Carbon Taxes and Carbon Right Costs Analysis for the Tire Industry

Abstract

:1. Introduction

2. Research Background

2.1. Carbon Emissions Cost and Carbon Tax

2.2. ABC Applied to Green Production and Environmental Protection in the Tire Industry

2.3. Application of TOC Theory of Constraints

3. Green Production Decision Model for the Tire Industry

3.1. Tire Manufacturing Process

- Kneading (j = 1): The first process mixes all the rubber materials and soot, and transports them to the kneader for kneading to change the strength of the rubber.

- Pressing out (j = 2): The second process uses glue and friction to generate heat, allowing the rubber to mature.

- Cutting off (j = 3): The third process mainly uses a cutting machine to cut off various tire sizes.

- Forming (j = 4): The fourth process is to perform the molding assembly work to assembly all the materials, strips, and steel rings to complete the tire prototype.

- Vulcanizing (j = 5): The fifth process is to perform the vulcanization process. The main purpose of tire vulcanization is to rearrange the molecules of the rubber, meaning to heat and mold the tires through steam. The tires that complete this process will become the finished tires.

- Inspecting (j = 6): Finally, the finished tires are inspected and the tires are moved to the warehouse for shipment.

3.2. The Model Formulation

3.2.1. Objective Function

3.2.2. The Associated Constraints

3.3. Summary

4. Illustration

4.1. Model 1: Green Decision Model without Carbon Rights Trading, but Has a Carbon Cap Allocated for Use by the Government

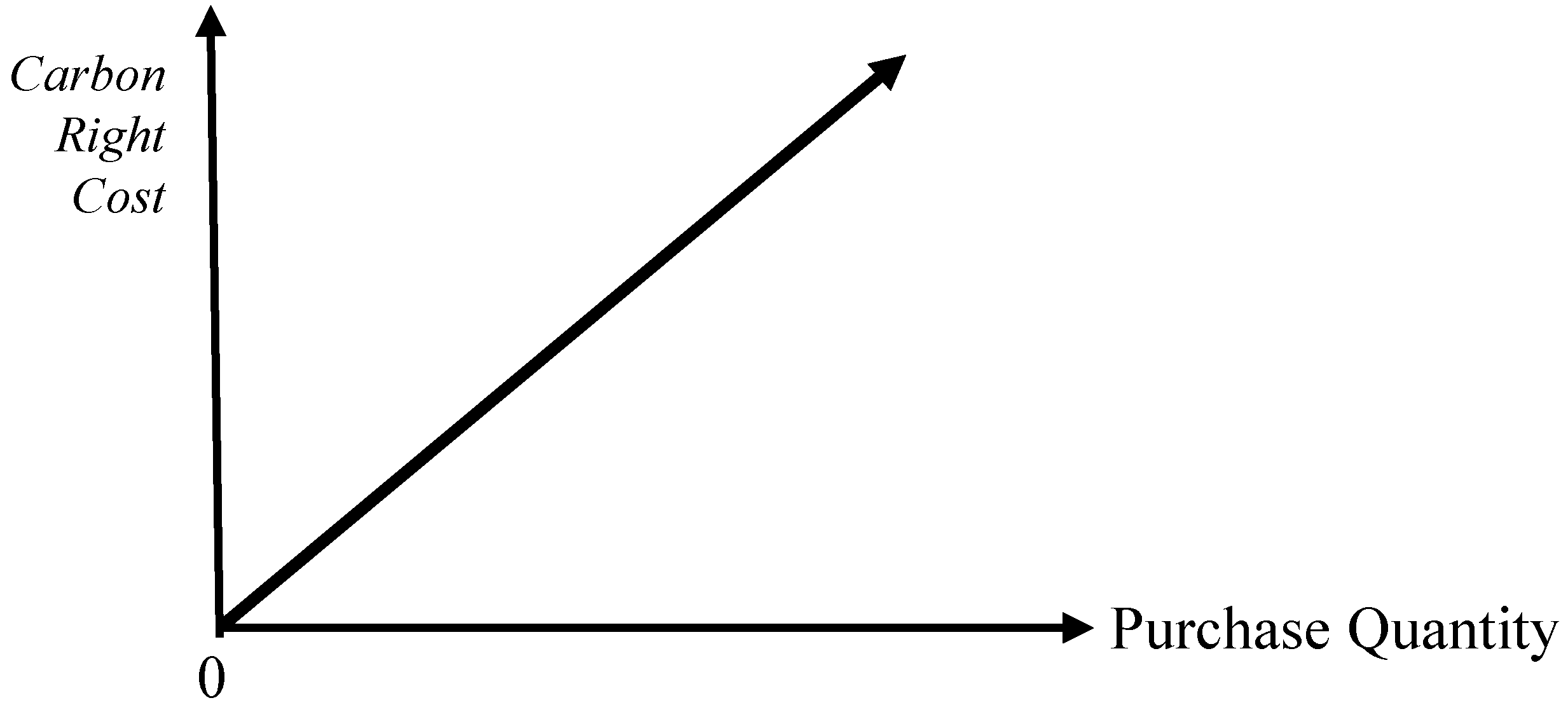

4.2. Model 2: Green Decision Model with Constant Carbon Right Cost

4.3. Model 3: Green Decision Model with a Minimum Purchase Quantity of Carbon Right

4.4. Sensitivity Analysis

- (1)

- Model 1: The original total profit of the company is USD $53,225, and the carbon tax rate is increased by 5%, 10%, 15%, 20%, 25%, and 30%, respectively. The total profit found was reduced by 0.31% (USD $53,057,500), 0.62% (USD $52,890,000), 0.94% (USD $52,772.50), 1.25% (USD $52,555,000), 1.57% (USD) $52,387.50), and 1.88% (USD $52,200), respectively; at the relative decreases of 5%, 10%, 15%, 20%, and 25%, then the total profit was found to increase by 0.31% (USD $53,392.50), 0.62% (USD $53,560), and 0.94% (USD $53,727.50), 1.25% (USD $53,895), 1.57% (USD $54,062.50), and 1.88% (USD $54,230), respectively. Therefore, as the carbon tax rate decreases, the total profit of the enterprise will increase. Conversely, increasing the carbon tax rate will lead to a decrease in total corporate profits.

- (2)

- Model 2: The original total profit of the company was USD $53,225, the carbon tax rate was increased by 5%, 10%, 15%, 20%, and 25%, respectively, and the total profit was found to decrease by 0.31% (USD $52,882), 0.63% (USD $52,714), 0.95% (USD $52,546), 1.26% (USD $52,378), 1.58% (USD $52,210), and 1.9% (USD $52,042), respectively; at the relative decrease of 5%, 10%, 15%, 20%, 25%, and 30%, it is found that the total profit increased by 0.31% (USD $53,218), 0.63% (USD $53,386), 0.95% (USD $53,554), 1.26% (USD $53,722), 1.58% (USD $53,890), and 1.9% (USD $54,058), respectively. Therefore, as the carbon tax rate decreases, the total profit of the company will increase. Conversely, increasing the carbon tax rate will lead to a decrease in total corporate profits.

- (3)

- Model 3: The original total profit of the company is USD $53,050, and the carbon tax rate is increased by 5%, 10%, 15%, 20%, 25%, and 30% respectively. The total profit found was reduced by 0.31% (USD $52,882), 0.63% (USD $52,714), 0.95% (USD $52,546), 1.26% (USD $52,378), 1.58% (USD $52,210), and 1.9% (USD $52,042), respectively. At the relative decrease of 5%, 10%, 15%, 20%, 25%, and 30%, it is found that the total profit increased by 0.31% (USD $53,218), 0.63% (USD $53,386), 0.95% (USD $53,554), 1.26% (USD $53,722), 1.58% (USD $53,890), and 1.9% (USD $54,058), respectively. Therefore, as the carbon tax rate decreases, the total profit of the company will increase. Conversely, increasing the carbon tax rate will lead to a decrease in total corporate profits.

5. Conclusions

Funding

Acknowledgments

Conflicts of Interest

References

- Baranzini, A.; Carattini, S. Taxation of Emissions of Greenhouse Gases. In Global Environmental Change; Freedman, B., Ed.; Springer: Dordrecht, The Netherlands, 2014; pp. 543–560. [Google Scholar]

- Energy Leaders Accelerate Climate Action Global Climate Action at COP22, UNFCCC. 2016. Available online: http://newsroom.unfccc.int/climate-action/energy-leaders-accelerate-climate- action/ (accessed on 3 July 2018).

- Sarkar, B.; Ahmed, W.; Kim, N. Joint effects of variable carbon emission cost and multi-delay-in-payments under single-setup-multiple-delivery policy in a global sustainable supply chain. J. Clean. Prod. 2018, 185, 421–445. [Google Scholar] [CrossRef]

- Schaltegger, S.; Synnestvedt, T. The link between ‘green’ and economic success: Environmental management as the crucial trigger between environmental and economic performance. J. Environ. Manag. 2002, 65, 339–346. [Google Scholar]

- Baranzini, A.; Goldemberg, J.; Speck, S. A Future for Carbon Taxes. Ecol. Econ. 2000, 32, 395–412. [Google Scholar] [CrossRef]

- Metcalf, G.E. Designing a Carbon Tax to Reduce U.S. Greenhouse Gas Emissions. Rev. Environ. Econ. Policy 2009, 3, 63–83. [Google Scholar] [CrossRef]

- Fang, G.; Tian, L.; Liu, M.; Fu, M.; Sun, M. How to optimize the development of carbon trading in China—Enlightenment from evolution rules of the EU carbon price. Appl. Energy 2018, 211, 1039–1049. [Google Scholar] [CrossRef]

- Martin, R.; Muûls, M.; De Preux, L.B.; Wagner, U.J. Industry Compensation under Relocation Risk: A Firm-Level Analysis of the EU Emissions Trading Scheme. Am. Econ. Rev. 2014, 104, 2482–2508. [Google Scholar] [CrossRef] [Green Version]

- Goulder, L.H.; Parry, I.W. Instrument Choice in Environmental Policy. Rev. Environ. Econ. Policy 2008, 2, 152–174. [Google Scholar] [CrossRef] [Green Version]

- Fan, J.H.; Todorova, N. Dynamics of China’s carbon prices in the pilot trading phase. Appl. Energy 2017, 208, 1452–1467. [Google Scholar] [CrossRef]

- Lin, B.; Jia, Z. The impact of Emission Trading Scheme (ETS) and the choice of coverage industry in ETS: A case study in China. Appl. Energy 2017, 205, 1512–1527. [Google Scholar] [CrossRef]

- Sathre, R.; Gustavsson, L. Effects of energy and carbon taxes on building material competitiveness. Energy Build. 2007, 39, 488–494. [Google Scholar] [CrossRef]

- Basanta, K.; Pradhan, J.G.; Yao, Y.F.; Liang, Q.M. Carbon pricing and terms of trade effects for China and India: A general equilibrium analysis. Econ. Model. 2017, 63, 60–74. [Google Scholar]

- Maryniak, P.; Trück, S.; Weron, R. Carbon pricing and electricity markets—The case of the Australian Clean Energy Bill. Energy Econ. 2018. [Google Scholar] [CrossRef]

- Kee, R.; Schmidt, C. A comparative analysis of utilizing activity-based costing and the theory of constraints for making product-mix decisions. Int. J. Prod. Econ. 2000, 63, 1–17. [Google Scholar] [CrossRef]

- Massood, Y.Z. Product-mix decisions under activity-based costing with resource constraints and non-proportional activity costs. J. Appl. Bus. Res. 1998, 14, 39–46. [Google Scholar]

- Lockhart, J.; Taylor, A. Environmental Considerations in Product Mix Decisions Using ABC and TOC. Manag. Account. Q. 2007, 9, 13–31. [Google Scholar]

- Onwubolu, G.C.; Mutingi, M. Optimizing the multiple constrained resources product mix problem using genetic algorithms. Int. J. Prod. Res. 2001, 39, 1897–1910. [Google Scholar] [CrossRef]

- Fernández, Y.F.; Fernández López, M.A.; Blanco, B.O. Innovation for sustainability: The impact of R&D spending on CO2 emissions. J. Clean. Prod. 2018, 172, 3459–3467. [Google Scholar]

- Hoinka, K.; Ziębik, A. Mathematical model for the choice of an energy management structure of complex buildings. Energy 2010, 35, 1146–1156. [Google Scholar] [CrossRef]

- Chen, X.; Chan, C.K.; Lee, Y.C.E. Responsible production policies with substitution and carbon emissions trading. J. Clean. Prod. 2016, 134, 642–651. [Google Scholar] [CrossRef]

- Chen, X.; Luo, Z.; Wang, X. Impact of efficiency, investment, and competition on low carbon manufacturing. J. Clean. Prod. 2017, 143, 388–400. [Google Scholar] [CrossRef]

- Du, Z.; Lin, B. Analysis of carbon emissions reduction of China’s metallurgical industry. J. Clean. Prod. 2018, 176, 1177–1184. [Google Scholar] [CrossRef]

- Baranzini, A.; Van den Bergh, J.C.; Carattini, S.; Howarth, R.B.; Padilla, E.; Roca, J. Carbon Pricing in Climate Policy: Seven Reasons, Complementary Instruments, and Political Economy Considerations. Wiley Interdiscip. Rev. Clim. Chang. 2017, 8, e462. [Google Scholar] [CrossRef]

- Aldy, J.E.; Stavins, R.N. The Promise and Problems of Pricing Carbon: Theory and Experience. J. Environ. Dev. 2012, 21, 152–180. [Google Scholar] [CrossRef]

- CDP. Putting a Price on Carbon: Integrating Climate Risk into Business Planning; CDP Report: Carbon Disclosure Project; CDP: London, UK, 2017; Available online: https://b8f65cb373b1b7b15feb-c70d8ead6ced550b4d987d7c03fcdd1d.ssl.cf3.rackcdn.com/cms/reports/documents/000/002/738/original/Putting-a-price-on-carbon-CDP-Report-2017.pdf?1507739326 (accessed on 3 July 2018).

- Zheng, G.; Jing, Y.; Huang, H.; Zhang, X.; Gao, Y. Application of life cycle assessment (LCA) and extenics theory for building energy conservation assessment. Energy 2009, 34, 1870–1879. [Google Scholar] [CrossRef]

- Fang, Y.P.; Zeng, Y. Balancing energy and environment: The effect and perspective of management instruments in China. Energy 2007, 32, 2247–2261. [Google Scholar] [CrossRef]

- Lee, C.F.; Lin, S.J.; Lewis, C. Analysis of the impacts of combining carbon taxation and emission trading on different industry sectors. Energy Policy 2008, 36, 722–729. [Google Scholar] [CrossRef]

- Martin, R.; Muuls, M.; Wagner, U.J. The Impact of the European Union Emissions Trading Scheme on Regulated Firms: What Is the Evidence after Ten Years? Rev. Environ. Econ. Policy 2016, 10, 129–148. [Google Scholar] [CrossRef]

- Oestreich, A.M.; Tsiakas, I. Carbon Emissions and Stock Returns: Evidence from the EU Emissions Trading Scheme. J. Bank. Financ. 2015, 58, 294–308. [Google Scholar] [CrossRef]

- Herber, B.P.; Raga, J.T. An international carbon tax to combat global warming: An economic and political analysis of the European Union proposal. Am. J. Econ. Sociol. 1995, 54, 257–267. [Google Scholar] [CrossRef]

- Nadel, S. Learning from 19 Carbon Taxes: What Does the Evidence Show? In Proceedings of the 2016 ACEEE Summer Study on Energy Efficiency in Buildings, Pacific Grove, CA, USA, 21–26 August 2016; pp. 9-1–9-7. Available online: https://aceee.org/files/proceedings/2016/data/papers/9_49.pdf (accessed on 3 July 2018).

- Xu, J.; Qiu, R.; Lv, C. Carbon emission allowance allocation with cap and trade mechanism in air passenger transport. J. Clean. Prod. 2016, 131, 308–320. [Google Scholar] [CrossRef]

- Johansson, B. Climate policy instruments and industry—Effects and potential responses in the Swedish context. Energy Policy 2006, 34, 2344–2360. [Google Scholar] [CrossRef]

- Liu, Y.; Chen, S.; Chen, B.; Yang, W. Analysis of CO2 emissions embodied in China’s bilateral trade: A non-competitive import input–output approach. J. Clean. Prod. 2017, 163, S410–S419. [Google Scholar] [CrossRef]

- Wang, B.; Liu, B.; Niu, H.; Liu, J.; Yao, S. Impact of energy taxation on economy, environmental and public health quality. J. Environ. Manag. 2017, 206, 85–92. [Google Scholar] [CrossRef] [PubMed]

- Cheng, B.; Dai, H.; Wang, P.; Zhao, D.; Masui, T. Impacts of carbon trading scheme on air pollutant emissions in Guangdong Province of China. Energy Sustain. Dev. 2015, 27, 174–185. [Google Scholar] [CrossRef]

- Ivan, D.R.; Tulloch, D.J. Carbon pricing and system linking: Lessons from the New Zealand Emissions Trading Scheme. Energy Econ. 2018, 73, 66–79. [Google Scholar]

- Roy, C.; Labrecque, B.; Caumia, B.D. Recycling of scrap tires to oil and carbon black by vacuum pyrolysis. Resour. Conserv. Recycl. 1990, 4, 203–213. [Google Scholar] [CrossRef]

- Cooper, R.; Kaplan, R.S. The Design of Cost Management Systems, 2nd ed.; Prentice-Hall: Upper Saddle River, NJ, USA, 1999. [Google Scholar]

- Puurunen, K.; Vasara, P. Opportunities for utillising nanotechnology in reaching near-zero emissions in the paper industry. J. Clean. Prod. 2007, 15, 1287–1294. [Google Scholar] [CrossRef]

- Duez, B. Towards a Substantially Lower Fuel Consumption Freight Transport by the Development of an Innovative Low Rolling Resistance Truck Tyre Concept. Trans. Res. Proced. 2016, 14, 1051–1060. [Google Scholar] [CrossRef]

- Wikipedia, Carbon Tax. Available online: https://en.wikipedia.org/wiki/Carbon_tax (accessed on 3 July 2018).

- Lin, B.; Li, X. The effect of carbon tax on per capita CO2 emission. Energy Policy 2011, 39, 5137–5146. [Google Scholar] [CrossRef]

- Conegrey, T.; Gerald, J.D.F.; Valeri, L.M.; Tol, R.S.J. The impact of a carbon tax on economic growth and carbon dioxide emissions in Ireland. J. Environ. Plan. Manag. 2013, 56, 934–952. [Google Scholar] [CrossRef]

- Kee, R. The sufficiency of product and variable costs for production-related decisions when economies of scope are present. Int. J. Prod. Econ. 2008, 114, 682–696. [Google Scholar] [CrossRef]

- Dekker, R.; Bloembof, J.; Mallidis, I. Operations resarch for greenlogistics—An overview of aspects, issues, contributions and challenges. Eur. J. Oper. Res. 2012, 219, 671–679. [Google Scholar] [CrossRef]

- Tsai, W.H.; Lin, W.R.; Fan, Y.W.; Lee, P.L.; Lin, S.J.; Hsu, J.L. Applying A Mathematical Programming Approach for A Green Product Mix Decision. Int. J. Prod. Res. 2012, 50, 1171–1184. [Google Scholar] [CrossRef]

- Qian, L.; David, B.A. Parametric cost estimation based on activity-based costing: A case study for design and development of rotational parts. Int. J. Prod. Econ. 2008, 113, 805–818. [Google Scholar] [CrossRef]

- Tsai, W.H.; Lin, S.J.; Liu, J.Y.; Lin, W.R.; Lee, K.C. Incorporating life cycle assessments into building project decision-making: An energy consumption and CO2 emission perspective. Energy 2011, 36, 3022–3029. [Google Scholar] [CrossRef]

- Tsai, W.H.; Lin, S.J.; Lee, Y.F.; Chang, Y.C.; Hsu, J.L. Construction method selection for green building projects to improve environmental sustainability by using an MCDM approach. J. Environ. Plan. Manag. 2013, 56, 1487–1510. [Google Scholar] [CrossRef]

- Tsai, W.H.; Yang, C.H.; Huang, C.T.; Wu, Y.Y. The Impact of the Carbon Tax Policy on Green Building Strategy. J. Environ. Plan. Manag. 2017, 60, 1412–1438. [Google Scholar] [CrossRef]

- Plenert, G. Optimizing theory of constraints when multiple constrained resources exist. Eur. J. Oper. Res. 1993, 70, 126–133. [Google Scholar] [CrossRef]

- Tsai, W.H.; Lai, C.W.; Tseng, L.J.; Chou, W.C. Embedding Management Discretionary Power into An ABC Model for A Joint Products Mix Decision. Int. J. Prod. Econ. 2008, 115, 210–220. [Google Scholar] [CrossRef]

- Tsai, W.H.; Kuo, L.; Lin, T.W.; Kuo, Y.C.; Shen, Y.S. Price elasticity of demand and capacity expansion eatufres in an enhanced ABC product-mix Decision Model. Int. J. Prod. Res. 2010, 48, 6387–6416. [Google Scholar] [CrossRef]

- Beale, E.M.L.; Tomlin, J.A. Special facilities in a general mathematical programming system for non-convex problems using ordered sets of variables. Oper. Res. 1970, 69, 447–454. [Google Scholar]

- Williams, H.P. Model Building in Mathematical Programming, 2nd ed.; Wiley: New York, NY, USA, 1985; pp. 173–177. [Google Scholar]

- Wang, Y.; Chen, W.; Liu, B. Manufacturing/remanufacturing decisions for a capital-constrained manufacturer considering carbon emission cap and trade. J. Clean. Prod. 2017, 140, 1118–1128. [Google Scholar] [CrossRef]

- Igor, L.W.; George, V.B.; Jose, L.D.M.; Ofelia, D.Q.F.A. Carbon dioxide utilization in a microalga-based biorefinery: Efficiency of carbon removal and economic performance under carbon taxation. J. Environ. Manag. 2017, 203, 988–998. [Google Scholar]

- Tsai, W.H.; Chen, H.C.; Liu, J.Y.; Chen, S.P.; Shen, Y.S. Using activity-based costing to evaluate capital investments for green manufacturing technologies. Int. J. Prod. Res. 2011, 49, 7275–7292. [Google Scholar] [CrossRef]

- Ward, S.C.; Chapman, C.B. Risk-management perspective on the project lifecycle. Int. J. Proj. Manag. 1995, 13, 145–149. [Google Scholar] [CrossRef]

- Tsai, W.H.; Shen, Y.S.; Lee, P.L.; Chen, H.C.; Kuo, L.; Huang, C.C. Integrating information about the cost of carbon through activity-based costing. J. Clean. Prod. 2012, 36, 102–111. [Google Scholar] [CrossRef]

- Zetterberg, L.; Wråke, M.; Sterner, T.; Fischer, C.; Burtraw, D. Short-Run Allocation of Emissions Allowances and Long-Term Goals for Climate Policy. Ambio 2012, 41, 23–32. [Google Scholar] [CrossRef] [PubMed] [Green Version]

- Du, S.; Ma, F.; Fu, Z.; Zhu, L.; Zhang, J. Game-theoretic analysis for an emission-dependent supply chain in a ‘cap-and-trade’ system. Ann. Oper. Res. 2015, 228, 135–149. [Google Scholar] [CrossRef]

| Product | PCR (i = 1) | TBR (i = 2) | MC (i = 3) | Available Capacity (thousand) | ||||

|---|---|---|---|---|---|---|---|---|

| Maximum demand: (thousand) | j | Bi | 1000 | 100 | 1500 | |||

| Selling price: (USD) | Ci | 310 | 1010 | 160 | ||||

| Direct material: | k = 1 | 21 | 4 | 6 | 2 | F1 = 10,600 | ||

| (USD/ton) | k = 2 | 11 | 2 | 10 | 1 | F2 = 8100 | ||

| k = 3 | 6 | 5 | 15 | 2 | F3 = 8700 | |||

| k = 4 | 38 | 2 | 6 | 1 | F4 = 7100 | |||

| k = 5 | 22 | 2 | 15 | 1 | F5 = 7900 | |||

| Machine hour constraint: | ||||||||

| Kneading | Machine hours | 1 | 5 | 10 | 1 | H1 = 13,300 | ||

| Pressing out | Machine hours | 2 | 2 | 4 | 1 | H2 = 22,100 | ||

| Cutting off | Machine hours | 3 | 2 | 3 | 1 | H3 = 22,100 | ||

| Forming | Machine hours | 4 | 3 | 5 | 1 | H4 = 26,500 | ||

| Vulcanizing | Machine hours | 5 | 2 | 3 | 1 | H5 = 13,300 | ||

| Inspecting | Machine hours | 6 | 3 | 6 | 1 | H6 = 6700 | ||

| Material handling constraint: | ||||||||

| Machine hours (h) Cost (USD) | G1 = 50 G2 = 150 G3 = 10 | 7 | 2 | 3 | 1 | H7 = 1860 | ||

| 5 | 10 | 1 | ||||||

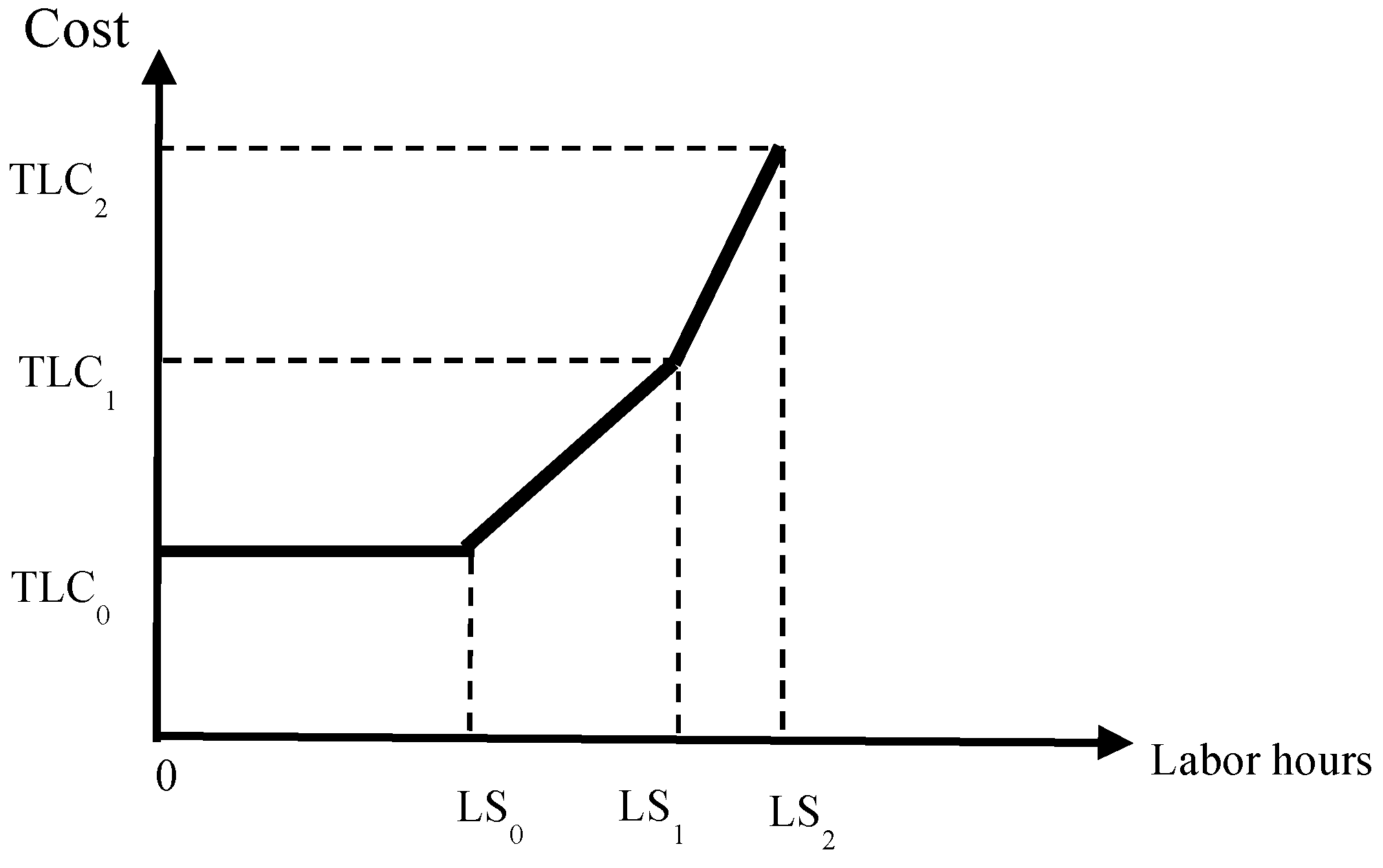

| Direct labor constraint: | ||||||||

| Cost: Labor hours (h) | TLC0 = 7040 | TLC1 = 11,000 | TLC2 = 15,840 | 1 | 1.5 | 0.5 | ||

| LS0 = 1760 | LS1 = 2200 | LS2 = 2640 | ||||||

| Wage rate (USD/h) | r0 = 4 | r1 = 9 | r2 = 11 | |||||

| Carbon emission constraint: | ||||||||

| Cost (USD) Emission quantities | CT1 = 20,400 CE1 = 2040 | CT2 = 46,800 CE2 = 2340 | UCE = 4000 | 0.2 | 0.1 | 0.1 | ||

| Tax rate (USD/ton) | TR1 = 10 | TR2 = 20 | TR3 = 30 | |||||

| Total fixed cost: (USD) | 22,000 | |||||||

| Max Z = (310*B1 + 1010*B2 + 160*B3) − (21*4 + 11*2 + 6*5 + 38*2 + 22*2)*B1 − (21*6 + 11*10 + 6*15 + 38*6 + 22*15)*B2-(21*2 + 11*1 + 6*2 + 38*1 + 22*1)*B3 − 7040 − (11,000 − 7040)*e1 − (15,840 − 7040)*e2 − 50*β1 − 150*β2 − 10*β3 − 10*W1 − 20*W2 − 30*W3 − F | |||

| Subject to direct material;4*B1 + 6* B2 + 2* B3 ≤ 10,600; 2*B1 + 10*B2 + 1*B3 ≤ 8100; 5*B1 + 15*B2 + 2*B3 ≤ 8700; 2*B1 + 6*B2 + 1*B3 ≤ 7100; 2*B1 + 15*B2 + 1*B3 ≤ 7900; | Subject to machine hours;5*B1 + 10*B2 + 1*B3 ≤ 13,300; 2*B1 + 4*B2 + 1*B3 ≤ 22,100; 2*B1 + 3*B2 + 1*B3 ≤ 22,100; 3*B1 + 5*B2 + 1*B3 ≤ 26,500; 2*B1 + 3*B2 + 1*B3 ≤ 13,300; 3*B1 + 6*B2 + 1*B3 ≤ 6700; | ||

| Subject to direct labor; 1*B1 + 1.5*B2 + 0.5*B3 − 1760-440*e1 − 880*e2 ≤ 0; e0 − m1 ≤ 0; e1 − m1 – m2 ≤ 0; e2 − m2 ≤ 0; e0 + e1 + e2 = 1; m1 + m2 = 1; 0 ≤ e0 ≤ 1; 0 ≤ e1 ≤ 1; 0 ≤ e2 ≤ 1; m1, m2 = 0,1; | Subject to Material handing; B1 − 5* = 0; B2 − 10* = 0; B3 − 1* = 0; 2* + 3* + 1* ≤ 1860; | ||

| Subject to carbon emission; GCE = , GCE = W1 + W2 + W3; W1 + W2 + W3 ≤ 4000; 0 ≤ W1; W1 ≤ 2040; 2040* < W2; W2 ≤ 2340*; W3 > 2340*; n1 + n2 + n3 = 1. | |||

| The optimal solutions for the example data | |||

| B1 = 895,000 | B2 = 85,000 | B3 = 1,475,000 | F = 22,000,000 |

| e0 = 1 | e1= 0 | e2 = 0 | Z = 53,225,000 |

| β1 = 181,000 | β2 = 8000 | β3 = 1,475,000 | GCE = 335,000 |

| = 1 | = 0 | = 0 | |

| W1 = 335,000 | W2 = 0 | W3 = 0 | |

| = 1 | = 0 | ||

| Max Z = (310*B1 + 1010*B2 + 160*B3) − (21*4 + 11*2 + 6*5 + 38*2 + 22*2)*B1 − (21*6 + 11*10 + 6*15 + 38*6 + 22*15)*B2 − (21*2 + 11*1 + 6*2 + 38*1 + 22*1)*B3 − 7040 − (11,000 − 7040) *e1 − (15,840 − 7040) *e2 − 50* − 150* − 10* − {(10* − 20* − 30*)*θ1 + [(10* − 20* − 30*) + 30*(GCE − 4000)]*θ2} − F | |||

| Subject to direct material; 4*B1 + 6* B2 + 2* B3 ≤ 10,600; 2*B1 + 10*B2 + 1*B3 ≤ 8100; 5*B1 + 15*B2 + 2*B3 ≤ 8700; 2*B1 + 6*B2 + 1*B3 ≤ 7100; 2*B1 + 15*B2 + 1*B3 ≤ 7900; | Subject to machine hours; 5*B1 + 10*B2 + 1*B3 ≤ 13,300; 2*B1 + 4*B2 + 1*B3 ≤ 22,100; 2*B1 + 3*B2 + 1*B3 ≤ 22,100; 3*B1 + 5*B2 + 1*B3 ≤ 26,500; 2*B1 + 3*B2 + 1*B3 ≤ 13,300; 3*B1 + 6*B2 + 1*B3 ≤ 6700; | ||

| Subject to direct labor; 1*B1 + 1.5*B2 + 0.5*B3 − 1760 − 440*e1 − 880*e2 = 0; e0 − m1 ≤ 0; e1 − m1 − m2 ≤ 0; e2 − m2 ≤ 0; e0 + e1 + e2 = 1; m1 + m2 = 1; 0 ≤ e0 ≤ 1; 0 ≤ e1 ≤ 1; 0 ≤ e2 ≤ 1; m1, m2 = 0,1; | Subject to batch handing; B1 − 5* = 0; B2 − 10* = 0; B3 − 1* = 0; 2* + 3* + 1*. ≤ 1860; | ||

| Subject to carbon emission; | |||

| GCE = ; GCE = W1 + W2 + W3; W1 + W2 + W3 ≤ 4000; | 0 ≤ W1; W1 ≤ 2040*; 2040* < W2; W2 ≤ 2340*; W3 > 2340*; + + = 1; | ||

| Subject to carbon emission right purchasing | |||

| GCE = CQ1 + CQ2; 0 ≤ CQ1; CQ1 ≤ 4000*θ1; | 4000*θ2 < CQ2; CQ2 ≤ (4000 + 160)* θ2; θ1 + θ2 = 1, | ||

| The optimal solutions for the example data | |||

| = 905,000 | = 80,000 | = 1,470,000 | F = 22,000,000 |

| = 1 | = 0 | = 0 | Z = 53,050,000 |

| = 181,000 | = 8000 | = 1,470,000 | |

| = 1 | = 0 | = 0 | |

| W1 = 336,000 | W2 = 0 | W3 = 0 | |

| CQ1 = 336,000 | CQ2 = 0 | GCE= 336,000 | |

| = 1 | = 0 | ||

| = 1 | = 0 | ||

| Max Z = (310*B1 + 1010*B2 + 160*B3) − (21*4 + 11*2 + 6*5 + 38*2 + 22*2)*B1 − (21*6 + 11*10 + 6*15 + 38*6 + 22*15)*B2-(21*2 + 11*1 + 6*2 + 38*1 + 22*1)*B3 − 7040 − (11,000 − 7040) *e1 − (15,840 − 7040) *e2 − 50* − 150* − 10* − {(10* − 20* − 30*)*θ1 + [(10* − 20* − 30*) + 1800]* + [(10* − 20* − 30*) + 1800 + 30*(GCE − 4000 − 60)]*} − F | |||

| Subject to direct material; 4*B1 + 6* B2 + 2* B3 ≤ 10,600; 2*B1 + 10*B2 + 1*B3 ≤ 8100; 5*B1 + 15*B2 + 2*B3 ≤ 8700; 2*B1 + 6*B2 + 1*B3 ≤ 7100; 2*B1 + 15*B2 + 1*B3 ≤ 7900; | Subject to machine hours; 5*B1 + 10*B2 + 1*B3 ≤ 13,300; 2*B1 + 4*B2 + 1*B3 ≤ 22,100; 2*B1 + 3*B2 + 1*B3 ≤ 22,100; 3*B1 + 5*B2 + 1*B3 ≤ 26,500; 2*B1 + 3*B2 + 1*B3 ≤ 13,300; 3*B1 + 6*B2 + 1*B3 ≤ 6700; | ||

| Subject to direct labor; 1*B1 + 1.5*B2 + 0.5*B3 − 1760 − 2200*e1 − 2640*e2 = 0; e0 − m1 ≤ 0; e1 − m1 − m2 ≤ 0;e2 − m2 ≤ 0; e0 + e1 + e2 = 1; m1 + m2 = 1; 0 ≤ e0 ≤ 1; 0 ≤ e0 ≤ 1; 0 ≤ e0 ≤ 1; m1, m2 = 0,1; | Subject to batch handing; B1 − 5* = 0; B2 − 10* = 0; B3 − 1* = 0; 2* + 3* + 1* ≤ 1860; | ||

| Subject to carbon emission; | |||

| GCE = , GCE = W1 + W2 + W3; W1 + W2 + W3 ≤ 4000; | 0 ≤ W1; W1 ≤ 2040*; 2040* < W2; W2 ≤ 2340*; W3 > 2340*; + + = 1; | ||

| Subject to carbon emission right purchasing | |||

| GCE = CQ1 + CQ2 + CQ3; 0 ≤ CQ1; CQ1 ≤ 4000*θ1; 4000*θ2 < CQ2; CQ2 ≤ (4000 + 60)*θ2; | (4000 + 60)*θ3 < CQ3; CQ3 ≤ (4000 + 160)*θ3; θ1 + θ2 + θ3 = 1, | ||

| The optimal solutions for the example data | |||

| = 905,000 | = 80,000 | = 1,470,000 | F = 22,000,000 |

| = 1 | = 0 | = 0 | Z = 53,050,000 |

| = 181,000 | = 8000 | = 1,470,000 | |

| = 1 | = 0 | = 0 | |

| W1 = 336,000 | W2 = 0 | W3 = 0 | GCE = 336,000 |

| CQ1 = 336,000 | CQ2 = 0 | CQ3 = 0 | |

| = 1 | = 0 | = 0 | |

| = 1 | = 0 | ||

| Carbon Tax Decrease/Increase Ratio (%) | Profit (A) | Increase/Decrease (Compared with the Initial Value) (%) (B) = (D)/(C) | Original Profit (C) | Increase Profit (D) = (A) − (C) |

|---|---|---|---|---|

| −30% | 54,230.00 | 1.88% | 53,225.00 | 1005.00 |

| −25% | 54,062.50 | 1.57% | 53,225.00 | 837.50 |

| −20% | 53,895.00 | 1.25% | 53,225.00 | 670.00 |

| −15% | 53,727.50 | 0.94% | 53,225.00 | 502.50 |

| −10% | 53,560.00 | 0.62% | 53,225.00 | 335.00 |

| −5% | 53,392.50 | 0.31% | 53,225.00 | 167.50 |

| 0% | 53,225.00 | 0.00% | 53,225.00 | 0.00 |

| 5% | 53,057.50 | −0.31% | 53,225.00 | −167.50 |

| 10% | 52,890.00 | −0.62% | 53,225.00 | −335.00 |

| 15% | 52,722.50 | −0.94% | 53,225.00 | −502.50 |

| 20% | 52,555.00 | −1.25% | 53,225.00 | −670.00 |

| 25% | 52,387.50 | −1.57% | 53,225.00 | −837.50 |

| 30% | 52,220.00 | −1.88% | 53,225.00 | −1005.00 |

| Carbon Tax Decrease/Increase Ratio (%) | Profit (A) | Increase/Decrease (Compared with the Initial Value) (%) (B) = (D)/(C) | Original Profit (C) | Increase Profit (D) = (A) − (C) |

|---|---|---|---|---|

| −30% | 54,058.00 | 1.90% | 53,050.00 | 1008.00 |

| −25% | 53,890.00 | 1.58% | 53,050.00 | 840.00 |

| −20% | 53,722.00 | 1.26% | 53,050.00 | 672.00 |

| −15% | 53,554.00 | 0.95% | 53,050.00 | 504.00 |

| −10% | 53,386.00 | 0.63% | 53,050.00 | 336.00 |

| −5% | 53,218.00 | 0.31% | 53,050.00 | 168.00 |

| 0% | 53,050.00 | 0.00% | 53,050.00 | 0.00 |

| 5% | 52,882.00 | −0.31% | 53,050.00 | −168.00 |

| 10% | 52,714.00 | −0.63% | 53,050.00 | −336.00 |

| 15% | 52,546.00 | −0.95% | 53,050.00 | −504.00 |

| 20% | 52,378.00 | −1.26% | 53,050.00 | −672.00 |

| 25% | 52,210.00 | −1.58% | 53,050.00 | −840.00 |

| 30% | 52,042.00 | −1.90% | 53,050.00 | −1008.00 |

| Carbon Tax Decrease/Increase Ratio (%) | Profit (A) | Increase/Decrease (Compared with the Initial Value) (%) (B) = (D)/(C) | Original Profit (C) | Increase Profit (D) = (A) − (C) |

|---|---|---|---|---|

| −30% | 54,058.00 | 1.90% | 53,050.00 | 1008.00 |

| −25% | 53,890.00 | 1.58% | 53,050.00 | 840.00 |

| −20% | 53,722.00 | 1.26% | 53,050.00 | 672.00 |

| −15% | 53,554.00 | 0.95% | 53,050.00 | 504.00 |

| −10% | 53,386.00 | 0.63% | 53,050.00 | 336.00 |

| −5% | 53,218.00 | 0.31% | 53,050.00 | 168.00 |

| 0% | 53,050.00 | 0.00% | 53,050.00 | 0.00 |

| 5% | 52,882.00 | −0.31% | 53,050.00 | −168.00 |

| 10% | 52,714.00 | −0.63% | 53,050.00 | −336.00 |

| 15% | 52,546.00 | −0.95% | 53,050.00 | −504.00 |

| 20% | 52,378.00 | −1.26% | 53,050.00 | −672.00 |

| 25% | 52,210.00 | −1.58% | 53,050.00 | −840.00 |

| 30% | 52,042.00 | −1.90% | 53,050.00 | −1008.00 |

© 2018 by the author. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (http://creativecommons.org/licenses/by/4.0/).

Share and Cite

Tsai, W.-H. Carbon Taxes and Carbon Right Costs Analysis for the Tire Industry. Energies 2018, 11, 2121. https://doi.org/10.3390/en11082121

Tsai W-H. Carbon Taxes and Carbon Right Costs Analysis for the Tire Industry. Energies. 2018; 11(8):2121. https://doi.org/10.3390/en11082121

Chicago/Turabian StyleTsai, Wen-Hsien. 2018. "Carbon Taxes and Carbon Right Costs Analysis for the Tire Industry" Energies 11, no. 8: 2121. https://doi.org/10.3390/en11082121