Interdependencies between Biofuel, Fuel and Food Prices: The Case of the Brazilian Ethanol Market †

Abstract

:1. Introduction

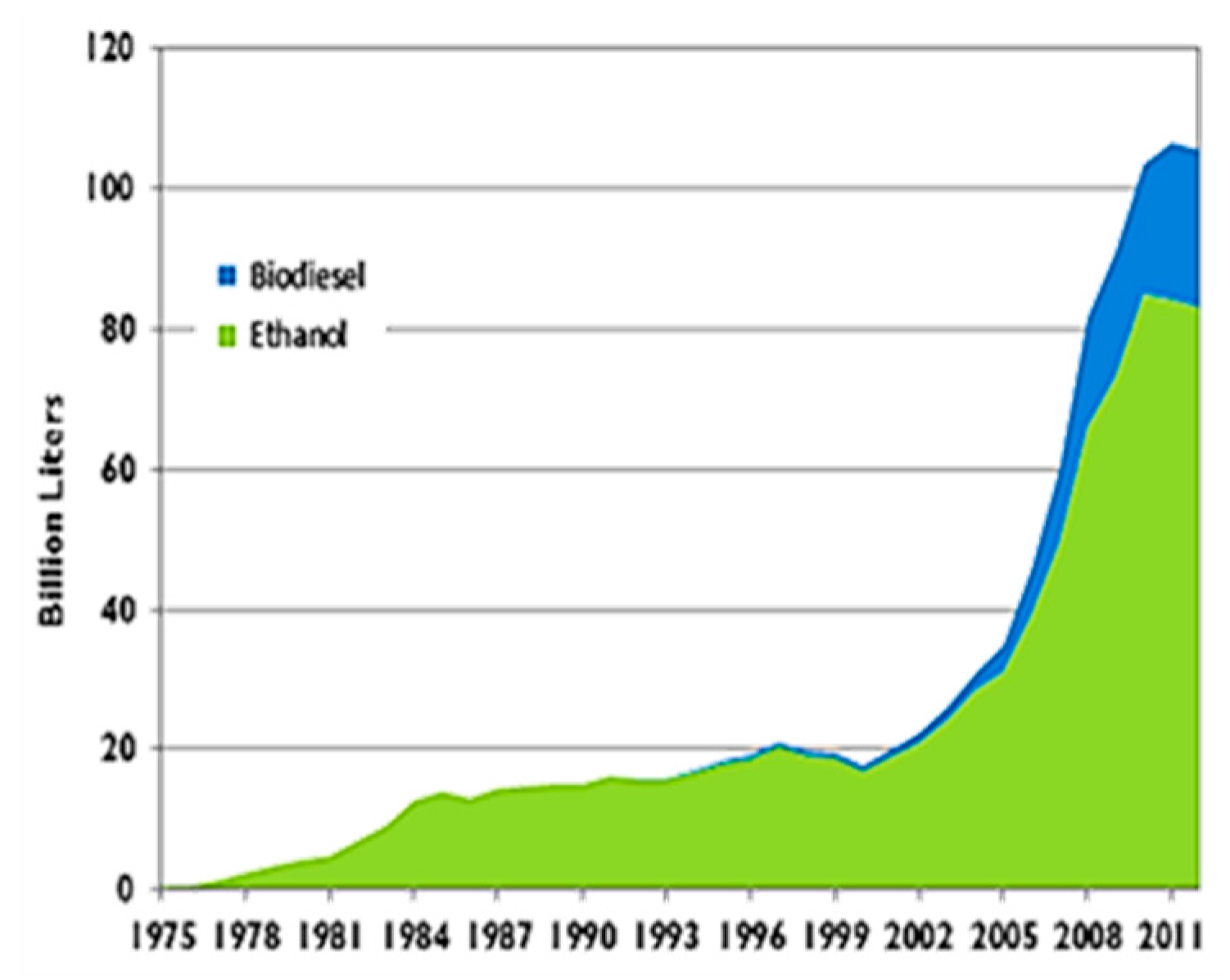

2. The Sugar-Ethanol Market in Brazil: An Overview

3. Food-Fuel Price Interdependence: A Brief Literature Review

4. Materials and Methods

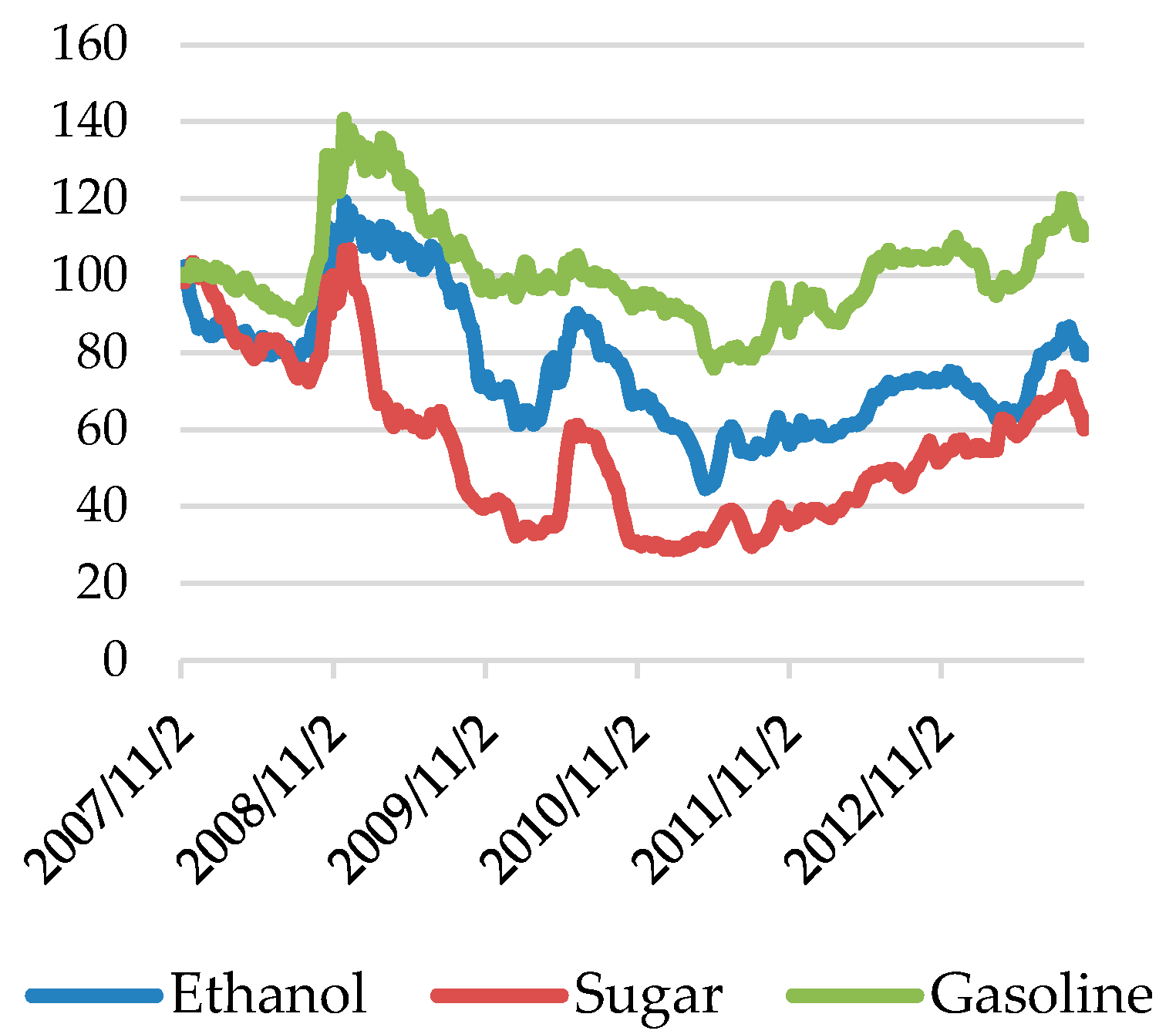

Database

5. Results

5.1. Stationary Analysis and Co-Integration Estimation

5.2. Vector Error Correction Model (VECM) Estimation

5.2.1. Granger Causality Tests

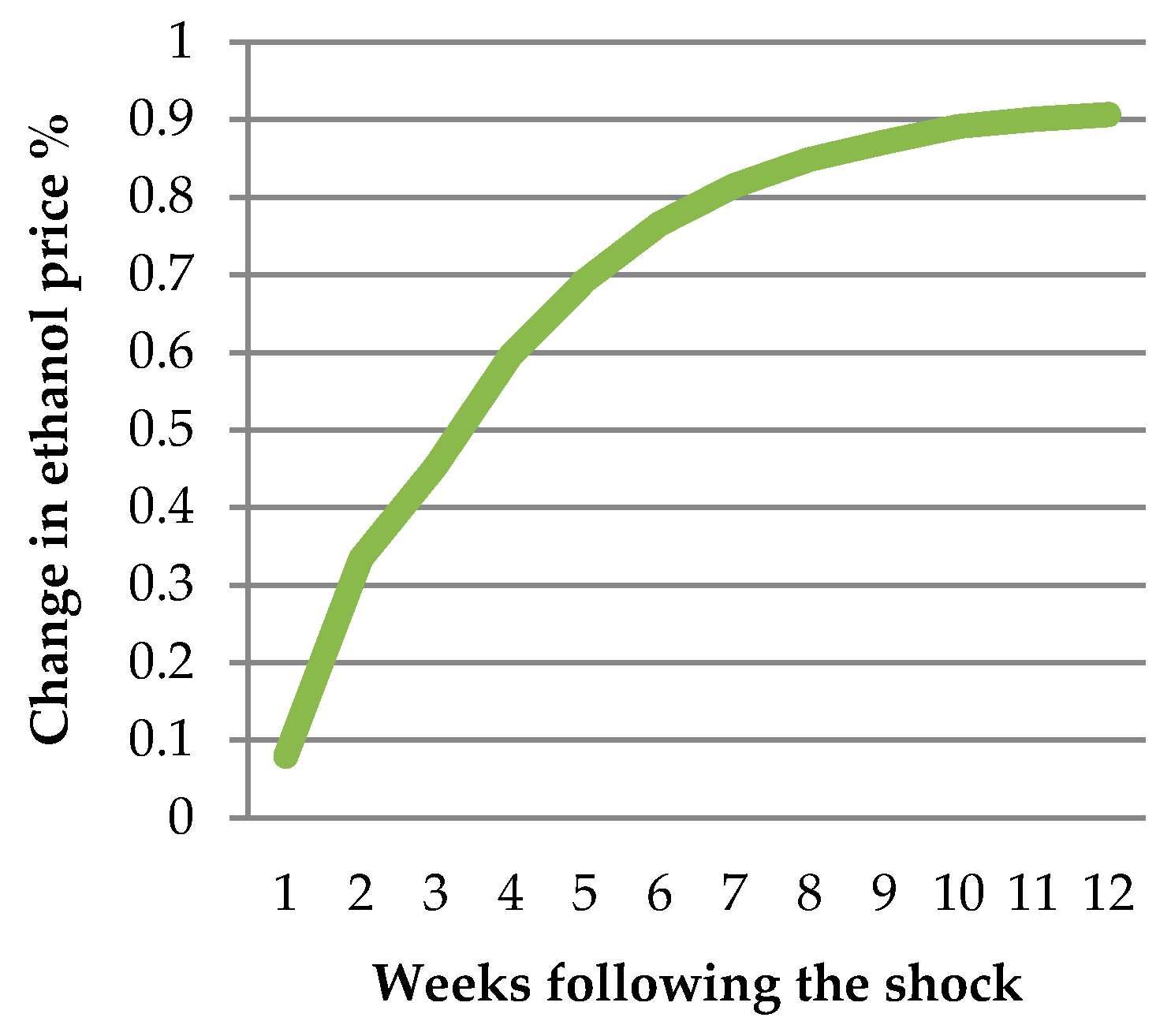

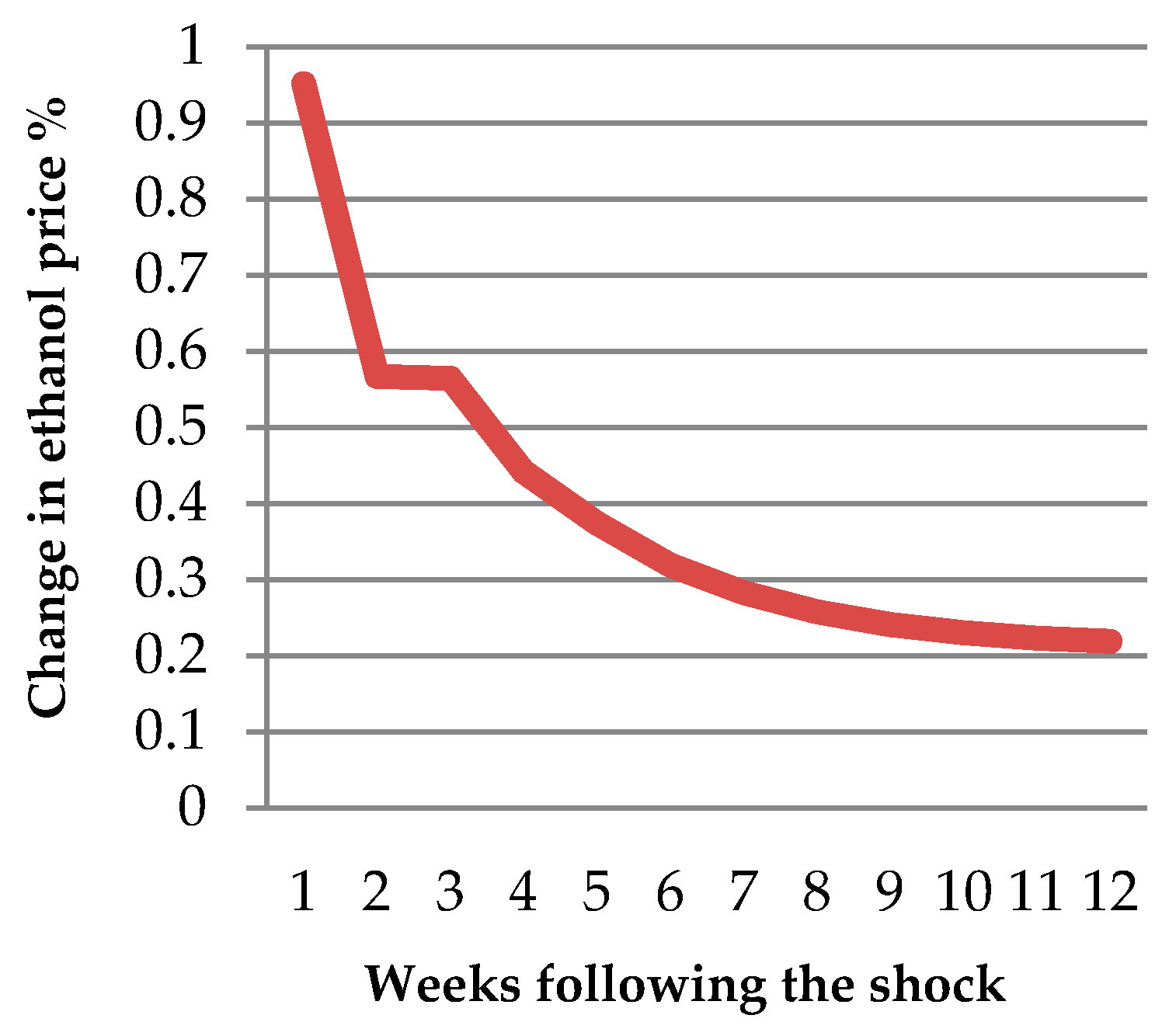

5.2.2. Impulse Response Analysis

5.2.3. Variance Decomposition Analysis

6. Discussion and Conclusions

Acknowledgments

Author Contributions

Conflicts of Interest

Abbreviations

| VECM | Vector Error Correction Model |

| ADF | Augmented Dickey Fuller Test |

| IRFs | Impulse Response Functions |

| FEVD | Forecast Error Variance Decomposition |

| VDC | Variance Decomposition |

| GHG | Greenhouse Gas |

| LUC | Land Use Change |

| PP | Phillips-Perron Test |

| KPSS | Kwiatkowski, Phillips, Schmidt & Shin Test |

References

- Abbott, P.; De Battisti, B.A. Recent global food price shocks: Causes, consequences and lessons for African governments and donors. J. Afr. Econ. 2011, 20, i12–i62. [Google Scholar] [CrossRef]

- Balcombe, K. The nature and determinants of volatility in agricultural prices: An empirical study from 1962–2008. FAO Commodity Market Rev. 2010, 1–24. [Google Scholar]

- Sarris, A. Evolving structure of world agricultural trade and requirements for new world trade rule. In Proceedings of Food and Agriculture Organization of the United Nations-FAO Expert Meeting on “How to Feed the World in 2050” FAO, Rome, Italy, 24–26 June 2009; Available online: ftp://ftp.fao.org/docrep/fao/012/ak979e/ak979e00.pdf (accessed on 24 January 2014).

- Gilbert, C.L. How to Understand High Food Prices. J. Agric. Econ. 2010, 61, 398–425. [Google Scholar] [CrossRef]

- Gilbert, C.L.; Morgan, C.W. Food price volatility. Philos. Trans. R. Soc. Lond. B Biol. Sci. 2010, 365, 3023–3034. [Google Scholar] [CrossRef] [PubMed]

- De Schutter, O. Food commodities speculation and food price crises: Regulation to reduce the risks of price volatility. United Nations Spec. Rapp. Right Food Brief. Note 2010, 2, 1–14. [Google Scholar]

- Jacks, D.S.; O’Rourke, H.K.; Williamson, J.G. Commodity Price Volatility and World Market Integration since 1700. Rev. Econ. Statist. 2011, 93, 800–813. [Google Scholar] [CrossRef]

- Huchet-Bourdon, M. Agricultural commodity Price volatility: An Overview. In OECD Food, Agriculture and Fisheries Working Papers; Organisation for Economic Co-operation and Development (OECD) Publishing: Paris, France, 2011; p. 52. [Google Scholar]

- Muller, S.A.; Anderson, J.E.; Wallington, J.T. Impact of biofuels production and other supply and demand factors on food price increases in 2008. Biomass Bioenergy 2011, 35, 1623–1632. [Google Scholar] [CrossRef]

- OECD-FAO. Agricultural Outlook 2011–2020. 2011. Available online: https://www.google.it/url?sa=t&rct=j&q=&esrc=s&source=web&cd=6&cad=rja&uact=8&ved=0ahUKEwjr_-nHgofMAhVCYQ8KHZewCTAQFghDMAU&url=https%3A%2F%2Fwww.donorplatform.org%2Findex.php%3Foption%3Dcom_cobalt%26task%3Dfiles.download%26tmpl%3Dcomponent%26id%3D1719%26fid%3D15%26fidx%3D0%26rid%3D1365%26return%3DaHR0cHM6Ly93d3cuZG9ub3JwbGF0Zm9ybS5vcmcvY29iYWx0L2NhdGVnb3J5LWl0ZW1zLzEtbGlicmFyeS84LWZvb2Qtc2VjdXJpdHk%252Fc3RhcnQ9MjA%253D&usg=AFQjCNExF9GlwBrP__b6WwkmDe82Hm1myQ (accessed on 3 February 2014).

- Finco, A. Biofuels Economics and Policy-Agricultural and Environmental Sustainability; Franco Angeli: Milano, Italy, 2013; pp. 94–109. [Google Scholar]

- Tyner, W.E. Biofuels and food prices: Separating wheat from chaff. Glob. Food Secur. 2013, 2, 126–130. [Google Scholar] [CrossRef]

- Brons, M.; Nijkamp, P.; Pels, E.; Rietveld, P.A. A meta-analysis of the price elasticity of gasoline demand. A SUR approach. Energy Econ. 2008, 30, 2105–2122. [Google Scholar] [CrossRef]

- Zhang, Z.; Lohr, L.; Escalante, C.; Wetzstein, M. Food versus fuel: What do price tell us? Energy Policy 2010, 38, 445–451. [Google Scholar] [CrossRef]

- Ciaian, P.; Kancs, D. Interdependencies in the energy-bioenergy-food price systems: A cointegration analysis. Resour Energy Econ. 2011, 33, 326–348. [Google Scholar] [CrossRef]

- Chinnici, G.; D’Amico, M.; Pecorino, B. Assessment and prospects of renewable energy in Italy. Calitatea 2015, 16, 126–134. [Google Scholar]

- Chinnici, G.; D’Amico, M.; Rizzo, M.; Pecorino, B. Analysis of biomass availability for energy use in Sicily. Renew. Sustain. Energy Rev. 2015, 52, 1025–1030. [Google Scholar] [CrossRef]

- Testa, R.; Foderà, M.; Di Trapani, A.M.; Tudisca, S.; Sgroi, F. Giant reed as energy crop for Southern Italy: An economic feasibility study. Renew. Sustain. Energy Rev. 2016, 58, 558–564. [Google Scholar] [CrossRef]

- Kafle, K.; Pullabhotla, H.K. Food for the Stomach or Fuel for the Tank: What do Prices Tell Us? In Proceedings of the 2014 Annual Meeting, Minneapolis, MN, USA, 27–29 July 2014.

- Havranek, T.; Irsova, Z.; Janda, K. Demand for gasoline is more price-inelastic than commonly thought. Energy Econ. 2012, 34, 201–207. [Google Scholar] [CrossRef]

- Lora, E.E.S.; Palacio, J.C.E.; Rocha, M.H.; Reno, G.; Venturini, O.J.; del Olmo, O.A. Issues to Consider, Existing Tools and Constraints in Biofuels Sustainability Assessments. Energy 2011, 36, 2097–2110. [Google Scholar] [CrossRef]

- De Souza Ferreira Filho, J.B.; Horridge, M. Ethanol expansion and indirect land use change in Brazil. Land Use Policy 2014, 36, 595–604. [Google Scholar] [CrossRef]

- Popp, J.; Lakner, Z.; Harangi-Rákos, M.; Fári, M. The effect of bioenergy expansion: Food, energy, and environment. Renewable and Sustainable. Renew. Sustain. Energy Rev. 2014, 32, 559–578. [Google Scholar] [CrossRef]

- Popp, J.; Harangi-Rákos, M.; Gabnai, Z.; Balogh, P.; Antal, G.; Bai, A. Biofuels and Their Co-Products as Livestock Feed: Global Economic and Environmental Implications. Molecules 2016, 21, 285. [Google Scholar] [CrossRef] [PubMed]

- Ahlgren, S.; Di Lucia, L. Indirect land use changes of biofuel production—A review of modelling efforts and policy developments in the European Union. Biotechnol. Biofuels 2014, 7, 1. [Google Scholar] [CrossRef] [PubMed]

- Searchinger, T.; Heimlich, R. Avoiding bioenergy competition for food crops and land. Creating a Sustainable Food Future. 2015, pp. 1–44. Available online: http://nocache.wri.org/sites/default/files/avoiding_bioenergy_competition_food_crops_land.pdf (accessed on 8 April 2015).

- Searchinger, T.; Heimlich, R.; Houghton, R.; Dong, F.; Elobeid, A.; Fabiosa, J.; Tokgoz, S.; Hayes, D.; Yu, T. Use of US Croplands for Biofuels Increases Greenhouse Gases through Emissions from Land Use Change. Science 2008, 319, 1238–1240. [Google Scholar] [CrossRef] [PubMed]

- Perimenis, A.; Walimwipi, H.; Zinoviev, S.; Muller-Langer, F.; Miertus, S. Development of a Decision Support Tool for the Assessment of Biofuels. Energy Policy 2011, 39, 1782–1793. [Google Scholar] [CrossRef]

- Edwards, R.; Mulligan, D.; Marelli, L. Indirect land use change from increased biofuels demand. Comparison of models and results for marginal biofuels production from different feedstocks. Joint Research Centre (JRC) Scientific and Technical Reports: Ispra, Italy, 2010; Available online: http://www.eac-quality.net/fileadmin/eac_quality/user_documents/3_pdf/Indirect_land_use_change_from_increased_biofuels_demand_-_Comparison_of_models.pdf (accessed on 8 April 2015).

- Delzeit, R.; Klepper, G.; Lange, K.M. Assessing the Land Use Change Consequences of European Biofuel Policies and its Uncertainties. Review of IFPRI study, study on behalf of the European Biodiesel Board by Kiel Institute for the World Economy: Kiel, Germany, 2011. Available online: http://www.ebb-eu.org/EBBpressreleases/Review_iLUC_IfW_final.pdf (accessed on 8 April 2015).

- Zilberman, D.; Hochman, G.; Rajagopal, D. Indirect Land Use: One Consideration Too Many in Biofuel Regulation. Agric. Resour. Econ. Update 2010, 13, 1–4. [Google Scholar]

- Bentivoglio, D.; Rasetti, M. Biofuel sustainability: Review of implications for land use and food price. REA 2015, 70, 7–31. [Google Scholar]

- Finco, A.; Padella, M.; Bentivoglio, D.; Rasetti, M. Sostenibilità dei biocarburanti e sistemi di certificazione. EDA 2012, 2, 247–269. (In Italian) [Google Scholar]

- Fatih, B. World energy outlook 2015. International Energy Agency, 2015; p. 1. Available online: http://www.worldenergyoutlook.org/weo2015/ (accessed on 20 January 2016).

- International Energy Agency. Medium-Term Renewable Energy Market Report 2015. Available online: https://www.iea.org/Textbase/npsum/MTrenew2015sum.pdf (accessed on 20 January 2016).

- Worldwatch Institute. Available online: http://www.worldwatch.org/biofuel-production-declines-0 (accessed on 12 March 2014).

- REN21. Renewables 2015 Global Status Report. 2015. Available online: http://www.ren21.net/wp-content/uploads/2015/07/REN12-GSR2015_Onlinebook_low1.pdf (accessed on 3 February 2016).

- De Freitas, L.C.; Kaneko, S. Is there a causal relation between ethanol innovation and the market characteristics of fuels in Brazil? Ecolog. Econ. 2012, 74, 161–168. [Google Scholar] [CrossRef]

- UNICA-The Brazilian Sugarcane Industry Association. Available online: http://www.unicadata.com.br/historico-de-producao-e-moagem.php?idMn=32&tipoHistorico=4 (accessed on 29 April 2014).

- UNICA. Detalhamento das exportações mensais de etanol pelo Brasil. 2014. Available online: http://www.unicadata.com.br/listagem.php?idMn=23 (accessed on 2 July 2014).

- Crago, C.L.; Khanna, M.; Barton, J.; Giuliani, E.; Amaral, W. Competitiveness of Brazilian sugarcane ethanol compared to US corn ethanol. Energy Policy 2010, 38, 7404–7415. [Google Scholar] [CrossRef]

- Shikida, P.F.A.; Finco, A.; Cardoso, B.F.; Galante, V.A.; Rahmeier, D.; Bentivoglio, D.; Rasetti, M. A comparison between ethanol and biodiesel production: The Brazilian and European experiences. In Liquid Biofuels: Emergence, Development and Prospects; Springer-Verlag: London, UK, 2014; pp. 25–53. [Google Scholar]

- Martins-Filho, J.; Burnquist, H.L.; Vian, C.E.F. Bioenergy and the rise of sugarcane based ethanol in Brazil. Choices 2006, 21, 91–96. [Google Scholar]

- Programa de Educação Continuada em Economia e Gestão de Empresas (PECEGE ESALQ/USP). Custos de produção de cana-de-açúcar, açúcar e etanol no Brasil: fechamento da safra 2012/2013; 1a Ediçao; Universidade de São Paulo, Escola Superior de Agricultura “Luiz de Queiroz”/Departamento de Economia, Administração e Sociologia: Piracicaba, SP, Brazil, 2013; pp. 23–44. (In Portuguese) [Google Scholar]

- Hochman, G.; Sexton, S.; Zilberman, D. Food and Biofuel in Global Environment. In Handbook of Bioenergy Economics and Policy; Khanna, M., Scheffran, J., Zilberman, D., Eds.; Springer Science & Business Media: New York, NY, USA, 2009; pp. 267–286. [Google Scholar]

- Kristoufek, L.; Janda, K.; Zilberman, D. Mutual Responsiveness of Biofuels, Fuels and Food Prices. CAMA Working Paper 38. 2012. Available online: http://cama.crawford.anu.edu.au/pdf/working-papers/2012/382012.pdf (accessed on 24 July 2014).

- Vacha, L.; Janda, K.; Kristoufek, L.; Zilberman, D. Time-Frequency Dynamics of Biofuels Fuels-Food System. Energ. Econ. 2013, 40, 233–241. [Google Scholar] [CrossRef]

- Zilberman, D.; Hochman, G.; Rajagopal, D.; Sexton, S.; Timilsina, G. The impact of biofuels on commodity food prices: Assessment of Findings. Am. J. Agr. Econ. 2013, 95, 275–281. [Google Scholar] [CrossRef]

- Serra, T.; Zilberman, D. Biofuels-related price transmission literature: A review. Energ. Econ. 2013, 37, 141–151. [Google Scholar] [CrossRef]

- Zhang, Z.; Lohr, L.; Escalante, C.; Wetzstein, M. Ethanol, corn, and soybean price relations in a volatile vehicle-fuels market. Energies 2009, 2, 230–339. [Google Scholar] [CrossRef]

- Saghaian, S.H. The impact of the oil sector on commodity prices: Correlation or causation? J. Agric. Appl. Econ. 2010, 42, 477–485. [Google Scholar] [CrossRef]

- Serra, T.; Zilberman, D.; Gil, J.M.; Goodwin, B.K. Nonlinearities in the US corn-ethanol-oil-gasoline price system. Agric. Econ. 2011, 42, 35–45. [Google Scholar] [CrossRef]

- Du, X.; McPhail, L. Inside the black box: The rice linkage and transmission between energy and agricultural markets. Energy J. 2012, 33, 171–194. [Google Scholar] [CrossRef]

- Qiu, C.; Colson, G.; Escalante, C.; Wetzstein, M. Considering macroeconomic indicators in the food before fuel nexus. Energy Econ. 2012, 34, 2021–2028. [Google Scholar] [CrossRef]

- Wixson, S.E.; Katchova, A.E. Price asymmetric relationships in commodity and energy markets. In Proceedings of the 123rd European Association of Agricultural Economists (EAAE) Seminar, Dublin, Ireland, 23–24 February 2012.

- Gardebroek, C.; Hernandez, M.A. Do energy prices stimulate food price volatility? Examining volatility transmission between US oil, ethanol and corn markets. Energy Econ. 2013, 40, 119–129. [Google Scholar] [CrossRef]

- Busse, S.; Brümmer, B.; Ihle, R. Interdependencies between fossil fuel and renewable energy markets: The German biodiesel market. Diskussionspapiere//Department für Agrarökonomie und Rurale Entwicklung, 2010. Available online: http://www.econstor.eu/handle/10419/45604 (accessed on 24 July 2014).

- Busse, S.; Brümmer, B.; Ihle, R. Price formation in the German biodiesel supply chain: A Markov-switching vector error correction modeling approach. Agric. Econ. 2012, 43, 545–560. [Google Scholar] [CrossRef]

- Peri, M.; Baldi, L. Vegetable oil market and biofuel policy: an asymmetric cointegration approach. Energy Econ. 2010, 32, 687–693. [Google Scholar] [CrossRef]

- Hassouneh, I.; Serra, T.; Goodwin, B.K.; Gil, J.M. Non-parametric and parametric modeling of biodiesel, sunflower oil, and crude oil price relationships. Energy Econ. 2012, 34, 1507–1513. [Google Scholar] [CrossRef]

- Rajcaniova, M.; Pokrivcak, J. The impact of biofuel policies on food prices in the European Union. Ekon. Cas. /J. Econ. 2011, 5, 459–471. [Google Scholar]

- Bentivoglio, D.; Finco, A.; Bacchi, M.R.P.; Spedicato, G. European biodiesel market and rapeseed oil: What impact on agricultural food prices? Int. J. Global Energy Issues 2014, 37, 220–235. [Google Scholar] [CrossRef]

- Rapsomanikis, G.; Hallam, D. Threshold cointegration in the sugar-ethanol-oil price system in Brazil: evidence from nonlinear vector error correction models. FAO commodity and trade policy research working paper 22. 2006. Available online: http://sharing.mywordsolution.com/xtringfiles/240_thresholdVectorErrorCorrection.pdf (accessed on 24 July 2014).

- Balcombe, K.; Rapsomanikis, G. Bayesian estimation of nonlinear vector error correction models: the case of sugar-ethanol-oil nexus in Brazil. Am. J. Agric. Econ. 2008, 90, 658–668. [Google Scholar] [CrossRef]

- Serra, T.; Zilberman, D.; Gil, J. Price volatility in ethanol markets. Eur. Rev. Agric. Econ. 2011, 38, 259–280. [Google Scholar] [CrossRef]

- Serra, T. Volatility spillover between food and energy market: A semiparametric approach. Energy Econ. 2010, 33, 1155–1164. [Google Scholar] [CrossRef]

- Wright, W. The economics of grain price volatility. Appl. Econ. Perspect Policy 2011, 33, 32–58. [Google Scholar] [CrossRef]

- Engle, R.; Granger, C. Cointegration and error correction representation, estimation and testing. Econometrica 1987, 55, 251–276. [Google Scholar] [CrossRef]

- Granger, C.W.J. Some Recent Developments in a Concept of Causality. J. Econometrics 1988, 39, 199–211. [Google Scholar] [CrossRef]

- Myers, R.J. Time series econometrics and commodity price analysis: A review. Rev. Mark. Agric. Econ. 1992, 62, 167–181. [Google Scholar]

- Erjavec, N.; Cota, B. Macroeconomic granger-causal dynamics in Croatia: evidence based on a vector error-correction modelling analysis. Ekonomski pregled 2003, 54, 139–156. [Google Scholar]

- Pfaff, B. Analysis of Integrated and Cointegrated Time Series with R, 2nd ed.; Springer: New York, NY, USA, 2008. [Google Scholar]

- Pfaff, B. Var, svar and svec models: Implementation within R package vars. J. Stat. Softw. 2008, 27, 1–32. Available online: http://vps.fmvz.usp.br/CRAN/web/packages/vars/vignettes/vars.pdf (accessed on 22 July 2014). [Google Scholar] [CrossRef]

- Zafeiriou, E.; Arabatzis, G.; Tampakis, S.; Soutsas, K. The impact of energy prices on the volatility of ethanol prices and the role of gasoline emissions. Renew. Sust. Energ. Rev. 2014, 33, 87–95. [Google Scholar] [CrossRef]

- Haixia, W.; Shiping, L. Volatility spillovers in China’s crude oil, corn and fuel ethanol markets. Energy Policy 2013, 62, 878–886. [Google Scholar] [CrossRef]

- Granger, C.W. Some recent development in a concept of causality. J. Econ. 1988, 39, 199–211. [Google Scholar] [CrossRef]

- Miller, S.M.; Russek, F.S. Co-integration and error-correction models: The temporal causality between government taxes and spending. Southern Econ. J. 1990, 57, 221–229. [Google Scholar] [CrossRef]

- Center for Advanced Studies on Applied Economics (CEPEA). Center for Advanced Studies on Applied Economics (CEPEA), Alcohol and sugar prices datasets. Available online: http://cepea.esalq.usp.br/alcool/ (accessed on 29 April 2014).

- Agência Nacional do Petróleo, Gás Natural e Biocombustíveis-ANP. Available online: http://www.anp.gov.br/preco/ (accessed on 29 April 2014).

- Dickey, D.A.; Fuller, W.A. Distribution of the Estimators for Autoregressive Time Series with a Unit Root. J. Amer. Statistical Assoc. 1979, 74, 427–431. [Google Scholar]

- Johansen, S. Statistical analysis of cointegration vectors. J. Econ. Dynam. Control 1988, 12, 231–254. [Google Scholar] [CrossRef]

- Tenkorang, F.; Dority, B.L.; Bridges, D.; Lam, E. Relationship between ethanol and gasoline: AIDS approach. Energy Econ. 2015, 50, 63–69. [Google Scholar] [CrossRef]

- Barros, S. Brazil-Biofuels-Ethanol and biodiesel. GAINT Report Number: BR15006; 2015. Available online: http://gain.fas.usda.gov/Recent%20GAIN%20Publications/Biofuels%20Annual_Sao%20Paulo%20ATO_Brazil_8-4-2015.pdf (accessed on 3 February 2016). [Google Scholar]

- Granger, C.W.J. Testing for Causality: A personal viewpoint. J. Econ. Dynam. Control 1980, 2, 329–352. [Google Scholar] [CrossRef]

- Pala, A. Structural Breaks, Cointegration, and Causality by VECM Analysis of Crude Oil and Food Price. Int. J. Energy Econ. Policy 2013, 3, 238–246. [Google Scholar]

- Marjotta-Maistro, M.C. Desafios e perspectivas para o setor sucroenergético do Brasil. 2011. Available online: http://hdl.handle.net/123456789/589 (accessed on 22 May 2014).

- Ratanapakorn, O.; Sharma, S.C. Dynamic analysis between the US stock returns and the macroeconomic variables. Appl. Finan. Econ. 2007, 17, 369–377. [Google Scholar] [CrossRef]

- Chagas, A.L.S. Etanol ou Alimento: Existe Esse Trade-off? Informaçoes FIPE: Sao Paulo, Brazil, 1 March 2010; pp. 11–16. (In Portuguese) [Google Scholar]

- Hochman, G.; Rajagopal, D.; Timilsina, G.; Zilberman, D. Quantifying the causes of the global food commodity price crisis. Biomass Bioenerg. 2014, 68, 106–114. [Google Scholar] [CrossRef]

- Kristoufek, L.; Janda, K.; Zilberman, D. Price transmission between biofuels, fuels, and food commodities. Biofuels, Bioprod. Biorefin 2014, 8, 362–373. [Google Scholar] [CrossRef]

- Nazlioglua, S.; Erdemb, C.; Soytasc, U. Volatility spillover between oil and agricultural commodity markets. Energy Econ. 2012, 36, 658–665. [Google Scholar] [CrossRef]

- Gerber, N.; van Eckert, M.; Breuer, T. Biofuels and food prices: A review of recent and projected impacts. RIO9-World Climate & Energy Event 2009, 17, 19. [Google Scholar]

- Goldemberg, J.; Coelho, S.T.; Guardabassi, P. The sustainability of ethanol production from sugarcane. Energy policy 2008, 36, 2086–2097. [Google Scholar] [CrossRef]

- Féres, J.; Reis, E.; Speranza, J. Assessing the “food-fuel-forest” competition in Brazil: Impacts of sugarcane expansion on deforestation and food supply. 2010. Available online: http://cerdi.org/uploads/sfCmsContent/html/323/Feres_foodfuelforest.pdf (accessed on 18 November 2015).

- Sousa, E.L.L.; Macedo, I.C. Ethanol and bioelectricity-Sugarcane in the future of the energy matrix; União da Indústria de Cana-de-Açúcar (UNICA): São Paulo, SP, Brazil, 2010; pp. 1–315. [Google Scholar]

- Finco, A.; Bentivoglio, D.; Nijkamp, P. Integrated evaluation of biofuel production options in agriculture: An exploration of sustainable policy scenarios. IJFIP 2012, 8, 173–188. [Google Scholar] [CrossRef]

- Rasetti, M.; Finco, A.; Bentivoglio, D. GHG balance of biodiesel production and consumption in EU. Int. J. Global Energy Issues 2014, 37, 191–204. [Google Scholar] [CrossRef]

- Padella, M.; Finco, A.; Tyner, W.E. Impacts of biofuels policies in the EU. Econ. Energy Environ. Policy 2012, 1, 87–104. [Google Scholar] [CrossRef]

| Price Series | Test Statistic | 1% |

|---|---|---|

| Ethanol | −0.985 | −2.58 |

| Sugar | −0.269 | −2.58 |

| Gasoline | −1.541 | −2.58 |

| p-r | r | Eigen-value | Trace | Trace * | Franc95 | P-value | P-value * |

|---|---|---|---|---|---|---|---|

| 3 | 0 | 0.070 | 34.059 | 33.911 | 35.070 | 0.065 | 0.067 |

| 2 | 1 | 0.022 | 11.514 | 11.484 | 20.164 | 0.502 | 0.504 |

| 1 | 2 | 0.015 | 4.6510 | 4.6470 | 9.1420 | 0.335 | 0.336 |

| Direction of Casuality | P-value |

|---|---|

| Psugar → Pethanol | 0.011 |

| Pgasoline → Pethanol | 0.000 |

| Pethanol → Psugar | 0.859 |

| Pethanol → Pgasoline | 0.924 |

| Step | Ethanol | Sugar | Gasoline |

|---|---|---|---|

| 1 | 20.980 | 0.788 | 78.233 |

| 2 | 22.700 | 6.777 | 70.523 |

| 3 | 23.639 | 7.872 | 68.489 |

| 4 | 23.146 | 9.474 | 67.380 |

| 5 | 22.905 | 10.211 | 66.884 |

| 6 | 22.755 | 10.613 | 66.632 |

| 7 | 22.687 | 10.798 | 66.515 |

| 8 | 22.657 | 10.882 | 66.462 |

| 9 | 22.644 | 10.918 | 66.438 |

| 10 | 22.638 | 10.934 | 66.428 |

| 11 | 22.636 | 10.940 | 66.424 |

| 12 | 22.635 | 10.943 | 66.422 |

| Step | Ethanol | Sugar | Gasoline |

|---|---|---|---|

| 1 | 0.000 | 100.000 | 0.000 |

| 2 | 0.035 | 78.783 | 21.182 |

| 3 | 0.032 | 79.193 | 20.775 |

| 4 | 0.049 | 78.536 | 21.415 |

| 5 | 0.065 | 78.417 | 21.518 |

| 6 | 0.077 | 78.340 | 21.583 |

| 7 | 0.083 | 78.310 | 21.606 |

| 8 | 0.087 | 78.297 | 21.616 |

| 9 | 0.088 | 78.291 | 21.620 |

| 10 | 0.089 | 78.289 | 21.622 |

| 11 | 0.089 | 78.288 | 21.623 |

| 12 | 0.089 | 78.288 | 21.623 |

| Step | Ethanol | Sugar | Gasoline |

|---|---|---|---|

| 1 | 0.000 | 0.000 | 100.000 |

| 2 | 0.008 | 3.069 | 96.923 |

| 3 | 0.040 | 3.055 | 96.906 |

| 4 | 0.041 | 3.208 | 96.751 |

| 5 | 0.041 | 3.238 | 96.721 |

| 6 | 0.041 | 3.259 | 96.700 |

| 7 | 0.041 | 3.268 | 96.692 |

| 8 | 0.041 | 3.271 | 96.688 |

| 9 | 0.041 | 3.273 | 96.686 |

| 10 | 0.041 | 3.274 | 96.685 |

| 11 | 0.041 | 3.274 | 96.685 |

| 12 | 0.041 | 3.274 | 96.685 |

© 2016 by the authors; licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC-BY) license (http://creativecommons.org/licenses/by/4.0/).

Share and Cite

Bentivoglio, D.; Finco, A.; Bacchi, M.R.P. Interdependencies between Biofuel, Fuel and Food Prices: The Case of the Brazilian Ethanol Market. Energies 2016, 9, 464. https://doi.org/10.3390/en9060464

Bentivoglio D, Finco A, Bacchi MRP. Interdependencies between Biofuel, Fuel and Food Prices: The Case of the Brazilian Ethanol Market. Energies. 2016; 9(6):464. https://doi.org/10.3390/en9060464

Chicago/Turabian StyleBentivoglio, Deborah, Adele Finco, and Mirian Rumenos Piedade Bacchi. 2016. "Interdependencies between Biofuel, Fuel and Food Prices: The Case of the Brazilian Ethanol Market" Energies 9, no. 6: 464. https://doi.org/10.3390/en9060464