In the previous section, we find some supportive evidence of the relation between excess returns and expected risk. However, the relation lacks robustness as shown in the test results based on a GARCH(1,1) model or from the sub-sample estimations. On the econometric front, this poor performance may be attributable to many factors, ranging from errors in the variables, mis-specification of the model, sensitivity to outliers, non-Gaussian error distributions, an artifact of small samples, to employing an inappropriate method. In this study, we address the issue that arises from using the conventional least squares method in estimations that are seriously deficient based on a non-Gaussian setting. One key source of lost efficiency is that the least squares estimators focus on the mean as a measure of location. Information about the tails of a distribution is lost. In addition, news in the form of extreme outliers can significantly distort the estimated results. To address this issue, we investigate the underlying functional relation by using a quantile regression method, which provides more robust and consequently more efficient estimates, since it enables us to cover a full range of conditional quantile functions.

4.1. Quantile Regression Model

A quantile regression is a statistical procedure designed to estimate conditional quantile functions developed by Koenker (2005), Chen (2006), and Taylor (2008). The model was used to analyze financial markets by Barns and Hughes (2002) and Chiang et al., (2010).

11 To elucidate, in an earlier section we estimated the coefficient

β through a WLS regression by minimizing the weighted squares of deviations from the conditional mean of the sample as

where

is the conditional mean of the sample of the dependent variable given

xi and

wi is the weighting factor. Analogously, we write a linear conditional quantile function as:

By minimizing weighted deviations from the conditional quantile, we obtain:

where the conditional distribution of the dependent variable

yi is characterized with different values of the

τth quantile given

xi (Koenker, 2005), and

ρτ is a weighting factor called a check function. For any

τ ∈ (0, 1), check function is defined as:

where

yi -

Equations (11) and (12) imply that

Expression (13) states that the quantile regression estimators can be achieved by minimizing a weighted sum of the absolute errors, where the weights are dependent on the quantile values. When

τ =0.5, the quantile regression becomes the median regression. The quantile regression is not restrictive at the median level; it allows us to estimate the interrelationship between a dependent variable and its explanatory variables at any specific quantile. Thus, it provides a broader picture in helping us examine the relation between return and risk.

In the spirit of our test equation, quantile regressions for estimating excess return for

quantiles are characterized as:

The quantile regression is solvable if the quantile is expressed as linear functions of the parameters.

12A quantile regression is more appropriate when extreme values are present. It has two advantages: (1) it can be used in various distributions, especially skewed distributions; (2) if the extreme values change, the quantile regression coefficient doesn’t change its value and standard error. This is especially true for stock returns that present fat tails and/or a skewed distribution.

13 Thus, unlike the least squares regression, quantile regressions help to alleviate some of the statistical problems due to fat tails or outliers (Barnes and Hughes, 2002).

4.2. Evidence from Quantile Regression Estimations

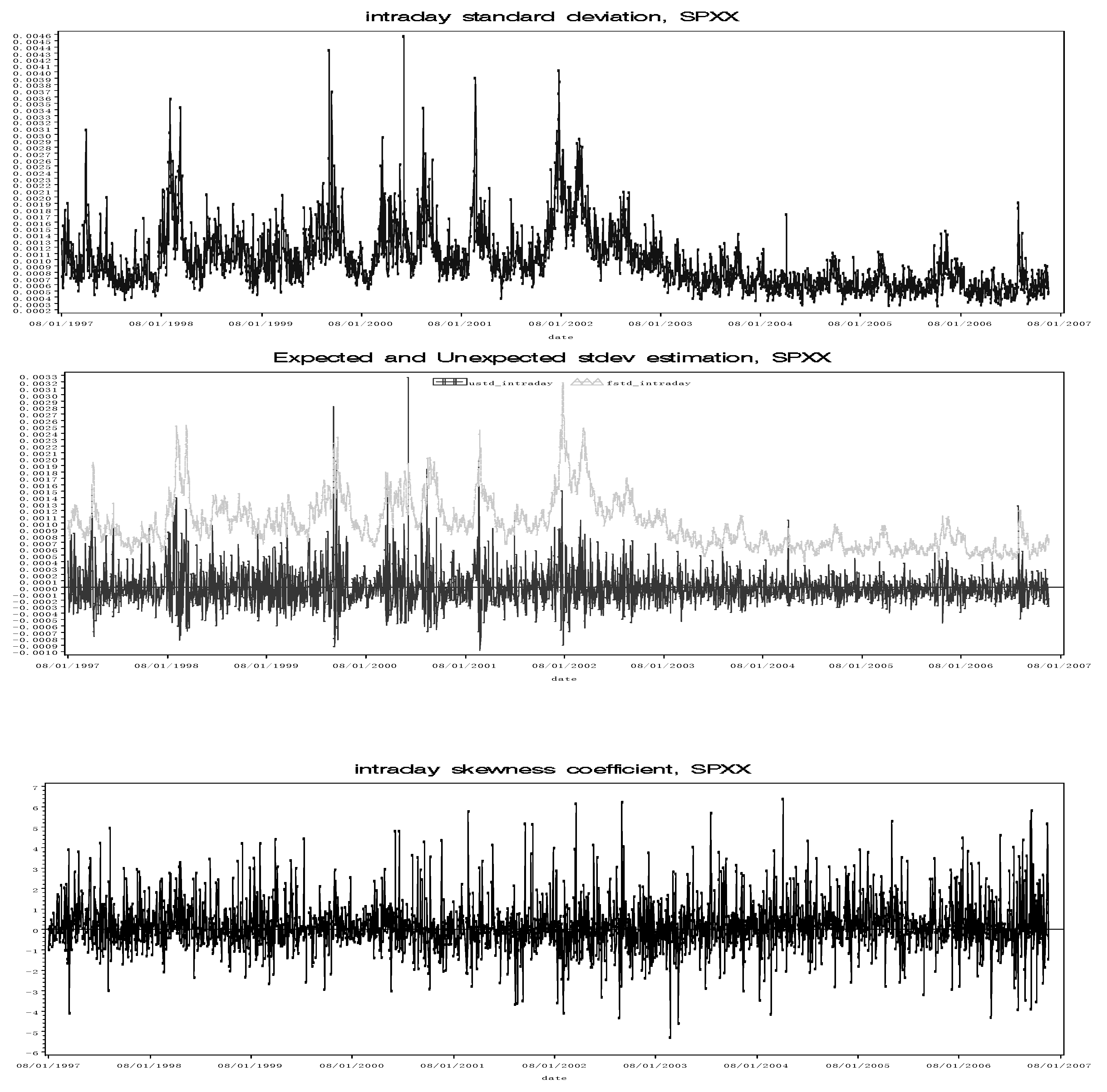

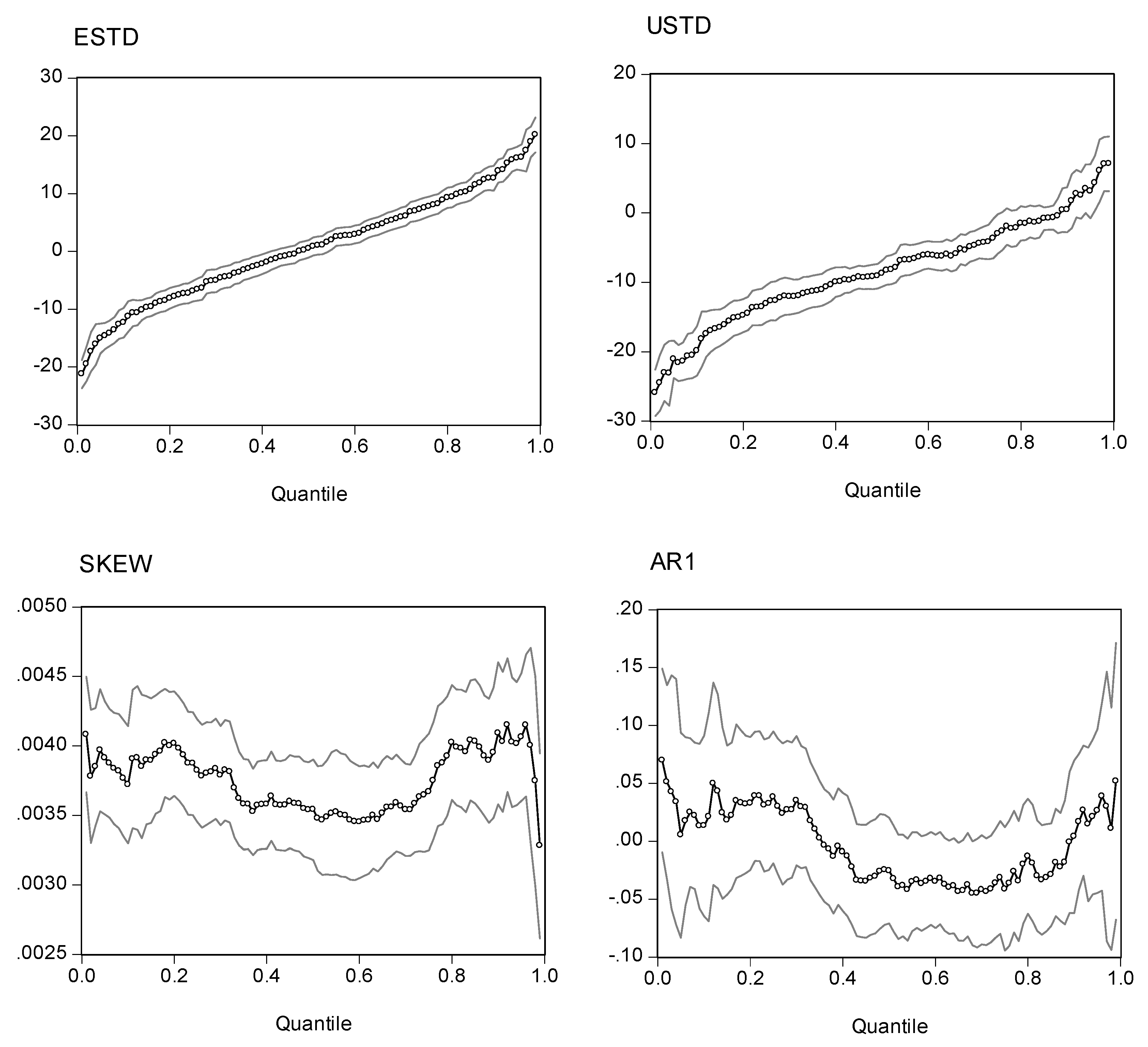

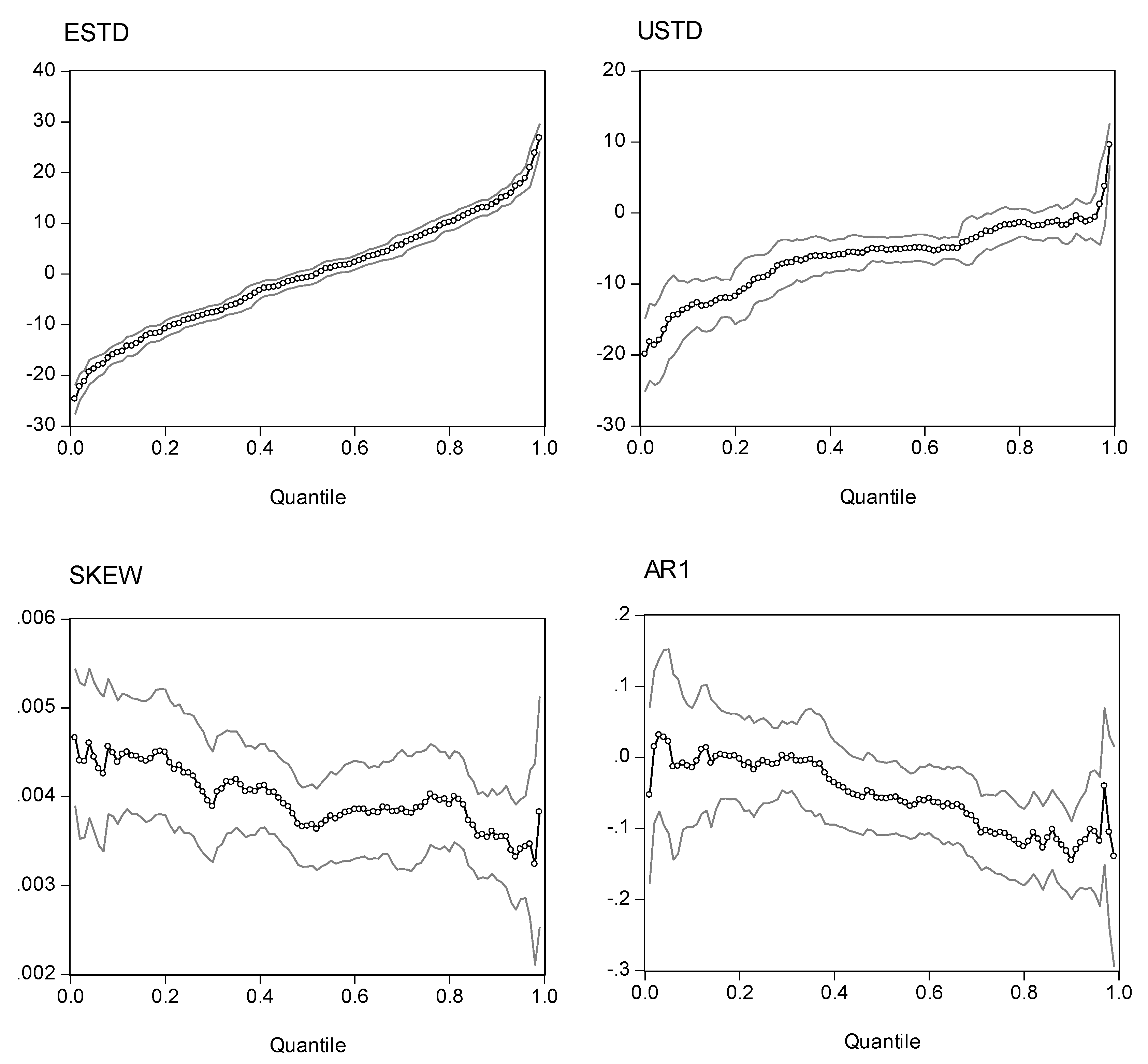

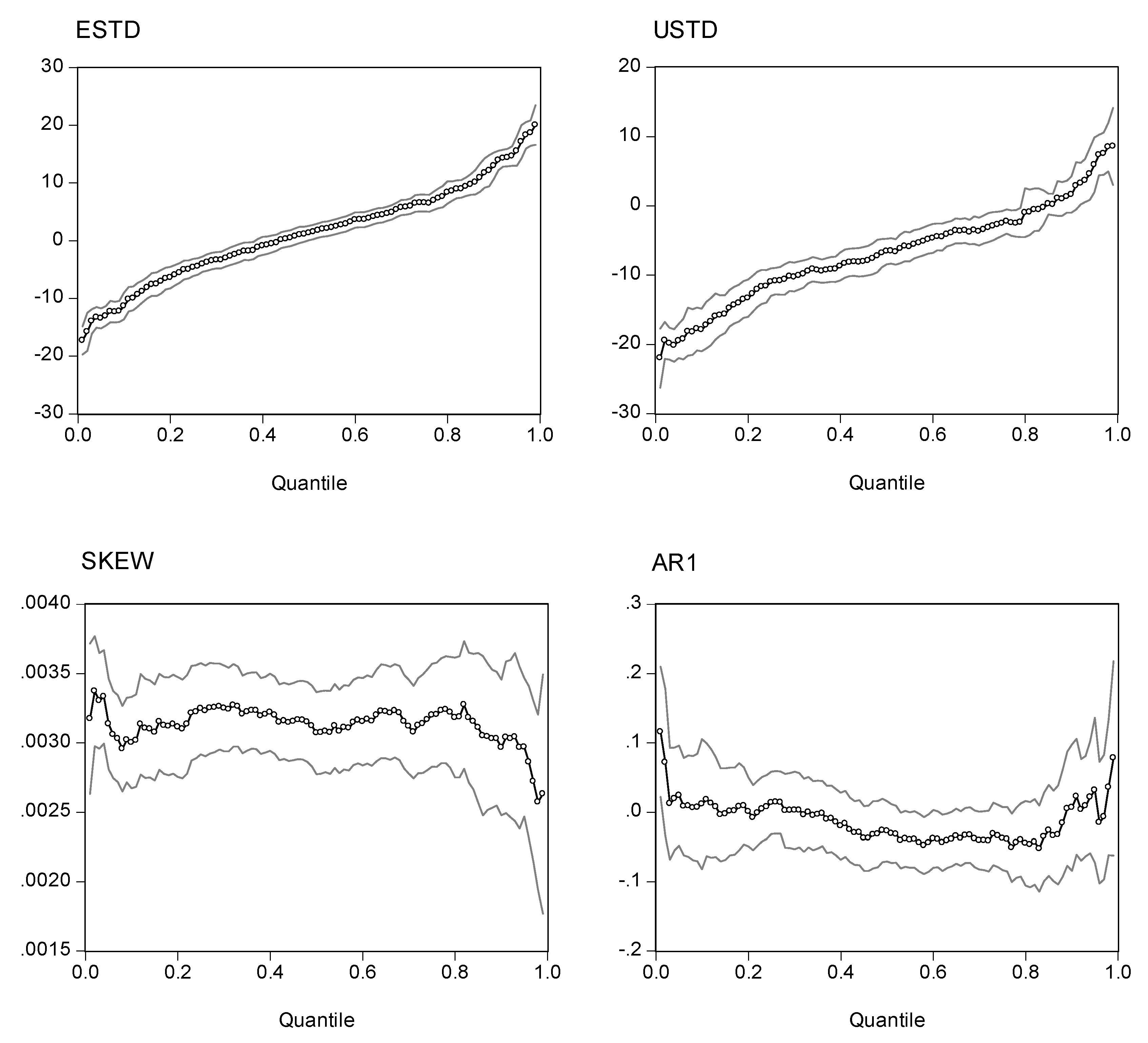

Before evaluating the statistics of the quantile regression estimations, it is more elucidative to inspect the plots of the point estimators with different quantiles. Presented in Figs. 2, 3, 4, and 5 are the estimated coefficients of the independent variables with a range of quantiles from 0.05 to 0.95 for the four indexes, which we obtain by running the regression model in Eq. (14). Each figure contains four panels, and each panel depicts point estimators for the slope of the explanatory variable along with a 95% pointwise confidence band. The vertical axis measures the magnitude of the coefficient and the horizontal, the quantiles. The plots show that the coefficient of the expected risk variable in the quantile regression is an upward function of the quantiles of the excess returns (the small-circle connected line in the panel charts). The relation between excess returns and expected risk evolves from negative to positive as the quantile increases. At lower quantiles, excess return is negatively related to expected risk; at higher quantiles, excess return is positively related to expected risk. Around the median, excess return is not correlated with expected risk, and the associated t-value is insignificant for the median regression.

We also plot the coefficients for three other explanatory variables in the figures. As with the coefficient in the expected standard deviation, the coefficient of the unexpected standard deviation increases with the quantile distributions. However, most of the estimated coefficients are in the negative zone, with minor exceptions in the upper tail of the conditional distributions. If we take the S&P 500 as an example, the coefficients are in the range (-20, 5). For quantiles lower than 0.81, the coefficients are negative; for quantiles higher than 0.92, the coefficients are positive; for quantiles between (0.81, 0.92), the coefficient is insignificant.

Turning to the intraday skewness variable, we find that the coefficients are consistent throughout the entire spectrum of quantiles. The coefficients are stable and always stay in a narrow positive regime irrespective of the quantile distributions being evaluated. This finding strengthens our earlier report that excess returns are positively related to intraday skewness.

With respect to the coefficients of the lagged index return variable (AR(1) term), those curves show a downward trend or a U-shape curve as the quantile increases. The coefficients stay in the negative zone for most of the distributions and reach a minimum level around the 80% quantile. This finding is consistent with our earlier evidence that the AR(1) coefficient in the WLS estimates has a negative value and that there is some disparity with coefficients from the GARCH model. However, at the two ends of the quantiles, we find that the AR(1) coefficients are positive (except for the NASDAQ 100 index). This finding implies that in the scenarios with more extreme movements of stock returns, there is a tendency toward moving in the same direction on the following day. However, as may be seen in the following section, the evidence shows that with the exception of the coefficients on the return of the NASDAQ 100 index in the upper tail, we find that most of the estimates are statistically insignificant. Thus, in general, we can conclude that there is a negative autocorrelation.

Table 6 reports the coefficients for the four indexes at five different quantiles (0.05, 0.25, 0.5, 0.75, and 0.95).

14 As the returns on the S&P 500 index show, the estimated coefficients for the expected risk variable are -14.63, -6.46, 7.28, and 16.75 for the 0.05, 0.25, 0.75, and 0.95 quantiles, respectively. All estimates are highly significant at conventional levels. Note that all estimates of these four quantiles are significantly different from that of the median quantile (which is 0.15 with a t-value of 0.20) in both the magnitude of the coefficient and statistical significance. This pattern also reveals itself in other three indexes: significantly negative at lower quantiles but significantly positive at higher quantiles. The coefficient for the median is typically insignificant (except for the Dow Jones Industrial Average 30). This finding implies that, in general, there is no correlation between the median of excess returns and expected risk. This also suggests that the single coefficient derived by a mean regression can obscure important results. The conditional expectation represents the average relation, which can be significantly different from quantile effects. It is evident from the figures that the positive and negative impacts on the tails cancel each other out, leaving very little effect on the mean.

As shown in the panels located in the northeastern quadrants of Figs. 2-5, most of the estimated coefficients for the unexpected volatility are negative, with a few minor exceptions in the 0.95-quantile distribution. The intraday skewness coefficients consistently display a positive value and are significant at the conventional levels. Negative autocorrelation is more apparent in a more volatile stock index, NDXX. An interesting finding is that the negative coefficient is more significant at the high quantiles. Particularly, we find strong evidence of a mean reversion for the NDXX at quantile 0.5 and higher. For the low quantile regime, no mean reversion has been observed. This finding provides important evidence for clarifying the sign of the autoregression of stock returns.

We can further illustrate the difference between least squares regression and quantile regressions that uses a simpler risk-return model.

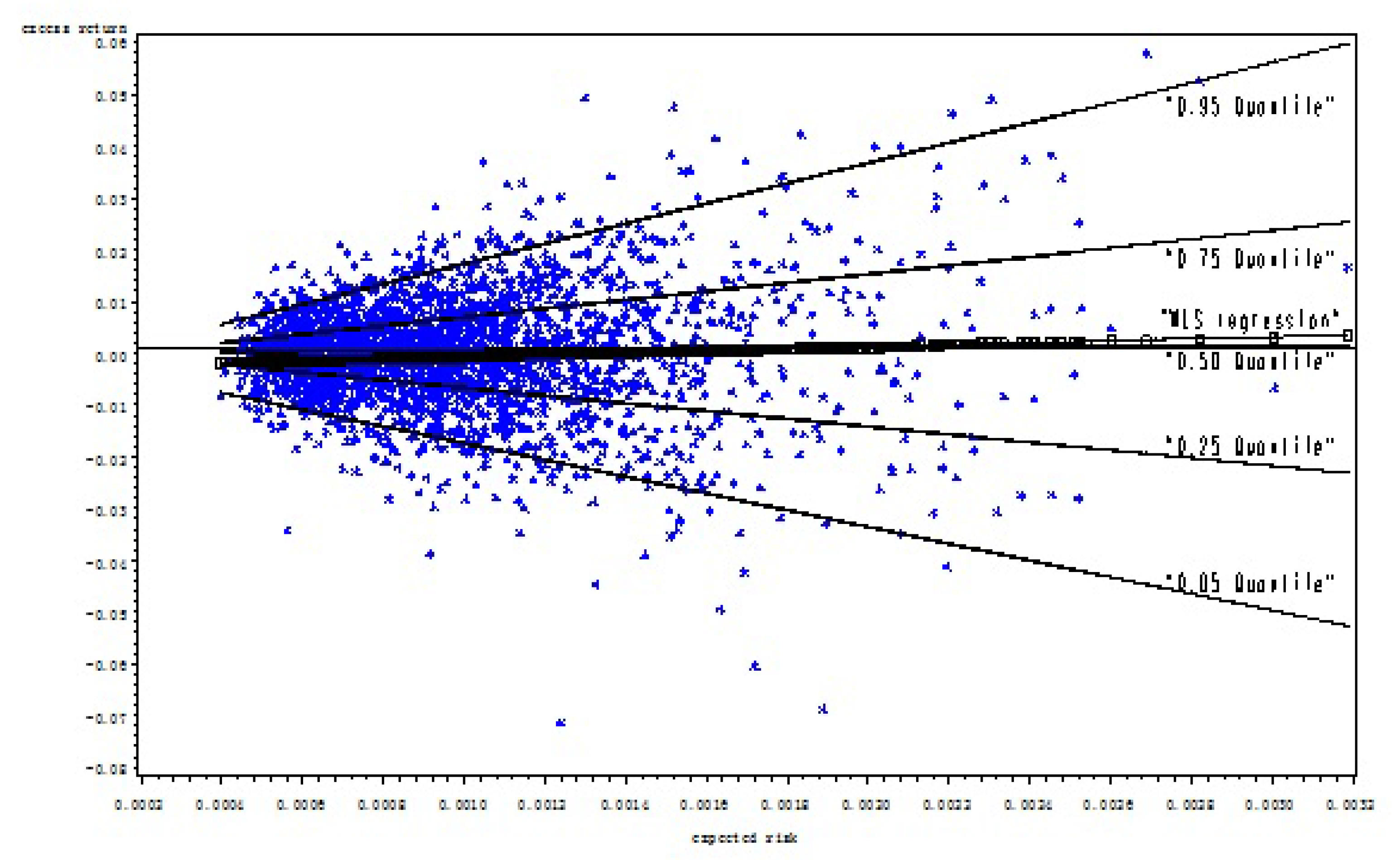

Fig. 6 shows the scatter plots between the excess return and risk variables for the S&P 500 index. Those plots form a cone or comet shape, suggesting that as risk increases, returns display a greater range of dispersion. The fitted WLS regression from Eq. (2) displays a minor upward slope, which is different from a horizontal line at the 1% significance level. However, if we compare the WLS line with the scatter plots, it is apparent that the positive risk-return relation derived from a mean-regression model is rather trivial. It fails to cover the entire spectrum of the risk-return relation.

This finding becomes clear if we compare the mean regression line with the lines derived from the quantile regression estimates. In

Fig. 6, we present the quantile regression lines labeled

0.05, 0.25, 0.5, 0.75, and 0.95, respectively. The quantile regression lines labeled 0.05 and 0.25 fall below the mean/median lines, presenting a negative slope, while the regression lines labeled 0.95 and 0.75 quantiles lie above the mean/median lines, showing a positive slope.

15 The risk-return relation evolves from negative to positive as the quantile increases.

Indeed, the WLS regression produces only one estimate; it provides very limited information about the risk-return relation. In contrast, a collection of conditional quantile regressions provides much more complete statistical information on the functional relations between dependent and independent variables and yields more robust results against possible outliers.

If we focus on the risk-return relation, it is tempting to ask: what is the underlying economic meaning of the sign-switching phenomenon from low to high conditional quantile distributions? Our interpretation is as follows. When economic conditions induce an optimism that corresponds to the return distributions in the upper quantiles, investors anticipate that the expected higher volatility will be compensated by the expected higher return. However, when the market is dominated by a pessimism that, in general, corresponds to the return distributions in the lower quantiles, investors perceive that high volatility will create more uncertainty, causing stock returns to fall. Thus, we observe a negative relation between excess return and expected volatility. In the median range of return quantiles, investors lack clear-cut information or fail to visualize market conditions. This ambivalent return and uncertainty render a vague risk-return relation. Our evidence suggests that when the excess return is expected to be relatively high, the risk-return hypothesis is likely to be established. However, when the excess return is expected to be low or negative, there is no tradeoff. This study also concludes that the tradeoff hypothesis does not apply to the median return.

Our empirical finding on the risk-return relation is consistent with the experience of the sub-prime crisis in the US market that started in early 2007. In this crisis, large numbers of sub-prime borrowers are at risk of defaulting on their loans, causing severe credit risk and having a cascading effect on credit markets. This perceived uncertainty is expected to cause greater volatility in stock returns, accompanied by a big loss for financial intermediaries. Under these scenarios, expected excess returns and expected volatility in stock markets are negatively correlated, since the returns are expected to be distributed to the low quantile (tail). In fact, when a big loss is anticipated in that < 0, it is hard to imagine that we can have γ > 0 in equation (1), since cannot be negative. Thus, Merton’s proposition of a risk-return tradeoff can survive only in the regime where expected excess returns are in positive territory. If we look at a long horizon, expected excess returns are anticipated to be positive because of economic growth. The tradeoff is possibly established, and this argument is consistent with the neoclassical long-run framework. However, in the short run, especially under the pessimistic market conditions, the data are not likely to confirm the tradeoff hypothesis. This argument is consistent with the study by Lundblad, who finds that “small-sample inference is plagued by the fact that conditional volatility has almost no explanatory power for realized returns.”

4.3. Test of Quantile Regression Coefficients

Although it seems obvious that the estimated coefficients vary with the quantile levels reported in

Table 6, we have superimposed five estimated linear conditional quantile functions on the data. It would be more compelling if we conduct a formal test of the hypothesis of the equality of slopes. Since the median quantile is close to the mean value of the least squares estimation that has been conventionally used in testing the risk-return relation, we shall address the equality test of various quantiles against the median quantile coefficient (

). Specifically, we test:

Table 7 reports the statistics for testing the null hypothesis of the equality of slopes. The Wald statistics show that the null is uniformly rejected on the coefficients of the expected risk variable at different quantile distributions, suggesting that the estimated coefficients for the quantiles of 0.05, 0.25, 0.75, and 0.95 are significantly different from that of the median distribution. The testing results point to the caveat about using a mean or median level of the data to examine the risk-return relation. The evidence suggests that the validity of the risk-return tradeoff occurs only in the upper tails, showing a significant difference from those derived from the median quantile. Thus, using the mean/median regression in the test equation tends to result in a loss of efficiency, which renders the testing results insignificant. Similar to that of the expected risk variable, the Wald statistics for the unexpected risk variable reach a parallel conclusion. Specifically, the coefficients at quantiles 0.95, 0.75, 0.25, and 0.05 are significantly different from those of the median.

16 Nonetheless, for the coefficients of intraday skewness and the AR(1) term, we cannot find strong evidence against the equality of the slopes between quantiles.

In addition to the evidence that the estimated coefficients deviate from the median quantile, we are also concerned about the symmetry of the risk-return relation for the quantiles that lie above the median vs. those that lie below the median. In particular, we test the following restrictions:

Test results are reported in

Table 8, where we find very little evidence of a departure from symmetry. The symmetry hypothesis cannot be rejected for the pair of (0.25, 0.75) and the pair of (0.05, 0.95) for the expected risk variable in all indexes. The risk-return relation from the quantile regression method is symmetric to the median. The other three variables’ coefficients also show symmetry except that the Russell 2000 index and the NASDAQ 100 index show little asymmetry for the intraday skewness coefficient variable at the 5% level of significance.

The symmetry property is more transparent by inspecting the plots between excess returns and standard deviations for the S&P 500 index. In

Fig. 6, it is easy to see that the pair-wise quantiles (0.05, 0.95) and (0.25, 0.75) are mainly symmetrical using the median quantile as a reference.

17 An implication of this test is that variance or standard deviation is still a crucial factor in modeling stock return. However, to validate the risk-return trade-off hypothesis, risk variables should be restricted to certain appropriate ranges.