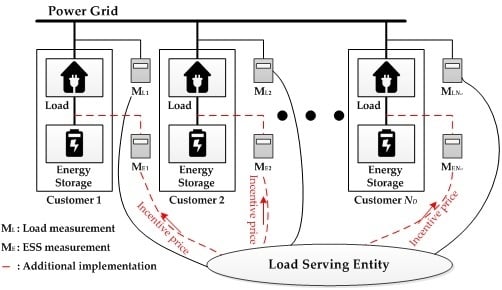

In this section, the effect of the proposed incentive scheme is verified by comparing the profits of the customer and the LSE from the proposed incentive method with those from the TOU rates. Δ

T is set to 1 h and

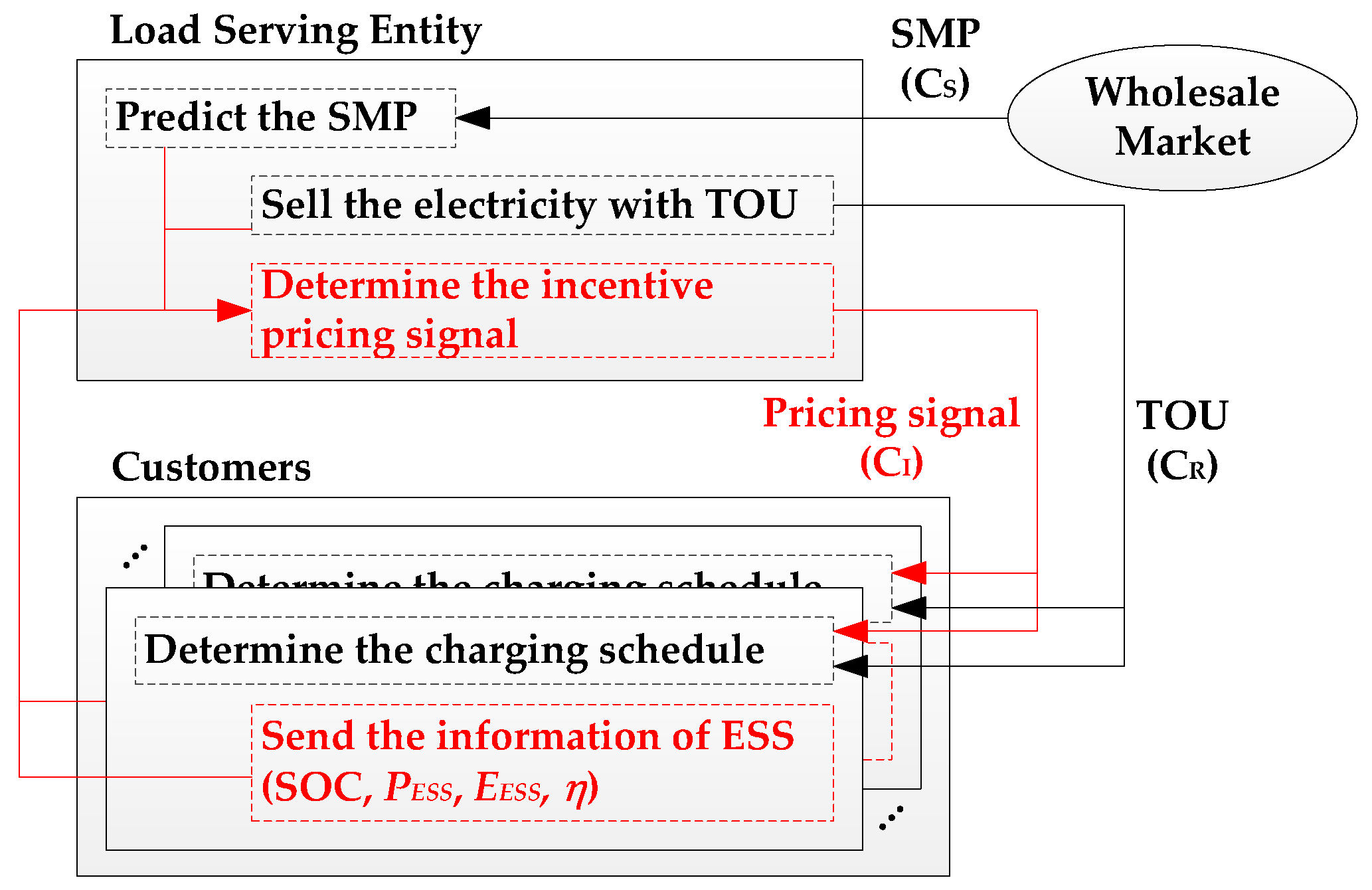

NT is set to 24. Therefore, the incentive price is derived as an hourly pricing signal. For simplicity, the SMP is assumed to be predicted with high accuracy, and historical data is used for the predicted SMP. The fmincon function in Matlab is used for a general nonlinear solver in Step 4 of

Section 4.5 because an interior point method is one of the solution methods provided by fmincon function.

5.1. Simulation Data

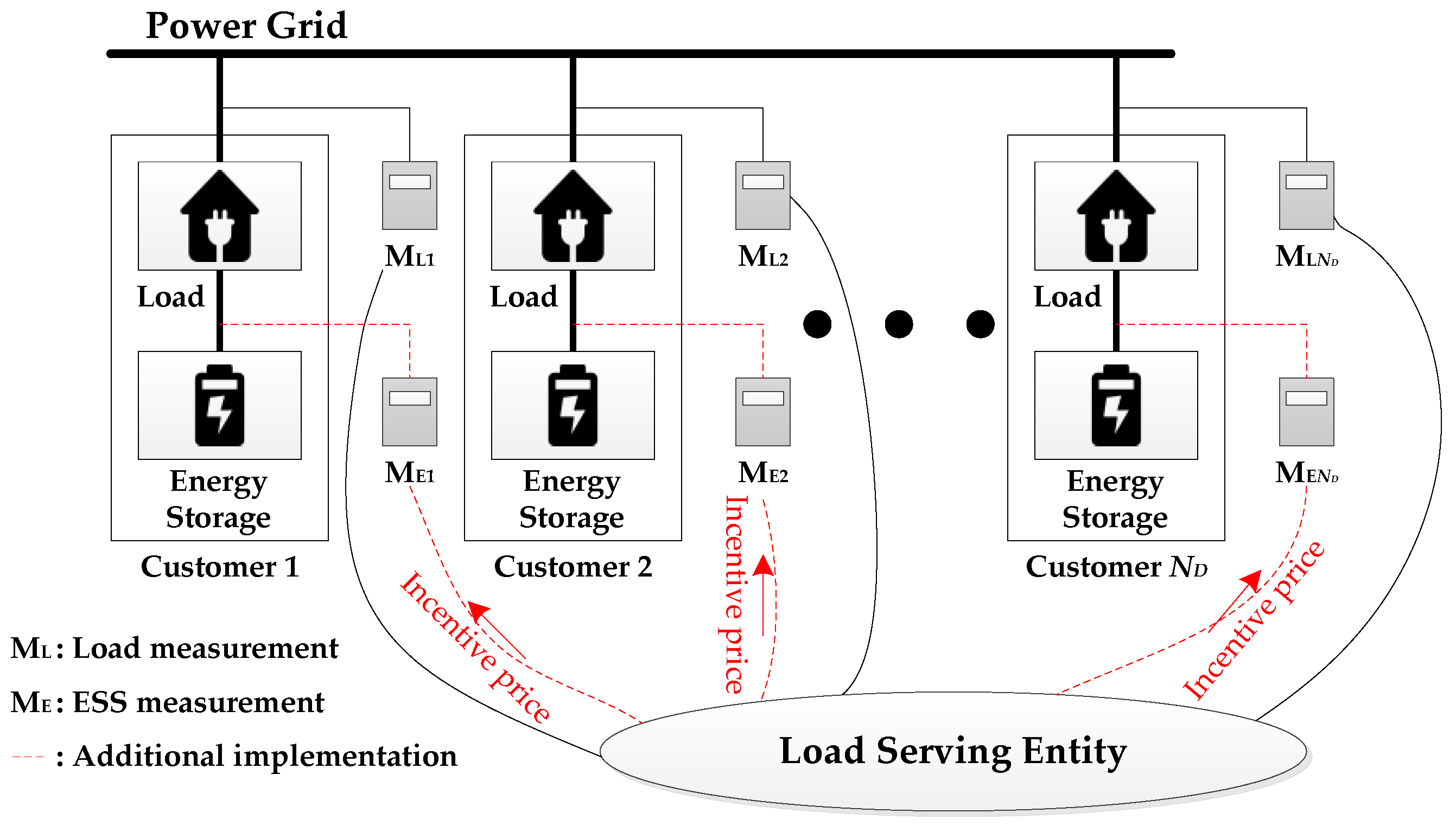

It is assumed that the number of customers owning the ESS is five. The detailed specification of the ESS is shown in

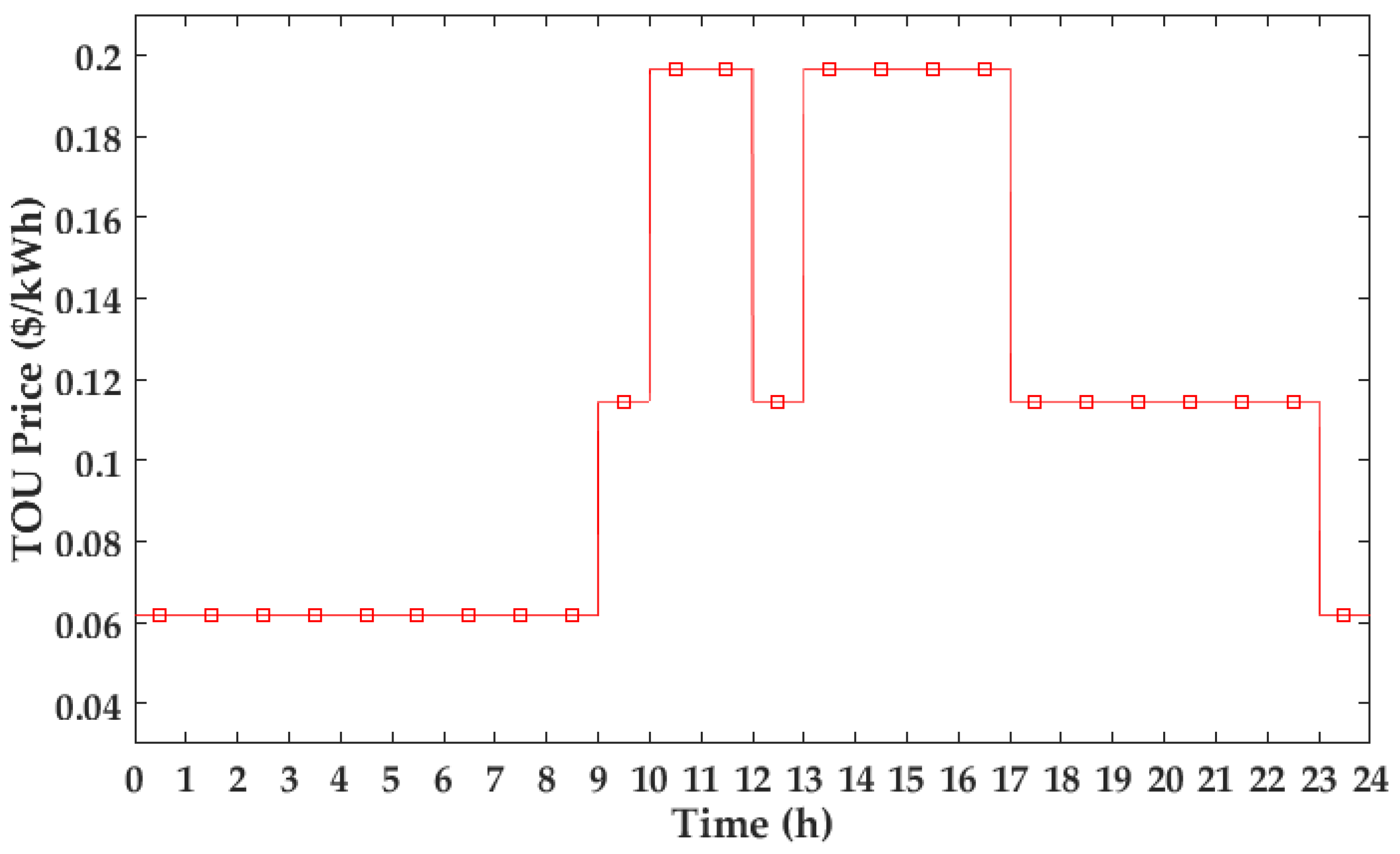

Table 1. The retail price in TOU tariff is determined depending on time and season. The TOU tariff in summer is shown in

Figure 5 and these are obtained from Korea electric power corporation website [

25]. The tariff is divided into three level prices. The peak time periods are 10:00–12:00 and 13:00–17:00. The off-peak time period is 23:00–9:00. The remaining are the mid-peak times.

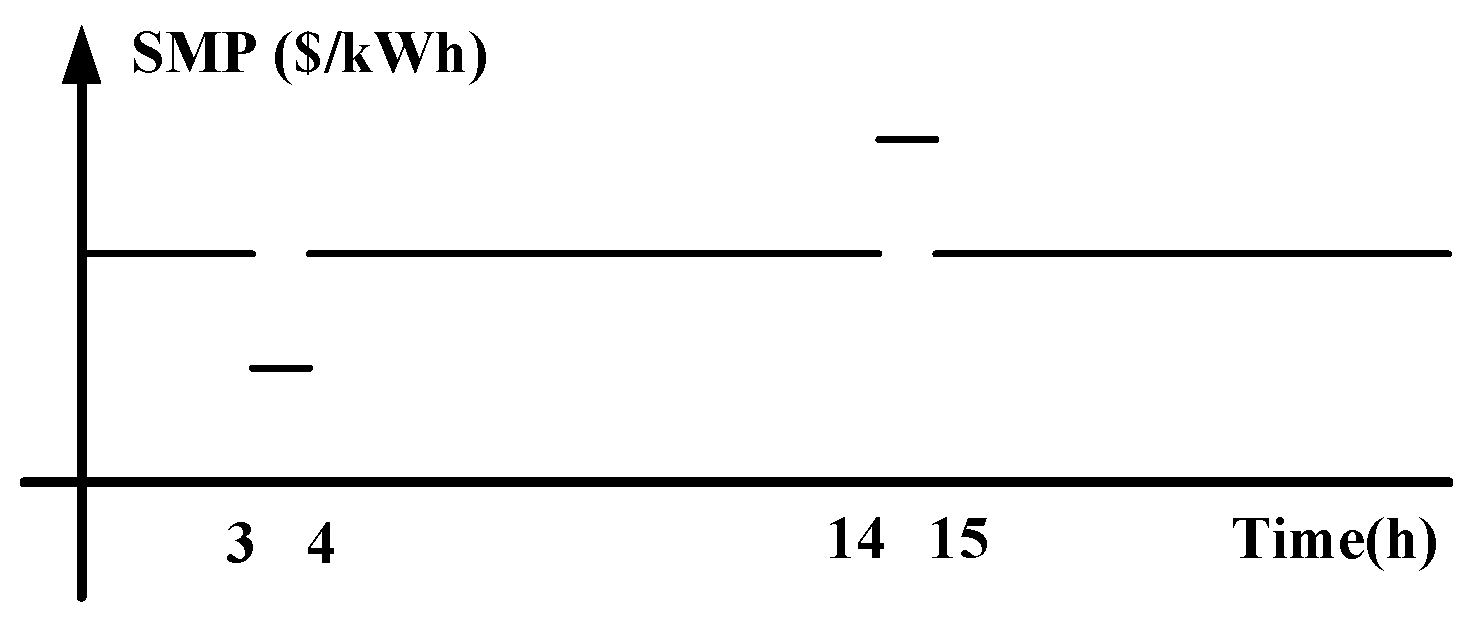

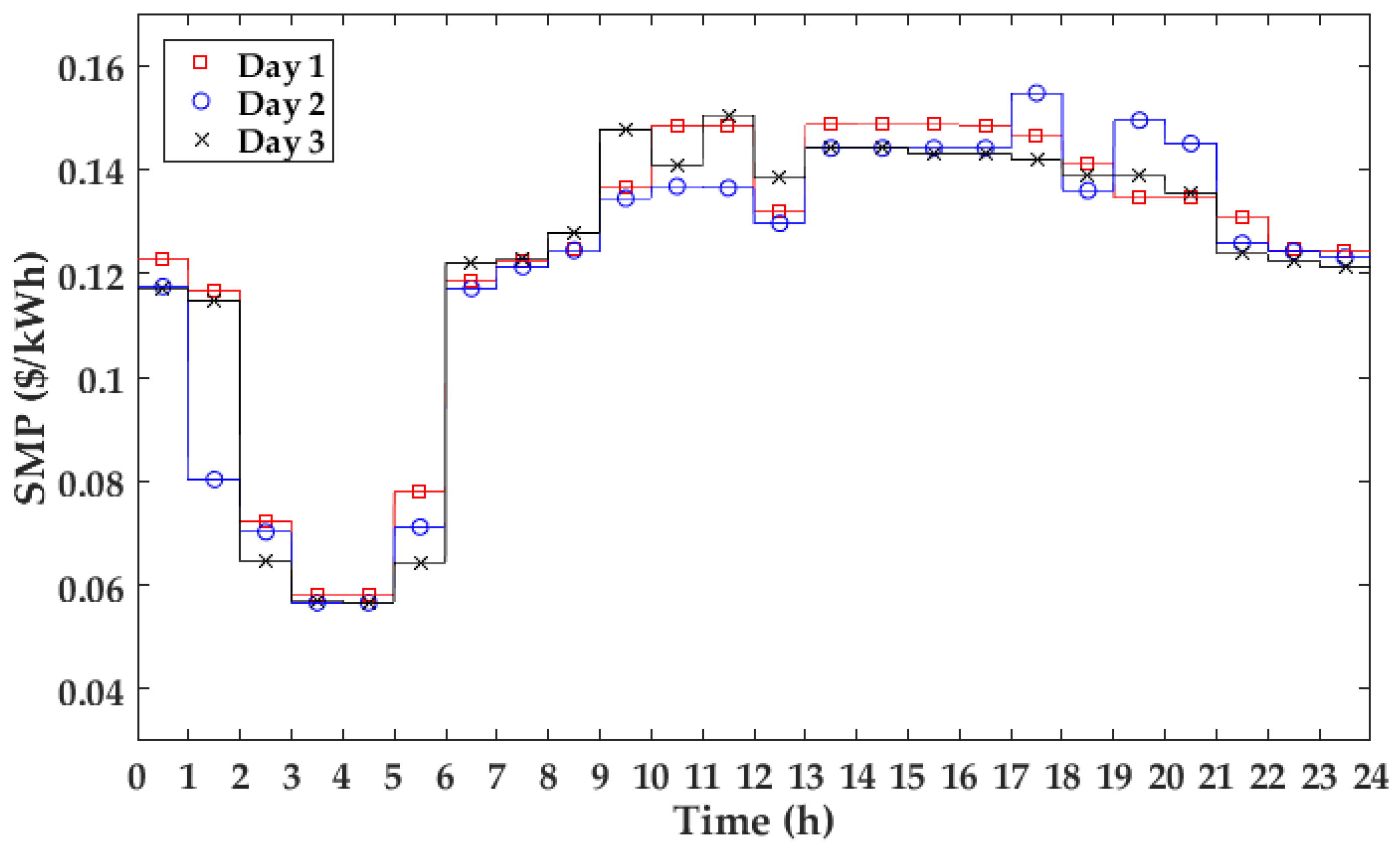

The three-day SMP data are obtained from Electric power statistics information system website, as shown in

Figure 6 [

26]. These are the weekday SMPs in summer. On Day 1, the SMPs are high when the TOU price is the peak-time price. On Day 2, the SMPs are high after 13:00 and the SMP from 12:00 to 13:00 is slightly different from the SMPs before 12:00. On Day 3, the SMPs are high during 9:00–10:00 and 11:00–12:00 and the SMP from 12:00 to 13:00 is slightly different from the SMPs after 13:00. Further, the SMPs from 3:00 to 5:00 are the lowest on these three days.

In order to satisfy the mathematical problem with equilibrium, the penalty parameter, π, is set to a large value. In this paper, the penalty parameter is set to 100. The minimum and maximum acceptable incentive prices are set to 0 ($/kWh) and 0.14 ($/kWh), respectively, because the unit of incentive price is kept within the unit of other prices, that is, TOU and SMP.

To identify the effect of the proposed incentive scheme, the following three case studies were simulated and the results were compared. Because the schedule is determined by the customer and not the LSE, it is possible that the customer determines the ESS charging schedule irrespective of the incentive pricing signal. Case 3 identifies this effect:

- Case 1

The customer determines the ESS charging schedule based on the TOU tariff, and there is no incentive.

- Case 2

The incentive pricing signal is determined by the proposed method when r is set to 0.5. The signal is sent to the customers. The customer determines the ESS charging schedule based on the TOU tariff and the incentive pricing signal.

- Case 3

The incentive pricing signal is equal to the incentive in Case 2. The signal is sent to the customers. However, the customer determines the ESS charging schedule based on the only TOU tariff. In other words, the ESS charging schedule is equal to the ESS charging schedule in Case 1.

5.2. Test Results

As explained in

Section 4.4, because the TOU tariff follows three-level pricing rates, the optimal ESS charging schedule is indeterminate. In order to determine the optimal ESS charging schedule in Cases 1 and 3, the objective Equation (37), is modified by Equation (42):

The constraints are Equations (20), (21), and (23). The additional term is related with the peak-to-average ratio. Further,

w is set to 0.000001. Owing to small

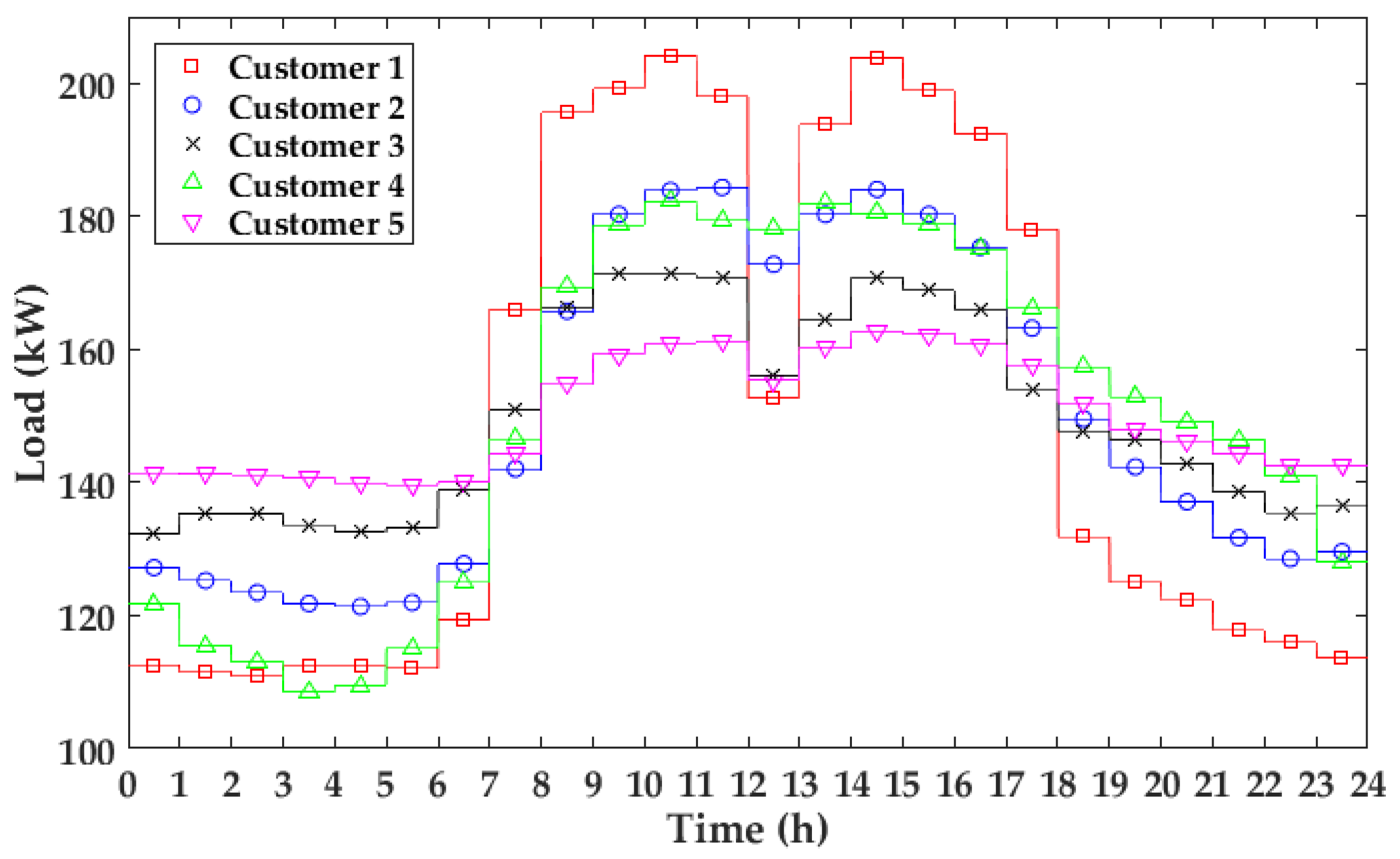

w, the charging periods and discharging periods are determined by TOU price dominantly. It is assumed that the load demands of customers are shown in

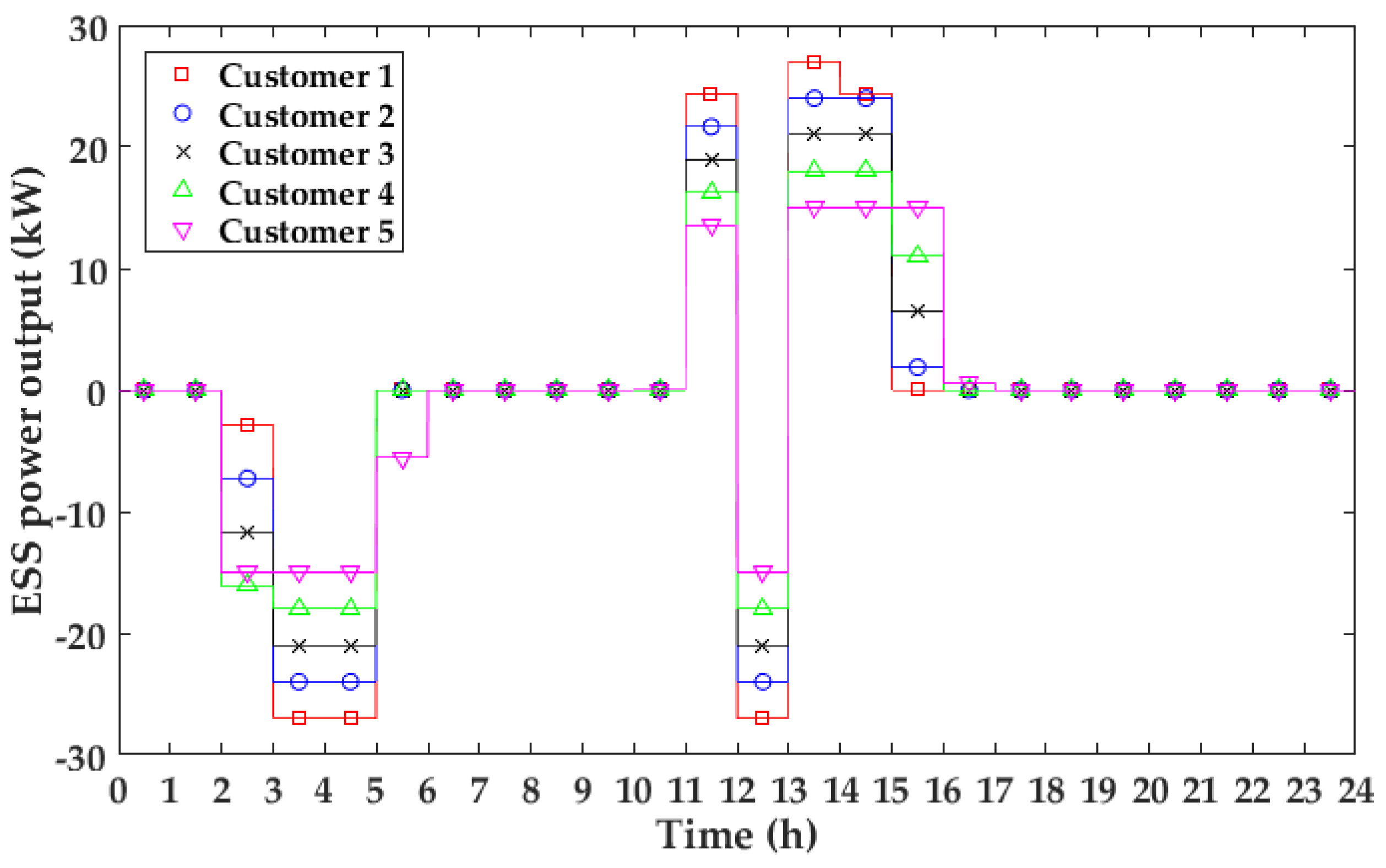

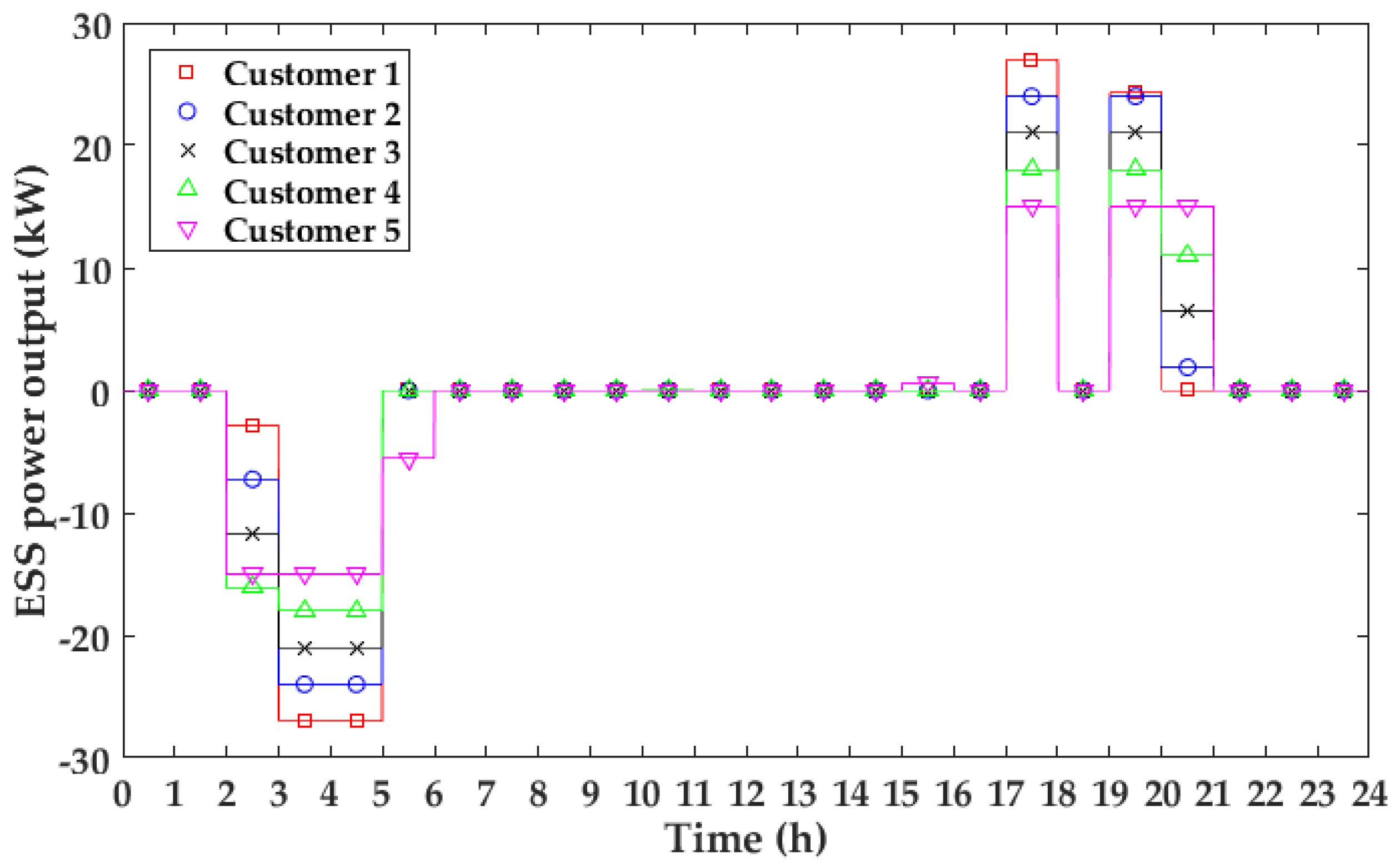

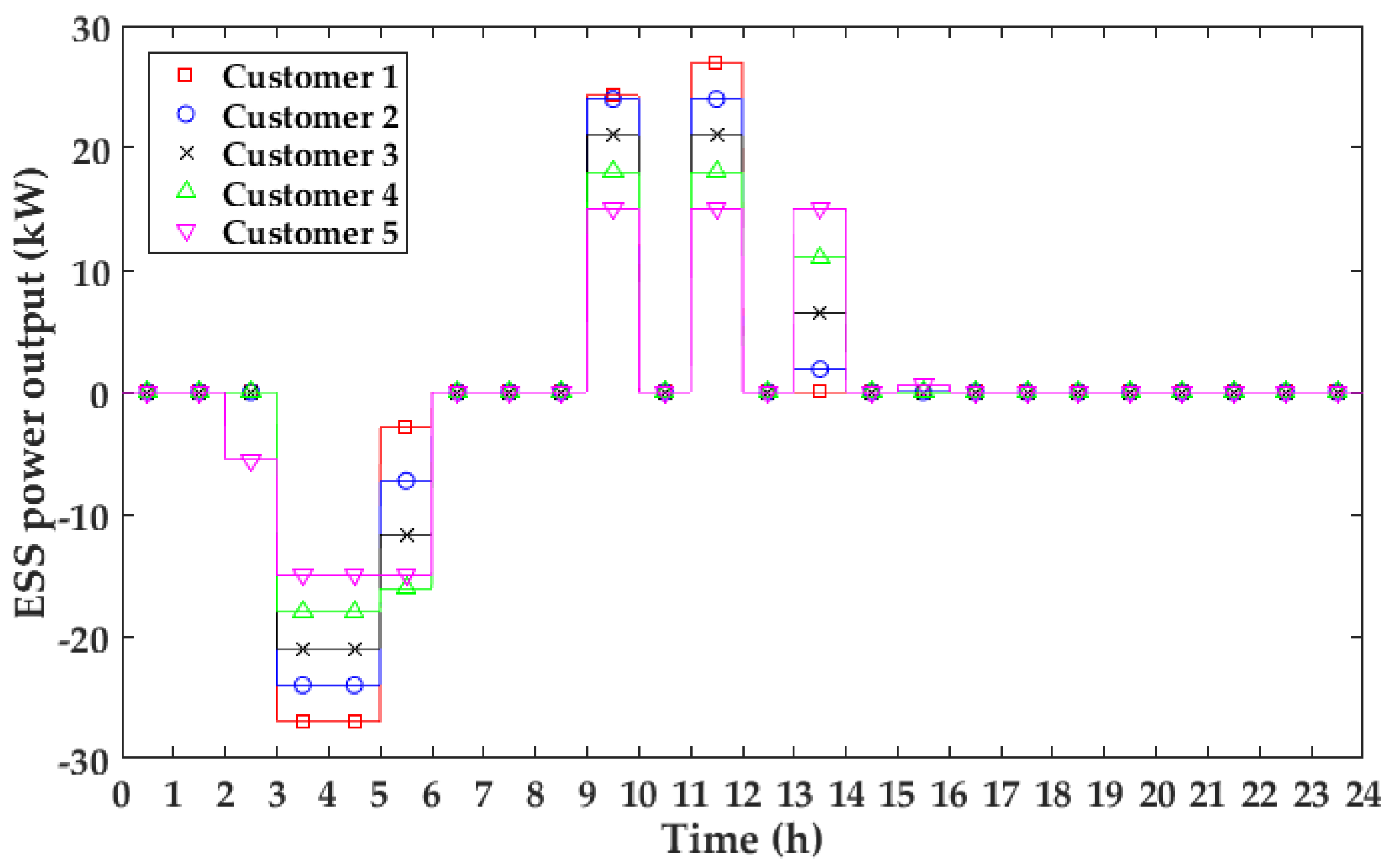

Figure 7. The ESS charging schedules in Cases 1 and 3 during the three days are fixed as shown in

Figure 8 because the TOU tariff is fixed. The discharging period is the peak time period and the charging periods are two time periods. One is the off-peak time period and the other is the mid-peak time between 12:00 and 13:00. Further, because of the additional term, more electricity is discharged when the load demand is higher during the discharging periods and more electricity is charged when the load demand is lower during the charging periods.

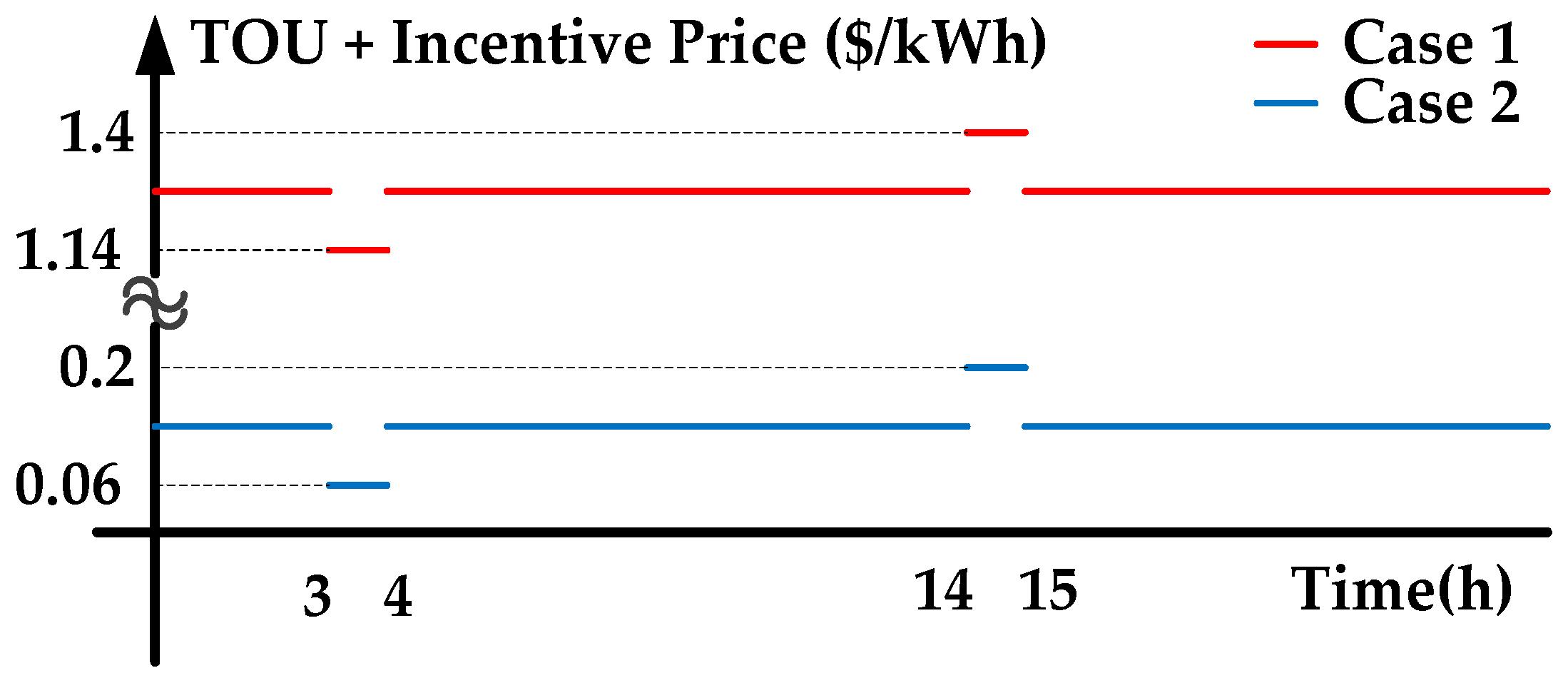

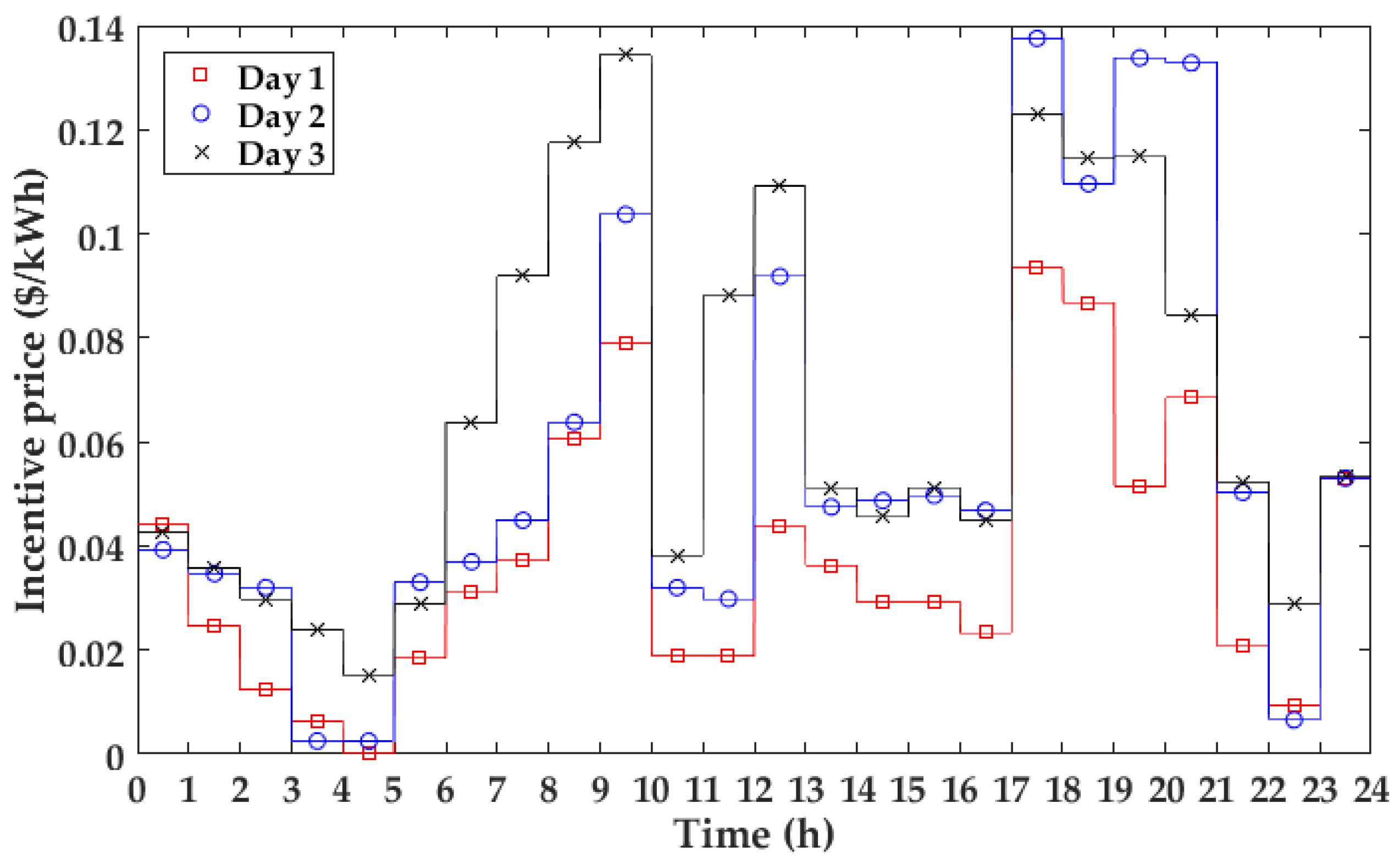

The three-day incentive prices in Cases 2 and 3 are shown in

Figure 9. The sums of incentive prices and TOU prices are shown in

Figure 10. The customers determine the ESS charging schedule based on these sums. In the proposed scheme, if the SMP is higher, the sum of the incentive price and TOU is also higher. Therefore, it seems that the customers determine the ESS charging schedules based on the SMP, although they use the TOU rates.

The incentive prices are lower from 3:00 to 5:00 than at other off-peak times as shown in

Figure 6, because the SMPs are the lowest among the off-peak time periods. Therefore, the ESSs charge the electricity during these times intensively. On Day 1, the SMP from 12:00 to 13:00 is sufficiently low compared to the SMPs in the peak time. Therefore, it is efficient to charge the electricity in this time period. On Day 2, because of little difference between SMP from 12:00 to 13:00 and SMPs before 12:00, charging the electricity during this time is improper to increase the cost savings from the wholesale market upon considering the charging and discharging efficiency. Similarly, on Day 3, charging the electricity from 12:00 to 13:00 is not efficient because of little difference between SMP in this time period and SMPs after 13:00. Therefore, the ESSs charge the electricity during this time period on Day 1 but the ESSs do not charge the electricity during this time period on Day 2 and Day 3 in the proposed incentive scheme.

The discharging times are determined as the time periods when the SMPs are high on three days, which are during 10:00–12:00 and 13:00–17:00 on Day 1, 17:00–18:00 and 19:00–21:00 on Day 2 and 9:00–10:00 and 11:00–12:00 on Day 3. The remaining energy caused by the limitation of discharging power is discharged when SMP is the highest among the remaining time periods, because the sum of the incentive price and TOU price is also the highest in the proposed method.

The profit and the loss related with the constant load demand are eliminated in the Tables. The cost savings of the customer is the cost savings from the retail prices and the cost savings of the LSE is the cost savings from the wholesale prices. The social welfare is equal to the cost savings from the wholesale market. The values in parentheses denote the ratio of increase in the profit and the ratio decrease in the loss compared to Case 1. Because the customers use the ESS for the purpose of the cost savings in the TOU scheme, the revenue of the LSE from the retail market decreases. Therefore, the total LSE profit caused by the ESS is negative and is described as the loss. Further, if the expenditure for incentive is negative, the LSE gives the incentive to customers. Otherwise, the bill of the customer increases.

In the incentive scheme using the proposed method, the social welfare increased compared only to the TOU scheme. In addition, the profit of the customer increased and the loss of the LSE decreased.

In Case 2, owing to setting

r to 0.5, more than 50% of increased social welfare compared to Case 1 is given to the customers. The portions of the customers for the increased social welfare on Day 1, Day 2, and Day 3 are 60.54%, 56.21%, and 54.96%, respectively. In order to verify the effect of

r,

r changes from 0.1 to 0.9 and the interval is 0.2. The portions of the total customers for the increased social welfare on Day 1, Day 2, and Day 3 are shown in

Table 5. Because the LSE increases its portions and the minimum ratio is maintained by Equation (41), the portion of the customer is close to

r. Therefore, the increased social welfare can be divided by the intention of the LSE. Further, when

r is set to 0.5, the portion of all customers is similar to the portion of the LSE.

On the other hand, as shown in Cases 2 and 3, when the customer determines the ESS charging schedule irrespective of the incentive pricing signal, the profit of the customer is reduced. Therefore, in order to maximize the profit, the customer considers the incentive price when it determines the ESS charging schedule.

Therefore, the social welfare is increased and the profit can be divided into the LSE and the customers equitably in the proposed incentive scheme. In addition, the customer follows the intention of the LSE to maximize his/her profit from the incentive scheme.