1. Introduction

The European Union and its Member States are seeking to decarbonize their energy systems including the electricity system. In order to achieve this goal, all European Member States have set renewable energy (RE) targets and introduced several support schemes for renewable energy deployment. However, no consensus has been reached regarding which specific energy transition pathway to follow, which policies and remunerations schemes are needed, what timing is appropriate and which responsibilities should rest on the EU and which on Member States.

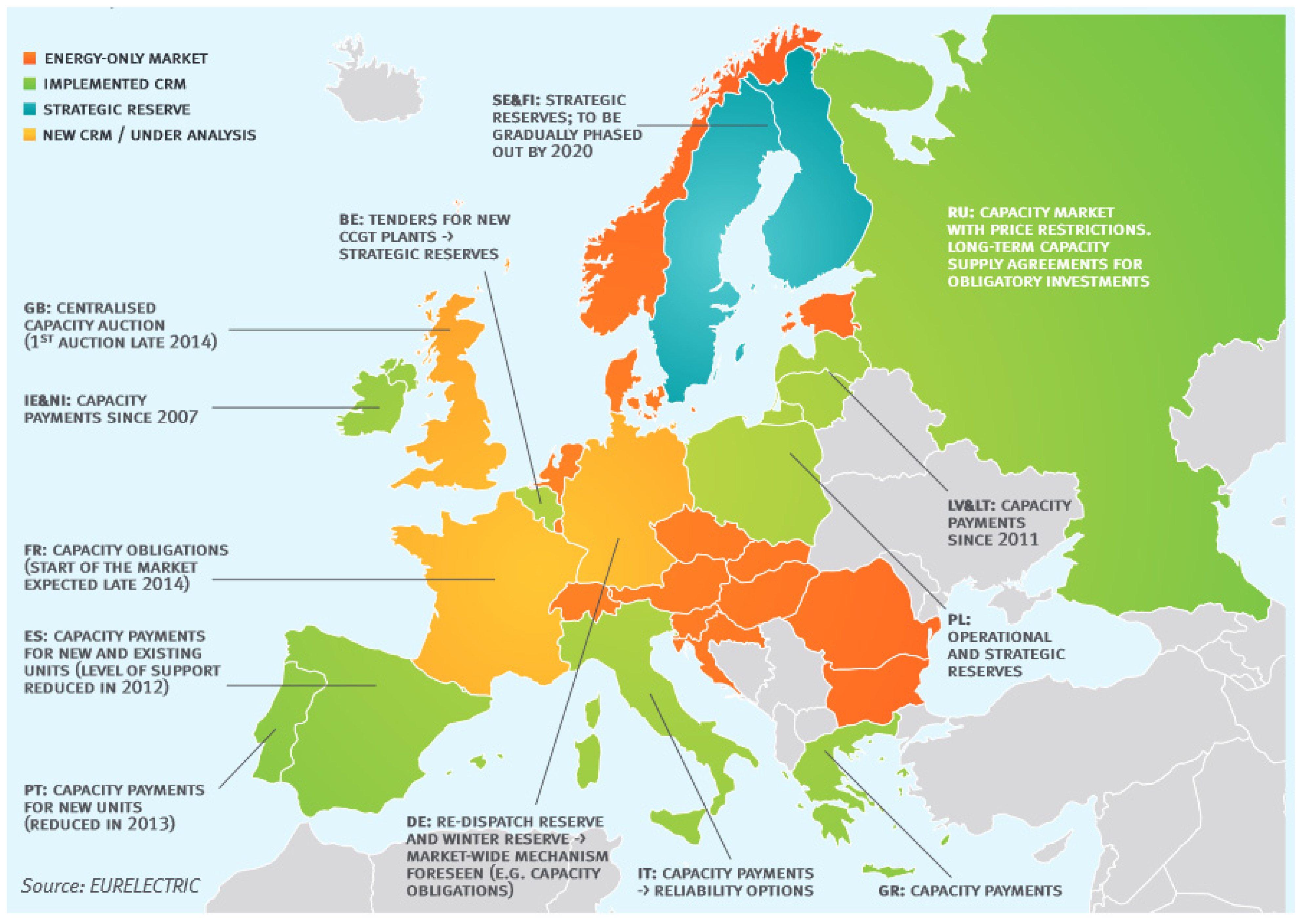

Recent discussions focus on the introduction of capacity markets as a specific remuneration scheme for installed capacity in order to meet EU energy policy targets. Capacity payments would add to those for produced energy in order to make new generation capacities profitable or to keep old ones in the market. Policy-makers mainly justify this new compensation mechanism at the Member State level, as there exists a perceived hesitation to invest in flexible capacities that could lead to an insufficient level of electricity supply in the future when aging assets go offline [

1,

2].

Thus, various countries have already introduced national capacity markets, remunerating generation capacity of different kinds of technologies including baseload capacities (see

Figure 1). This is motivated by differing arguments, which can also be found in the available literature. Some authors [

3,

4] have questioned the ability of the liberalised energy-only market, in general, as a means to provide the right signals for appropriate long-term investments. Others refer to the changing needs of an electricity system driven by base-load, to a more residual load driven system that addresses the variability characteristic of renewable energy, especially wind and solar [

5,

6]. In this perspective, the increasing feed-in of variable renewable electricity with very low operating costs is changing the spot market price formation results under the merit order regime, which would call for a new market design to address these changes [

7,

8]. In contrast, some authors do not see any need to change the system at all and question the threat of a future shortage [

9]. Policy-makers are thus confronted with conflicting ideas on how to stimulate the appropriate investment, and which changes in the market design are needed to deliver the wanted energy security capability of the system.

In this article, we broaden the perspective on how investment decisions in the electricity market are taken. We thus challenge the narrow view of the market design, and accordingly capacity mechanism, as being the only determinant for investments in security of supply options. Based on the insights of institutional sociology and economics, we understand the market to be a social institution that structures the behavioural expectations of market participants. In the following, we discuss the investment behavior of electricity market actors in the context of uncertain, diverging and sometimes conflicting strategic interests of different kinds of actors in European Member States. As a result, we find four determinants for investment behaviour beyond the formal market design.

The article is therefore structured in five parts. In the second section, we briefly describe the European energy sector, review the literature about investment decisions in the electricity sector and then present the theoretical foundation of understanding the electricity market as a social institution. Derived from that perspective, in the third section, we elaborate on four variables that have an impact on the investment decisions of market actors beyond the formal market design. In the fourth part of the article, we will discuss whether the recently proposed European Energy Union might be able to address these factors and if yes—How? Finally, we will discuss our results and hint to further research needs. Although national policies and strategies differ across the EU, we explicitly do not compare different remuneration schemes and market design options, but are rather interested in other—more informal—factors that influence the investment decisions of market actors. This should, on the one hand, point to the need for further research and on the other hand, help policy-makers explore new approaches to stipulate investments in security of supply capacities.

Figure 1.

Implementation of capacity remuneration mechanisms (CRMs) across Europe as of June 2014 [

10].

Figure 1.

Implementation of capacity remuneration mechanisms (CRMs) across Europe as of June 2014 [

10].

2. Investment Decisions in the Electricity Market

2.1. The European Electricity Market

Traditionally, electricity generation and distribution was a public domain executed by governmental agencies or publicly owned companies in most European countries. Furthermore, the electricity sectors were organized mainly nationally with very low regional interconnections. This has changed with the liberalization directives of the European Union, the first in 1996 [

11] and the second in 2003 [

11]. With the third energy package in 2009 [

11] an ownership unbundling obligation was introduced that led to a legal separation of generation and sales activities from the transmission network. While investments in transmission networks remain highly regulated, investments in generation capacities are not. Although the internal market for electricity was aimed to be completed by 2014, today there are still several features of the market that lead to differing electricity prices and investment conditions within Europe. These features include differing energy policy targets and accompanying instruments across Member States, insufficient interconnector capacities, and related weak intra-European physical integration and the characteristics of the traded good electricity, such as the obligation to balance supply and demand at any time. Although most of the liberalization policies have been implemented in all Member States, some deficits mainly in the field of competition and actual unbundling remain. National electricity markets are still dominated by the successors of the former public utilities, distribution is still largely owned by utilities and new market players are not properly rewarded to actively participate in the market, thus, de facto, delaying market liberalization and the overall energy transition. In parallel to the liberalization process, European countries agreed on RE targets and are currently increasing the shares of renewable energy in their electricity mix. In view of this and despite of this, most countries face public and expert debates about underinvestment into security of supply options. Investments in renewable generation in 2013 account for 72% of total investments in electricity generation, while only ten years before 80% of investments were made in conventional fossil fuel capacities in the EU-27 (plus Norway and Switzerland). This is increasing concerns among energy actors about the ability of the system to deliver the same level of security as in the past dominated fossil fuel generation fleet.

2.2. The Market as an Efficiency Maximizer

While in regulated markets utilities are mostly paid on the basis of their costs and could therefore expect a stable return from investments in new generation capacities, in a market system, investment decisions have to be made under higher uncertainty [

12]. For both systems, classical economic theory describes investment decisions as a purely rational economic action that is determined by economic factors and determinants such as for example price volatility [

12,

13], risks [

14,

15], costs [

16,

17,

18,

19],

etc., sometimes considering also regulatory and political aspects [

20]. Some studies also take the behavior of market actors into account especially those analyzing the strategic interests of power companies as well as the changing objectives and interests following market liberalization [

21]. A big part of the literature is purely quantitative and proposes a set of economic assumptions and optimality functions to calculate efficient behavior. However, some scholars also look at more qualitative factors. Masini and Menichetti [

22] for example describe that “the investors’ a priori beliefs, preferences over certain policy instruments and attitude towards technological risk affects the likelihood of investing in RE projects” ([

22], page 1). Generally, the relatively young field of behavioral corporate finance research suggests that, due to various psychological factors, managers as well as investors act at least partly irrationally [

23]. For energy efficiency investments of companies Cooremans [

24] developed a model of the investment process, stating that it is applicable to all investment decisions. In this model the choice between different investments options, where the neo-classical perspective usually focuses on, is only one out of several steps of decision-making and in reality may or may not be based on rational tools for profit maximization like Internal Rate of Return (IRR) or Net Present Value (NPV). All steps are embedded in a bigger societal (environmental) and organizational context [

24]. A study for the British Department of Energy & Climate Change [

25] elaborates this model further defining a space of four dimensions in which a company makes its choices: “material”, “regulatory-policy”, “market” and “social-cultural”. In the literature regarding investment decisions in the electricity market we find only limited research on issues that explicitly acknowledge the social context of investment decisions and thus do not understand efficiency and profit maximization as main driver of market decisions. In the next section we will use the theoretical concept of social institutionalism and apply it to the electricity sector.

2.3. The Market as a Social Institution

The market is understood here as a social institution that shapes the behaviour of actors in a way that expectations about the market result can be made [

26,

27]. Institutions are seen as social structures of meaning, as formal and informal systems of rules, which have an impact on the behaviour of actors and thus, the social interactions among themselves. Social interactions are enabled and facilitated by a common understanding of norms, language, identity and other patterns of social action to reduce the levels of complexity and uncertainty. As a consequence, social order is (re)produced by institutions [

28,

29,

30]. Actors constantly evaluate their behaviour in the context of others: “Actors seek to fulfil the obligations encapsulated in a role, an identity, a membership in a political community or group, and the ethos, practices and expectations of its institutions” [

31]. The electricity market as a social institution can thus be understood as a set of formal and informal rules, which shape the behaviour of actors. The course of action, identities and norms and as a result, the corresponding social order is thus established. Social order is defined here as all formal and informal rules that lead to the actual market result (not as the contingency of possible market outcomes). The market result includes all decisions regarding investments, pricing, contracts. These decisions are synonymic to what is called the behaviour of market actors later on. Market participants are defined as all actors that could potentially make a technically defined contribution to the security of supply. As the EU electricity markets are liberalized, these actors are mostly private companies or cooperative bodies. The market result of the electricity market can thus be understood as the total of all investment decisions in the market and their distributional consequences determined by the social order of the market. This view reflects the common interpretation of the market as a coordinating body between different participants in order to exchange services and goods. However, decisions on these exchange processes are embedded into a social, institutional-historical and cultural context [

32]. The market as an institution therefore (re)produces a certain social order, without which the coordination of complex economic activities in the electricity sector would not be possible [

26]. The market result (which is relevant here as a certain level of security of supply), is thus conceived as the dependent variable reliant on the social order and underlying rules. The set of rules that govern the market and coordinate the behaviour of actors in a certain way can be both formal and informal [

33,

34]. While prices may be considered as a central means of communication within the electricity market [

34], market actors also inform themselves about the market context in other ways, such as via modelling and calculation of future developments. Formal rules in the current market are the regulatory framework of the remuneration scheme, such as in the assignment of property rights and definitions of products and responsibilities [

33]. Informal rules include implicit factors that affect the market actor’s behaviour such as the actor’s assumptions on the level and volatility of prices and quantities, the behaviour of other market participants and the knowledge on the characteristics of the good and perception of market actors’ own interests [

32]. The electricity market is here limited to all factors that determine investments in security of supply options from a market participant’s point of view. Other economic and policy areas that are affected or closely linked to the electricity market are either left out when they are not part of the technical or regulatory configuration of the electricity market itself, such as the financial crises or they are included into the broad categories of “expectations about the future” or “focusing events”.

3. Factors that Influence the Market Result

In the following, we apply preliminary conceptual remarks on the market as a social institution to the case of security of supply in European electricity markets [

35]. We define the behaviour of market actors as the dependent variable. If investments in flexible capacities are high enough, the threat of insufficient security of supply in the future is diminished. Capacities for security of supply in the electricity sector are defined here as the total of all investments in flexible options that are available to the respective electricity market at a certain point in time. Flexible options can be flexible generation capacities such as gas fired power plants, storage opportunities as well as demand side flexibility. We identify five determinants that may have an impact on the investment activity of a market actor: The current market design, the material opportunities in the national system and in coupled systems, the market participant’s expectations about future developments, the strategic interest and identity of a market participant and focusing events that may pose a shock to the market, such as the Fukushima disaster. These variables are shown in

Figure 2. We identified these five variables by literature review, by working together with practitioners in previous projects such as BETTER (

http://www.better-project.net/), CLIM-RUN (

http://www.climrun.eu/) and within RGI (

http://www.renewables-grid.eu/) and by applying the theoretical concept of sociological institutionalism to the case of the electricity market. The market design variable is the most accepted one, which is discussed in most scientific and political analyses [

1,

3,

4,

5,

6]. The material opportunities variable was identified by the work with practitioners within the above mentioned projects, as practitioners generally do not focus on theoretical cases, but on real existing ones and take real world settings into account. The market participant’s expectations about future developments and the actor’s strategic interest and identity variables are derived from the theoretical concept of sociological institutionalism that understands any type of actor as embedded into a social order where non-formalized factors can be equally important as formal ones. The focusing events factor is taken from the study of empirical cases in political science and according to the literature [

36,

37,

38,

39,

40].

3.1. Electricity Market Design

The electricity market design is an explicitly created regulation consisting of legally defined rules for allocation, remuneration and the assignment of individual rights and obligations [

41]. In theory, a change in the formal regulatory system can initiate a behavioural change in the market if specific cost-benefit ratios are restructured. This corresponds to calls for the introduction of capacity mechanisms as a means to secure future supply [

1,

5,

42,

43,

44]. While the currently discussed proposals for new market designs within EU Member State countries differ from each other, they all intend to induce a change in the market actor’s investment behaviour, either by introducing an administratively fixed capacity or an administered price [

45]. Previous practical experience has shown that market design reforms did not always generate the intended effects or were created to achieve further political objectives such as saving jobs or keeping an industry alive. The consideration of context-specific factors as well as the design of the capacity mechanism does heavily influence the success or failure of the instrument [

4]. Indeed, the global experience with capacity markets is very different; in some cases capacity mechanisms were even removed again because they didn’t significantly improve security of supply compared to a situation without a capacity mechanism (e.g., New Zealand and Australia) [

46]. Policy makers should therefore be aware of the complex design details as well as other factors that may have an impact on the behaviour of market actors before a capacity market is introduced.

Figure 2.

Factors that can influence investment decisions in the electricity market.

Figure 2.

Factors that can influence investment decisions in the electricity market.

3.2. Characteristics of the Material Opportunities within the System and in Coupled Systems

In addition to the question of the formal market design, the material opportunities of the electricity system have a significant impact on the behaviour of market participants. In the electricity market, material opportunities are to be understood as the given technical equipment and capacities of the power system and the impact of these characteristics on the quantities supplied and the prices at any given time. Electricity markets are characterized by very long investment cycles, both in terms of cost calculations for new investments as well as the break-even point of energy infrastructure investments [

47]. Conventional electricity generation capacities are also characterized by high fixed costs and high dismantling costs. Unused power plants cannot be easily used for other purposes or shipped elsewhere and are therefore typically characterized by high opportunity costs of a low utilization rate. In particular, inflexible base load power plants have the potential to hinder the market entry of flexible generation capacities after their depreciation, as they solely have to return the variable costs and are only able to lower their generation load to a certain level [

41]. The existence of negative prices and rising export shares of the electricity produced, e.g., in Germany, are a result of these material opportunities in the system [

48]. Power plants, which operate with higher-priced fuels such as gas power plants compared to lignite coal power plants, are therefore urged out of the market when over capacities of base load power plants exist. If market actors base their investment decision on the current market situation at this stage of the investment cycle, they will perceive possible investments in additional capacity as unprofitable.

The beginning of the investment cycle is characterized by the construction of new generating capacities. However, in the case of rising proportions of fluctuating renewable energy, there also exists a high demand for flexible options to meet the growing amount of variable residual load which could lead to high electricity prices in times of low wind and sun generation output [

49]. This differs from those situations when numerous depreciated must-run units are still in place hindering electricity prices to send out these scarcity signals. The behaviour of market participants could therefore also change as a result of a modification in material opportunities. A large number of base load power plants going offline—for example by reaching the maximum lifetime or due to restrictive emission regulations—would massively increase the demand for flexibility options. This is especially the case in a system with a high proportion of fluctuating renewable energy as a pilot study commissioned by the Federal Ministry for the Environment 2012 calculated for Germany [

49]. Thus, both the peak load electricity price and the volume of the residual load would significantly increase without the need to change the market design in case of discontinuation of base-load power plants [

50]. Depending on the phase of the investment cycle and on how the material opportunities are set, market participant behaviour changes in relation to volume and price of peak (residual) load.

Mechanisms and characteristics of coupled systems also influence results in the electricity market [

1,

3,

51]. For market participants involved in long-term investments, not only does the market situation in the respective market matter, but also the characteristics of physically coupled electricity systems that are thus able to provide electricity in shortage situations. The European Commission is making strong efforts to increase and facilitate cross-border electricity flows in Europe—And beyond—in its push for the implementation of the European internal electricity market [

52]. For example, if sufficiently flexible (pumped storage) capacities in Norway, Switzerland and other electricity markets are available in coupled markets, or if this is at least expected by market actors, it could lead to decreased investments in flexible options in a regime of low electricity prices. Thus, the effects of coupled systems on security of electricity supply depend on a variety of factors such as the quantity and price for available flexible power in coupled systems, future interconnector capacities and market and grid regulations. Therefore, reluctance among national market participants to invest in flexibility options can also be explained by a perceived future possibility of coupled systems to satisfy demand in cases of domestic scarcity, thus lowering the economic incentive for those investments.

3.3. Strategic Actor Behaviour and Actor Identity

Conflicts of interest and information asymmetry between relevant actors can also impact the current market result [

53]. In the context of the European electricity market, characterized by high technical complexity, economic uncertainty and sometimes a lack of transparency in decision-making, market actors may find a space to act strategically.

Despite liberalisation and unbundling strategies implemented in the past, the European electricity sector still exhibits oligopolistic features and is still largely dominated by operators of inflexible large power stations from the traditional energy industry. Their business activity is challenged by the politically desired transition to a flexible and mainly carbon-free generation park. Large market players in particular, who would be most able to invest in capital-intensive, more flexible capacities, could therefore have an interest in taking advantage of their influential position, which results from the possession of large capacities and further resources [

54]. Market relevant information can be distortedly or selectively made public by major players in the market as to facilitate the pursuit of one’s own interests in energy policy-making.

In view of the debate on the introduction of the so-called “strategic reserve” in Germany for example, the European Commission’s Directorate-General for Energy communicated that there exists a “risk [in that] companies deliberately over exaggerate their intentions and taking capacities offline in order to make more profit” [

55].

An undesired market performance can therefore also be interpreted as the result of a strategic reluctance in investing in flexible generation capacities in order to put pressure on policy-makers to shape the future market design in one’s own interest.

These perceived “one’s own” interests and responsibilities can differ widely depending on the actor’s identity and network. Big oligopolistic energy producers with a long history in a specific field may have other priorities and targets as small independent power producers feeding into the grid and participating in the spot market. Publicly owned companies may follow other objectives than profitability such as those with industrial, environmental and social aspects. But even profitability targets can differ from each other depending on the shareholders’ base and interests. For example, pension funds are seeking long-term stable returns on investments while others may focus more on high dividends in the short-term. Also, the expected and perceived appropriate rate of return can differ between actors depending on the discursive construction of a “successful” company strategy and thus, the actor’s identity. Perceived responsibility for the functioning of the electricity system and the position within the economic system and society are important aspects for defining investment strategies.

3.4. Focusing Events

Investment decisions are also influenced by unexpected events, which make the concrete issue salient and concentrate the attention of the public, policy-makers and market actors. These often disastrous events called focusing events, are described as sudden and attention grabbing, lifting issues on the political agenda and therefore as triggers to induce policy change [

36], or at least to open up “windows of opportunity” [

37]. Moreover, the occurrence of a specific focusing event may also have an impact on the strategic actor’s behavior and its success in co-shaping political decisions [

38] (p. 40).

One focusing event for the energy sector was the Fukushima reactor meltdown in 2011 [

39]. As empirical findings suggest, an affected policy is only likely to change when non-institutional interest groups or political parties are actively advocating this change [

36,

39]. This was certainly the case in Japan, where a big protest movement sprouted and all reactors were shut down. Characteristically, focusing events generate ripple effects well beyond the immediate scope of the disaster itself [

40]. Next to Italy, Belgium and Switzerland these effects were notably visible in Germany [

39]. A grand coalition of all parties represented in the German national parliament decided to finally phase out all nuclear power plants by 2022, after it just had prolonged reactor run-time licenses one year before, arguing that nuclear energy is still needed for the energy transition as a “bridging technology”. We do not want to address the reasons here (see for a discussion e.g., [

39,

56]); it is however apparent how focusing events can influence the formal market design on the one hand, but also societal debates and discursive aspects of the investment decisions of market actors on the other hand. The utility company E.ON even announced the intention to divest all its nuclear and fossil fuel assets [

57]. It can be assumed that this strategy shift is partly due to the formal change in nuclear policy but the decision also hints to more informal aspects such as the company’s expectations about the future. In the following section, we argue that discursive narratives are playing a role in decision-making. In this sense, the focusing event of Fukushima would have weakened the narrative of a nuclear future in Germany to a point where E.ON decided to (officially) not follow up on it any further.

It can be argued that another example of such a focusing event is the ongoing armed conflict in Eastern Ukraine. In the past, in 2006 and 2009, the interruptions of gas exports from Russia to Ukraine raised the question of the security of energy source supply to the EU [

58,

59]. These events were perceived by some actors as a sign of the EU’s vulnerability. The political strife between Ukraine and Russia started in late 2013 and developed into military conflict in 2014. Once again, some market actors raised warning questions about the security of supply. Thus, these kind of events directly have an impact on investment decisions as it changes risk assessments and may effect profitability margins and even the feasibility of specific economic actions. Politically, the former Prime Minister of Poland, Donald Tusk, and now President of the European Council, introduced the idea of the European Energy Union as a reaction to these focusing events in 2014 (see

Section 4 of this paper).

3.5. Uncertainties and Expectations

The expectations and actual investment behaviour of market participants are based on calculations and assumptions regarding future policies, demand, supply quantities, the characteristics of other market participants, resource availability and price developments. These assumptions pertain to timeframes spanning decades and are characterized by a high degree of uncertainty.

At the same time, market participants must constantly monitor the impact of current events, such as for example, relative price changes in global markets. Whatever actor-specific consequences and changes in expectations result from this, it is always dependent on the actor’s interpretation and perspective. Due to limited information processing capacities of investment decision makers towards, for example policy change, future threats and consumer preferences, they have to rely on discursive narratives (discursive narratives constitute commonly shared patterns of perception and structures that can lead to common experience and reduce complexity when coming to a common understanding of and processing of new information. Discursive narratives give context to pure information to create an understanding of and to an issue and thus produce knowledge. Contextualized information can be interpreted and empowers actors to make decisions [

60].) in order to reduce their individual uncertainty about future developments. Inter-subjective and commonly shared stable expectations regarding for example, the learning curves of technologies are crucial determinants of investment decisions. Authoritative actors (authoritative actors are those that are able to explicitly and implicitly influence the behaviour of other actors without coercion or pressure as they are attributed with particular expert knowledge. The knowledge of and decision recommendations from these authoritative actors are considered by their addressees to carry a high level of legitimacy, thus acknowledging the experts’ authority (similar to Max Weber’s concept of power) [

61,

62])) contribute to discursive narratives and reproduce their narratives within institutionalized stakeholder networks. This typically results in stakeholder group-specific expectations regarding developments in the future [

63].

This can be seen in the varying perceptions of stakeholders regarding the consequences resulting from the nuclear energy phase-out in Germany. While predominantly representatives of local producers were concerned about the decision to extend the lifetime of nuclear power plants in 2010, major power supply companies (PSCs) welcomed this [

64]. These differing perceptions also became apparent during the nuclear energy phase-out debates in 2011; municipal utility companies announced an investment offensive in efficient and flexible generating capacity while other big utilities started to sue the German government over the nuclear phase-out [

65].

Based on the Social Construction of Technology (SCOT) approach [

66,

67], the technology assessment of a certain stakeholder group goes hand-in-hand with how the group is economically, ideologically and organizationally connected to that technology. Apart from economic interests, worldviews and networks, social and ideological factors also play a role such as discursive narratives about policies, prices, appropriate behavior and causal relationships between different events. The possible impact these differing expectations may have on model assumptions in energy and electricity market models (for example on the price of electricity or the electricity mix) was made clear in a study conducted by the German Institute for Economic Research (DIW). In particular, the overestimation of photovoltaic costs as well as the assumptions regarding carbon capture and nuclear power technology within the Energy Roadmap 2050 and the European Commission’s Green Papers has led to distorted results in scenario developments and potential disincentives [

68]. Conversely, a discursive change in contextual assumptions can also change profitability assessment results regarding investments in flexible capacities. This is especially valid for markets that are currently undergoing big systematic changes due to political targets and policies that make business-as-usual model assumptions unreasonable.

4. The European Energy Union as a Means to Stabilize Expectations

In early 2015, the new Commissioner for Energy Miguel Arias Cañete and the Vice-President of the Commission Maroš Šefčovič announced a framework strategy for the implementation of a European Energy Union [

69]. It aims at merging the already existing 2030 Framework for Climate and Energy as well as the European Energy Security Strategy with a set of new measures into one coherent strategy. Central points include the further integration of the internal energy markets and more coordination between Member States. Already in the rationale behind the communication, two visions are expressed that are crucial to our context. The Commission illustrates “an integrated continent-wide energy system where energy flows freely across borders, based on competition and the best possible use of resources, and with effective regulation of energy markets at EU level where necessary” [

69] (p. 2). Furthermore, investors should get confidence “through price signals that reflect long term needs and policy objectives” [

69] (p. 2). Both points are fully in line with provisions foreseen in the third energy package and which have not been yet fully delivered, thus bringing possibly new energy into the implementation of already agreed policies.

Although the European Union only has limited competencies to shape the formal determinants of electricity market participant behaviour (as for example changing the market designs and introducing a European capacity market), it can play a crucial role in influencing the informal determinants of market behaviour. For all four factors identified above, the introduction of the Energy Union would have the potential to contribute to changes in investment behaviour and thus, might help trigger the desired investments.

Firstly, within a European Energy Union material opportunities, as the physical characteristics and capacities of the electricity system, could be better planned and publicly presented on a European level so that market participants are able to assess possible changes in the physical configuration of the market. This could not only deliver more transparency but also better planning mechanisms because national vested interests will need to be discussed in a broader context.

Secondly, strategic behaviour to advocate capacity market mechanisms for national (energy) industry objectives is less likely in a European approach due to a lower market share of actors in a European system. Furthermore, a European Energy Union could challenge the previously national oriented actor’s strategies and might create a more European frame of acting and thus help to develop a more European energy identity of market actors in the long-term.

Thirdly, although it is not clear what effects focusing events would have, by having a European Energy Union in place, it could be expected that the effects of focusing events are no longer solely perceived and discussed on the national level, but on the European level as well, perhaps contributing to the creation of a more European energy identity through a more European debate. Furthermore, the focusing event of political instability and the armed conflict in the Ukraine is seen as a pivotal motivation for the proposal of the Energy Union in the first place and thus is perceived to address concerns which came up by the event itself.

Fourthly, contextual assumptions could be stabilized in a way that is politically agreed on due to long-term credible targets and accompanying measures. Depending on the specific design of the Energy Union, this undertaking has the potential to help overcome informal barriers in investment calculations. To actually reach this target, the Energy Union would have to fulfil at least two conditions:

- a)

The agreed targets and measures have to be concrete, transparent and credible. The governance on how to achieve them should be in place to decrease risks and thus, lower the risk premium. Due to renewable energy integration and economic and physical integration, investment decisions toward long-term participation will strongly benefit from clarity and transparency in the fast changing electricity market. Furthermore, targets and policies have to be agreed upon with a broad political consensus to also guarantee stability in different subsequent political constellations, as in the case of the German and Swiss nuclear phase-out after the Fukushima events.

- b)

A strong alignment between national policies and European targets needs to be developed to deliver confidence in the implementation and the long-term commitment of Member States. This alignment would avoid the multi-level governance trap [

70] common to several areas in European policies. Further clarity could be added by setting not only fixed targets for RE generation but also for residual load.

In a nutshell, the European Energy Union could address the above mentioned informal barriers to security of supply investments in several ways, but most importantly it could trigger public debates on a European level and thus help to develop a grand narrative regarding the future common market, challenges and socio-technical solutions, which currently mainly exist at the national level.

5. Discussion and Conclusions

The perceived need to stimulate investment in flexible options and the surrounding public debates have translated into a call for capacity mechanisms that has even led to the introduction of capacity mechanisms in some countries. The underlying fear is that under the current market conditions, too few investments in storage, flexible power plants and transmission capacity expansions are being made. Some market actors consider the low prices and subsequent lack of incentives to invest in security of supply options as a failure of the energy-only market. In this paper, we have criticised the strong and exclusive link between the formal market design and the present market results and identified other factors of market actor behaviour. Thus, additional determinants apart from the market design can influence the behaviour of market actors.

Firstly, the material opportunities in the electricity system play a crucial role in the investment decisions of market actors. A low market price can thus be rather understood as the result of investment cycles when phases of over-capacity and insufficient capacity alternate. Incentives for investments in flexible capacity can therefore be present within the existing market design under modified material conditions. For example, less base load power plants in the case of high proportions of fluctuating renewable energy would result in higher prices and amounts of residual (peak) load and might made flexible options profitable on their own. Furthermore, market actors are taking the developments and determinants of coupled systems into account as well as the evolution of technologies when making their investment decisions. A lack in domestic investment activity can therefore be seen as an expected and sufficient foreign provision of security of supply options. Under these conditions, no domestic capacity mechanisms would be necessary.

Secondly, when it comes to capital-intensive investments in the energy sector, there is a possibility that dominant market actors, which benefit from the status quo, may have an interest in delaying investments in flexible options. A clear decision regarding the introduction—Or dismissal of a capacity mechanism could bring an end to the possibility of strategically delaying investments as a means of political pressure. Furthermore, the identity and perceived role in the market and society as a whole play an important part in defining the actor’s “own interest” and thus, the investment strategy. Depending on the timeframe, the objectives of the company’s business and the ownership structure, the definition of a “successful” investment strategy and subsequently, the perceived personal interest of a company differs widely between market actors.

Thirdly, focusing events have a tremendous potential to the discursive context around specific market decisions. Such events can change the political climate and development priorities by concentrating the attention of the broad public and many stakeholders, which as a result can influence the market actor’s long-term decisions and investments.

Last but not least, it is possible that market actors revert back to narratives when they are highly uncertain about future developments. Following certain specific contextual assumptions, they might expect that investments in flexible options are not profitable. Conversely, this means that a change in market actor-specific contextual assumptions could stimulate investment. Policy-makers might achieve this change in perception by agreeing on a concrete energy roadmap along with credible targets regarding residual load and capacity development in base load power plants.

The Energy Union can play a crucial role in building up this credible narrative—Completely lacking until now (besides RE and climate targets)—On the energy transition and the (market) instruments that will support it. This narrative would have to be based on answers regarding the discontinuity of technologies and provide an unambiguous pathway that addresses all aspects of, for example, a possible fossil fuel phase-out. Accompanying a political and regulatory framework, it would have to address the conflict between a marginal cost-based electricity market and an electricity system with increasing proportions of RE electricity with almost no marginal costs. To be credible, this grand narrative would have to be in line with communications and decisions on other levels (national and regional) and other policy areas that are affected as, e.g., job market, technology and innovation policies or fiscal policies. This might be facilitated when a great proportion of stakeholders and policymakers from different levels and domains are informed, able to participate, and agree to the process and accept its result.

But also intra-European learning on the formal side could constitute an outcome of a European Energy Union. As the discussions on capacity mechanisms have evolved over time and moved from being dedicated to base-load energy generation options to more flexible options, new regulation proposals could be observed and evaluated by other Member States and a common learning process could be facilitated.

However, a systematic and comprehensive empirical study on the social and discursive determinants and other informal factors of market actor behaviour in the electricity market is still pending. Such an undertaking could provide detailed insight into expectation formation, knowledge production and thus, political actions regarding investments in security of supply. Having discussed the points above, it can be said however, that evidence of an urgent need of capacity mechanisms is equivocal. This of course in no way allows for the reversed conclusion: The formal market design with its set of legal remuneration and allocation schemes is of course an important determinant of investment behaviour; but it is not the only one. Thus, policy-makers can choose between different measures addressing formal or informal determinants to stipulate specific behaviour in the electricity market. We have substantiated that each of the five determinants discussed here may have an influence on investment decisions. Given the high levels of complexity and uncertainty, policy-makers must carefully consider the pros and cons in order to prevent the risk of generating unwanted disincentives. What specific instruments are available, at what cost, and the underlying political acceptance of these measures cannot be answered here. However, in light of the existence of several determinants of market actor investment behaviour, we do not see a compelling reason to focus solely on the implementation of capacity mechanisms to secure the desired investment behaviour.