Integrated Simulation Model for Energy Security Evaluation

Abstract

:1. Introduction

2. Integrated Simulation Approach

2.1. Simulation Model Development

2.1.1. Energy Security Problem Formulation

2.1.2. Energy Security Conceptualization and Measurement

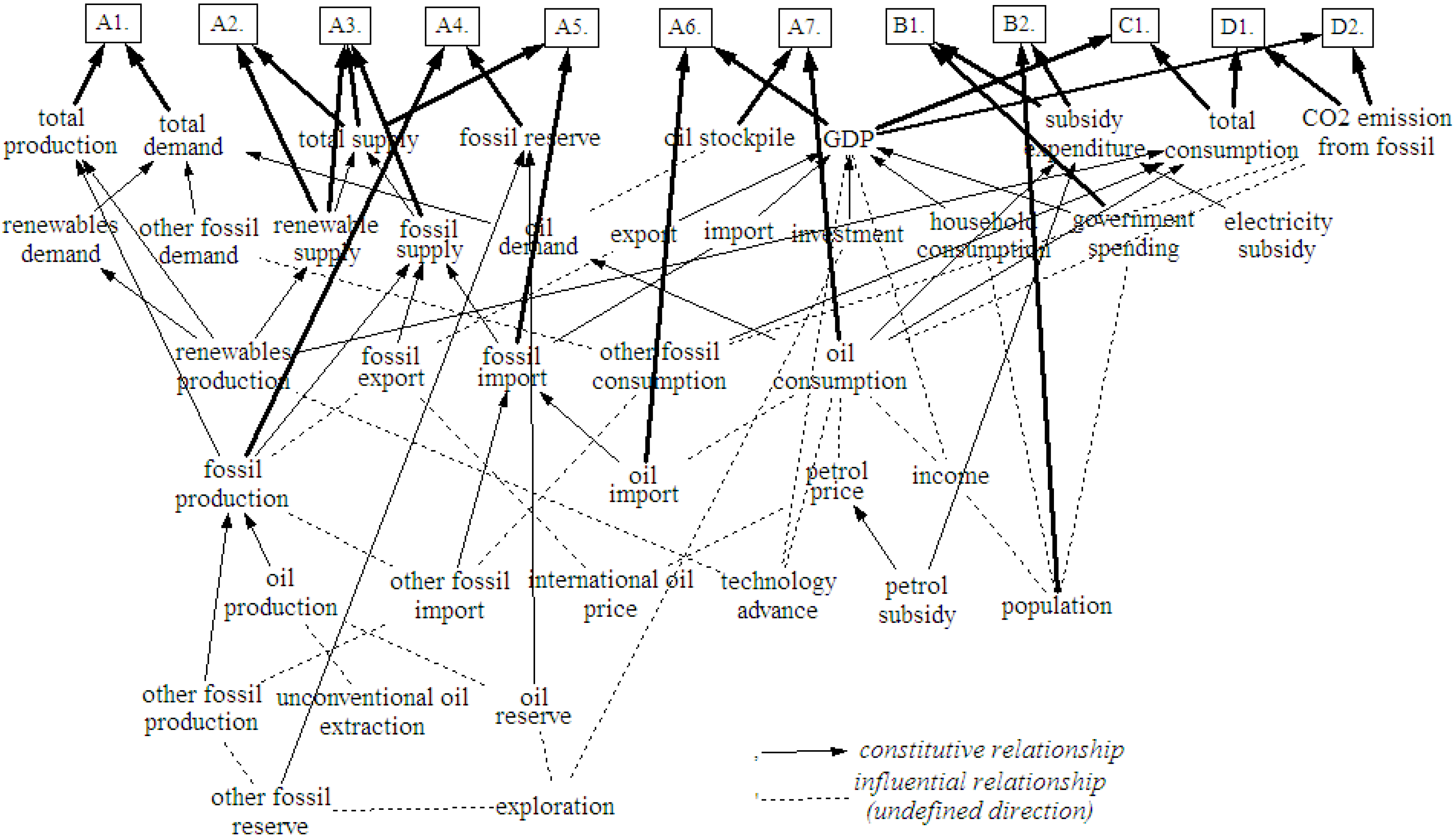

Conceptualization

Measurement

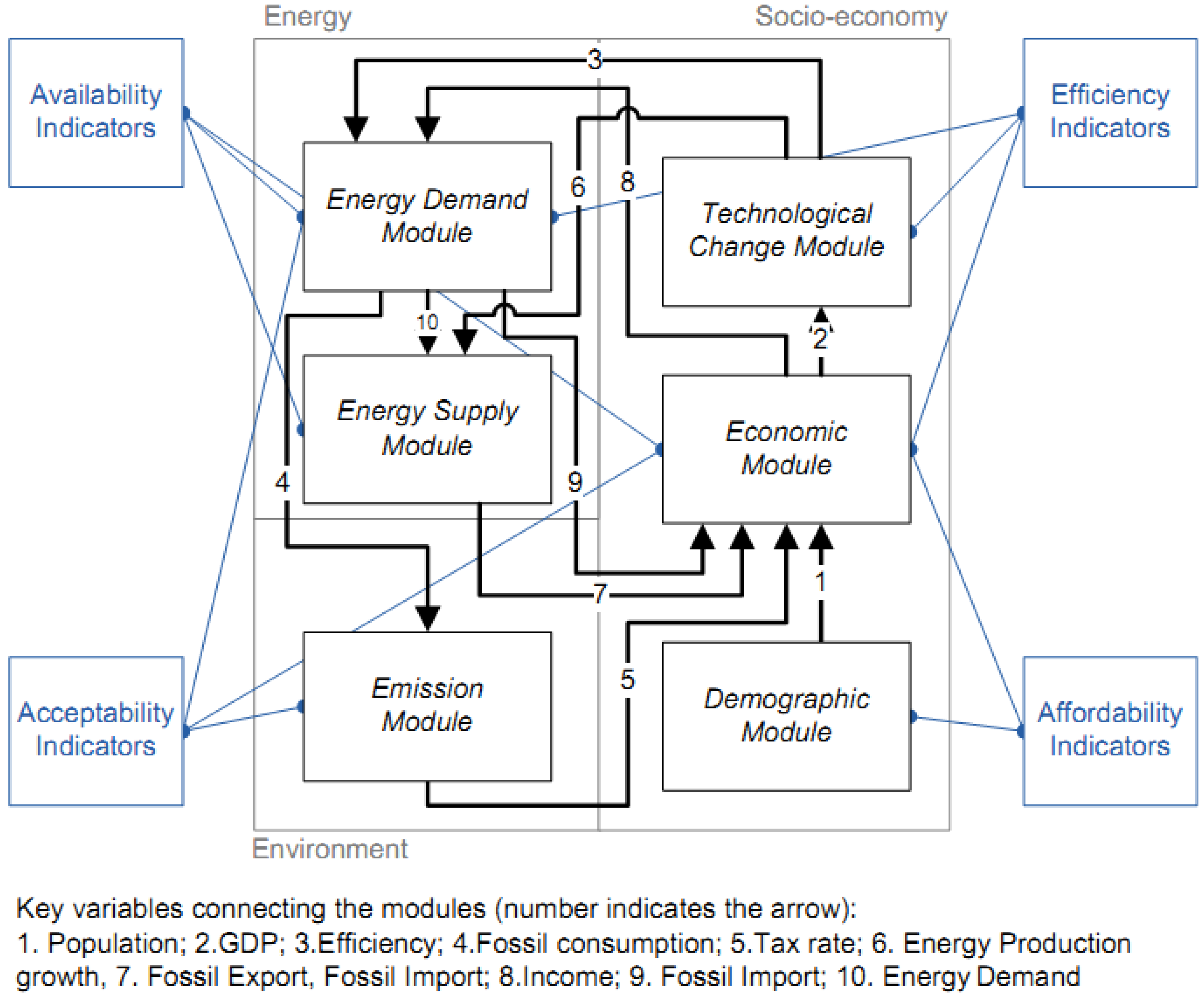

2.1.3. Model Definition

2.1.4. Model Construction

2.1.5. Verification Test

2.2. Experimentation

2.3. Result Analysis

3. Implementation

3.1. Developing a Simulation Model for Indonesia

3.1.1. Formulating Indonesia’s Energy Security Problem

3.1.2. Conceptualizing and Measuring Energy Security in Indonesia

Conceptualization

| Stakeholder | Policy Maker | R&D | Operator | Market Regulator | Consumer |

|---|---|---|---|---|---|

| President | x | ||||

| Ministry of Energy and Mineral Resources | x | ||||

| Ministry of Environment | x | ||||

| Ministry of Transport | x | ||||

| Ministry of Finance | x | ||||

| Ministry of Industry | x | ||||

| Ministry of Research and Technology | x | ||||

| Ministry of Trade | x | ||||

| BAPPENAS | x | ||||

| DEN | x | x | x | ||

| DPR 7th Commission | x | x | x | ||

| BPPT | x | ||||

| Universities and Research Institutes | x | x | |||

| WALHI | x | x | |||

| PT Pertamina | x | ||||

| PT PGN | x | ||||

| PT PLN | x | x | |||

| PT Bukit Asam | x | ||||

| BPMigas | x | ||||

| BPHMigas | x | ||||

| ORGANDA | x | ||||

| YLKI | x | ||||

| KADIN | x |

| Dimension | Indicator | Metric and Unit | Equation | |

|---|---|---|---|---|

| A. Availability | A1 | Self-sufficiency | Share of energy demand (Di) met by domestic production (Pi), % | |

| A2 | Diversification (Non-fossil) | Share of non-fossil energy supply (Si) in total primary energy supply (S), % | ||

| A3 | Diversification (Total) | Diversity of energy source in total primary energy supply (SWI *) | ||

| A4 | Remaining production | Average fossil energy reserve (Ri) to production (Pi) ratio | ||

| A5 | Import dependence | Share of fossil energy import (Mi) in total primary energy supply (S), % | ||

| A6 | Oil import cost | Share of oil import value (MVoil) in GDP, % | ||

| A7 | Stockpile | Ratio of emergency stockpiles for oil (Loil) to oil consumption (Coil) | ||

| B. Affordability | B1 | Cost of subsidy | Expenditure on subsidy (SUB) as part of government spending (G), % | |

| B2 | Subsidy | Ratio of energy subsidy per capita (SUBC) and Income (N) | ||

| C. Efficiency | C1 | Energy intensity | Energy consumption (Ci) per GDP, Mtoe/Bil-USD | |

| D. Acceptability | D1 | Emission intensity (energy) | Energy-related CO2 emissions (EMi) per energy consumption (Ci), kg-CO2/Mtoe | |

| D2 | Emission intensity (economy) | Energy-related CO2 emissions(EMi) per GDP, kg-CO2/Bil-GDP | ||

Composite Index Measurement

3.1.3. Defining Indonesia’s Model

3.1.4. Constructing the Model

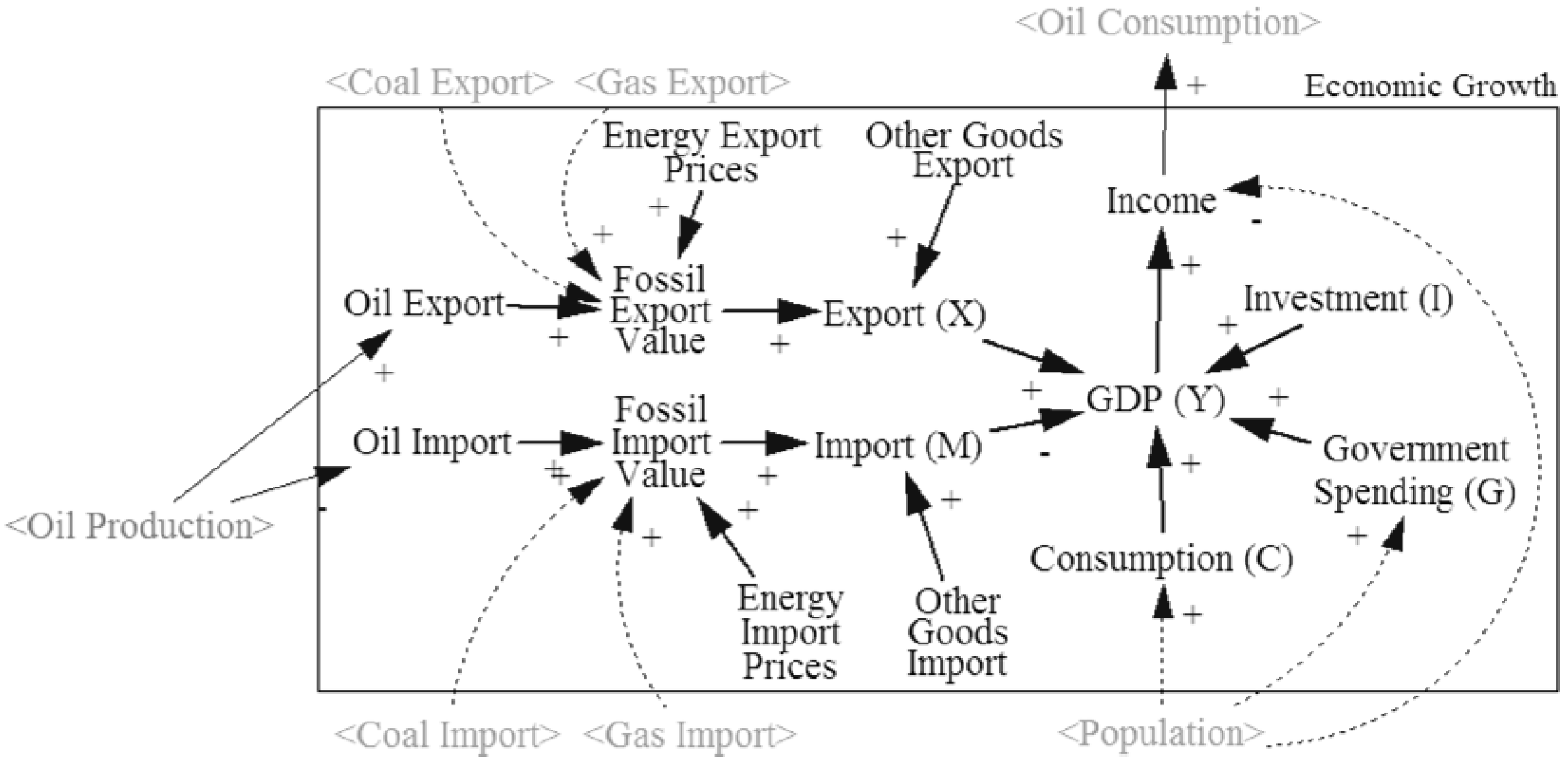

Major Loops between Oil Supply, Economic and Oil Demand Modules

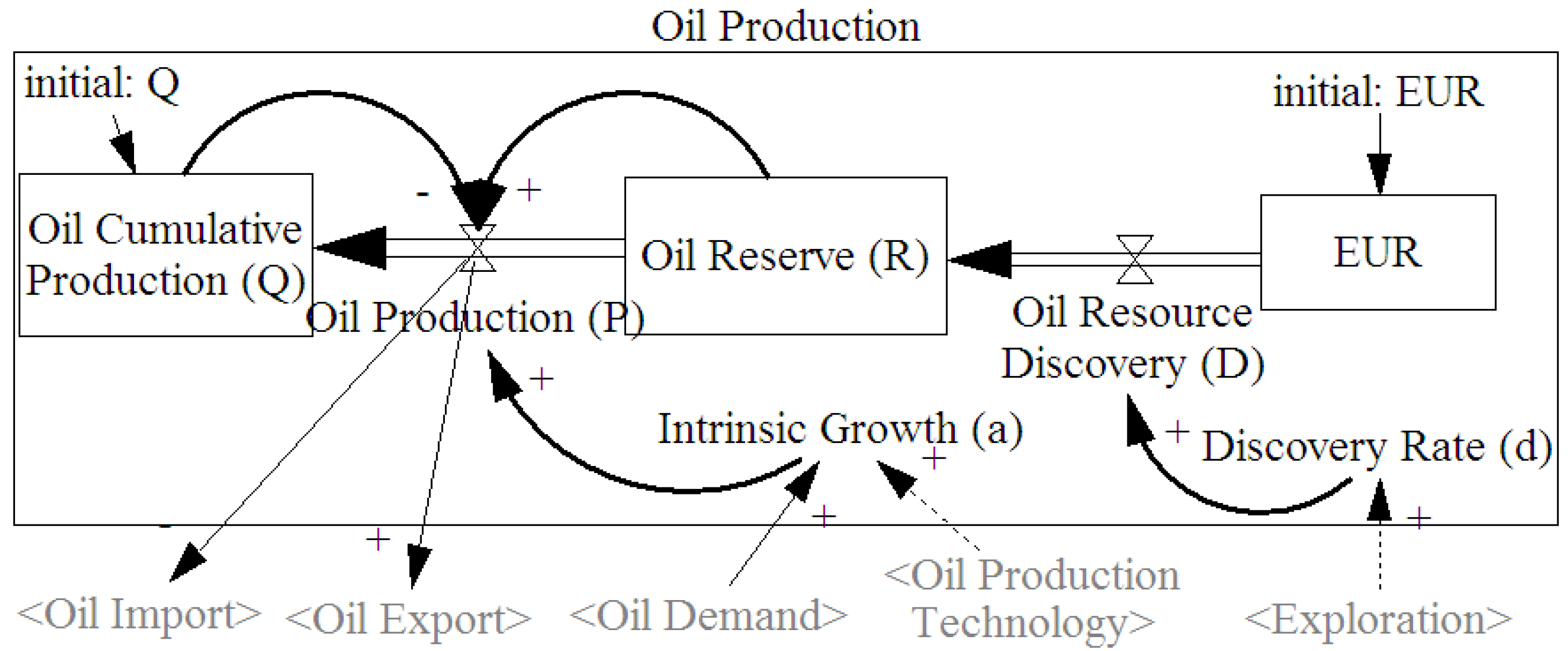

Construction of Oil Production, Economic Growth and Oil Consumption Sub-Modules

3.1.5. Verifying the Model

Structure Test

| Variable 1 | Variable 2 | R2 |

|---|---|---|

| Oil Production | Oil Import | 0.58 |

| Oil Production | Oil Export | 0.83 |

| Oil Consumption | Oil Import | 0.90 |

| Oil Demand | Oil Production | 0.78 |

| Income | Oil Consumption | 0.96 |

| Petrol Price | Oil Consumption | 0.88 |

Behavior Test

| Variable | RMSE (in respective units) | RMSPE (%) |

|---|---|---|

| Oil Production (Mtoe) | 2.1 | 2.9 |

| Oil Consumption (Mtoe) | 2.9 | 1.7 |

| Oil Export (Mtoe) | 4.7 | 1.2 |

| Oil Import (Mtoe) | 4.3 | 2.1 |

| Export (Billion USD) | 9.3 | 3.1 |

| Import (Billion USD) | 7.6 | 1.4 |

| GDP (Billion USD) | 30.7 | 1.8 |

| Population (Million Persons) | 2.4 | 0.9 |

3.2. Experimentation

| Variable | Scenarios | ||

|---|---|---|---|

| BAU | PROD | SUB | |

| Production growth rate | Oil: −3.2 Mtoe/year | −0.96 Mtoe/year by 2015 | as BAU |

| Gas: 1.2 Mtoe/year | 1.6 Mtoe/year by 2018 | as BAU | |

| Coal: 10.1 Mtoe/year | 30.3 MToe/year by 2025 | as BAU | |

| Subsidy | Petrol *: Constant at IDR 9,500/L | as BAU | IDR 0/L by 2020 |

| Electricity **: Constant at IDR 402/kWh | as BAU | IDR 0/kWh by 2020 | |

3.3. Result Analysis

3.3.1. Performance by Dimensions

Availability

Affordability

Efficiency

Acceptability

3.3.2. Overall Performance

4. Discussion

5. Conclusions

Acknowledgements

References

- Alhajji, A.F. What is energy security? 2007. Available online: http://archives.mees.com/issues/219/articles/8541 (accessed on 2 August 2012).

- Yergin, D. Energy security in the 1990s. Foreign Aff. 1988, 67, 110–132. [Google Scholar] [CrossRef]

- Yergin, D. Ensuring energy security. Foreign Aff. 2006, 85, 69–82. [Google Scholar] [CrossRef]

- Study on Energy Security and Geopolitics: Final Report; Institute for International Relations “Clingendael”: The Hague, The Netherlands, 2004.

- Feygin, M.; Satkin, R. The oil reserves-to-production ratio and its proper interpretation. Nat. Resour. Res. 2004, 13, 57–60. [Google Scholar] [CrossRef]

- Energy Security and Climate Change: Assessing Interactions; International Energy Agency: Paris, France, 2007.

- Von Hippel, D.; Savage, T.; Hayes, P. Introduction to the Asian energy security project: Project organization and methodologies. Energy Policy 2011, 39, 6712–6718. [Google Scholar]

- Vivoda, V. Evaluating energy security in the Asia-Pacific region: A novel methodological approach. Energy Policy 2010, 38, 5258–5263. [Google Scholar] [CrossRef]

- Sovacool, B.K. Evaluating energy security in the Asia pacific: Towards a more comprehensive approach. Energy Policy 2010, 39, 7472–7479. [Google Scholar] [CrossRef]

- Sovacool, B.K.; Mukherjee, I.; Drupady, I.M.; D’Agostino, A.L. Evaluating energy security performance from 1990 to 2010 for eighteen countries. Energy 2011, 36, 5846–5853. [Google Scholar] [CrossRef]

- Von Hippel, D.; Suzuki, T.; Williams, J.H.; Savage, T.; Hayes, P. Energy security and sustainability in Northeast Asia. Energy Policy 2011, 39, 6719–6730. [Google Scholar] [CrossRef]

- Winzer, C. Conceptualizing energy security. Energy Policy 2012, 46, 36–48. [Google Scholar] [CrossRef]

- Bassi, A.M. Evaluating the use of an integrated approach to support energy and climate policy formulation and evaluation. Energies 2010, 3, 1604–1621. [Google Scholar] [CrossRef]

- Sterman, J.D. A Skeptic’s guide to computer models. In Managing a Nation: The Microcomputer Software Catalog; Barney, G.O., Kreutzer, W.B., Garrett, M.J., Eds.; Westview Press: Boulder, CO, USA, 1998; pp. 209–229. [Google Scholar]

- Chester, L. Conceptualising energy security and making explicit its polysemic nature. Energy Policy 2010, 38, 887–895. [Google Scholar] [CrossRef]

- Sterman, J.D. Business Dynamics: Systems Thinking and Modeling for a Complex World; Irwin/McGraw-Hill: Boston, MA, USA, 2000. [Google Scholar]

- Kiani, B.; Pourfakhraei, M.A. A system dynamic model for production and consumption policy in Iran oil and gas sector. Energy Policy 2010, 38, 7764–7774. [Google Scholar] [CrossRef]

- Bassi, A.M.; Shilling, J.D. Informing the US energy policy debate with Threshold 21. Technol. Forecast. Soc. Change 2010, 77, 396–410. [Google Scholar] [CrossRef]

- Chi, K.C.; Nuttall, W.J.; Reiner, D.M. Dynamics of the UK natural gas industry: System dynamics modelling and long-term energy policy analysis. Technol. Forecast. Soc. Change 2009, 76, 339–357. [Google Scholar] [CrossRef]

- Prambudia, Y.; Nakano, M. Exploring Malaysia’s transformation to oil net importer and oil import dependence. Energies 2012, 5, 2952–2981. [Google Scholar] [CrossRef]

- Naill, R.F. A systems dynamic model for national energy policy planning. Syst. Dyn. Rev. 1992, 8, 1–19. [Google Scholar] [CrossRef]

- Pertumbuhan Ekonomi Indonesia; Biro Pusat Statistik: Jakarta, Indonesia, 2011.

- Proyeksi Penduduk 2000–2025; Badan Perencanaan Nasional and Biro Pusat Statistik: Jakarta, Indonesia, 2005.

- Outlook Energy Indonesia 2011; Badan Pengkajian and Penerapan Teknologi: Jakarta, Indonesia, 2011.

- Total Carbon Dioxide Emissions from the Consumption of Energy; Energy Information Administration: Washington, DC, USA.

- Handbook of Energy and Economic Statistics of Indonesia; Ministry of Energy and Mineral Resources: Jakarta, Indonesia, 2011.

- United Nations Development Programme. Human Development Report 2001: Making New Technologies Work for Human Development; Oxford University Press: Oxford, UK, 2001. [Google Scholar]

- Nasir, A.; Ali, T.M.; Shahdin, S.; Rahman, T.U. Technology achievement index 2009: Ranking and comparative study of nations. Scientometrics 2011, 87, 41–62. [Google Scholar] [CrossRef]

- APEC Energy Database. The Institute of Energy Economics Website. Available online: http://www.ieej.or.jp/egeda/ (accessed on 27 January 2011).

- Annual Report: Reserves, Resources and Availability of Energy Resources, 2005–2011; Bundesanstalt für Geowissenschaften und Rohstoffe: Hannover, Germany, 2011.

- International Energy Statistics, 2011. Energy Information Administration Website. Available online: http://www.eia.gov/cfapps/ipdbproject/IEDIndex3.cfm (accessed on 5 January 2011).

- Industrial Development Report 2005: Capability Building for Catching-up; United Nations Industrial Development Organization: Vienna, Austria, 2005.

- Hubbert, M.K. Nuclear energy and the fossil fuels. In Drilling and Production Practice; The American Petroleum Institute: New York, NY, USA, 1956; pp. 7–25. [Google Scholar]

- Hubbert, M.K. Techniques of Prediction as Applied to Production of Oil and Gas; U.S. Department of Commerce: Washington, DC, USA, 1982; pp. 1–121. [Google Scholar]

- National Accounts Statistics: Main Aggregates and Detailed Tables, 2011. United Nations Statistics Division Website. Available online: http://unstats.un.org (accessed on 14 December 2011).

- Pemerintah Siapkan Dua Aturan Peningkatan Produksi Migas. Kementerian Energi Dan Sumber Daya Mineral Website. Available online: http://www.esdm.go.id/berita/migas/40-migas/5196-pemerintah-siapkan-dua-aturan-peningkatan-produksi-migas.html (accessed on 25 March 2012).

- Terry, R.E. Enhance oil recovery. In Encyclopedia of Physical Science and Technology, 3rd ed.; Meyers, R.A., Ed.; Academic Press: San Diego, CA, USA, 2001; Volume 18, pp. 503–518. [Google Scholar]

- Blueprint Pengelolaan Energi Nasional 2010–2025; Ministry of Energy and Mineral Resources: Jakarta, Indonesia, 2009.

- Adi, A.C. Indonesia gas balance and energy policy. In Proceedings of 5th International Indonesia Gas Conference and Exhibition, Jakarta, Indonesia, 27 January 2011.

- Subsidi BBM buat Apa? Menjelaskan Kenaikan Harga Premium dan Solar; Ministry of Energy and Mineral Resources: Jakarta, Indonesia, 2012.

- Rahayu, S.L. Studi Efektifitas Pemberian Subsisi Listrik. Kaji. Ekon. Keuang. 2008, 12, 41–82. [Google Scholar]

- Resosudarmo, B.P.; Alisjahbana, A.; Nurdianto, D.A. Energy Security in Indonesia; Working Papers no. 2010/08; The Arndt-Corden Department of Economics Crawford School of Economics and Government ANU College of Asia and the Pacific: Canberra, Australia, 2010. [Google Scholar]

- Cebu Declaration on East Asian Energy Security; Association of Southeast Asian Nations: Jakarta, Indonesia, 2007.

- Sriyana, S. Current status of Indonesia’s nuclear power programme. Presented at IAEA Technical Meeting/Workshop on Topical Issues on Infrastructure: Managing the Development of National Infrastructure for NPP. Center for Nuclear Energy Development. IAEA Headquarters: Vienna, Austria, 2012. [Google Scholar]

- Ministry of Finance Green Paper: Economic and Fiscal Policy Strategies for Climate Change Mitigation in Indonesia; Ministry of Finance and Australia-Indonesia Partnership: Jakarta, Indonesia, 2009.

© 2012 by the authors; licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution license (http://creativecommons.org/licenses/by/3.0/).

Share and Cite

Prambudia, Y.; Nakano, M. Integrated Simulation Model for Energy Security Evaluation. Energies 2012, 5, 5086-5110. https://doi.org/10.3390/en5125086

Prambudia Y, Nakano M. Integrated Simulation Model for Energy Security Evaluation. Energies. 2012; 5(12):5086-5110. https://doi.org/10.3390/en5125086

Chicago/Turabian StylePrambudia, Yudha, and Masaru Nakano. 2012. "Integrated Simulation Model for Energy Security Evaluation" Energies 5, no. 12: 5086-5110. https://doi.org/10.3390/en5125086