4.1. Hypothesis

The company that runs these plants has not provided specific economic information for this analysis. Therefore, information is taken from literature and government standards developed along with the remuneration system for hydroelectric power plants in Spain under the so-called “Special Regime” (feed-in tariff). Although none of these plants operate under this special scheme, it has been assumed that their cost structure does not differ substantially from similar plants that operate under this regime.

As noted, the selected values remain constant over time, in accordance with the chosen ceteris paribus approach. Therefore, future changes have not been taken into account, such as changes in the electricity market, management upgrades, changes in the plants’ configurations, new technologies, or other variables that could impact the cost and revenue structure.

Two types of economic analyses have been performed, one on operating margins and another on investments. In the first, the costs of civil works and engineering have been omitted, as these plants are in operation and the analysis only considers the investment required to replace machinery, as suggested by the company. This equipment is assigned a useful lifespan of 25 years, based on the regulatory lifespan set out by the Ministerial Order.

With regard to capital costs, a study conducted by the Boston Consulting Group for the Spanish Government has been used [

22], along with the Ministerial Order 1045/2014. This study provides a detailed analysis by installed capacity and plant type, disaggregated by cost category (

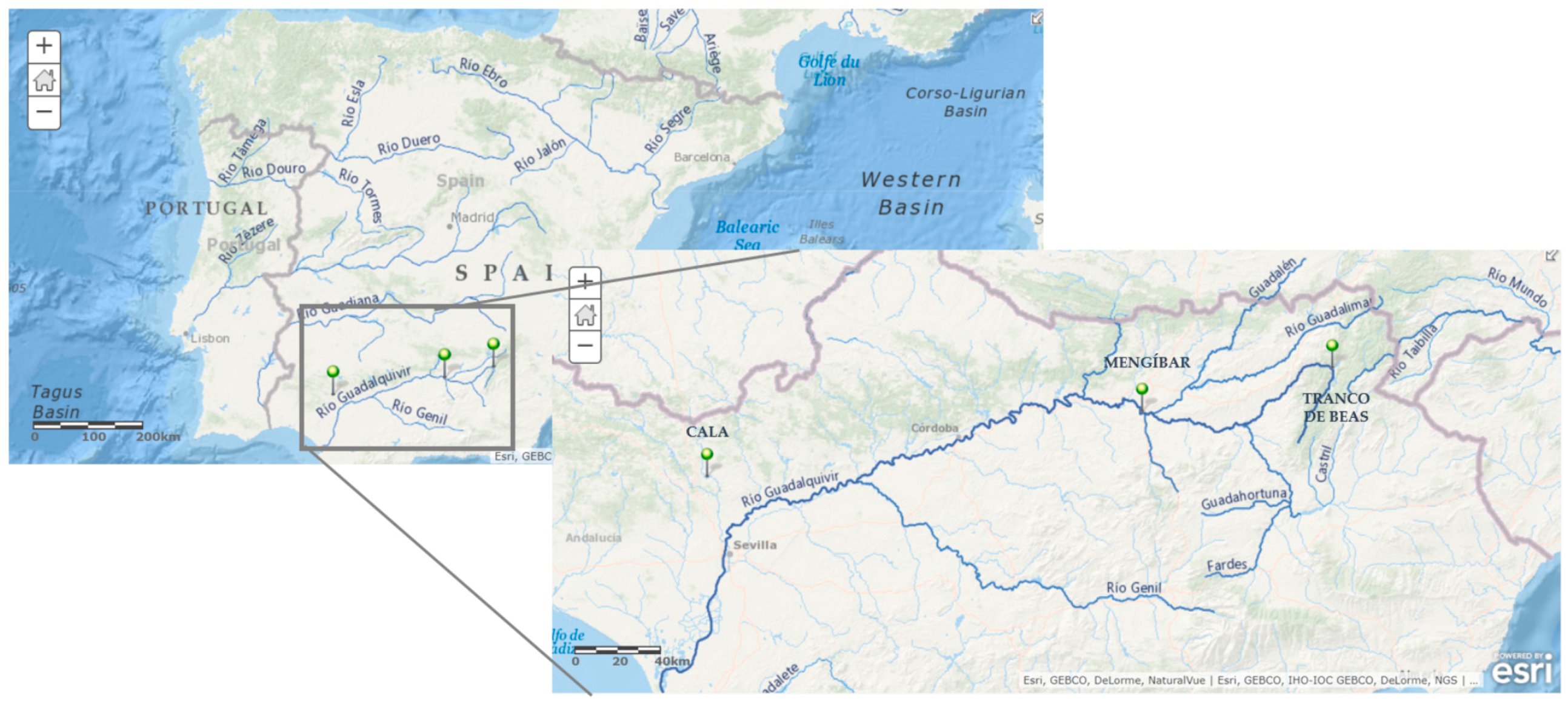

Table 5). A linear interpolation of values has been calculated, with total investment costs of 841 €/kW for Cala, 1572 for Mengíbar, and 759 for Tranco de Beas.

These estimates seem conservative in view of the literature, although the main sources do not offer such a detailed breakdown for Spain. On the other hand, existing studies show significant variations due to the fact that investments costs are, understandably, very different depending on the plant and location. IRENA estimates that 3/4 of investment costs are determined by the local physical characteristics, and gives values of 1000 to 8000 USD/kW for small power stations in the European Union [

23]. More specifically, their curves depicting power and head show higher values than those of IDAE [

22].

Meanwhile, while a study commissioned by the European Commission [

24] do not offer a systematic classification of power, in categories equivalent to the analyzed plants it gives values of 1275–5025 €/kW, 975–1600 for medium sized plants, and 1450–5750 for the largest plants. The values do not greatly differ from those of IDAE, except in the case of Tranco de Beas, where they are substantially higher as, surprisingly, no economies of scale are reported for large plants.

Finally, a paper also commissioned by the Spanish Government [

25] distinguishes between three types of plants, which can be linked to those mentioned here (run-of-river to 10 MW, storage plants of less than 10 MW, and storage plants of between 10 and 50 MW). Investment costs fluctuate between 2000, 1400, and 1100 €/kW, greater than those of IDAE [

22].

For the estimation of operation and maintenance costs, IDAE [

22] has been chosen in line with Order 1045/2014, which includes a separate analysis per plant type, size, and commissioning date. In this regard, costs are fixed per unit of power (between 40–50 €/MW, according to IDAE and are then adjusted for each plant so that historical costs per MWh produced resemble as closely as possible the estimates of Ministerial Order 1045/2014.

In the case of Tranco, corrections have been made, as the plant is operating well below capacity, and only two of the three groups are operating stably. It has therefore been estimated that operation and maintenance costs are 2/3 of what would correspond to the plant’s theoretical installed capacity.

These data are consistent with the literature, despite the fact that there are very different reference values, given the large disparity in costs for hydroelectric plants depending on the type, size, and location. Furthermore, many of the pertinent papers have a different scope and consider different cost categories.

IRENA [

23], for example, estimates a similar range of costs, of 45 to 53 USD/kW/year. De Jager et al. [

24] give lower values for Europe, of 35 €/kW for the largest plants, and 40 €/kW for the smaller ones.

Several taxes have been considered in the assessment. The tax on electricity production has been taken into account, introduced by Law 15/2012, which records production and incorporation into the Spanish Electricity System (at a rate of 7% of the total revenues obtained by the taxpayer). Also considered is the currently applicable charge for the use of inland water for energy production (2.2% in plants of less than 50 MW, owing to article 8 of Royal Decree 198/2015). Finally, a charge of the Water Confederation, estimated at 3% (the value is not published in the concession), is added.

Of lesser importance, local taxes such as those on economic activities and property have not been taken into account. The Special Tax on electricity has not been considered, given that in its current form it taxes energy supply for consumption, rather than production. Finally, the Added Value tax is not included, due to its neutral impact on businesses.

Regarding revenue, Order 1045/2014 assumes an average market price of 52 €/MWh from 2017 which has served as the primary reference. However, some hydroelectric power plants, due to their operational capacity can choose the time to produce considering existing prices in the electricity market. To take this into consideration, an alignment ratio has been calculated to reflect the difference between the average daily electricity market price since 2011, and the weighted average that hydroelectric energy has been sold at (

Table 6). This ratio is estimated at 6.672%, and has been applied to all of the analyzed centers, as it has been calculated with data from all existing hydroelectric power stations.

By reason of the ceteris paribus approach explained above, these costs and revenues remain stable over time. It has also been assumed that concessions do not change over time, as any change in the company managing concessions is not relevant to the objectives of this study. Similarly, no costs related to the hypothetical end of operating life of the plants have been considered.

4.2. Analysis of Operating Margin

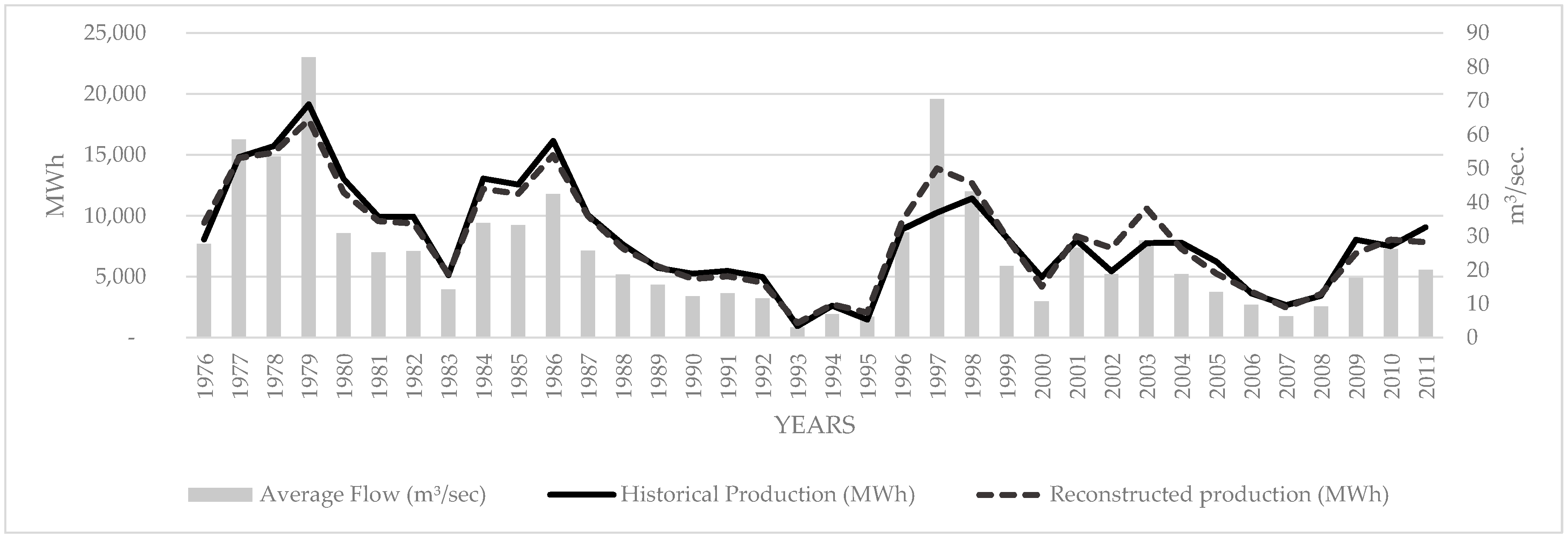

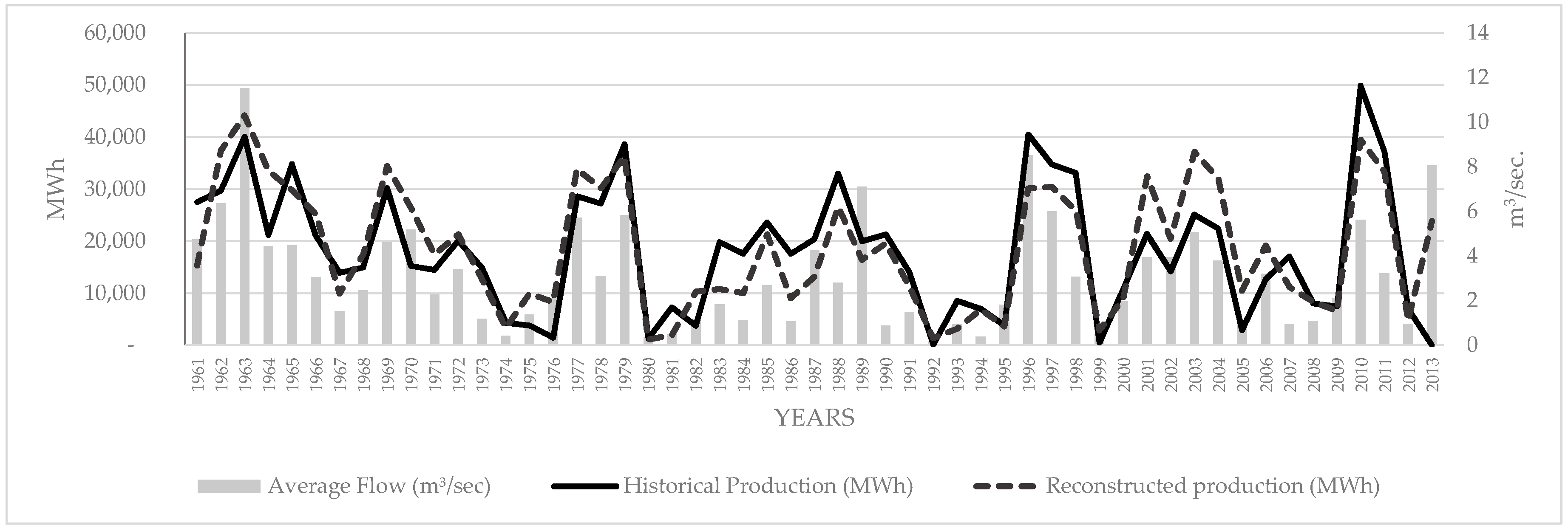

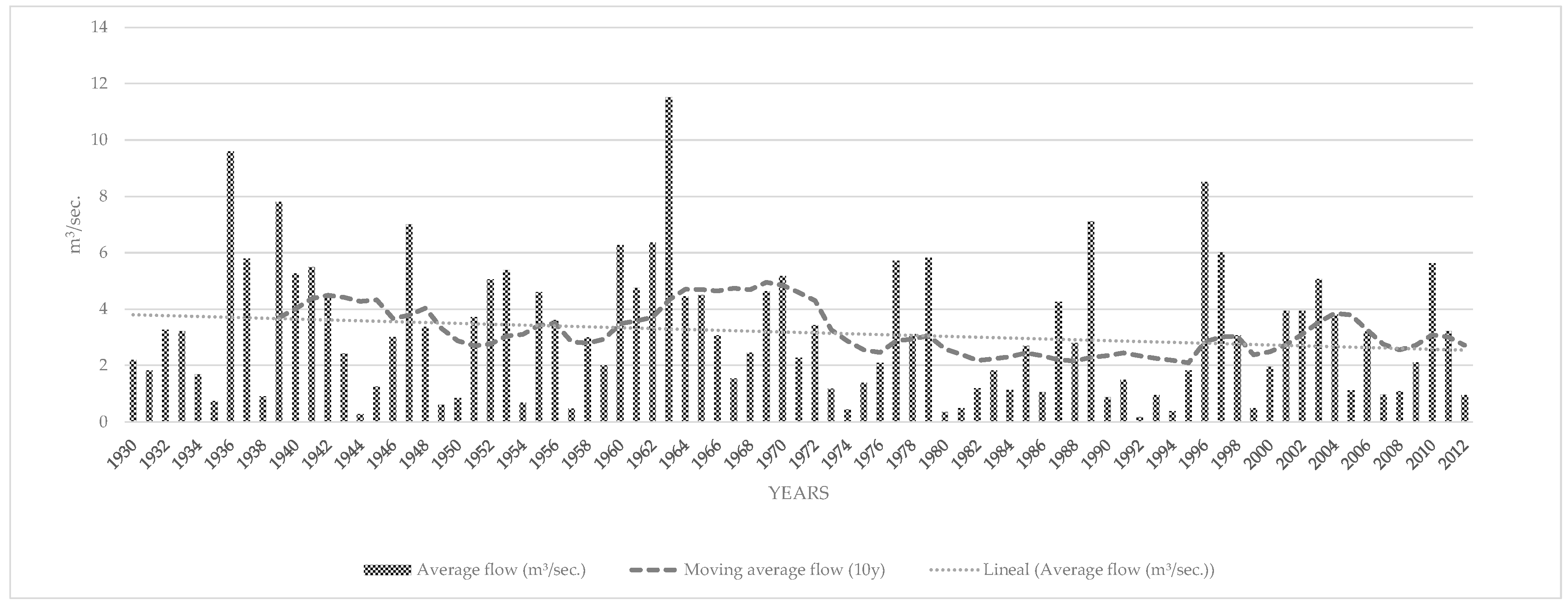

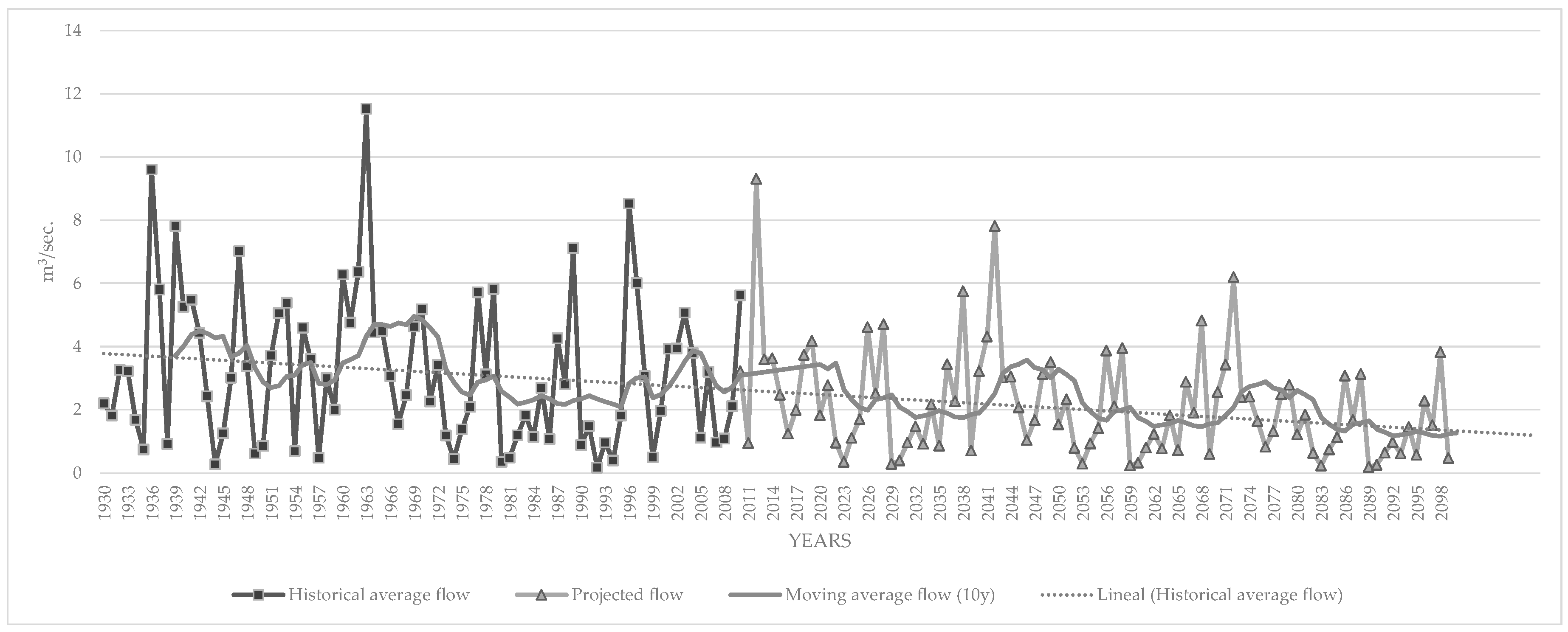

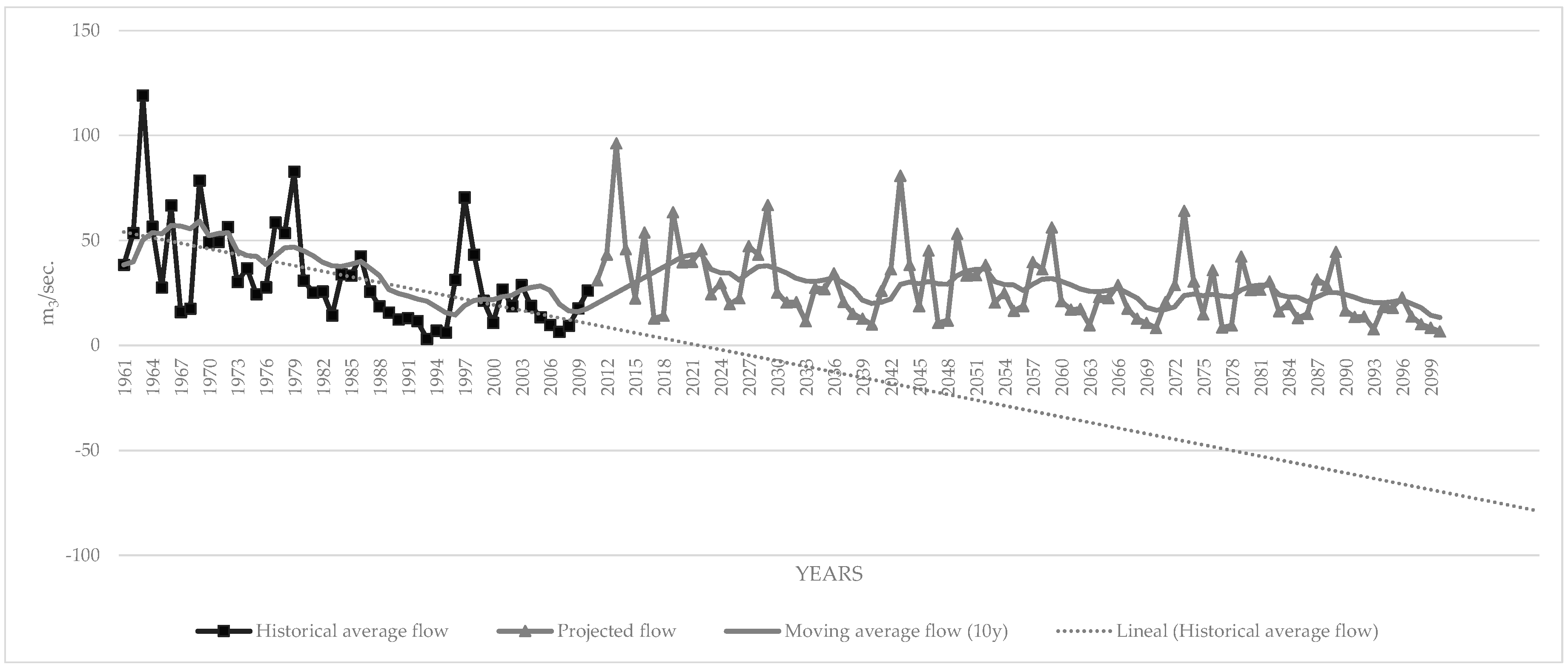

With these presuppositions in mind, results concerning the plants’ margins are shown below. The period from 1961–1990, on which CEDEX projections are based, is considered a Business As Usual scenario, and has been compared with the results for all plants for each distinct scenario.

As shown in the historical period, in accordance with the above-mentioned hypotheses, Mengíbar is the center with the highest operating profit. This is because it is the center with the best ratio of production to installed power capacity, and operating and maintenance costs have been estimated as fixed. Tranco de Beas shows the worst results, as it needs a higher capacity factor per unit of electricity produced, when valued in light of its historical performance.

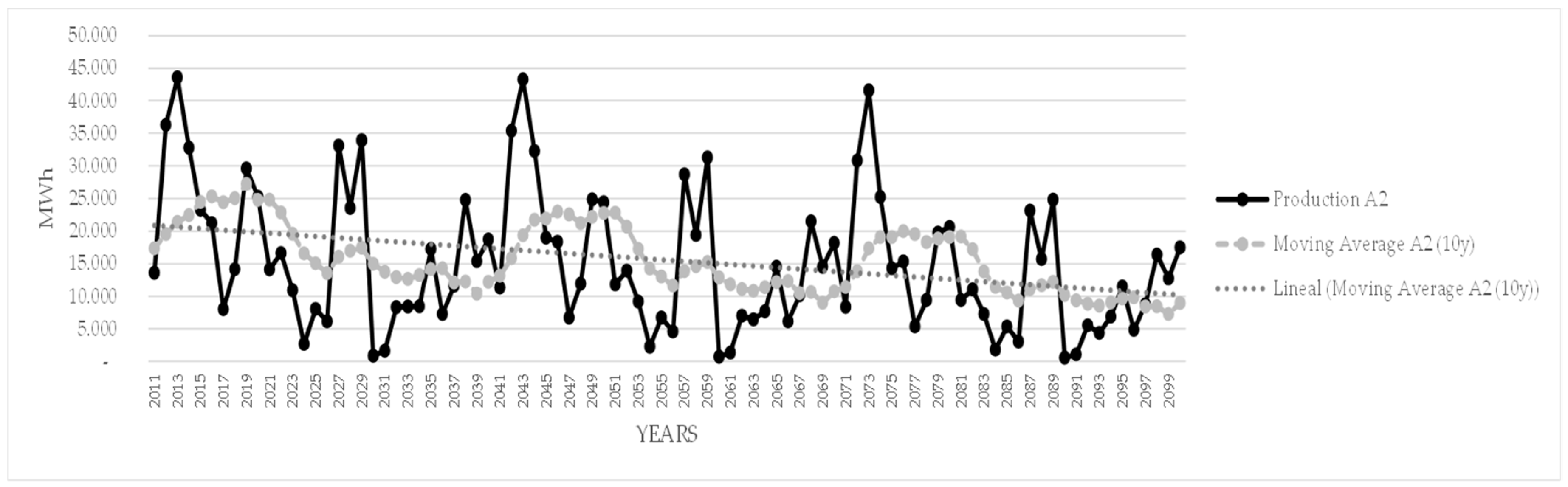

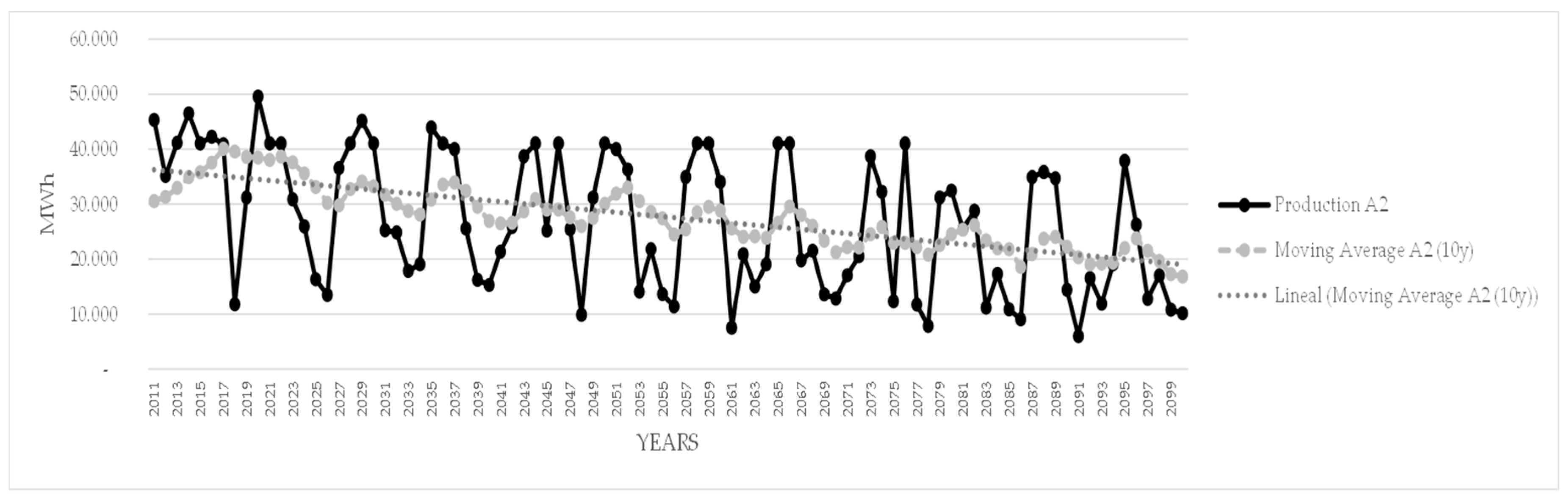

Concerning future evolution, in the A2 scenario the two plants with a reservoir, Cala and Tranco de Beas, end up being unprofitable. In the B2 scenario this only occurs with Tranco de Beas. Mengíbar is, once again, the least affected plant as the projections show a small drop in production and because it is, historically, the plant with better operating margins. The results are shown in

Table 7.

If the analysis is disaggregated by periods of time, (as shown in

Table 8) in scenario A2, Cala would cease to have a positive margin for the period of 2041–2070, and Tranco the Beas even from 2011–2040. In the B2 scenario, Cala would continue to be profitable while Tranco would be unprofitable again from the first period (2011–2040).