5.2. Energy Earned Life Cycle Value

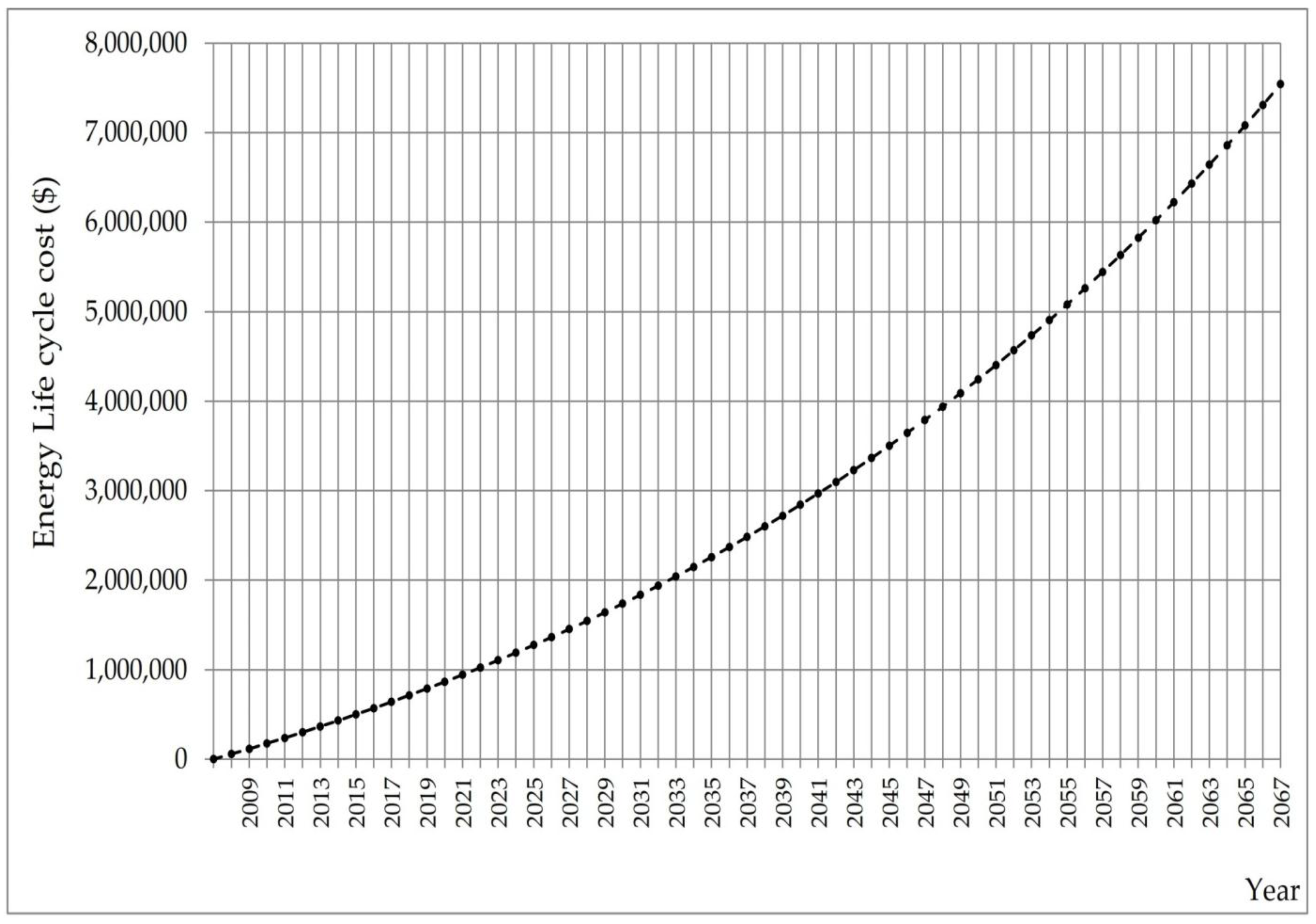

Based on the actual energy consumption percentage in the case study up to data date, the ELCV for energy equals $254,899, calculated by multiplying the actual energy consumption percentage (3.38%) by the total life cycle budget for energy which equals $7,541,385. The actual energy consumption percentage can be found by dividing the actual consumed energy up to data date which equals 1,175,772 kWh by the total end use energy demand in the building along its life cycle which equals 34,830,000 kWh.

The ELCV of energy under this measurement method also can be found by multiplying the actual consumed energy up to data date (1,175,772 kWh) by the average planned energy rate along the period of analysis which equals 0.217 $/kWh. The average planned energy rate can be found by dividing the total life cycle budget of energy ($7,541,385) over the total baseline energy demand (34,830,000 kWh). The resultant energy rate (0.217 $/kWh) represents the average escalated energy rate along the life cycle of the building. Multiplying the actual energy consumption (1,175,772 kWh) by the baseline average energy rate (0.217 $/kWh) equals $255,143. The difference between this figure and using the percentage is attributed to rounding; using unrounded figures yields exactly the same result.

The ELCV was calculated in reference to the budgeted life cycle cost of energy which is highly impacted by energy price inflation. The energy price inflation also highly influences the calculated ELCV and leads to an overestimated value. The exponential effect of energy price escalation on the total life cycle energy cost increases the calculated ELCV of energy. In other words, the future inflated energy cost is forwarded to impact the currently calculated ELCV. Therefore, using the above calculated ELCV to measure energy cost performance does not allow for fair and accurate cost performance measurement due to the significant effect of energy price escalation on the calculated ELCV.

The ELCV of energy can be more accurately determined using the annual baseline energy rates for the elapsed building operating period only. This is because the actual energy cost is determined based on the actual energy consumption and the actual applied rates by the utility service provider, and hence, calculating the ELCV of energy following the same approach allows fair and accurate cost variance calculations. It is worth reminding that the ELCV of energy is the corresponding value of the actual consumed energy quantity in reference to the estimated life cycle budget of energy, and hence, the baseline energy rates should be used in finding the earned life cycle value of energy.

The annual baseline energy rates can be found by dividing the baseline energy cost in each year by the baseline energy consumption for the same year. This information is already available in the life cycle energy baseline. The calculated ELCV according to this approach equals $124,640 as illustrated in

Table 4. It is far below the calculated value using the actual energy consumption percentage which equals $254,899. This, however, significantly affects the cost variance and performance indices calculations.

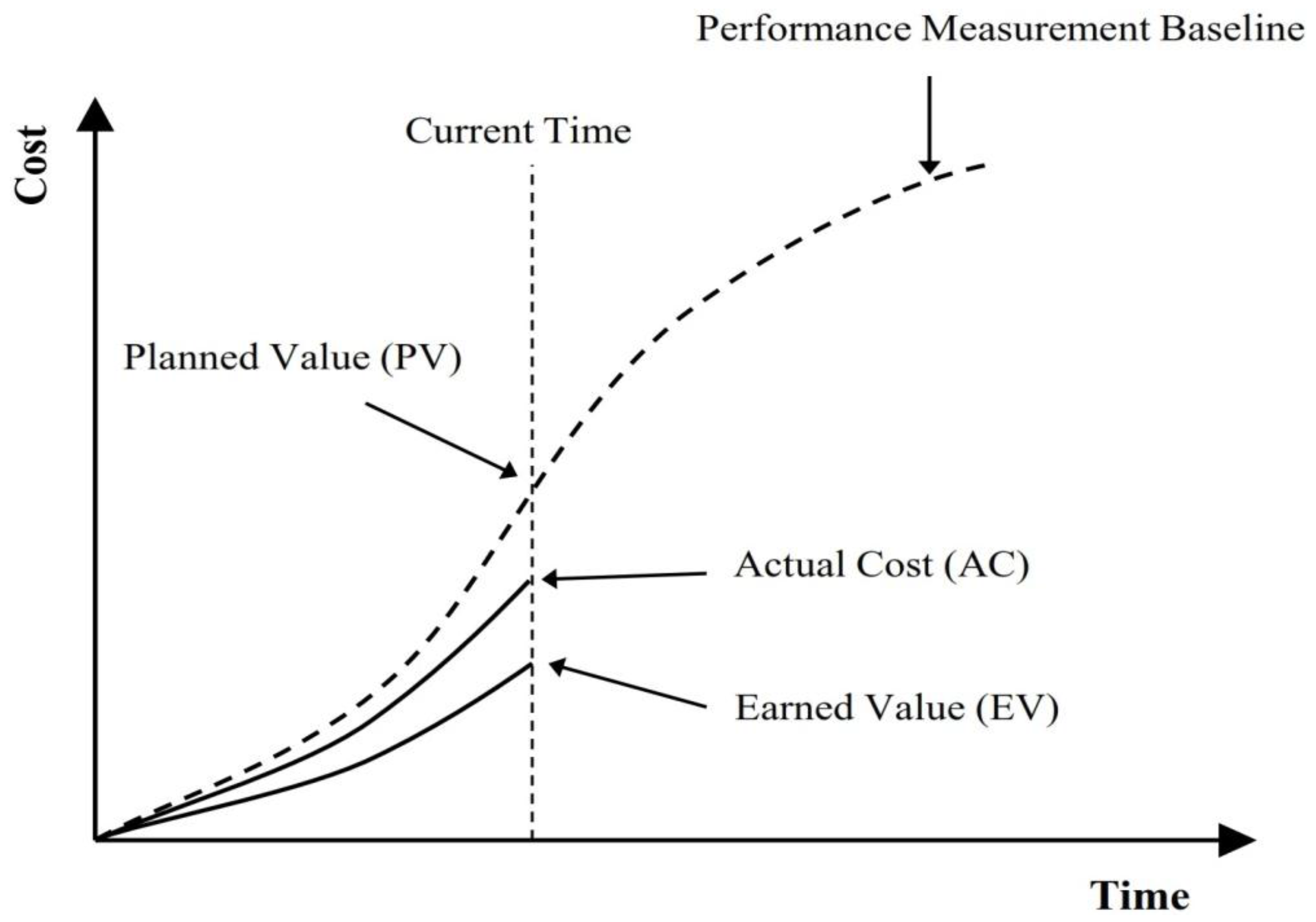

Figure 5 is a graphic representation of

Table 4 and illustrates the earned value parameters which were used to examine the earned value performance indicators and metrics for the case study. Using the ELCV of energy, the typical earned value management performance indicators and metrics which are: cost variance (CV), cost variance percentage (CV%), cost performance index (CPI), schedule variance (SV), schedule variance percentage (SV%), and schedule performance index (SPI) [

22,

24,

25,

26] were examined and explained in the light of earned value management approach to measure the actual cost performance of energy.

5.3. Energy Cost Performance Indicators and Metrics

The ELCV was compared to the actual life cycle cost (ALCC) accrued up to the data date, the resultant cost variance (CV) is a cost performance metric quantifies the amount of cost deviation from the life cycle cost performance baseline of energy. Following the calculation procedure of the EVM, Equation (1) was applied to calculate the cost variance (CV) as follow:

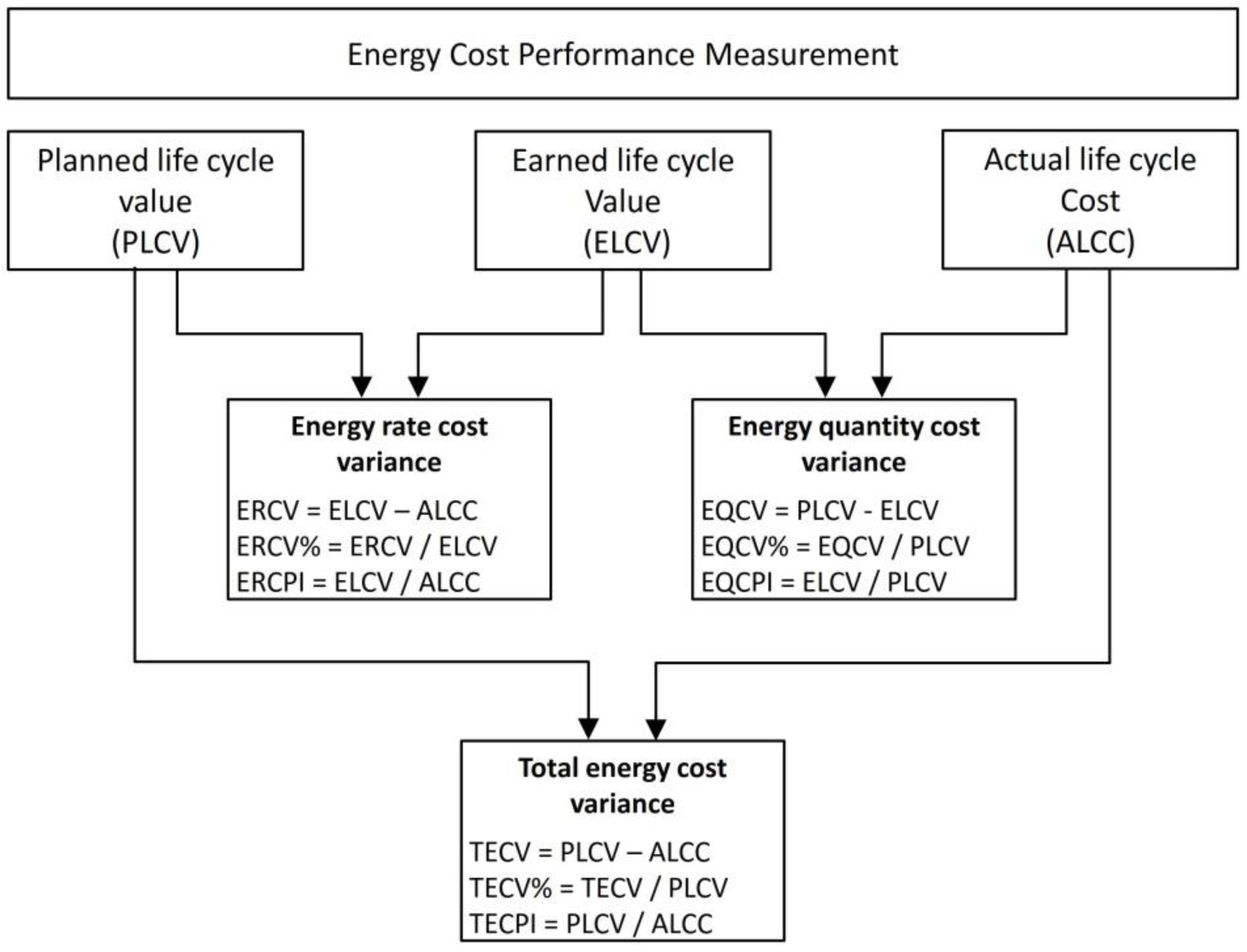

The negative variance implies that the actual energy cost is higher than its equivalent value in reference to the budgeted life cycle energy cost. However, this cost variance does not inform whether more or less energy has been consumed by the building; it quantifies the cost variance resulted from energy rate differences rather than consumed energy quantity in the building. This is because that the actual energy quantity is a common variable in both the ELCV and the actual life cycle cost (ALCC), and hence, the cost variance (CV) is determined based on energy rate variations rather than energy quantity. Consequently, since the cost variance (CV) only quantifies the cost deviation resulted from energy rate variations, it can be termed as energy rate cost variance, abbreviated ERCV.

The energy rate cost variance (ERCV) can be expressed as a percentage following Equation (2) by dividing the energy rate cost variance (ERCV) over the ELCV as follow:

The energy rate cost variance percentage (ERCV%) corresponds to the cost variance percentage (CV%) used in the EVM. The ERCV% reports the percentage of the cost deviation from the budgeted value; it quantifies the magnitude of the cost saving or overrun resulted from energy rate variations. In the light of EVM, the above calculated ERCV% means that the energy cost is over budget by 14.53% since the result is negative.

Dividing the earned value over the actual cost yields the cost performance index (CPI) in a typical earned value analysis [

22,

35]. Similarly, dividing the ELCV by the actual life cycle cost (ALCC) of energy yields the energy rate cost performance index (ERCPI). The ERCPI is a measure of money spending efficiency, based on Equation (3), it can be calculated as follow:

The simple interpretation of the energy rate cost performance index (ERCPI) is that for each one dollar spent, only 0.87 dollar was earned. Keeping in mind that the cost deviation is resulted from energy rate variance, the ERCPI quantifies the magnitude of the cost deviation resulted from energy rate variations only.

Similar to the concept of comparing the earned value to the planned value in a typical earned value analysis which yields the schedule variance (SV) [

22,

24,

25,

26], comparing the ELCV with the planned life cycle value (PLCV) yields energy quantity cost variance (EQCV). The energy quantity cost variance (EQCV) is a modified term for the schedule variance (SV) proposed in the research to describe the difference between the ELCV and the planned life cycle value (PLCV). It can be calculated by adapting Equation (4) as follow:

The energy quantity cost variance (EQCV) is different than the schedule variance (SV) which is used to determine whether the project is ahead or behind schedule in the EVM. For the case of energy, the energy quantity cost variance (EQCV) indicates whether less or more energy is being consumed in a building. This is because the ELCV is the product of multiplying the actual energy consumption by the baseline energy rates for the elapsed building operating years, and the planned life cycle value (PLCV) is determined by the baseline energy quantity and the baseline energy rates for the elapsed years as well. Consequently, the difference between the ELCV and the planned life cycle value (PLCV) represents the cost difference resulted from energy quantity variation rather than energy rates.

The energy quantity cost variance (EQCV) can be negative only in the case when less energy has been consumed than the baseline. This is because that for the EQCV to be negative, the ELCV should be less than the PLCV, and for this to happen, less actual energy should be consumed than the baseline. It is worth mentioning that the above calculations according to the earned value management approach yields a negative sign for a positive indicating variance, and hence, the sign of the variance has to be interpreted carefully. However, this issue can be resolved by adapting Equation (4) in reversed order as follow:

Following Equation (5), the energy quantity cost variance (EQCV) can be expressed as a percentage as follow:

This percentage is very close to the energy variance percentage which equals 71.07% which can be calculated as follow:

The energy quantity cost variance percentage (EQCV%) informs the percentage of energy saving or overrun but in term of monetary value. It can be inferred from the above EQCV% that around 71% of energy has been saved by the building since its commissioning compared to the baseline energy consumption.

Similar to the concept of the schedule performance index (SPI), following Equation (6), the energy quantity cost performance index (EQCPI) can be calculated as follow:

The energy quantity cost performance index (EQCPI) measures the efficiency of energy consumption in the building. The above calculated EQCPI for the case study means that for each day, month, or year, the building consumed 29% of the baseline energy calculated based on the monetary value.

The basic concept of the EVM is that comparing the planned cost with the actual cost can be misleading and does not allow for accurate cost performance measurement in projects [

24,

26]. However, it is found in the research that this not valid for the case of energy cost performance; comparing the planned life cycle value (PLCV) with the actual life cycle cost (ALCC) is still required to measure the overall cost performance of energy. This is because neither the ERCV nor the EQCV quantifies the overall cost variance resulted from actual energy consumption and actual energy rates. In the light of earned value approach, the total energy cost variance (TECV) can be calculated and reported as follow:

The total energy cost variance (TECV) quantifies the cost deviation resulted from both energy consumption and rates variation. A positive variance implies cost saving while a negative variance indicates cost overrun. The shortcoming of the total energy cost variance (TECV) is that it does not inform whether the cost deviation is resulted from energy consumption or energy rate variations. Therefore, it should be used in conjunction with the ERCV and the EQCV to provide more detailed information about the causes of cost deviation.

The total energy cost variance (TECV) can be expressed as a percentage as follow:

This means that the total energy cost saving in the building is 66.99% compared to the baseline energy cost. The total energy cost performance index (TECPI) for the building can be calculated as follow:

The total energy cost performance index (TECPI) quantifies the magnitude of the total cost saving or overrun. Similar to the concept of cost performance index (CPI) in the EVM, a value greater than 1.0 implies cost saving and vice versa. The above calculated TECPI means that for each one dollar spent on energy, a value of 3.03 dollars has been gained due to energy saving.

Table 5 shows annual analysis for energy cost performance using the earned value approach. The earned value calculations for energy cost performance indicators and metrics are summarized in

Figure 6.