1. Introduction

Principia College, a small liberal arts college located in Elsah, Illinois, is considering installing a Vestas V82 (1.65 MW) or another turbine of similar size. This paper calculates the costs and benefits of the proposed turbine and determines the discounted net present value (NPV). To calculate the costs and benefits a nine-step cost-benefit analysis (CBA) process is used.

The amount of wind energy that a wind turbine would generate is calculated using measured onsite wind velocity in conjunction with power curves provided by turbine manufacturers. Sensitivity analyses are run to examine how robust the results are. Specifically, the discount rate, the initial costs, the value of renewable energy credits (RECs), and the quantity and value of electricity generated are tested to determine their impact on the project’s NPV. Finally, the results are compared with a business as usual (BAU) scenario.

The results presented do not consider social, environmental, and educational costs and benefits. While these topics are important, they are externalities (i.e., they are not included in the market price of electricity). More information about these costs and benefits can be obtained from the authors.

2. Wind Power and Energy Policy

2.1. Growth and Costs

Wind power is currently the most commercially viable renewable energy source in the United States (with the exception of traditional hydroelectric power, which has largely stagnated due to market saturation,

i.e., a lack of available additional sites). In the US, the annual growth rate of wind power has been about 25% per year over the past ten years, and as of January 2010, capacity from commercial turbines was 35,062 MW [

1]. In 2008 wind power accounted for more than 40% of total new capacity in the US, up about five percent from 2007. Between 2008 and 2009 wind power capacity increased 39 percent. [

2,

3]. Worldwide wind power capacity is now 157,000 MW [

3]. The recent penetration of wind power in Europe has been directly linked to a decrease in capital costs, and the US has seen similar results [

4,

5].

The main costs of wind energy include wind development costs, transmission grid growth and reinforcement, cycling costs of conventional power generation (

i.e., the need to turn conventional power plants off and on as demand changes), and additional reserve costs (

i.e., the need to ensure enough power generation capacity during times of low wind speed). The major benefits include increased capacity (

i.e., new capacity added to the grid), reduced emissions (of both greenhouse gasses and conventional air pollution), and fuel savings [

6]. Further importance of wind power stems from it being a partial solution to the problem of energy security.

2.2. Wind Power at US Colleges and Universities

Eleven US universities have an installed wind power capacity of more than 100 kW, and five of these have installed capacities of greater than 1 MW. Carleton College, St. Olaf College, University of Minnesota-Morris, and Iowa Lakes Community College have all installed 1.65 MW turbines manufactured by Vestas or its predecessor NEG Micon [

7]. Whitman College has nearly 38 MW installed on its property in Washington State, comprised of 65,660 kW Vestas turbines. The turbines are owned by Florida Power and Light Company, which leases the land from Whitman for an estimated $100,000 per year, as part of a 175 MW project [

8]. Both the University of Oklahoma and the University System of Maryland are planning projects of over 100 MW [

7].

While no universities in Illinois have installed wind turbines, Bureau Valley High School, located in Manlius, IL, installed a 660 kW Vestas turbine in late 2004. About half of the $1 million project was funded by the Illinois Clean Energy Community Foundation, and the remainder was funded through tax-free bonds. The turbine is used primarily to offset a portion of the school’s electricity generation requirements. Additional power generation is sold to the local utility at the avoided cost rate, about $0.03/kWh [

9]. The project was initially conceived and promoted by a local hog farmer, and is expected to save the school approximately $100,000 per year for 20 years.

About 30 colleges now offer majors or programs that focus on wind power technical training for maintenance as well as wind power development [

10]. For instance, Iowa Lakes Community College has developed a program in Wind Energy and Turbine Technology as part of an Associate degree in Applied Science, which grew from 15 students in 2004 to over 100 students last year [

11].

2.3. Renewable Energy Fees at Colleges and Universities

More than two dozen college campuses in the US have mandatory renewable energy student fees. Typically costing about $1–$10 per student per year, these fees are not necessarily utilized to purchase solely wind power, but include the purchase of other types of renewable energy and/or RECs, along with projects improving efficiency of energy use on campus as well as energy conservation projects. For example, the University of Illinois—Urbana Champaign (UIUC) instituted a $2 per semester student fee in 2003, which garners approximately $140,000 per year into a green energy fund. The money is overseen by a committee made up of eight students, and four faculty and staff members [

12].

In 2007 Northeastern Illinois University instituted a student referendum for a $3 per semester green fee, which is controlled by a student-led committee modeled on UIUC’s committee. The money has been used primarily for projects to reduce energy consumption, such as the purchase and installation of motion sensors in bathrooms. Passive solar energy projects, including a solar water heater and window awnings, are being considered for the future, as well as the purchase of a 2.8 kW solar panel [

13].

3. Background

Principia College is a small, private, liberal arts college located on the bluffs of Elsah, Illinois, just north of St. Louis, Missouri. It is situated in rural Jersey County. The school has a population of 550 students, and owns approximately 2500 acres of land. Nearly all money used for operating expenses and research comes from a combination of an endowment and private donations rather than public funds.

Although Principia College has a small student body of only 550, it uses nearly $500,000 worth of electricity each year. The electric rate for the past three years has been $0.06867/kWh [

14]. The electricity is not purchased from the local investor owned utility (IOU), but on the open market for a bundled rate.

During the spring of 2007 the head of Principia College’s Facilities Department invited the Principia College community to be involved in a web-cast conference about wind power. The conference was hosted by Carleton College, St. Olaf Collage, and the University of Minnesota-Morris, all of whom had recently installed Vestas V82 1.65 MW turbines. In June 2007, meteorological equipment provided by NRG Systems was installed on a pre-existing 60 meter communications tower (owned by Principia College).

Due to the encouraging data, a 60 meter tilt-up NRG Symphonie Tower was raised 1.5 miles away, at the location a turbine would actually be placed. The location, North Farm, is just across from the main entrance of the campus. It was chosen because it is at the top of a hill with several hundred meters of clearance around it in all directions, and because it is near both the local IOU substation and the campus power distribution center.

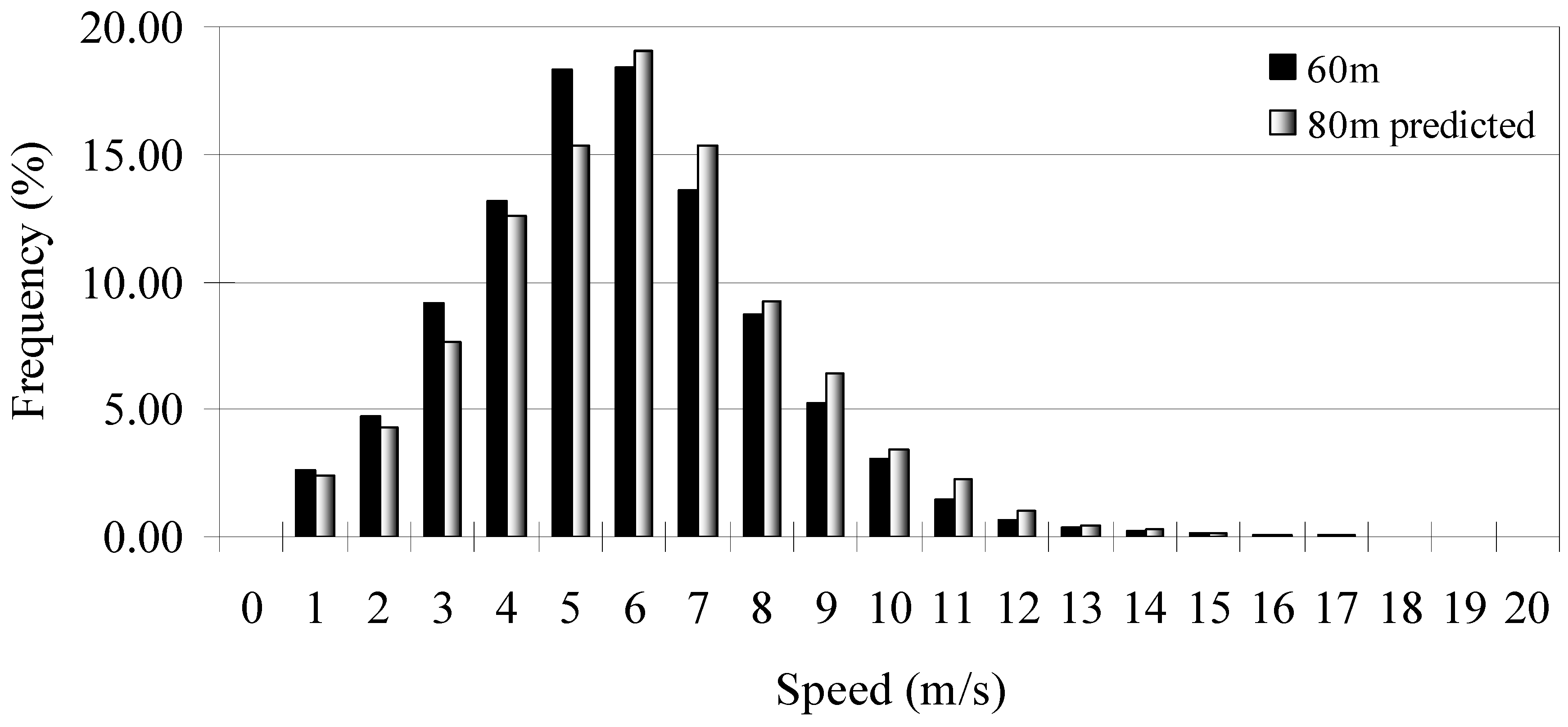

Figure 1.

A histogram of wind speeds at North Farm, Principia College for April 2008–March 2009.

Figure 1.

A histogram of wind speeds at North Farm, Principia College for April 2008–March 2009.

Figure 1 shows a histogram for the mean-average wind speed over 10-minute intervals. The wind speed average at 60 meters is 5.3 m/s and is predicted to be 5.5 m/s at 80 meters using the 1/7th square law.

Once the velocity is known, the theoretical power can be calculated; power is proportional to the cube of the wind speed:

where P is the power produced, ρ is the air density, A is the cross sectional area of the blade sweep, v is the speed of the wind, Ng and Nb are the efficiencies of the generator and the gearbox, and Cp is the coefficient of performance (

i.e., the amount of energy transferred from the wind to the turbine blades) [

15,

16]. Note that the occasional high winds with periods of low wind speeds is significantly more advantageous than a steady wind at a constant medium speed due to the cube of the velocity being a factor.

Practically speaking, to determine the power output of a potential turbine the data from a wind speed histogram can be fitted to the energy output of a specific turbine’s power curve. A

very general rule of thumb is that the average power output of a wind turbine must be at least 25 to 30% of the rated output for the turbine to be profitable. For a Vestas V82 1.65 MW turbine, Principia College’s average power output is predicted to be 25 percent, or approximately 3.6 million kWh per year. The power curve for the V82 is given by

Figure 2, and the frequency of power generation expected is given in

Figure 3.

Figure 2.

The power curve for the Vestas V82 1.65 MW turbine is shown [

17]. An air density of 1.225 kg/m

3 is assumed.

Figure 2.

The power curve for the Vestas V82 1.65 MW turbine is shown [

17]. An air density of 1.225 kg/m

3 is assumed.

Figure 3.

The expected frequency of power generation. Notice that the turbine is expected to not be producing power about 14% of the time, 1650 kW about one percent of the time, and 300 kW about 19% of the time.

Figure 3.

The expected frequency of power generation. Notice that the turbine is expected to not be producing power about 14% of the time, 1650 kW about one percent of the time, and 300 kW about 19% of the time.

4. Research Method

4.1. Introduction to Cost-Benefit Analysis

CBA is a common methodology used as a decision making tool. Various costs and benefits of a project (or policy) are determined with the goal usually being to determine a discounted NPV, or the total worth of the project. If the benefits are greater than the costs the CBA has a positive NPV. The NPV is expressed as a specific dollar amount. The CBA procedure used here is the one described by Pearce

et al. (2006), in work supported by the Organization for Economic Co-operation and Development (OECD) [

19].

CBA was used in this project for three reasons. First, CBA provides a rational framework for determining the value of the project. With matters concerning the environment and ecological systems, some people have strong feelings—CBA allows for quantified results. Second, CBA emphasizes that the project is just one of several options that should be considered. While this paper only calculates an NPV for one turbine at one particular location, it lists numerous other ways in which the same goals could possibly be fulfilled. Finally, by converting the measurable impacts of the project into the same unit (money), the scope of the costs and benefits are displayed [

19].

4.2. Economic Models

In order to examine the economic effects that the turbine would have, two economic models are used: IMPLAN, and JEDI. IMPLAN (IMpact analysis for PLANing) is a commonly used input-output model for estimating economic changes at either the regional, state, or county level (e.g., see [

20]). This model is used in conjunction with JEDI (Job and Economic Development Impact model), by importing the multipliers from IMPLAN into JEDI. JEDI was developed by the US National Renewable Energy Laboratory, specifically for estimating economic changes from wind power development. By using multipliers from IMPLAN, the resolution of JEDI estimates can be narrowed from statewide to the local county.

4.3. Laws and Policies

Numerous local, state, and federal laws and policies can affect wind turbine projects. Illinois has two laws which, while they do not directly pertain to Principia College, could affect other universities considering wind power.

Legislation passed in Illinois in 2007, the Illinois Power Agency Act, created the state’s first mandatory Renewable Portfolio Standard (RPS). While the Illinois Power Agency Act (and 2009 amendments) requires the two largest IOUs in the state to generate an increasing amount of wind energy each year until 2025, or purchase RECs in-state or in nearby states, the Act also gives the Illinois Power Agency (IPA) broad powers to develop renewable energy procurement plans in conjunction with the IOUs. These plans are affected by set consumer cost caps that are outlined in the Act. This means that if the IOUs do not want to purchase the energy from a wind developer, they are not required to if the IPA believes that it would not be cost-effective [

18]. Therefore, all electricity generated by a wind turbine at Principia College would have to be consumed by Principia College.

While Illinois has a net metering law, whish allows producers of up to 2 MW to sell electricity back to the grid, it does not apply in this case. Principia College purchases its electricity from “alternative suppliers” (

i.e., on the open market), rather than from the local IOU. The Illinois Commerce Commission, which regulates net metering, does not set pricing standards for alternative suppliers, and thus could offer extremely unfavorable terms [

21].

4.4. Required Permits

The State of Illinois does not have laws requiring permits specifically for wind turbine siting. While interconnection standards are set by the Illinois Commerce Commission, they are not relevant here because there would not be an interconnection between the turbine and the electric grid. Local governments, such as counties and municipalities, are allowed to permit wind turbines according to the Illinois County Code and Illinois Municipal Code.

If state grants are obtained, the Illinois Department of Natural Resources would need to be consulted to ensure that the project satisfies the requirements of the Illinois Endangered Species Protection Act. If the construction site were to be larger than one acre, a National Pollutant Discharge Elimination System (NPDES) permit from the Illinois Environmental Protection Agency would be needed [

22].

The Illinois Department of Transportation is responsible for issuing permits to oversize and overweight trucks, which would be used to transport turbine and crane components.

4.5. Available Incentives

There are two incentives that Principia College is eligible for: the federal Renewable Electricity Production Tax Credit, and RECs. In addition, Illinois has various grants for renewable energy projects.

The federal Renewable Energy Production Tax Credit (PTC) is a corporate tax credit that a variety of renewable energy systems are eligible for. It is typically available for ten years. A major part of 1992 Energy Policy Act, the PTC gives $0.021 /kWh ($0.015 in 1993 dollars, and indexed for inflation) of energy produced. The credit is good for ten years from the in-service date of the turbine. While initially the PTC only ran through 2001, it has been extended numerous times since. The US American Recovery and Reinvestment Tax Act of 2009 extended the in-service deadline for wind turbines to 2012 [

23]. Principia College could use the PTC because it pays taxes on its endowment [

24].

An REC is “a tradable credit that represents the environmental attributes of a certain amount of energy produced from a renewable energy resource” [

25]. Several different organizations provide and certify these RECs, each with a unique serial number. The RECs can then either be retired by the producing company or sold. Thus, IOUs can purchase RECs to meet their renewable energy requirements. For instance, Illinois’ RPS allows for IOUs to purchase RECs from the Midwest Renewable Energy Tracking System and the Generation Attributes Tracking System, which is owned and operated by PGM Interconnection. The IPA expects RECs to be worth approximately $25 (

i.e., $0.025/kWh) for the foreseeable future [

18,

25].

There are three large grant programs in Illinois which Principia College could apply to. The Illinois Clean Energy Foundation is a private grant program which gives money to nonprofit organizations, schools, and local governments to use towards energy efficient technologies, renewable energy generation, as well as land and wildlife habitat preservation. The renewable Energy Resources Trust Fund is a state-run public benefits fund, which supports energy efficiency and renewable energy projects. It is funded by small monthly charges to both residential and nonresidential electric and gas customers in Illinois. Finally, the Illinois Department of Commerce and Economic Opportunity Bureau of Energy and Recycling Programs offers several rebate programs, such as the Renewable Energy Resource Program which gives money to renewable energy projects [

23,

26].

The Database of State Incentives for Renewables & Efficiency, funded by the US Department of Energy, maintains a comprehensive list of state and federal laws, programs, and incentives, which is very useful for finding funding sources [

26].

4.6. Externalities

Table 1 lists some externalities that should be considered along with the NPV of the project. It may be practical to quantify some of these, such as the ecological costs that the turbine would have on birds and bats, although not in financial terms. Several, such as carbon dioxide (CO

2) emissions and conventional air pollution, could potentially be quantified using plug-in values. Others, such as the increase in energy security that Principia College would gain, and how the community perception of Principia College would change, would require the use of survey methods such as the contingent valuation method or conjoint analysis. Note that the visibility of the turbine would have both a positive and negative effect, as some people at Principia College would enjoy the sight of the turbine and others would not.

Table 1.

Externalities produced by a wind turbine.

Table 1.

Externalities produced by a wind turbine.

| Externality | Effect on Principia College |

|---|

| | Positive | Negative |

| Offset of carbon dioxide emissions | ● | |

| Offset of conventional air pollutants | ● | |

| Energy security | ● | |

| Bird deaths | | ● |

| Bat deaths | | ● |

| Visibility of turbine | ● | ● |

| Noise | | ● |

| Educational opportunities | ● | |

5. Analysis

5.1. Alternative Projects and Policies

To specify alternative projects or policies that would allow Principia College to reap the same benefits, the goal or reason for the purchase of a wind turbine must be specified. This is surprisingly complex, because the community of Principia College has expressed strong but varied interest in investing in the wind turbine and renewable energy in general. Different supporters of renewable energy in the community have different reasons for supporting renewable energy, and thus somewhat different goals.

Over the past year the first author has had discussions about this CBA with the school administration, faculty, and current and former students. Specific ideas have come from the department of facilities, the Biology and Natural Resources department, Physics department, the Dean’s office, Project Centered Learning, and students. At least two informal categories of reasons for interest have emerged.

Almost everyone with an interest in this CBA has brought up the subject of educational opportunities. This has included strong interest in the construction of multiple renewable energy projects for long-term research purposes, as well as specific educational opportunities for current students and “softer” educational opportunities for the community as a whole.

Another area of interest has been in renewable energy. Interests in other renewable energy sources have been discussed, including both passive and active solar power, small-scale wind turbines, direct geothermal exchange, and biomass utilization. Similarly, the concepts of environmental protection and sustainability are also important to the community. For instance, the upcoming academic school year will see the opening of the Principia College Center for Sustainability.

Surprisingly, the financial implications of renewable energy production at Principia have been discussed only minimally. In addition, the social implications (i.e., what a wind turbine would say about the Principia College community) have also been only minimally discussed. Concerns about the ecological impacts of the turbine, specifically how bats and birds would be affected, have been expressed by several members of the Principia College community.

Some specific alternatives that Principia College should consider to meet the educational opportunities that a wind turbine would provide include:

other renewable energy options, including direct geothermal exchange, solar, and small-scale wind;

a class about renewable energy;

providing community members an opportunity to visit a nearby wind turbine e.g. Pike Country Illinois;

the implementation of a degree in sustainability.

As for investment in renewable energy, alternatives to installing a wind turbine include:

the purchase of an electric utility mix that has a high percentage of renewable energy;

other renewable energy options, including direct geothermal exchange, solar, and small-scale wind;

the purchase of RECs.

These alternatives won’t be quantified in financial terms here, but these options should generally be considered vs. the purchase a large-scale wind turbine. Survey methods could be utilized to assist in aggregating the various community goals and comparing them with both the wind turbine and the listed alternatives.

5.2. Physical Impacts

Long-term physical impacts from the turbine would include a possible impact on birds and bats, the visual impact of the turbine, and land-use change around the turbine. Short-term physical impacts include a 700 meter power trench from the turbine to the campus power distribution center, and a staging and construction area.

5.3. Financial Analysis

This CBA assumes that the costs and the benefits of the project belong solely to Principia College. The expected lifetime of the project is 20–30 years because this is the normal expected lifespan of a typical wind turbine. Therefore, the NPV has been calculated for both a 20-year period and a 30-year period.

A list of the base case economic costs and benefits considered is given in

Table 2. Years refer to which years of the project (0–30) the cost or benefit is accrued. Assuming a real discount rate of 2.9% over a 20-year period and a real discount rate of 2.7% discount over a 30-year period [

27], the NPVs are $1,017,000 and $2,378,000 respectively. This means that Principia College would save nearly a million dollars over a 20-year period, and nearly two million dollars over 30-year period compared to doing nothing else.

Table 2.

The expected project costs and benefits.

Table 2.

The expected project costs and benefits.

| Project Benefits | Quantity of electricity generated (kWh/year) | Value of generated electricity ($/kWh) | Benefit of generated electricity ($/year) | Year(s) |

|---|

| Electricity generationa | 3,600,000 | 0.06 | 216,000 | 1–30 |

| Renewable Energy Creditb | 3,600,000 | 0.025 | 90,000 | 1–30 |

| Production Tax Credit | 3,600,000 | 0.021 | 75,600 | 1–10 |

| Project Costs | | | Cost ($/year) | Year(s) |

| Turbinec | | | 2,400,000 | 0 |

| Transportationd | | | 200,000 | 0 |

| Constructione | | | 800,000 | 0 |

| Bird & bat collision studyf | | | 5,000 | 1–5 |

| Annual maintenanceg | | | 50,000 | 1–30 |

| Insuranceh | | | 3,000 | 1–30 |

| Annual operating costs | | | 0 | 1–30 |

Because the majority of the costs would be incurred before the first year, and the benefits are spaced out evenly over time, the expected lifespan of the wind turbine is an important factor in determining the NPV. This explains the large differences between the 20-year NPV and the 30-year NPV. If the service of the wind turbine could be extended beyond 30 years, then the NPV would increase. In the long run, the initial construction cost matters very little; the expected value of the electricity is the most important factor in this case.

Table 3 and

Table 4 show the results of three BAU scenarios. These scenarios assume that Principia College invests the initial $3.4 million at a constant interest rate, and that Principia College also makes an annual payment of $216,000, which is the value of the cost of the electricity the turbine is estimated to offset. For simplicity sake, interest is compounded monthly, and the $216,000 is paid in equal monthly installments of $18,000 each immediately after the interest is earned. The results show that a real interest rate of 6% has a similar NPV as the base case.

Table 3.

The annual results of the base case.

Table 3.

The annual results of the base case.

| Year | Benefit ($) | Cost ($) | Benefit – Cost ($) | 20 Year NPV | 30 Year NPV |

|---|

| 0 | 0 | 2,840,00 | –2,840,000 | –3,400,000 | –3,400,000 |

| 1 | 381,600 | 58,500 | 323,100 | 313,994 | 314,606 |

| 2 | 381,600 | 58,500 | 323,100 | 305,145 | 306,335 |

| 3 | 381,600 | 58,500 | 323,100 | 296,545 | 298,281 |

| 4 | 381,600 | 58,500 | 323,100 | 288,188 | 290,439 |

| 5 | 381,600 | 58,500 | 323,100 | 280,066 | 282,803 |

| 6 | 381,600 | 53,500 | 328,100 | 276,385 | 279,630 |

| 7 | 381,600 | 53,500 | 328,100 | 268,595 | 272,278 |

| 8 | 381,600 | 53,500 | 328,100 | 261,026 | 265,120 |

| 9 | 381,600 | 53,500 | 328,100 | 253,669 | 258,150 |

| 10 | 381,600 | 53,500 | 328,100 | 246,520 | 251,363 |

| 11 | 306,000 | 53,500 | 252,500 | 184,371 | 188,359 |

| 12 | 306,000 | 53,500 | 252,500 | 179,175 | 183,407 |

| 13 | 306,000 | 53,500 | 252,500 | 174,125 | 178,585 |

| 14 | 306,000 | 53,500 | 252,500 | 169,218 | 173,890 |

| 15 | 306,000 | 53,500 | 252,500 | 164,449 | 169,319 |

| 20 | 306,000 | 53,500 | 252,500 | 142,546 | 148,201 |

| 25 | 306,000 | 53,500 | 252,500 | - | 129,718 |

| 30 | 306,000 | 53,500 | 252,500 | - | 113,540 |

| | | | NPV Total: | 1,016,753 | 2,378,449 |

The JEDI results indicate that the economic impact the turbine would have on the local (i.e., county-level) economy would be negligible, and no job creation would result. In large part, this is because the money spent on the project, including the purchase, construction, and annual maintenance expense would not be spent in the local economy, nor would the project generate tax revenue. It is possible that the economic impacts could be more clearly measured for either a project involving more wind turbines, or a project constructed in a county with a larger commercial construction base.

Table 4.

The annual results of the BAU scenarios.

Table 4.

The annual results of the BAU scenarios.

| Year | Interest Rate (Real) |

|---|

| | 5% | 6% | 7% |

| 0 | 3,352,931 | 3,387,664 | 3,422,720 |

| 1 | 3,303,454 | 3,374,568 | 3,447,082 |

| 5 | 3,078,904 | 3,313,591 | 3,563,462 |

| 10 | 2,727,228 | 3,213,677 | 3,762,981 |

| 15 | 2,275,903 | 3,078,909 | 4,045,825 |

| 20 | 1,696,690 | 2,897,126 | 4,446,791 |

| 25 | 953,352 | 2,651,928 | 5,015,211 |

| 30 | –617 | 2,321,193 | 5,821,018 |

| 20-Year NPV Total: | 1,696,690 | 2,897,126 | 4,446,791 |

| 30-Year NPV Total: | –617 | 2,321,193 | 5,821,018 |

5.4. Externalities

While it is not possible to accurately monetize all of the externalities listed in

Table 1, both the offset of CO

2 emissions and the offset of conventional air pollutants can be estimated in part by using plug-in values from the research literature. Additionally, bird deaths and bat deaths can be quantified. It is important to note that it is not Principia College that gains or loses from these four externalities, as the air and birds and bats are common and public goods respectively.

Monetization of CO

2 emissions would increase the project’s NPV. For instance, the wind turbine would offset around 1000 tonnes of CO

2 per year, assuming the energy it offset would have been derived from coal [

30]. A carbon market that offered $20 per tonne would thereby increase the value of the turbine by $20,000 per year. Some or all of this benefit is already captured by the REC. However, there is much debate as to what the marginal value of carbon should be. A recent meta-study showed a wide range of estimates from $0 to over $100 with little consensus [

31]. The reason for the wide range in estimates is because of uncertainty as to the speed at which climate change will take place and of the economic effects which will result.

Coal, which was the fuel source for nearly 50% of the electricity generated in the US last year, directly or indirectly emits the pollutants SO

2, NO

x, CO, PM, Pb, and O

3. A 2009 National Academy of Sciences report, in an attempt to monetize the externalities of power generation in the United States, determined that the marginal cost to society of SO

2, NO

x, and PM from coal fired power plants is $0.032/kWh. This number includes both environmental costs and social costs such as human health costs and loss of recreation value. It is important to note that the damage per coal-fired power plant is highly dependent upon the age (and thus technology) of the power plant. For instance, the damage caused by the five percent dirtiest power plants is estimated to cost more than $0.12/kWh, whereas the damage caused by the five percent least dirtiest power plants is estimated to cost less than $0.005/kWh [

31]. Assuming half of the electricity Principia College was to purchase would be generated by coal, this externality would increase the NPV by more than $50,000 per year.

The combustion of natural gas, which was the fuel source for just over 20% of the electricity generated in the US last year, was estimated to have an average marginal cost of just $0.0016/kWh. Similar to the situation with coal-fired power plants, a high percentage of the cost comes from a disproportionately small percentage of power plants. In this case, ten percent of the power plants cause 65% of the damages [

31].

It is difficult to determine the financial cost of bird deaths and bat deaths that the wind turbine may cause. The value would need to include both an ecological value as well as use and existence values. Instead of determining a financial value, it is common to quantify the total number of bird and bat deaths per turbine (or per total energy generated) during a given time period.

It is not known just how many birds are killed by wind turbines each year. As of 2006, estimates have ranged from 0.01 to 23 collisions per turbine per year [

32]. One of the reasons for such a wide range is that there is not standardized survey methodology for measuring the mortality rate. For instance, scavengers may remove carcasses [

33,

34]. Mortality rates vary by both species and by season as well as by location [

35]. Surprisingly, bird abundance does not necessarily correlate with mortality rate [

36]. In any case, the only way to know the death rate from a single turbine is an ex-post analysis.

However, it is worth putting the expected mortality rate in context with other human activities. A 2009 report by the North American Bird Conservation Initiative states, “As many as one billion birds [in North America] each year may die from collisions with manmade obstacles, including windows, transmission towers, power lines, and wind turbines. Tall, lighted buildings and other structures along coastlines kill millions of migrating birds each year” [

37]. Note that with onsite consumption of power generated by wind turbines, which is what would happen at Principia College, fewer transmission towers and power lines are needed. In addition, climate change is expected to negatively alter bird habitats and migratory patterns [

31,

38].

A 2007 National Academy of Sciences study reported, “At the current level of wind-energy development… the committee sees no evidence that fatalities caused by wind turbines result in measurable demographic changes to bird populations in the United States…” [

39].

Bats are also threatened by wind turbines, and Jersey County has hibernaculums of two endangered species: the Indiana bat and the gray bat. Bat deaths now outnumber bird deaths at wind turbines, but even less is known about bat behavior around wind turbines than about birds around wind turbines [

40]. In Illinois, the only mortality study done found that three times as many bats (91) died as birds (30) at the 33 turbine Crescent Ridge Farm [

41].

5.5. Sensitivity Analysis

Table 5 gives the results from a variety of sensitivity analyses that were run beyond the base case described above, along with the assumed conditions for each.

The sensitivity analysis shows that the results are fairly robust. Even with a discount rate of 3% higher than assumed, the 20-year NPV remains positive. Variations to the transportation and construction costs, both of which are uncertain, still yield a positive NPV. Increasing all the costs by 50% (except the initial turbine price) tests the effect of the long-term maintenance contract on the NPV.

Slight changes in electricity prices show large changes in the NPV, meaning that the results are highly sensitive to the assumed price of electricity. It is worth noting the negative result for the 20-year NPV if the RECs were not able to be sold. This is because the REC effectively increases the price the electricity is worth by $0.025. While the 20-year NPV is negative, the 30-year NPV remains positive. This indicates that without the income of the REC, the pricing structure of electricity plus the PTC is marginal.

The NPV is less sensitive to changes in the quantity of electricity generated. In all likelihood, the turbine would not produce 100% of the expected quantity of electricity due to yearly maintenance, the turbine being shut off occasionally for educational tours of the nacelle, and so forth. If the turbine were to only produce about 80% of the expected electricity, the 20-year NPV is slightly negative, at $–31,861, but the 30-year NPV remains about $1,000,000.

Table 5.

The sensitivity analysis.

Table 5.

The sensitivity analysis.

| Assumption | 20-Year NPV ($) | 30-Year NPV ($) |

|---|

| Original assumptions | 1,016,753 | 2,378,449 |

| Discount rate is 1% higher | 656,071 | 1,729,774 |

| Discount rate is 3% higher | 57,763 | 733,282 |

| Discount rate is 1% lower | 1,427,874 | 3,161,595 |

| Transportation costs are increased 100% | 816,753 | 2,178,449 |

| Construction costs are increased 100% | 216,753 | 1,578,449 |

| All costs are increased 50% | –1,096,406 | 121,659 |

| All costs except the initial turbine price are increased 50% | 103,594 | 1,321,659 |

| Electricity prices increase $0.01 | 1,557,328 | 3,112,232 |

| Electricity prices decrease $0.01 | 476,179 | 1,644,665 |

| RECs are worth $0.00 | –334,683 | 543,990 |

| 10% more electricity is produced | 1,541,060 | 3,067,651 |

| 10% less electricity is produced | 492,446 | 1,689,246 |

| 20% less electricity is produced | –31,861 | 1,000,043 |

| 30% less electricity is produced | –556,168 | 310,840 |

6. Conclusions

The results of this CBA indicate that Principia College should consider installing a wind turbine because of the positive economic impact it would have on the college. Not only is the NPV positive, but the sensitivity analysis shows that it remains positive under a wide variety of conditions including varying the discount rate, costs, and quantity of electricity generated. An investment of the initial capital, $3.4 million, would return a similar NPV if it were to have a real annual return rate of 6 percent. Furthermore, there are several grant programs in Illinois that could potentially fund some or all of the initial capital costs.

It should be re-emphasized that CBA is one decision-making tool among many. Various positive externalities (such as an offset of future CO2 emissions, reduced pollution, increased energy security, and educational benefits) and negative externalities (such as possible bird or bat deaths) should also be considered. Principia College should also involve the local community, especially those who would have their view visually impacted by the wind turbine.