Economic Feasibility Analysis for Renewable Energy Project Using an Integrated TFN–AHP–DEA Approach on the Basis of Consumer Utility

Abstract

:1. Introduction

2. Background of the Study

2.1. The Related Literature

2.2. Method Description

- (1)

- Because of the different influences of the input and output values, the proposed method utilizes the AHP to calculate the weights.

- (2)

- The traditional AHP method uses a lack of linguistic variables; thus the proposed method can avoid information distortion by combining TFNs with the AHP method.

- (3)

- The common cost analysis methods generally require function expression and database normalization, while the DEA method does not have to take these into consideration. Additionally, most scholars have been studying cost analysis from the investor’s perspective rather than from the consumer’s perspective. The DEA method is significant for the consumers’ decision. It is utilized in the comparison analysis, sensitivity analysis and efficiency analysis.

- (4)

- The conventional DEA model can only process precise data. To reflect decision-makers’ subjective judgments, the TFN–AHP–DEA method can calculate fuzzy data, which is obtained by specialists.

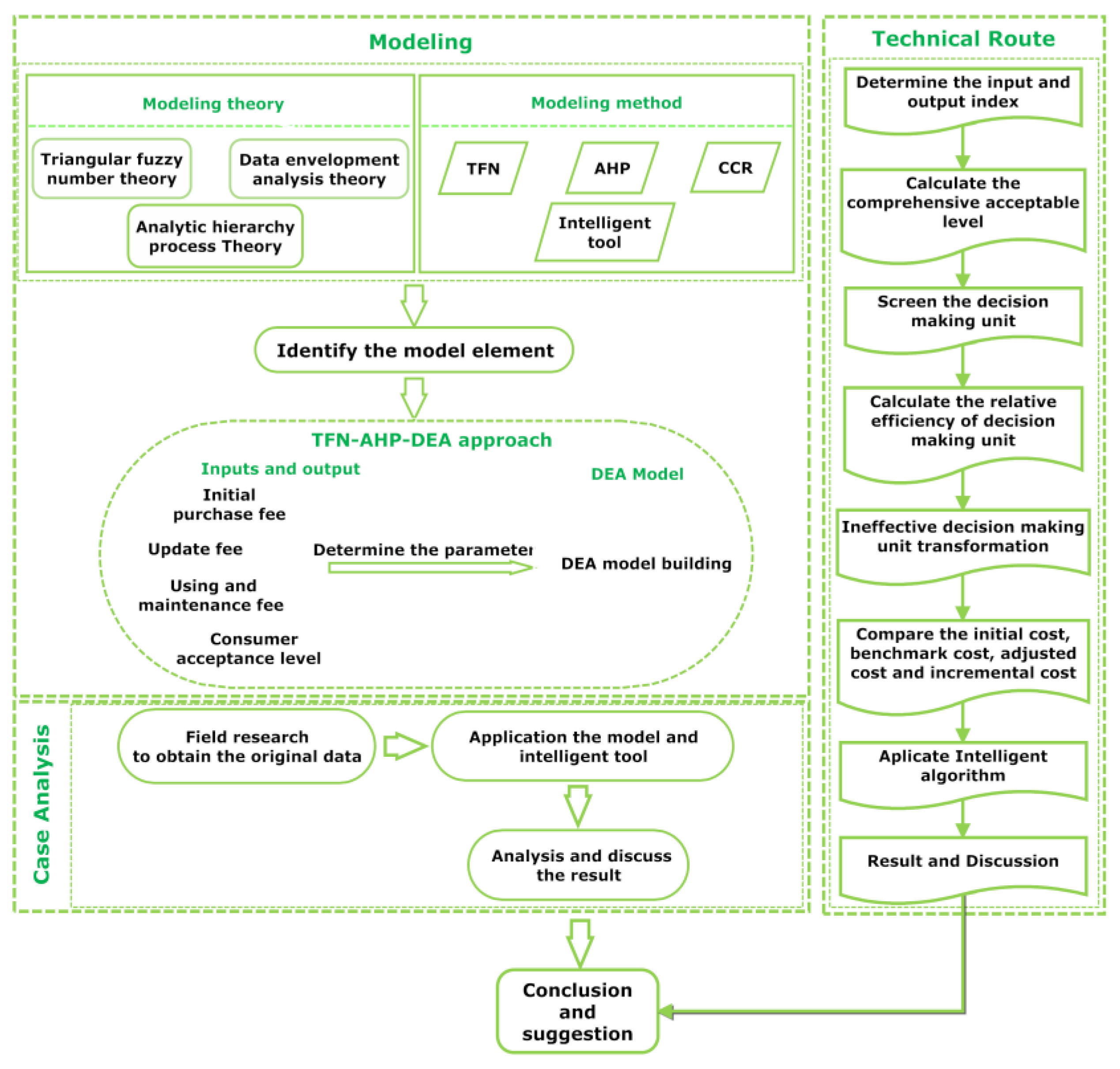

2.3. Proposed Research Framework

3. TFN–AHP–DEA Approach

3.1. Approach Preparation

3.2. Consumer Acceptable Level Calculation

3.2.1. Index Weight Determination

3.2.2. Comprehensive Acceptable Level Calculation

3.3. DEA Model Building

3.3.1. C2R Model

3.3.2. Ineffective Decision-Making Unit Transformation

3.3.3. Adjusted Cost Calculation

3.3.4 Incremental Cost Calculation

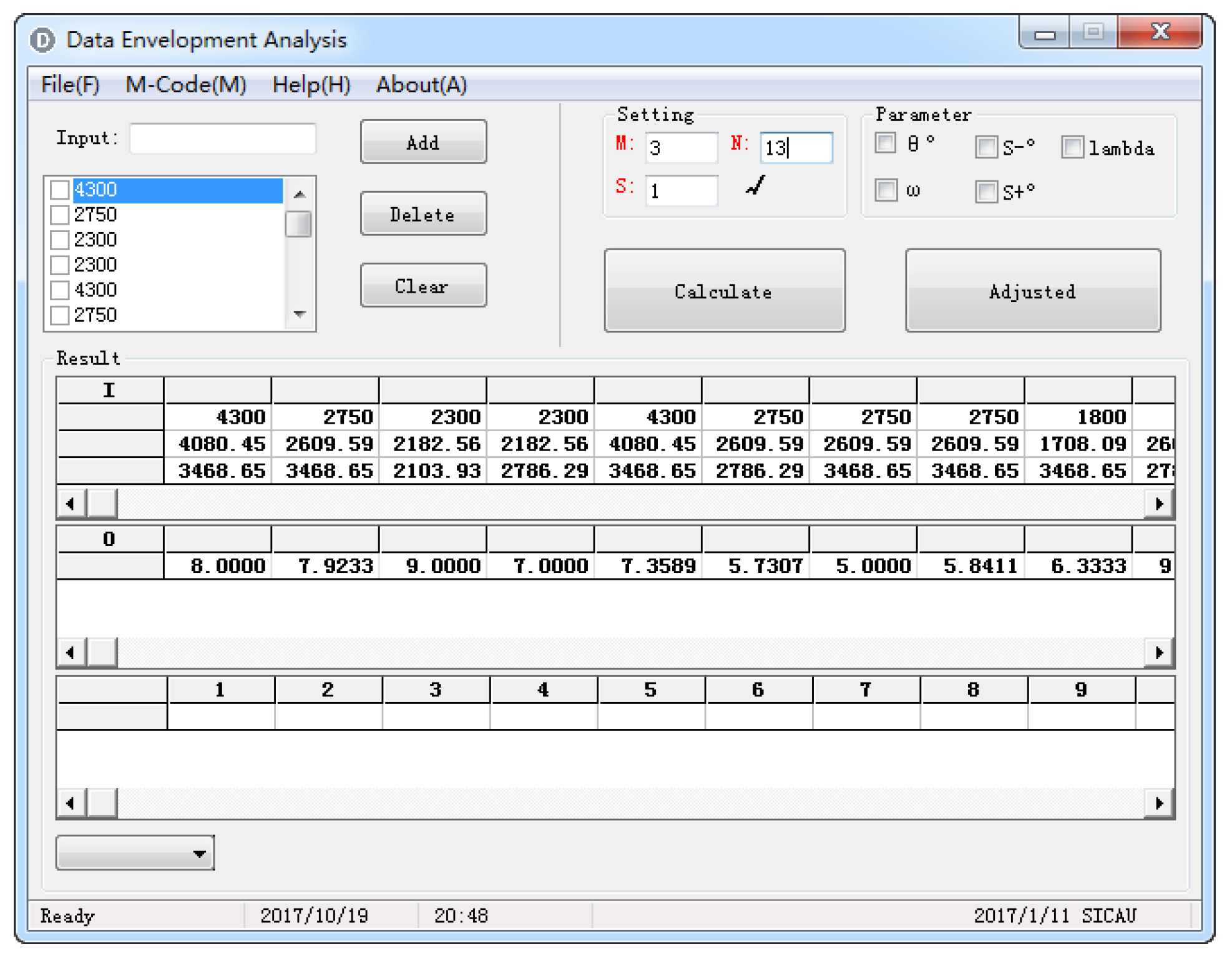

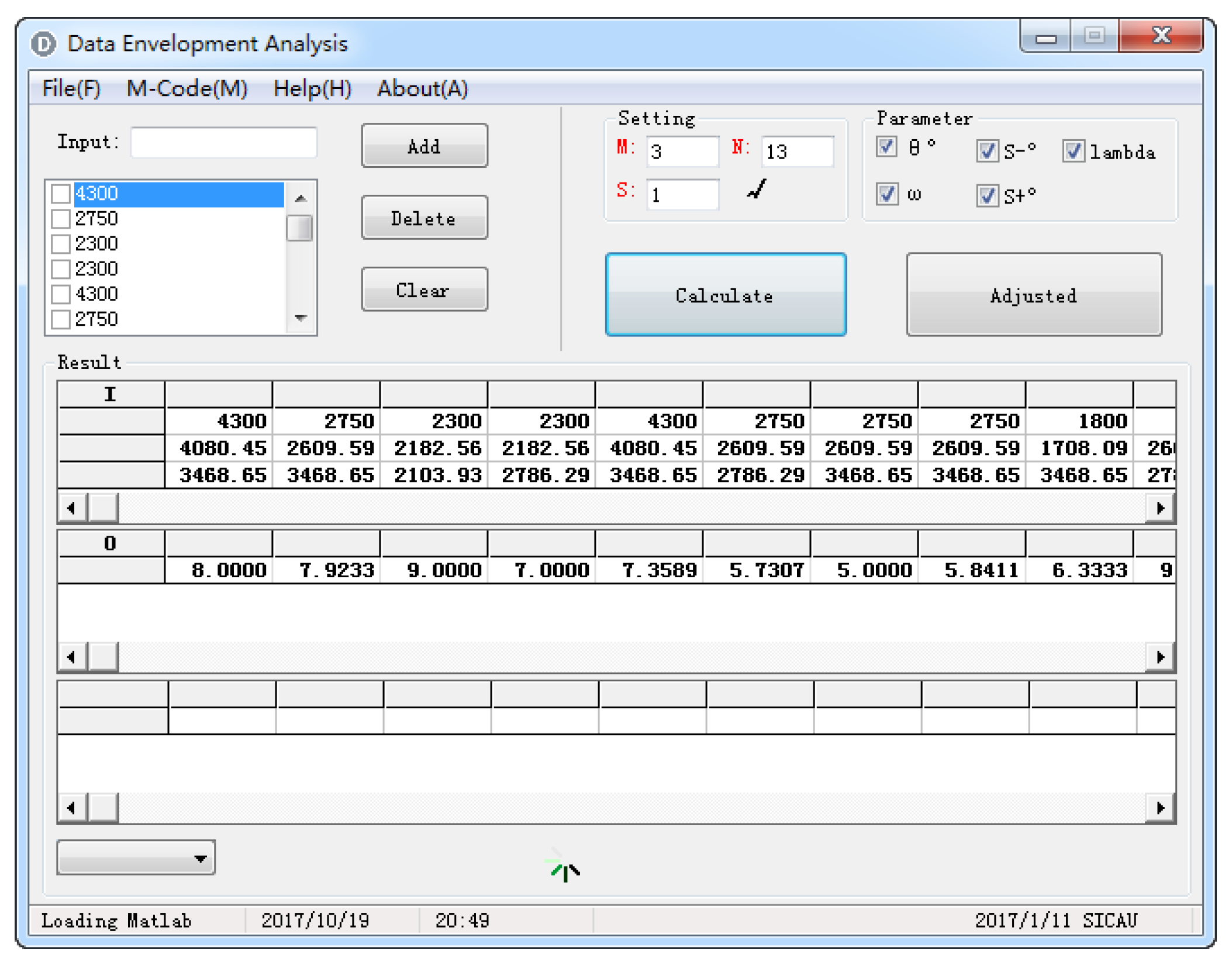

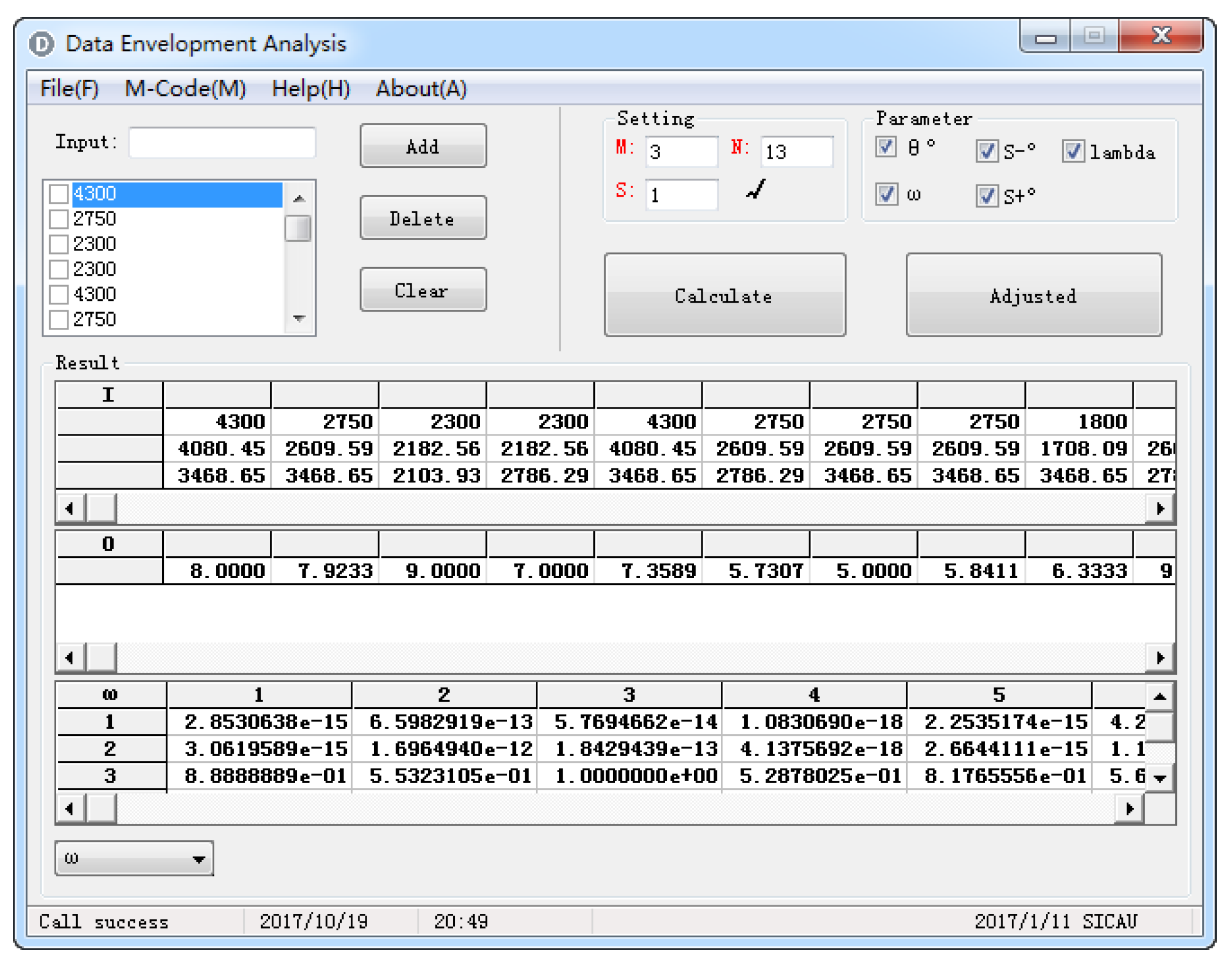

4. CBII Design

4.1. Data Import

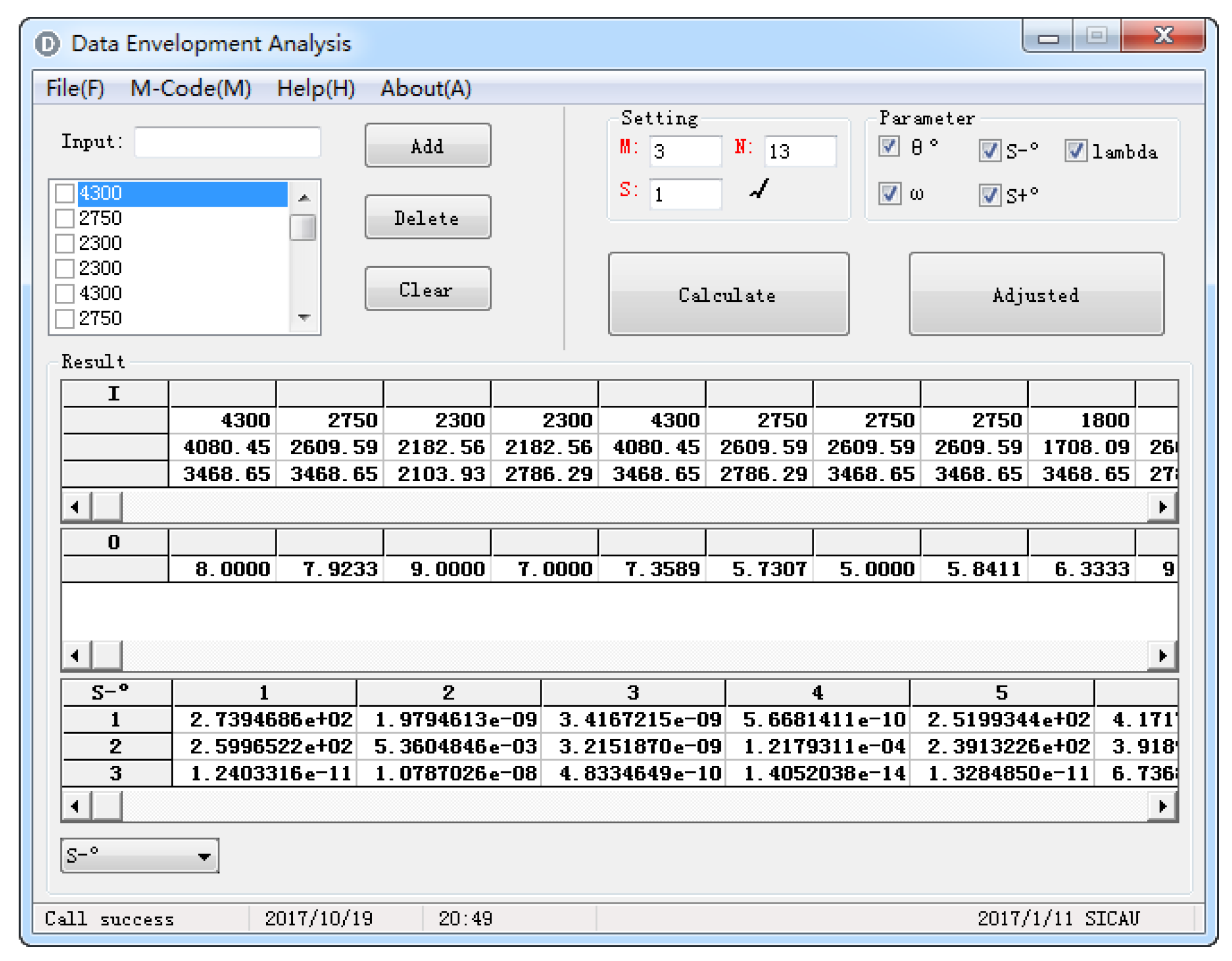

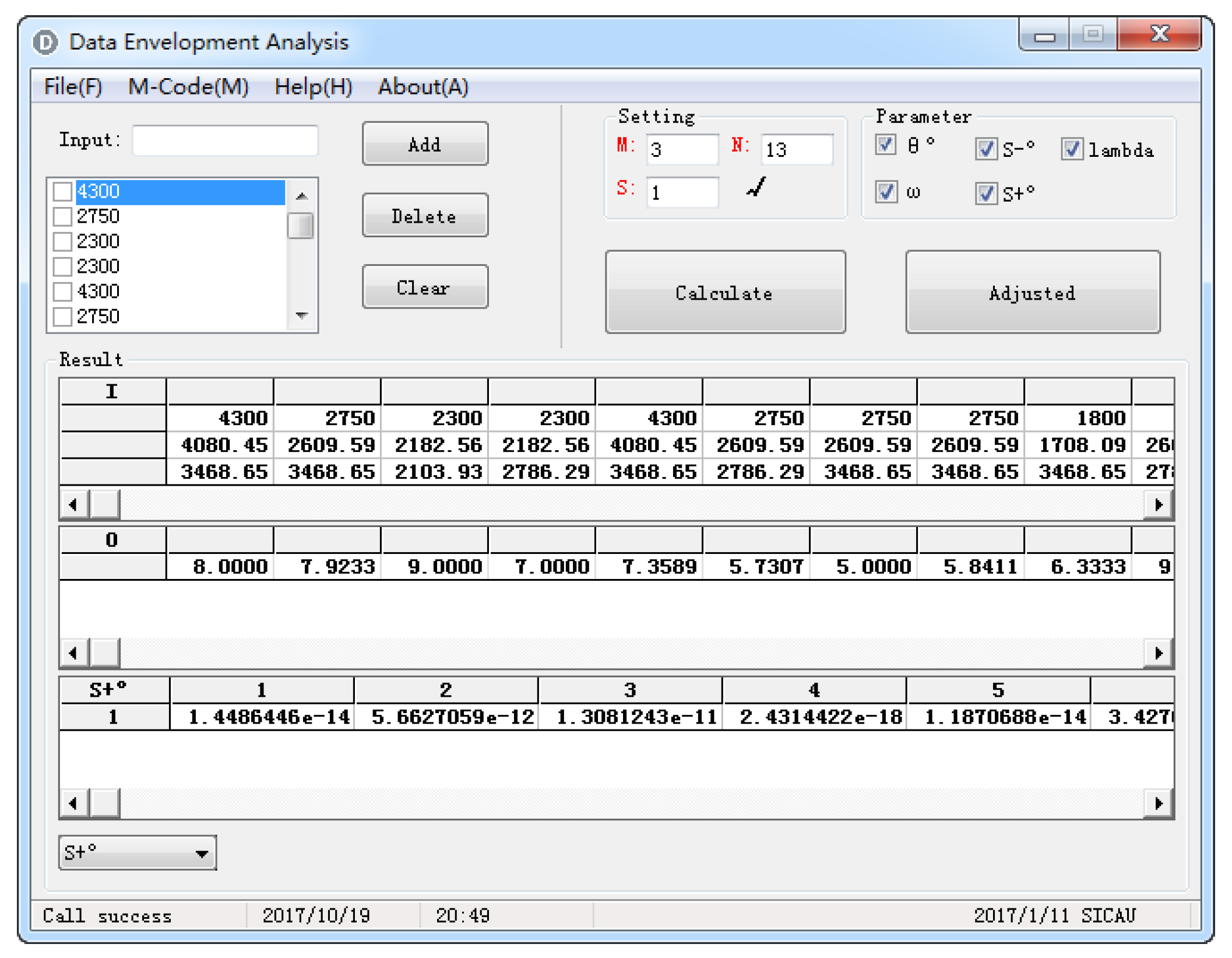

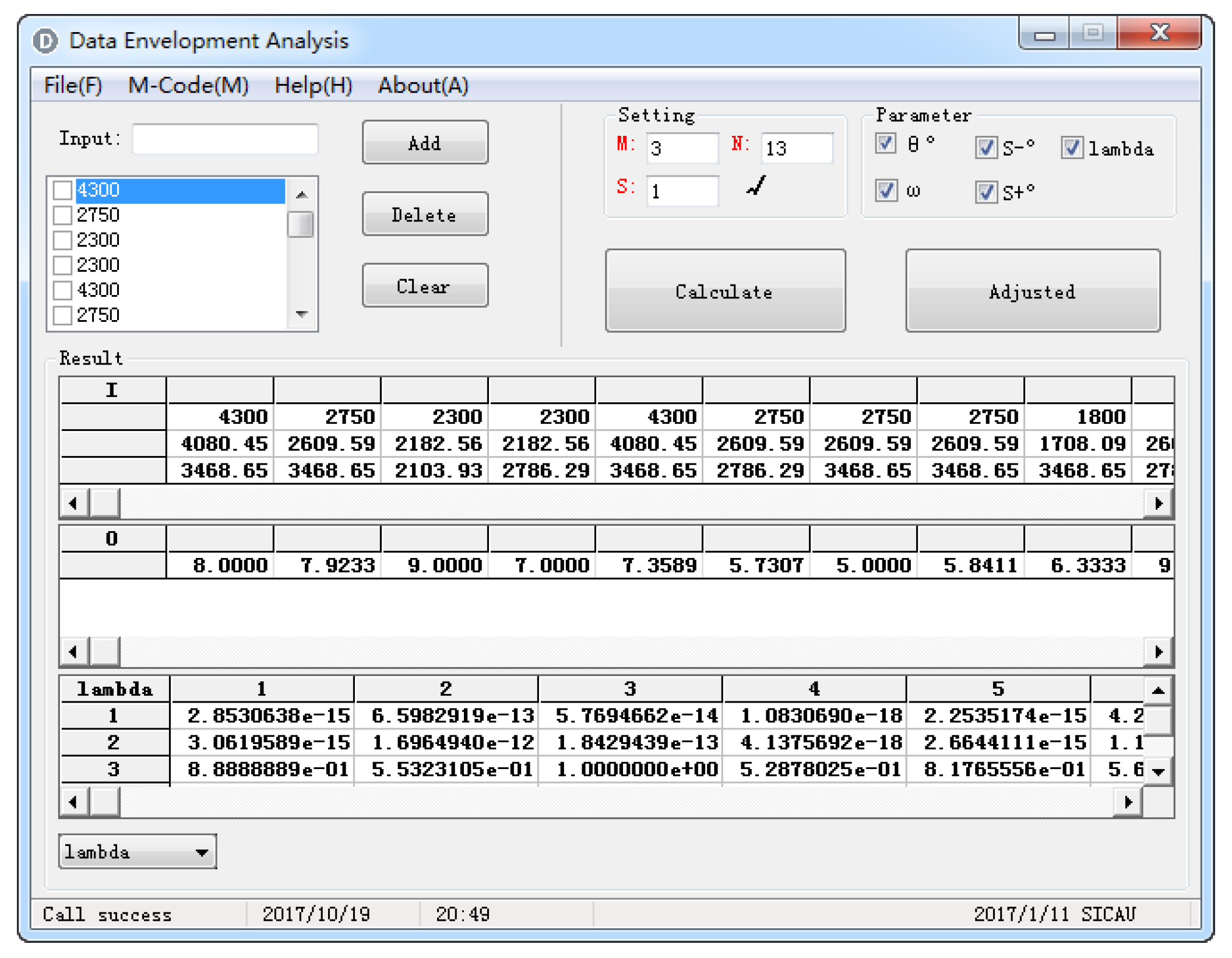

4.2. Relative Effectiveness Calculation

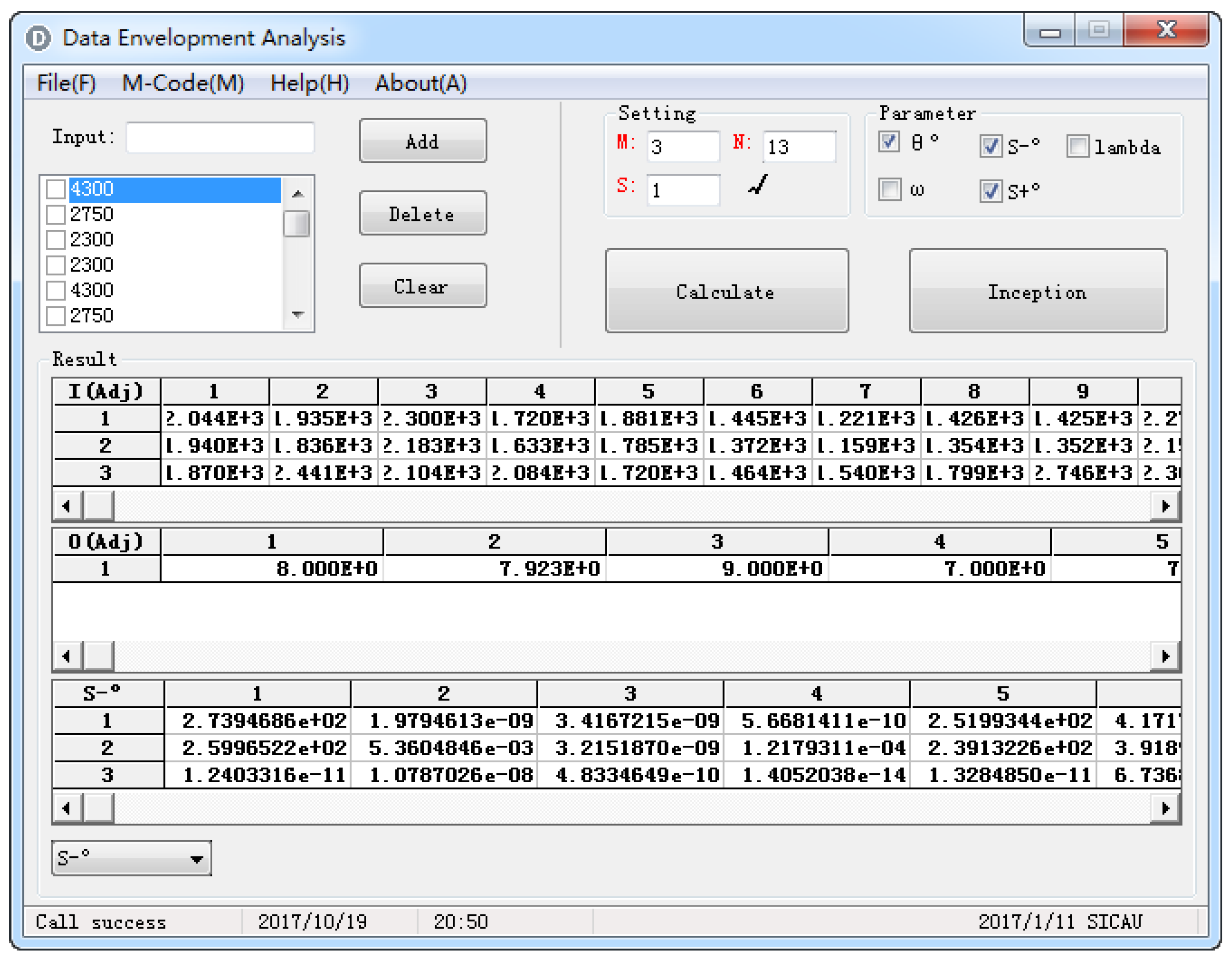

4.3. The Adjustment of Ineffective Decision-Making Unit

5. Case Study

5.1. Input and Output Data Collection

5.1.1. Case Study 1

5.1.2. Case Study 2

5.2. Case Implementation

5.2.1. Case Study 1

5.2.2. Case Study 2

5.2.3. CBII Implementation Process

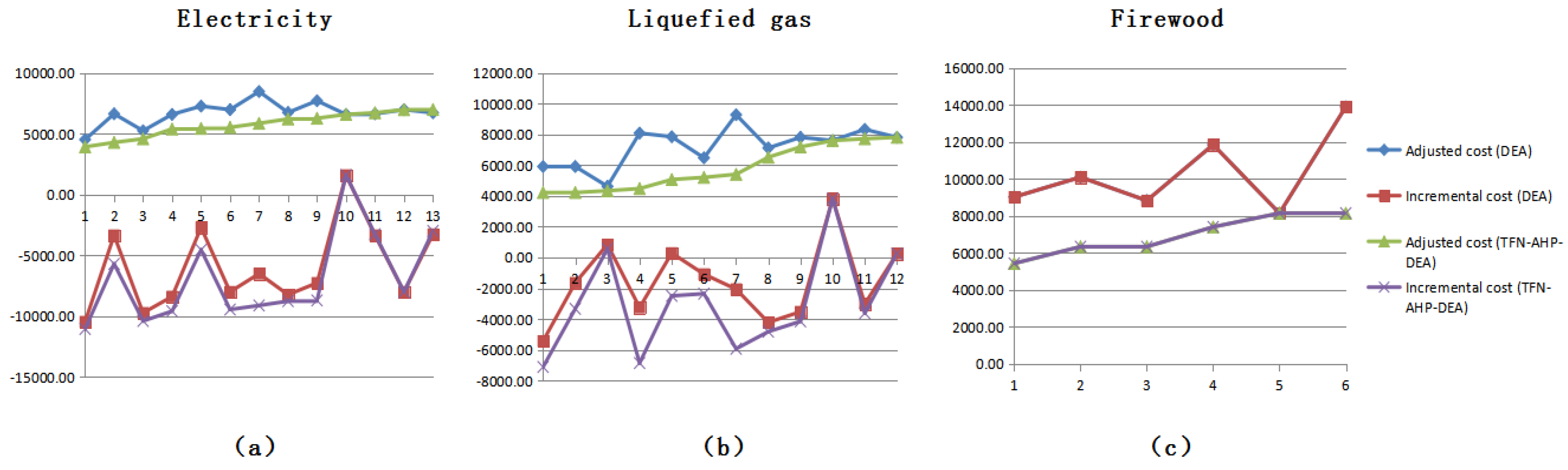

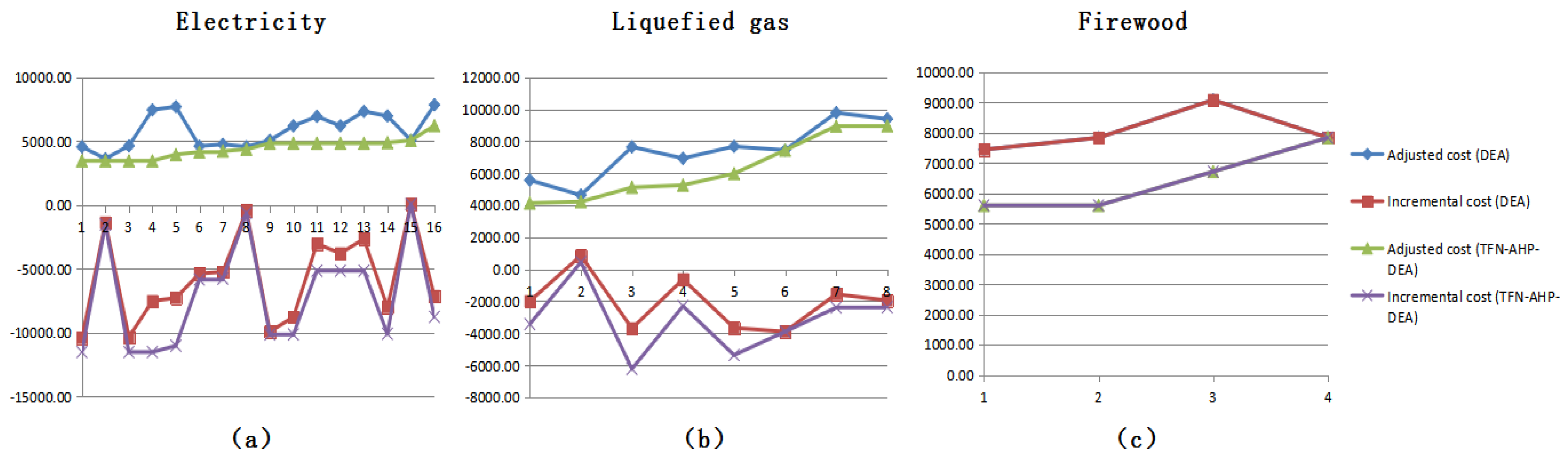

5.3. Result Analysis

6. Conclusions

Acknowledgments

Author Contributions

Conflicts of Interest

References

- Sharma, R.; Goel, S. Performance evaluation of stand alone, grid connected and hybrid renewable energy systems for rural application: A comparative review. Renew. Sustain. Energy Rev. 2017, 78, 1378–1389. [Google Scholar]

- Chang, C.Y. A critical analysis of recent advances in the techniques for the evaluation of renewable energy projects. Int. J. Proj. Manag. 2013, 31, 1057–1067. [Google Scholar] [CrossRef]

- Atsu, D.; Agyemang, E.O.; Tsike, S.A.K. Solar electricity development and policy support in Ghana. Renew. Sustain. Energy Rev. 2016, 53, 792–800. [Google Scholar] [CrossRef]

- Wiser, R.; Bolinger, M.; Heath, G.; Keyser, D.; Lantz, E.; Macknick, J.; Millstein, D. Long-term implications of sustained wind power growth in the United States: Potential benefits and secondary impacts. Appl. Energy 2016, 179, 146–158. [Google Scholar] [CrossRef]

- Aghahosseini, A.; Bogdanov, D.; Breyer, C. A Techno-Economic Study of an Entirely Renewable Energy-Based Power Supply for North America for 2030 Conditions. Energies 2017, 10, 1171. [Google Scholar] [CrossRef]

- Ortegaizquierdo, M.; Río, P.D.; Kazmerski, L. Benefits and costs of renewable electricity in Europe. Renew. Sustain. Energy Rev. 2016, 61, 372–383. [Google Scholar] [CrossRef]

- Akikur, R.K.; Saidur, R.; Ullah, K.R.; Hajimolana, S.A.; Ping, H.W.; Hussain, M.A. Economic feasibility analysis of a solar energy and solid oxide fuel cell-based cogeneration system in Malaysia. Clean Technol. Environ. Policy 2016, 18, 669–687. [Google Scholar] [CrossRef]

- Park, E. Potentiality of renewable resources: Economic feasibility perspectives in South Korea. Renew. Sustain. Energy Rev. 2017, 79, 61–70. [Google Scholar] [CrossRef]

- Štreimikienė, D.; Baležentis, A. Assessment of willingness to pay for renewables in Lithuanian households. Clean Technol. Environ. Policy 2015, 17, 515–531. [Google Scholar] [CrossRef]

- Park, S.H.; Jung, W.J.; Kim, T.H.; Lee, S.Y.T. Can Renewable Energy Replace Nuclear Power in Korea? An Economic Valuation Analysis. Nucl. Eng. Technol. 2016, 48, 559–571. [Google Scholar] [CrossRef]

- Solangi, K.H.; Saidur, R.; Luhur, M.R.; Aman, M.M.; Badarudin, A.; Kazi, S.N.; Islam, M.R. Social acceptance of solar energy in Malaysia: Users’ perspective. Clean Technol. Environ. Policy 2015, 17, 1975–1986. [Google Scholar] [CrossRef]

- Xu, R. The restriction research for urban area building integrated grid-connected PV power generation potential. Energy 2016, 113, 124–143. [Google Scholar]

- Hast, A.; Alimohammadisagvand, B.; Syri, S. Consumer attitudes towards renewable energy in China—The case of Shanghai. Sustain. Cities Soc. 2015, 17, 69–79. [Google Scholar] [CrossRef]

- Sundt, S.; Rehdanz, K. Consumers’ willingness to pay for green electricity: A meta-analysis of the literature. Energy Econ. 2015, 51, 1–8. [Google Scholar] [CrossRef]

- Lee, C.Y.; Heo, H. Estimating willingness to pay for renewable energy in South Korea using the contingent valuation method. Energy Policy 2016, 94, 150–156. [Google Scholar] [CrossRef]

- Otay, I.; Oztaysi, B.; Onar, S.C.; Kahraman, C. Multi-expert performance evaluation of healthcare institutions using an integrated intuitionistic fuzzy AHP&DEA methodology. Knowl.-Based Syst. 2017, 133, 90–106. [Google Scholar]

- Zadeh, L.A. Fuzzy sets. Inf. Control 1965, 8, 338–353. [Google Scholar] [CrossRef]

- Baloi, D.; Price, A.D.F. Modelling global risk factors affecting construction cost performance. Int. J. Proj. Manag. 2003, 21, 261–269. [Google Scholar] [CrossRef]

- Saaty, T.L. The Analytic Hierarchy Process: Planning, Priority Setting, Resource Allocation; McGraw-Hill: New York, NY, USA, 1980. [Google Scholar]

- Kahraman, C.; Cebeci, U.; Da, R. Multi-attribute comparison of catering service companies using fuzzy AHP: The case of Turkey. Int. J. Prod. Econ. 2004, 87, 171–184. [Google Scholar] [CrossRef]

- Macharis, C.; Springael, J. PROMETHEE and AHP: The design of operational synergies in multicriteria analysis: Strengthening PROMETHEE with ideas of AHP. Eur. J. Oper. Res. 2004, 153, 307–317. [Google Scholar] [CrossRef]

- Bertolini, M.; Braglia, M.; Carmignani, G. Application of the AHP methodology in making a proposal for a public work contract. Int. J. Proj. Manag. 2006, 24, 422–430. [Google Scholar] [CrossRef]

- Veerabathiran, R.; Srinath, K.A. Application of the extent analysis method on fuzzy AHP. Int. J. Eng. Sci. Technol. 2012, 4, 3472–3480. [Google Scholar]

- Beukers, E.; Bertolini, L.; Brömmelstroet, M.T. Why Cost Benefit Analysis is perceived as a problematic tool for assessment of transport plans: A process perspective. Transp. Res. Part A 2012, 46, 68–78. [Google Scholar] [CrossRef]

- Martens, K. Substance precedes methodology: On cost–benefit analysis and equity. Transportation 2011, 38, 959–974. [Google Scholar] [CrossRef] [Green Version]

- Yang, X.; Teng, F.; Xi, X.; Khayrullin, E.; Zhang, Q. Cost–benefit analysis of China’s Intended Nationally Determined Contributions based on carbon marginal cost curves. Appl. Energy 2017, in press. [Google Scholar] [CrossRef]

- Giuseppe, E.D.; Iannaccone, M.; Telloni, M.; D’Orazio, M.; di Perna, C. Probabilistic life cycle costing of existing buildings retrofit interventions towards nZE target: Methodology and application example. Energy Build. 2017, 144, 416–432. [Google Scholar] [CrossRef]

- Martin, R.; Lazakis, I.; Barbouchi, S.; Johanning, L. Sensitivity analysis of offshore wind farm operation and maintenance cost and availability. Renew. Energy 2016, 85, 1226–1236. [Google Scholar] [CrossRef] [Green Version]

- Charnes, A.; Cooper, W.W.; Rhodes, E. Measuring the efficiency of decision making units. Eur. J. Oper. Res. 1979, 2, 429–444. [Google Scholar] [CrossRef]

- Han, Y.; Long, C.; Geng, Z.; Zhang, K. Carbon emission analysis and evaluation of industrial departments in China: An improved environmental DEA cross model based on information entropy. J. Environ. Manag. 2017, 205, 298. [Google Scholar] [CrossRef]

- Podinovski, V.V. Bridging the gap between the constant and variable returns-to-scale models: Selective proportionality in data envelopment analysis. J. Oper. Res. Soc. 2004, 55, 265–276. [Google Scholar] [CrossRef]

- Vitner, G.; Rozenes, S.; Spraggett, S. Using data envelope analysis to compare project efficiency in a multi-project environment. Int. J. Proj. Manag. 2006, 24, 323–329. [Google Scholar] [CrossRef]

- Shiraz, R.K.; Fukuyama, H.; Tavana, M.; di Caprio, D. An integrated data envelopment analysis and free disposal hull framework for cost-efficiency measurement using rough sets. Appl. Soft Comput. 2016, 46, 204–219. [Google Scholar] [CrossRef]

- Geng, X.; Qiu, H.; Gong, X. An extended 2-tuple linguistic DEA for solving MAGDM problems considering the influence relationships among attributes. Comput. Ind. Eng. 2017, 112, 135–146. [Google Scholar] [CrossRef]

- Chau, C.K.; Tse, M.S.; Chung, K.Y. A choice experiment to estimate the effect of green experience on preferences and willingness-to-pay for green building attributes. Build. Environ. 2010, 45, 2553–2561. [Google Scholar] [CrossRef]

- Mell, I.C.; Henneberry, J.; Hehl-Lange, S.; Keskin, B. To green or not to green: Establishing the economic value of green infrastructure investments in The Wicker, Sheffield. Urban For. Urban Green. 2016, 18, 257–267. [Google Scholar] [CrossRef]

- Zhou, X.G.; Gao, X.D. Method of selection construction projects based on FANP model and its application. Syst. Eng.-Theory Pract. 2012, 32, 2459–2466. [Google Scholar]

- Zhao, W. Extension and Application of AHP. Math. Pract. Theory 1997, 27, 165–180. [Google Scholar]

- Si, S.K.; Sun, Z.L.; Sun, X.J. Mathematical Modeling Algorithm and Application; National Defense Industrial Press: Beijing, China, 2015. [Google Scholar]

- Ma, Z.X. Data Envelopment Analysis Model and Method; Science Press: Beijing, China, 2010. [Google Scholar]

- Liu, X.J. Engineering Economics; China Architecture & Building Press: Beijing, China, 2008. [Google Scholar]

| Linguistic Variable | TFN | The Reciprocal of TFN |

|---|---|---|

| Equally important | (1, 1, 1) | (1, 1, 1) |

| Intermediate | (1, 2, 3) | (1/3, 1/2, 1) |

| Moderately important | (2, 3, 4) | (1/4, 1/3, 1/2) |

| Intermediate | (3, 4, 5) | (1/5, 1/4, 1/3) |

| Important | (4, 5, 6) | (1/6, 1/5, 1/4) |

| Intermediate | (5, 6, 7) | (1/7, 1/6, 1/5) |

| Very important | (6, 7, 8) | (1/8, 1/7, 1/6) |

| Intermediate | (7, 8, 9) | (1/9, 1/8, 1/7) |

| Absolutely important | (9, 9, 9) | (1/9, 1/9, 1/9) |

| Category | Conversion Parameter |

|---|---|

| Liquefied gas (kg/L) | 0.012 |

| Electricity (kw/L) | 0.1 |

| Respondent | Input (Ren Min Bi (RMB)) | Output | ||||||

|---|---|---|---|---|---|---|---|---|

| I1 | I2 | I3 | O1’ | O1 | O2 | O3 | ||

| Electricity | 1 | 2750.00 | 2609.59 | 3468.65 | 5.0000 | 5 | 5 | 5 |

| 2 | 2750.00 | 2609.59 | 2786.29 | 5.7307 | 9 | 5 | 7 | |

| 3 | 2750.00 | 2609.59 | 3468.65 | 5.8411 | 5 | 5 | 7 | |

| 4 | 4300.00 | 4080.45 | 3468.65 | 7.3589 | 5 | 7 | 9 | |

| 5 | 2300.00 | 2182.56 | 2786.29 | 7.0000 | 9 | 9 | 5 | |

| 6 | 1800.00 | 1708.09 | 3468.65 | 6.3333 | 7 | 3 | 9 | |

| 7 | 4300.00 | 4080.45 | 3468.65 | 8.0000 | 5 | 9 | 7 | |

| 8 | 2750.00 | 2609.59 | 3468.65 | 7.9233 | 3 | 1 | 9 | |

| 9 | 2750.00 | 2609.59 | 3468.65 | 8.0000 | 7 | 9 | 7 | |

| 10 | 2300.00 | 2182.56 | 2103.93 | 9.0000 | 9 | 7 | 9 | |

| 11 | 2750.00 | 2609.59 | 2786.29 | 9.0000 | 7 | 3 | 9 | |

| 12 | 1800.00 | 1708.09 | 3468.65 | 8.0000 | 9 | 7 | 9 | |

| 13 | 2300.00 | 2182.56 | 2786.29 | 9.0000 | 9 | 5 | 9 | |

| 14 | 2750.00 | 2609.59 | 3468.65 | 4.1807 | 9 | 4 | 5 | |

| Liquefied Gas | 1 | 2750.00 | 2609.59 | 4785.05 | 5.0000 | 5 | 7 | 5 |

| 2 | 2300.00 | 2182.56 | 3953.31 | 5.0000 | 5 | 7 | 5 | |

| 3 | 2300.00 | 2182.56 | 1937.95 | 5.0000 | 5 | 5 | 5 | |

| 4 | 2750.00 | 2609.59 | 4785.05 | 5.3031 | 5 | 7 | 9 | |

| 5 | 2300.00 | 2182.56 | 3953.31 | 6.0000 | 6 | 8 | 9 | |

| 6 | 2750.00 | 2609.59 | 2454.32 | 6.0000 | 7 | 7 | 5 | |

| 7 | 2750.00 | 2609.59 | 4785.05 | 6.4043 | 9 | 7 | 5 | |

| 8 | 2750.00 | 2609.59 | 4785.05 | 7.7162 | 5 | 6 | 8 | |

| 9 | 6700.00 | 6357.91 | 4785.05 | 8.2822 | 7 | 5 | 9 | |

| 10 | 2300.00 | 2182.56 | 3121.56 | 9.0000 | 7 | 9 | 9 | |

| 11 | 2750.00 | 2609.59 | 2970.7 | 9.0000 | 9 | 9 | 9 | |

| 12 | 2750.00 | 2609.59 | 2454.32 | 9.0000 | 7 | 9 | 9 | |

| 13 | 4300.00 | 4080.45 | 4785.05 | 4.3745 | 5 | 3 | 7 | |

| Firewood | 1 | 4300.00 | 4080.45 | 2786.29 | 6.0000 | 6 | 6 | 6 |

| 2 | 3750.00 | 3558.53 | 2786.29 | 7.0000 | 7 | 5 | 7 | |

| 3 | 2750.00 | 2609.59 | 3468.65 | 7.0000 | 7 | 1 | 7 | |

| 4 | 4300.00 | 4080.45 | 3468.65 | 8.1795 | 8 | 9 | 9 | |

| 5 | 2750.00 | 2609.59 | 2786.29 | 9.0000 | 5 | 4 | 9 | |

| 6 | 5350.00 | 5076.84 | 3468.65 | 9.0000 | 9 | 7 | 9 | |

| 7 | 3500.00 | 3321.29 | 3468.65 | 3.0000 | 7 | 3 | 7 | |

| Respondent | Input (RMB) | Output | ||||||

|---|---|---|---|---|---|---|---|---|

| I1 | I2 | I3 | O1’ | O1 | O2 | O3 | ||

| Electricity | 1 | 1600.00 | 1518.31 | 2956.88 | 5.0000 | 9 | 3 | 3 |

| 2 | 1600.00 | 1518.31 | 1933.35 | 5.0000 | 5 | 5 | 3 | |

| 3 | 2300.00 | 2182.56 | 2956.88 | 5.0000 | 5 | 5 | 5 | |

| 4 | 2300.00 | 2182.56 | 2956.88 | 5.0000 | 5 | 5 | 9 | |

| 5 | 3300.00 | 3131.51 | 2956.88 | 5.7178 | 9 | 5 | 9 | |

| 6 | 3300.00 | 3131.51 | 2445.11 | 6.0000 | 7 | 5 | 5 | |

| 7 | 2300.00 | 2182.56 | 2445.11 | 6.1047 | 7 | 6 | 5 | |

| 8 | 1600.00 | 1518.31 | 1933.35 | 6.3142 | 9 | 5 | 3 | |

| 9 | 3300.00 | 3131.51 | 2956.88 | 7.0000 | 5 | 7 | 3 | |

| 10 | 3500.00 | 3321.29 | 2956.88 | 7.0000 | 7 | 7 | 7 | |

| 11 | 2300.00 | 2182.56 | 2445.11 | 7.0000 | 9 | 5 | 8 | |

| 12 | 2300.00 | 2182.56 | 2445.11 | 7.0000 | 7 | 7 | 7 | |

| 13 | 2500.00 | 2372.35 | 2445.11 | 7.0000 | 5 | 7 | 9 | |

| 14 | 2500.00 | 2372.35 | 2956.88 | 7.0735 | 8 | 5 | 8 | |

| 15 | 1600.00 | 1518.31 | 1933.35 | 7.3333 | 10 | 7 | 5 | |

| 16 | 2500.00 | 2372.35 | 2956.88 | 9.0000 | 9 | 4 | 9 | |

| 17 | 2300.00 | 2182.56 | 2445.11 | 3.0000 | 5 | 3 | 3 | |

| 18 | 2300.00 | 2182.56 | 2956.88 | 4.0000 | 5 | 3 | 3 | |

| 19 | 2300.00 | 2182.56 | 2956.88 | 3.0000 | 5 | 3 | 3 | |

| Liquefied Gas | 1 | 1600.00 | 1518.31 | 2445.11 | 5.0000 | 5 | 5 | 5 |

| 2 | 1600.00 | 1518.31 | 1933.35 | 5.0000 | 5 | 3 | 5 | |

| 3 | 2500.00 | 2372.35 | 2956.88 | 6.0000 | 3 | 3 | 9 | |

| 4 | 2300.00 | 2182.56 | 2445.11 | 5.7178 | 9 | 5 | 7 | |

| 5 | 2500.00 | 2372.35 | 2956.88 | 7.0000 | 5 | 5 | 9 | |

| 6 | 2300.00 | 2182.56 | 2956.88 | 9.0000 | 5 | 5 | 9 | |

| 7 | 3500.00 | 3321.29 | 2956.88 | 9.0000 | 9 | 9 | 7 | |

| 8 | 3300.00 | 3131.51 | 2956.88 | 9.0000 | 9 | 5 | 9 | |

| 9 | 2300.00 | 2182.56 | 2445.11 | 3.0000 | 3 | 3 | 3 | |

| 10 | 2500.00 | 2372.35 | 2956.88 | 4.6411 | 5 | 3 | 5 | |

| Firewood | 1 | 2300.00 | 2182.56 | 2956.88 | 5.0000 | 5 | 5 | 5 |

| 2 | 2500.00 | 2372.35 | 2956.88 | 5.0000 | 7 | 5 | 4 | |

| 3 | 3300.00 | 3131.51 | 2956.88 | 6.0000 | 5 | 5 | 7 | |

| 4 | 2500.00 | 2372.35 | 2956.88 | 7.0000 | 5 | 5 | 9 | |

| Decision Making Unit (DMU) | Initial Cost | Benchmark Cost | Adjusted Cost 1 | Incremental Cost 1 | Adjusted Cost 2 | Incremental Cost 2 | |

|---|---|---|---|---|---|---|---|

| Electricity (RMB) | 1 | 8828.24 | 14,984.56 | 4516.52 | −10,468.04 | 3919.74 | −11,064.82 |

| 2 | 8145.88 | 9989.71 | 6634.00 | −3355.71 | 4281.47 | −5708.23 | |

| 3 | 8828.24 | 14,984.56 | 5243.97 | −9740.59 | 4579.21 | −10,405.36 | |

| 4 | 11,849.10 | 14,984.56 | 6587.01 | −8397.55 | 5386.03 | −9598.53 | |

| 5 | 7268.86 | 9989.71 | 7268.86 | −2720.85 | 5437.10 | −4552.60 | |

| 6 | 6976.74 | 14,984.56 | 6976.74 | −8007.82 | 5523.49 | −9461.07 | |

| 7 | 11,849.10 | 14,984.56 | 8468.84 | −6515.72 | 5855.11 | −9129.45 | |

| 8 | 8828.24 | 14,984.56 | 6742.12 | −8242.44 | 6211.54 | −8773.02 | |

| 9 | 8828.24 | 14,984.56 | 7710.58 | −7273.98 | 6271.57 | −8712.99 | |

| 10 | 6586.50 | 4994.85 | 6586.50 | 1591.65 | 6586.50 | 1591.65 | |

| 11 | 8145.88 | 9989.71 | 6634.00 | −3355.71 | 6724.41 | −3265.29 | |

| 12 | 6976.74 | 14,984.56 | 6976.74 | −8007.82 | 6976.74 | −8007.82 | |

| 13 | 7268.86 | 9989.71 | 6721.51 | −3268.20 | 6990.46 | −2999.25 | |

| 14 | 8828.24 | 14,984.56 | 6742.12 | −8242.44 | — | — | |

| Liquid Gas (RMB) | 1 | 10,144.64 | 11,339.57 | 5914.27 | −5425.30 | 4224.04 | −7115.53 |

| 2 | 8435.87 | 7559.71 | 5914.50 | −1645.21 | 4224.89 | −3334.82 | |

| 3 | 6420.52 | 3779.86 | 4627.84 | 847.98 | 4341.17 | 561.31 | |

| 4 | 10,144.64 | 11,339.57 | 8088.41 | −3251.16 | 4480.47 | −6859.10 | |

| 5 | 8435.87 | 7559.71 | 7850.89 | 291.18 | 5069.69 | −2490.02 | |

| 6 | 7813.91 | 7559.71 | 6478.97 | −1080.74 | 5209.54 | −2350.18 | |

| 7 | 10,144.64 | 11,339.57 | 9281.51 | −2058.06 | 5410.54 | −5929.03 | |

| 8 | 10,144.64 | 11,339.57 | 7123.54 | −4216.03 | 6519.82 | −4819.74 | |

| 9 | 17,842.96 | 11,339.57 | 7813.66 | −3525.91 | 7190.60 | −4148.97 | |

| 10 | 7604.12 | 3779.86 | 7604.12 | 3824.26 | 7604.12 | 3824.26 | |

| 11 | 8330.29 | 11,339.57 | 8330.29 | −3009.28 | 7719.68 | −3619.89 | |

| 12 | 7813.91 | 7559.71 | 7813.91 | 254.20 | 7813.91 | 254.20 | |

| 13 | 13,165.5 | 7559.71 | 5992.93 | −1566.78 | — | — | |

| Firewood (RMB) | 1 | 11,166.74 | 0.00 | 9022.18 | 9022.18 | 5430.96 | 5430.96 |

| 2 | 10,094.82 | 0.00 | 10,094.82 | 10,094.82 | 6335.85 | 6335.85 | |

| 3 | 8828.24 | 0.00 | 8828.24 | 8828.24 | 6335.90 | 6335.90 | |

| 4 | 11,849.10 | 0.00 | 11,849.10 | 11,849.10 | 7402.74 | 7402.74 | |

| 5 | 8145.88 | 0.00 | 8145.88 | 8145.88 | 8145.88 | 8145.88 | |

| 6 | 13,895.48 | 0.00 | 13,895.48 | 13,895.48 | 8146.24 | 8146.24 | |

| 7 | 10,289.94 | 0.00 | 9420.44 | 9420.44 | — | — | |

| DMU | Initial Cost | Benchmark Cost | Adjusted Cost 1 | Incremental Cost 1 | Adjusted Cost 2 | Incremental Cost 2 | |

|---|---|---|---|---|---|---|---|

| Electricity (RMB) | 1 | 6075.19 | 14,984.56 | 4546.49 | −10,438.07 | 3444.20 | −11,540.36 |

| 2 | 5051.65 | 4994.85 | 3608.39 | −1386.46 | 3444.22 | −1550.64 | |

| 3 | 7439.45 | 14,984.56 | 4616.58 | −10,367.99 | 3444.24 | −11,540.33 | |

| 4 | 7439.45 | 14,984.56 | 7439.45 | −7545.12 | 3444.24 | −11,540.33 | |

| 5 | 9388.39 | 14,984.56 | 7689.12 | −7295.44 | 3938.72 | −11,045.84 | |

| 6 | 8876.62 | 9989.71 | 4598.11 | −5391.60 | 4132.84 | −5856.87 | |

| 7 | 6927.68 | 9989.71 | 4734.48 | −5255.23 | 4205.12 | −5784.58 | |

| 8 | 5051.65 | 4994.85 | 4546.49 | −448.37 | 4349.47 | −645.38 | |

| 9 | 9388.39 | 14,984.56 | 5051.21 | −9933.35 | 4821.77 | −10,162.79 | |

| 10 | 9778.18 | 14,984.56 | 6184.71 | −8799.85 | 4821.77 | −10,162.80 | |

| 11 | 6927.68 | 9989.71 | 6927.68 | −3062.03 | 4822.32 | −5167.39 | |

| 12 | 6927.68 | 9989.71 | 6184.91 | −3804.80 | 4822.32 | −5167.39 | |

| 13 | 7317.47 | 9989.71 | 7317.47 | −2672.24 | 4822.34 | −5167.37 | |

| 14 | 7829.23 | 14,984.56 | 6961.75 | −8022.81 | 4872.82 | −10,111.74 | |

| 15 | 5051.65 | 4994.85 | 5051.65 | 56.80 | 5051.65 | 56.80 | |

| 16 | 7829.23 | 14,984.56 | 7829.23 | −7155.33 | 6200.16 | −8784.40 | |

| 17 | 6927.68 | 9989.71 | 2865.68 | −7124.02 | — | — | |

| 18 | 7439.45 | 14,984.56 | 2903.84 | −12,080.72 | — | — | |

| 19 | 7439.45 | 14,984.56 | 2903.84 | −12,080.72 | — | — | |

| Liquid Gas (RMB) | 1 | 5563.42 | 7559.71 | 5563.42 | −1996.29 | 4132.96 | −3426.75 |

| 2 | 5051.65 | 3779.86 | 4629.29 | 849.44 | 4217.15 | 437.30 | |

| 3 | 7829.23 | 11,339.57 | 7644.16 | −3695.41 | 5114.25 | −6225.31 | |

| 4 | 6927.68 | 7559.71 | 6927.68 | −632.03 | 5252.48 | −2307.23 | |

| 5 | 7829.23 | 11,339.57 | 7673.48 | −3666.09 | 5975.18 | −5364.39 | |

| 6 | 7439.45 | 11,339.57 | 7439.45 | −3900.12 | 7439.45 | −3900.12 | |

| 7 | 9778.18 | 11,339.57 | 9778.18 | −1561.39 | 8945.77 | −2393.80 | |

| 8 | 9388.39 | 11,339.57 | 9388.39 | −1951.18 | 8959.94 | −2379.63 | |

| 9 | 6927.68 | 7559.71 | 3479.08 | −4080.63 | — | — | |

| 10 | 7829.23 | 11,339.57 | 4629.3 | −6710.27 | — | — | |

| Firewood (RMB) | 1 | 7439.45 | 0.00 | 7439.45 | 7439.45 | 5592.32 | 5592.32 |

| 2 | 7829.23 | 0.00 | 7829.23 | 7829.23 | 5592.42 | 5592.42 | |

| 3 | 9388.39 | 0.00 | 9077.46 | 9077.46 | 6710.36 | 6710.36 | |

| 4 | 7829.23 | 0.00 | 7829.23 | 7829.23 | 7829.23 | 7829.23 | |

| Case | Integrated TFN–AHP–DEA Approach | |||

|---|---|---|---|---|

| Firewood | Liquefied Gas | Electricity | Weighted Mean | |

| Panxi Region (RMB/m2) | 52.09 | −35.80 | −74.64 | −35.08 |

| Yunnan-Guizhou Plateau (RMB/m2) | 77.39 | −30.80 | −70.17 | −37.84 |

© 2017 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (http://creativecommons.org/licenses/by/4.0/).

Share and Cite

Gan, L.; Xu, D.; Hu, L.; Wang, L. Economic Feasibility Analysis for Renewable Energy Project Using an Integrated TFN–AHP–DEA Approach on the Basis of Consumer Utility. Energies 2017, 10, 2089. https://doi.org/10.3390/en10122089

Gan L, Xu D, Hu L, Wang L. Economic Feasibility Analysis for Renewable Energy Project Using an Integrated TFN–AHP–DEA Approach on the Basis of Consumer Utility. Energies. 2017; 10(12):2089. https://doi.org/10.3390/en10122089

Chicago/Turabian StyleGan, Lu, Dirong Xu, Lin Hu, and Lei Wang. 2017. "Economic Feasibility Analysis for Renewable Energy Project Using an Integrated TFN–AHP–DEA Approach on the Basis of Consumer Utility" Energies 10, no. 12: 2089. https://doi.org/10.3390/en10122089