1. Introduction

Due to the large size of and tremendous growth in the Chinese automotive market, forecasting the development trend of China’s vehicle fleet is important for academic researchers as well as policymakers in the fields of sustainable mobility and environmental protection.

Firstly, fossil fuels are the most important primary energy source in most countries around the world and the transportation sector, particularly individual transport, is highly dependent on fossil fuels [

1]. There is strong demand for oil because of increasing private vehicle ownership [

2]. China is also facing energy supply problems due to limited fossil energy resources. Its

per capita reserves of coal, petroleum and natural gas (NG) are 67.0%, 5.4%, and 7.5% of world average reserves, respectively [

3]. Furthermore, as Organization for Economic Co-operation and Development (OECD) oil use declines, China will become the largest consumer of oil by 2030s and Chinese demand is concentrated in transport [

4].

Secondly, vehicle emissions are the dominant source of air pollution and the transportation sector accounts for a large fraction of air pollution emissions [

5,

6,

7]. According to the International Maritime Organization’s second Greenhouse Gas (GHG) study [

8] the highest CO

2 emitting transport mode is road, which contributes 21.3% of the CO

2 emitted globally and is second only to electricity and heat production which contributes 35%. Because of the overwhelming use of petroleum as the fuel of choice, Gao and Winfield [

9] further note that road vehicles not only reduce petroleum resources but also release a significant amount of exhaust fumes which contribute to global warming and harm the environment and human health.

Thirdly, the fast growth in vehicle ownership has caused concerns over traffic congestion, especially in large Chinese cities [

10]. In the urban areas of China, the rapid growth in traffic has led to severe congestion problems and particularly a lack of parking space [

11]. According to the reports by TomTom Traffic Index [

12], China’s congestion level in 2013 was 36%, exceeding levels in Europe (26%), Australia & New Zealand (26%) and the Americas (20%). The congestion level in Beijing far exceeds congestion levels in all other capital cities within Organization for Economic Co-operation and Development (OECD) countries, with the exception of Mexico City (see

Figure 1).

Finally, the automotive industry is one of the largest sectors in the global market and the automobile is an increasingly technology intensive product [

13]. The growth rate of China’s car market has accelerated rapidly over the past two decades [

14]. In China, the production and sales of vehicles exceeded 20 million units in 2013 and China has had the highest vehicle production and vehicle sales in the world for five consecutive years [

15]. According to projections by Huo

et al. [

16], total vehicle stock in China will exceed that of the U.S. within 15 years.

Figure 1.

Congestion levels in capital cities in 2013 (data source: [

12]). All founding members of OECD are included, excepting Iceland and Turkey, because of lack of data.

Figure 1.

Congestion levels in capital cities in 2013 (data source: [

12]). All founding members of OECD are included, excepting Iceland and Turkey, because of lack of data.

It is standard practice in the vehicle forecast literature to model projected vehicle ownership using the Gompertz function when economic variables such as

per capita income or

per capita gross domestic product (GDP) are being used as the main explanatory variables. Huo and Wang [

17] employ

per capita income as an economic factor, while several researchers use

per capita GDP on the basis of macro level [

18,

19,

20,

21,

22]. Meyer

et al. [

23] use income data based on a micro level; moreover the authors use GDP time series from the World Bank database (World Development Indicators). Wu

et al. [

15] notes that GDP should be used instead of income to estimate vehicle demand in China because of biases in the reporting of Chinese income statistics and the impact of Chinese Government intervention on the balance between vehicle supply and demand. Indeed, most studies use the GDP-dependent Gompertz function to estimate Chinese vehicle stocks [

15,

24,

25,

26]. We therefore employ the GDP-dependent Gompertz function.

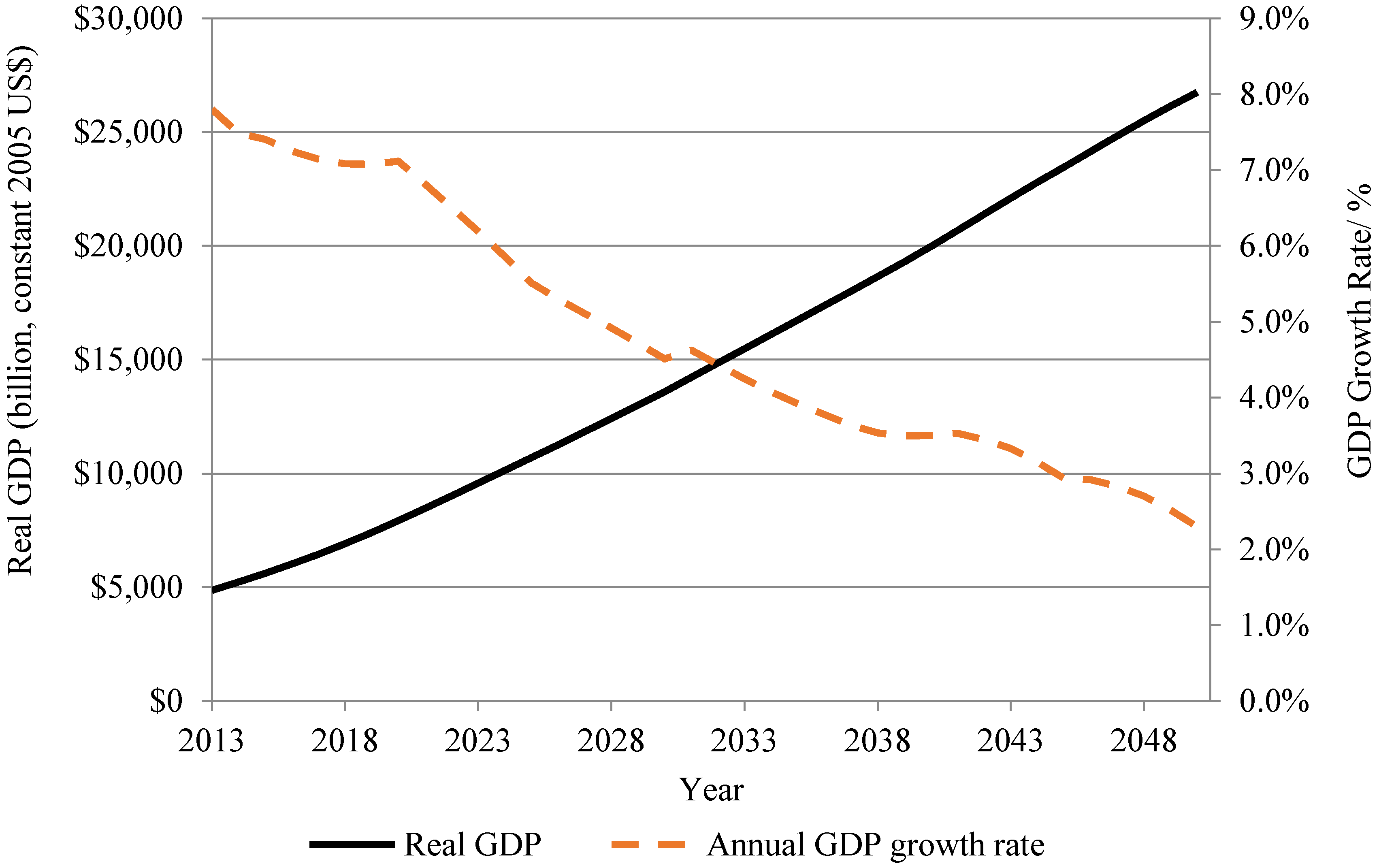

As Wang

et al. [

27] note, the first major challenge in forecasting vehicle populations using the GDP approach is the accuracy of the GDP forecasts themselves. The latest reports show that growth in China is set to slow in the post-industrial era at around 2020 [

28,

29] because of a “middle-income trap” referred by World Bank [

30] or the characteristics of the industrialization process. The process of industrialization can be divided into three stages, consistent with Bell’s conception of post-industrialization: pre-industrialization, industrialization and post-industrialization [

31]. The index of industrial production (IIP) is generally used to quantify the economic value of industrial production and indicate industrial output and activity [

32]. The IIP is probably the most important and widely analyzed indicator, given the driving role played by manufacturing in the business cycle. Further, the IIP is a crucial variable used to forecast the short-run evolution of GDP in most countries [

33].

Figure 2 illustrates the annual IIP and annual GDP growth rate in the United States (U.S.) and United Kingdom (UK).

Figure 2.

Annual growth rate of industrial production (IIP) and gross domestic product (GDP) in the U.S. and UK (Data source: [

34,

35,

36,

37]). (

a) United States (Index 2007 = 100); (

b) United Kingdom (Index 2010 = 100).

Figure 2.

Annual growth rate of industrial production (IIP) and gross domestic product (GDP) in the U.S. and UK (Data source: [

34,

35,

36,

37]). (

a) United States (Index 2007 = 100); (

b) United Kingdom (Index 2010 = 100).

International experience shows that the growth rate of annual GDP decreases with industrialization (see

Figure 2). China has not yet reached the post-industrialization stage till now, with most provinces being in the industrialization and pre-industrialization stages, with the exception of Beijing and Shanghai (see

Figure 3). According to the Report of Hu Jintao to the 18th CPC (Communist Party of China) National Congress [

38], industrialization should be complete by approximately 2020. We therefore expect GDP growth in China to slow over the next decade.

Figure 3.

The process of industrialization across regions of China in 2010 (data source: [

39]).

Figure 3.

The process of industrialization across regions of China in 2010 (data source: [

39]).

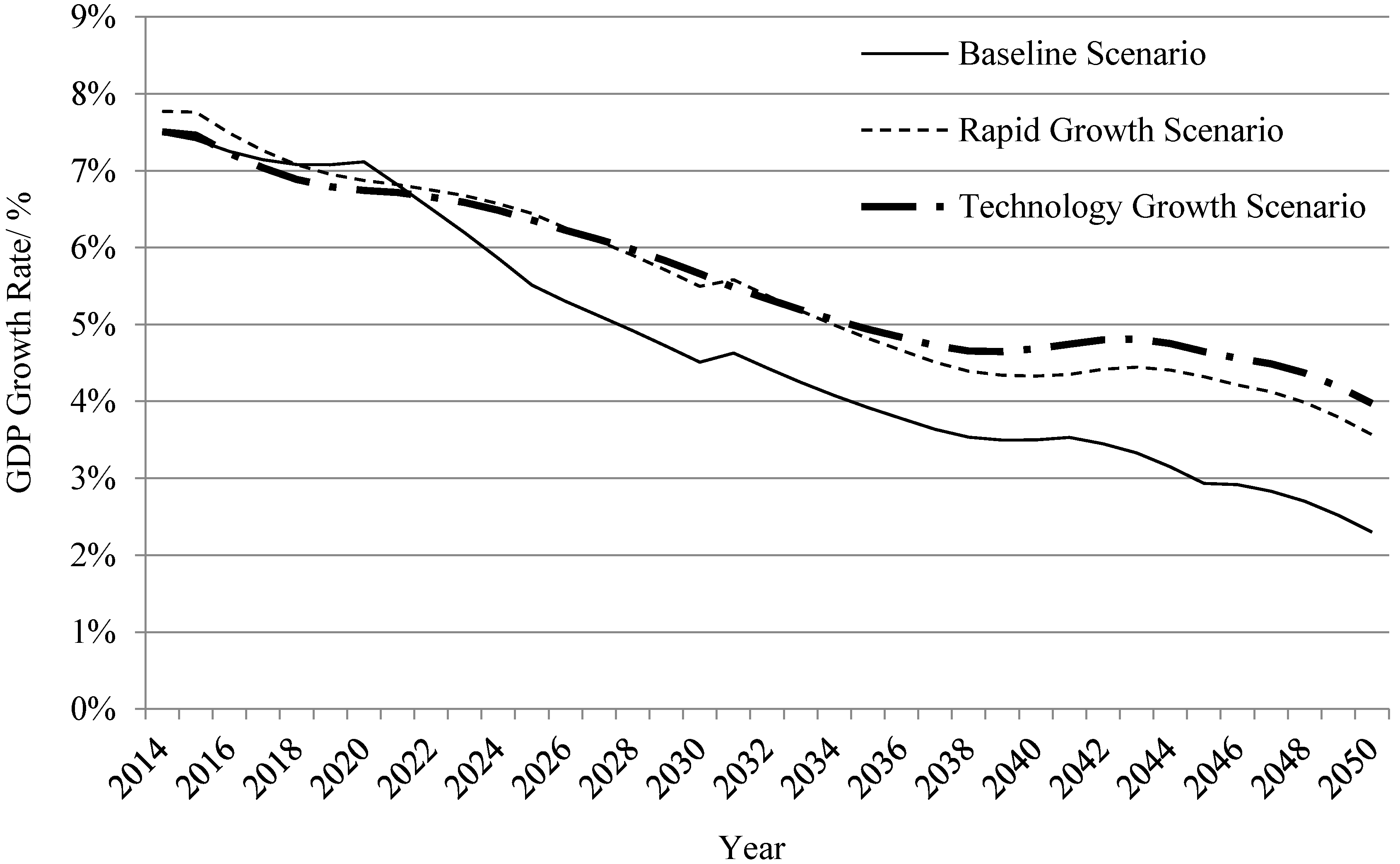

It is therefore necessary to obtain a detailed and full understanding of Chinese automotive developments, particularly during the transition from pre-industrialization to post-industrialization. The accuracy of GDP forecasts are especially important over this transitional period as is the impact of alternative GDP growth rates on vehicle fleet projections. In contrast to previous studies that assumed a single annual Chinese GDP growth rate [

24], this paper establishes a recursive dynamic Computable General Equilibrium (CGE) model to forecast the Chinese economic growth rate from 2013 to 2050. Unlike traditional econometric methods [

15], the CGE model is based on the general equilibrium theory of Walras and therefore uses a series of simultaneous equations to characterize the interdependence between different economic sectors and agents in a macroeconomic system [

40]. Agents and sectors make choices to maximize their objective function, for example, utility functions for consumers and profit functions for firms. Finally, we used the model to estimate the price and resource allocation in equilibrium.

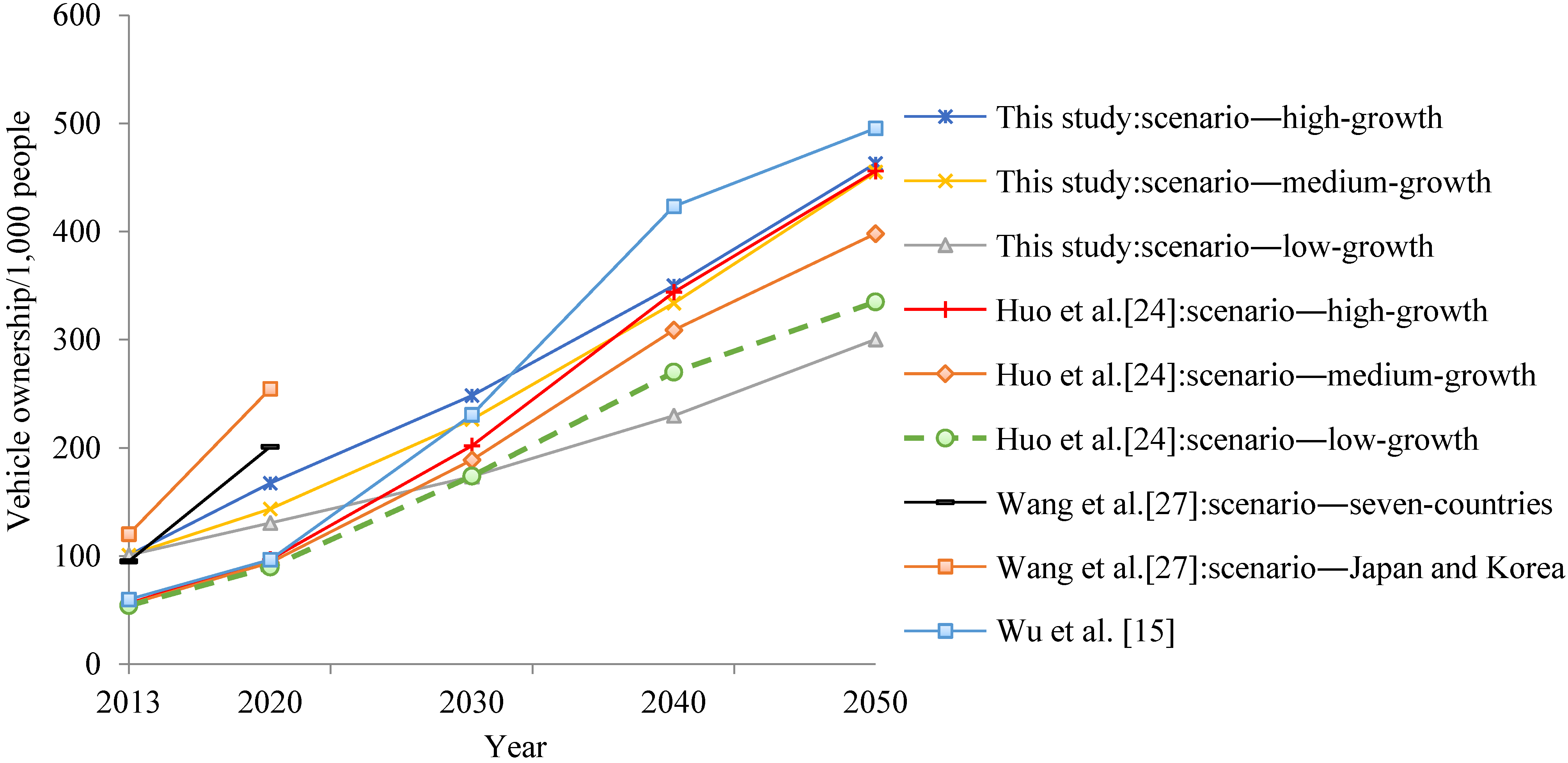

Our analysis contributes to several literature topics. Firstly, the existing Gompertz function analyses are widely used to specify dynamic features of the automotive market and to estimate the growth in vehicle ownership using economic explanatory variables. Of the three growth functions—Gompertz, Logistic and Richards—several studies have showed that the Gompertz function best fits the historical vehicle ownership data [

17,

18]. Secondly, this paper is directly related to previous research on projected Chinese vehicle ownership. Huo

et al. [

24] estimated the highway vehicle stocks from 2011 to 2050 in China based on three different growth scenarios—high-growth, medium-growth and low-growth. Wu [

25] forecasted China’s vehicle stock through 2030 and projected the share of each major vehicle category, including cars, buses and trucks. The truck category is subdivided into a further four categories: heavy-duty, medium-duty, light-duty and mini trucks. Zheng

et al. [

26] estimated county-level vehicle ownership using the Gompertz function and observed significant spatial differences in vehicle population and ownership between Chinese counties. Furthermore, the results in Zheng

et al. [

26] demonstrate that economic development is highly correlated with vehicle ownership. Wu

et al. [

15] projected vehicle stock levels in China based on the extant patterns of vehicle development across all OECD countries, Europe, the U.S. and Japan, respectively. Their results show that the OECD and European patterns better describe the growth in China’s vehicle stock than Japanese or U.S. patterns. Thirdly, this paper also relates to the empirical literature on long-term projections of GDP growth rates. There are two broad classes of methodologies: the CGE model and, the production function method with a growth accounting framework. The CGE model is widely used in many fields such as tax reform, international trade, employment, education and energy resources. A number of CGE models have been used to estimate China’s economic growth in the next several decades [

41,

42,

43]. We extend these analyses by forecasting a series of GDP growth rates under three possible growth scenarios.

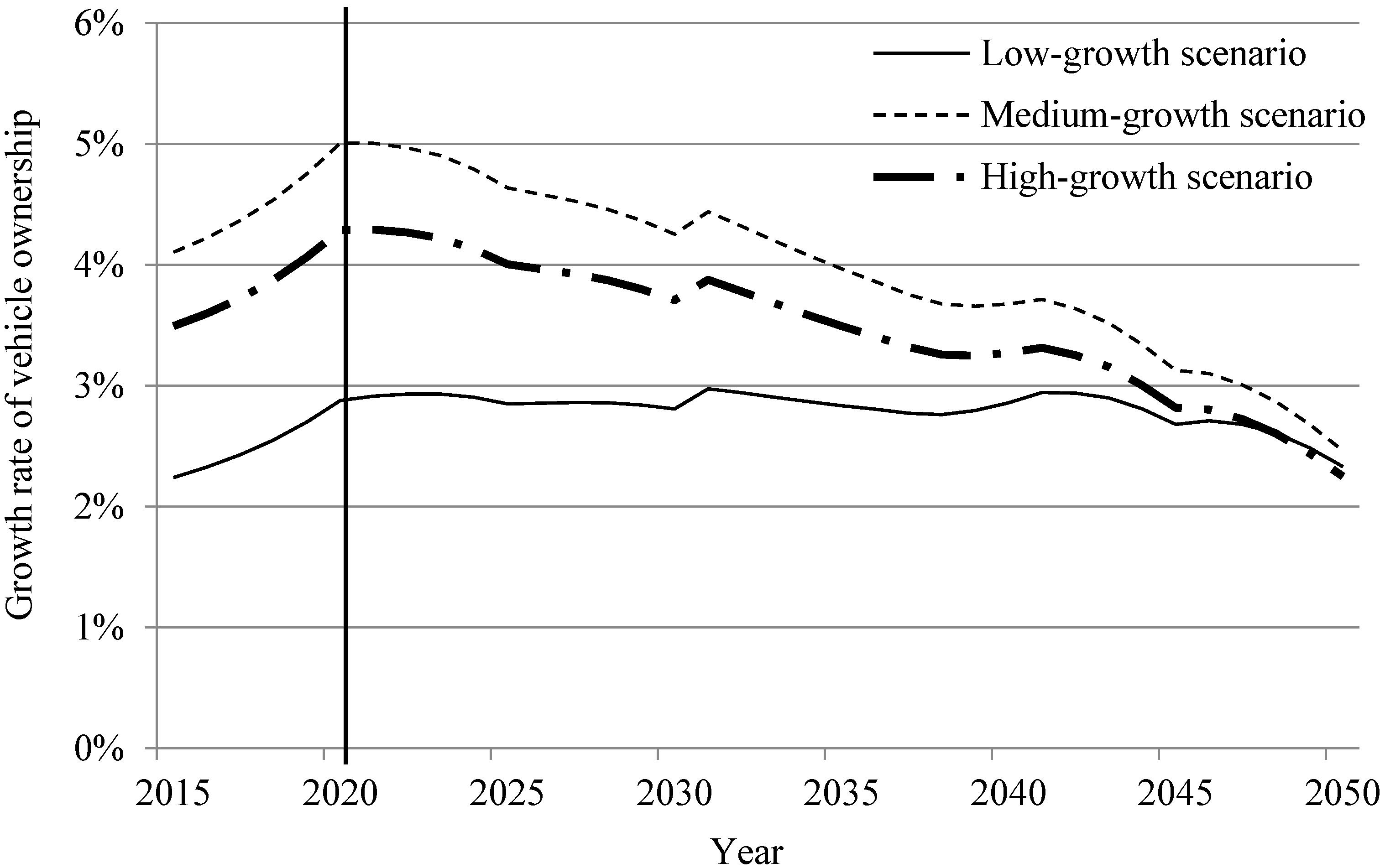

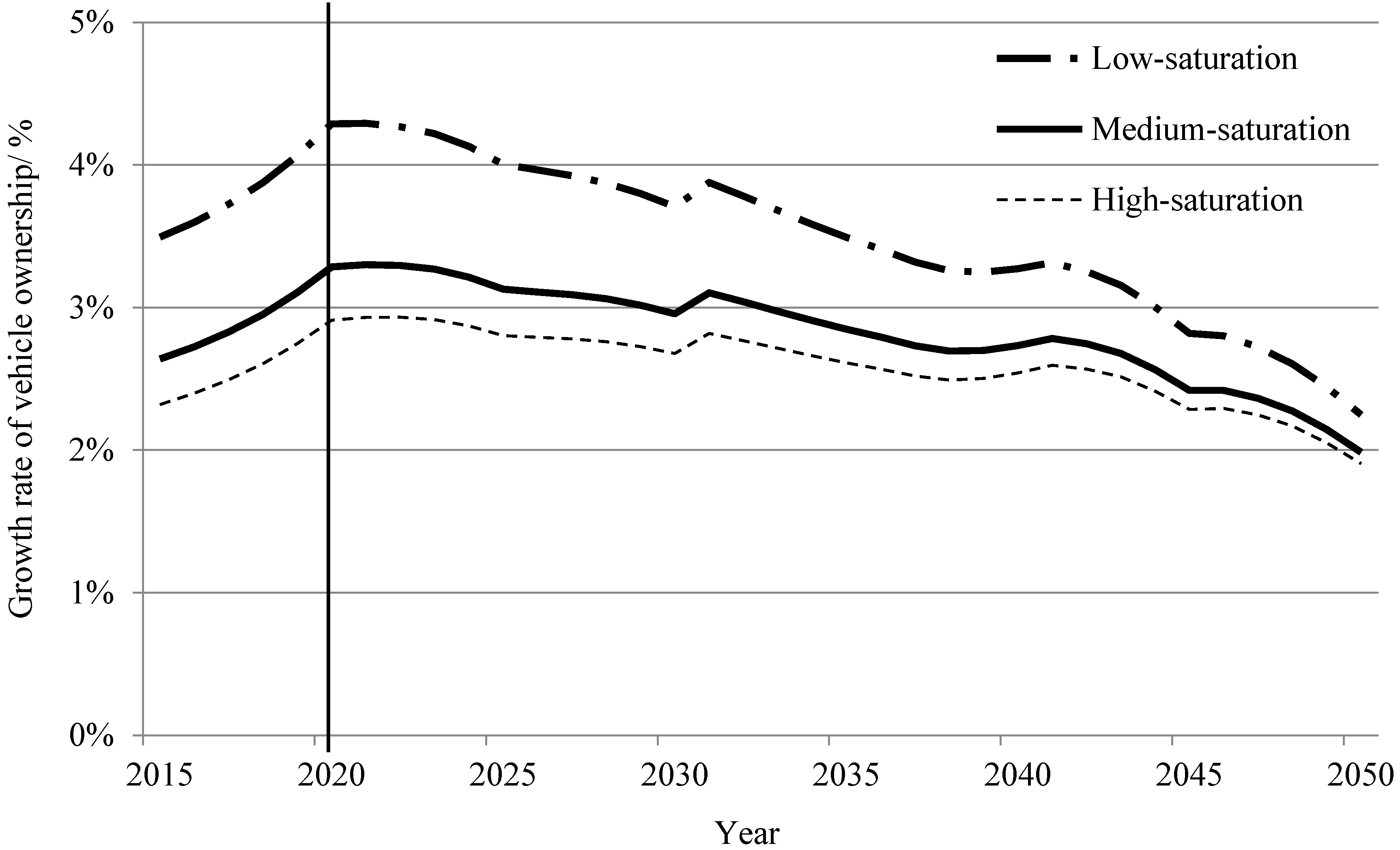

This paper makes several important advances over the previously cited literature on Chinese vehicle ownership. Firstly, we forecast China’s annual GDP growth rate using a recursive dynamic CGE model rather than a multiple autoregressive moving average (MARMA) model. The CGE model is more general used for long-term GDP growth forecasts. Secondly, we use data for all OECD countries and estimate vehicle growth rates under three scenarios—high-growth, mid-growth and low-growth. Thirdly, by estimating vehicle populations under three growth scenarios enables us to explore the sensitivity in vehicle projections according to variations in key factors, including vehicle saturation level, GDP growth rate and population growth. This is important given the uncertainty over Chinese economic and automotive industry development. Finally, the total energy consumption of road vehicles and the fuel consumption of other major categories of vehicle are analyzed.

The paper is organized as follows.

Section 2 presents the methodology, research approach and the data sources.

Section 3 reports the projected annual vehicle ownership and energy demand in the transport sector in China from 2013 to 2050. This section also includes a discussion of the impact of the different key parameters (

i.e., vehicle saturation level, GDP growth rate and population growth rate) on vehicle stock projections and energy consumption. Finally,

Section 4 presents our conclusions and provides policy suggestions.

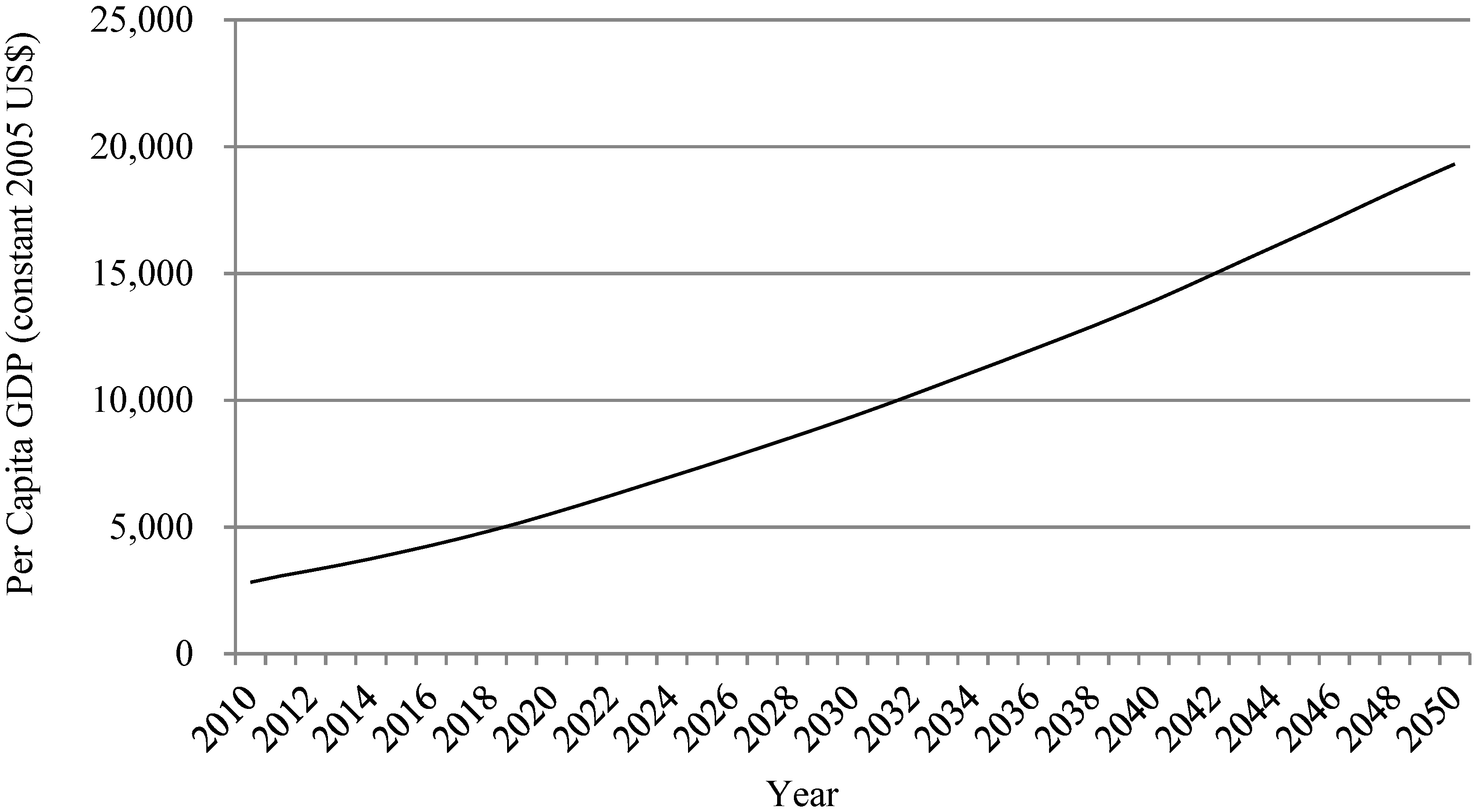

2. Methodology and Data

There are three factors in the Gompertz function: (a)

per capita GDP; (b) the saturation level of vehicle ownership and; (c) curvature parameters [

44]. Therefore, each of these parameters needs to be estimated to obtain a projection of Chinese vehicle ownership.

This study proceeds as follows. Firstly, we build a CGE model to project China’s annual GDP growth rate from which

per capita GDP can be derived. Secondly, we set the ultimate saturation level of vehicle ownership for each country according to the existing literature [

20]. Finally, we determine the curvature parameters. The rule of thumb stating that sample size

N > 30 is sufficient for asymptotic theory to provide a good approximation for inference on a single variable does not extend to models with regresses [

45]. Historical data on Chinese vehicle ownership is unavailable for a sufficiently long period, therefore the Gompertz function is estimated using data on vehicle development trends of the founding members of the OECD countries under the assumption that the OECD pattern best describes China’s vehicle stock growth, as illustrated by Wu

et al. [

15]). The estimated parameters are used to predict the annual vehicle ownership in China. The data before 2013 are historical, with all projections based on the historical data.

Before introducing the methodology and data, we describe the vehicle development trends across OECD countries (see

Figure 4).

The Development Research Center of the State Council [

46] and Huo

et al. [

24] divide vehicle demand growth into three periods: incubation period (with an initial slow growth period), booming period (intermediate stage of the Gompertz S-curve, covering the inflection point) and saturated growth period (the growth rate of the Gompertz S-curve is decreasing).

Figure 4 shows that most OECD countries present different characteristics but closely follow the Gompertz curve. The Pacific Rim and North America patterns display the greatest curvature in the booming period and both have entered the saturated growth phase. European countries remain in the booming period, presenting rapid growth in automotive markets, but display a comparably smoother growth pattern in the intermediate stage of the Gompertz S-curve. The red circle trend line (lower left corner of the first quadrant) represents China’s current position; China has not reached the inflection point of the increasing curve and remains in the rapid growth period. Therefore, it is necessary to estimate future Chinese vehicle ownership under different growth scenarios.

Figure 4.

Growth trends of vehicle stocks in representative OECD countries (data source: [

47,

48]).

Figure 4.

Growth trends of vehicle stocks in representative OECD countries (data source: [

47,

48]).

2.1. Gompertz Function

The Gompertz function has been widely used to estimate vehicle ownership [

15,

17,

18,

19,

20,

21,

22,

23,

24,

25,

26]. This study therefore follows standard econometric methodology by employing the Gompertz function to estimate vehicle ownership in China. The Gompertz function is regularly expressed as the following Equation (1):

where

Vi,t represents the number of vehicles per 1000 people in country

i in year

t;

is the ultimate saturation level of vehicle ownership (vehicles per 1000 people) in country

i;

EFi,t is

per capita GDP in country

i in year

t; α and β are two negative parameters that determine the shape of the S-curve in different economic levels. The parameter α determines the demands of vehicle stocks at low or zero economic levels and the parameter β is a curvature parameter that controls the slope of the Gompertz function at high economic levels.

Taking the logarithm of both sides of Equation (1), the estimating equation can be expressed as the following Equation (2):

As shown as Equation (2), time-subscripts and region-subscripts are added where appropriate. Therefore, we implement panel regressions for unbalanced panel data because, for several countries, data for a sufficiently long period were unavailable.

2.2. Computable General Equilibrium (CGE) Model

The recursive dynamic CGE model in our study consists of 42 production sectors (see

Table 1), four primary economic factors (productive labor, professional labor, agricultural labor, capital), four types of energy input (coal, crude oil, gas, electricity), two classes of household (rural and urban) and five basic account types (enterprise, government, investment and saving, stock, foreign).

Table 1.

Sector classification in CGE model.

Table 1.

Sector classification in CGE model.

| No. | Sector | No. | Sector |

|---|

| 1 | Agriculture, forestry, animal husbandry and fishery | 22 | Scrap waste |

| 2 | Coal mining and washing | 23 | Electricity, heat production and supply industry |

| 3 | Oil and gas exploration industry | 24 | Gas Production and Supply |

| 4 | Metal mining industry | 25 | Water production and supply industry |

| 5 | And other non-metallic mineral mining industry | 26 | Construction |

| 6 | Food manufacturing and tobacco processing industry | 27 | Transportation and Warehousing |

| 7 | Textile industry | 28 | Postal Services |

| 8 | Textile, leather and feather products industry | 29 | Information transmission, computer services and software industry |

| 9 | Wood processing and furniture manufacturing | 30 | Wholesale and retail trade |

| 10 | Paper printing and Educational and Sports Goods | 31 | Accommodation and Catering Services |

| 11 | Petroleum processing, coking and nuclear fuel processing industry | 32 | Financial Industry |

| 12 | Chemical Industry | 33 | Real Estate |

| 13 | Non-metallic mineral products industry | 34 | Leasing and Business Services |

| 14 | Metal smelting and rolling processing industry | 35 | Research and Development Industry |

| 15 | Fabricated Metal Products | 36 | Integrated Technical Services |

| 16 | General, special equipment manufacturing industry | 37 | Water conservancy, environment and public facilities management industry |

| 17 | Transportation Equipment Manufacturing | 38 | Resident Services and Other Services |

| 18 | Electrical machinery and equipment manufacturing | 39 | Education |

| 19 | Communications equipment, computers and other electronic equipment manufacturing | 40 | Health, social security and social welfare |

| 20 | Measuring Instruments and Office Machinery | 41 | Culture, Sports and Entertainment |

| 21 | Handicrafts and other manufacturing | 42 | Public administration and social organizations |

2.2.1. Production

Each production sector produces a differentiated product. Within each sector, the production process follows a five-level, nested, constant elasticity of substitution production (CES) function. At the top level, the aggregate output for the sector is the product of aggregate intermediate input and capital-energy-labor composition through a CES function. At the second level, we assume that the composition of different intermediate inputs follows a Leontief function. We also assume that the capital-energy-labor composition is constitutive of aggregate labor input and capital-energy composition in a CES function. The setting of the capital-energy-labor composition follows the structure of various energy CGE models; the input of capital in production is usually accompanied by a corresponding energy input [

49]. At the third level, the aggregate labor input is a combination of two components through a CES function. In the agricultural sector, these two components consist of agricultural labor and professional labor whereas in the other sectors, the two constituents’ parts are productive labor and professional labor. Moreover, the capital-energy composition is a synthesis of capital input and composite energy input through a CES function. The remainder is a two-level nested structure of energy aggregation, following Liang

et al. [

50]. Electricity is regarded as a secondary energy—it is composed of the fossil fuel energy aggregation in a CES function at the forth level. At the last level, fossil fuel energy aggregation is a composition of coal, crude oil and gas by a CES function.

2.2.2. Income Distribution, Taxation and Transfer

The revenue generated in production is distributed to the resident, enterprise, government and foreign accounts. The total income of residents includes labor income, capital interest and transfer payments from enterprise, government and abroad. In the model, the residents are subject to personal income tax, so real disposable income is equal to total resident income minus personal income tax payments. The revenue of enterprises comes from capital interest and transfers from government and foreign accounts—the tax item is corporate income tax. Government income is obtained from various taxes including: personal income tax; corporate income tax; production tax and; import tax. Production tax is the sum of value-added tax and other taxes in production, where value-added tax is levied in proportion to the value of the capital-energy-labor composition. The other taxes on production are levied in proportion to the value of aggregate sector output. Government makes transfers to residents, enterprise and foreign accounts. Finally, the income of foreign accounts originates from the return of foreign capital supply and transfers from the domestic government. However, foreign accounts also make transfer payments to domestic residents.

2.2.3. Domestic Demand

Domestic demand for products is a function of residential consumption, government consumption and investments. We assume that residential disposable income is spent on consumption and saving, and that the utility function of residents is a Stone-Geary function. Therefore, residential demand for each product satisfies a linear expenditure system (LES) function as Equation (3) shows:

where

QHi,h,t is the consumption of commodity

i by household

h at time

t;

PQi,t is the price of commodity

i in a domestic market at time

t;

YHh,t is the disposable income of household

h at time

t; γ

i,h,t is the subsistence level amount of commodity

i by household

h at time

t; β

i,h is the share of expenditure on commodity

i, and;

mpch is the marginal propensity of consumption by household

h. This assumes that the share of expenditure on commodities and the marginal propensity of consumption is constant.

Government consumption of each commodity and transfers are assumed to be constant over time. Assuming that government expenditure is fixed simplifies the model but does not substantially alter the final results.

It is assumed that the share of nominal investment demand of each commodity in the contemporary aggregate domestic nominal investment (including fixed investment and stock accumulation) is exogenously determined. Moreover, the capital supply is assumed to be perfectly flexible among all production sectors.

2.2.4. Foreign Trade

We employ the normal setting of foreign trade that is widely used in various CGE models. With respect to imports, we adopt the Armington assumption that the substitutability between domestic output and imported commodities is not perfect and that the domestic supply of each commodity is a CES composition of the domestic output and the import [

51]. With respect to exports, total domestic output is allocated through a constant elasticity transformation (CET) function between exports and domestic supply.

2.2.5. Model Closure and Market Clearing

We assume that the commodity, labor factor and capital market are all cleared. As for model closure, we adopt the neo-classical framework, assuming that capital and labor supply are exogenous and, finally, that all savings are transformed into investments.

2.2.6. Dynamic Structure

We use the recursive method to characterize the dynamic path of labor, capital and technology. The annual growth path of labor and technology is exogenously determined, whereas the labor growth path is set according to United Nations figures [

52] and the technology growth path is set according to Li [

41]. Capital accumulation is endogenous and the dynamic accumulation formula is following Equation (4):

where

Kt is real capital stock at time

t;

FIXINVt is nominal fixed investment at time

t and;

KPIt is capital price index at time

t. The depreciation rate δ is exogenously set to 0.094 as defined in Zhang

et al. [

53].

2.3. Energy Consumption

Following Ou

et al. [

54], total energy consumption of on-road motor vehicles is calculated as the aggregate of different vehicle types as expressed by the following Equation (5):

where

EC (tons of oil equivalent, toe) is total energy consumption;

t is the calendar year,

i is the vehicle type (including car, bus and truck);

VPi,t is the vehicle population for vehicle type

i in the year

t;

AFEi,t (toe) is the fleet average on-road fuel economy for vehicle type

i in the year

t;

POPt is the total population in year

t and;

Vt is vehicle ownerships per 1000 people in year

t as derived by the Gompertz function.

Due to the unavailability of long-running vehicle ownership data for China, we cannot estimate the vehicle population for different vehicle types in China from the Gompertz functions directly. Instead, we use data on the proportion of each vehicle type in the vehicle population (see more data details in

Section 2.4).

Defining

si,t as the proportion of each major vehicle category in the total vehicle population in the year

t, we have:

Energy demand by vehicles is then derived using a combination of Equations (1), (5) and (6):

2.4. Data

Our data is obtained from five sources. The first is the World Road Statistics dataset (WRS) [

46]. The WRS is the only universal source of strategic data on road networks, traffic and inland transport and is conducted by the International Road Federation (IRF). It contains data on vehicle ownerships in all OECD countries and China from 1963 to 2011. Some countries are excluded from our analysis. Firstly, North America and the majority of European countries are founding members of the OECD community. To eliminate the selection effects of using data on OECD countries, countries that joined in or after 1963 are excluded. Secondly, of the founding members of the European countries with comparable data, Turkey is excluded because its

per capita GDP and vehicle ownership is six times smaller than any of the other countries while Luxembourg is excluded because its

per capita GDP is twice as large as any other country. Greece, Iceland and Portugal are excluded because comparable data is unavailable for a sufficiently long period. Among the Asia-Pacific region with comparable data, Korea is excluded because its

per capita GDP is half the size of any other country. Therefore, a sample of 18 OECD countries is used in this paper, including Australia, Austria, Belgium, Canada, Denmark, France, Germany, Ireland, Italy, Japan, the Netherlands, New Zealand, Norway, Spain, Sweden, Switzerland, United Kingdom and the United States.

The second source of data for this study is the World Development Indicators (WDI) from World Bank open data [

47], which publishes annual GDP and population data for each country from 1960 to 2013. The WDI is collected by the World Bank and represents the most current and accurate global development data available. The virtues of the WDI include its comprehensive global coverage and the fact that its annual GDP data is expressed in constant 2005 U.S. $.

The third data source is from the Social Accounting Matrix (SAM) and is used in our CGE model. We constructed a 2007 China SAM based on a series of available datasets, which include Input-Output Table 2007 [

55] and various yearbooks and literatures [

56,

57,

58]. The exogenous model parameters—elasticity of substitution, utility function parameters and the population growth path—are obtained from related research [

52,

59,

60,

61,

62].

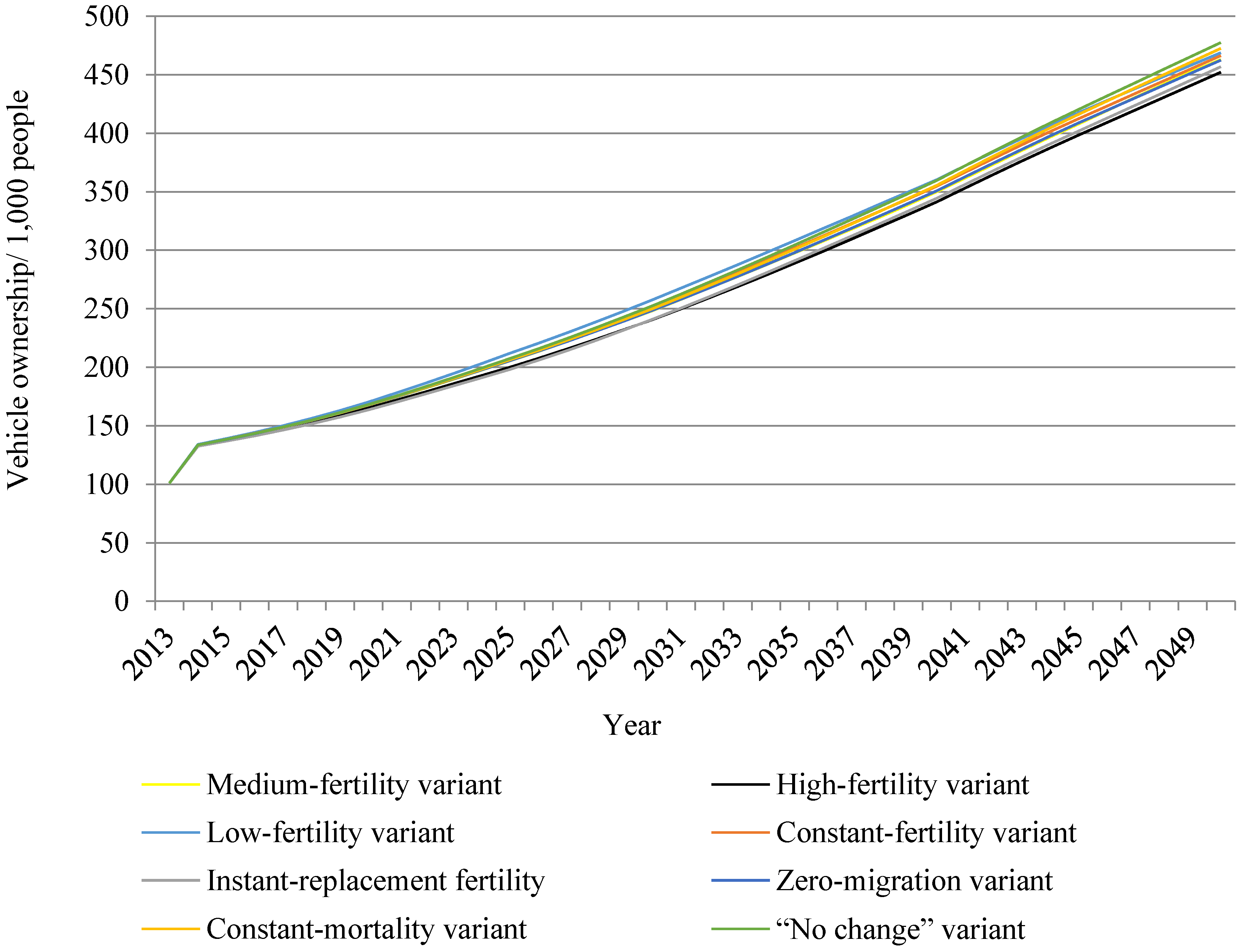

The fourth data set is the 2012 Revision of World Population Prospects (WPP 2012) [

52] which is prepared by the United Nations Population Division. WPP 2012 provides a comprehensive and consistent set of annual population data for the world’s countries for 2010–2100, including eight different fertility projection variants based on varying assumptions for fertility, mortality and international migration (low, medium, high, constant-fertility, instant-replacement fertility, constant-mortality variant, zero-migration variant and a “no change” variant). The high, low, constant-fertility and instant-replacement variants differ from the medium variant only in the projected level of total fertility. The constant-mortality variant and the zero-migration variant both employ the same fertility assumption (medium fertility). Lastly, the “no change” variant employs the same assumption of international migration as the medium variant but differs from the latter by having constant fertility and mortality. Among these, we adopt the medium fertility assumption to calculate Chinese GDP

per capita. The remaining seven potential fertility trends are used to perform the sensitivity analysis.

The ultimate saturation level of vehicle ownership for each country is obtained from Dargay

et al. [

20], who estimated vehicle ownership saturation for 45 countries. The on-road fuel economy of the average vehicle and, the share of each major vehicle category to total vehicle population in 2010–2050, are obtained from China Automotive Energy Research Center (CAERC) [

44]. CAERC [

44] contains estimates of the fuel economy and the share of car, bus and truck to total vehicles in the Business as Usual (BAU) scenario, in which the current trends of vehicle propulsion technologies continue as do existing market conditions and fuel economy improves, but not in an aggressive manner.

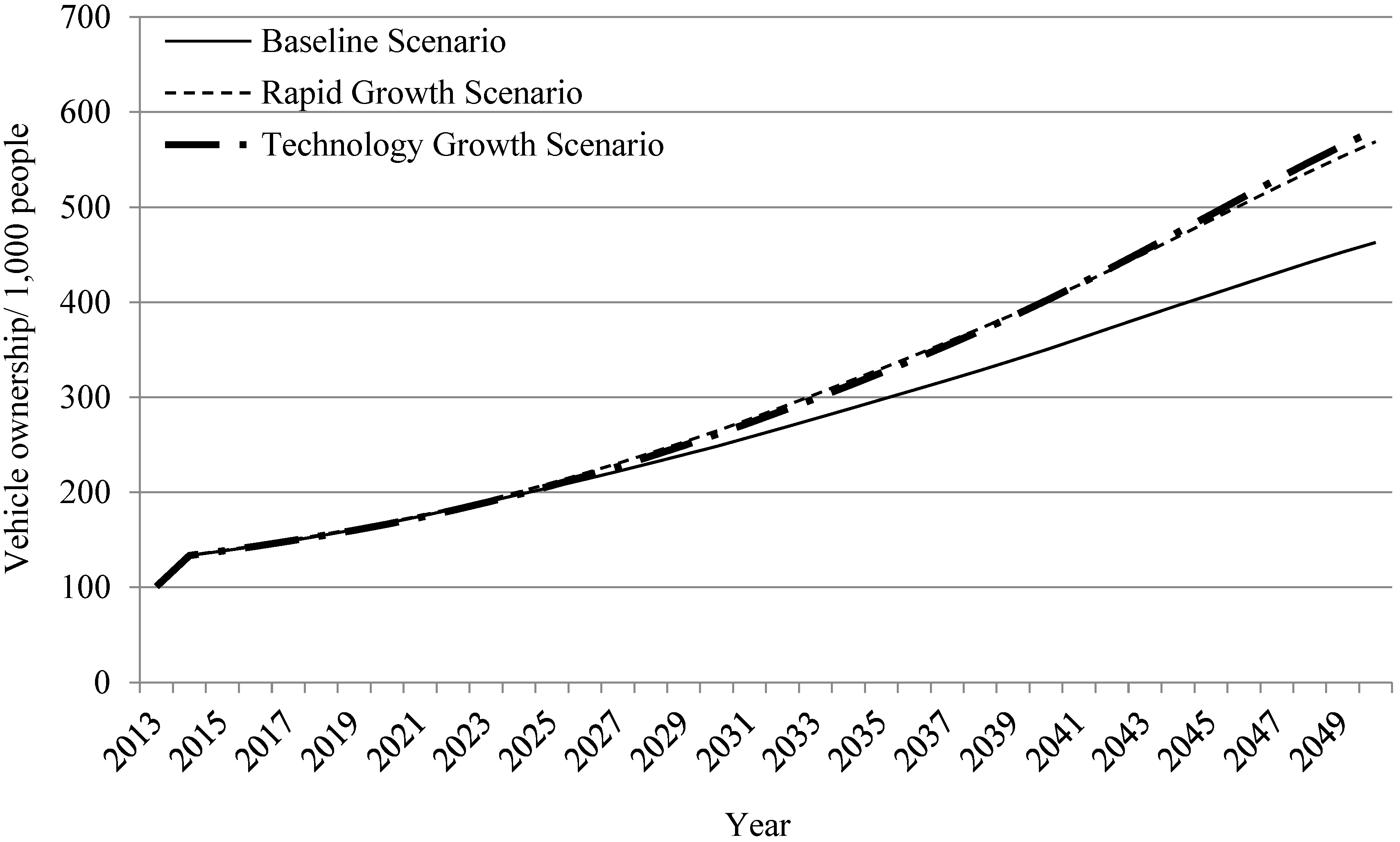

4. Concluding Remarks

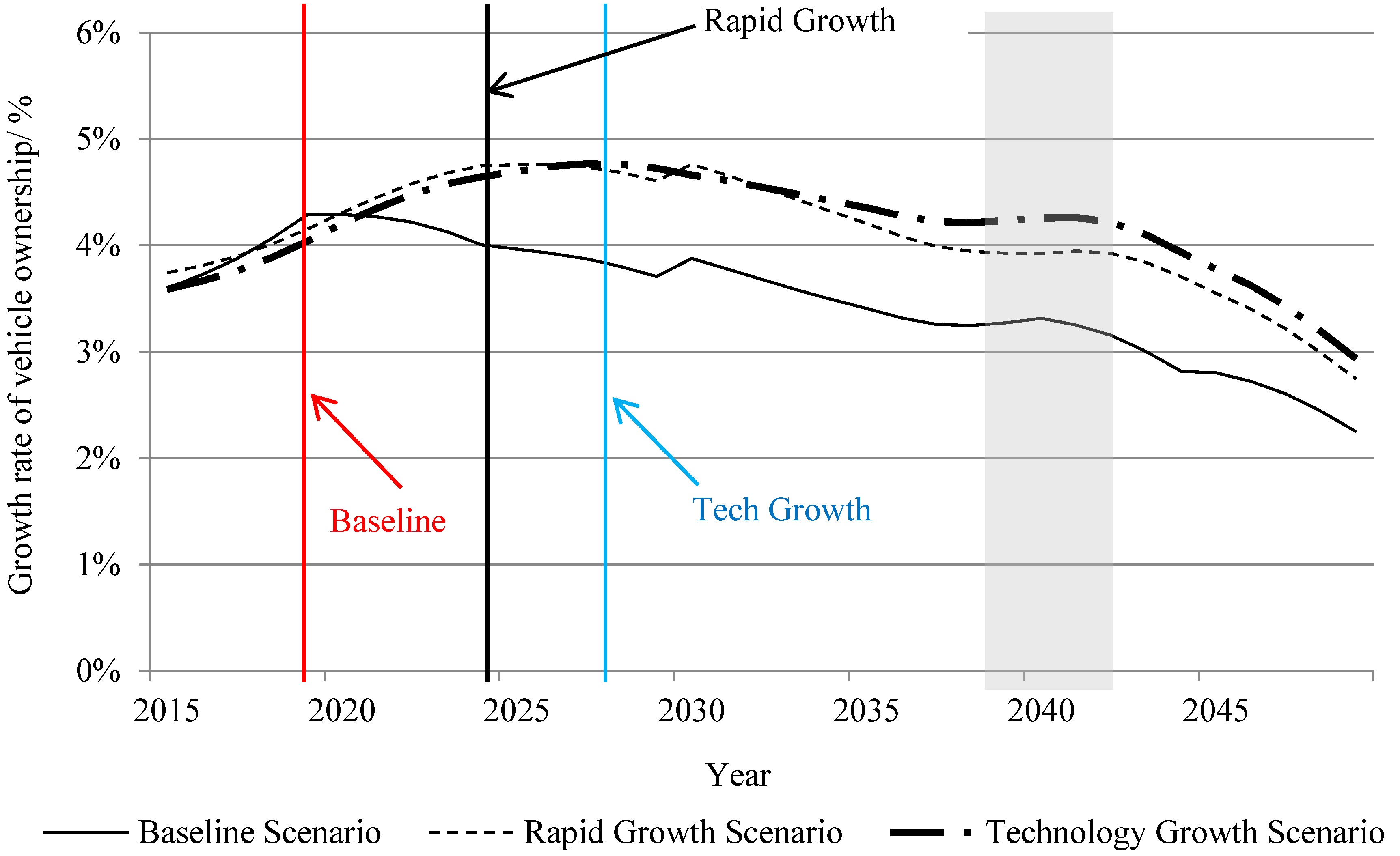

This study projects that, by 2050, vehicle ownership in China will reach 300, 455 and 463 vehicles per 1000 people under low-, medium-, and high-growth scenarios, respectively. Our results suggest that China’s vehicle stock will be of a similar size regardless of whether the Chinese economy grows at a high or medium rate. Growth in Chinese vehicle ownership will not reach the saturation point by the year 2050 under either the medium or high growth scenarios. However, vehicle demand will enter the booming period during the period from now to 2050 and is estimated to reach the inflection point of the Gompertz curve at around the year 2020.

According to our forecasts, Chinese economic growth declines steadily until the year 2030. After 2030, our model approximates the steady state due to the exogenous population growth and total factor productivity plays a significant role in determining the economic growth rate during the period 2030–2050. The trade-off between growth in total factor productivity and growth in the Chinese labor force decreases after 2030, giving rise to different economic growth paths under different scenarios.

Our results suggest that the total energy consumption of road vehicles will reach 380, 580 and 590 Mtoe in 2050 under low-, medium-, and high-growth scenarios, respectively. Moreover, our results estimate that more than 90% of the road transport industry’s total fuel consumption will be consumed by cars and trucks by the year 2015. Finally, our results suggest that energy demand in the road transport industry will be highest under the high vehicle saturation with high-growth scenario and lowest under the baseline low-growth scenario.

The sensitivity analyses results suggest that: vehicle saturation levels only influence the shape of the growth in Chinese vehicle stocks; population growth has a weak impact on vehicle demand and; the economic indicator, GDP per capita, is the dominant factor explaining growth in Chinese vehicle demand. Furthermore, with the exception of population growth estimates, vehicle ownership projections are sensitive to all of the key explanatory factors (economic growth and the vehicle saturation level). The projection of Chinese vehicle demand could be influenced by different variables such as for instance public policies, government intervention, and the variation between different regions. An important implication of this result is that, to further improve the accuracy of Chinese vehicle demand, in-depth scenario analysis on different influencing factors are necessary.

There are several important policy implications for energy demand, greenhouse gas emissions and traffic congestion in China. The likely growth in China’s vehicle stock suggests that China’s automotive industry will become a huge consumer of energy. Policymakers should therefore consider increasing vehicle energy efficiency standards, changing consumer energy consumption patterns and reducing the transportation sector’s high dependency on fossil fuels. Several energy consumption policies should be introduced across China to reduce the energy demand of on-road vehicles, such as the car License Auction Policy in Shanghai [

64] and Beijing’s Vehicle Lottery [

65]. These government interventions and regulations could help to restrict vehicle demand and therefore energy consumption by the transport industry. The boom in China’s automotive industry poses a great challenge to the environment, especially in relation to greenhouse gas emissions. It is therefore essential to promote the use of low-emission vehicles such as hybrid electric vehicles, electric vehicles and fuel cell vehicles. Policymakers should also increase exhaust emission standards and introduce regulations for all vehicle engines, including conventional internal combustion engines. Developed Chinese cities—including some provincial capitals, industrial and coastal cities—have the highest numbers of road vehicles [

26]. Chronic traffic jams could be reduced by promoting the use of public transport in these cities. Alternatively, the government may wish to consider reducing the imbalance in Chinese regional development and population density in developed cities.