Co-Movement Analysis of Italian and Greek Electricity Market Wholesale Prices by Using a Wavelet Approach

Abstract

:1. Introduction

EU Target Model and the Greece—Italy Cross-Border Trade History—Methodology Analysis via Wavelet Transform

2. Wavelet and Interconnector Utilization Analysis

3. Greece (GR)-Italy (IT) cross Border Trade History—Empirical Results

- From 2010 until the end of 2011 and 2013, Italy remained an export destination for Greece, for the most of the months.

- In the second quarter of 2010 an outage due to the fault of the submarine cable had reduced exports to zero level.

- From April 1st 2011 the auctioning for Transmission Capacity Rights (TCR) is done by Capacity Allocation Service Company S.A. (CASC S.A.), located in Luxemburg. As a result, for the Greece-Italy interconnector, monthly auctions were taken place during the first three months of 2011, while correspondingly the daily auctions were more reduced. A product of 250 MW however was auctioned, on which the transmission capacity for 2011 was based.

- 2012 is a year that imports are increased to the 1/3 of exports and trade is conducted and not influenced by cable faults.

- In 2013 after August the fault of the submarine cable had reduced its capacity to the level of 200 MW. At the end of the year an increase in imports was observed as prices where increased after a regulatory change.

- The largest average price in the transmission rights auctions for 2011 was observed in Greece-Italy interconnector (5.06 €/MWh), reflecting the relatively high price that was attained in the annual auction taking place in Italy that year.

- After the transfer of the auctioning of the TCR, for the Greece-Italy interconnector and taking into account the fall in the average price of auctions in the rest of interconnections, the total volume of transactions in the primary market of TCR (which were under the management of HTSO—the former TSO, before ADMIE S.A.) were reduced by almost 1/3, to €25.2 million.

- During 2010 the interconnection with Italy was the highest with 47% of the total transactions volume in the Greek primary market, even though for 3/4 of the same year there were no daily auctions for TCR, mainly due to a relatively high price set by the annual auction.

| Year | Daily Imports of Greece (from Italy) MWh | Daily Exports of Greece (to Italy) MWh | ||||||

|---|---|---|---|---|---|---|---|---|

| Mean | Max | Min | Annual Total | Mean | Max | Min | Annual Total | |

| 2005 | 29.86 | 500 | 0 | 261,575 | 82.06 | 500 | 0 | 718,863 |

| 2006 | 56.30 | 452 | 0 | 493,211 | 114.23 | 496 | 0 | 1,000,736 |

| 2007 | 132.6 | 530 | 0 | 1,162,128 | 22.8 | 500 | 0 | 199,963 |

| 2008 | 215 | 680 | 0 | 1,887,151 | 34 | 645 | 0 | 298,110 |

| 2009 | 66.3 | 754 | 0 | 582,276 | 283 | 685 | 0 | 2,488,230 |

| 2010 | 37 | 674 | 0 | 325,007 | 299 | 645 | 0 | 2,621,359 |

| 2011 | 54.4 | 595 | 0 | 476,285 | 250 | 550 | 0 | 2,193,250 |

| 2012 | 94.4 | 819 | 0 | 827,309 | 359 | 590 | 0 | 3,148,949 |

| 2013 | 33.71 | 685 | 0 | 295,872 | 241 | 534 | 0 | 2,113,110 |

| 2005–2013 | 80 | 819 | 0 | 6,310,817 (or 6310 GWh) | 187 | 685 | 0 | 14,782,074 (or 14,782 GWh) |

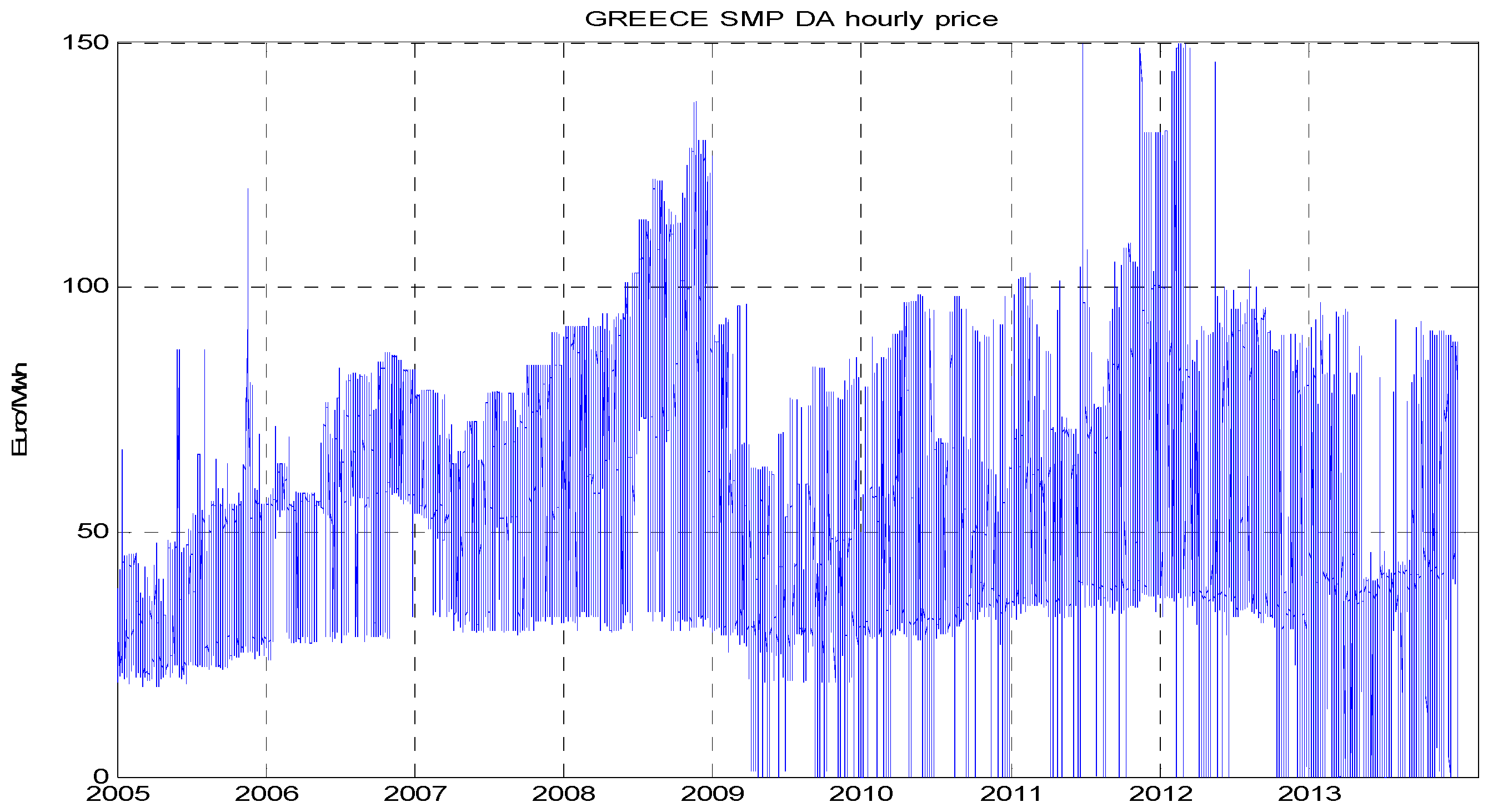

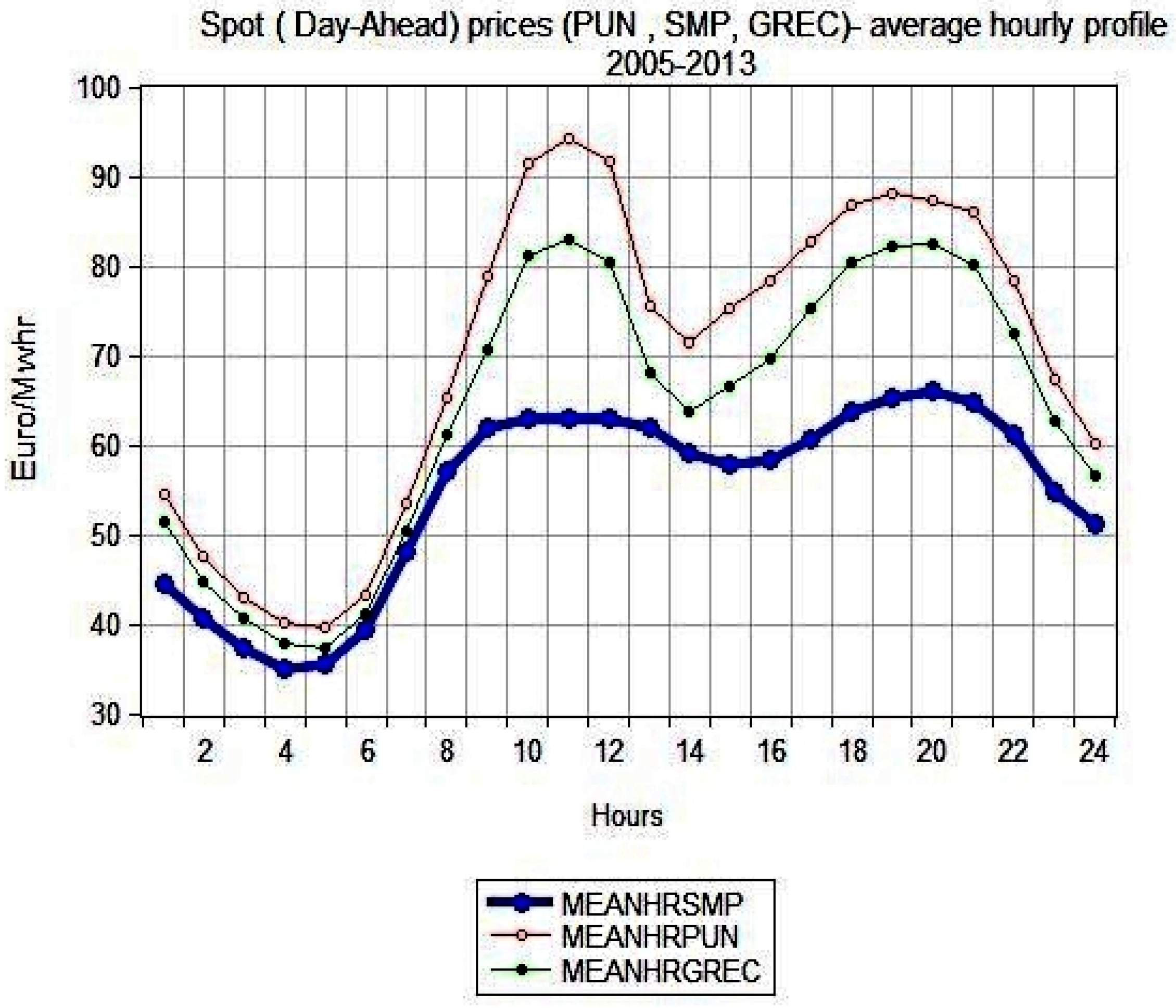

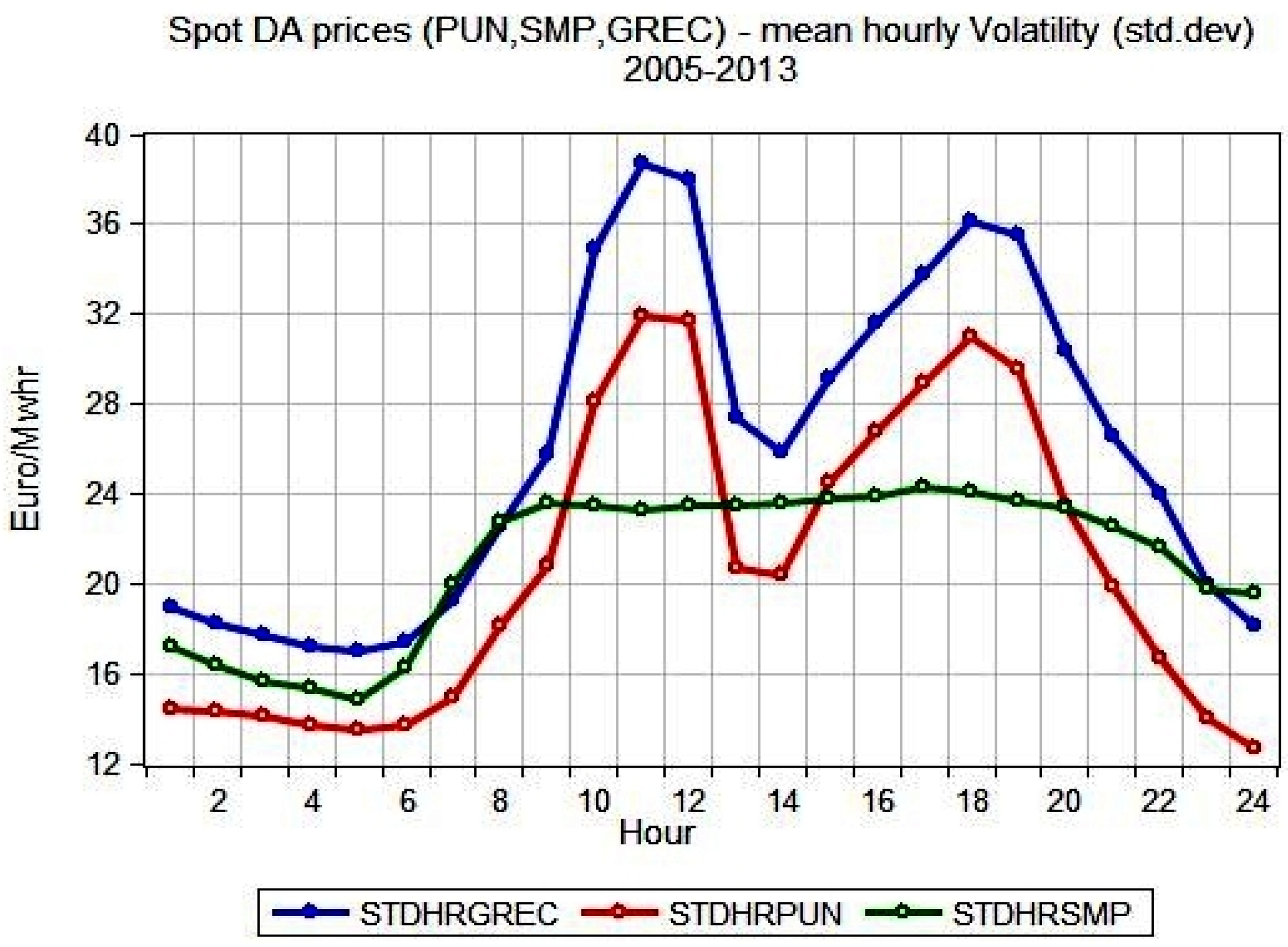

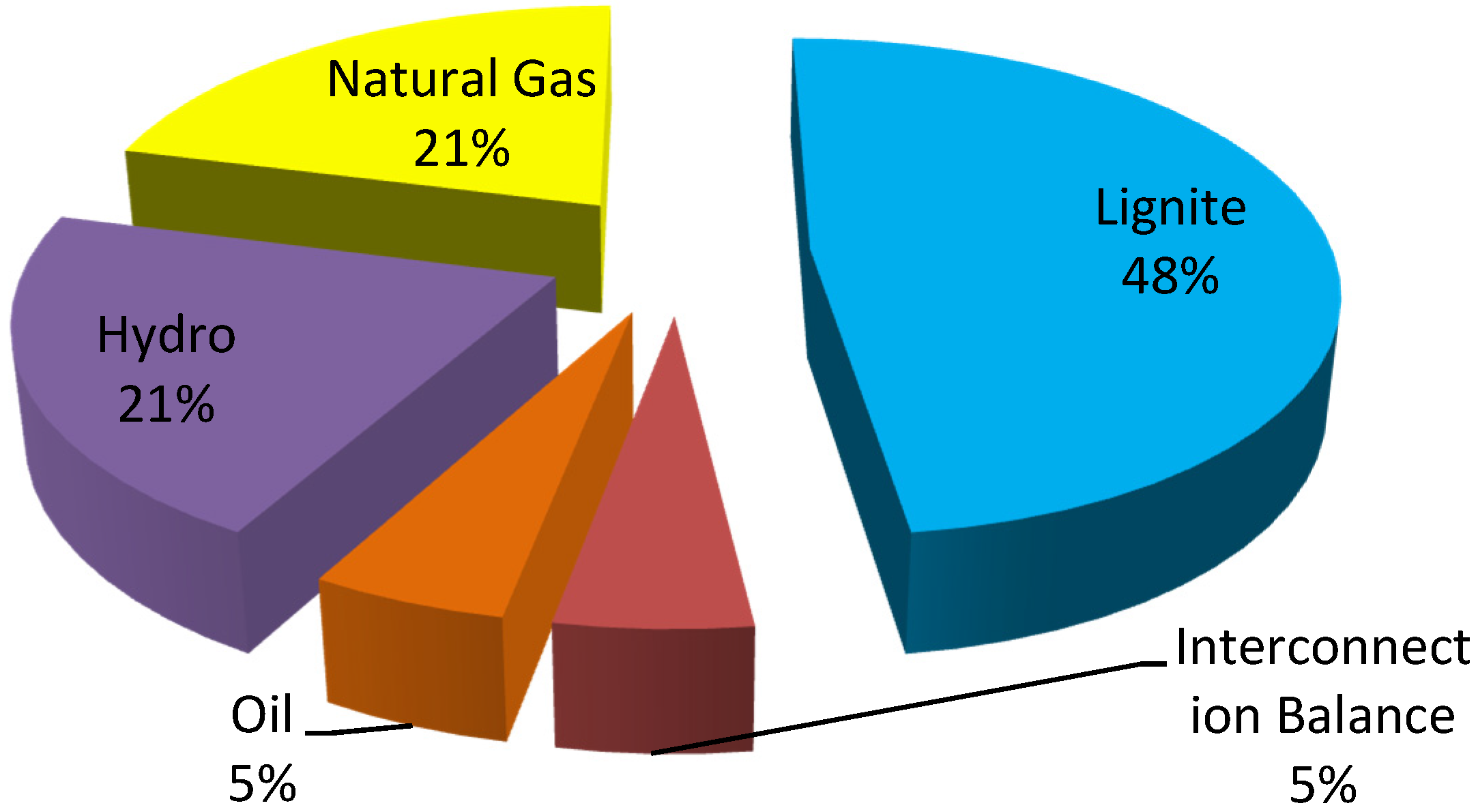

3.1. Data Description

- (1)

- the Wholesale Energy and Ancillary Services Market;

- (2)

- the Capacity Assurance Mechanism.

- (1)

- The Day-ahead Scheduling (DAS);

- (2)

- The Dispatch Scheduling (DS);

- (3)

- The Real time dispatch (RTD);

- (4)

- Imbalances settlement (IS).

- ◾

- The Spot Electricity Market (MPE) which includes:

- The Day-Ahead Market (MGP), where all market participants (producers, wholesalers, consumers) can sell/purchase electricity for the next day

- The Intra-Day Market where the initial schedules can be modified by the market participants

- The Ancillary Services Market (MSD), which consists of the ex-ante MSD and of the Balancing Market (MB)

- ◾

- The Forward Electricity Market (MTE), where market participants can sell/purchase future electricity supplies

- ◾

- The platform for physical delivery of financial contracts concluded on IDEX (CDE). IDEX is the segment of the financial derivatives market operated by Borsa Italiana S.p.A where the electricity financial derivatives are traded.

| ITALY | GREECE | ||||||||||

|---|---|---|---|---|---|---|---|---|---|---|---|

| Year | PUN (€/MWh) | Total volumes (GWh) | Liquidity (%) 1 | Participants (31 December) | SMP (€/MWh) | Total Volumes (GWh) 2 | Participants (31 December) 3 | ||||

| average | min | max | average | min | max | ||||||

| 2004 | 51.6 | 1.1 | 189.19 | 231.572 | 29.1 | 73 | 28.21 | 14.32 | 48.77 | 51721 | 8 |

| 2005 | 58.59 | 10.42 | 170.61 | 323.185 | 62.8 | 91 | 38.82 | 18.25 | 120 | 53400 | 13 |

| 2006 | 74.75 | 15.06 | 378.47 | 329.790 | 59.6 | 103 | 62.32 | 23.81 | 86.58 | 54207 | 10 |

| 2007 | 70.99 | 21.44 | 242.42 | 329.949 | 67.1 | 127 | 62.62 | 28.89 | 90.78 | 55253 | 17 |

| 2008 | 86.99 | 21.54 | 211.99 | 336.961 | 69 | 151 | 82.27 | 29.6 | 138 | 55675 | 19 |

| 2009 | 63.72 | 9.07 | 172.25 | 313.425 | 68 | 167 | 43.36 | 0 | 96.5 | 52436 | 30 |

| 2010 | 64.12 | 10 | 174.62 | 318.562 | 62.6 | 198 | 45.66 | 0 | 98.3 | 52365 | 38 |

| 2011 | 72.23 | 10 | 164.8 | 311.494 | 57.9 | 181 | 59.36 | 0 | 150 | 51872 | 37 |

| 2012 | 75.48 | 12.14 | 324.2 | 298.669 | 59.8 | 192 | 56.45 | 0 | 150 | 50558 | 33 |

| 2013 | 62.99 | 0 | 151.88 | 289.154 | 71.6 | 214 | 41.48 | 0 | 97 | 50717 | 28 |

| PUN | GREC | Imports | Exports | SMP | |

|---|---|---|---|---|---|

| PUN | 1 | 0.809 (0.000) | −0.084 (0.000) | −0.009 (0.000) | 0.583 (0.000) |

| GREC | 0.809 (0.000) | 1 | −0.047 (0.000) | 0.021 (0.000) | 0.484 (0.000) |

| Imports | −0.084 (0.000) | −0.047 (0.000) | 1 | −0.280 (0.000) | 0.208 (0.000) |

| Exports | −0.009 (0.000) | 0.021 (0.000) | −0.280 (0.000) | 1 | −0.237 (0.000) |

| SMP | 0.583 (0.000) | 0.484 (0.000) | 0.208 (0.000) | −0.237 (0.000) | 1 |

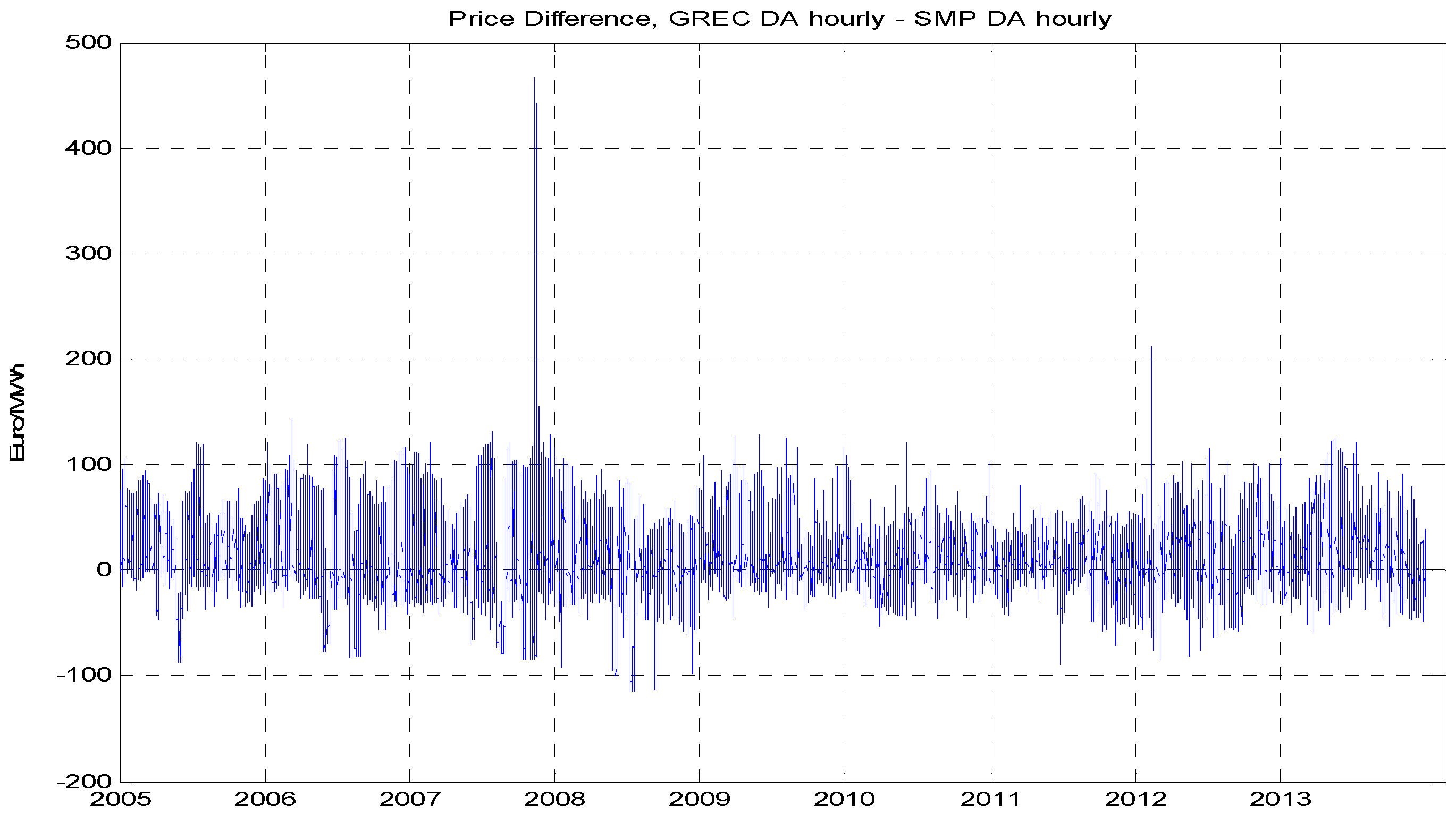

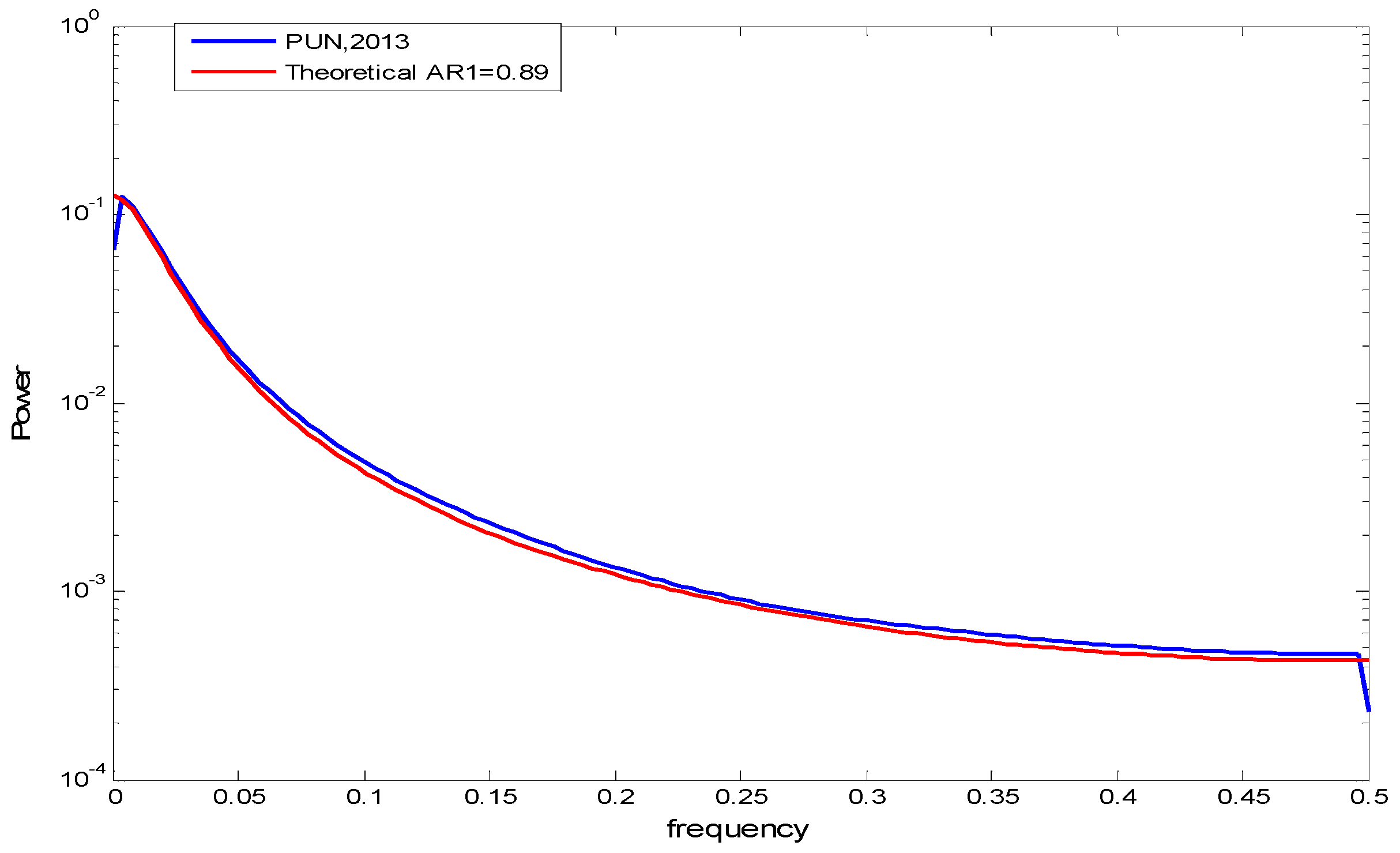

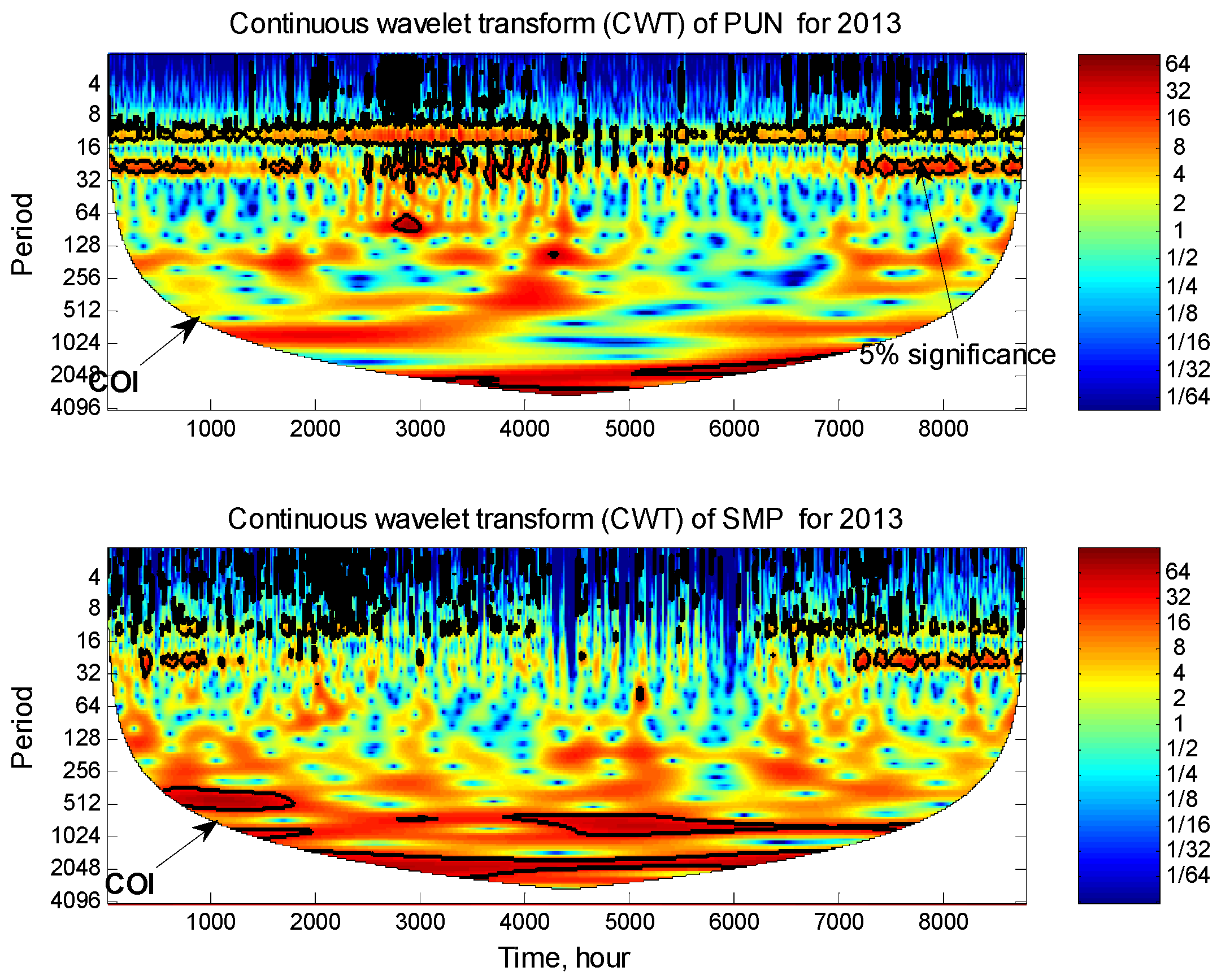

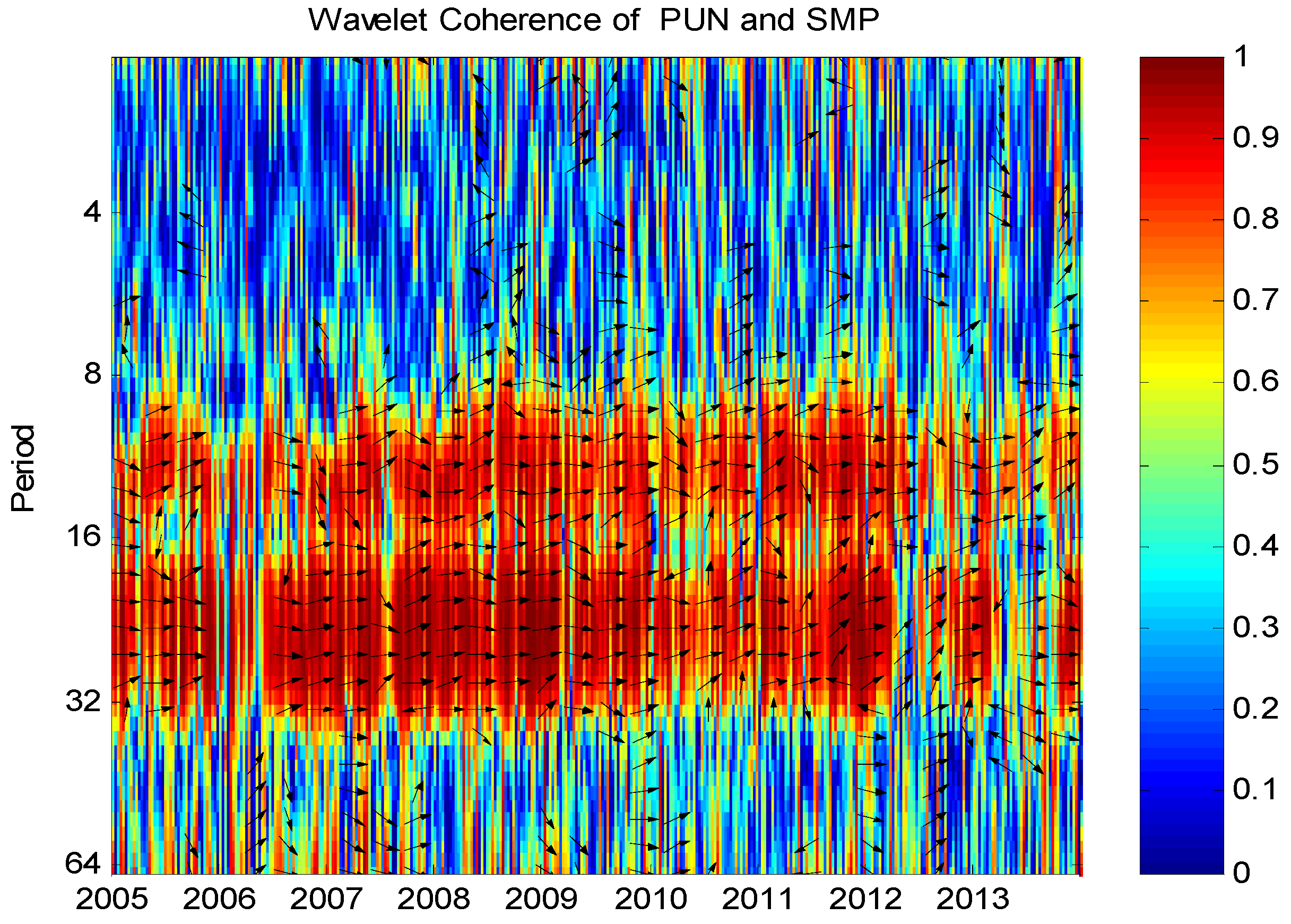

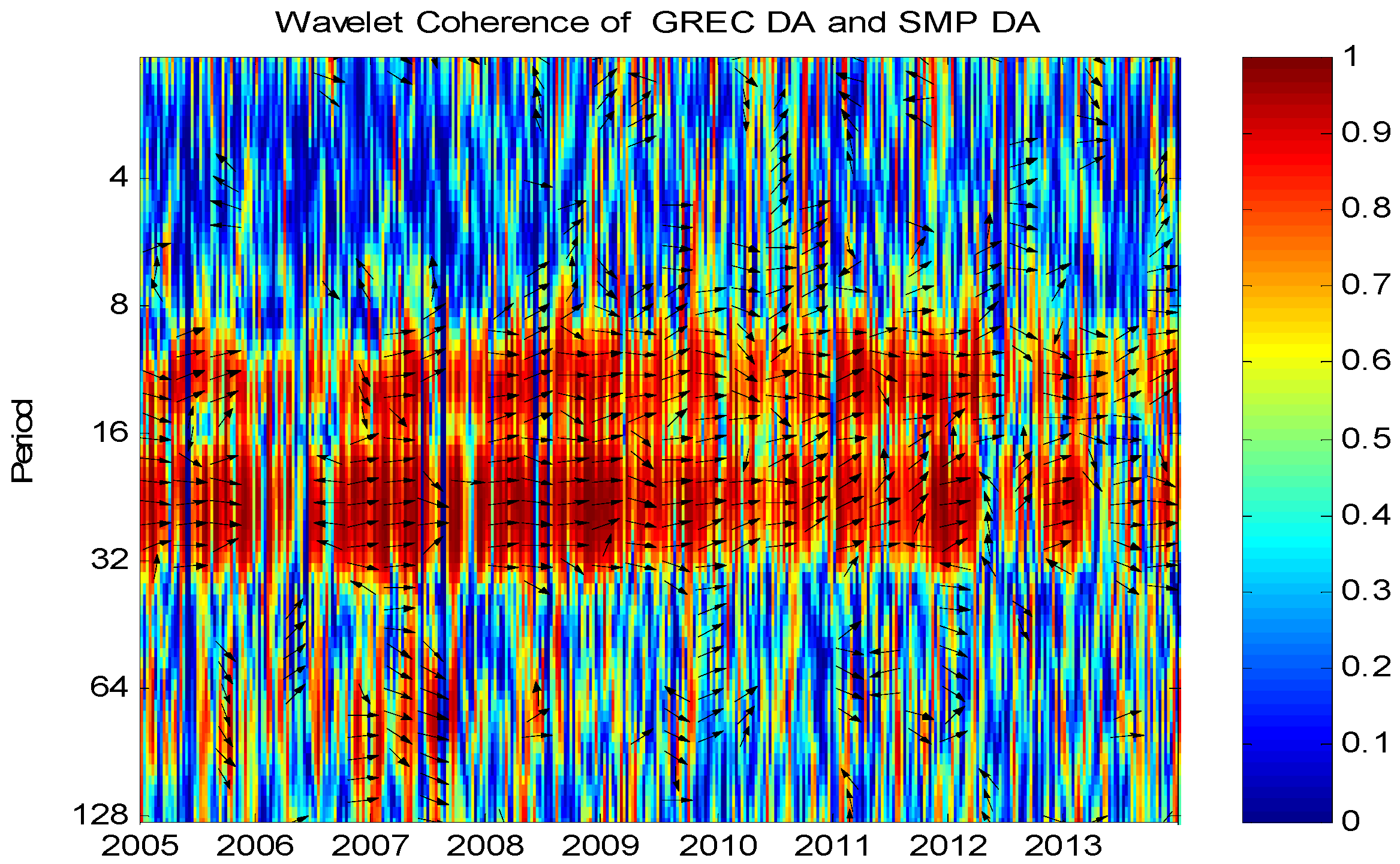

3.2. Evidence from the Wavelet Coherence

| Price Difference GREG-SMP | ITALY’s NET Exports Exports-Imports | |

|---|---|---|

| Wrong Flow | Right Flow | |

| + (>0) | + (>0) | − (<0) |

| − (<0) | − (<0) | + (>0) |

| Arrow Direction | ← | → |

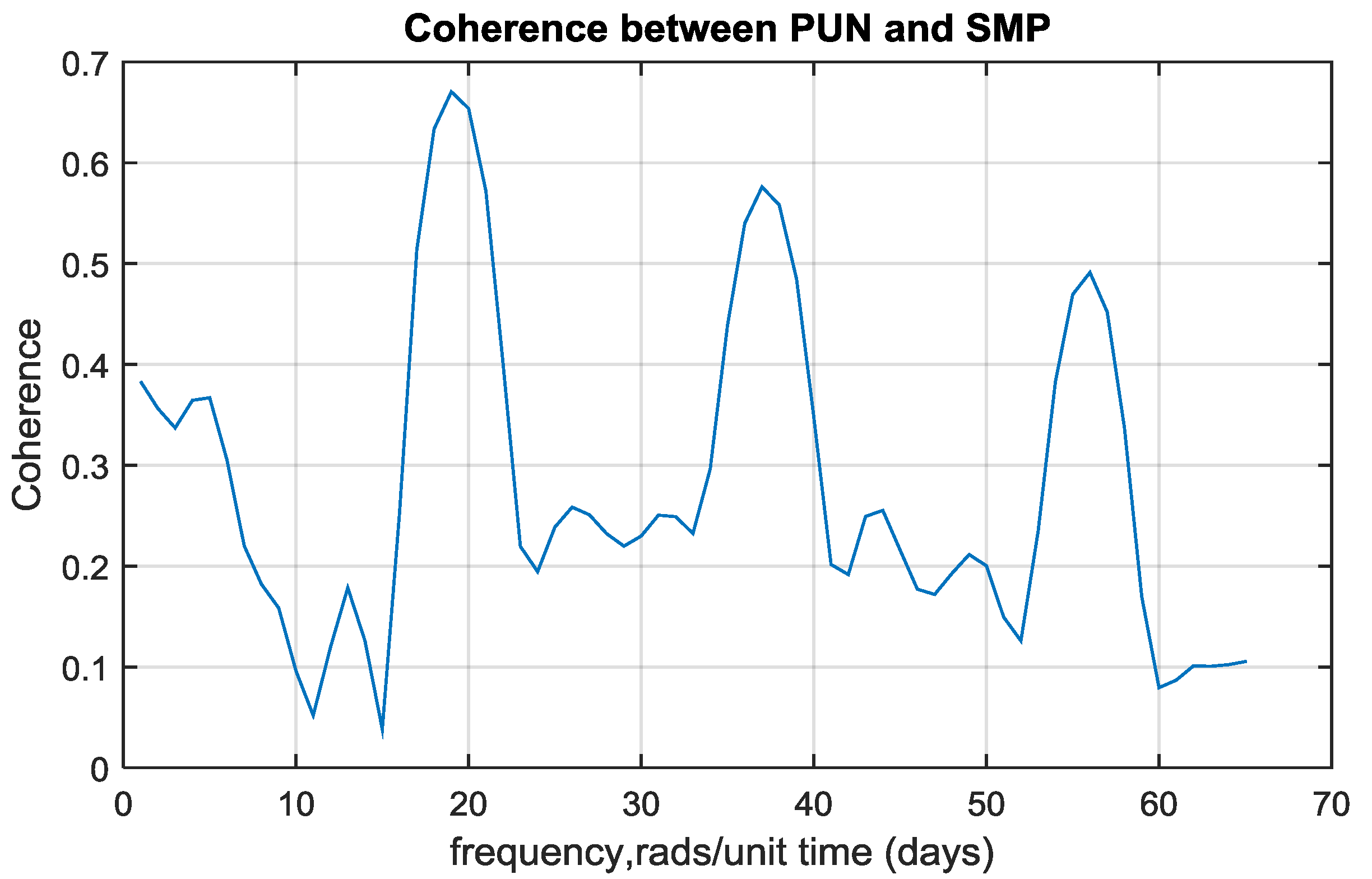

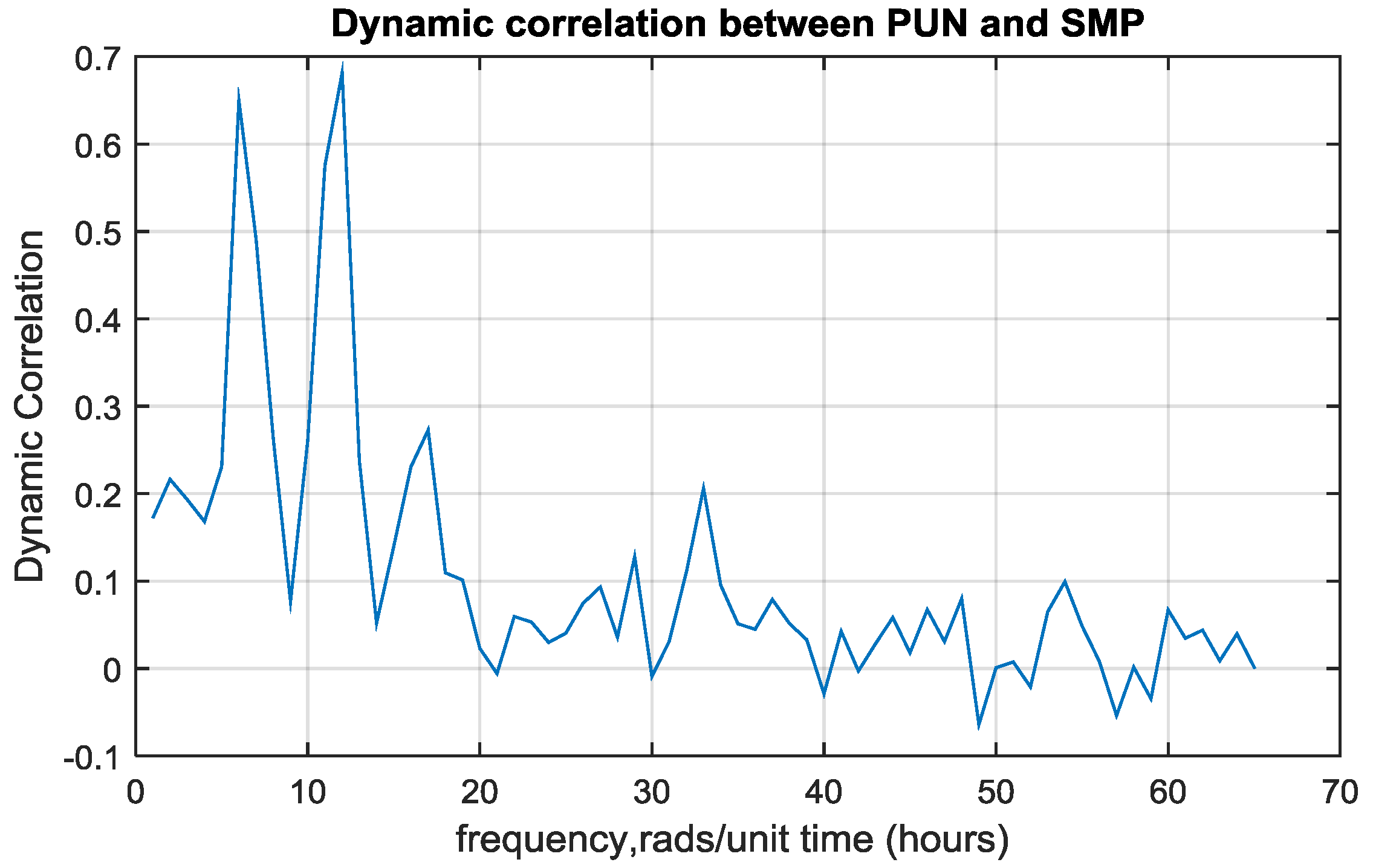

3.3. Evidence from Dynamic Correlation and Coherence Analysis

4. Conclusions

Acknowledgments

Author Contributions

Conflicts of Interest

References

- Regulation (EC) No 714/2009. In Proceedings of the European Parliament and the Council on the conditions for access to the network for cross-border exchanges in electricity and repealing Regulation (EC), Regulation of European Parliament and of the Council, Brussels, Belgium, 13 July 2009.

- Bunn, D.W. Modelling in Competitive Electricity Markets; Wiley: New York, NY, USA, 2004; pp. 1–17. [Google Scholar]

- Hong, Y.; Wu, C.P. Day-ahead electricity price forecasting using a hybrid principal component analysis network. Energies 2012, 5, 4711–4725. [Google Scholar] [CrossRef]

- Aguiar-Conraria, L.; Azevedo, N.; Soares, M.J. Using wavelets to decompose the time frequency effects of monetary policy. Physica A 2008, 387, 2863–2878. [Google Scholar] [CrossRef] [Green Version]

- Ramsay, J.B. Wavelets in economics and finance: Past and future. Stud. Nonlinear Dyn. Econ. 2002, 6. [Google Scholar] [CrossRef]

- Voronin, S.; Partanen, J. price forecasting in the day-ahead energy market by an iterative method with separate normal price and price spike frameworks. Energies 2013, 6, 5897–5920. [Google Scholar] [CrossRef]

- Naccache, T. Oil price cycles and wavelets. Energy Econ. 2011, 33, 338–352. [Google Scholar] [CrossRef]

- Tan, Z.; Zhang, J.; Wang, J.; Xu, J. Day-ahead electricity price forecasting using wavelet transform combined with ARIMA and GARCH models. Appl. Energy 2010, 87, 3606–3610. [Google Scholar] [CrossRef]

- Connor, J.; Rossiter, R. Wavelet transforms and commodity prices. Stud. Nonlinear Dyn. Econ. 2005, 9. [Google Scholar] [CrossRef]

- Yousefi, S.; Weinreich, I.; Reinarz, D. Wavelet-based prediction of oil prices. Chaos Solut. Fractals 2005, 25, 265–275. [Google Scholar] [CrossRef]

- Davidson, R.; Labys, W.C.; Lesourd, J. Wavelet analysis of commodity price behaviour. Comput. Econ. 1997, 11, 103–128. [Google Scholar] [CrossRef]

- Ghoshray, A.; Johnson, B. Trends in world energy prices. Energy Econ. 2010, 32, 1147–1156. [Google Scholar] [CrossRef]

- Grine, S.; Diko, P. Multi-layer model of correlated energy prices. J. Comput. Appl. Math. 2010, 233, 2590–2610. [Google Scholar] [CrossRef]

- Ciarreta, A.; Zarraga, A. Analysis of volatility transmissions in integrated and interconnected markets: The case of the Iberian and French markets. Document. Trabajo Biltoki 2012, 4, 1–25. [Google Scholar]

- Bunn, D.; Zachmann, G. Inefficient arbitrage in inter-regional electricity transmission. J. Regul. Econ. 2010, 37, 243–265. [Google Scholar] [CrossRef]

- Boffa, F.; Sapio, A. Introduction to the special issue “The Regional Integration of Energy Markets”. Energy Policy 2015, 85, 421–425. [Google Scholar] [CrossRef]

- McInerney, C.; Bunn, D. Valuation anomalies for interconnector transmission rights. Energy Policy 2015, 55, 565–578. [Google Scholar] [CrossRef]

- Boffa, F.; Scarpa, C. An anticompetitive effect of eliminating transport barriers in network markets. Rev. Ind. Organ. 2009, 34, 115–133. [Google Scholar] [CrossRef]

- Fuss, R.; Mahringer, S.; Prokopczuk, M. Market Coupling in Electricity Markets: Status quo and Future Challenges. Available online: http://papers.ssrn.com/sol3/Papers.cfm?abstract_id=2509239 (accessed on 13 October 2015).

- Mallat, S.G. A theory for multiresolation signal decomposition: the wavelet representation. IEEE Trans. Pattern Anal. Mach. Intell. 1989, 11, 674–693. [Google Scholar] [CrossRef]

- Gençay, R.; Selçuk, F.; Whitcher, B. An Introduction to Wavelets and Other Filtering Methods in Finance and Economics; Academic Press: London, UK, 2002. [Google Scholar]

- Warner, R.M. Spectral Analysis of Time-Series Data; The Guildford Press: New York, NY, USA, 1998. [Google Scholar]

- Percival, D.; Walden, A. Wavelet Methods for Time Series Analysis; Cambridge University Press: Cambridge, UK, 2000. [Google Scholar]

- Bruce, A.; Gao, H. Applied Wavelet Analysis with S-Plus; Springer-Verlag: Berlin, Germany, 1996. [Google Scholar]

- Adisson, P. The Illustrated Wavelet Transform Handbook; The Institute of Physics: London, UK, 2002. [Google Scholar]

- Grinsted, A.; Moore, J.C.; Jevrejeva, S. Application of the cross wavelet transform and wavelet coherence to geophysical time series. Nonlinear Process. Geophys. 2004, 11, 561–566. [Google Scholar] [CrossRef]

- Rua, A.; Nunes, L.C. International co-movement of stock market returns: A wavelet analysis. J. Empir. Financ. 2009, 16, 632–639. [Google Scholar] [CrossRef]

- Torrence, C.; Webster, P.J. Interdecadal changes in the ENSO-monsoon system. J. Clim. 1999, 12, 2679–2690. [Google Scholar] [CrossRef]

- Torrence, C.; Compo, G. A practical guide to wavelet analysis. Bull. Am. Meteorol. Soc. 1998, 79, 61–78. [Google Scholar] [CrossRef]

- Martina, E.; Rodriguez, E.; Escarela-Perez, R.; Alvarez-Ramirez, J. Multiscale entropy analysis of crude oil price dynamics. Energy Econ. 2011, 33, 936–947. [Google Scholar] [CrossRef]

- Allen, M.R.; Smith, L.A. Monte Carlo SSA: Detecting irregular oscillations in the presence of coloured noise. J. Clim. 1996, 9, 3373–3404. [Google Scholar] [CrossRef]

- Bollerslev, T. Modelling the coherence in short-run nominal exchange rates: A multivariate generalized arch model. Rev. Econ. Stat. 1990, 72, 498–505. [Google Scholar] [CrossRef]

- Engle, R. Dynamic conditional correlation: A simple class of multivariate generalized autoregressive conditional heteroskedasticity models. J. Bus. Econ. Stat. 2002, 20, 339–350. [Google Scholar] [CrossRef]

- Lanza, A.; Manera, M.; McAleer, M. Modelling dynamic conditional correlations in WTI oil forward and futures returns. Financ. Res. Lett. 2006, 3, 114–132. [Google Scholar] [CrossRef]

- Croux, C.; Forni, M.; Reichlin, L. A measure of co-movement for Economic variables: Theory and empirics. Rev. Econ. Stat. 2001. [Google Scholar] [CrossRef]

- Annual Report on the Results of Monitoring the Internal Electricity and Natural Gas Markets in 2012. Agency for the Cooperation of Energy Regulators, ACER/CEER, 29 November 2012.

- Papaioannou, G.P.; Papaioannou, P.G.; Parliaris, N. Modelling the Stylized Facts of the Wholesale System Marginal Price and the Impact of Regulatory Reforms on the Greek Electricity Market. Available online: http://arxiv.org/abs/1401.5452 (accessed on 13 October 2015).

- Petrella, A.; Sapio, A. Assessing the impact of forward trading, retail liberalization and white certificates on the Italian wholesale electricity prices. Energy Policy 2012, 40, 307–317. [Google Scholar] [CrossRef]

- Andrianesis, P.; Biskas, P.; Liberopoulos, G. An overview of Greece’s wholesale electricity market with emphasis on ancillary services. Electr. Power Syst. Res. 2011, 81, 1631–1642. [Google Scholar] [CrossRef]

- Regulatory Authority for Energy (RAE). National Report to the European Commission, Athens, Greece, November 2010. Available online: http://www.rae.gr (accessed on 13 October 2015).

- Di Cosmo, V. Modelling the Italian electricity price. In Proceedings of the Economic and Social Research Institute Trinity College, IEB Symposium, Dublin, Ireland, 20–23 August 2015.

- Corrado, C.; Assanelli, M. An overview of Italy’s Energy Mix. Gouvern. Eur. Géopol. L’Énergie, June 2012. Available online: http://www.ifri.org (accessed on 13 October 2015).

- Cataldi, A.; Stefano, C.; Zoppoli, P. The Merit-Order effect in the Italian power market: The Impact of solar and wind generation on national wholesale electricity prices. Energy Policy 2015, 77, 79–88. [Google Scholar]

- Italian Power Exchange, IPEX. Available online: http://www.mercatoellettrico.org (accessed on 13 October 2015).

- Greek Independent Power Transmission Operator, IPTO, ADMIE SA. Available online: http://www.admie.gr (accessed on 13 October 2015).

© 2015 by the authors; licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution license (http://creativecommons.org/licenses/by/4.0/).

Share and Cite

Papaioannou, G.P.; Dikaiakos, C.; Evangelidis, G.; Papaioannou, P.G.; Georgiadis, D.S. Co-Movement Analysis of Italian and Greek Electricity Market Wholesale Prices by Using a Wavelet Approach. Energies 2015, 8, 11770-11799. https://doi.org/10.3390/en81011770

Papaioannou GP, Dikaiakos C, Evangelidis G, Papaioannou PG, Georgiadis DS. Co-Movement Analysis of Italian and Greek Electricity Market Wholesale Prices by Using a Wavelet Approach. Energies. 2015; 8(10):11770-11799. https://doi.org/10.3390/en81011770

Chicago/Turabian StylePapaioannou, George P., Christos Dikaiakos, George Evangelidis, Panagiotis G. Papaioannou, and Dionysios S. Georgiadis. 2015. "Co-Movement Analysis of Italian and Greek Electricity Market Wholesale Prices by Using a Wavelet Approach" Energies 8, no. 10: 11770-11799. https://doi.org/10.3390/en81011770