Financial Dilemmas Associated with the Afforestation of Low-Productivity Farmland in Poland

Abstract

:1. Introduction

2. Background

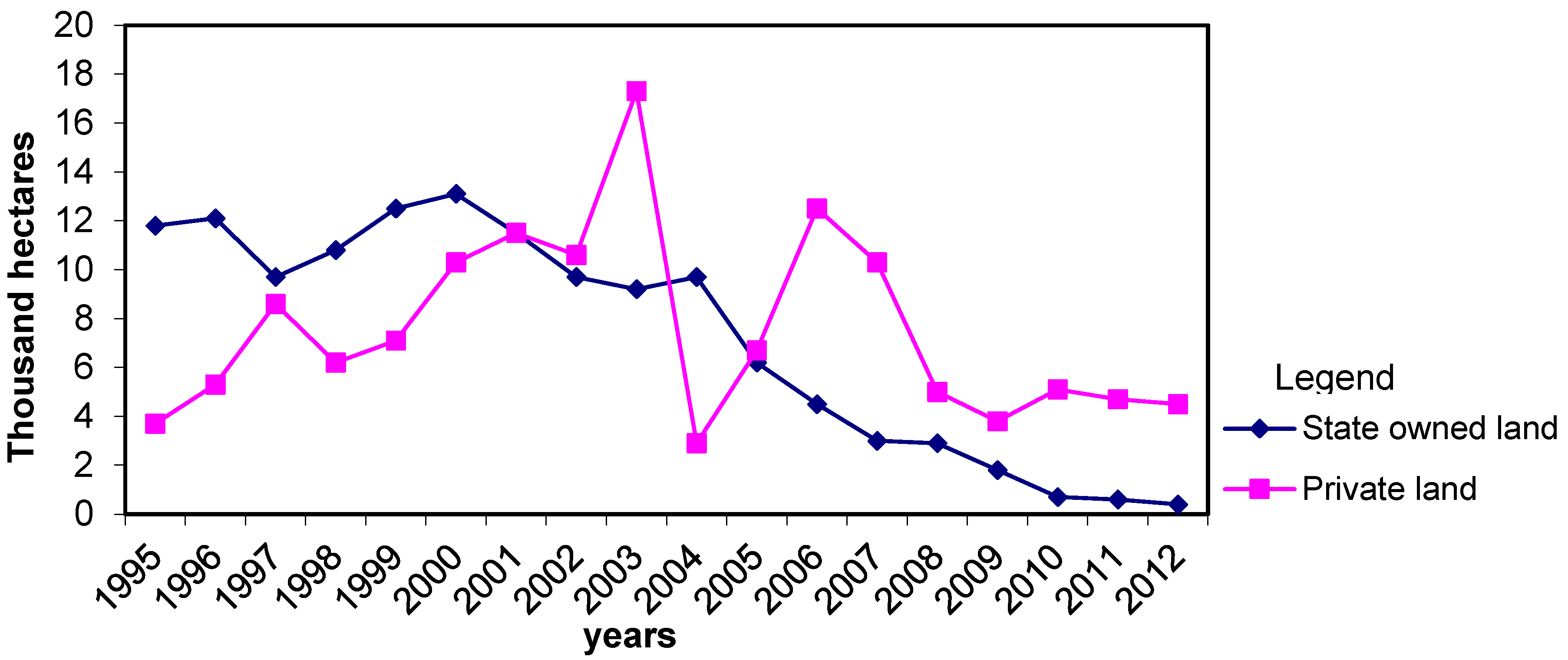

2.1. Afforestation Rate and Conditions for Afforestation in Poland

2.2. Legal Regulations for the Afforestation of Farmland with EU Financial Assistance

- Forests established by agricultural producers have to be maintained over a period of 15 years, counting from the date of the first afforestation subsidy payment;

- Land covered by the Natura 2000 network is not entitled to afforestation subsidy payments;

- The minimum area of afforested land is 0.5 ha (there are plans to lower this requirement to 0.1 ha);

- Permanent grasslands (meadows and pastures) are not entitled to afforestation subsidy payments (only arable land and orchards are eligible for financial aid);

- The maximum area of afforested land has been limited to 20 ha per farmer throughout the RDP implementation period;

- Afforestation premiums are paid over a period of 15 years, counting from the date of forest planting (there are plans to shorten this period to 12 years);

- The applicants have to derive minimum 25% of total income from farming;

- Subsidies are also available for woodland creation on non-agricultural land, including in areas undergoing ecological succession, where trees are not older than 20 years [12].

- Establishment expenditures—this is a single payment that covers the expenditures associated with establishing and, optionally, fencing the forest, per hectare of afforested land. The payment is made in the first year after establishment;

- Maintenance premium—this is a lump-sum payment that covers maintenance services per hectare of afforested land. The payment is made over a period of five years, counting from the date of forest planting (beginning from the second year);

- Afforestation premium—this is a lump-sum payment that compensates for the loss of income resulting from farmland conversion. The payment is made annually over a period of 15 years, counting from the date of forest planting.

| No. | Forms of support | Trees | |

|---|---|---|---|

| Coniferous | Deciduous | ||

| 1 | Grant for: (EUR per hectare) | ||

| A | Afforesting land with favorable configuration * | 1109 | 1258 |

| B | Afforesting slopes steeper than 12° | 1332 | 1495 |

| C | Afforesting land with favorable configuration using seedlings with Mycorrhiza helper fungi stimulating the root system | 1373 | 998 |

| D | Afforesting slopes steeper than 12° using seedlings with Mycorrhiza helper fungi stimulating the root system | 1502 | 1169 |

| E | Protection against wild animals—two-meter-high wire net: | (EUR) | |

| - Per one hectare of fenced land | 622 | ||

| - Per one running meter of fenced land | 1.6 | ||

| 2 | Maintenance premium: (EUR per hectare per year) | ||

| A | Maintenance premium: | ||

| - Land with favorable configuration | 233 | ||

| - Slopes steeper than 12° | 326 | ||

| B | Protection against animals: | ||

| - With repellents | 46 | ||

| - With three pickets | 168 | ||

| - With sheep wool | 67 | ||

| 3 | Forestry premium: (EUR per hectare per year) | ||

| 379 | |||

2.3. Decision Making Process on Afforestation

3. Methods for Evaluating the Return from Afforestation

3.1. Financial Analysis

3.2. Other Factors Determining the Profitability of Afforestation Schemes

- The inflows generated by forests are also influenced by soil quality class which determines the time required for trees to reach the right size for timber production (the average soil quality class for a given area, e.g. a municipality, is used in calculations);

- Timber production benefits from economies of scale due to the presence of fixed expenditures and the fact that the amount of subsidies is determined by the size of the afforested area;

- Expenses differ depending on whether the farmer owns or leases the afforested land, and whether the land has to be reclaimed after tree felling [25];

- Discount rates vary for different types of investments and investors, e.g., the discount rate for a small farm that diversifies its production profile by planting several hectares of forests will be higher than the discount rate for a well-established enterprise with vast experience on the timber market and the capital market [14].

4. Case study—Detailed Assumptions and Results

| No. | Specification | Year | ||||||||||||||||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| Scenario—Basic | 0 | 1 | 2 | 3 | 4 | 5 | 6 | 7 | 8 | 9 | 10 | 11 | 12 | 13 | 14 | 15 | 20 | |

| 1. | Inflows | 8116 | 3252 | 3252 | 3252 | 3252 | 3252 | 1896 | 1896 | 1896 | 1896 | 1896 | 1896 | 1896 | 1896 | 1896 | ||

| 1.1. | Afforestation grant—deciduous trees | 1509 | ||||||||||||||||

| 2. | Afforestation grant—coniferous trees | 4213 | ||||||||||||||||

| 1.3. | Fence premium | 498 | ||||||||||||||||

| 1.4. | Maintenance premium without repellents | 187 | 187 | 187 | 187 | 187 | ||||||||||||

| . | Maintenance premium with repellents | 1169 | 1169 | 1169 | 1169 | 1169 | ||||||||||||

| 1.6. | Forestry premium | 1896 | 1896 | 1896 | 1896 | 1896 | 1896 | 1896 | 1896 | 1896 | 1896 | 1896 | 1896 | 1896 | 1896 | 1896 | ||

| 1.7. | Incomes from timber sale | |||||||||||||||||

| 2. | Outflows | 5496 | 1666 | 1666 | 910 | 636 | 1188 | 912 | 1171 | 912 | 912 | 259 | 259 | |||||

| 2.1. | Soil preparation | 900 | ||||||||||||||||

| 2.2. | Cost of seedlings | 564 | 84 | 84 | ||||||||||||||

| 2.3. | Planting | 2045 | 307 | 307 | ||||||||||||||

| 2.4. | Maintenance—weed control | 828 | 828 | 828 | 636 | 636 | ||||||||||||

| 2.5 | Maintenance—early brushing | 276 | ||||||||||||||||

| 2.6. | Maintenance—late brushing | 259 | 259 | 259 | ||||||||||||||

| 2.7. | Protection against tree chewing | 449 | ||||||||||||||||

| 2.8 | Protection against bark stripping | 912 | 912 | 912 | 912 | 912 | ||||||||||||

| 2.9. | Fencing 0.80 hectare with 2 meter wire net | 316 | ||||||||||||||||

| 2.10. | Transport | 360 | 168 | 168 | ||||||||||||||

| 2.11. | Protection against tree grub worms | 34 | 5 | 5 | ||||||||||||||

| 2.12. | Cost of labor | 274 | 274 | 274 | ||||||||||||||

| 3.0 (B). | Net Cash Flow | 2620 | 1586 | 1586 | 2342 | 2616 | 3252 | 732 | 984 | 1896 | 725 | 744 | 744 | 1896 | 1896 | 1637 | −259 | |

| Scenario—Optimistic Outflows | ||||||||||||||||||

| 2.9. | Fencing 5.00 h | 1980 | ||||||||||||||||

| 2.2. | Cost of seedlings | 564 | 28 | 28 | ||||||||||||||

| 2.3 | Planting | 2045 | 102 | 102 | ||||||||||||||

| 2.7 | Protection against tree chewing | |||||||||||||||||

| 2.8. | Protection against bark stripping | |||||||||||||||||

| 4.0(O) | Net Cash Flow | 508 | 1642 | 1642 | 2342 | 2616 | 3252 | 1644 | 1896 | 1896 | 1637 | 1656 | 1656 | 1896 | 1896 | 1637 | −259 | |

| Scenario—Pessimistic Outflows | ||||||||||||||||||

| 2.1. | Soil preparation | 480 | 900 | |||||||||||||||

| 2.10 | Transport | 414 | 192 | 192 | ||||||||||||||

| 2.12 | Cost of labor | 312 | 312 | |||||||||||||||

| 5.0.(P) | Net Cash Flow | −480 | 2566 | 1579 | 1579 | 2342 | 2616 | 3252 | 732 | 984 | 1896 | 725 | 744 | 744 | 1896 | 1896 | 1637 | −259 |

| Year | NCF for Three Scenarios | Discount Rate i at 5% | Discounted NCF | ||||

|---|---|---|---|---|---|---|---|

| Basic | Optimistic | Pessimistic | Basic | Optimistic | Pessimistic | ||

| 0 | −480 | 1 | 0 | 0 | −480 | ||

| 1 | 2620 | 508 | 2566 | 0.9524 | 2495 | 484 | 2444 |

| 2 | 1586 | 1642 | 1579 | 0.9070 | 1439 | 1489 | 1432 |

| 3 | 1586 | 1642 | 1579 | 0.8638 | 1370 | 1418 | 1364 |

| 4 | 2342 | 2342 | 2342 | 0.8227 | 1927 | 1927 | 1927 |

| 5 | 2616 | 2616 | 2616 | 0.7835 | 2050 | 2050 | 2050 |

| 6 | 3252 | 3252 | 3252 | 0.7462 | 2427 | 2427 | 2427 |

| 7 | 732 | 1644 | 732 | 0.7107 | 520 | 1168 | 520 |

| 8 | 984 | 1896 | 984 | 0.6768 | 666 | 1283 | 666 |

| 9 | 1896 | 1896 | 1896 | 0.6446 | 1222 | 1222 | 1222 |

| 10 | 725 | 1637 | 725 | 0.6139 | 445 | 1005 | 445 |

| 11 | 744 | 1656 | 744 | 0.5847 | 435 | 968 | 435 |

| 12 | 744 | 1656 | 744 | 0.5568 | 414 | 922 | 414 |

| 13 | 1896 | 1896 | 1896 | 0.5303 | 1005 | 1005 | 1005 |

| 14 | 1896 | 1896 | 1896 | 0.5051 | 958 | 958 | 958 |

| 15 | 1637 | 1637 | 1637 | 0.4810 | 787 | 787 | 787 |

| 16 | 0 | 0 | 0 | 0.4581 | 0 | 0 | 0 |

| 17 | 0 | 0 | 0 | 0.4363 | 0 | 0 | 0 |

| 18 | 0 | 0 | 0 | 0.4155 | 0 | 0 | 0 |

| 19 | 0 | 0 | 0 | 0.3957 | 0 | 0 | 0 |

| 20 | −259 | −259 | −259 | 0.3769 | −98 | −98 | −98 |

| NPV | 18,062 | 19,016 | 17,519 | ||||

| E(NPV) | σ2(NPV) | σ(NPV) | VNPV | kf |

|---|---|---|---|---|

| 18,089 | 12,815 | 55 | 0.003 | 0.009 |

| Scenario | Basic | Change | Optimistic | Change | Pessimistic | Change | |

|---|---|---|---|---|---|---|---|

| NPV for n years | |||||||

| 0 | 0.00 | 9,279 | 0.00 | 7,367 | −480 | 9,216 | |

| 5 | 9,279 | 7,367 | 8,736 | ||||

| 5,280 | 7,105 | 5,280 | |||||

| 10 | 14,559 | 14,471 | 14,016 | ||||

| 3,600 | 4,641 | 3,600 | |||||

| 15 | 18,159 | 19,112 | 17,615 | ||||

| −97 | −96 | −96 | |||||

| 20 | 18,062 | 19,016 | 17,519 | ||||

- The expenses associated with afforestation will be covered from surplus EU funds until year 19 of the forecast (Table 2).

- Discounted total net inflows for the forecast period of 20 years are highest for the optimistic scenario due to nearly twice higher net cash flow values in years seven and eight. Less satisfactory results were generated by the pessimistic scenario because afforestation took place on low-productivity farmland, and the expenses associated with soil preparation are not reimbursed. Those considerations should be taken into account by farmers in the decision-making process.

- Low risk premium kf results from the low value of coefficient of variation VNPV (Table 4). This suggests that in financial assessments of afforestation projects in small farms, the discount rate should be based on observations of investment risk on a given real estate market.

5. Discussion and Conclusions

- Afforestation of farmland can be integrated with agricultural production to deliver positive external effects.

- In weakly developed regions and in areas affected by a crisis where agriculture is the only available source of income, afforestation could create new jobs during stand establishment, tree maintenance, timber preparation for sale (In Poland, farmers can achieve and sell timber after receiving permission from relevant forest inspectorate; usually only for the trees that are 90-120 years old), etc. [20].

- Farmland conversion has an associated opportunity cost (loss of income resulting from farmland conversion). Several scenarios should be analyzed by simulating the benefits and costs of various decisions: (a) change in land-use type; (b) maintenance of farmland for agricultural use; (c) diversification of land-use types. This issue was not discussed in the study, and it could be the topic of a separate paper. However, average opportunity cost resulting from the loss of income from agriculture was calculated by Polish governmental institutions and is compensated by annual forestry premium.

- Afforestation of considerable land areas could create additional sources of income from the sale of forest produce (mushrooms, berries) and recreational activities organized in the forest [25].

- Afforestation projects could secure future pension stability or offer financial security for the investor’s heirs.

Acknowledgement

Author Contributions

Conflicts of Interest

References and Notes

- De Groot, R.S. Functions of Nature; Evaluation of Nature in Environmental Planning, Management and Decision-Making; Wolters-Noordhoff: Groningen, The Netherlands, 1992. [Google Scholar]

- Nguyen, T.T.; Pham, V.D.; Tenhunen, J. Linking regional land use and payments for forest hydrological services: A case study of Hoa Binh Reservoir in Vietnam. Land Use Policy 2013, 33, 130–140. [Google Scholar]

- The Ministry of Agriculture and Rural Development. Available online: http://www.minrol.gov.pl/pol/Wsparcie-rolnictwa-i-rybolowstwa/PROW-2007-2013/Dzialania-PROW-2007-2013/Os-2-Poprawa-srodowiska-naturalnego-i-obszarow-wiejskich/Zalesianie-gruntow-rolnych-oraz-zalesianie-gruntow-innych-niz-rolne (accessed on 29 July 2014).

- Eurostat. Agriculture, Forestry and Fishery Statistics; European Comission: Luxembourg, Germany, 2013, 2013 ed. p. 25. Available online: http://epp.eurostat.ec.europa.eu/cache/ITY_OFFPUB/KS-FK-13-001/EN/KS-FK-13-001-EN.PDF (accessed on 9 September 2014).

- Main Statistical Office of Poland. Agriculture in 2013; GUS: Warszawa, Poland, 2014; p. 127. [Google Scholar]

- Kolovos, K.; Kyriakopoulos, G.; Chalikias, M. Co-evaluation of basic woodfuel types used as alternative heating sources to existing energy network. J. Environ. Prot. Ecol. JEPE 2011, 12, 733–742. [Google Scholar]

- Main Statistical Office of Poland. Leśnictwo 2013; GUS: Warszawa, Poland, 2014; p. 341. [Google Scholar]

- State Forests General Directorate. Report on the Condition of Polish Forests 2012; DGLP: Warszawa, Poland, 2013; p. 85. [Google Scholar]

- The Ministry of Environment. National Program for Increasing Forest Cover; MŚ: Warszawa, Poland, 2003; p. 55. [Google Scholar]

- The Ministry of Agriculture and Rural Development. Draft for Rural Development Program 2014–2020; MRiRW: Warszawa, Poland, 2013; p. 380. Available online: http://www.arimr.gov.pl/fileadmin/pliki/dokumenty/Zarys_PROW_2014-2020_15042013.pdf (accessed on 9 September 2014).

- Regulation of the Agriculture and Rural Development Minister from 19 March 2009 on afforestation of agricultural and non-agricultural land measure under the Rural Development Program for 2007–2013. Available online: http://www.arimr.gov.pl/fileadmin/pliki/zdjecia_strony/204/kfl/Rozporzadzenie_2009.pdf (accessed on 20 November 2014).

- Regulation of the Council of Ministers from 11 August 2004. Available online: http://isap.sejm.gov.pl/DetailsServlet?id=WDU20041871929 (accessed on 20 November 2014).

- Nguyen, T.T.; Koellner, T.; Le, Q.B.; Lambini, C.L.; Choi, I.; Shin, H.; Pham, V.D. An economic analysis of reforestation with a native tree species: The case of Vietnamese farmers. Biodivers. Conserv. 2014, 23, 811–830. [Google Scholar]

- Gregsen, H.; Contreras, A. Economic Assessment of Forestry Project Impacts; World Bank United Nations Environemnt Programme: Rome, Italy, 1995. Available online: http://www.fao.org/docrep/008/t0718e/t0718e04.htm#bm04 (accessed on 30 July 2014).

- Lette, H.; de Boo, H. Economic Valuation of Forests and Nature: A Support Tool for Effective Decision-Making; Theme Studies Series/ (Forests, Forestry and Biodiversity Support Group); International Agricultural Centre (IAC): Wageningen, The Netherlands, 2002; p. 20. [Google Scholar]

- Marey-Perez, M.F.; Rodriguez-Vicente, V. Forest transition in Northern Spain: Local responses on large-scale programmes of field-afforestation. Land Use Policy 2009, 26, 139–156. [Google Scholar] [CrossRef]

- Daniels, S.E.; Kilgore, M.A.; Jacobson, M.G.; Greene, J.L.; Straka, T.J. Examining the Compatibility between Forestry Incentive Programs in the US and the Practice of Sustainable Forest Management. Forests 2010, 1, 51. [Google Scholar] [CrossRef]

- McCarthy, S.; Matthews, A.; Riordan, B. Economic determinants of private afforestation in the Republic of Ireland. Land Use Policy 2003, 20, 51–59. [Google Scholar] [CrossRef]

- Ma, Z.; Butler, B.J.; Catanzaro, P.F.; Greene, J.L.; Hewes, J.H.; Kilgore, M.A.; Kittredge, D.B.; Tyrrell, M. The effectiveness of state preferential property tax programs in conserving forests: Comparisons, measurements and challenges. Land Use Policy 2014, 36, 492–499. [Google Scholar] [CrossRef]

- Duesberg, S.; Ni Dhubhain, A.; O’Connor, D. Assessing policy tools for encouraging farm afforestation in Ireland. Land Use Policy 2014, 38, 194–203. [Google Scholar] [CrossRef]

- Lawrence, A.; Dandy, N. Private landowners’ approaches to planting and managing forests in the UK: What’s the evidence? Land Use Policy 2014, 36, 351–360. [Google Scholar] [CrossRef]

- Regulation of the Council of Ministers from 21 September 2004 on property valuation and appraisal reports. Available online: http://isap.sejm.gov.pl/DetailsServlet?id=WDU20042072109 (accessed on 20 November 2014).

- Klajn, J. Określanie wartości innych niż rynkowa w odniesieniu do nieruchomości przemysłowych w Krakowie. Stud. Mater. Tow. Nauk. Nieruchomo. 2010, 18, 17–28. [Google Scholar]

- Clinch, P. Economics of Irish Forestry; COFORD: Dublin, Ireland, 1999. [Google Scholar]

- International Valuation Standards Council. The Valuation of Forests; Exposure Draft: London, UK, 2013; p. 29. [Google Scholar]

- Poczta, W. Gospodarstwa Rolne w Polsce na tle Gospodarstw Unii Europejskiej—Wplyw WPR 2013; Main Statistical Office in Poland: Warszawa, Poland; p. 162.

- The Ministry of Finance. Treasure Bonds. Available online: http://www.obligacjeskarbowe.pl (accessed on 6 August 2014).

- National Bank of Poland. Inflation report for July 2014. Available online: http://nbp.pl/polityka_pieniezna/dokumenty/raport_o_inflacji/raport_lipiec_2014.pdf (accessed on 6 August 2014).

- Warsaw City Report, Jones Lang LaSalle: Warszawa, Poland, 2013.

- Duesberg, S.; O’Connor, D.; Ni Dhubhain, A. To plant or not to plant—Irish farmers’ goals and values with regard to afforestation. Land Use Policy 2013, 32, 155–164. [Google Scholar] [CrossRef]

- Chalikias, M.; Kyriakopoulos, G.; Kolovos, K. Environmental sustainability and financial feasibility evaluation of woodfuel biomass used for a potential replacement of conventional space heating sources. Part I: A Greek Case Study. Oper. Res. 2010, 10, 43–56. [Google Scholar]

- Kyriakopoulos, G.; Kolovos, K.; Chalikias, M. Environmental sustainability and financial feasibility evaluation of woodfuel biomass used for a potential replacement of conventional space heating sources. Part II: A Combined Greek and the nearby Balkan Countries Case Study. Oper. Res. 2010, 10, 57–69. [Google Scholar]

© 2014 by the authors; licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution license (http://creativecommons.org/licenses/by/4.0/).

Share and Cite

Źróbek-Różańska, A.; Nowak, A.; Nowak, M.; Źróbek, S. Financial Dilemmas Associated with the Afforestation of Low-Productivity Farmland in Poland. Forests 2014, 5, 2846-2864. https://doi.org/10.3390/f5112846

Źróbek-Różańska A, Nowak A, Nowak M, Źróbek S. Financial Dilemmas Associated with the Afforestation of Low-Productivity Farmland in Poland. Forests. 2014; 5(11):2846-2864. https://doi.org/10.3390/f5112846

Chicago/Turabian StyleŹróbek-Różańska, Alina, Andrzej Nowak, Magdalena Nowak, and Sabina Źróbek. 2014. "Financial Dilemmas Associated with the Afforestation of Low-Productivity Farmland in Poland" Forests 5, no. 11: 2846-2864. https://doi.org/10.3390/f5112846