1. Introduction

With the increasing concern about environmental pollution and fossil energy shortage, EVs are becoming an important alternative means of transport due to their higher energy efficiency and lower emissions compared with conventional internal combustion engine (ICE) vehicles. In this situation, the EV industry is booming due to the incentives of government policies and market requirements [

1]. However, regarding when all those EVs are connected to the distribution network, the uncertainties of the charging and discharging demands could lead to risks in the safety of the distribution network [

2,

3]. In a way, scientific and effective risk assessment is conducive to ensure the safe and stable operation of the power system. Therefore, it is significant to study the operational risk assessment of substantial numbers of EVs’ charging and discharging behaviors on the distribution system.

Large-scale unordered charging demand of EVs [

4,

5], however, is more likely to coincide with the overall peak load, which would make the node voltage and line flow exceed the acceptable ranges [

6,

7,

8]. References [

9,

10,

11] comprehensively analyze the impacts of EVs on distribution networks, while coordinated EV scheduling methods [

12,

13] could reduce those adverse effects. Note that, EV owners are able to actively adjust the charging or discharging time in accordance with variable electricity prices. Hence, a reasonable price incentive mechanism is necessary to guide the charging and discharging behaviors of EVs [

14,

15,

16], which could shift the peak load and reduce the safety risks of the power grid. References [

17,

18,

19] introduce an EV charging model based on the time-of-use (TOU) price, and the EV charging load can be shifted from peak load hours to off-peak load hours. However, few works focus on the discharging price of EV. Considering Vehicle to Grid (V2G) technology [

20,

21], EVs can reverse discharge to the power system, which plays a very significant role in “cut peak and fill valley”, and further the operational risks may be potentially reduced. Gao et al. [

22] preliminarily studied EVs’ power demands where the discharging price is selectively included, but the impact of the EVs on the operation of power grid under different prices is not taken into account.

The uncertainties of substantial numbers EVs will result in a significant change in the power flow distribution, and unstable operation of the distribution network may be caused. The Probabilistic Load Flow (PLF) calculation method using cumulants and Gram-Charlier series [

23,

24] can quickly calculate the probability density function (PDF) and cumulative distribution function (CDF) of state variables, which can provide the basic data for the calculation of risk assessment. Further, the operational risk assessment can comprehensively measure the possibility and severity of uncertainties [

25]. In consideration of randomness and fuzziness, Feng et al. [

26] presents a risk assessment method to deal with the two-fold uncertainty. Deng et al. [

27] introduces the conditional value-at-risk (CVaR) to a risk-based security assessment method considering future conditions. Hu [

28] proposes a risk assessment method for distribution network integrated with wind power and EVs, but this study does not involve the discharging characteristics of EVs.

Considering EVs’ charging and discharging behaviors, this paper proposes a risk assessment method to evaluate the operational risks of distribution network, and also the assessment method’s performance is studied under different simulation cases. The paper is organized in the following manner: in

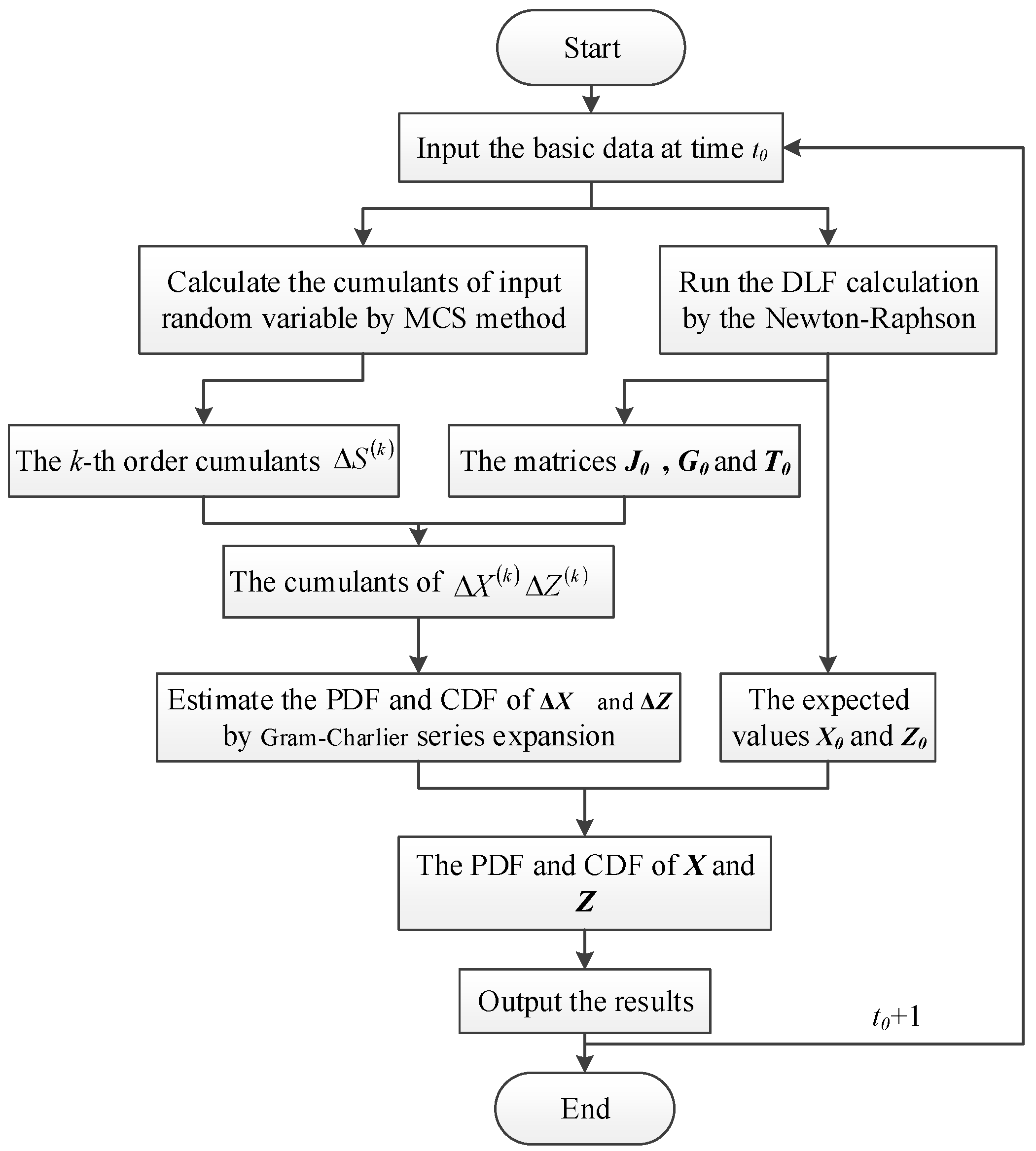

Section 2, the EV charging/discharging demand models corresponding to different electricity prices are built.

Section 3 conducts a dynamic PLF method using cumulants and Gram-Charlier. In

Section 4, a calculation method of risk assessment on distribution network is proposed. In

Section 5, numerical simulations are carried out in an IEEE 33-bus system and an IEEE 69-bus system, respectively. In

Section 6, conclusions are summarized and next steps are suggested.

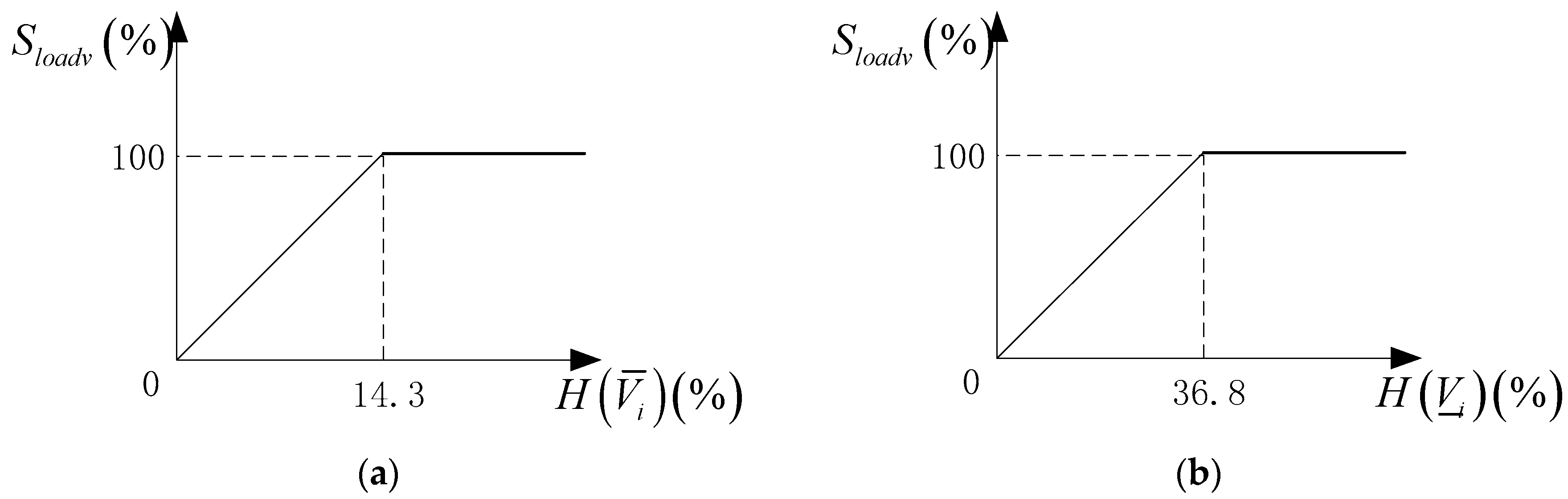

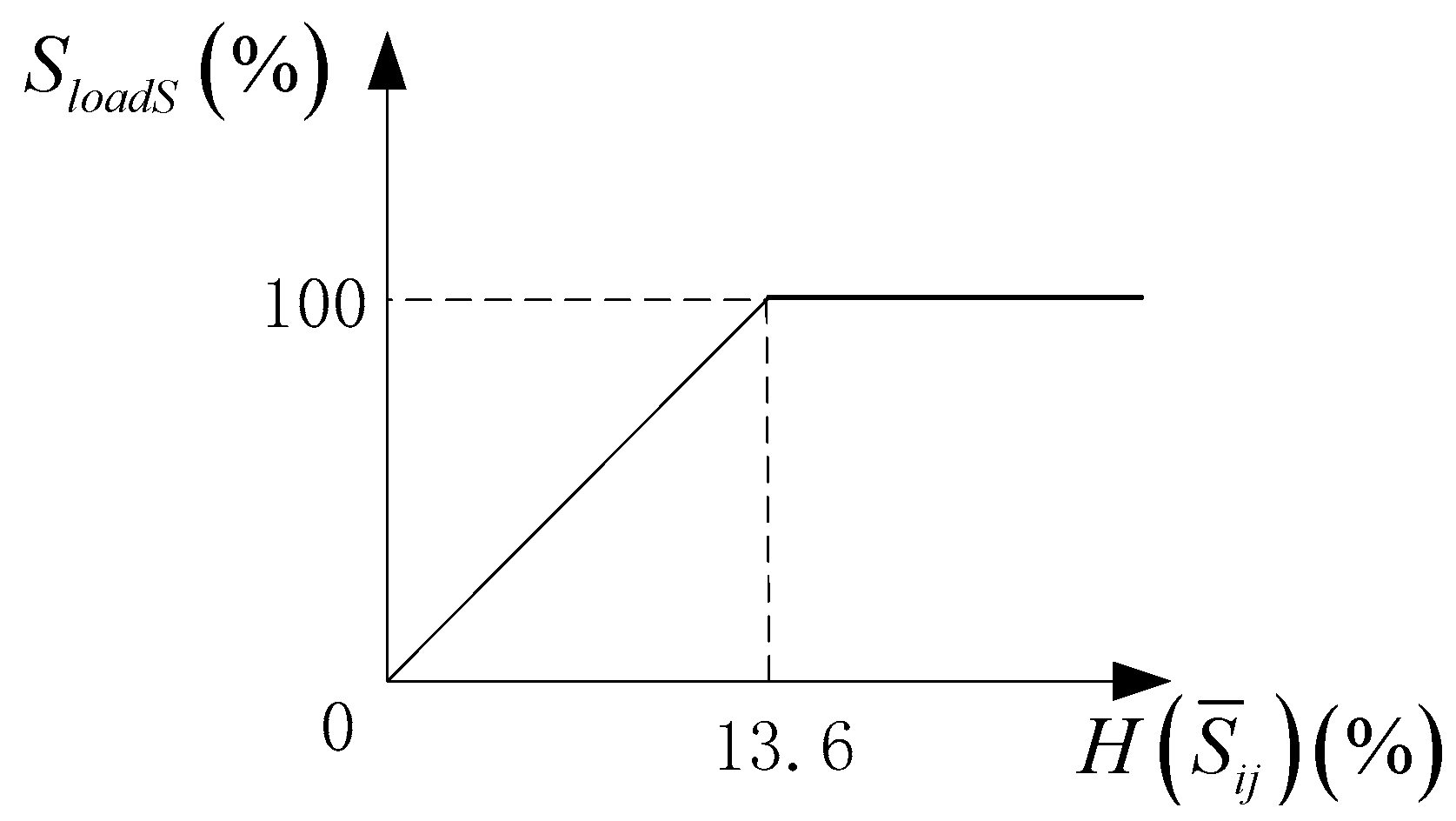

2. The EV Charging/Discharging Load Models under Different Electricity Prices

A reasonable price incentive is conducive to managing the charging and discharging power loads of EVs. In this section, the slow charging household EVs are studied, and herein three load models for EV charging/discharging are established based on typical electricity prices, including the constant electricity price, the ordinary TOU price and the improved TOU price, respectively.

2.1. The Unordered Charging Load Model under Constant Price

It is assumed that EVs have similar driving characteristics as conventional ICE vehicles. According to the National Household Travel Survey (NHTS) conducted by the US Department of Transportation [

29], the probability density functions of the home arrival time and the daily driving distance can be respectively obtained by use of the normalization and maximum likelihood parameter estimation method.

- (1)

Home arrival time

It is assumed that most users will charge their EVs once they return home from work without relevant regulations and price stimulus. The probability density function of the start time of charging [

29], which is considered to be normally distributed, is denoted as follows.

where

x is the start time of charging, μ

s = 17.6 and σ

s = 3.4.

- (2)

Daily driving distance

Daily driving distance represents the electricity consumption of an EV in a single day. The probability density function of the daily driving distance [

29], which is considered to be log-normally distributed, is expressed as:

where

x is the daily driving distance, μ

D = 3.2 and σ

D = 0.88.

The duration time of charging for a certain EV can be obtained by:

where

D is the daily traveling distance.

W100 represents the energy consumption per 100 kilometers. The term

Pc is the charging power of EVs, and herein it is supposed to be unchangeable.

The probability density function of the charging time is denoted as:

- (3)

The distribution model of EVs’ charging power

When the total number of EVs in the system is

N, the amount of EVs which begin to charge from time

i to time

i + 1can be expressed as:

To simplify the analysis, the start time of EV charging is taken as the nearest smaller integer in this paper.

Most EVs can be fully charged in 16 h [

5]. Therefore, the number of EVs which start charging at time

i and lasting for

k hours can be expressed as:

2.2. The Charging Load Model under the Ordinary TOU Price

In general, the out-of-order charging of EVs may lead to serious overloading. The ordinary TOU price mechanism can be used to guide the EV owners’ charging behavior to optimize the EV loads.

- (1)

The model of TOU price

According to the daily load curve, the ordinary TOU price divides the 24-h of a day into different periods. The electricity price at time

t is denoted as:

where

denote the price in peak, valley and flat time, respectively. [

], [

] represent the peak and valley load period, respectively.

- (2)

The response model of EVs considering the ordinary TOU price

The charging demand is directly affected by the electricity price. The price’s elasticity coefficient which reflects the demand response to price is expressed as:

where

d0 and

represent the basic demand and price, respectively.

and

refer to the changes in demand and price, respectively.

The demand at a certain time is not only affected by the price of the current time but also by the prices of other time. Thus, the self-elasticity coefficient and the cross-elasticity coefficient can be written as:

where

represents the demand change at time

i.

and

represent the price changes at time

i and

j, respectively.

The cost of charging for an EV which starts charging at time

i and lasting for

k hours is given by:

where

represents the price at time

n, and

Tik represents the duration of charging.

Under the ordinary TOU price, some EV owners will change the start time for charging from time

i to time

j. As a result, the EV loads will be shifted. The amount of EVs which starts charging at time

i and lasts for

k hours after the execution of ordinary TOU price can be calculated as:

2.3. The Charging Load Model Cosidering V2G under the Improved TOU Price

On the basis of the V2G technology, EVs can be used as green renewable distributed energy sources to provide electrical power for the power system during their idle time. In this section, an improved TOU price [

30], considering the discharging price in peak hours is appreciatively adopted to study the charging/discharging loads of EVs.

Considering the reasonable use of battery, EV owners will stop discharging when the battery margin is less than 20% [

5]. The maximum duration of discharging is calculated by:

where

Dmax represents the maximum daily traveling distance, and

Pd represents the discharging power.

EVs will only discharge when the discharging price is applied in the period (

t1,

t2, …,

tf). The duration of discharging is denoted as:

The cost for an EV which participates in V2G can be expressed as:

The number of EVs applying the TOU price and the discharging price is:

where

xbattery represents the battery’s life loss cost for each discharging.

5. Case Studies

In this section, an IEEE 33-bus distribution network [

32] and an IEEE 69-bus distribution network [

33] are respectively selected for the case studies. The acceptable voltage magnitude of the distribution networks is in the range of (0.95, 1.05) p.u. It is assumed that each branch has the same transmission power limit, and the upper limit of power flow is set as 1.2 times of the maximum value of daily load curve. Since the efficiency of EV charging and discharging has little effect on the risk assessment, it is ignored in the case studies.

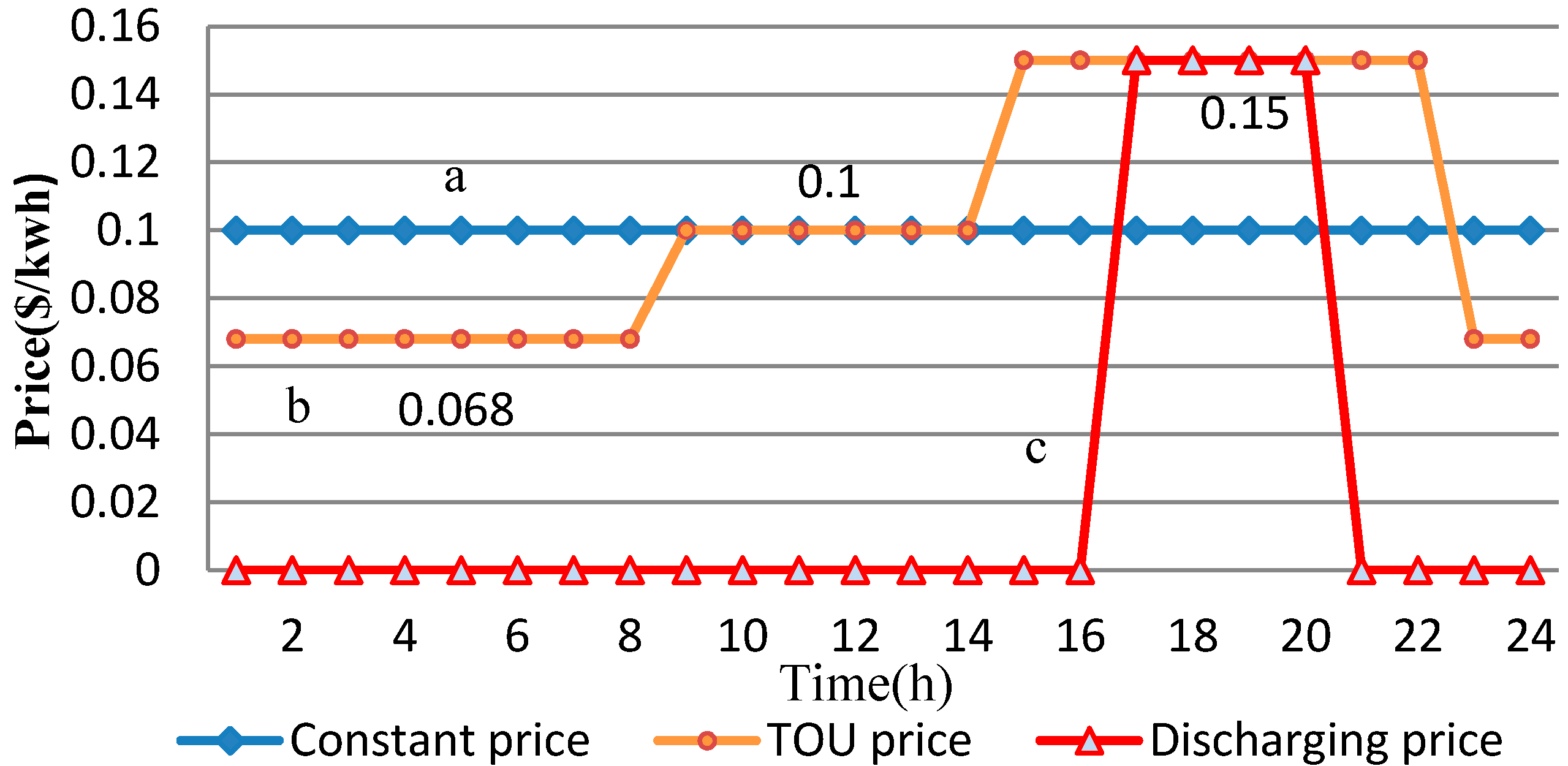

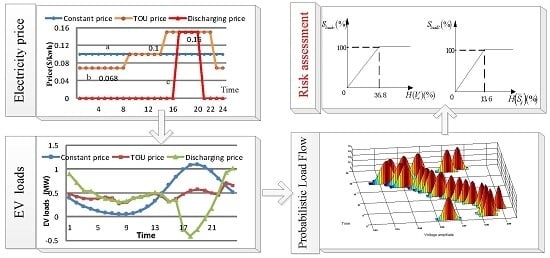

To analyze the charging and discharging behaviors of EVs under different price incentives, four cases are enumerated and investigated. The consumer-price elasticity matrix is referring to [

34]. The price profiles of charging or discharging in different time are shown in

Figure 4.

- Case 1:

There are no EVs in the distribution network. As the uncertainty of regular load, the basic load at each bus follows a normal distribution, and the standard deviation is 10% of the mean values.

- Case 2:

There are a total of 1000 EVs charging in five EV-stations with a daily constant price which is shown in

Figure 4 (profile a). The basic load is same to that in Case 1.

- Case 3:

There are 1000 EVs charging in five EV-stations with the TOU price, and the price profile of charging in this case is shown in

Figure 4 (profile b). The basic load is same to that in Case 1.

- Case 4:

There are totally 1000 EVs charging or discharging in five EV-stations. The TOU price of charging is same as Case 3. The discharging price is shown in

Figure 4 (profile c). The basic load is same to that in Case 1.

5.1. The Charging or Discharging Load of EVs under Different Electricity Prices

During the simulations, the battery capacity of each EV is supposed to be 15 kW·h for a cruise duration of 100 km, and the charging power

Pc and discharging power

Pd are both 2.5 kW [

5].

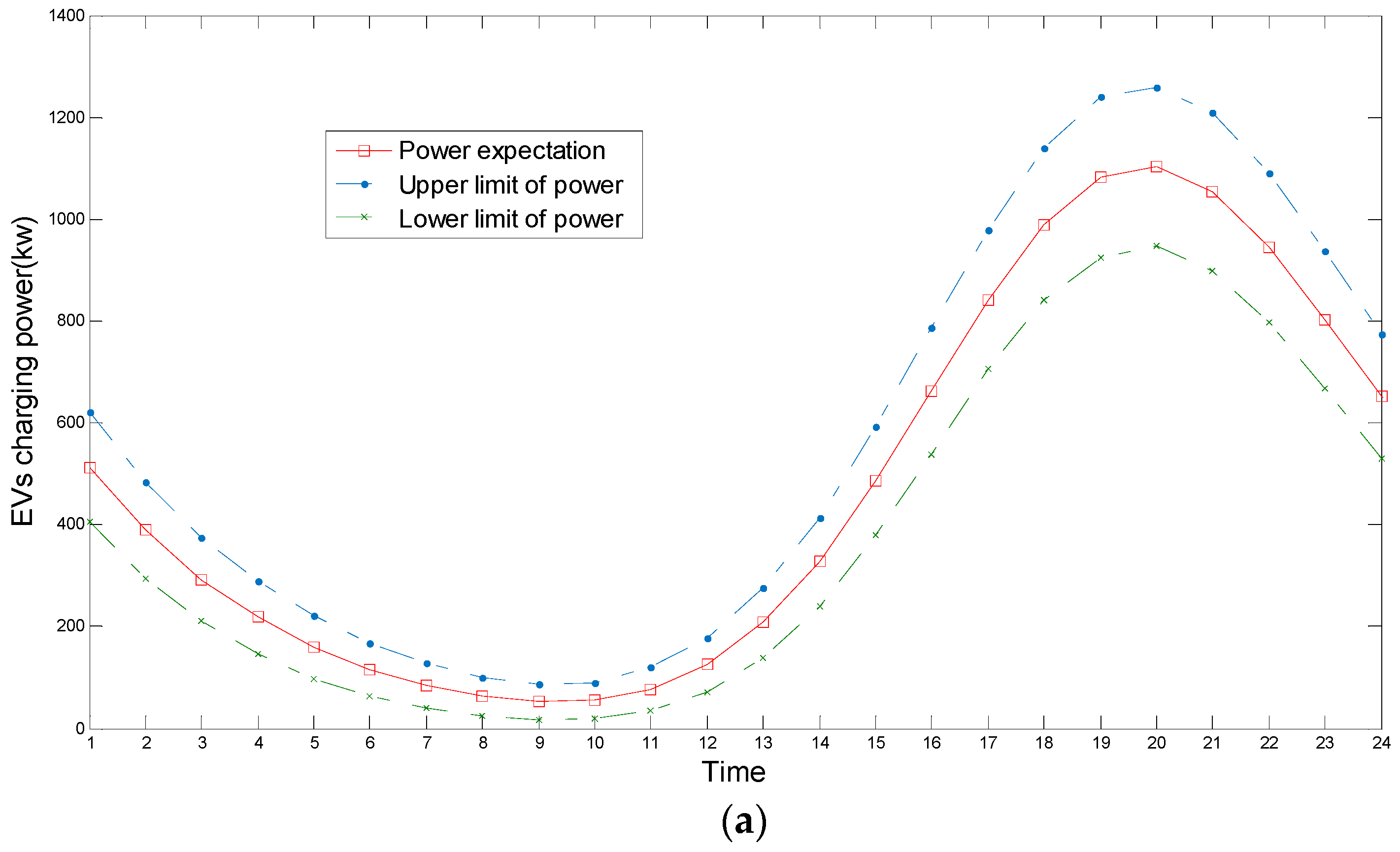

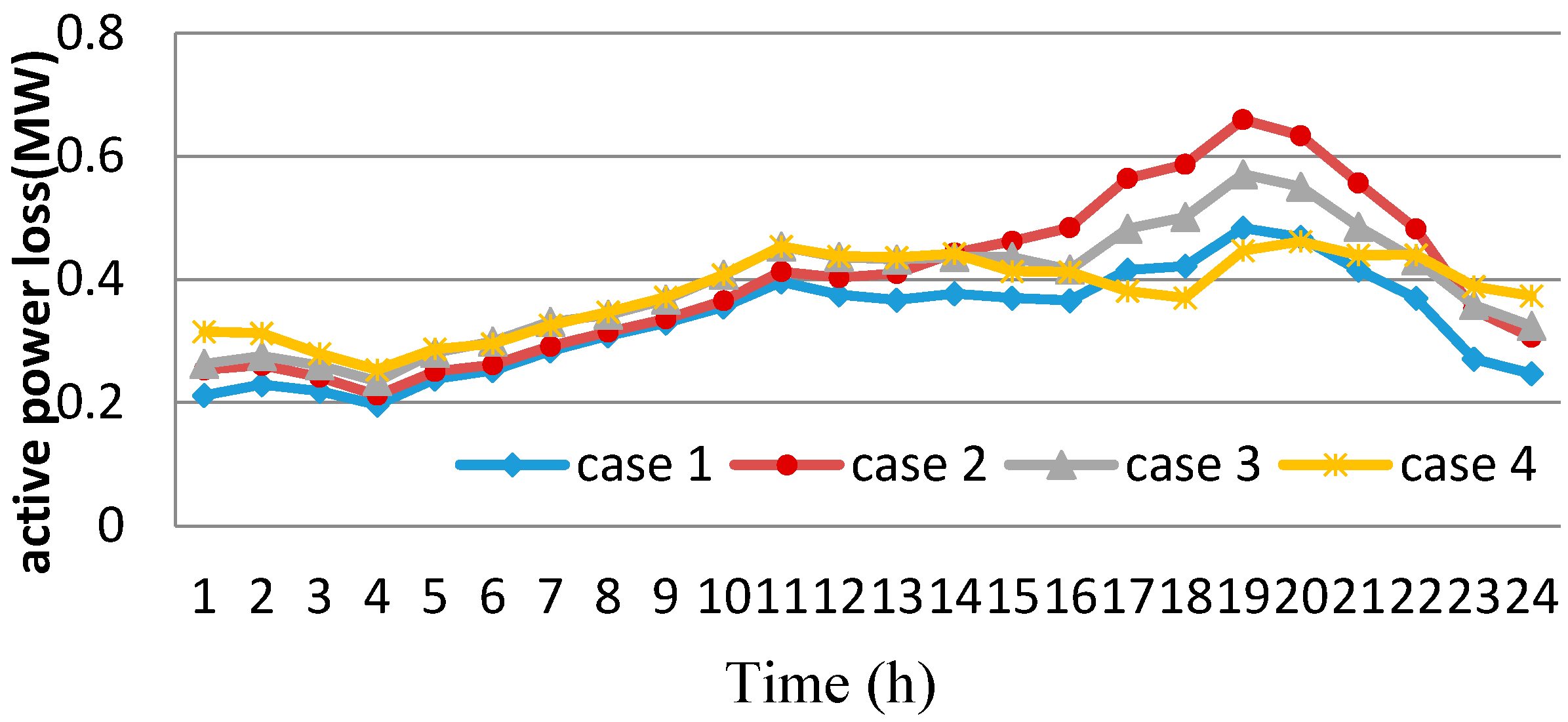

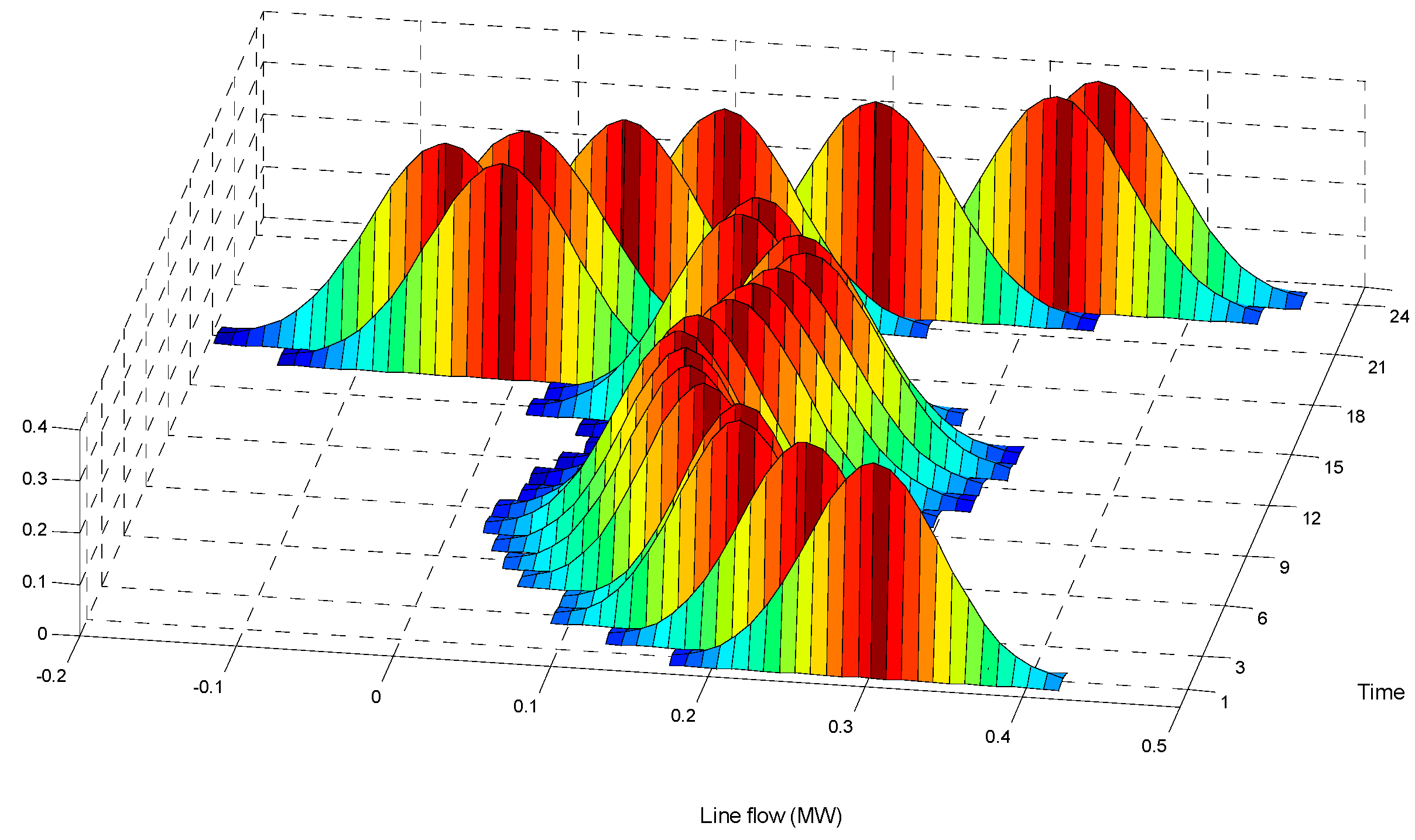

Figure 5 shows the probability distribution of charging or discharging load of 1000 EVs within 24 h in case 2–4 calculated by MCS. As shown in

Figure 5a, the peak load of the EVs charging occurs between 17:00 p.m. and 21:00 p.m. in Case 2, which is similar to the basic peak load. In

Figure 5b, the ordinary TOU price is taken into account, and some EV users are guided to charge in off-peak time. It is found that the fluctuation of charging load decreases compared with Case 2. As shown in

Figure 5c, when the discharging price at peak load is applied in Case 4, some EV users are guided to discharge in the peak hours and charge in valley period because of economic benefits.

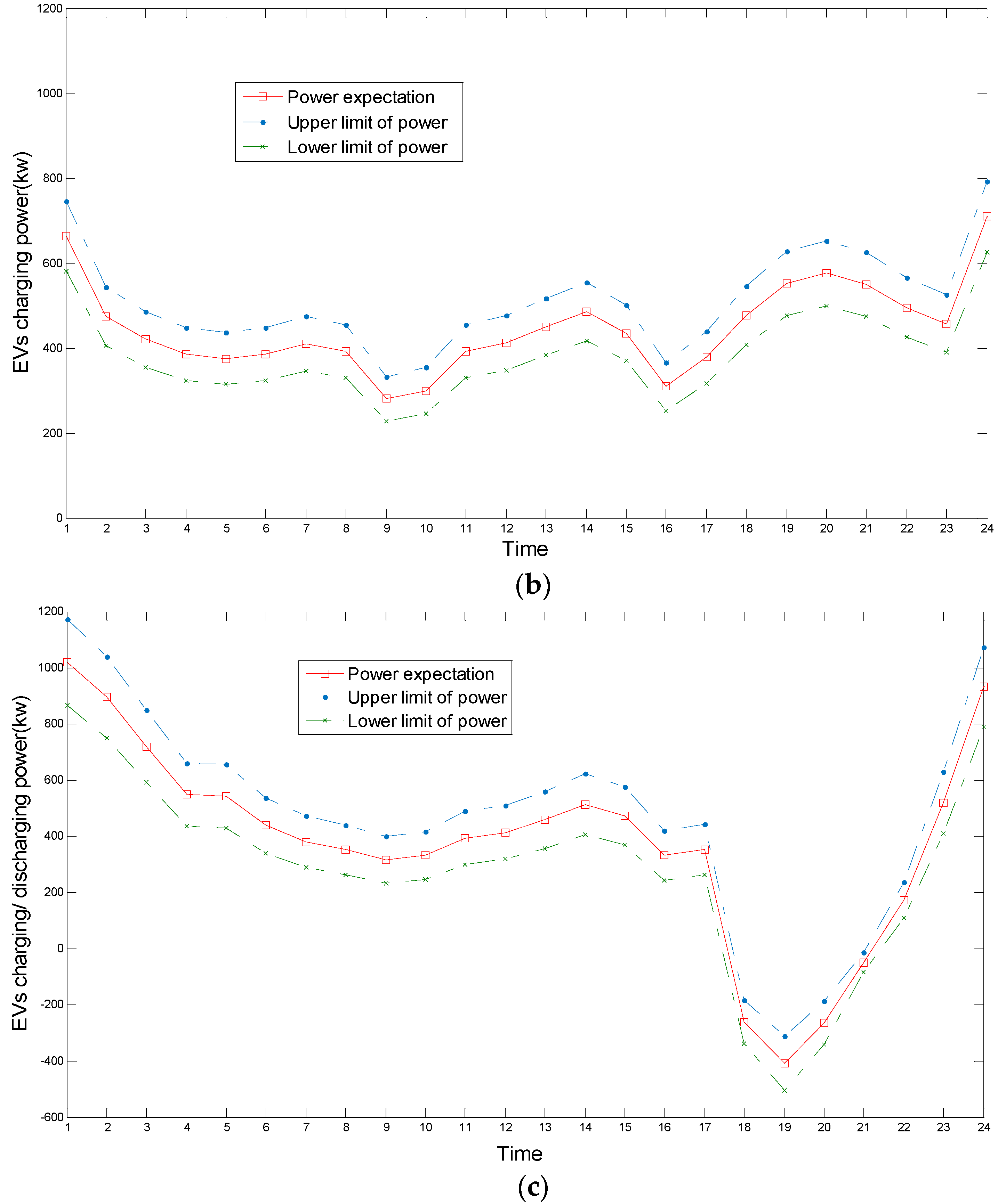

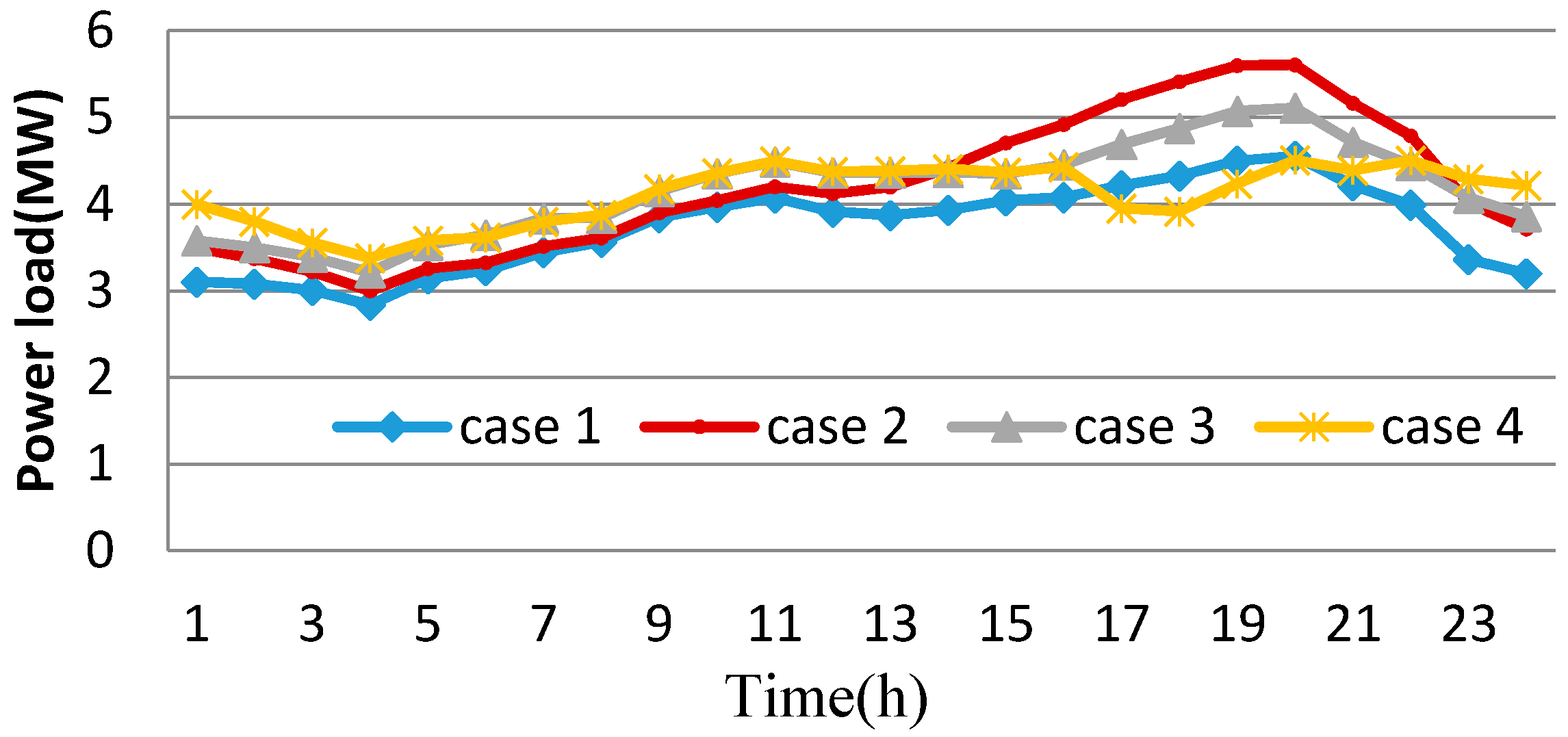

Figure 6 shows the load curves of the distribution network with different prices, and

Figure 7 shows the active power loss curves. The difference in the peak-valley and the increase of the active power losses can be observed in Case 2, and it is because of the overlap between the basic peak load and the unordered EV charging power. Under the incentive of the TOU price in Case 3, the peak load and the power loss are both smaller than that in Case 2, but the peak-valley difference is greater than that in Case 1. When the improved TOU price is applied in Case 4, the peak-valley difference and the network power losses decrease significantly compared to the ordinary TOU price.

5.2. Risk Assessment of IEEE 33-Bus Distribution Network with EVs under Different Electricity Prices

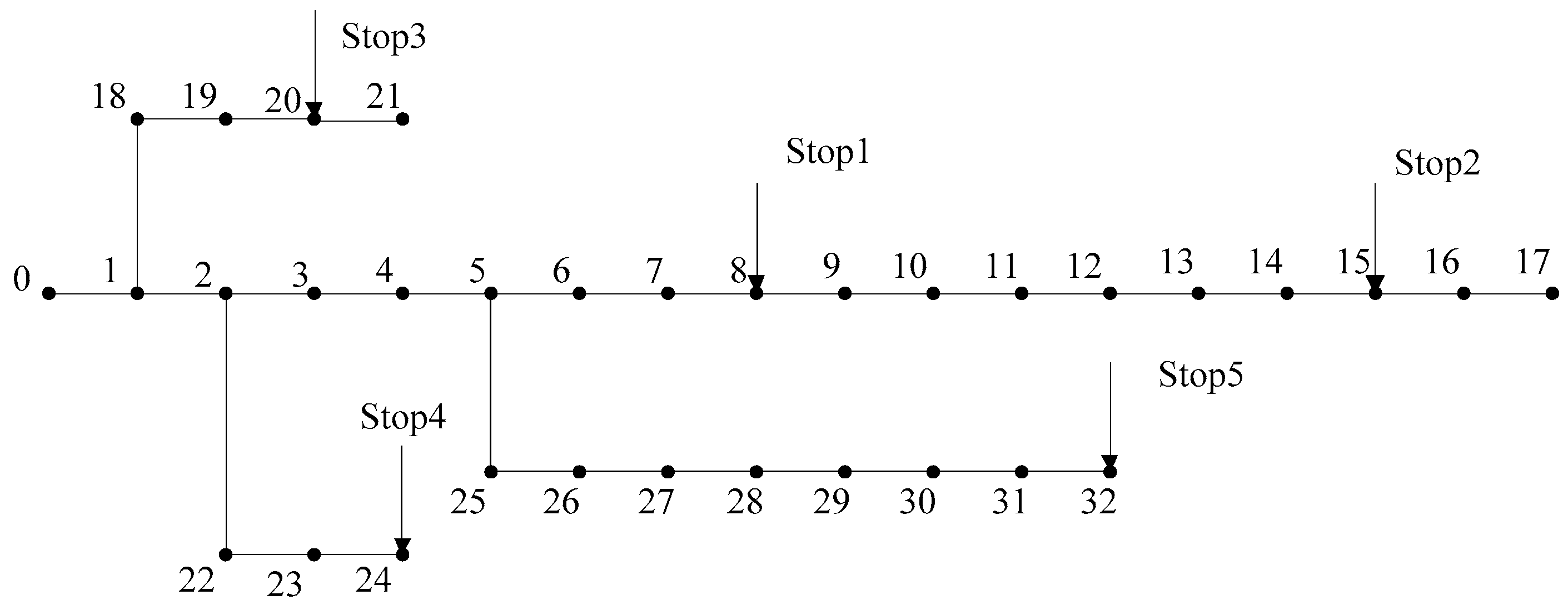

The schematic diagram of an IEEE 33-bus distribution network is shown in

Figure 8. Stop 1–Stop 5 represent five EV-stations in the system, and the number of EVs in each station is shown in

Table 1.

- (1)

The risk assessment of node voltage in a day

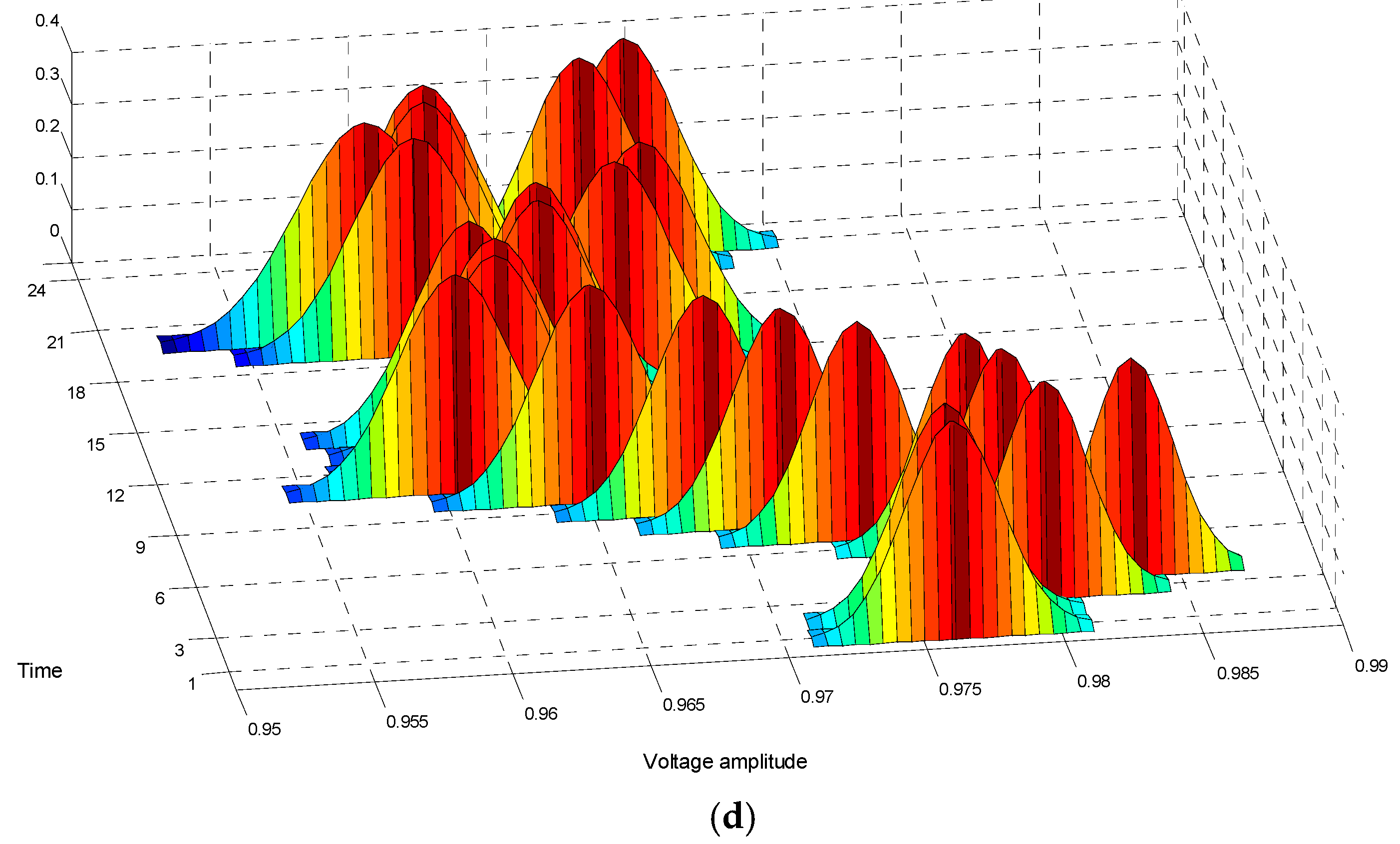

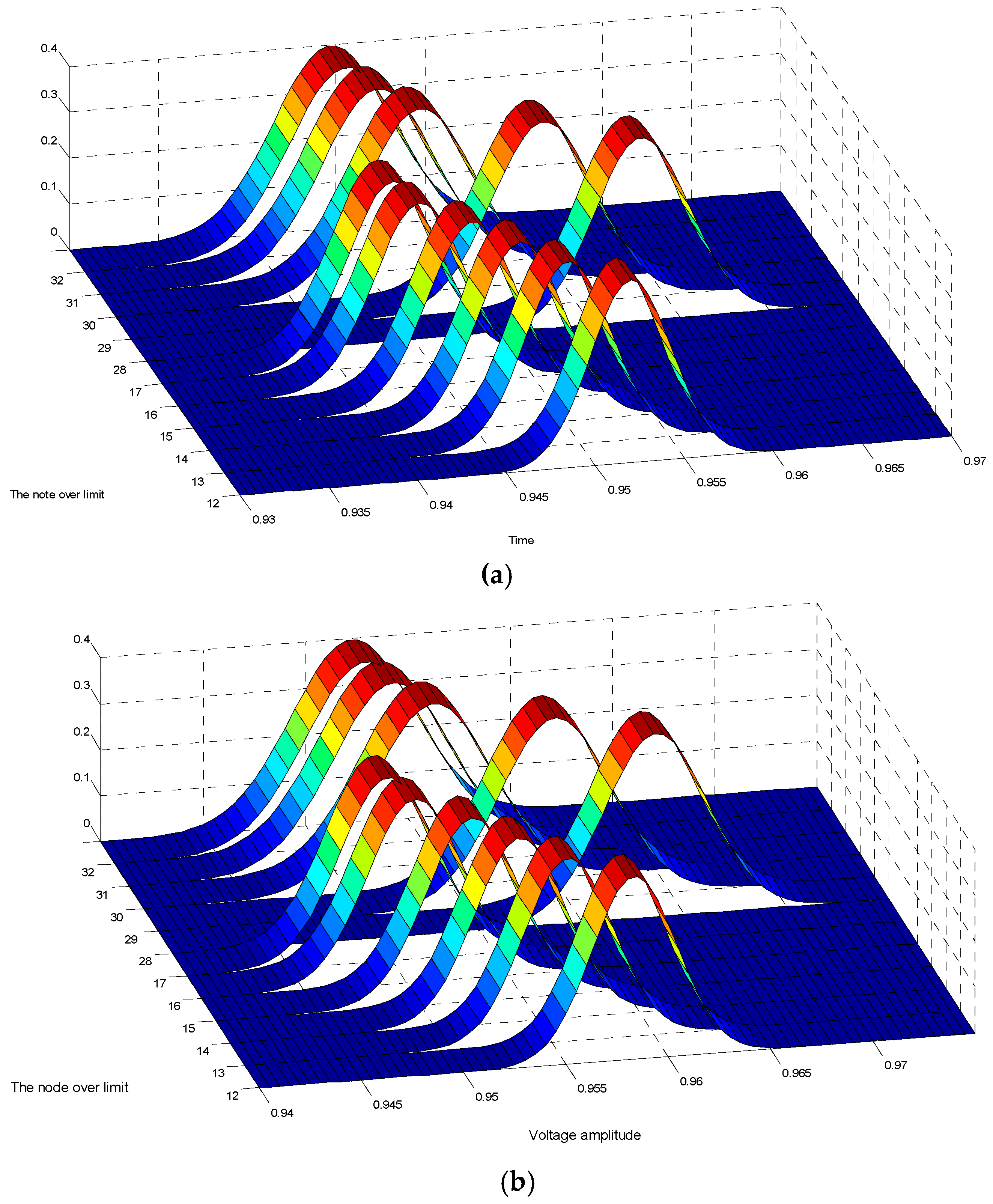

The probability distribution of voltage will fluctuate with the EV charging or discharging power and basic load, so that the node voltage may exceed the acceptable limit. As the bus 17 is located in the end of the distribution network, its node voltage is generally the lowest.

Figure 9 shows the voltage distribution of the bus 17 under different cases. For Case 1, the voltage distribution of the bus 17 is maintained at an acceptable range. For Case 2, the voltage distribution of the bus 17 will be below the lower limit, especially when the system is justly in the peak load period (18:00 p.m.–21:00 p.m.). In addition, the fluctuation of the node voltage increases with the decrease of the expected value of the node voltage. Regarding that Case 3 is applied, the voltage being out of limits can be alleviated in contrast to Case 2, and it still exists in 18:00 p.m.–21:00 p.m. In Case 4, the voltage of the bus 17 is maintained at a reasonable level because of the voltage support caused by the discharging price of EVs.

Due to that the voltage distribution of the bus 17 in Case 1 and Case 4 can meet the requirements, the risks can be ignored in the system.

Table 2 shows the risk assessment results of the bus 17 in Case 2 and Case 3. The risk index of node voltage in Case 3 is much smaller than that in Case 2 at the same time. The results demonstrate that the reasonable electricity pricing mechanism of EVs can keep the node voltage in the acceptable range and reduce the operational risk of the distribution network.

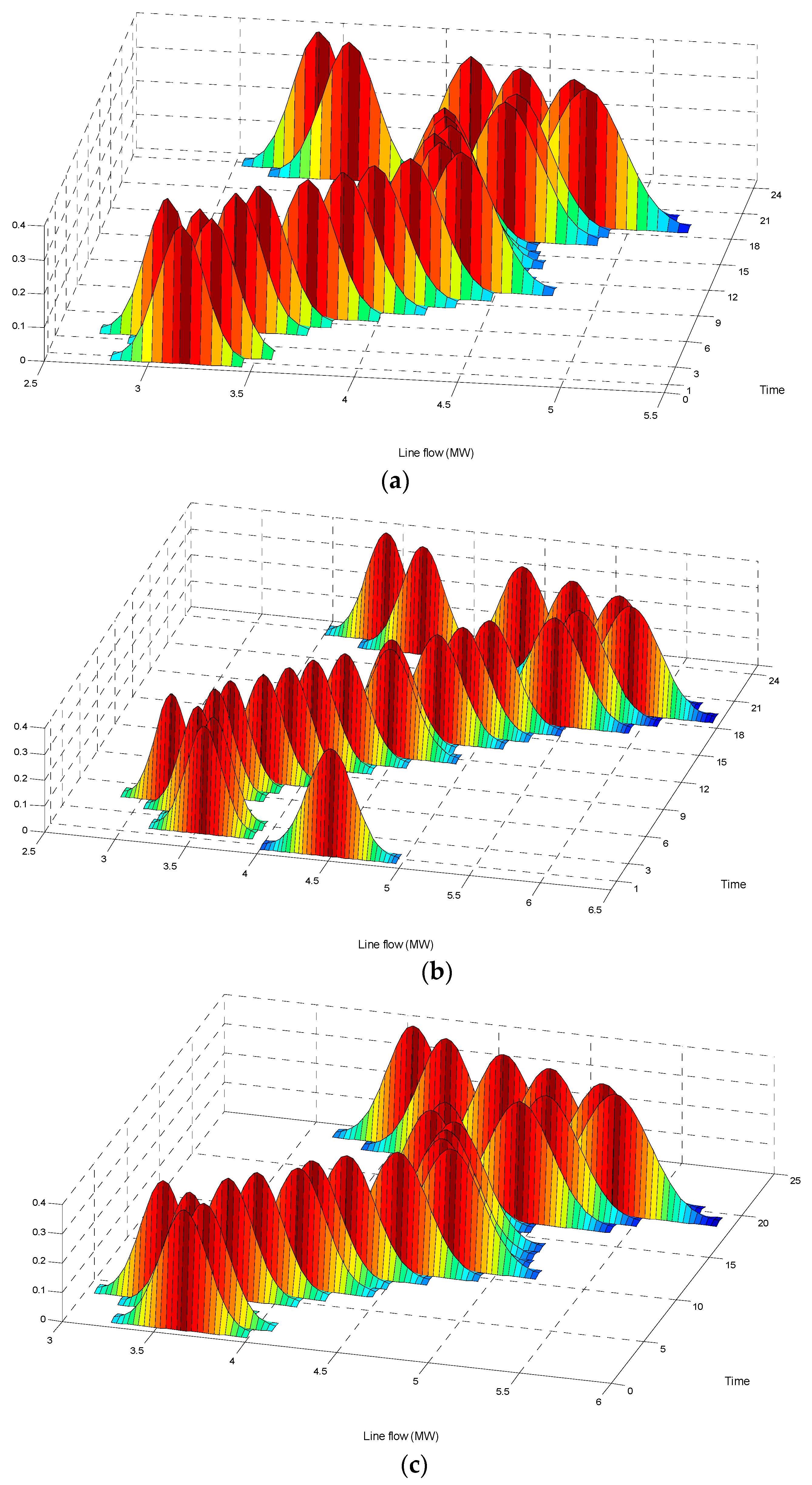

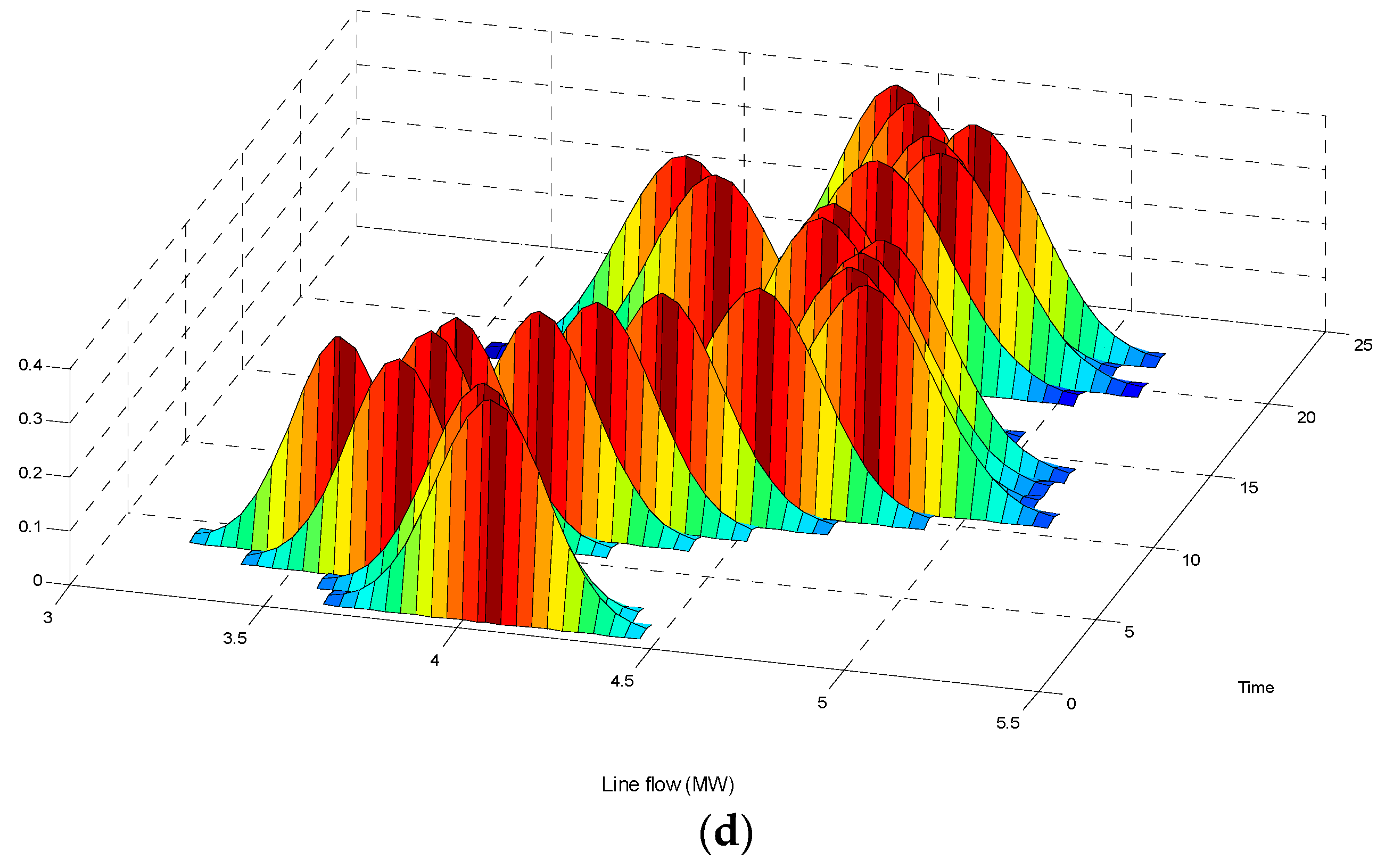

For that branch 0–1 belongs to the beginning end of the 33-bus distribution network, the maximum line flow can be obtained.

Figure 10 shows the probabilistic distribution of line flow in branch 0–1 under different cases. In Case 1 and Case 4, the line flow distribution will be under the transmission power limit, and the risks are ignored.

Table 3 shows the risk assessment results of branch 0–1 in Case 2 and Case 3.

For Case 1, the line flow in branch 0–1 is smaller than the transmission power limit. For Case 2, the line flow exceeds the upper limit in the evening peak load period. In addition, the fluctuation of the power flow increases with the rise of the expected value of the power flow. For Case 3, the line flow being out of limits can be mitigated compared with Case 2. For Case 4, the line flow is well controlled with the improved TOU price, and according to

Figure 11 where the flow in branch 31–32 is studies, the flow direction will reverse due to the discharging behavior of EVs in peak time.

- (2)

The risk assessment of node voltage at 19:00 p.m.

Based on the aforementioned simulation results, the node voltage being out of limits will be the most obvious at 19:00 p.m. In Case 1 and Case 4, all of the node voltages at 19:00 p.m. will not exceed the limit, and the safe operation of the network is ensured. For Case 2 and Case 3,

Figure 12 shows the dangerous nodes whose voltages are smaller than the lower limit at 19:00 p.m., and the related off-limit probability and risk index are shown in

Table 4. It is found that, the voltage over the end-terminal node is prone to exceed the limitation in the radial distribution network. Comparing to the node voltage with the ordinary TOU price, the node voltage with the constant price is more likely to exceed the limit. For a certain node, the risk index of the node voltage in Case 3 is much smaller than that in Case 2.

5.3. Risk Assessment of IEEE 69-Bus Distribution Network with EVs under Different Electricity Prices

As shown in

Figure 13, an IEEE 69-bus distribution network is further introduced to verify the method applicability. The number of EVs in each station is shown in

Table 5.

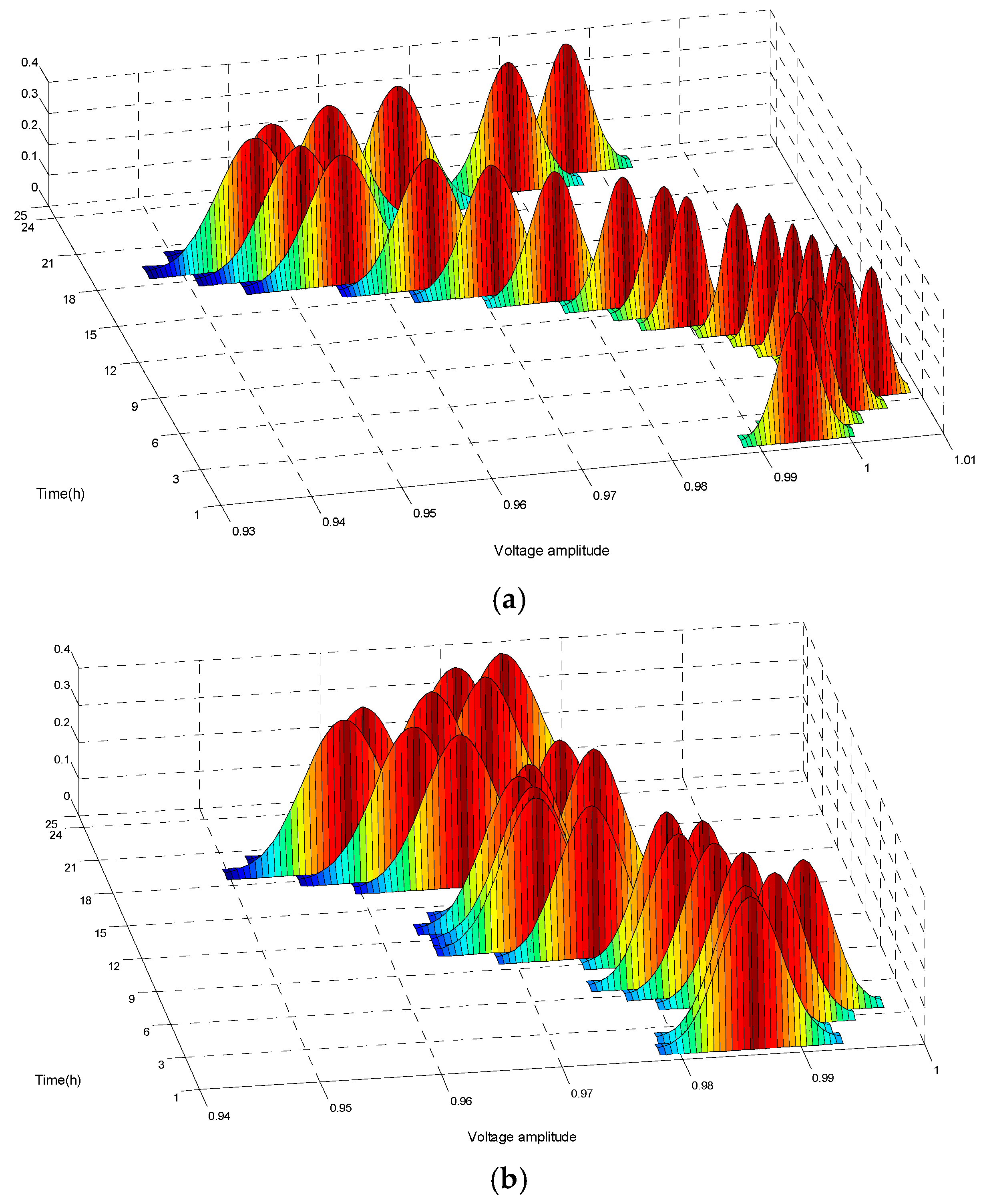

The voltage distribution of the terminal bus 26 is shown in

Figure 14. For Case 1 and Case 4, all of the node voltages can be maintained in an acceptable range.

For Case 2 and Case 3,

Table 6 and

Table 7 respectively indicate the risk assessment results of the bus 26 and branch 0–1. Meanwhile, considering the discharging behavior of EVs in Case 4,

Figure 15 shows that the power flow in some branches will reverse.

The aforementioned simulations show that the IEEE 69-bus distribution network could obtain the consistent results with the IEEE 33-bus distribution network, and the availability and suitability of the proposed method can be confirmed.