The Financial Effect of the Electricity Price Forecasts’ Inaccuracy on a Hydro-Based Generation Company

Abstract

:1. Introduction

- Extensive analysis of the financial influence of electricity price estimation inaccuracy;

- Analysis of statistical methods, Artificial Neural Networks (ANN), Long Short Term Memory (LSTM), Gated Recurrent Units (GRU) and hybrid methods for electricity price estimation;

- Use of a hybrid ANN–LSTM method for estimating electricity prices to maximize the profit;

- Detailed statistical analysis between electricity price estimation and profit maximization of GenCos.

1.1. Electricity Price Forecasting

1.2. Generator Companies’ Profit Maximization

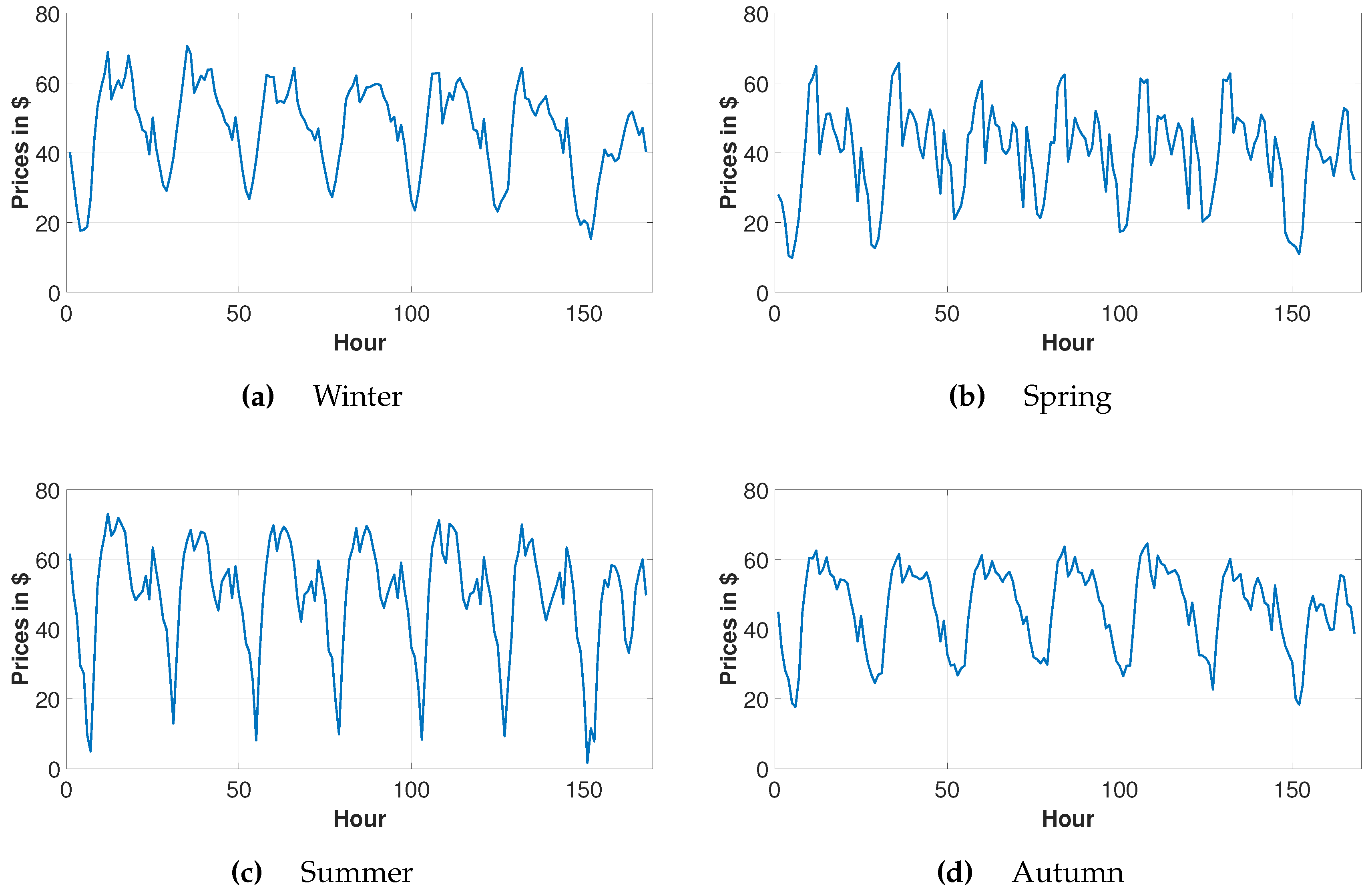

1.3. Turkish Market

2. Data and Methods

2.1. Electricity Price Forecasts

2.1.1. Naive Method

2.1.2. Seasonal Auto-Regressive Integrated Moving Average (SARIMA) Model

2.1.3. Artifical Neural Networks

2.1.4. Long Short Term Memory

2.1.5. Gated Recurrent Units

2.1.6. Hybrid Models

- 50% LSTM–50% GRU

- 50% ANN–50% GRU

- 50% ANN–50% LSTM

- 33% ANN–33% LSTM–33% GRU

2.2. Hydro-Based Power Plant

Price Based Unit Commitment According to Mixed Integer Linear Programming

2.3. Financial Effect of the Forecast Inaccuracy Measures

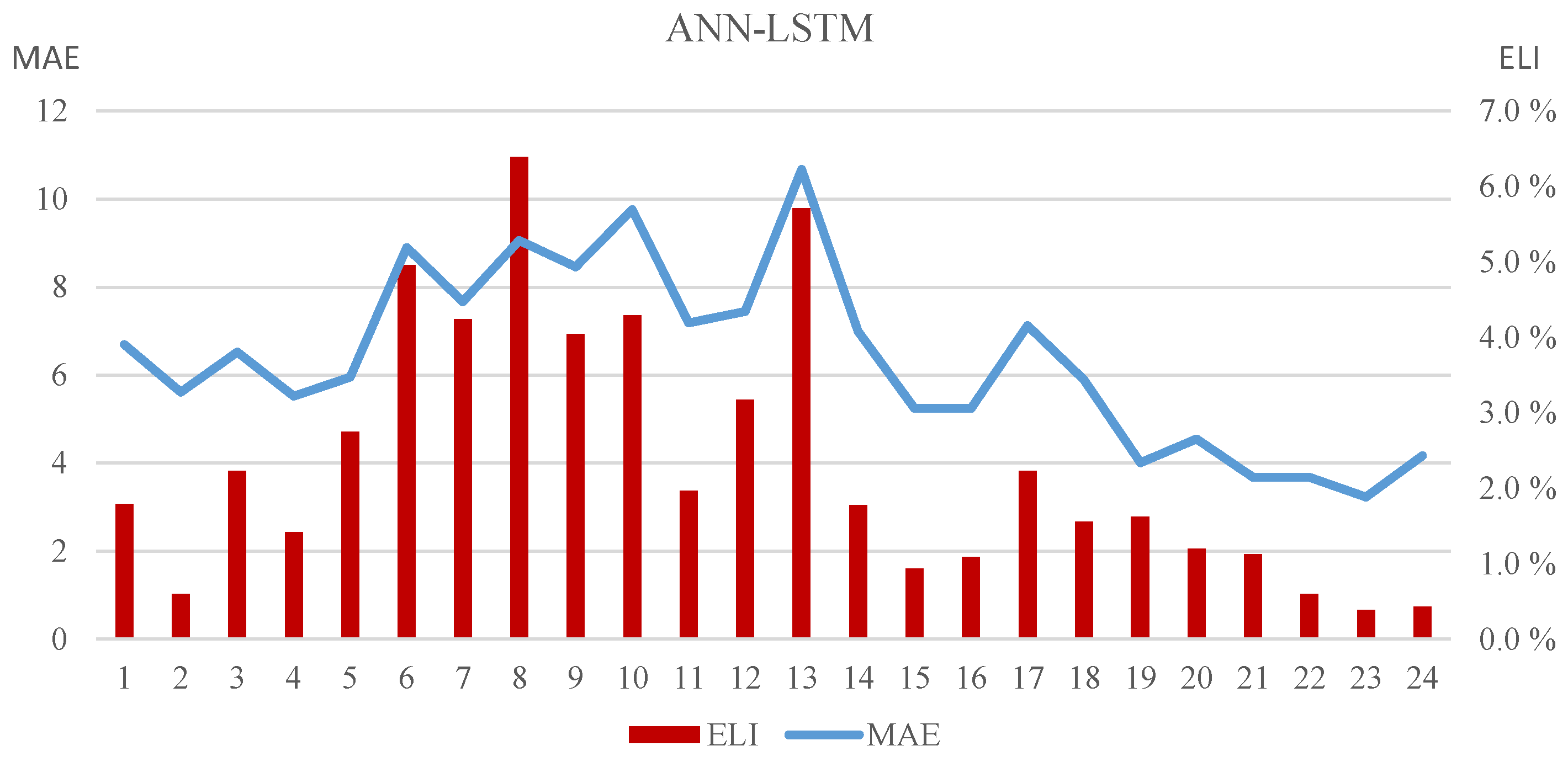

3. Results and Discussion

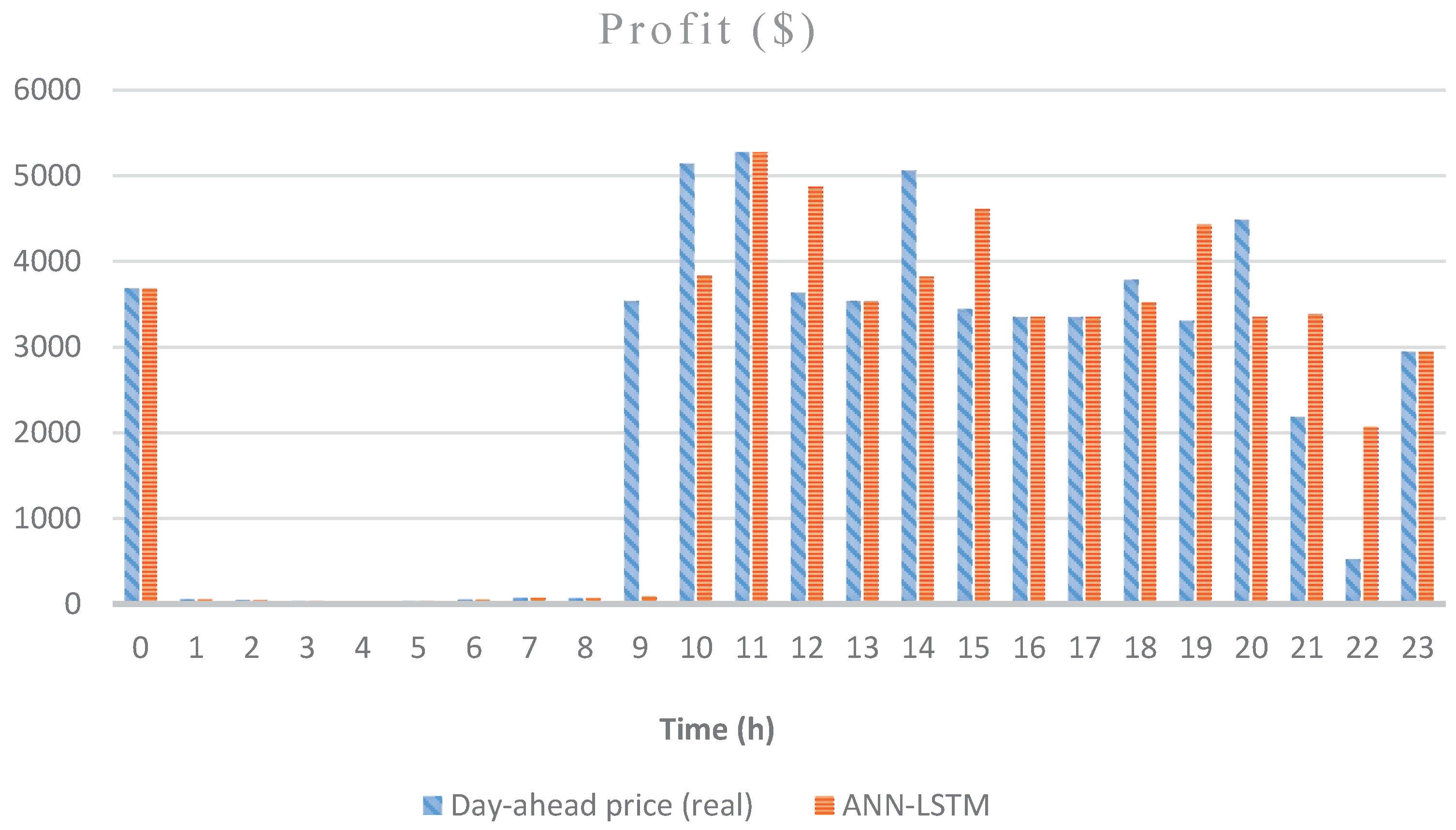

3.1. Profit Loss Comparison

3.2. Seasonal Performance Comparison

3.3. Energy Price Profile and Production Scheduling

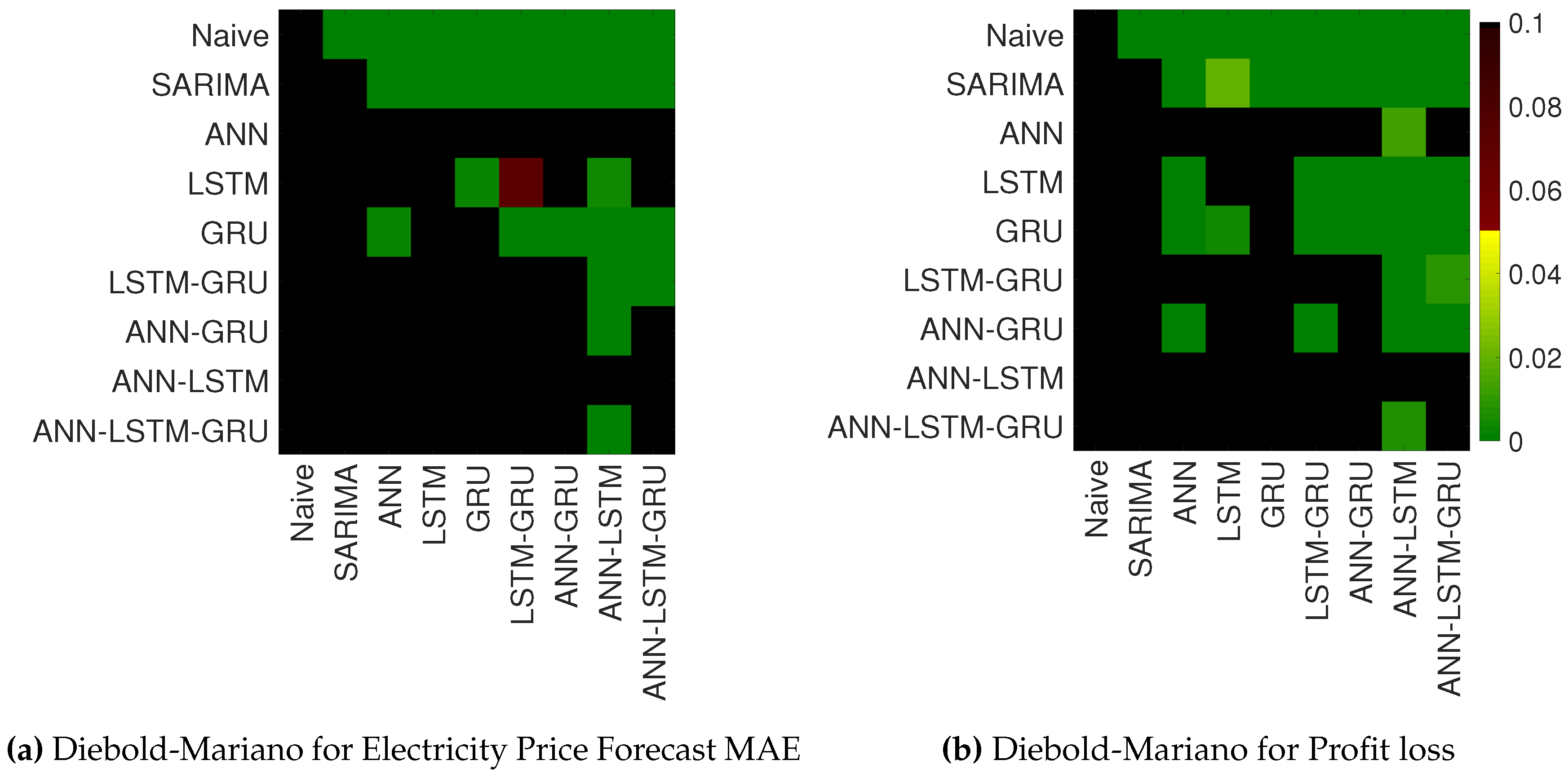

3.4. Diebold-Mariano Tests

4. Conclusions

Author Contributions

Funding

Acknowledgments

Conflicts of Interest

Appendix A. Mathematical Model

| Set Values | |

|---|---|

| M | Plants of the hydro generating company |

| T | Time periods (hour) {1,.., T} |

| K | Performance curves {1,..,K} |

| L | Set of blocks relating to the performance curve {1,.., L} |

| Upstream reservoirs of plant i |

| Parameters | |

|---|---|

| M | Conversion factor (3.6 × Hms/mh) |

| Forecasted price of energy in period t ($/MWh) | |

| Capacity of plant i (MW) | |

| Minimum power output of plant i for performance curve k (MW) | |

| Start-up cost of plant i | |

| Minimum water discharge of plant i (mh/s) | |

| Maximum water discharge of block l of plant i (m/s) | |

| Forecasted natural water inflow of the reservoir associated to plant i in period t (Hm/h) | |

| Initial water content of the reservoir associated to plant i (Hm) | |

| Final water content of the reservoir associated to plant i (Hm) | |

| Lower bound of the water content pertaining to the reservoir of plant i (Hm) | |

| Upper bound of the water content to the kth performance curve of plant i (Hm) | |

| The slope of the lth block of the kth performance curve of plant i (MW/m/s) | |

| Time delay between reservoir of plant i and plant j (h) | |

| Maximum spillage of the reservoir associated to plant i (m/s) |

| Decision Variables | |

|---|---|

| 0/1 variable used for the discretization of the performance curve k | |

| 0/1 variable which is equal to 1 if plant i is on-line in period t | |

| 0/1 variable which is equal to 1 if plant i is started-up at the beginning of period t | |

| 0/1 variable which is equal to 1 if plant i is shut-down at the beginning of period t | |

| 0/1 variable which is equal to 1 if water discharged i has exceeded block l in period t | |

| Power output of plant i in period t (MW) | |

| Spillage of the reservoir associated to plant i in period t (m/s) | |

| Water discharge of plant i in period t (m/s) | |

| Water discharge of block l of plant i in period t (m/s) | |

| Water content of the reservoir associated to plant i in period t (Hm) |

References

- Weron, R. Electricity price forecasting: A review of the state-of-the-art with a look into the future. Int. J. Forecast. 2014, 30, 1030–1081. [Google Scholar] [CrossRef]

- Nogales, F.J.; Contreras, J.; Conejo, A.J.; Espínola, R. Forecasting next-day electricity prices by time series models. IEEE Trans. Power Syst. 2002, 17, 342–348. [Google Scholar] [CrossRef]

- Ziel, F.; Weron, R. Day-ahead electricity price forecasting with high-dimensional structures: Univariate vs. multivariate modeling frameworks. Energy Econ. 2018, 70, 396–420. [Google Scholar] [CrossRef] [Green Version]

- Lago, J.; De Ridder, F.; De Schutter, B. Forecasting spot electricity prices: Deep learning approaches and empirical comparison of traditional algorithms. Appl. Energy 2018, 221, 386–405. [Google Scholar] [CrossRef]

- Ugurlu, U.; Oksuz, I.; Tas, O. Electricity Price Forecasting Using Recurrent Neural Networks. Energies 2018, 11, 1255. [Google Scholar] [CrossRef]

- Ziel, F. Forecasting electricity spot prices using lasso: On capturing the autoregressive intraday structure. IEEE Trans. Power Syst. 2016, 31, 4977–4987. [Google Scholar] [CrossRef]

- Ludwig, N.; Feuerriegel, S.; Neumann, D. Putting Big Data analytics to work: Feature selection for forecasting electricity prices using the LASSO and random forests. J. Decis. Syst. 2015, 24, 19–36. [Google Scholar] [CrossRef]

- Neupane, B.; Woon, W.; Aung, Z. Ensemble Prediction Model with Expert Selection for Electricity Price Forecasting. Energies 2017, 101, 77. [Google Scholar] [CrossRef]

- Alamaniotis, M.; Bargiotas, D.; Bourbakis, N.G.; Tsoukalas, L.H. Genetic Optimal Regression of Relevance Vector Machines for Electricity Pricing Signal Forecasting in Smart Grids. IEEE Trans. Smart Grid 2015, 6, 2997–3005. [Google Scholar] [CrossRef]

- Shrivastava, N.A.; Panigrahi, B.K. A hybrid wavelet-ELM based short term price forecasting for electricity markets. Int. J. Electr. Power Energy Syst. 2014, 55, 41–50. [Google Scholar] [CrossRef]

- Chaâbane, N. A hybrid ARFIMA and neural network model for electricity price prediction. Int. J. Electr. Power Energy Syst. 2014, 55, 187–194. [Google Scholar] [CrossRef]

- Hong, Y.Y.; Wu, C.P. Day-ahead electricity price forecasting using a hybrid principal component analysis network. Energies 2012, 5, 4711–4725. [Google Scholar] [CrossRef]

- Keles, D.; Genoese, M.; Möst, D.; Fichtner, W. Comparison of extended mean-reversion and time series models for electricity spot price simulation considering negative prices. Energy Econ. 2012, 34, 1012–1032. [Google Scholar] [CrossRef]

- Bordignon, S.; Bunn, D.W.; Lisi, F.; Nan, F. Combining day-ahead forecasts for British electricity prices. Energy Econ. 2013, 35, 88–103. [Google Scholar] [CrossRef] [Green Version]

- Aggarwal, S.K.; Saini, L.M.; Kumar, A. Electricity price forecasting in deregulated markets: A review and evaluation. Int. J. Electr. Power Energy Syst. 2009, 31, 13–22. [Google Scholar] [CrossRef]

- Li, T.; Shahidehpour, M. Price-based unit commitment: A case of Lagrangian relaxation versus mixed integer programming. IEEE Trans. Power Syst. 2005, 20, 2015–2025. [Google Scholar] [CrossRef]

- Delarue, E.; Van Den Bosch, P.; D’haeseleer, W. Effect of the accuracy of price forecasting on profit in a price based unit commitment. Electr. Power Syst. Res. 2010, 80, 1306–1313. [Google Scholar] [CrossRef]

- Zareipour, H.; Canizares, C.A.; Bhattacharya, K. Economic impact of electricity market price forecasting errors: A demand-side analysis. IEEE Trans. Power Syst. 2010, 25, 254–262. [Google Scholar] [CrossRef]

- Mohammadi-Ivatloo, B.; Zareipour, H.; Ehsan, M.; Amjady, N. Economic impact of price forecasting inaccuracies on self-scheduling of generation companies. Electr. Power Syst. Res. 2011, 81, 617–624. [Google Scholar] [CrossRef]

- Mathaba, T.; Xia, X.; Zhang, J. Analysing the economic benefit of electricity price forecast in industrial load scheduling. Electr. Power Syst. Res. 2014, 116, 158–165. [Google Scholar] [CrossRef]

- Doostmohammadi, A.; Amjady, N.; Zareipour, H. Day-Ahead Financial Loss/Gain Modeling and Prediction for a Generation Company. IEEE Trans. Power Syst. 2017, 32, 3360–3372. [Google Scholar] [CrossRef]

- Conejo, A.J.; Nogales, F.J.; Arroyo, J.M. Price-taker bidding strategy under price uncertainty. IEEE Trans. Power Syst. 2002, 17, 1081–1088. [Google Scholar] [CrossRef] [Green Version]

- Esmaeily, A.; Ahmadi, A.; Raeisi, F.; Ahmadi, M.R.; Nezhad, A.E.; Janghorbani, M. Evaluating the effectiveness of mixed-integer linear programming for day-ahead hydro-thermal self-scheduling considering price uncertainty and forced outage rate. Energy 2017, 122, 182–193. [Google Scholar] [CrossRef]

- Ahmadi, A.; Aghaei, J.; Shayanfar, H.A.; Rabiee, A. Mixed integer programming of multiobjective hydro-thermal self scheduling. Appl. Soft Comput. 2012, 12, 2137–2146. [Google Scholar] [CrossRef]

- Karami, M.; Shayanfar, H.; Aghaei, J.; Ahmadi, A. Mixed integer programming of security-constrained daily hydrothermal generation scheduling (SCDHGS). Sci. Iran. Trans. D Comput. Sci. Eng. Electr. 2013, 20, 2036. [Google Scholar]

- IEEE. IEEE 118-Bus Test System. Available online: http://motor.ece.iit.edu/data (accessed on 5 June 2018).

- Bisanovic, S.; Hajro, M.; Dlakic, M. Hydrothermal self-scheduling problem in a day-ahead electricity market. Electr. Power Syst. Res. 2008, 78, 1579–1596. [Google Scholar] [CrossRef]

- Yamin, H.; Shahidehpour, S. Self-scheduling and energy bidding in competitive electricity markets. Electr. Power Syst. Res. 2004, 71, 203–209. [Google Scholar] [CrossRef]

- Shahidehpour, M.; Yamin, H.; Li, Z. Market Operations in Electric Power Systems: Forecasting, Scheduling, and Risk Management; IEEE: New York, NY, USA, 2003. [Google Scholar]

- Hayfavi, A.; Talasli, I. Stochastic multifactor modeling of spot electricity prices. J. Comput. Appl. Math. 2014, 259, 434–442. [Google Scholar] [CrossRef]

- Özyildirim, C.; Beyazit, M.F. Forecasting and modelling of electricity prices by radial basis functions: Turkish electricity market experiment. Iktisat Isletme ve Finans 2014, 29, 31–54. [Google Scholar] [CrossRef]

- Ugurlu, U.; Tas, O.; Gunduz, U. Performance of Electricity Price Forecasting Models: Evidence from Turkey. Emerg. Mark. Finance Trade 2018, 54, 1720–1739. [Google Scholar] [CrossRef]

- Díaz, G.; Planas, E. A note on the normalization of Spanish electricity spot prices. IEEE Trans. Power Syst. 2016, 31, 2499–2500. [Google Scholar] [CrossRef]

- Hryshchuk, A.; Lessmann, S. Deregulated day-ahead electricity markets in Southeast Europe: Price forecasting and comparative structural analysis. SSRN Electr. J. 2018. [Google Scholar] [CrossRef]

- Avci-Surucu, E.; Aydogan, A.K.; Akgul, D. Bidding structure, market efficiency and persistence in a multi-time tariff setting. Energy Econ. 2016, 54, 77–87. [Google Scholar] [CrossRef] [Green Version]

- Ozozen, A.; Kayakutlu, G.; Ketterer, M.; Kayalica, O. A combined seasonal ARIMA and ANN model for improved results in electricity spot price forecasting: Case study in Turkey. In Proceedings of the 2016 Portland International Conference on Management of Engineering and Technology (PICMET), Honolulu, HI, USA, 4–8 September 2016; pp. 2681–2690. [Google Scholar]

- EPDK (Republic of Turkey Energy Market Regulatory). Available online: http://www.epdk.org.tr/TR/Dokumanlar/Elektrik/YayinlarRaporlar/ElektrikPiyasasiGelisimRaporu (accessed on 23 May 2018).

- Filipovic, D.; Larsson, M.; Ware, T. Polynomial processes for power prices. arXiv, 2017; arXiv:1710.10293. [Google Scholar] [CrossRef]

- Fanone, E.; Gamba, A.; Prokopczuk, M. The case of negative day-ahead electricity prices. Energy Econ. 2013, 35, 22–34. [Google Scholar] [CrossRef]

- EPIAS. Epias Transparency Platform. Available online: https://seffaflik.epias.com.tr/transparency (accessed on 12 May 2018).

- Conejo, A.J.; Plazas, M.A.; Espinola, R.; Molina, A.B. Day-ahead electricity price forecasting using the wavelet transform and ARIMA models. IEEE Trans. Power Syst. 2005, 20, 1035–1042. [Google Scholar] [CrossRef]

- Taylor, J.W. Triple seasonal methods for short-term electricity demand forecasting. Eur. J. Oper. Res. 2010, 204, 139–152. [Google Scholar] [CrossRef] [Green Version]

- Keles, D.; Scelle, J.; Paraschiv, F.; Fichtner, W. Extended forecast methods for day-ahead electricity spot prices applying artificial neural networks. Appl. Energy 2016, 162, 218–230. [Google Scholar] [CrossRef]

- Mandal, P.; Senjyu, T.; Funabashi, T. Neural networks approach to forecast several hour ahead electricity prices and loads in deregulated market. Energy Conv. Manag. 2006, 47, 2128–2142. [Google Scholar] [CrossRef]

- Kolmek, M.A.; Navruz, I. Forecasting the day-ahead price in electricity balancing and settlement market of Turkey by using artificial neural networks. Turk. J. Electr. Eng. Comput. Sci. 2015, 23, 841–852. [Google Scholar] [CrossRef]

- Diebold, F.X.; Mariano, R.S. Comparing Predictive Accuracy. J. Bus. Econ. Stat. 1995, 13, 253–263. [Google Scholar] [Green Version]

- Nowotarski, J.; Liu, B.; Weron, R.; Hong, T. Improving short term load forecast accuracy via combining sister forecasts. Energy 2016, 98, 40–49. [Google Scholar] [CrossRef]

- Kuo, P.H.; Huang, C.J. A High Precision Artificial Neural Networks Model for Short-Term Energy Load Forecasting. Energies 2018, 11, 213. [Google Scholar] [CrossRef]

- Zhang, G.P. Time series forecasting using a hybrid ARIMA and neural network model. Neurocomputing 2003, 50, 159–175. [Google Scholar] [CrossRef]

- Uniejewski, B.; Nowotarski, J.; Weron, R. Automated variable selection and shrinkage for day-ahead electricity price forecasting. Energies 2016, 9, 621. [Google Scholar] [CrossRef]

| Hours | Mean | Standard Deviation | Lower Bound | Upper Bound | Median |

|---|---|---|---|---|---|

| 0 | 49.27 | 13.47 | 0.28 | 78.42 | 47.98 |

| 1 | 41.80 | 14.99 | 0.00 | 78.05 | 42.84 |

| 2 | 35.89 | 15.98 | 0.00 | 76.69 | 37.85 |

| 3 | 27.40 | 16.31 | 0.00 | 76.13 | 27.57 |

| 4 | 25.42 | 16.55 | 0.00 | 76.12 | 26.27 |

| 5 | 23.77 | 15.36 | 0.00 | 77.86 | 25.12 |

| 6 | 22.65 | 17.62 | 0.00 | 77.94 | 24.55 |

| 7 | 34.52 | 17.54 | 0.00 | 78.08 | 40.27 |

| 8 | 44.76 | 17.91 | 0.00 | 79.20 | 48.88 |

| 9 | 55.74 | 15.32 | 0.00 | 99.83 | 58.98 |

| 10 | 59.53 | 13.93 | 0.00 | 132.36 | 60.40 |

| 11 | 62.66 | 13.20 | 0.32 | 127.62 | 63.92 |

| 12 | 51.64 | 15.30 | 0.32 | 99.26 | 51.11 |

| 13 | 54.27 | 14.18 | 1.71 | 99.26 | 55.14 |

| 14 | 57.26 | 14.51 | 0.36 | 113.16 | 59.41 |

| 15 | 55.13 | 14.27 | 0.36 | 96.14 | 57.41 |

| 16 | 54.12 | 14.34 | 0.34 | 96.14 | 54.23 |

| 17 | 50.80 | 15.56 | 1.70 | 124.03 | 50.69 |

| 18 | 48.85 | 13.46 | 0.27 | 90.88 | 49.25 |

| 19 | 49.24 | 12.15 | 3.60 | 81.36 | 50.66 |

| 20 | 51.56 | 9.75 | 20.52 | 78.66 | 52.30 |

| 21 | 49.16 | 9.78 | 17.88 | 78.61 | 49.33 |

| 22 | 46.30 | 12.58 | 1.59 | 78.74 | 45.26 |

| 23 | 39.17 | 14.34 | 0.00 | 78.42 | 40.41 |

| 24 Weeks | Profit | Profit Loss | ELI | PFDI | MAE |

|---|---|---|---|---|---|

| Actual | 9815726 | - | - | - | - |

| Naïve | 9513169 | 302557 | 0.0308 | 1.6576 | 9.3066 |

| SARIMA | 9576815 | 238911 | 0.0243 | 1.3089 | 8.3289 |

| ANN | 9594006 | 221721 | 0.0226 | 1.2147 | 6.3774 |

| LSTM | 9589966 | 225760 | 0.0230 | 1.2369 | 6.5489 |

| GRU | 9584191 | 231536 | 0.0236 | 1.2685 | 6.4586 |

| LSTM–GRU | 9596195 | 219532 | 0.0224 | 1.2027 | 6.4472 |

| ANN–GRU | 9591269 | 224457 | 0.0229 | 1.2297 | 6.3929 |

| ANN–LSTM | 9599316 | 216410 | 0.0220 | 1.1856 | 6.3851 |

| ANN–LSTM–GRU | 9597754 | 217972 | 0.0222 | 1.1942 | 6.4018 |

© 2018 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (http://creativecommons.org/licenses/by/4.0/).

Share and Cite

Ugurlu, U.; Tas, O.; Kaya, A.; Oksuz, I. The Financial Effect of the Electricity Price Forecasts’ Inaccuracy on a Hydro-Based Generation Company. Energies 2018, 11, 2093. https://doi.org/10.3390/en11082093

Ugurlu U, Tas O, Kaya A, Oksuz I. The Financial Effect of the Electricity Price Forecasts’ Inaccuracy on a Hydro-Based Generation Company. Energies. 2018; 11(8):2093. https://doi.org/10.3390/en11082093

Chicago/Turabian StyleUgurlu, Umut, Oktay Tas, Aycan Kaya, and Ilkay Oksuz. 2018. "The Financial Effect of the Electricity Price Forecasts’ Inaccuracy on a Hydro-Based Generation Company" Energies 11, no. 8: 2093. https://doi.org/10.3390/en11082093