that enterprises fulfill basic social obligation. The starting point for internal control of auditing is to be aware of relevant laws and regulations and to implement effective compliance control. Enterprises spontaneously implement measures for internal control and strive to comply with national laws. On the one hand, they want to reduce their own legal risks while on the other hand, fulfill their basic corporate responsibilities and obligations to society. Through the establishment of coordinated internal control mechanisms, enterprises can fulfill their contractual goals as well as their social responsibilities for a harmonious society.

In the dimension of corporate social responsibility-oriented (D), customer/stakeholder (d2) is the most important criterion with a stronger influential effect ( = 1.485), whereas financial or stewardship (d1) is the least influential criterion ( = 0.679). From the perspective of corporate social responsibility, customers are also viewed as stakeholders that need to be satisfied in addition to the company’s shareholders. Therefore, in addition to meeting the expectations and vision of shareholders, companies need to actively fulfill their social responsibilities. In order to improve operations and assist the board of directors and management to fulfill their responsibilities, the company should facilitate the learning and growth of employees, establish a complete internal control system and internal processes, and ensure the effective use of finances and resources.

4.1. Using DANP for Calculating the Weights of the Criteria

In the next section, we expect to obtain the most accurate influential weights after confirming the influential relationships among the criteria. By utilizing a combination of the DEMATEL and ANP methods, the influential weights of DANP for each criterion can be obtained as shown in

Table 4. The DANP approach allows us to derive the local weights of the assessment factors at their respective hierarchical levels and global weights, which helps us understand the absolute weights of individual criteria across all four dimensions. The DEMATEL total influence-relation matrix is used to construct the weighted supermatrix by applying Equations (A10) and (A11) in DANP’s step 2. The weighted supermatrix for each criterion can be obtained by applying Equations (A8) and (A14). Consequently, the limit supermatrix is used to obtain the global weights of the elements, which are applied to the modified VIKOR approach to evaluate the sustainability performance of the case companies.

4.2. Performance Measurement of Empirical Cases

The compromise ranking method is an applicable technique that not only assists researchers to evaluate the overall performance gap in empirical cases’ sustainability performance of CSR-oriented internal control system, but also to identify and prioritize improvement strategies. The evaluation results of the modified VIKOR method are obtained as a performance matrix as shown in

Appendix E.

The values of

,

, and

are computed by selecting

v = 0.5 based on Equations (A16) and (A17) and the results are shown in

Table 5. The values of “concordance” (

) and “discordance” (

) represent the group utility and the individual regret measures, respectively, for alternative

. From this table, it can be seen that the values of

are (A1, A2, A3, A4, A5, A6, A7) = (0.337, 0.272, 0.142, 0.326, 0.341, 0.314, 0.576, respectively), with the ranking of

; the values of

are (A1, A2, A3, A4, A5, A6, A7) = (0.500, 0.500, 0.250, 0.500, 0.500, 0.550, 0.750, respectively), with the ranking of

. In addition, the values of

are (A1, A2, A3, A4, A5, A6, A7) = (0.419, 0.386, 0.196, 0.413, 0.420, 0.432, 0.663, respectively). Therefore, the empirical cases are ranked as follows:

, where

means the A is preferred to B. If an alternative is the closest to the ideal solution, it has the smallest value of

. Meanwhile, a compromise solution could be accepted by the decision-makers because it provides the maximum “group utility” (measure

represents “concordance”), and a minimum of individual regret of the “opponents” (measure

represents “discordance”) [

78]. The results show the A3 has the best performance overall and is the closest to the ideal point. The performance variance rate of A3 is 0.196 indicating that there are still some gaps (0.196) to the goal value (0). In contrast, A7 is the farthest from the ideal solution, because if its larger

value (0.663) than the others.

Given these results, conditions C1 and C2 are satisfied. Hence, A3 has an acceptable advantage; in other words, Q[2] − Q[1] = 0.19 DQ = 0.077. In addition, A3 is stable within the decision-making process; in other words, it also has the best rank in R [·]. Therefore, A3 is the best alternative among the seven empirical cases. There are no other compromise solutions in these case studies.

5. Management Implications and Discussion

Given the importance of the role enterprises play in society, corporate social responsibility is receiving increasing attention in relation to long-term development. Corporate social responsibility is one of the factors that enhance the competitiveness of an enterprise. It contributes to the realization of the long-term economic goals of the enterprise and is key to the company’s long-term success under the current socio-economic environment.

The research results from the modified VIKOR method show that the companies in these empirical cases performed poorly in terms of the aspects of corporate social responsibility aspect (D), compliance with regulations (C) and operational performance (A). The average variance rates for these criteria are 0.429–0.157, as shown in

Table A5. First, particular attention should be given to the dimension of corporate social responsibility (D) with the criterion of the customer/stakeholder (d2) within this dimension being in most urgent need of improvement. Next, the dimensions of compliance with regulations (C) and operational performance (A) have the second highest variance rate.

With the rapid development of the economy and society, and continuous improvement in the people’s quality of life, education, and civilization, consumers have changed from being merely concerned with the satisfaction of their own needs to concern for the future development of society as a whole. Enterprises should therefore be customer-centric, actively thinking about how to combine internal processes, employees’ learning and growth, as well as financial and resource allocation, to promote excellence, so that companies can continue to maintain competitiveness and sustainable development.

Secondly, in the dimensions of compliance with regulations, companies have long considered their own interests as having priority, coupled with fear of punishment. Therefore, although there is greater compliance with relevant laws and regulations, the construction of internal controls for social responsibility-oriented self-development is relatively insufficient. In order to fulfill its role as a social organization, enterprises need to conduct on-the-spot inspections and review the company’s compliance with regulations on issues such as product safety, environmental safety, labor safety, personal data protection, and corporate social responsibility through the establishment of a harmonious internal control mechanism, especially for major social security incidents in recent years. Enterprises should also expand the scope of their internal control objectives, actively achieve their goals of fulfilling social responsibilities to produce a harmonious society.

Next, within the aspect of business operation performance, the value of the company usually consists of two parts. The first part is corporate value in the traditional sense, that is, the return of value for capital based on the cash flow from assets which reflects the value of the asset’s future profitability. The second part is the value of positive externalities brought about by corporate social responsibility. Enterprises usually only strive to pursue their own interests, to avoid punishment, with less efforts at deriving the positive external effects of social responsibility. For this purpose, companies need to weigh the relationship between the company, the community, and society, to obtain government support, optimize the company’s living environment, and actively take care of the interests of all parties, thereby realizing greater social value for the company.

Moreover, business operations mostly focus on short-term operating efficiency, paying little attention to long-term social responsibility; social responsibility is seldom incorporated into management objectives. As a result, the process of operational effectiveness sometimes contradicts the goals set by the company, resulting in a conflict between the company’s goals and the stakeholder’s goals and vision. Therefore, apart from seeking corporate profits, companies should also actively respond to corporate social responsibilities through technological and managerial innovation, improve environmental protection measures, to bring the company’s operating results more in line with the interests of various stakeholders. Finally, the results indicate that within the dimension of financial reporting (B) the company performs relatively well in terms of the criteria representational faithfulness (b1) and verifiability (b2). These two criteria have the second lowest variance rate, but improvement is still needed in order to produce the accounting-related information that stakeholders care about, such as green accounting, environmental investment, carbon emissions, other environmental accounting information, etc.

6. Conclusions and Future Research

In the past, the corporate social responsibility and internal control fields conformed to the development of the enterprise. Each had its own history and development process, forming two independent disciplines each with its own theoretical framework. However, because there is too much emphasis on theory, these disciplines are not compatible with practice, with bottlenecks and problems derived from corporate practice. For example, the theoretical goal of corporate social responsibility cannot be achieved, although the internal control objectives have been reached. The expectations of interested people could not be met. The failure of internal control not only causes the company to suffer great losses, but has also hurts the long-term accumulation of goodwill, along with the loss of related stakeholders.

The goal of internal control is to identify, analyze, and control risks by integrating corporate social responsibility goals into corporate strategic goals. Then, in compliance with regulations, the internal control report on corporate social responsibility (whether individual reports or embedded in the internal control report) is compiled and disclosed, and internal control evaluation reports and audit reports on corporate social responsibility are generated based on the statutory procedures and the company’s procedures. Therefore, the company can promote the efficient allocation of various stakeholders’ capital and the equitable distribution of equity, and realize the maximization of comprehensive value including the economic, social and environmental benefits to the company. Finally, socially-oriented internal control objectives will promote the harmonious co-existence of enterprises and society and the sustainable development of the company itself.

Effective internal controls can help companies realize the maximization of corporate value; actively shouldering social responsibilities not only helps companies create profits, maximize economic value, but also contributes to the long-term development of the company. As a for-profit organization, it is indeed important for companies to achieve financial goals but these are not the only goals. The goals of internal control can integrate the motivation to pursue profit with social performance from the perspective of a broad-based stakeholder, reduce the waste of resources, and achieve corporate comprehensive social responsibility. Therefore, corporate social responsibility is the driving force for the improvement of internal control. The effectiveness of internal control is the guarantee for the company to fulfill its social responsibility.

In sum, this article uses the management tool of the balanced scorecard, commonly used in the current strategic management theory to incorporate corporate social responsibility into the internal control objectives, and to synthesize a framework for internal control and corporate social responsibility. Therefore, this method not only can further integrate theory and practice, but can also transform the abstract vision of corporate social responsibility into tangible, concrete and practical goals and measurement indicators. It is hoped that we can achieve comprehensive internal control objectives for the sustainable development of a company.

In addition, this work makes several contributions to the sustainability performance literature. First, the focus is on the sustainability performance of CSR-oriented internal control, which has rarely been studied in the prior literature. Second, this paper establishes a hybrid MCDM model combining DEMATEL with ANP and VIKOR based on BSC to evaluate the sustainability performance of empirical cases. This model is able to illustrate the influential network among the criteria for Taiwanese social sustainability internal control performance, which has been ignored in traditional models that have presumed the dimensions and criteria of sustainability performance to be independent and hierarchical in structure. Furthermore, this model presents the key factors and their weights of CSR-oriented sustainability performance, which were not provided by models in prior internal control performance studies.

This study is of course subject to several limitations. At present, in academic research on the internal control of corporate social responsibility, the main problems are the lack of basic theoretical research, and lack of determination of the interactive mechanism between social responsibility and internal control. The lack of clarity about the interaction directly leads to problems with constructing the theoretical framework. Although, the content of social responsibility is incorporated into the objectives of internal control, the understanding of the concept of sustainable development performance, and the objectives of future internal controls should also be adjusted and developed with changes in the environment. For example, other criteria related to economic, environmental, and social factors should be considered in future. Such considerations will make for more complete, concrete and operational internal control objectives.

In addition, in practice, the construction of the internal control framework for social responsibility is still limited to the development of industries or companies that have already experienced major accidents. There are few studies in other industries or of companies with high social responsibility risks. The lack of systematic and comprehensive research results may weaken the guiding role of the application of theories in practice, and may eventually lead to a disconnect between the development of theory and practice. In the case study herein, this paper investigates only empirical cases in Taiwan. Therefore, further applications of this model and comparative studies can be conducted based on the data of firms or industries from other countries.

Finally, research on the internal control of corporate social responsibility in future will turn to the mechanism for the realization of internal control of social responsibility, control paths, performance evaluation, internal control auditing of social responsibility, and reporting of internal control of social responsibility information. The research of the internal control framework system of social responsibility also highlights the connotation of “social responsibility”. At the same time, the case study of internal control of social responsibility in different industries will also become an important area of research. By promoting the development of internal control of enterprises, and then expanding to other industries, it can eventually be extended to the country, or the appropriate industry to establish an internal framework for supporting the industrial social responsibility.