1. Introduction

In the process of economic development, the formation of capital is crucial, regardless of its origin. In view of finding a solution to this problem, developing states rely on foreign capital, constructing strategies to attract FDI in order to support development. It is considered that foreign capital facilitates the reduction of saving constraints, by increasing savings availability, and the reduction of commercial constraints, by extending the beneficiary country’s import capacity. In this way, the flow of foreign capital influences savings and national investment and promotes economic growth. Empirical evidence available regarding the impact of foreign capital flow on inner savings and economic development in general is divided into two categories. While a series of studies has shown that foreign capital flows lead to an accumulation of savings, others have noted that the former replace the savings and generate an increase in consumption, stimulating economic growth differently. More than that, some identified the channels through which the increase of foreign capital flows leads to a decrease in savings (Griffin [

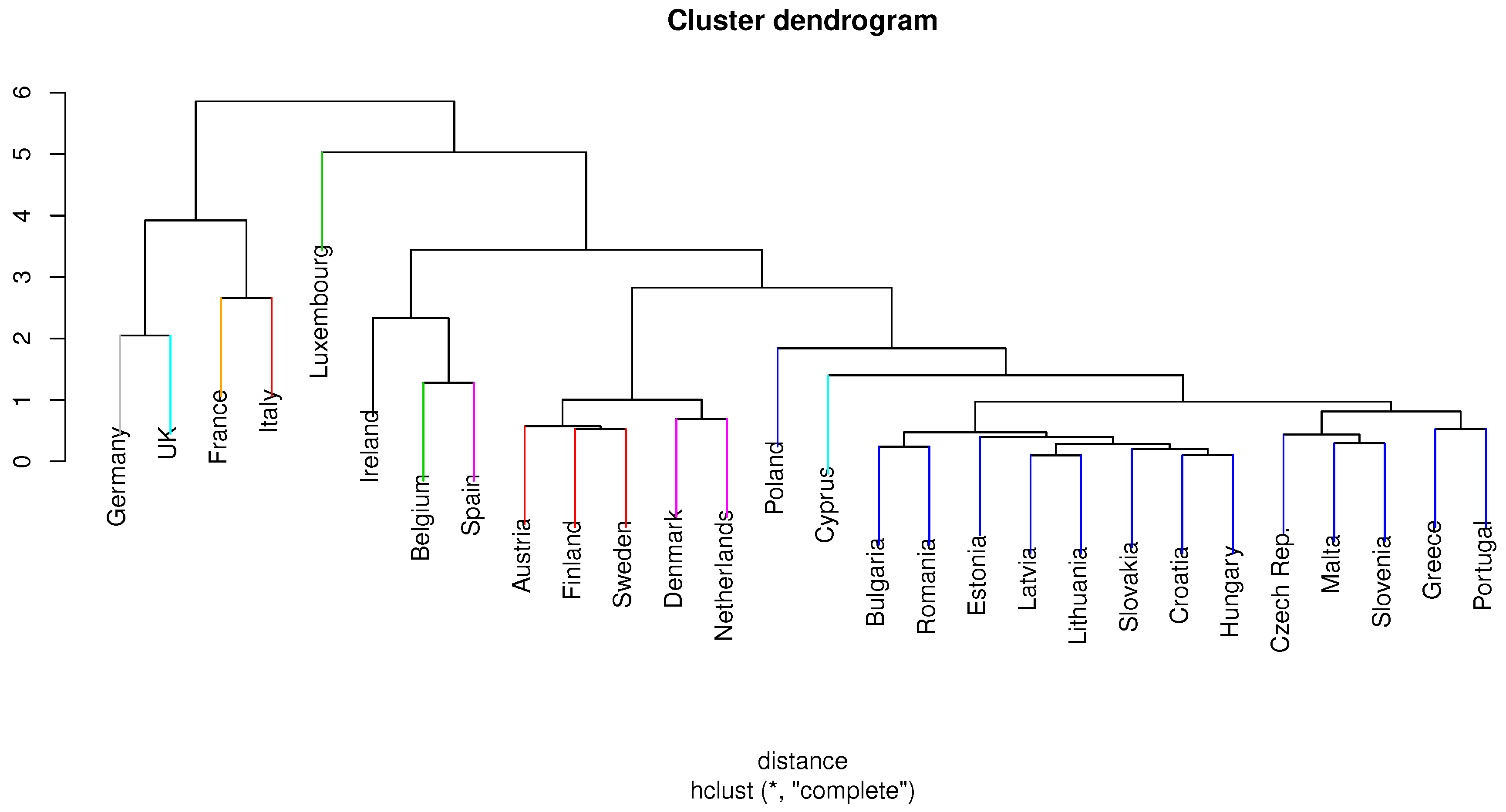

1]). Together with the FDI, developing economies are benefiting more and more from another substantial flow of financial resources, immigrant remittances, that came predominantly from developed economies to developing ones. Because immigrant remittances represent a substantial flow of financial resources, the role of this financial flow in economic development is an important issue both for researchers and policymakers. However, whether remittances are really flows of investment capital is still a debated issue, and because of that, it deserves cautious examination, because of its substantial implications for policymakers. We focused on a group of Central and Eastern European countries that traditionally had been an area of emigration before their accession to the EU, and this became more consistent after the accession to the EU. From initial panel data of the EU28, we chose a panel of data of EU7, with seven countries from Central and Eastern Europe: Romania, Bulgaria, Croatia, Czech Republic, Hungary, Slovakia and Slovenia, according to the hierarchical cluster analysis methodology and geographical area. In our study, we focus on foreign direct investment and remittances; among the most important external financial resources starting with the year 1980. For the selected countries, the question we intend to approach is if remittances behave in the same way as other capital flows, especially FDI. In particular, the assumption is that remittances would have a positive correlation with output growth if they are like other capital flows, such as FDI.

We study one specific aspect of migration: the role of remittances on the macroeconomic performance of selected Central and East European Countries (CEEC), and at the same time, we consider it important to analyze which of the two components of foreign capital flows, remittances or FDI, have the biggest impact on the GDP of the analyzed states. It should be emphasized that this is only one face of the analysis of the behavior of remittances and their impact on the source country economy, and therefore, our conclusions and any policy implications should be taken with caution and correlated with other results. We are using panel data design that allows for correlation between unobservable individual effects and observable determinants of behavior. In our approach, we choose heterogeneous data with the following fields: countries, foreign direct investment, remittances and economic growth, because no control of this implied obtaining biased results like in Baltagi and Levin [

2].

Our findings underline that in EU27 countries, foreign direct investment capital and remittances have a positive impact on economic growth. Research limitations on EU7 countries in the period 2010–2016 with panel data analysis involve annual data covering a short span of time for each individual. The implication of remittances is the same as foreign direct investment and private capital inflows to support economic growth.

The outline of this paper is as follows:

Section 2 presents the literature review.

Section 3 underlines the materials and methodological issues. In

Section 4, results and discussions are presented. In

Section 5, we provide the conclusions.

2. Literature Review

A state’s major purpose lies within the growth of the economic level and the welfare of the population. The changes in foreign direct investment, remittances and exports determine the evolution of the level of growth in a state. Foreign direct investment is the most important external financial resource that contributes to the economic development of beneficiary states.

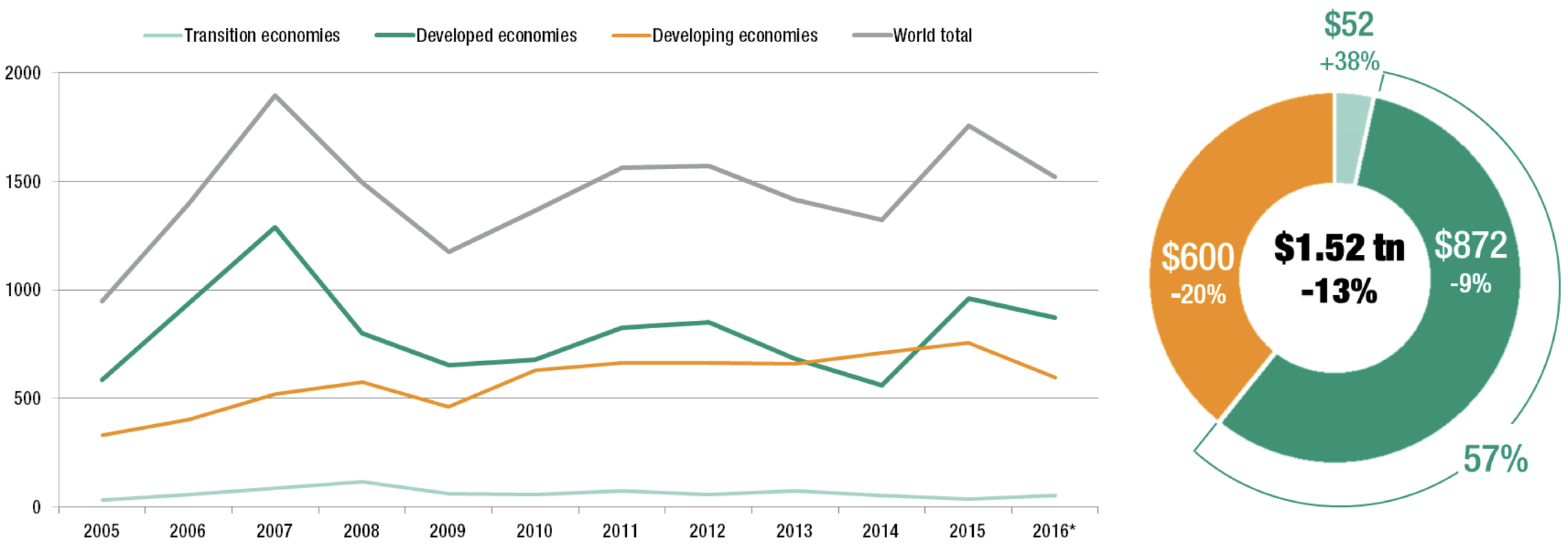

According to official UNCTAD data (2017) (

Figure 1), FDI entries for the year 2015 went over

$1600 billion globally, with more than

$600 billion directed towards poorly-developed states. Developing countries work on promotion strategies that will attract FDI te Velde and Loewendahl [

3,

4,

5], as a consequence of the positive impact it has on the economic growth. Caves [

6] demonstrated that FDI leads to an increase in the productivity of companies, with a technological transfer happening from foreign companies to local ones Glass and Saggi [

7] and Saggi [

8].

Technological transfer may take place either via a workforce that was active in foreign companies or the introduction of new products on the market of the beneficiary country Caves [

9]. Therefore, FDI contributes to the growth of the level of technology implementation and modernization and, implicitly, to economic growth. There are, however, opinions, according to which the influence of FDI on economic growth of beneficiary states is conditioned by certain factors. Studies demonstrate that the impact of FDI on economic growth depends on the level of education and training the workforce possesses Borensztein [

10]. The higher the qualification level of the workforce, the more FDI contributes to the growth of the economic level. On the other hand, Blomstrom [

11] claims that FDI has a strong impact on economic growth if the beneficiary state is wealthy; vice versa, FDI has a larger impact on developed states than on less developed ones, and the level of qualification of its workforce is not at all relevant. Sustaining the idea that FDI impact on economic growth is higher in developed states, Balasubramanyam [

12] and Nair-Reichert [

13] observed that a state’s commercial openness is primordial in view of obtaining major impacts of FDI on economic growth.

Analyzing FDI coming from the USA to developing countries, Nunnenkamp [

15] stressed that the impact of FDI on economic growth is dependent on the characteristics of the industrial sector and the beneficiary country. In states with lower GDP per capita levels, low education level, little infrastructure and low commercial openness, the impact of FDI on economic growth was small (Mottaleb [

16]). Alfaro [

17] demonstrated the positive impact of FDI in states with a developed financial market; as long as the financial market is underdeveloped, FDI exerts no influence over the level of economic growth Azman-Saini [

18].

Carkovic [

19] showed that FDI does not impact the level of economic growth of states, regardless of their level of development. Beugelsdjijk et al. [

20] sustain that FDI influence on the economic growth of developing countries is ambiguous. Following foreign direct investment, remittances seem to represent the second most important financing source for the development of a state. In the past 15 years (

Figure 2), the volume of remittances has increased substantially, as a result of the increase in the number of international migrants, according to data supplied by the UN, the number of international migrants went over 243 billion people in the year 2015, with over 70 million people more than compared to the year 2000, [

21].

According to official World Bank data [

22], the volume of remittances grew from more than

$100 billion in the year 2000 to nearly

$600 billion in the year 2015, although it is difficult to estimate the real value of remittances transferred to the countries of origin through unofficial channels. Thus, remittances have become an important source of financial flux, after foreign direct investment, surpassing the volume of official assistance for development, starting with the year 2000.

Within the European Union in the year 2015, according to data presented by Eurostat [

23], the states with the greatest remittance share in the GDP were Latvia and Croatia, with 5% and 4.3% respectively. The high level of remittance share in the GDP is determined by the dependence of the population on these external financial income sources.

At present, there are contradictory opinions as regards the impact of remittances on the growth of the economic level a state has. Much of this disagreement centers on a discussion about whether remittances are in fact a form of capital transfer or only income. Some specialists claim there is no connection between the evolution of remittances and the economic growth of the country of origin, while others say that remittances have either a positive or a negative effect on the level of economic growth. Barajas et al. [

25] analyzed the connection between remittances and the level of economic growth of 84 beneficiary states in the period 1970–2004 and observed that in the case of some states, remittances exerted no influence on the gross domestic product, while in other analyzed states, the impact was a negative one.

Posso [

26] and Chami et al. [

27] analyzed households that benefited from remittances and noted that these have a lower workforce participation rate as compared with non-migrant households. Besides, countries of origin are confronted with a reduction of the workforce offer Hanson [

28], a phenomenon that halts economic growth. At the same time, remittances are frequent in consumption. Entzinger [

29] observed that the biggest share of remittances goes towards expensive import goods Adams [

30], thus discouraging small internal producers Zarate-Hoyos [

31]. Directing remittances towards consumption attracts, in its turn, an increase in the monetary mass in the country of origin, thereby generating the appearance of inflationist processes Ratha [

32]. Similarly, the increase of the volume of remittances in undeveloped states leads to an increase in the real exchange rate and the birth of the Dutch disease phenomenon Acosta [

33], and Lopez [

34]. In spite of all this, Adams et al. [

35] demonstrated, following a study that focused on 71 developing countries, the positive impact of remittances on economic growth. Thus, an increase by 10% of remittance per capita contributes to the reduction of the level of poverty by 3.5%. Ratha [

36] claims that remittances have a positive influence on the increase of population income, leading to the reduction of the unemployment rate.

A study performed by Giannetti et al. [

37] in the Eastern states of the European Union (Slovenia, Poland, The Czech Republic and Hungary), demonstrated the existence of the link between remittances and economic growth of the countries of origin. Giuliano et al. [

38] carried out a study that included 100 developing countries over the period 1975–2002, demonstrating the strong link between remittances and economic growth, the biggest impact being registered in the developing countries that have a lower level of financial sector development.

This finding is supported also by Pradhan et al. [

39], who use random effects and fixed effects estimators and find that remittances have a positive impact on economic growth across a group of 39 developing countries. Standard growth models where FDI and migrant remittances are all introduced as components of investment (Burnside and Dollar [

40], Catrinescu et al. [

41]) are also available. In this type of model, it is considered that each financial flow finances the investment that determines economic growth. Catrinescu et al. conclude that the effect of remittances on economic growth depends on the way in which remittances are used and highlights the ability of policymakers and institutions to encourage or require remittances to be invested in order to generate significant economic benefit. In this perspective, our idea is not only to highlight the importance of FDI and remittances for growth, but to explore the relationships between these variables.

4. Results and Discussion

Starting from the remittance flows and investments received by the seven analyzed states, we checked, using empirical studies based on descriptive and inferential statistics, the existence of a correlation between the gross domestic product and the entries of remittances and foreign direct investments. For econometric calculations, the software R was applied, using gross domestic product, foreign direct investment flows and remittances for the period 2010–2016.

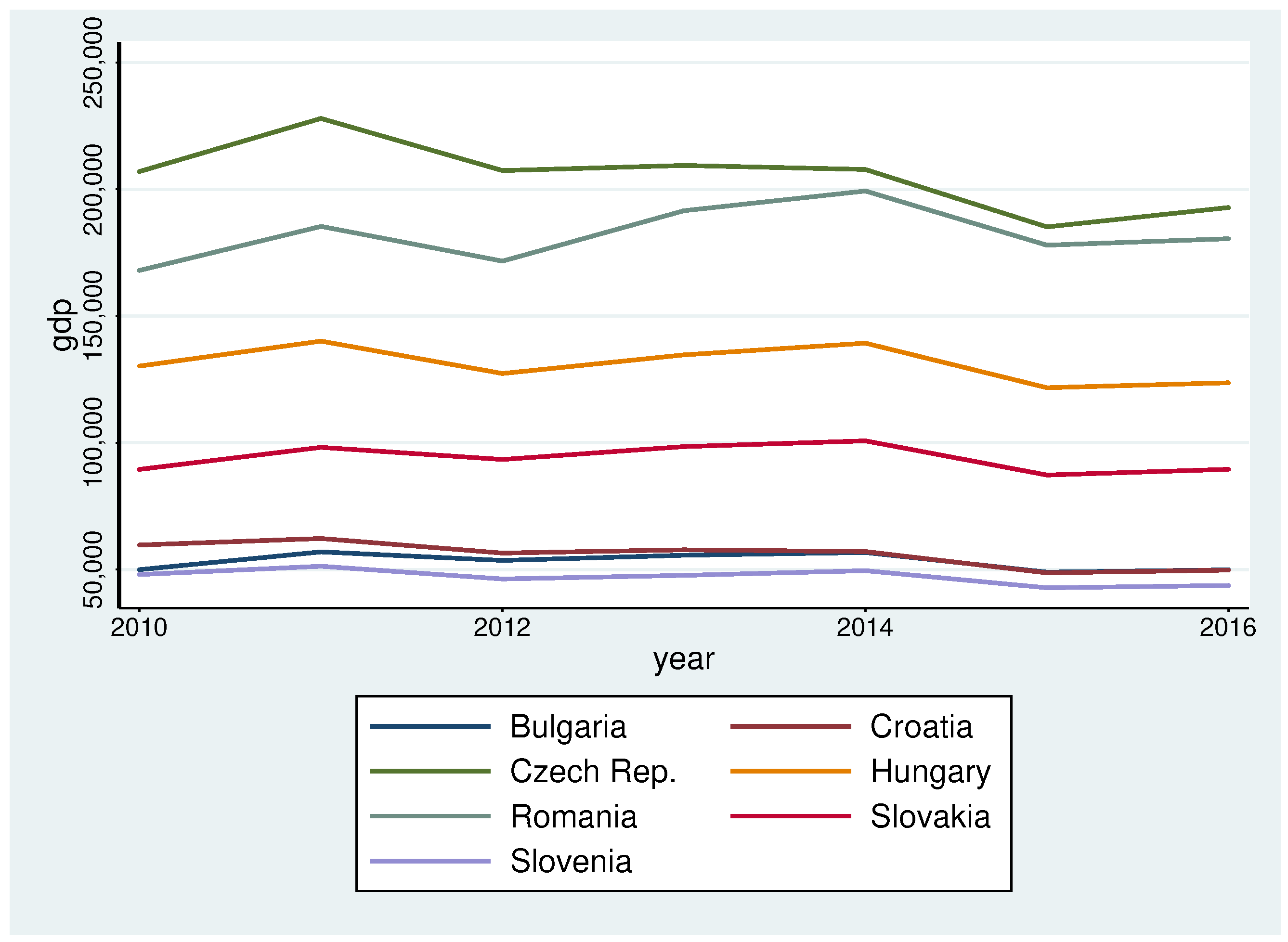

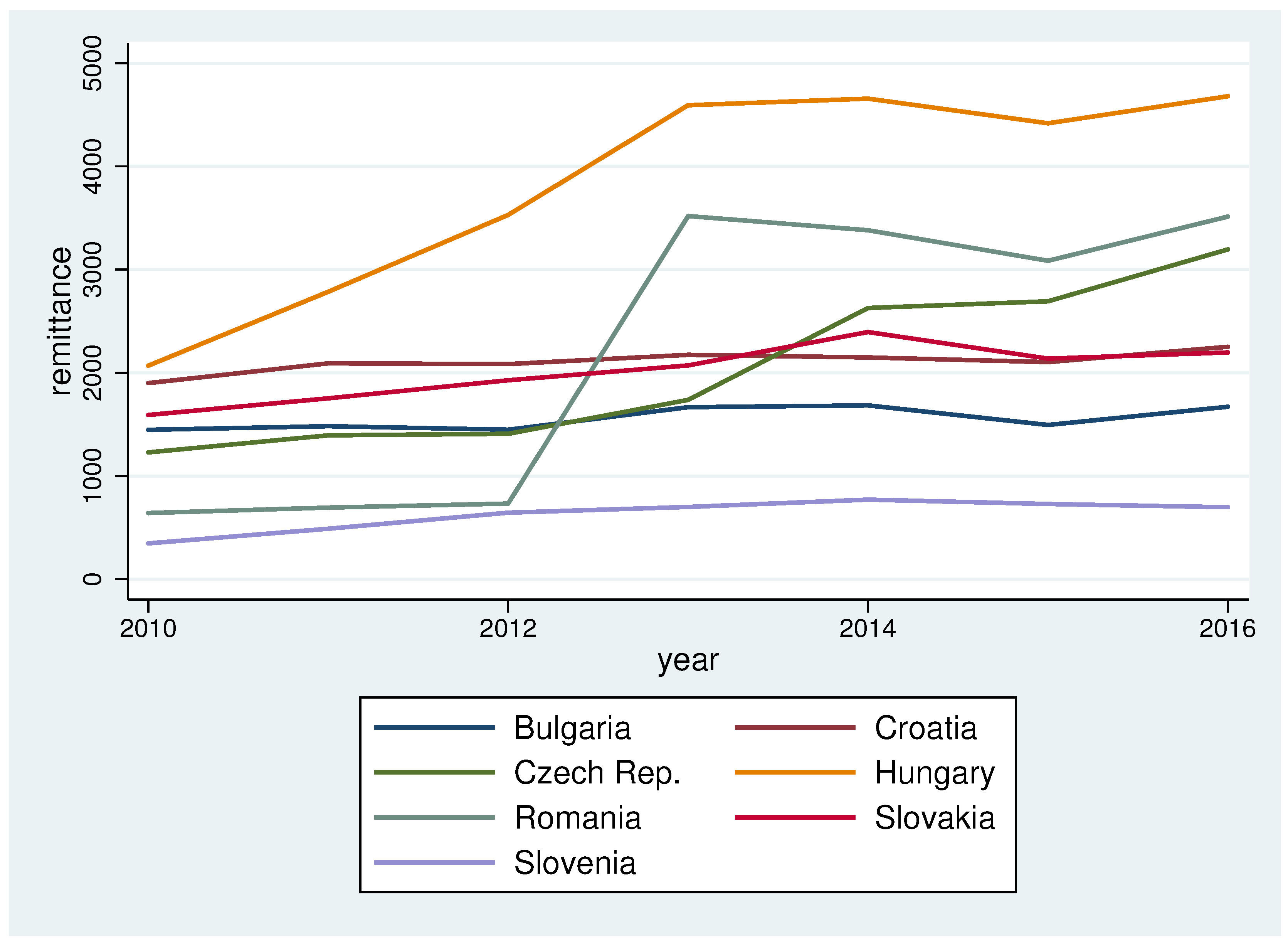

In

Appendix Figure A1, we present the evolution of remittances for Bulgaria, Croatia, Czech Republic, Hungary, Romania, Slovakia and Slovenia, starting with the bottom row, left to right. Analyzing the evolution of this indicator, we observe that the state with the highest values in 2015 is Hungary with over

$4 billion, whereas Slovenia is at the opposite pole with only

$728 million. At the same time, Romania is the state that registers a significant decrease from nearly

$4 billion in the year 2010 to under

$3 billion in 2015. The other analyzed states have a relatively stable evolution.

We analyzed the heterogeneity per country and year for the seven states. The research is comprised of the global development product and remittances in

Appendix Figure A1,

Figure A2,

Figure A3 and

Figure A4; this allows us to continue with the inferential analysis. Following the empirical study, we applied the method of least squares, for panel data, in view of demonstrating the link between remittances and gross domestic product, as well as foreign direct investments and gross domestic product. In order to try to establish if there is a correlation between remittances and gross domestic product, we considered the following hypotheses:

: null hypothesis, according to which the impact of remittances’ entries on gross domestic product is negative;

: alternative hypothesis, which contradicts the null hypothesis; the impact of remittances’ entries on gross domestic product is positive.

To test the proposed hypotheses, we used the method of least squares, for panel data, in matrix form, which is represented as follows:

where

i stands for the seven countries where the panel type model was applied,

t stands for the time series, respectively the period 2010–2016,

represents a scalar,

represents a

-dimensional vector,

represents gross domestic product,

represents the observations of the remittances explicative variable and

is the discrepancy variable or deviation. To interpret the results obtained, following econometric calculations, a probability value higher than 0.05 will generate the acceptance of the formulated null hypothesis

, according to which remittance entries have a negative impact on gross domestic product. When the value obtained is less than 0.05, the formulated alternative hypothesis is true,

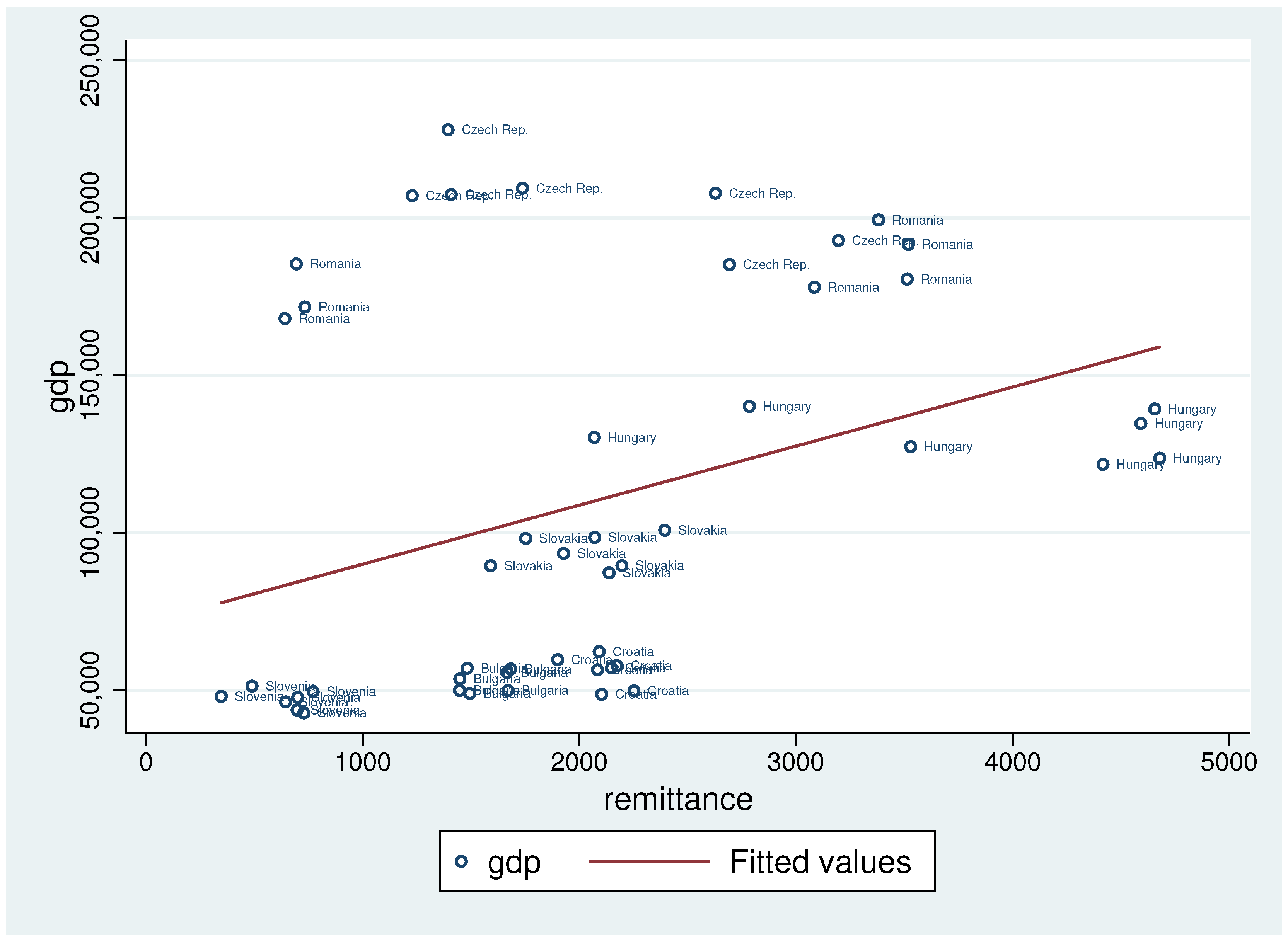

: the impact of remittances on gross domestic product is positive. In

Table 1, we observe that there is a 3.03 × 10

probability, smaller than the significance threshold of 0.05, rejecting the null hypothesis

, according to which the impact of remittance entries on GDP is negative. Under these circumstances, the alternative formulated hypothesis is accepted,

, which states that the impact of remittance entries on gross domestic product is positive.

In accordance with the results obtained after applying the least squares method, the value obtained for the estimated coefficient of the remittance entries indicator is a positive one, amounting to 36.719. The estimated econometric model for the impact of remittances on gross domestic product, in panel type data for the CEEC analyzed states in the period 2010–2016, is:

The same analysis is made in the case of foreign direct investment in view of demonstrating its impact on the evolution of gross domestic product. The hypotheses used are identical to those in the relation remittances: gross domestic product. In order to test the proposed hypotheses, we used the method of least squares, for the panel type data model, in matrix form, with the following econometric representation:

where

i stands for the CEEC where the panel type model was applied,

t stands for the time series, respectively the period 2010–2016,

represents a scalar,

represents a

-dimensional vector,

represents gross domestic product, the

represents the observations of the foreign direct investment explicative variable and

is the discrepancy variable or deviation.

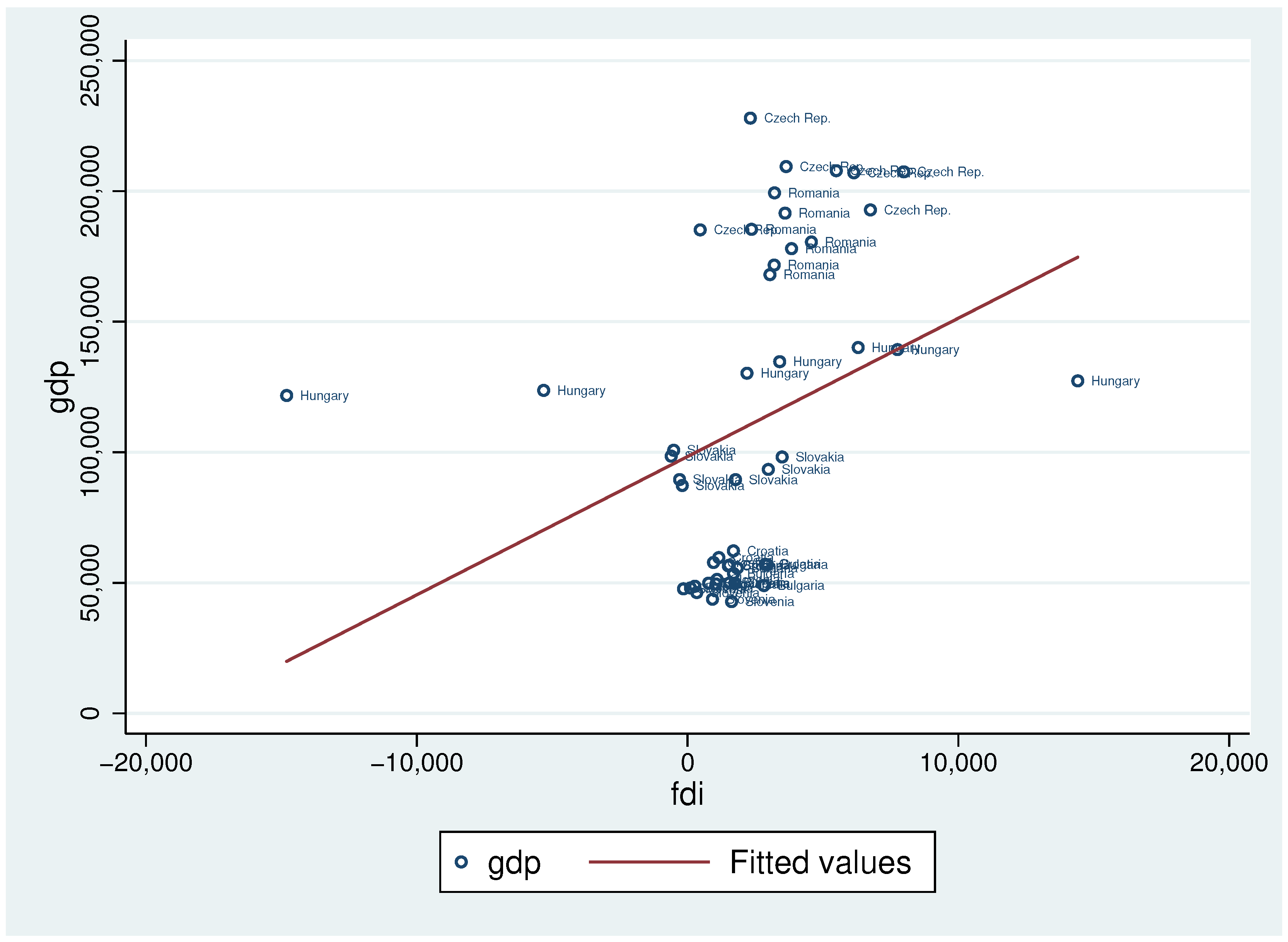

In order to interpret the results obtained, following econometric calculations, a value of probability higher than 0.05 leads to acceptance of the formulated null hypothesis,

, according to which the impact of foreign direct investment entries on gross domestic product is negative. In case the value obtained is less than 0.05, the formulated alternative hypothesis is true,

, that is the impact of foreign direct investment entries on gross domestic product is positive. As we can see in

Table 2, the model is correctly defined and accepted, with a

p-value equal to 2.5 × 10

, less than 0.05. The probability value is 2.5 × 10

, smaller than the 0.05 significance threshold, rejecting the null hypothesis, according to which the impact of foreign direct investment entries on gross domestic product is negative. Under these circumstances, the formulated alternative hypothesis is accepted, that is the impact of foreign direct investment entries on gross domestic product is positive.

According to the results obtained following the application of the method of least squares, the value obtained for the estimated coefficient of the indicator for foreign direct investment entries is positive, being 1.436. The econometric model estimated for the impact of foreign direct investment on gross domestic product, in panel type data for the CEEC states analyzed in the period 2010–2016, is Equation (

4).

Following econometric calculations, we used the Hausman test in view of determining the best model, fixed or random. If we obtain a probability less than 0.05, it follows that the right model for the data in our use is the fixed effects model, otherwise the random effects model will be applied. Thus, in

Table 3, we observe that the probability obtained was less, 0.0141, the reason for which we conclude that the fixed effects model is the most appropriate.

For the fixed effects model, the most used estimator is within. Through this estimator, the method of the least squares is applied to the obtained model, and the average individual values are eliminated, which leads to the elimination of fixed effects. Fixed effects are eliminated when the extraction of the corresponding model for individual averages is extracted from the initial model, as follows in Equation (

5):

As a result of the fact that the fixed effects were eliminated, the regression of the method of the least squares offers consistent estimators for

, even if the fixed effects are correlated with

, as is the case with the models of fixed effects; this result is a significant advantage of data panels. According to

Table 4, we observe that probability stays within the 0.05 limit, both in the case of remittances and in foreign direct investments, this being equal to 0.03374 for remittances and 0.00706 for foreign direct investment. This means that the null hypothesis is rejected and the alternative hypothesis is accepted, according to which remittance and foreign direct investments have a positive impact on economic growth.

In view of a better understanding of fixed effects, we will use the method of least squares with dummy variables. With the least squares method, the effect on the GDP is mediated by the differences among the countries studied. By adding a dummy variable for each country, the pure effect of GDP is estimated as a result of the fact that such fictitious variables absorb the specific and individual effects of each analyzed state. We highlighted the individual effects by decomposing the discrepancy variable or deviation

into three components, as follows in Equation (

6) in Baltagi [

47]:

where:

represents the estimation of the specific individual effect of the seven analyzed states, unnoticeable and independent of time;

estimates the specific temporal effect that is time dependent, invariable in transversal structures, respectively dependent on the seven European states;

depends on the values registered for remittance entries in the seven European states and the analyzed period, respectively the time interval 2010–2016.

As seen in

Table 5, the value of the coefficient

is 0.03374, less than the 0.05 significance threshold, thus rejecting the null hypothesis

, according to which the impact of remittance entries on gross domestic product is negative. Under these circumstances, the alternative hypothesis is accepted,

, which states the impact of remittance entries on gross domestic product in the analyzed states is positive.

According to the results obtained for the estimated coefficients in the case of the CEEC economies presented in

Table 5, all values are positive, which indicates a positive impact of remittance entries on the country of destination. Analyzing the significance threshold for the seven economies, we note that Czech Republic, Romania and Hungary register high values for the significance threshold. According to the results obtained for the estimated coefficients, from the seven states analyzed, Romania ranks second with 191,543.727, as compared to the other states, in terms of the impact of remittances on economic growth.

In view of making a comparison between the connection of remittances-gross domestic product and foreign direct investment-gross domestic product, we also analyze the impact of foreign direct investment on gross domestic product. As we can see in

Table 6, the value of the coefficient is 0.007069, less than the 0.05 significance threshold, thus the null hypothesis,

, is rejected; this hypothesis states that the impact of foreign direct investment on gross domestic product is negative. As such, the formulated alternative hypothesis,

, is true, stating that the impact of foreign direct investment on gross domestic product in the seven states is positive.

According to

Table 6, we observe that the results obtained for the estimated coefficients for the CEEC in Europe are positive; thus, we may conclude that foreign direct investments have a positive impact on the economic growth of the analyzed states. Unlike the significance threshold for remittances, in the case of foreign direct investment in Romania we find the highest of values (1.466 × 10

), followed by Czech Republic (1.464 × 10

) and Hungary (8.565 × 10

). Thus, of the seven states analyzed, the highest influence of foreign direct investment on the level of economic growth is registered in Romania, whereas in the case of remittances, Romania falls second.

According to

Table 5 and

Table 6, we observe that remittances have a lower influence on economic growth as compared to foreign direct investment in all analyzed states at the time of analysis through the uni-factorial model. In view of obtaining a comparison of the results obtained, we analyze the impact of remittances and foreign direct investments on gross domestic product, through a multi-factorial model. Applying the multi-factorial model regarding the determination of the impact of remittances and foreign direct investment on economic growth, we observe in

Table 7 that the model is accepted, the probability being equal to 0.02981, less than the 0.05 threshold. After the application of the method of least squares to the multi-factorial model, we notice that both remittance and foreign direct investments have a positive influence on the level of economic growth.

The multi-factorial econometric models estimated for the impact of remittance and foreign direct investment on GDP, in panel type data for the seven analyzed states in the period 2010–2016, are Equations (

7) and (

8):

We may then conclude that the impact of foreign direct investment on the increase of GDP is more emphasized than in the case of remittances, both after using a uni-factorial model, as well as through the use of the multi-factorial model.

5. Conclusions

Economic growth is an important aim for each state. The analyzed economic growth determinants, remittance and foreign direct investment, are presented from two perspectives in the specialty literature. There are specialty studies that present the impact of remittance on economic growth as a positive one, underlining their importance in view of an increase in consumption, which, in turn, generates an enhanced demand, leading to an increase of GDP; directing remittances towards the educational sector; health; or even establishment of companies. On the other hand, there are opinions that states’ investments have a negative effect on GDP, as reflected in the Dutch disease phenomenon; inflationist processes; directing remittances to consumption of import products; and sometimes encouraging a lack of work. Some studies have demonstrated that there is no connection between remittances and GDP. As regards foreign direct investment, the situation is similar. Specialists are divided into three groups: those who notice a positive impact of foreign direct investment on economic growth; those who demonstrate the negative relationship between foreign direct investment and GDP; the third group does not correlate economic growth with the evolution of FDI. Although there are studies that analyze the influence of remittances and foreign direct investment as determinants of economic growth, they do not cover the states analyzed in this research, and there is no comparison made.

The economic analysis performed for the seven European states: Romania, Bulgaria, Croatia, Czech Republic, Hungary, Slovakia and Slovenia, was made using the software R, applying the fixed effects model. Following the application of the Hausman test, we note that the fixed effects model is the most appropriate one. The method of least squares and the method of least squares with dummy variables demonstrate the positive influence of remittances and foreign direct investments on economic growth, for all the analyzed states. The most significant influence of remittances on GDP was registered by Czech Republic, Romania and Hungary. In the case of foreign direct investment, out of the seven analyzed states, Romania shows the greatest degree of influence on GDP, followed by Czech Republic and Hungary.

Our empirical analysis points to the fact that remittances along with FDI play an important role in economic growth. Based on the result, we conclude that policy makers should actively attempt to encourage remittances and support to be invested in order to create significant economic benefit. Similar policy as those created for FDI could generate a higher positive impact of remittances at the economic level. This policy should encourage the use of remittances as investments to ensure that remittances contribute to positive economic growth. Even if there is empirical evidence that remittances contribute to economic growth through their positive impact on consumption, savings or investment, we keep some reservation regarding the effects of remittances. We have to admit that countries can face a situation like the "Dutch Disease” in which the influx of remittances creates a real appreciation, or postpones depreciation, of the exchange rate and can affect the findings of our research and further investigation on this issue and in other areas. We expect that further research in this direction cumulated with the result of the present study can improve the perspective on constructing accurate policies that can maximize the positive effect of remittances on economic growth.