Hedonic Price Function for Residential Area Focusing on the Reasons for Residential Preferences in Japanese Metropolitan Areas

Abstract

:1. Introduction

2. Related Work

- PRP: Residential land prices (yen/m2).

- AC: Land area (m2).

- DS: Distance to the closest station (m).

- DTH: Width of the road in front of the residential section (m).

- DIS: Linear distance to Otsu (prefectural capital) (km).

- GAS: City gas maintenance area.

- CHO: Urbanization control area.

- BIW: Biwako line of the West Japan Railway Company (JR West).

- RAP: Stops for rapid trains.

3. Framework and Method

3.1. Framework and Process

3.2. Method

3.2.1. Hedonic Approach

3.2.2. Details of the Methods

3.3. Selection of Target Area

4. Overview of Residential Land Price Estimations

4.1. Overview of Function

4.2. Overview of Explanatory Variables

4.2.1. Configuration of Explanatory Variables

4.2.2. Regional Vulnerability

4.2.3. Accessibility to Destination Stations

- N.A.: Accessibility value.

- : Time between stations ij (min).

- : Maximum transportation capacity between stations ij (10,000 people).

- : Number of people getting on and off at station j (arrival station) (people).

- α, β: parameter (α, β > 0).

5. Collection and Processing of Data

5.1. Collection of Data

5.2. Processing of Data

5.2.1. Distance to Tokyo Station

- : Longitude and latitude of point 1; : Longitude and latitude of point 2.

- : Equatorial radius (6,378,137.000); : Polar radius (6,356,752.314).

- , , , .

- , , .

5.2.2. Accessibility to Destination Stations

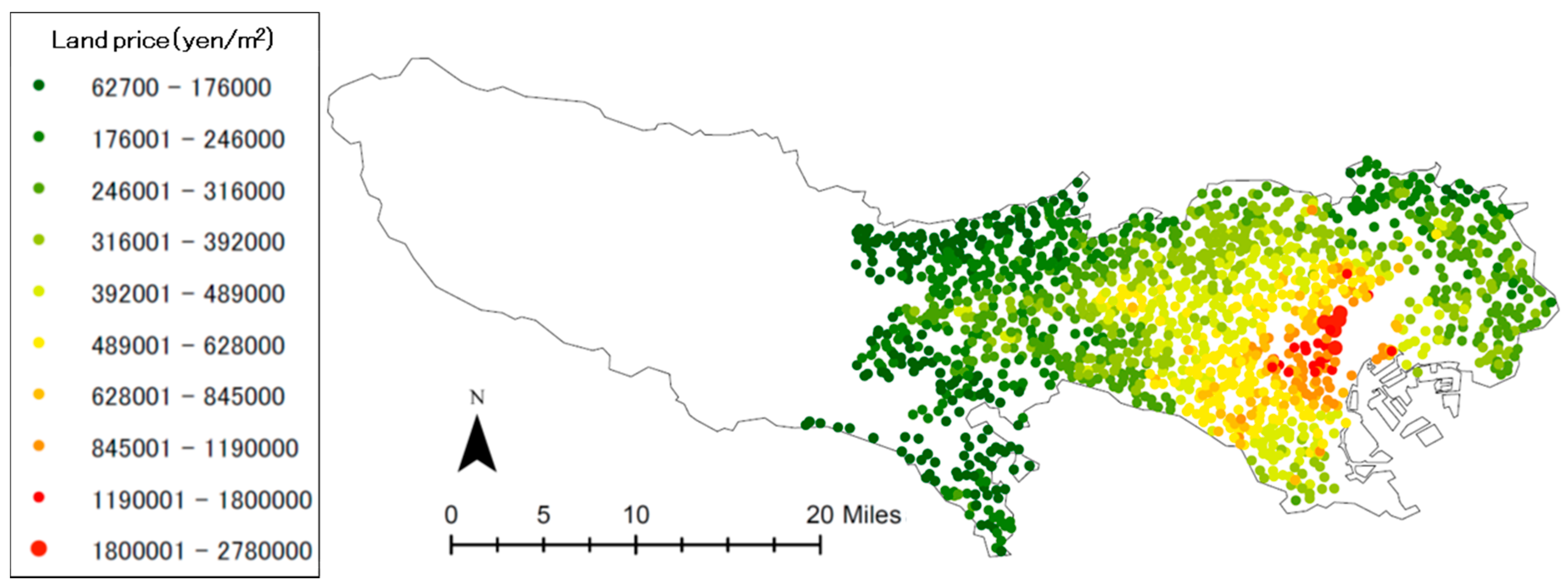

5.3. Visualization of Residential Land Price Distribution and Advanced Settings for the Target Area by Means of GIS

6. Estimations of Hedonic Price Function for Residential Area

6.1. Advanced Settings for Explanatory Variables

6.2. Estimations of Hedonic Price Function for Residential Area

- PRP: Residential land price (yen/m2).

- DS: Distance to the closest station (m).

- RA: Acreage (m2).

- WD: Width of the road in front of the residential section (m).

- BC: Building coverage ratio (%).

- FR: Floor area ratio (%).

- T_DS: Distance to Tokyo station (m).

- DA: Regional vulnerability.

- AC: Accessibility to destination stations.

- C: Municipality division.

- E: Direction of frontal road (east).

- S: Direction of frontal road (south).

- W: Direction of frontal road (west).

6.3. Determining the Multicollinearity of Explanatory Variables

7. Evaluation of Hedonic Price Function for Residential Area

7.1. Estimation of Hedonic Price Function for Residential Area Using Conventional Explanatory Variables

- PRP: Residential land price (yen/m2).

- DS: Distance to the closest station (m).

- RA: Acreage (m2).

- WD: Width of the road in front of the residential section (m).

- BC: Building coverage ratio (%).

- FR: Floor area ratio (%).

- T_DS: Distance to Tokyo station (m).

- C: Municipality division.

- N: Direction of frontal road (north).

- E: Direction of frontal road (east).

- S: Direction of frontal road (south).

- W: Direction of frontal road (west).

7.2. Evaluation and Examination of Hedonic Price Function for Residential Area

8. Conclusions

Author Contributions

Funding

Conflicts of Interest

References

- Aikoh, Tetsuya, Naruko Sakiyama, and Yasushi Shoji. 2008. Analysis of Economic Effect of Green Spaces on Land Price in Residential Areas by Hedonic Approach. Landscape Research Japan 71: 727–30. [Google Scholar] [CrossRef]

- Bonetti, Federico, Stefano Corsi, Luigi Orsi, and Ivan De Noni. 2016. Canals vs. streams: To what extent do water quality and proximity affect real estate values? A hedonic approach analysis. Water 8: 577. [Google Scholar] [CrossRef]

- Bureau of Urban Development, Tokyo Metropolitan Government. 2013. District-Based Assessment of Vulnerability to Earthquake Disaster (No. 7); Tokyo: Bureau of Urban Development, Tokyo Metropolitan Government.

- Cohen, Jeffrey P., and Cletus C. Coughlin. 2008. Sptial Hedonic Models of Airport Noise, Proximity and Housing Prices. Journal of Reginal Science 48: 859–78. [Google Scholar] [CrossRef]

- Conway, Delores, Christina Q. Li, Jennifer Wolch, Christopher Kahle, and Michael Jerrett. 2010. A Spatial Autocorrelation Approach for Examining the Effects of Urban Greenspace on Residential Property Values. Journal of Real Estate Finance and Economics 41: 150–69. [Google Scholar] [CrossRef]

- Dziauddina, Mohd F., Seraphim Alvanidesb, and Neil Powec. 2013. Estimating the Effects of Light Rail Transit (LRT) System on the Property Values in the Klang Valley, Malaysia: A Hedonic House Price Approach. Jurnal Teknologi 18: 35–47. [Google Scholar] [CrossRef]

- Feng, Xia, and Brad R. Humphreys. 2016. Assessing the Economic Impact of Sports Facilities on Residential Property Values: A Spatial Hedonic Approach. Journal of Sports Economics 19: 188–210. [Google Scholar] [CrossRef]

- Fik, Timothy J., David C. Ling, and Gordon F. Mulligan. 2003. Modeling Spatial Variation in Housing Prices: A Variable Interaction Approach. Real Estate Economics 31: 623–46. [Google Scholar] [CrossRef]

- Gouriéroux, Christian, and Anne Laferrèreac. 2009. Managing hedonic housing price indexes: The French experience. Journal of Housing Economics 18: 206–13. [Google Scholar] [CrossRef]

- Hill, Robert J., and Danel Melser. 2007. Comparing House Prices across Regions and Time: A Hedonic Approach. School of Economics Discussion Paper, Sydney, NSW, Australia: University of New South Wales, 34p. [Google Scholar]

- Ismail, Suriatini. 2005. Hedonic Modelling of Housing Markets Using Geographical Information System (GIS) and Spatial Statistics: A Case Study of Glasgow, Scotland. Ph.D. thesis, University of Aberdeen, Aberdeen, UK. [Google Scholar]

- Jang, Taekyoung, Yoshitaka Aoyama, Ryoji Matsunaka, and Daisuke Kirobayashi. 2000. A Study on the Accessibility Index for Evaluating the Railway Service Level. Infrastructure Planning Review 17: 75–82. [Google Scholar] [CrossRef] [Green Version]

- Hyogo, Kanda, and Yuzuru Isoda. 2017. The Relationship between Population Density, Land Price and Commuting Flow in Metropolitan Area: The Case of Tokyo Metropolitan Area. Papers and Proceedings of the Geographic Information Systems Association 26: 1–4. [Google Scholar]

- Kim, Chong Won, Tim T. Phipps, and Luc Anselinc. 2003. Measuring the Benefits of Air Quality Improvement: A Spatial Hedonic Approach. Journal of Environmental Economics and Management 45: 24–39. [Google Scholar] [CrossRef]

- Kutsuzawa, Ryuji. 2008. Economic Analysis of Financial Market of Housing and Real Estate. Tokyo: Nippon Hyoron Sha Co., Ltd. [Google Scholar]

- Wei, Li, Kenneth Joh, Chanam Lee, Jun-Hyun Kim, Han Park, and Ayoung Woo. 2015. Assessing Benefits of Neighborhood Walkability to Single-Family Property Values: A Spatial Hedonic Study in Austin, Texas. Journal of Planning Education and Research 35: 471–88. [Google Scholar]

- Oana, Mihaescu, and Rainer vom Hofe. 2012. The Impact of Brownfields on Residential Property Values in Cincinnati, Ohio: A Spatial Hedonic Approach. Journal of Regional Analysis & Policy 42: 223–36. [Google Scholar]

- Mikanagi, Kiyoyasu, and Hisayoshi Morisugi. 1981. Social Capital and Public Investment. Tokyo: Gihodo Shuppan. [Google Scholar]

- Ministry of Internal Affairs and Communications. 2016. Survey on Time Use and Leisure Activities in 2016. Available online: http://www.stat.go.jp/data/shakai/2016/index.html (accessed on 5 July 2018).

- Ministry of Land, Infrastructure, Transport and Tourism. 2013. Public Data of Residential Land Price in 2013. Available online: http://www.land.mlit.go.jp/webland/ (accessed on 14 April 2017).

- Ministry of Land, Infrastructure, Transport and Tourism. n.d. Digital National Land Information. Available online: http://nlftp.mlit.go.jp/ksj/ (accessed on 14 April 2017).

- Mittal, Jay, and Sweta Byahut. 2017. Scenic Landscapes, Visual Accessibility and Premium Values in a Single Family Housing Market: A spatial hedonic approach. Environment and Planning B: Urban Analytics and City Science, Sage. [Google Scholar] [CrossRef]

- Nakamura, Hideo, Yoshitsugu Hayashi, and Kazuaki Miyamoto. 1981. Land Use Model in Suburban Areas. Proceedings of the Japan Society of Civil Engineers 309: 103–12. [Google Scholar] [CrossRef]

- Nomura, Koji, Miho Ohara, and Kimiro Meguro. 2009. Consideration on Change of Land Price after an Urban Earthquake–Case Study in Affected Area due to the 1995 Kobe Earthquake-. Seisan Kenkyu 61: 709–12. [Google Scholar]

- Shimuzu, Chihiro. 2004. Analysis of Real Estate Market. Tokyo: Jutaku-Shimpo-Sha Inc. [Google Scholar]

- Shimuzu, Chihiro, and Hiroshi Karawatari. 2007. Econometric Analysis of Real Estate Market. Tokyo: Asakura Publishing Co., Ltd. [Google Scholar]

- Syabri, Ibnu. 2011. The Influence of Railway Station on Residential Property Values-Spatial Hedonic Approach: The Case of Serpong’s Railway Station. Journal of Civil Engineering 18: 291–300. [Google Scholar]

- Tokuda, Masaaki. 2009. The Analysis of the Land Value by the Hedonic Approach: The Residential Quarter in Shiga Prefecture as a Subject. The Hikone Ronso 381: 183–205. [Google Scholar]

- Tse, Raymond Y. C. 2002. Estimating Neighbourhood Effects in House Prices: Towards a New Hedonic Model Approach. Urban Studies 39: 1165–80. [Google Scholar] [CrossRef]

- Uchida, Osamu. 2011. Logistic Regression Analysis Using SPSS. Tokyo: Ohmsha. [Google Scholar]

- Wanatabe, Masayuki, and Hajime Koshimizu. 2012. Effect of Line Shape’s Green to Land Price in Residential Areas. Landscape Research Japan 75: 703–6. [Google Scholar] [CrossRef]

- Winke, Tim. 2017. The impact of aircraft noise on apartment prices: A differences-in-differences hedonic approach for Frankfurt, Germany. Journal of Economic Geography 17: 1283–300. [Google Scholar] [CrossRef]

- Yahoo! n.d. JAPAN, Transit. Available online: https://transit.yahoo.co.jp/ (accessed on 14 April 2017).

- Yamaga, Hisaki, Masayuki Nakagawa, and Makoto Saito. 2002. Earthquake Risk and Land Price Formation: The case of Tokyo. Journal of Applied Regional Science 966: 1–18. [Google Scholar]

| Variables | Explanatory Variables | Overview |

|---|---|---|

| Quantitative variables | Distance to the closest station (m) | Linear distance from the addresses taken from public data of residential land price provided by the MLIT to the closest station |

| Acreage (m2) | Area of 1 residential block | |

| Width of Frontal road (m) | Width of the road in front of the residential section | |

| Building coverage ratio (%) | Maximum ratio of the allowed building area with regards to the residential area | |

| Floor area ratio (%) | Maximum ratio of the allowed gross floor area with regards to the residential area | |

| Dummy variables (qualitative variables) | Municipality division | Each municipality is a dummy variable |

| Gas condition | 1 if not maintained, 0 if maintained | |

| Water condition | 1 if not maintained, 0 if maintained | |

| Sewage condition | 1 if not maintained, 0 if maintained | |

| Other contact surface road | 1 if such areas exist, 0 if not | |

| Urban planning area | 1 for urbanization control areas, 0 for urbanization promotion areas | |

| Direction of frontal road | Each of the 8 directions are dummy variables | |

| Jurisdiction of frontal road | 1 for private roads, 0 for public roads | |

| Forest area/Nature parks/Nature conservation area | 1 if such areas exist, 0 if not |

| Variables | Explanatory Variables | Overview |

|---|---|---|

| Quantitative variables | Distance to Tokyo station (m) | Linear distance from the addresses taken from the public data of residential land price provided by the MLIT to Tokyo station |

| Regional vulnerability | 5-grade indicator of regional vulnerability for each district of each municipality | |

| Accessibility to destination stations | A quantitative indicator that shows the convenience between the closest station to other stations |

| Data | Overview |

|---|---|

| House price (yen/m2) Distance to the closest station (m) Conditions of frontal road Other contact surface roads Building coverage ratio (%) Floor space ratio (%) Acreage (m2) Division of urban planning area Water supply and drainage conditions Forest area/Nature parks/Nature conservation areas (Public data of residential land price provided by the MLIT (Ministry of Land, Infrastructure, Transport and Tourism 2013) | Public data of residential land price in 2013 provided by the MLIT was used. To eliminate causes of error due to the decision to hold the 2020 Olympics and Paralympics in Tokyo, data closest to when they were decided was used. |

| Address (Public data of residential land price by the MLIT) | The public data of residential land price in 2013 provided by the MLIT was used to calculate the distance to Tokyo station. |

| Regional vulnerability (District-based assessment of vulnerability to earthquake disaster (No. 7) (Bureau of Urban Development, Tokyo Metropolitan Government 2013)) | Because the public data of residential land price in 2013 provided by the MLIT was used, the data of regional vulnerability in 2012 was used. |

| Number of incoming and outgoing passengers (Digital national land information (Ministry of Land, Infrastructure, Transport and Tourism n.d.)) | Because the public data of residential land price in 2013 provided by the MLIT was used, the data of incoming and outgoing passengers for each station in 2012 was used to calculate accessibility to destination stations. |

| Time between station (Transit (Service of train line information) (Yahoo! n.d.)) | The search system in 2017 was used. As the search system allows for extra time when calculating the required travel time, conditions such as “fastest route” or “earliest arrival” was selected to calculate the value of accessibility to destination stations. |

| Number of Passengers (People) | Total Values of Accessibility to Major Stations | Change Rate (%) |

|---|---|---|

| 50,000 | 50,547,994 | 103.4 |

| 60,000 | 48,868,003 | 103.1 |

| 70,000 | 47,376,508 | 104.7 |

| 80,000 | 45,241,355 | 103.9 |

| 90,000 | 43,535,595 | 102.1 |

| 100,000 | 42,644,767 | 102.0 |

| 110,000 | 41,795,140 | 101.0 |

| 120,000 | 41,398,627 | 102.2 |

| 130,000 | 40,513,363 | 101.8 |

| 140,000 | 39,812,429 | 101.3 |

| 150,000 | 39,300,999 | 101.7 |

| 160,000 | 38,633,164 | 102.1 |

| 170,000 | 37,842,920 |

| Number of Passengers (People) | Total Values of Accessibility to Major Stations | Change Rate (%) |

|---|---|---|

| 70,000 | 47,376,508 | 100.5 |

| 71,000 | 47,126,647 | 100.6 |

| 72,000 | 46,845,573 | 100.3 |

| 73,000 | 46,705,457 | 100.4 |

| 74,000 | 46,519,379 | 100.4 |

| 75,000 | 46,334,043 | 101.6 |

| 76,000 | 45,604,373 | 100.2 |

| 77,000 | 45,513,346 | 100.2 |

| 78,000 | 45,422,501 | 100.2 |

| 79,000 | 45,331,838 | 100.2 |

| Explanatory Variables | Code | Overview | |

|---|---|---|---|

| Quantitative variables | Distance to the closest station (m) | DS | Linear distance from the addresses taken from the public data of residential land price provided by the MLIT to the closest station |

| Acreage (m2) | RA | Area of 1 residential block | |

| Width of Frontal road (m) | WD | Width of the road in front of the residential section | |

| Building coverage ratio (%) | BC | Maximum ratio of the allowed building area in the residential section | |

| Floor area ratio (%) | FR | Maximum ratio of the allowed gross floor area in the residential section | |

| Distance to Tokyo station (m) | T_DS | Linear distance from the addresses taken from the public data of residential land price provided by the MLIT to Tokyo station | |

| Regional vulnerability | DA | 5-grade indicator of regional vulnerability for each district of each municipality | |

| Accessibility to destination stations | AC | A quantitative indicator that shows the convenience between the closest station to destination stations | |

| Dummy variables (Qualitative variables) | Municipality division | C | 1 for the Tama area, 0 for special wards |

| Other contact surface road | A_R | 1 if such areas exist, 0 if not | |

| Direction of frontal road (north) | N | Direction of the road in front of the residence—North | |

| Direction of frontal road (northeast) | NE | Direction of the road in front of the residence—Northeast | |

| Direction of frontal road (east) | E | Direction of the road in front of the residence—East | |

| Direction of frontal road (south) | S | Direction of the road in front of the residence—South | |

| Direction of frontal road (southwest) | SW | Direction of the road in front of the residence—Southwest | |

| Direction of frontal road (west) | W | Direction of the road in front of the residence—West | |

| Direction of frontal road (northwest) | NW | Direction of the road in front of the residence—Northwest | |

| Jurisdiction of frontal road | F_R | 1 for private roads, 0 for public roads | |

| Explanatory Variables | Mean | Median | Mode | Variance | Standard Deviation | Maximum | Minimum |

|---|---|---|---|---|---|---|---|

| PRP | 376,004.25 | 316,000 | 346,000 | 65,162,143,940.16 | 255,268.77 | 2,780,000 | 62,700 |

| DS | 953.26 | 760 | 1200 | 481,475.53 | 693.88 | 5300 | 60 |

| RA | 233.05 | 164.5 | 165 | 98,059.71 | 313.14 | 4291 | 47 |

| WD | 5.93 | 5.4 | 4 | 11.55 | 3.40 | 40 | 2 |

| BC | 53.08 | 60 | 60 | 89.16 | 9.44 | 80 | 30 |

| FR | 166.37 | 150 | 200 | 8155.44 | 90.31 | 600 | 60 |

| T_DS | 17,100.42 | 14,162 | 22,672 | 84,863,271.86 | 9212.13 | 42,619 | 1574 |

| DA | 1.86 | 2 | 1 | 0.83 | 0.91 | 5 | 1 |

| AC | 79,725.99 | 1891.10 | 191,629.54 | 34,131,580,371.22 | 184,747.34 | 2,587,021.62 | 1.55 × 10−7 |

| C | 0.60 | 1 | 1 | 0.24 | 0.49 | 1 | 0 |

| A_R | 0.06 | 0 | 0 | 0.06 | 0.24 | 1 | 0 |

| N | 0.15 | 0 | 0 | 0.13 | 0.36 | 1 | 0 |

| NE | 0.08 | 0 | 0 | 0.07 | 0.27 | 1 | 0 |

| E | 0.16 | 0 | 0 | 0.13 | 0.37 | 1 | 0 |

| S | 0.17 | 0 | 0 | 0.14 | 0.38 | 1 | 0 |

| SW | 0.09 | 0 | 0 | 0.08 | 0.29 | 1 | 0 |

| W | 0.16 | 0 | 0 | 0.14 | 0.37 | 1 | 0 |

| NW | 0.08 | 0 | 0 | 0.08 | 0.28 | 1 | 0 |

| F_R | 0.09 | 0 | 0 | 0.08 | 0.29 | 1 | 0 |

| Explanatory Variables | When Using All Explanatory Variables | When Using the Sequential Selection Method | |||||||

|---|---|---|---|---|---|---|---|---|---|

| Factor | t Value | p Value | Factor | t Value | p Value | ||||

| Constant terms | 9.73 × 105 | 21.16 | <2.00 × 10−16 | *** | 9.68 × 105 | 22.207 | <2.00 × 10−16 | *** | |

| Quantitative variables | DS | −5.86 × 10 | −8.505 | <2.00 × 10−16 | *** | −5.85 × 10 | −8.502 | <2.00 × 10−16 | *** |

| RA | 1.28 × 102 | 8.227 | 4.19 × 10−16 | *** | 1.33 × 102 | 9.048 | <2.00 × 10−16 | *** | |

| WD | 3.58 × 103 | 2.448 | 1.45 × 10−2 | * | 3.93 × 103 | 2.728 | 6.44 × 10−3 | ** | |

| BC | −3.49 × 103 | −4.086 | 4.62 × 10−5 | *** | −3.49 × 103 | −4.099 | 4.38 × 10−5 | *** | |

| FR | 5.57 × 102 | 6.11 | 1.27 × 10−9 | *** | 5.73 × 102 | 6.345 | 2.96 × 10−10 | *** | |

| T_DS | −1.88 × 10 | −17.805 | <2.00 × 10−16 | *** | −1.87 × 10 | −17.737 | <2.00 × 10−16 | *** | |

| DA | −8.70 × 104 | −14.88 | <2.00 × 10−16 | *** | −8.68 × 104 | −14.862 | <2.00 × 10−16 | *** | |

| AC | 2.01 × 10−1 | 8.864 | <2.00 × 10−16 | *** | 2.02 × 10−1 | 8.962 | <2.00 × 10−16 | *** | |

| Dummy variables | C | −3.52 × 104 | −1.897 | 5.80 × 10−2 | * | −3.33 × 104 | −1.81 | 7.05 × 10−2 | * |

| A_R | 1.90 × 104 | 0.952 | 3.41 × 10−1 | ||||||

| N | −6.40 × 103 | −0.37 | 7.11 × 10−1 | ||||||

| NE | 2.31 × 103 | 0.114 | 9.09 × 10−1 | ||||||

| E | −1.69 × 104 | −0.982 | 3.26 × 10−1 | −2.29 × 104 | −1.898 | 5.79 × 10−2 | * | ||

| S | −1.53 × 104 | −0.903 | 3.67 × 10−1 | −2.12 × 104 | −1.82 | 6.90 × 10−2 | * | ||

| SW | 1.92 × 104 | 0.993 | 3.21 × 10−1 | ||||||

| W | −4.48 × 104 | −2.627 | 8.70 × 10−3 | ** | −5.14 × 104 | −4.313 | 1.72 × 10−5 | *** | |

| NW | 2.61 × 104 | 1.09 | 2.76 × 10−1 | ||||||

| F_R | −1.80 × 104 | −1.204 | 2.29 × 10−1 | ||||||

| Adjusted R2 | 0.6044 | 0.6043 | |||||||

| Explanatory Variables | When Using All Explanatory Variables | When Using the Sequential Selection Method |

|---|---|---|

| DS | 1.32 | 1.31 |

| RA | 1.36 | 1.22 |

| WD | 1.42 | 1.38 |

| BC | 3.75 | 3.73 |

| FR | 3.89 | 3.83 |

| T_DS | 5.43 | 5.41 |

| DA | 1.63 | 1.62 |

| AC | 1.08 | 1.07 |

| C | 4.77 | 4.69 |

| A_R | 1.27 | |

| N | 2.26 | |

| NE | 1.67 | |

| E | 2.27 | 1.12 |

| S | 2.36 | 1.12 |

| SW | 1.79 | |

| W | 2.30 | 1.12 |

| NW | 1.73 | |

| F_R | 1.09 |

| Explanatory Variables | When Using All Explanatory Variables | When Using the Sequential Selection Method | |||||||

|---|---|---|---|---|---|---|---|---|---|

| Factor | t Value | p Value | Factor | t Value | p Value | ||||

| Constant terms | 9.12 × 105 | 18.224 | <2.00 × 10−16 | *** | 9.13 × 105 | 19.182 | <2.00 × 10−16 | *** | |

| Quantitative variables | DS | −5.31 × 10 | −7.021 | 3.35 × 10−12 | *** | −5.33 × 10 | −7.066 | 2.45 × 10−12 | *** |

| RA | 1.76 × 102 | 10.526 | <2.00 × 10−16 | *** | 1.83 × 102 | 11.548 | <2.00 × 10−16 | *** | |

| WD | 4.95 × 103 | 3.085 | 2.07 × 10−3 | ** | 5.33 × 103 | 3.37 | 7.71 × 10−4 | *** | |

| BC | 5.42 × 103 | −5.829 | 6.86 × 10−9 | *** | −5.42 × 103 | −5.848 | 6.12 × 10−9 | *** | |

| FR | 5.97 × 102 | 5.972 | 2.94 × 10−9 | *** | 6.10 × 102 | 6.143 | 1.04 × 10−9 | *** | |

| T_DS | 1.77 × 10 | −15.471 | <2.00 × 10−16 | *** | −1.76 × 10 | −15.436 | <2.00 × 10−16 | *** | |

| Dummy variables | C | 7.88 × 104 | −3.892 | 1.04 × 10−4 | *** | −7.66 × 104 | −3.815 | 1.42 × 10−4 | *** |

| A_R | 2.71 × 104 | 1.237 | 2.16 × 10−1 | ||||||

| N | −1.68 × 104 | −0.884 | 3.77 × 10−1 | −2.51 × 104 | −1.78 | 7.54 × 10−2 | * | ||

| NE | 1.61 × 103 | 0.072 | 9.42 × 10−1 | ||||||

| E | −2.87 × 104 | −1.52 | 1.29 × 10−1 | −3.69 × 104 | −2.645 | 8.25 × 10−3 | ** | ||

| S | −2.59 × 104 | −1.392 | 1.64 × 10−1 | −3.46 × 104 | −2.558 | 1.06 × 10−2 | * | ||

| SW | 1.76 × 104 | 0.828 | 4.08 × 10−1 | ||||||

| W | −6.12 × 104 | −3.266 | 1.12 × 10−3 | ** | −7.03 × 104 | −5.085 | 4.14 × 10−7 | *** | |

| NW | 1.24 × 104 | 0.569 | 5.69 × 10−1 | ||||||

| F_R | −1.15 × 104 | −0.701 | 4.83 × 10−1 | ||||||

| Adjusted R2 | 0.5200 | 0.5207 | |||||||

© 2018 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (http://creativecommons.org/licenses/by/4.0/).

Share and Cite

Sasaki, M.; Yamamoto, K. Hedonic Price Function for Residential Area Focusing on the Reasons for Residential Preferences in Japanese Metropolitan Areas. J. Risk Financial Manag. 2018, 11, 39. https://doi.org/10.3390/jrfm11030039

Sasaki M, Yamamoto K. Hedonic Price Function for Residential Area Focusing on the Reasons for Residential Preferences in Japanese Metropolitan Areas. Journal of Risk and Financial Management. 2018; 11(3):39. https://doi.org/10.3390/jrfm11030039

Chicago/Turabian StyleSasaki, Mitsuru, and Kayoko Yamamoto. 2018. "Hedonic Price Function for Residential Area Focusing on the Reasons for Residential Preferences in Japanese Metropolitan Areas" Journal of Risk and Financial Management 11, no. 3: 39. https://doi.org/10.3390/jrfm11030039