1. Introduction

1.1. Financial Specificity of Hard Coal Mining

Underground coalmining is a sector with a complex production process, requiring interdisciplinary knowledge and competencies, including, geology, tectonics, geodesy, civil engineering, mining, mechanics, chemistry and environmental protection. Additionally, each mining lifecycle stage requires large capital expenditures, including the liquidation stage, due to the reclamation processes and the requirement to repair the damage caused by coalmines. Therefore, hard coalmining is a capital-intensive industry [

1].

The aforementioned conditions significantly affect the efficiency of hard coalmining production and require efficient cost management, especially regarding long-term cost predictions [

2,

3]. To be profitable, management knowledge and experience working in the hard coalmining sector is crucial because production costs depend not only on current expenditures but also on irreversible and cost-intensive decisions concerning investments in hard coalmine infrastructure. The long-term cost-management perspective is challenging to develop and difficult to implement because of challenges such as the incomplete measurement of the parameters of deposits, a changing economic environment, and the long-term market forecast. Moreover, there are several subjective challenges related to political and social conditions, as well as the prioritization of production goals, such as the maximization of hard coal extraction, national energy safety, the maintenance of employment levels and the prevention of the economic collapse of the region [

4]. In several cases, especially in less developed economies, the long-term cost planning of the hard coalmining sector is replaced by a policy of reducing current costs, resulting in the destruction of local societies, economies and the environment. As a result, the cost-intensiveness of hard coalmining causes ethical, social and environmental abuse and results in activities that harm the public image of the hard coalmining sector.

The circumstances mentioned above justify the necessity of conducting research on the area of costs in coalmining in the general perspective, but, in each geographic localization, there are also specific reasons that motivate considering financial aspects of extractive industries. Therefore, the next part of the article concerns Polish coalmining. Such approach enables deeper analysis and it includes following issues:

The description of the previous and current situation in Polish coalmining industry;

The review of literature on costs in Polish coalmining;

The case studies analysis including examining the relationships between main production and infrastructure parameters and production costs;

The indication of irregularities in examined relationships and the ways of removing them that are oriented at improving efficiency in Polish coalmining.

1.2. Insights from Coal Mining in Poland

This study concerns the cost management of Polish hard coalmining enterprises by examining the dependence of total production costs on the costs of production and infrastructure parameters. The context of the study is coalmining in Poland, which is one of the largest producers of hard coal globally. However, the Polish hard coalmining sector is struggling, primarily due to the decarbonization of the European Union, decreasing hard coal consumption by the local and regional markets and the decreasing price competitiveness of the sector. The latter is caused by the continued increase in unit costs, which justifies research on the cost determinants of the Polish hard coalmining industry and makes the results of the study applicable to the industry. Since 1990, sales of hard coal in Poland have dropped by 56% while the unit cost of production has increased more than fifteen times. The main causes of the unit cost increase are: the high share of fixed costs, including remuneration costs, in the total production costs and deterioration of mining condition (deepening of excavation and increase in natural hazards). As the result of the long-term crisis, the number of coalmines in Poland has decreased from 70 to 14. Nevertheless, hard coal remains the most important energy source with the share in total energy consumption being 55%, thus, for this reason, the improvement of its price competitiveness is crucial for the survival of the industry.

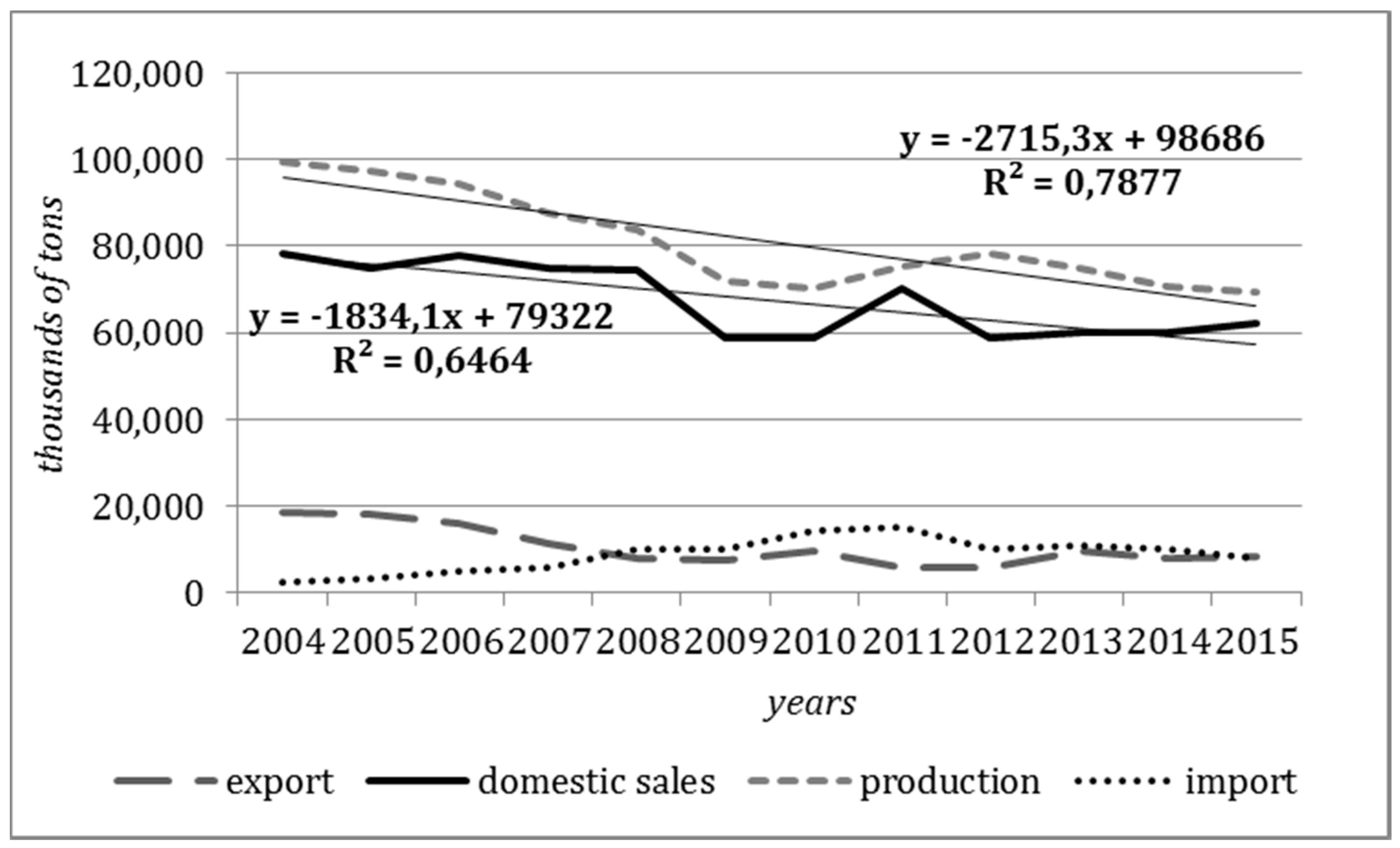

The decreased price competitiveness of Polish hard coal resulted in decreased domestic sales and reduced exports (

Figure 1). These effects were especially pronounced over the last three years because of the global decrease in hard coal prices, which further decreased production efficiency through increased unit costs. As a result, since 2008, Poland, the primary energy resource of which is hard coal, has imported more hard coal than it has exported (

Figure 1).

Since the European Commission abolished state operating subsidies in 2010, the Polish hard coalmining industry has dramatically declined. By 2015, the loss of operating subsidies forced the hard coalmining sector to restructure, resulting in consolidation of economically efficient hard coalmining enterprises and liquidation of economically inefficient hard coalmining enterprises. The hard coalmining enterprises that survived the restructuring and are currently operating must take steps to reduce their unit costs and increase their price competitiveness to avoid liquidation and ensure the energy security of Poland.

1.3. Literature Studies on Costs in Coal Mining in the Context of Research Intends

The previous literature rarely addresses mining production costs, primarily due to the technical and interdisciplinary nature of the industry. The extant studies focus on using new technologies for coalmining and improving employee safety in coalmines [

5,

6,

7,

8,

9,

10,

11]. Therefore, coalmining production costs are scarcely researched.

Issues of health and wellness include not only protection from natural hazards during coalmining [

12] but also the safety of local and regional citizens that are exposed to the harmful by-products of coalmining production [

13,

14]. All actions taken by coalmining enterprises to improve the health and wellness of employees and citizens require additional expenditures that increase mining production costs. However, the previous literature and research shows that these costs could be efficiently optimized [

15,

16,

17].

A primary interest of coalmining enterprises is implementing clean coal technologies (CCT). Therefore, the calculation and reduction of the cost of implementing CCT is the focus of existing research [

18,

19,

20]. The most promising of the new CCTs is the Natural Gas Combined Cycle (NGCC). This cycle significantly reduces CO

2 emissions through a highly efficient use of energy. The increased efficiency of power generation in an integrated system of steam and gas with coal gasification (IGCC -Integrated Gasification Combined Cycle) reduces carbon dioxide emissions. Moreover, the benefit of IGCCs over combustion systems is a result of a more efficient removal of carbon dioxide from emissions [

21]. Many previous studies on coalmining have examined greenhouse gas (GHG) emissions and underground carbon dioxide storage [

22].

Because of the development of and increasing interest in sustainable development (SD), the number of publications devoted to the environmental and social aspects of mining has increased [

23,

24,

25,

26,

27,

28,

29,

30]. Research on the SD of the mining industry focuses on reclamation costs [

31,

32,

33,

34,

35], the balance of expenditures, the level of local communities’ satisfaction with the mining enterprise and the public image of the mining enterprises [

36,

37]. Furthermore, the social costs of mining are analyzed [

38,

39,

40]. Additionally, researchers evaluate the effect of by-product use on mining production efficiency [

41,

42,

43,

44]. The study of the environmental and social effects of coalmining allows researchers to evaluate the product life cycle (PLC) of coal [

45]. Moreover, several studies have focused on the procedures and the costs of the disposal of mining waste using methods that protect the environment [

46,

47].

Another area of cost analysis research includes the cooperation of mining enterprises. Mining enterprises may participate in vertical relationships, in which the mining enterprises cooperate with the energy industry, or in horizontal relationships, in which mining enterprises consolidate [

48,

49,

50]. The primary aim of those relationships is to achieve synergy between mining production and investment [

51].

Based on the aforementioned studies, one could conclude that the extant literature on mining is focused on the advanced and specialized elements of cost management. However, all cost management elements require stable and sufficient financing. Such financing could be assured if a mining enterprise operates efficiently and produces positive financial results, which earns the enterprise financial credibility [

52,

53,

54,

55]. In the mining industry, work safety, environmental protection, implementing new technologies and sustainable development are not possible without adequate financial support [

56,

57,

58]. Therefore, research on the operational cost management of mining enterprises is still uncommon, and more studies are warranted. The extant research addresses three aspects of the operational cost management of mining enterprises. The first aspect addresses the unit cost calculations and their determinants [

59]. The second aspect relates to the costs of new operational investments, such as new longwalls. The third aspect focuses on strategic investments, such as building a mine or opening a mining deposit [

60,

61,

62].

Due to the capital intensity of mining production, a considerable number of studies focus on investigating the proportion of fixed to variable costs. In this study, the linear function of the total production costs is used to estimate and predict the unit costs in selected Polish hard coalmines based on data regarding production volume and the historic total production costs. The results show that, in the Polish hard coalmining sector, fixed costs make up a higher proportion of total production costs than in other industries. This is because of the need to maintain a large mining infrastructure and to guarantee environmental safety, even during periods of reduced or paused production. In the Polish hard coalmining sector, the proportion of fixed costs has been rising because of the high wages demanded by the trade unions. Several cost models have been developed based on the structure of fixed costs, including amortization, materials, energy, wages, and services. Additionally, these costs are linear functions. However, the coefficients are independent variables defined as the share of each cost in the total production cost structure.

The majority of the aforementioned research is on the enterprises’ internal perspective of cost estimations and predictions and does not address mining production. They focus on mining production cost regularities. This study addresses this knowledge gap through research on project-based costing in which the direct costs of hard coalmining enterprises are budgeted from zero for each new longwall and the indirect costs are calculated using the appropriate accounting indicators. This approach enables the research to take into account the exact capital expenditures and varied geological conditions of hard coalmining enterprises as well as the level of natural hazards characterizing each newly opened longwall. However, the method is time-consuming and complicated because a considerable share of the total production costs of hard coalmining enterprises is indirect costs.

Because of the aforementioned financial and technical complications, the research on mining production costs frequently focuses on a single source of production costs. Importantly, the quality and size of each tangible and intangible cost as well as human resource costs are crucial determinants of total mining production costs and must be included in the cost analyses. Therefore, in this article, the authors evaluate the relationship between production and infrastructure parameters and their influence on the total production costs of hard coalmining enterprises [

63,

64,

65]. This study furthers previous research on the Polish hard coalmining sector by the Central Mining Institute over the period of 2006 to 2009. It evaluated the feasibility of examining and forecasting the unit production costs of hard coalmining enterprises when taking into account the technical and organizational parameters of hard coalmines. The study used linear regression models and included an analysis to determine the amount of the total production costs that depended on technical and production parameters. However, the study did not directly analyze the economic rationality of the examined correlations or their effect on the financial performance of the hard coalmines and the hard coalmining industry of Poland.

Based on the aforementioned justification and conditions of the Polish hard coalmining sector, we pose the following research questions: (1) How does the reduction in employment and production influence the total production costs of Polish hard coalmining enterprises? (2) How do the changes to the infrastructure of Polish hard coalmining enterprises affect their production costs? In the

Section 2, these research questions are the basis of four research hypotheses that are tested using Pearson’s coefficients and linear regression models.

This paper addresses the research questions in the following order. In

Section 2, the research method is described. In

Section 3, three categories of cost determinants are described, and their influence on the total production costs of five hard coalmines is estimated. In the summary, the implications for the policies concerning the Polish hard coalmining sector are discussed and future research topics are suggested.

2. Methods and Materials

As stated in the Introduction, hard coalmining is a capital-intensive industry that has a long payback period. Therefore, the current financial position and investment decisions of hard coalmining enterprises have an irreversible effect on their financial performance. There are three categories of coalmining production cost determinants [

66]. The first category includes the costs of production parameters, such as employment and production volume. This category is broadly addressed in the current literature in the context of unit costs structure and fixed and variable costs [

67,

68,

69,

70,

71]. The second category includes the costs of technical parameters that indicate current excavation conditions, such as the number of longwalls, the length of a longwall, the daily longwall advance and the preparatory work advance. These determinants describe present operational conditions and change dynamically based on production capacity and plans. The third category includes the costs of technical parameters of the hard coalmine model that are constant over the long-term and meet production requirements, such as the number of levels in exploitation, the number of layers in exploitation and the number of shafts.

As the costs of the parameters of the first and the third group increase, the total production costs should increase and the costs of the parameters should be positively correlated with the total production costs because they contribute to the production and infrastructure development of a hard coalmining enterprise [

72,

73]. By contrast, as the cost of these parameters decrease, total production costs should decrease. Additionally, the costs of the concentration of excavation—indicated by a reduction in longwalls and the increased length of a longwall—could be associated with a decrease in total production costs. These relationships result from economic regularities and allow us to formulate the following research hypothesis:

Hypothesis 1 (H1). A reduction in employment (A) and production (B) causes a decrease in total production costs.

Hypothesis 2 (H2). The concentration of mining production (indicated by a reduction in longwalls and the increased length of a longwall) reduces total production costs.

Hypothesis 3 (H3). Reducing the number of levels (A), layers (B), and shafts (C) reduces total production costs.

The third category of parameters, including the average daily longwall advance and the average preparatory work advance, directly affect hard coalmining productivity and require additional inputs that increase the total production cost but decrease the unit production cost. These economic assumptions allow us to formulate the fourth research hypothesis:

Hypothesis 4 (H4). An increase in the dynamic infrastructure parameters that improve hard coalmine productivity (average daily longwall advance and average preparatory work advance) increases total production costs.

As discussed, several studies on cost dependencies in extractive industries have analyzed the linear dependence of the total production costs on production volume or other parameters. We verified the presence of linear dependencies between the total production costs and the select parameters. Then, we used the method of analyzing linear dependencies that previous studies employed to ensure that our research findings were comparable to previous findings. Our contribution the literature is as follows: (1) the results of the research; (2) the selection of unstudied independent variables; (3) the assessment of the economic rationality of existing correlations; and (4) the proposal of methods to correct irrational regularities to improve production efficiency.

The research was completed in three stages. During the first stage, the raw data were analyzed in the form of individual parameters for each of the selected hard coalmines. The independent variables were divided into two groups: production and infrastructure. The production group included the employment and production volume, which were the primary factors influencing the total production costs of traditional mining industries. The second group included parameters the define the infrastructure range and its cost-consumption, such as average number of longwalls, number of levels in exploitation, number of layers in exploitation, number of shafts, average longwall length, average daily longwall advance and average preparatory work advance.

In the second stage, the relationship between the total production costs and the selected parameters were examined. First, spread charts were created to assess the shape and type of relationship. Then, to identify linear relationships, the Pearson’s coefficient was used to estimate the direction and strength of the graphically observed relationships.

where

cov(x,y)—covariance between variables x and y;

s(x)—standard deviation of the variable x;

s(y)—standard deviation of the variable y.

The Pearson’s coefficient takes values from −1 to 1, and the closer the value is to 1 or −1, the stronger the correlation is. The significance level (p) was 0.05, which means that there was a 5% chance that the finding of a particular correlation was due to random error in the sample (chance).

In the third stage, we further examined the relationships between the total production costs and the selected variables using multiple linear regression analyses, which enabled the determination of the relationships between the independent variables and the dependent variable:

where

We estimated the parameters using the classical least squares method while taking into account the following assumptions: (1) the model is linear; (2) the expected value of the random component is zero and its variance does not change over time; (3) there is no randomization of the random component over time; (4) the explanatory variables are not random variables; and (5) the explanatory variables are independent.

Additionally, we developed two variants of model for each of the examined hard coalmines. The first variant included all selected parameters. The second variant included parameters that were strongly correlated with the total production costs (they had large Pearson’s coefficients) and were not strongly correlated among themselves (they did not have large Pearson’s coefficients). This approach improves model adjusting and exposes the most important determinants of production costs. It is a result of searching the equations that describe the dependent variable in the best possible way and such methodology is advised in the literature to increase the regression model’s credibility. The limited model is created step-by-step by testing the model adjustment and choosing the best one. Using and presenting two models (full and limited one) also enables the comparison between the independent variables influences on production costs.

To assess the fit of the adjusted model to the data, we used the following parameters:

R: multiply by the Pearson’s correlation coefficient, which measures the strength of the linear association of the independent variables to the dependent variable (R∊<0;1>);

R2: multiply by the coefficient of determination, which measures the fit of the model and the proportion of the variability of the dependent variable that is explained by the model (R2∊<0;1>; 0—means a lack of fitting and 1 means perfect fitting);

R2 adjusted: multiply by the adjusted coefficient of determination, which defines the fit of the model independent from the number of variables and the size of the sample (R2∊<0;1>; 0—means a lack of fitting and 1 means perfect fitting);

p: indicates if the results are statistically significant α = 0.05 (if p > α then reject H0; if p < α then fail to reject H0; H0: βi = 0 and H1: βi ≠ 0); and

SE: standard error of the estimate assesses the difference between the value of the dependent variable and the value of dependent variable estimated by the model (the closer that the value of SE is to zero, the better is the fit of the model).

All parameters are presented in the tables that show the results of the multiple linear regression models for the examined coalmines.

The research was conducted in the Polish hard coalmining sector under the conditions of the restructuring process over the period of 1998 to 2015. At the beginning of the period there were approximately 70 hard coalmines operating in the Upper Silesian region. In 2015, there were 13 remaining and the government divided them into two groups: (1) those with strong financial performance that continued operating; and (2) those with weak financial performance that were liquidated. The five examined hard coalmines belonged to the first group. However, although expected to succeed, their recent production efficiency and competitive cost advantage was unsatisfactory and they required improvements to their cost management to survive and guarantee the energy security of the Polish economy. The importance of the five hard coalmines to Poland justifies their inclusion in the research sample. Thus, we use the case study as a research method.

3. Results

3.1. Production Costs in the Polish Hard Coal Mining Industry

As discussed, the reduction of the costs of the Polish hard coalmining industry is crucial for its survival, which protects one hundred thousand jobs and ensures Poland’s energy security. If costs do not decrease, then the demand for hard coal will be met by imported hard coal and Poland will be dependent on foreign sources of hard coal.

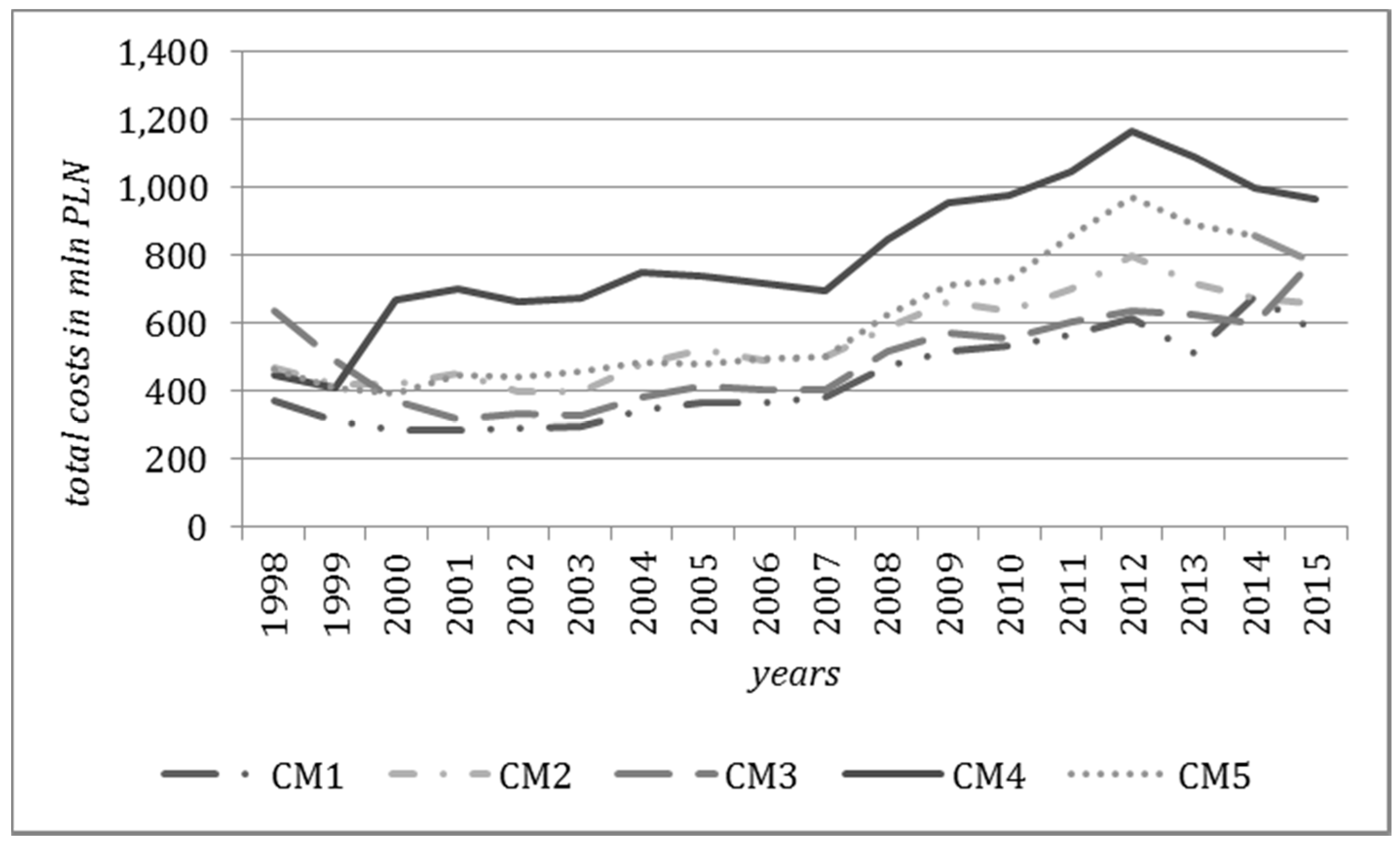

Across the examined coalmines, total production costs have been consistently rising (

Figure 2). There were several reasons for this increase. One reason was the increased depth of excavation and resulting increase in natural hazards. However, several reasons for the increase in total production costs were not economically rational and were caused by the pressure of trade unions to increase employee salaries. These subjective and societally based actions were not intended to improve financial performance and represent fifty percent of remuneration costs in total production costs, causing the economically irrational total production costs to increase over the period studied.

Additionally, the production of Polish hard coalmines has been consistently decreasing in conjunction with declining domestic and European demand. Furthermore, the price competitiveness of Polish hard coal has been decreasing (

Figure 3) [

74]. The increase in total production costs and fluctuations in hard coal prices caused the sales reduction and the production decrease from 19.5 mln tons to 15 mln tons.

The increase in total production costs and decline in production negatively affected unit costs, which were rising until 2013, as shown in

Figure 4. Since 2013, the examined hard coalmines have attempted to reduce unit costs because Polish hard coalmining became at risk for bankruptcy. Their efforts were only partially successful and the restructuring processes must intensify and accelerate to ensure the survival of Polish hard coalmining enterprises.

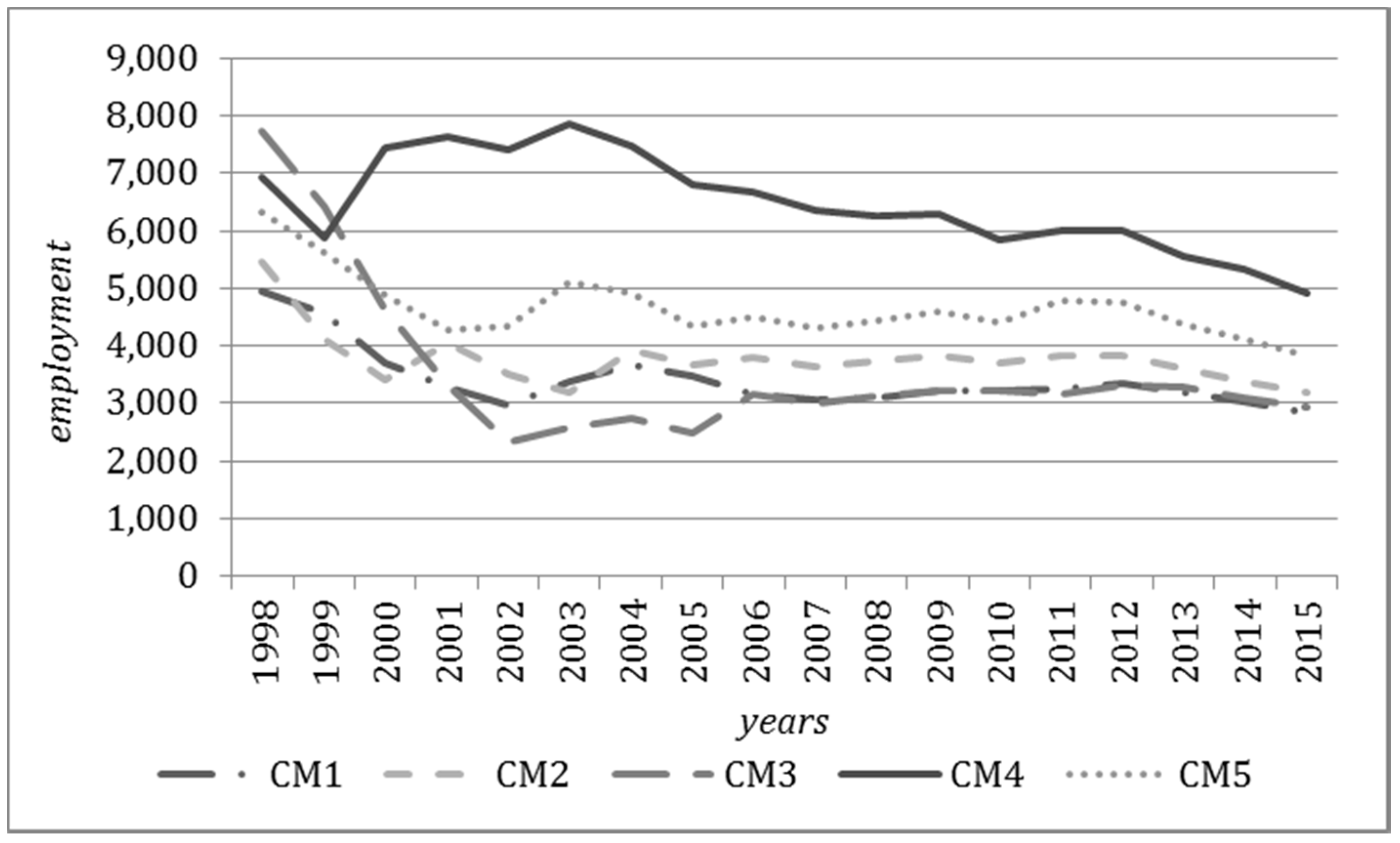

Given the increase in unit costs and the decrease in production, employment restructuring has been insufficient. In all examined hard coalmines, a needed decrease in employment began in 2006 (

Figure 5) and continued over the period of 2012 to 2015.

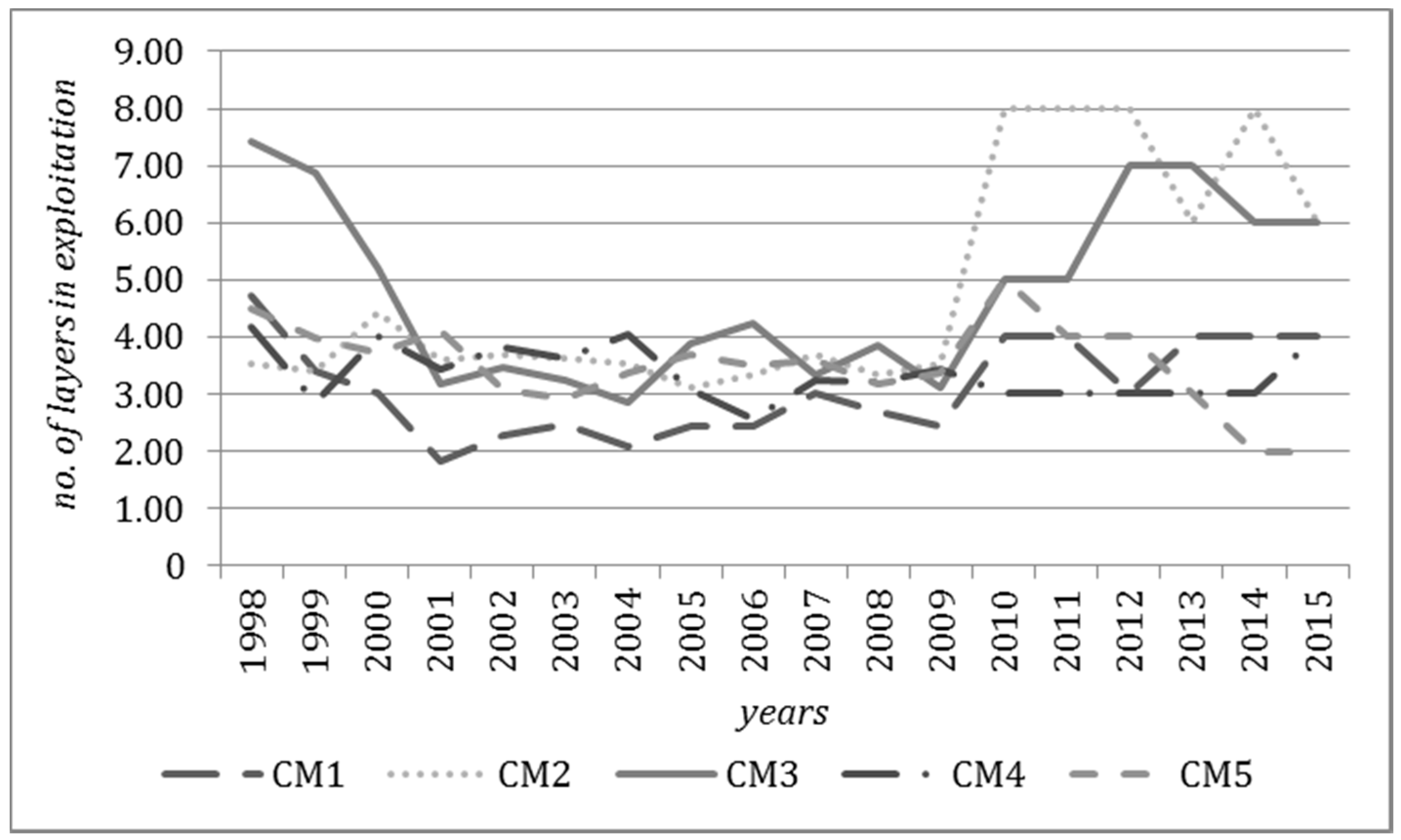

3.2. Total and Unit Costs in the Context of Infrastructure Parameters of the Examined Coal Mines

Over the 18 years that were analyzed, the underground and ground infrastructure of the examined hard coalmines have been transformed due to market changes and the restructuring processes. Because of the decrease in production and costs, the number of longwalls decreased from 3–9 in 1998 to 3–5 in 2015 (

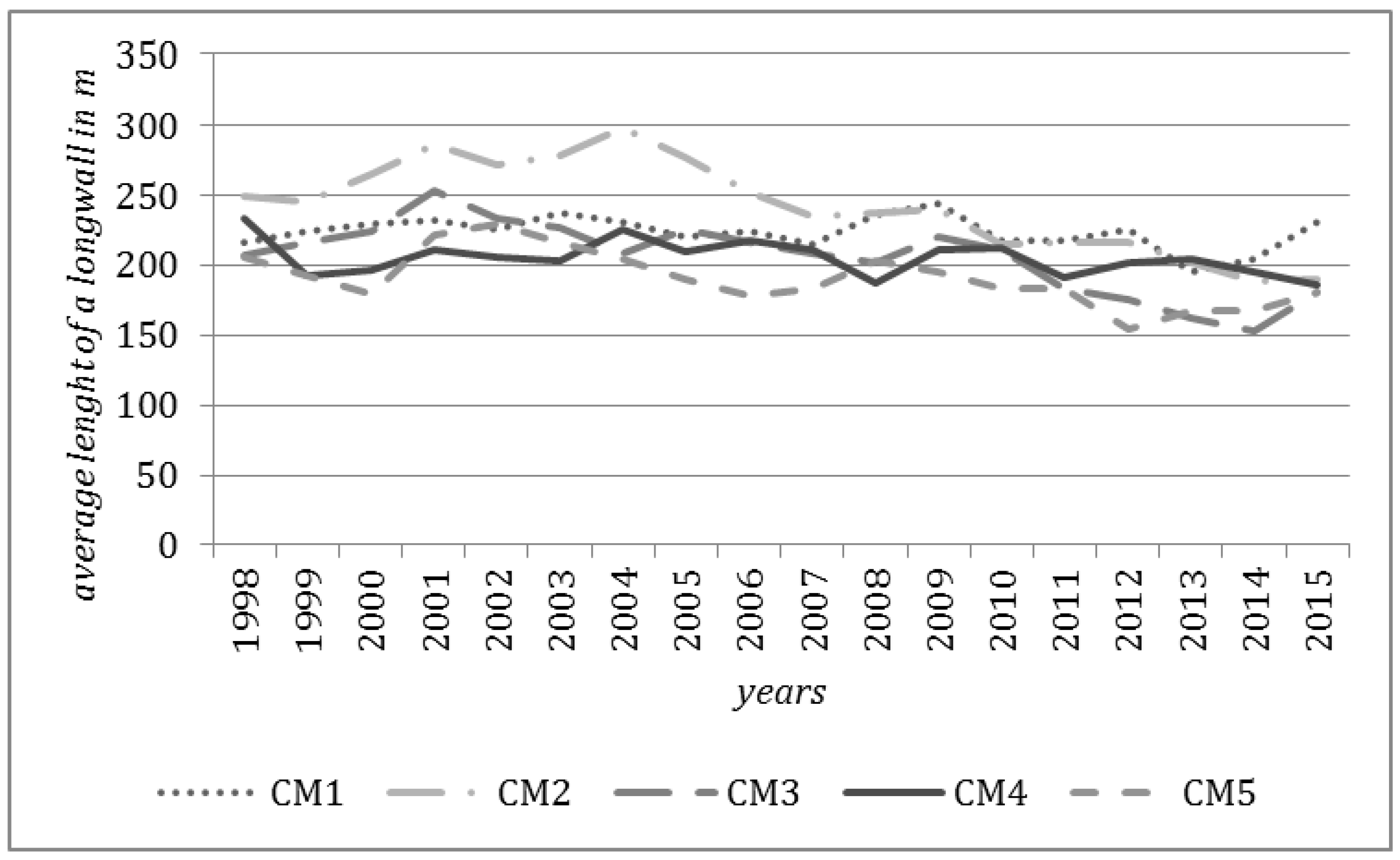

Figure 6). The concentration of extraction was intended to increase productivity and reduce costs. However, because of an insufficient reduction in employment it was largely ineffective. Additionally, over the period studied, the length of longwalls has decreased (

Figure 7). In 1998, the average length of a longwall ranged 200–250 m, and, in 2015, it ranged 180–230 m.

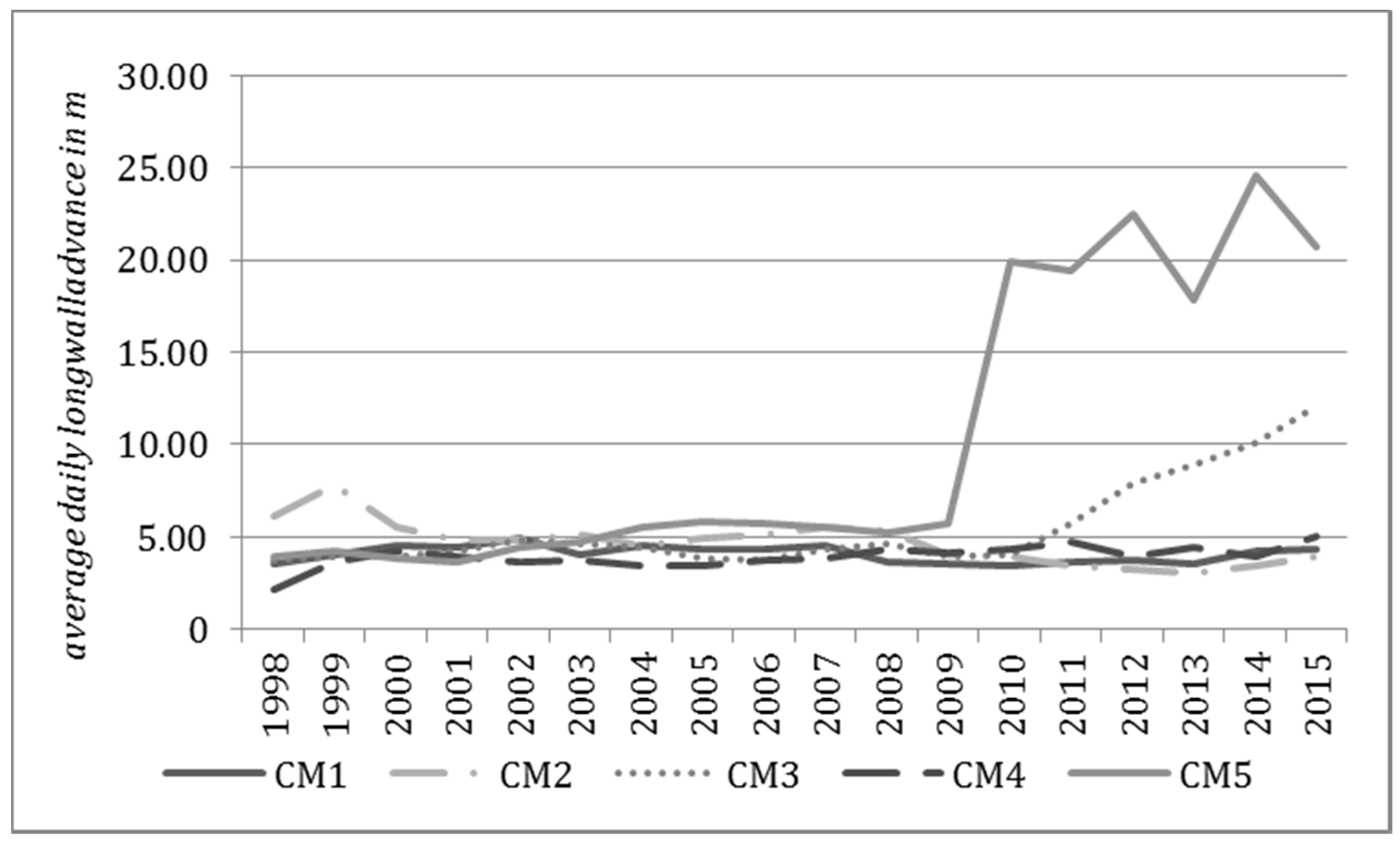

Until 2009, the concentration of excavation was not accompanied by an increase in the average daily longwall advance, which varied 3–5 m in all examined hard coalmines (

Figure 8). The primary barrier to increasing the longwall advance was the presence of numerous geological faults in excavated deposits and the number of natural hazards, especially coal bumps and methane hazards that are typical of the majority of Polish hard coalmines (Turek, 2008). Since 2010, a large increase in the average daily longwall advance was observed in CM3 and CM5. In CM3, the increase was connected to the need to increase quality production and improve cost conditions, which could be achieved through equipment modernization, especially of the load bearing capacity of powered support and the installed power of cutter loaders. Additionally, the increase of the average daily longwall advance in CM3 was encouraged by the relatively low level of natural hazards. The relatively low level of natural hazards also allowed CM5 to increase its average daily longwall advance over the period 2009–2015, but the quality of its hard coal—especially its calorific value and sulfur content—was the lowest of the examined mines, and the longwall advance was increased to maximize the excavation, which resulted in decreased unit costs.

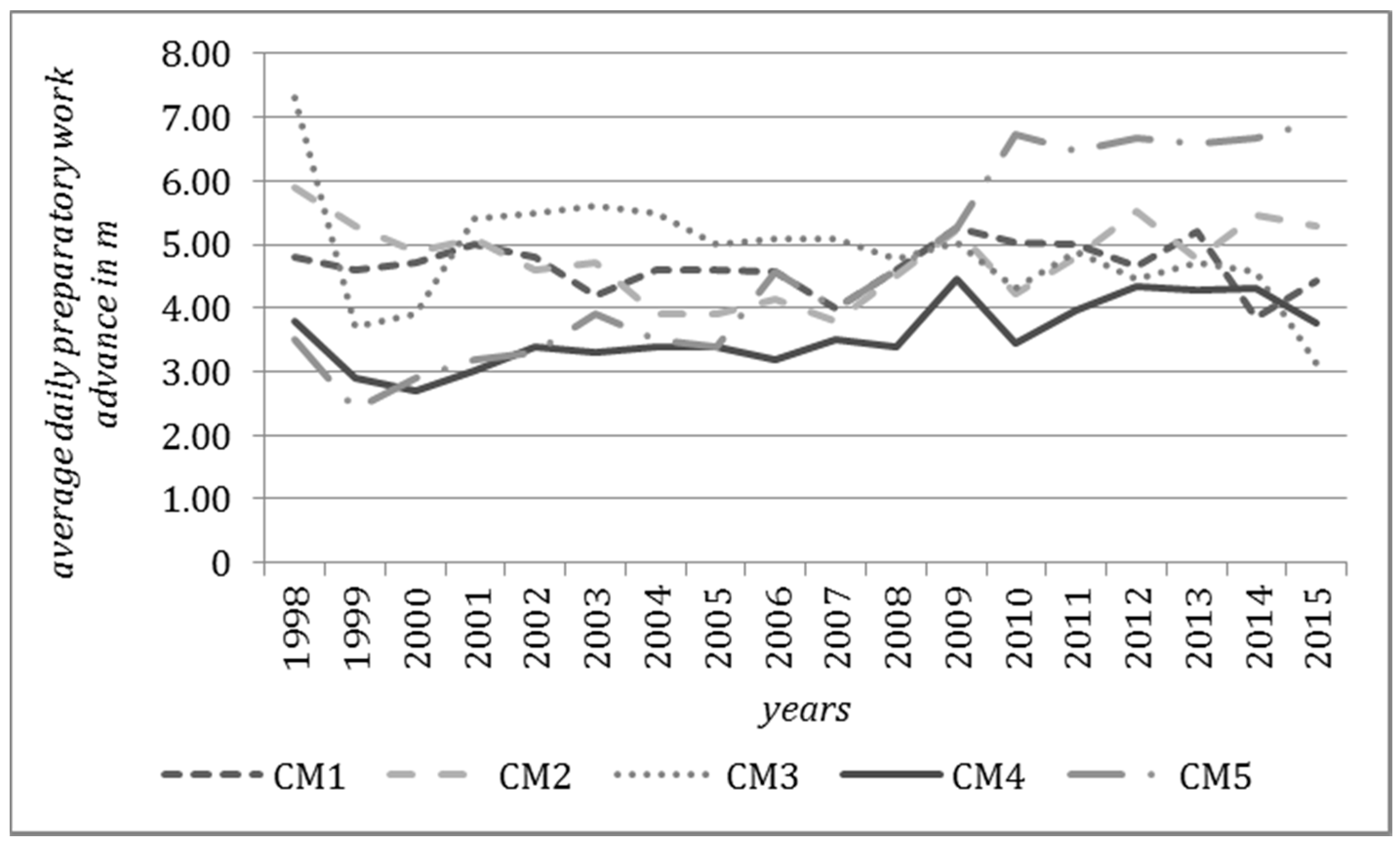

Another determinant of the productivity and costs of hard coalmines is the average preparatory work advance (

Figure 9). This parameter varied among the examined hard coalmines, and has increased considerably since 2010, especially in CM5. This change is in conjunction with the increase of the daily longwall advance and intensification of production. These changes demonstrate that there has been an increase in the production capacity of the best performing Polish hard coalmines, as expected by the restructuring process, which requires the selection of highly performing hard coalmines and the minimize unprofitable mines.

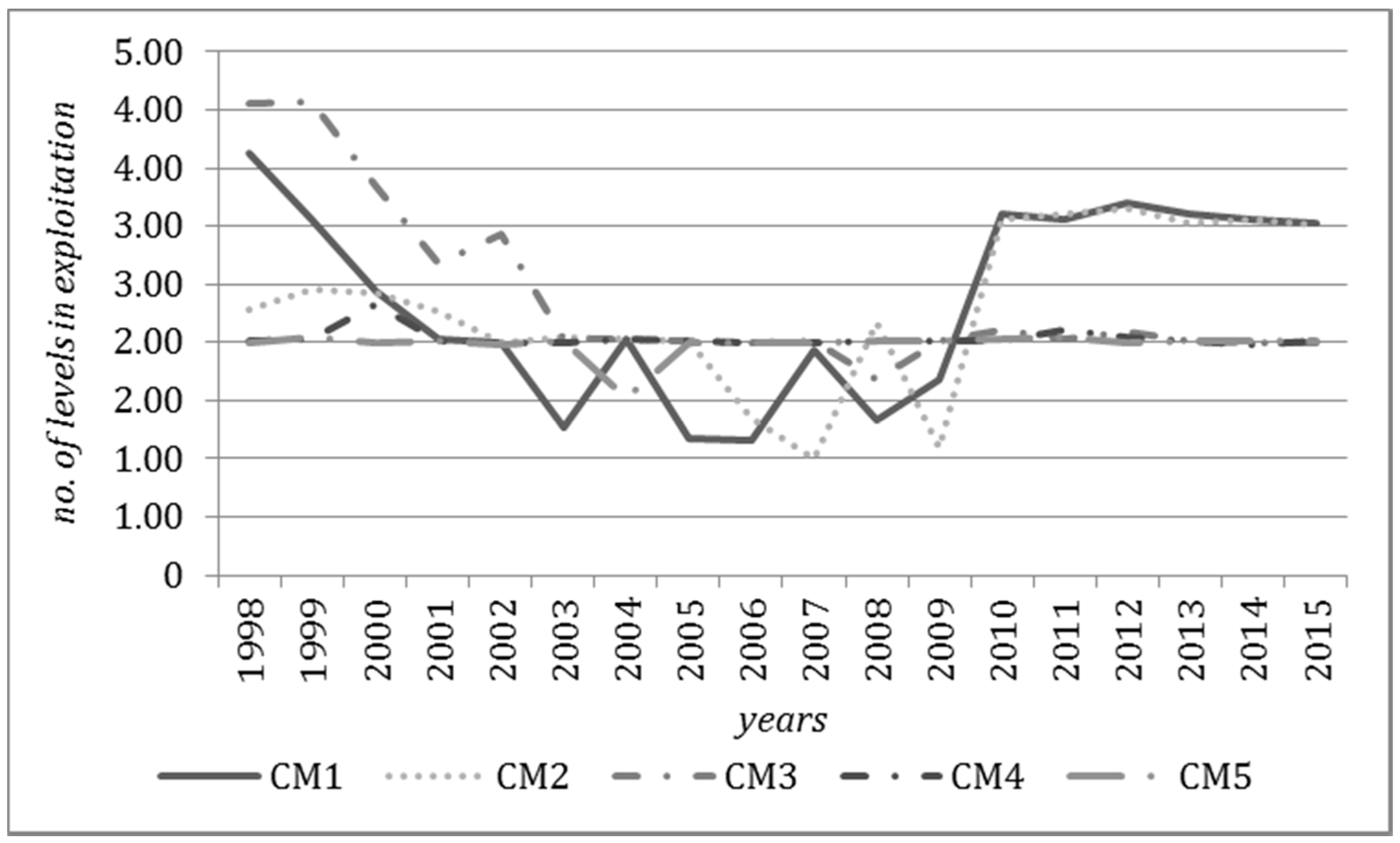

Additionally, the total production costs of hard coalmines were affected by infrastructure scope, which defines the model of a hard coalmine. This model included elements such as shafts, levels of exploitation and layers of exploitation. Generally, the greater the number of shafts, levels and layers are, the higher the total production costs are. As a result, a reduction in total production costs required at least a partial liquidation of infrastructure. A reduction in the number of shafts occurred in CM1, CM2 and CM4 (

Figure 10). In the hard coalmines that experienced a considerable increase in production—CM3 and CM5—the number of shafts increased. The number of levels in exploitation was constant in CM3, CM4 and CM5 but increased in CM1 and CM3 (

Figure 11). Since 2009, the number of layers in exploitation rapidly increased in CM1, CM2, CM3 and CM4 (

Figure 12). All observable changes in infrastructure confirmed the development of the highest performing Polish hard coalmines and that investment in their expansion should ensure the survival of the Polish hard coalmining industry.

In summary, all examined hard coalmines exhibited decreasing production and employment. Additionally, they were limiting aboveground and underground infrastructure wherever it was unnecessary to maintain and develop planned hard coal production capacity. Investments were (and are) obtained by the hard coalmines characterized by the highest production efficiency and the lowest unit costs. However, despite the efforts to improve the financial results of the hard coalmines, the total and unit costs increased over the period studied, which suggests that restructuring was insufficient and ineffective. To find the directions and ranges of total production costs determinants, in the following paragraphs, regression models for each examined hard coalmine were developed and their results were interpreted.

3.3. Dependence of the Total Production Costs on the Production and Infrastructure Parameters

To evaluate the dependence of the total production costs on the production and infrastructure parameters, the Pearson’s correlation coefficients have been calculated to estimate the direction and strength of the relationships between the total production costs and the independent variables. The majority of the important influences on total production costs are included in the regression model of each hard coalmine. The results are presented in

Table 1.

There were statistically significant correlations between the production level and the total production costs of three hard coalmines (CM1, CM2, CM5). For all hard coalmines, there were negative correlations between the production level and the total production costs. This indicates that, as production decreased, total production costs increased. Such regularity was economically irrational and resulted from two conditions. The first was high fixed costs, which were as much as 80% of total production costs. The second was an unjustified increase in salaries due to the demands of trade unions. Therefore, this increase occurred in isolation from the efficiency and productivity of the hard coalmining enterprises. As with the production level, there was a negative correlation between employment and the total production costs of all hard coalmines, although only one reached a statistically significant level (CM4). This strengthened the argument against the economically unjustified increase in salaries.

The correlations between the total production costs and the infrastructure parameters differed in significance, strength and direction. Moreover, the predicted relationship confirming the positive effect of production concentration on total production costs was observed in one hard coalmine (CM2). In the other mines, the total production costs increased as the number of longwalls decreased (in two of four hard coalmines there was a strong, statistically significant correlations). Additionally, in CM4, there was a positive statistically significant and strong to average correlation between total production costs and the number of levels in exploitation and the number of layers in exploitation. This positive statistically significant and strong to average correlation was also characteristic of CM1 but only between total production costs and the number of layers in exploitation. Based on the Pearson’s correlation coefficients, a decrease in the number of shafts resulted in an increase in the total production costs of all examined hard coalmines (the relationship was statistically significant and strong for three hard coalmines).

Of the parameters defining the progress of production, the strongest significant correlations were between total production costs and the average daily longwall advance, but the directions of the correlations were not homogenous. The Pearson’s correlation coefficients of three hard coalmines were positive (CM3, CM4, and CM5) but were negative for two hard coalmines (CM1 and CM2). The correlation between total production costs and the average length of the wall was negative for all mines, which means that a decrease in the length of the wall causes an increase in the total production costs. Similarly, there was a negative correlation between total production costs and the number of longwalls, which illustrated a lack of effects from production concentration (the Pearson’s correlation coefficients for three mines were statistically significant). The correlation between total production costs and the average preparatory work advance was statistically significant for two hard coalmines. However, only one reflected an economically reasonable correlation with total production costs.

The above results showed that there were numerous statistically significant and strong correlations between total production costs and the production and infrastructure parameters. However, several were incompatible with economic regularities, which was a likely explanation for the ineffectiveness of the restructuring processes and the lack of improvement to efficiency. The majority of economically rational relationships were found in CM2.

In the second stage of the study, the regression models were used to estimate the effect of individual parameters on the total production costs of production in the examined hard coalmines. A full model included all independent variables and a limited model included only those that were significantly correlated with total production costs and resulted in a model that was a good fit to the data. The results are shown in

Table 2,

Table 3,

Table 4,

Table 5 and

Table 6.

The regression models showed that the factors that had the greatest influence on total production costs for each hard coalmine are as follows:

CM1: employment, number of levels in exploitation, number of shafts, and average daily longwall advance;

CM2: production, number of shafts, average length of a longwall, and average preparatory work advance;

CM3: employment, number of levels in exploitation, and average length of a longwall;

CM4: employment, average number of longwalls, number of shafts, average daily longwall advance, and average preparatory work advance; and

CM5: production, employment, average number of longwalls, average daily longwall advance, and average preparatory work advance.

Among the production parameters, the most impactful was employment, which was a significant predictor for four hard coalmines. This illustrated the importance of this factor and indicated the need to correct its relationship with total production costs. Among the static infrastructure parameters, the most important were the number of levels in exploitation, the number of shafts and the average number of longwalls. Finally, the most important of the dynamic infrastructure parameters were the average daily longwall advance and the average preparatory work advance.

4. Discussion

The results showed that employment and production were negatively correlated with total production costs, which failed to support H1: The reduction in employment (A) and production (B) causes a decrease in total production costs. Such economically irrational regularity resulted from the high proportion of fixed costs in the total production costs. The importance of this conclusion is emphasized by the regression models that indicated that employment and production levels were crucial determinants of total production costs. Therefore, total production costs were influenced by irrational economic relationships that had a negative impact on the financial performance of hard coalmines.

The relationships between the total production costs and the production concentration varied among parameters. Only one of hard coalmines showed a positive and significant correlation between the total production costs and the number of longwalls. In CM4 and CM5, the number of longwalls had an extreme negative effect on total production costs. It is an important predictor in the regression models and had a strong negative correlation with the costs of production. The parameter, the length of a longwall, was negatively correlated with total production costs for all hard coalmines. The correlation was statistically significant for three of the hard coalmines. From the above observations, there was partial support for H2: The concentration of mining production (demonstrating mostly in longwalls reducing) (A) and increasing of the length of a longwall (B) influences the total production costs reduction.

Additionally, we rejected H3: Reducing the number of levels (A), layers (B), and shafts (C) enables the total production costs decrease. Economically rational relationships (positive correlations) between the number of levels and layers and the total production costs were present only in the case of CM2. However, the regression models showed that their impact on the total production costs was irregular and not of primary importance (the most important parameters are: the average length of a longwall and average number of longwalls).

The analyses of the dynamic parameters led to different results for each parameter. In three of the five hard coalmines, the relationship between the total production costs and the average daily longwall advance matched the prediction. The relationship between the total production costs and the average preparatory work advance matched the prediction for one of the five examined hard coalmines (CM4). We rejected the fourth research hypothesis, H4: Increase in dynamic infrastructure parameters improving the productivity (average daily longwall advance) (A) and average preparatory work advance (B) increases the total production costs.

In summary, although the regression models are well-fitted to the data and could statistically forecast the total production costs of the examined hard coalmines, they confirmed the presence economically irrational relationships. Therefore, we concluded that the restructuring process was ineffective because, for example, limiting the scale of infrastructure did not reduce total production costs. The variable of most concern was employment. It was a strong predictor of total production costs in the regression models and was negatively correlated with the total production costs of all the examined hard coalmines. Therefore, employment represented a significant barrier to financial success. This assertion was also confirmed by the results of the analyses of CM2. In this hard coalmine, there were the highest number of predicted relationships between total production costs and the production and technical parameters. Additionally, its financial performance was superior to those of the other examined hard coalmines.

As it was mentioned, the Polish coalmining is under deep restructuring now and supporting the examined mines is one of the most important restructuring actions. These mines were evaluated as the prospective ones, and have been included in the structure of the newly established mining enterprise. The inefficient coalmines were liquidated or will be liquidated by 2018. Further restructuring of survived coalmines have to include: (1) increasing productivity that can be achieved through improvement of employment structure (increasing the share of production employees in the total employment); (2) introducing the motivation system in which the salaries will be partly dependent on productive and financial results; (3) increasing current and future investment expenditures in the most efficient activities; and (4) reviewing the infrastructure for its usability. The mentioned activities should also improve inappropriate relationships—described in the article—between the production and infrastructure relationships and the total costs of production.

The presented research has some limitation worth of mentioning. It includes only five coalmines operating in Poland and it was conducted using the case study methodology. Moreover, it does not include all conditions influencing the total cost of mining production. We did not consider: geological conditions, rock types, resources’ reserves as well as the competences and skills of workers because we treated them as the necessary conditions required for extraction and fulfilled in all examined coalmines in advance. Nevertheless, the research contributes to mining economics development in the aspect of cost determinants and cost management in hard coalmining. It also provides practical implications for examined coalmines and extractive industry in Poland.