1. Introduction

The expected loss of a credit instrument comprises an assessment of default probability as well as loss expectation in the event of a credit default. The default risk is reflected in the rating assignments of the major credit rating agencies such as Standard and Poor’s, Fitch, and Moody’s. For instance, it is Moody’s intention that the expected loss rate associated with a given rating symbol and time horizon to be the same across obligations to ensure a consistency of meaning (see

Moody’s Investors Service (

2009), p. 6). The same rating assigned to bond obligations issued by a nonfinancial corporation, bank, insurance, sovereign, subsovereign borrower, or a structured finance obligation must imply the same expected loss. Originally, “Moody was in effect addressing the stability of the security’s credit spread,”

Moody’s Investors Service (

2009) (p. 6). The idea that each rating class translates into a rating-specific credit spread can also be found in modern finance (see, e.g.,

Jarrow et al. (

1997), Figures 5 and 6).

Ratings reduce the knowledge gap, or “information asymmetry,” between borrowers (sellers) and lenders (buyers) by providing an ordinal assessment about the expected loss. I will demonstrate that the advent of structured finance obligations and other credit derivatives has completely broken down the monotone relation between expected loss (rating) and credit spread (pricing). Even if the rating truly conveys an unbiased, powerful estimate for the expected loss of an underlying obligation,

1 ratings alone are informationally insufficient for the pricing of collateralized debt obligations (CDOs) and other credit instruments.

2 I will show that in equilibrium an investment-rated structured finance obligation can have a significantly higher credit spread than a subinvestment-rated corporate bond due to systematic risk. That is, rating and pricing can be far apart since there is no longer a one-to-one relation between expected loss and systematic risk for structured finance obligations.

3 However, a market in which potential buyers know the true rating but cannot correctly judge the systematic risk attracts sellers offering credit derivatives of good rating quality but of low systematic risk quality which can in the end lead to a market breakdown. Thus, I will demonstrate that a necessary precondition for a credit market to have an equilibrium at all is to have symmetric information between issuers and investors on rating

and systematic risk.

The beta according to the CAPM of

Treynor (

1962),

Sharpe (

1964),

Lintner (

1965), and

Mossin (

1966) based on the mean-variance criterion of

Markowitz (

1952) reflects the systematic risk of an asset in the form of a scaled correlation with the market.

4 However, as highlighted by

Embrechts et al. (

1999), correlation is only a linear risk measure and of limited suitability for measuring dependence. In a stylized market, I will demonstrate that the non-linear systematic risk of credit derivatives is highly substantial and even more important than the linear CAPM beta. I thereby offer another explanation for the high expected return of highly-rated debt securities given the low CAPM beta.

5According to the criticism of

Krugman (

2009), financial economists rarely ask the seemingly obvious question of whether asset prices make sense given real-world fundamentals. Instead, they ask only whether asset prices make sense given other asset prices. The central insight of asset pricing is that in the absence of arbitrage there exists a risk-neutral measure

equivalent to the real-world probability

(see

Harrison and Kreps (

1979)). Hence, to find the equilibrium value of any derivative you can assume a risk-neutral world without making statements about the real world. However, to be in equilibrium, market participants need first a consensus on all pricing-relevant attributes. The paper of

Collin-Dufresne et al. (

2012) is a case in point relevant to the pricing of CDOs. The contribution of

Collin-Dufresne et al. (

2012) “is to investigate the

relative pricing across the stock option and CDO markets” and they provide a model “to

jointly price long-dated S&P 500 options and tranche spreads on the five-year CDX index.”

Summers (

1985) once characterized financial economists with a parable about “ketchup economists” who “have shown that two-quart bottles of ketchup invariably sell for exactly twice as much as one-quart bottles of ketchup,” and conclude that the ketchup market is perfectly efficient.

Collin-Dufresne et al. (

2012) use the model of

Duffie et al. (

2000) in which return dynamics under the

risk-neutral measure are specified and they emphasize the importance of “catastrophic”

risk-neutral jumps for the pricing of highly-rated securities.

Collin-Dufresne et al. (

2012) remain silent on whether these “catastrophic” jumps are also a real-world phenomenon or induced by risk aversion and therefore “only” a phenomenon in the risk-neutral world.

I derive a four-moment CAPM under standard risk aversion to characterize the quality of a credit instrument by four fundamental real-world factors (i.e., three systematic risk factors in addition to the rating factor) to provide an elementary relation between risk and price. I show that aversion to fat tails primarily affects the pricing of senior debt securities whereas variance aversion has a proportionally higher impact on equity. Unlike equity, the systematic risk of senior debt is dominated by non-linear cokurtosis rather than linear covariance risk, i.e., I explain the “risk-neutral catastrophic jumps” affecting senior debt by kurtosis aversion. Instead of expressing the CAPM traditionally in terms of relative returns—which was also heavily criticized by

Krugman (

2009)—I express the equilibrium price in terms of the promised end-of-period face amount with the expected loss rate as a direct input. The four factors—expected loss rate, covariance, coskewness, cokurtosis—can be interpreted as quality attributes in the spirit of

Akerlof (

1970). In my model, the factors for each asset can simply be aggregated to obtain the corresponding factors of the portfolio.

6Finally, I will show in an empirical application that the huge losses at the trading desks of two Wall Street titans, namely Morgan Stanley and UBS, were basically realized with a CAPM beta of zero but nonetheless with considerable non-linear systematic risk. These “hedged” structured finance portfolios had no covariation with the market and were no economic assets (

) in the sense of

Coval et al. (

2009a) but unfortunately also no actuarial claims whose risk could be diversified away in large portfolios. Morgan Stanley’s and UBS’s beta-neutral structured finance portfolios were nevertheless treated as actuarial claims in the corresponding risk departments despite the portfolios’ inherent non-linear systematic risk. Even worse, they misinterpreted the small premium for non-linear systematic risk as CAPM alpha and therefore leveraged their positions. Thus, I provide empirical evidence that even “too big to fail” banks were exposed to huge risks without proper assessment about all quality attributes by considering only rating and correlation/beta.

My findings are highly relevant since structured finance markets such as the market for asset backed securities (ABSs) improve the efficiency of resource allocation and help contain systemic risk by freeing up the banks’ balance sheets. Given the absence of symmetric information, my model offers an explanation why public ABS issuances remain low in the EU as reported by the

BOE and ECB (

2014). The low demand for ABSs is unfortunate since “ABS can support the transmission of accommodative monetary policy in conditions where the bank lending channel may otherwise be impaired” (p. 2).

I proceed as follows:

Section 2 highlights the difference between linear systematic risk (CAPM beta), non-linear systematic risk and idiosyncratic risk. In

Section 3 I derive a simple four-moment equilibrium CAPM.

Section 4 demonstrates that a credit market under asymmetric information about non-linear systematic risk is in a disequilibrium.

Section 5 shows in an illustrative market that some credit products can have superb rating quality but also high systematic risk exposures or exactly the other way around. I also discuss the influence of counterparty risk on credit derivatives.

Section 6 investigates the empirical cases of Morgan Stanley and UBS. Finally,

Section 7 concludes.

2. CAPM Beta and Premium for Residual Risk

Credit portfolio distributions are typically characterized by non-linear risks such as skewness and heavy tails. However, many papers on credit portfolio risk such as

Coval et al. (

2009a,

2009b);

Hamerle et al. (

2009);

Brennan et al. (

2009) largely ignore the pricing of non-linear systematic risks. In their CAPM-like models, based on the credit portfolio framework of

Merton (

1974), an asset uncorrelated with the market portfolio

is also assumed to be stochastically independent and therefore an actuarial claim. However, stochastic independence is too strong an assumption, the cash flows of a beta-neutral portfolio may still contain significant non-linear systematic risk which—unlike the risk of actuarial claims—cannot be diversified away in a large portfolio and must be priced. For instance,

Coval et al. (

2009a) resort to a kind of

Black and Scholes (

1973) model in discrete time in the spirit of

Rubinstein (

1976), but they make a crucially different assumption by changing the Gaussian assumption regarding the market portfolio:

7Proposition 1 (Black and Scholes (1973) in discrete time). If the market portfolio M and the payoff of asset P follow a bivariate log-normal distribution such thatwhere ρ is the correlation and if the von Neumann-Morgenstern utility function of the representative agent exhibits constant relative risk aversion with risk aversion coefficient λ then the price of end-of-period payoff P is given by . The Radon-Nikodym derivative induces the risk-neutral measure :where and are the shifted means under .

The proof can be found in the Appendix. By linear projection of the logarithmic portfolio cash flow

onto the logarithmic cash flow of the market portfolio

, one obtains an additive, mean-square efficient decomposition into market and residual/idiosyncratic risk:

with

denoting the CAPM beta. The inclusion of further transformations of

M such as polynomial expansions cannot improve the goodness-of-fit (see

Hamilton (

1994), p. 102). Due to normality, the systematic risk exposure is completely described by

. That is, the residuum

follows a standardized normal distribution under the real-world measure

as well as under the risk-neutral measure

, so there is no premium associated with this residual risk. Hence, the value of any financial derivative of

P—the price

of any

-measurable payoff

—can be written as:

where

is the probability density function (pdf) of the market factor

M under the risk-neutral measure

,

is the probability density function of

under

and

. Under the assumption of

Rubinstein (

1976),

and

both correspond to the Gaussian pdf

.

A common failing when giving up the Gaussian assumption is to preserve—as you will see later—the easily rejectable assumption that the residual

is independent from

M so that

is idiosyncratic, can be diversified away and has the same distribution under

and

.

Coval et al. (

2009a);

Brennan et al. (

2009);

Hamerle et al. (

2009) all analyze the CDO market under assumed independence between

M and

. However, under non-normality, orthogonality only implies that

(see

Hamilton (

1994), p. 74). In the following, I will consider not only covariance but also coskewness and cokurtosis risk because agents under standard risk aversion care about all three co-moments. For a general credit portfolio

P, I will show that

and that

. I therefore extend the CAPM by two further statistical (co-)moments.

3. Four-Moment Valuation Model

I consider a portfolio choice problem faced by (buy-and-hold) investors/individuals in a general equilibrium involving a finite number of agents and a finite number of assets. My ultimate goal in the following sections is not to find “the best” multi-period pricing model to fit observable market prices for daily mark-to-market valuation but to show within a simple, one-period model that the non-linear systematic risk of equally rated credit products can be vastly different, and if buyers and sellers cannot agree on systematic risk then this credit market has no equilibrium. Thus, to revive the market for structured finance obligations requires a parsimonious set of publicly available systematic risk figures (such as systematic covariance, coskewness and cokurtosis)—the credit rating alone is arguably only sufficient for the market of corporate bonds.

I derive a four-moment CAPM, but not via the standard way in terms of relative returns such as

Kraus and Litzenberger (

1976) or

Harvey and Siddique (

2000), instead the equilibrium price is a function of expected loss rate and systematic risk contributions per unit notional. In other words, the risk metrics are directly measured per unit at risk. For the time being, I assume to be in a representative agent economy under standard risk aversion as defined by

Kimball (

1993). Later, I will extend the model for an asymmetric market. The triple

is the probability space and I have a representative von Neumann-Morgenstern maximizer of expected utility whose utility function

exhibits the following properties:

- (a)

positive marginal utility for wealth, i.e., non-satiety, or monotonicity ,

- (b)

decreasing marginal utility for wealth, i.e., risk aversion, or concavity ,

- (c)

decreasing absolute risk aversion,

- (d)

decreasing absolute prudence.

The quartic utility function is compatible with non-satiation, risk aversion, decreasing absolute risk aversion, decreasing absolute prudence, with positive coefficients for odd powers and negative coefficients for even powers (see the

Appendix A for a proof):

Lemma 1. Standard risk aversion implies , , , and .

The expected utility of a

-measurable payoff

X can be approximated by a quartic utility function via fourth-order Taylor series expanded at the point

by assuming that the fourth moment of

X and fourth derivative of

indeed exist (see also

Samuelson (

1970)):

For a higher order expansion, the series converges in the case of logarithmic and power utility functions if

,

almost surely (see,

Jurczenko and Maillet (

2006), p. 81). However, even for divergent Taylor series

Hlawitschka (

1994) shows that truncated expansions provide “excellent approximations to expected utility for the purpose of portfolio selection” even though moments do not fulfill the axioms of coherent risk measures according to

Artzner et al. (

1999).

Lemma 2. A quartic von Neumann-Morgenstern utility exhibiting standard risk aversion implies preference for right-skewness and preference for platykurtic distributions.

Similar as in

Brennan (

1979), I derive the equilibrium prices in a one-period, one-good economy with a capital market with

assets with end-of-period payoffs

as though there existed only identical representative agents, i.a., all

N buy-and-hold investors have the same probability beliefs and the same utility function. The payoff

is assumed to be strictly positive and non-random.

Proposition 2 (Symmetric equilibrium)

. Today’s equilibrium price of payoff at the end of the period for any can be expressed in terms of risk-free asset 0:where the variable has mean one and is positive under the assumption of non-satiation, i.e., , Z therefore fulfills all requirements of a Radon-Nikodym derivative. The Radon-Nikodym derivative Z induces a measure change from the real-world measure to the risk-neutral measure , i.e.,where is the indicator function of any event .

8 The proof can be found in the Appendix. Without loss of any generality, I assume that the price of the risk-less asset

is expressed per unit notional, i.e.,

, to approximate the equilibrium relation in (

3) with the first four statistical moments and first four mathematical derivatives of

:

Proposition 3 (4-moment CAPM)

. Under the assumption of a representative von Neumann-Morgenstern expectation maximizers under standard risk aversion whose utility function is approximated by a fourth order Taylor series around the mean end-of-period wealth w, today’s equilibrium price under the pricing measure in (3) of any -measurable financial derivative payoff X can be written as follows:with , andwhere denotes the averaged payoff of the market portfolio, captures the covariance risk of X with M, the coskewness risk, the cokurtosis risk. Under standard risk aversion, the premium for systematic skewness risk is positive if M is left-skewed and negative if right-skewed. The premia for variance and kurtosis risk, , , are positive.

The proof can be found in the Appendix. Note,

,

,

,

are computed under the physical risk measure

but do not depend on the degree of risk aversion or the form of the utility function

. On the other hand, the risk premia

,

, and

depend on

,

,

, and

. Rating agencies provide an assessment about the expected loss

but are silent on the other physical risk metrics

,

,

. Two important remarks are in order: First, since the equilibrium price in (

4) is not expressed in relative returns like other capital asset pricing models such as

Sharpe (

1964);

Kraus and Litzenberger (

1976); or

Harvey and Siddique (

2000), the risk metrics must be expressed relative to the underlying notional amount to make them comparable across instruments. Since the bond price is by convention expressed as a percentage of nominal value, for comparative statistics it is necessary to express

,

,

, and

of a financial derivative

X also relative to its notional amount, i.e., per unit at risk.

Second, even if the relation between price and risk metrics is only approximately true in practice, the real-world risk statistics of a -measurable payoff X—rating , linear systematic risk , and non-linear systematic risk , —with respect to a well-defined market portfolio (e.g., a credit default swap index like CDX or iTraxx) provide pricing-relevant information about the underlying credit quality. The absence of such publicly available risk metrics may result in a non-functioning market due to information asymmetry between buyer and seller of credit risks. The market for structured finance products may even collapse.

4. Credit Markets under Asymmetric Information

I introduce a market under asymmetric information in the spirit of

Akerlof (

1970). The risk metrics

,

,

, and

in (

4) play here the role of the underlying quality of a credit derivative with payoff

X. I still assume homogenous probability beliefs and risk aversions. Formally, I have the probability space

, the sigma fields

and the risk-neutral measure

induced by the four-moment CAPM kernel in (A8). So far, I implicitly assumed that the buyer’s information set

and the seller’s sigma algebra

are equal and both equal to the naive field

. Now, the buyer still starts with the naive information

, but rating agencies make public the information to calculate the mean

of

X under the seller’s information

so that a potential buyer has then the sigma algebra generated by

available for decision making, i.e.,

.

Definition 1 (Asymmetric credit market)

. In an asymmetric market, the statistical moments conditional on the seller’s information and conditional on the buyer’s information differ. In a symmetric market, however, the sigma algebras and result in the same (scaled) conditional moments , , , and , e.g., , almost surely, and I have again the equilibrium in (4). Under asymmetric information at least one of the risk metrics is different under and .

In simple words, in an asymmetric market some pricing-relevant quality attributes are known to sellers but unknown to buyers. Such a market cannot function:

Proposition 4 (No equilibrium)

. An asymmetric credit market in which sellers and buyers disagree on at least one of the four quality factors , , , has no equilibrium.

Proof. To show that a market with such asymmetric information cannot work properly, I work with a proof by contradiction, i.e., I start with the assumption that there is nonetheless an equilibrium.

9 By

I denote the compounded equilibrium price

and by

the risk premium (credit spread) of the positive cash flow

X with

. The positivity assumption is without loss of generality because a payoff with negative outcomes can be split into a long and short position of two positive cash flows. Thus, the price of

X is given by:

From Proposition 3, I know that

is indeed the equilibrium price under symmetric information and a four-moment CAPM when

,

,

are known. However, now I assume that

is known but at least one of the factors

,

,

is only known to the seller (

-measurable) but not known to the buyer (not

-measurable). In particular, I assume there is no

-measurable pricing function

such that

, but the buyer knows that

The upper bound in (

6) must be

, otherwise an arbitrage opportunity would arise for a positive end-of-period payoff

X must have a positive price with probability one. Now, conditional on the information generated by

and

, the buyer of payoff

X knows that the mean risk premium on offer at the assumed equilibrium price

is given by:

The expectation is taken under the risk-neutral measure

induced by the Radon-Nikodym derivative in (A8) to account for risk aversion. The price bidden

by the buyer given she knows

and that the average risk premium on offer is

is therefore given by:

However, the bid price is always smaller than the assumed equilibrium price . I only have a strict equality if or else if is -measurable so that . However, a positive end-of-period cash flow X with must have a strictly positive price to exclude arbitrage and if is a function of then the market is symmetric, i.e., the rating is sufficient for pricing. I have a contradiction that is the equilibrium price under asymmetric information. That is, there is no equilibrium price and therefore no risk-neutral risk measure . No trade takes place. ☐

Note, the rating can be sufficient for pricing in a four-moment CAPM. Technically speaking, in this special case, the factors

in (

5) are

-measurable and the rating is informationally sufficient in order to have an equilibrium. Sufficiency may hold for the segment of corporate bonds, but in general there is no rating-pricing nexus. On the contrary, as I will show, the risk premium can even be negative for derivatives with high expected losses and significantly positive for structured finance obligations of high rating quality. Counterparty risk further complicates the quality assessment of financial derivatives. As a consequence, besides the expected payoff

as quality factor of a financial derivative

X, I suggest making also public the systematic risk as the contribution to the variance with respect to a well-diversified portfolio

M,

, as well as the contribution to third moment

, and contribution to fourth moment

(again under the seller’s information set

) so that

for the smooth functioning of markets. Importantly, the information to calculate the risk figures must be made public, not necessarily the factors themselves. Thus, ordinal assessments can be sufficient.

5. Results and Discussion in a Stylized Market

Coval et al. (

2009a),

Brennan et al. (

2009),

Blöchlinger (

2011) have already concluded that, given the same credit rating, structured asset backed securities should offer a higher risk premium than single-name corporate bonds (except for the most senior tranche, see

Blöchlinger (

2018)). Surprisingly, this implication turns out not to be supported by the data. In the following, I will show in a controlled Monte Carlo experiment that structuring credit derivatives can inherently create significant systematic risks. I thereby control the credit rating: Given the same expected loss rate, the (non-linear) systematic risk can vary massively across credit instruments.

Thus, to demonstrate the often non-monotone relation between rating and systematic risk of various credit instruments, I create a stylized market with underlying digital bonds, i.e., bonds which can be synthetically replicated by digital default swaps.

Assumption 1. I have the following market:

- (1)

The market portfolio consists of default-risky digital bonds. Each bond pays out one (notional amount) in case of survival and zero else. The price of the risk-free bond with end-of-period payoff , almost surely, is one.

- (2)

The binary payoff for any is driven by two independent standardized Gaussian factors, namely a systematic factor m and an idiosyncratic factor :where is the indicator function and is the distance to default. The sequence of idiosyncratic factors is independent and identically distributed.

- (3)

I have four equally sized groups of 250 digital bonds with unconditional default probabilities (PDs) of 0.1%, 0.3%, 0.9%, and 2.7% such that , , , and .

- (4)

The correlation coefficient ρ to induce default dependence equals .

Note, the real-world correlation

under

should not be confused with the asset correlation in the risk-neutral world under

as used by

Hull and White (

2004);

Li and Zhao (

2012);

Andersen et al. (

2003);

O’Kane and Livesey (

2004) for pricing. My parametrization of

in the real world is motivated by

Blöchlinger and Leippold (

2011),

Blöchlinger (

2012). The correlation

controls, i.a., variance, skewness and kurtosis of the market portfolio

M under the physical measure

. Because I am in a one-period CAPM economy,

is by definition fixed and neither stochastic nor a time/maturity-dependent function (=correlation curve) as in a multi-period mark-to-market valuation model. Under my set of assumptions, the end-of-period cash flow of the market portfolio can be written as:

The higher the distance to default

, the lower is the

kth bond’s physical default probability, and the mean payoff

of bond

k can be written as:

Note, the multivariate distribution imposed with my parametrization is the physical distribution under the real-world measure

. The most junior tranche can be shown to be long the correlation

while the most senior tranche is short this correlation coefficient

. However, the risk-neutral distribution under

for pricing and hedging is obtained by three additional parameters in the form of the premia

,

, and

. In other words, with the correlation coefficient

I can fit the physical pdf. Given

, with

,

,

I can then perfectly match the risk-neutral pdf of three tranches (equity, mezzanine, senior debt). In the standard base correlation model of

O’Kane and Livesey (

2004), I obtain three different implied correlations to fit the prices of three different tranches.

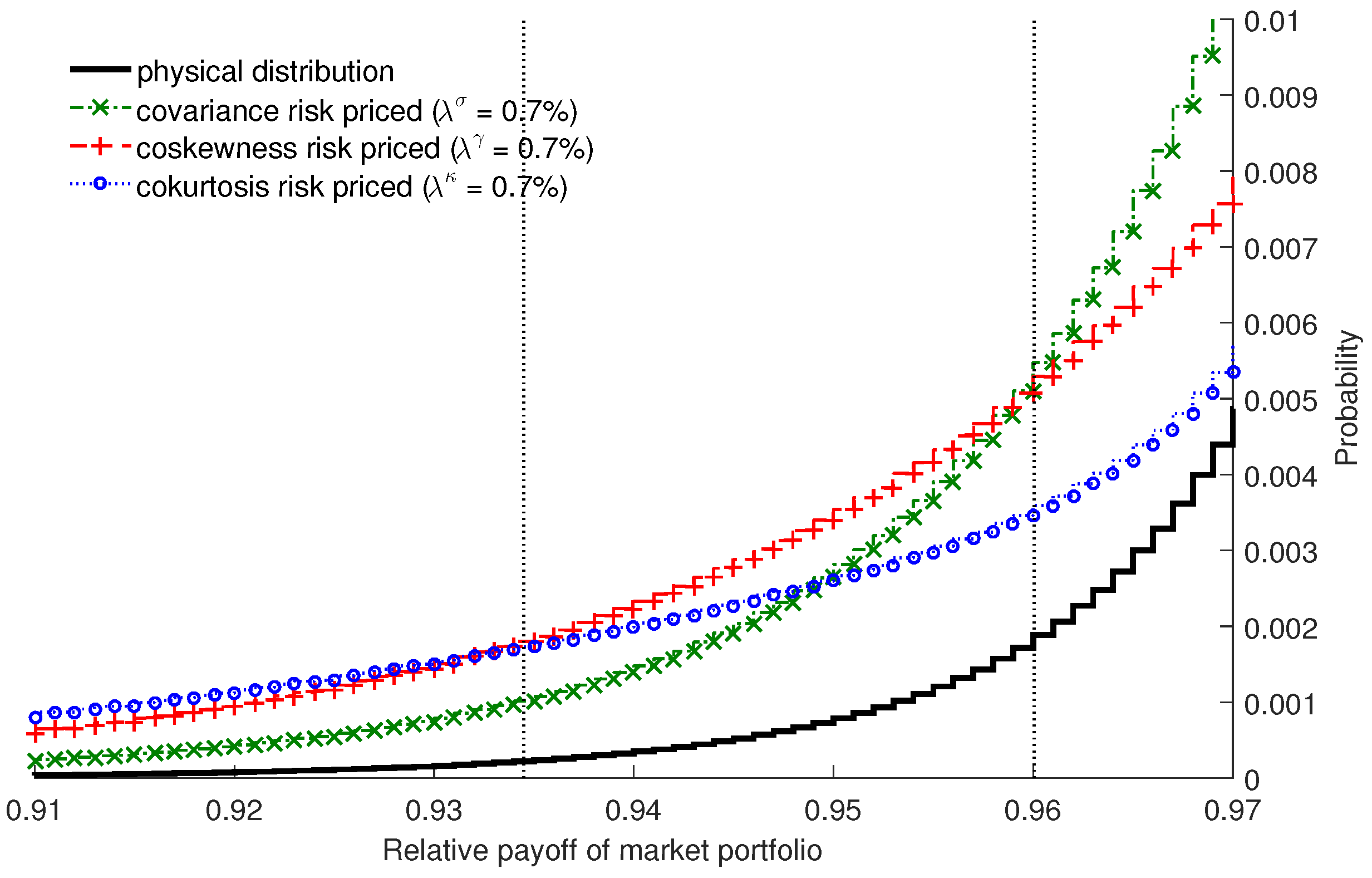

Figure 1 shows the physical and risk-neutral distributions of

M. The physical distribution is skewed to the left and leptokurtic. With the cokurtosis parameter

I can price up and down the tail, with the standardized market price of coskewness risk

I can influence in particular the middle or mezzanine part, the market premium for covariance risk

has the greatest effect on the first losses (equity).

Figure 1 highlights the fact that for senior tranches the kurtosis contribution has a higher impact on prices than covariance (CAPM beta). Beta is particularly relevant for equity. In other words, variance aversion is more relevant for equity, kurtosis aversion more relevant for senior debt.

5.1. Single-Name Corporate Bond

The information provided by rating agencies in the form of an expected loss, i.e., the sigma algebra

, can be sufficient for pricing single-name bonds. The compounded price

of a corporate bond in (

5) in my illustrative market can be written as:

In particular, I have the following function

for the compounded price

:

Simply speaking, given the corporate rating I know the credit spread and vice versa. Since

,

, and

are all decreasing in

as can be seen in

Table 1, there is a monotone function

between rating and price, the higher the mean payoff

the higher the price

. In general, if a credit market is homogeneous, in the sense that two bonds with the same expected loss have also the same systematic risk exposure, the information provided by rating agencies is sufficient for the market to have an equilibrium. This information symmetry between issuers and investors is no longer given for structured finance obligations.

Importantly, the risk contributions of single-name bonds in

Table 1 can be used to benchmark the quality of other instruments. A AAA-rated bond has systematic risk contributions of zero. An average portfolio (consisting of an equal number of bonds from each PD class) has an expected loss of 1% and systematic risk contributions of one. Thus, a credit instrument

X with risk metrics

,

, or

higher (lower) than one shows more (less) systematic risk exposure w.r.t. variance, skewness, or kurtosis than an average portfolio. Systematic risk contributions higher than three are worse than that of a BB-rated corporate bond.

5.2. Collateralized Debt Obligation (CDO)

To show that the relation between rating (domain) and pricing (range) is not a functional relation in case of structured asset backed securities, I create ten CDO asset pools with 100 underlying digital bonds with 25 bonds from each PD group:

where

is the payoff of one unit notional invested into the asset pool,

denotes the default rate. I drop the index

ℓ to avoid cumbersome notations in this subsection, but the index

ℓ becomes relevant in a following subsection when the underlying asset pool is itself a portfolio of different CDOs (CDO squared). The

jth tranche in a CDO transaction is defined by an attachment point

and a detachment point

, such that the tranche pays out one unit if the portfolio’s default rate

d is less than

, zero if it is more than

, and a linearly scaled payoff if the default rate is between

and

. The set of attachment points is therefore given by an increasing sequence

, where

n are the number of tranches. Hence,

is the notional amount of tranche

j. Overall, the payoff of one unit notional invested into tranche

j is given by:

Similarly, I create seven CDO securities out of the market portfolio

M with

underlying digital bonds. In

Table 2 it becomes clear that there is no monotone function

between rating

and price

p. For instance, the sixth loss tranche with 100 underlying bonds has the lower expected payoff than the sixth loss tranche with 1000 underlying bonds, 0.999819 vs. 0.999848, but the systematic risk contributions

,

, and

are also lower. Depending on market prices of risks,

,

,

, the better rated security can have the lower or the higher price than the lower rated security. There is no one-to-one relation between rating and pricing as within the corporate bond segment with the function

in (

8).

However, the credit rating is also not sufficient for pricing between bond segments: The expected payoff of the single-name digital bond with binary payoff

is smaller than the mean of the structured payoff

with attachment point

and detachment point

as can be seen in

Table 2:

. So thanks to credit enhancement, investors have now an opportunity to invest into a structured security with an expected loss of 0.018% which is much better than the best rated single-name bond with an expected loss of 0.1%. However, the credit enhancement comes at a cost. The new derivative security

shows higher covariance, coskewness, and cokurtosis with the market portfolio

M than a single-name bond with a PD of 0.1%.

Especially noteworthy are two observations: First, the cokurtosis exposure of

(under an expected loss of 0.018%) is higher than that of an average corporate bond portfolio (under a more than fifty times higher expected loss of 1%), i.e., 1.1861 vs. 1. Second, the most senior tranche of the more diversified asset pool (

n = 1000 vs.

n = 100) has the greater notional amount (0.875 vs. 0.86) but shows nonetheless better risks both from an expected loss and systematic exposure point of view. Thus, investing one unit into the unleveraged tranche of the more diversified asset pool with

1000 assets is of better quality and hence has a higher price as compared to investing 10 tenth into 10 different most senior CDO tranches with 100 underlying assets. The former investment is closer to the risk-less asset 0 with

and

. This finding confirms the conclusion of

Blöchlinger (

2018) that the most senior tranche of a CDO transaction based on a well-diversified collateral pool can be considered a close substitute for a AAA-rated government bond. The more diversified the asset pool the better is the approximation.

It is possible to hedge the systematic risk, e.g., the following portfolio

X constructed with four CDO tranches out of an underlying asset pool with 100 digital bonds in

Table 2:

has

and

,

X is still random but given my assumptions that only covariance, coskewness, and cokurtosis risk are priced, the price

must equal the value of the (non-random) risk-free asset

. In a two-moment CAPM world, the price of all beta-neutral portfolios would be the discounted mean payoff under

independent from skewness or kurtosis considerations. I am going to consider now some further long-short strategies.

5.3. Long-Short Strategies of CDO Tranches

Conventional wisdom says that an asset or a portfolio of assets with a CAPM beta of zero is free of systematic risk and the remaining risk is diversifiable or idiosyncratic. After all, in the famous two-moment CAPM, the systematic risk of a security is solely measured as the contribution to the variance of the market portfolio. However, the CAPM beta is a poor statistic to measure the systematic risk exposure. Unlike conventional wisdom, the risk of a portfolio showing no correlation with the market portfolio can still be of systematic and not of diversifiable nature. To illustrate my point, I create a CDO structure with five tranches and 100 underlying digital bonds as in

Table 3. Starting with a long position in the fourth loss tranche with payoff

, I can create portfolios with no covariance, no coskewness, and no cokurtosis by shorting either the first or second loss tranche, i.e., shorting either

or

.

For instance, the payoff with has no correlation with M, i.e., , but shows significant coskewness, , and cokurtosis exposure, . In other words, besides the CAPM beta, to understand the systematic risk of credit exposures, I need to look at skewness and kurtosis contributions, i.e., and . The market portfolio M has systematic variance, skewness, and kurtosis contributions of 1. Thus, from a systematic kurtosis perspective the leveraged portfolio X is more risky than the average bond portfolio even though X and M are not correlated. From a systematic variance point of view, however, X is as risk-less as the default-free bond.

Coval et al. (

2007) create the term “economic assets,” i.e., “assets with a positive CAPM beta” (p. 7). Since

X shows no covariance with the market, its beta is zero,

X is no economic asset and the expected return of

X must equal the risk-free return in a two-moment CAPM world. In the four-moment CAPM, however, the value of

X must be lower than

. On the other hand, the long-short portfolio

with

shows no cokurtosis with

M, but negative coskewness and negative covariance with

M. Under the four-moment CAPM the value of

V must be higher than its discounted mean payoff, i.e., the price of

V must be higher than

, because

V added to the market portfolio

M reduces the variance and skewness of the market portfolio

M, i.e., any convex combination of

M and

V is of better quality and therefore has a higher price than the market portfolio

M alone.

5.4. CDO Squared

As CDOs developed, some dealer banks repackaged tranches into yet another iteration, known as “CDO squared” or “CDOs of CDOs”. Thus, a CDO squared is identical to a CDO except for the assets securing the obligation. Unlike the CDO, which is backed by a pool of bonds, loans and other credit instruments, CDO squared are backed by CDO tranches. CDO squared allows the banks to resell the risk that they have taken in CDOs.

Table 4 shows the repackaging of second loss CDO tranches from

Table 3. Each CDO squared structure consists of

underlying CDO tranches

on the asset side and a senior debt tranche and an equity tranche on the liability side. The more diversified the underlying asset pool, i.e., the greater

n, the higher the possible leverage

N for a given rating and the systematic risk of debt (equity) decreases (increases) with increasing

n. However, a CDO squared debt tranche compared to a simple CDO tranche, such as the third loss tranche in

Table 3, the expected payoff

, systematic variance

, and skewness

are lower, but the systematic kurtosis

is higher. In a three-moment CAPM all CDO squared debt tranches in

Table 4 must have the higher price compared to the third loss tranche

in

Table 3. However, in the four-moment CAPM, the pricing relation between simple CDO and CDO squared is also influenced by

which is higher for the latter. The CDO squared example highlights the relevance of all four quality factors for pricing risky debt.

10 5.5. Credit Linked Note (CLN) under Counterparty Risk

The relation between rating and pricing can be completely turned upside down as I will demonstrate for credit linked notes (CLNs). The issuer of a CLN is not obligated to repay the notional amount in full if a specified event occurs. With the structuring of a credit linked note, I can create a payoff X with a low expected loss but high systematic risk contributions , , or the other way around, i.e., a payoff with low rating quality but of high quality with respect to systematic risk. Besides the risk metrics of the underlying payoff characteristic X, it is the credit quality of the issuing counterparty that matters for pricing.

In

Table 5 I create fourteen structured products. The first CLN replicates the payoff of an average bond portfolio so that the systematic risk contributions

,

,

are all equal to one and the expected payoff

is 99%. CLN (2) and (3) replicate digital CDO tranches with 100 and 1000 underlying digital bonds in the asset pool. CLN (2) and (3) have far higher expected payoffs with 99.93% and 99.94% than CLN (1) with a mean payoff of 99%, but the systematic skewness and the systematic kurtosis are higher. The more diversified CLN (3) has even higher systematic risk contributions than the less diversified CLN (2). CLN (3a), (3b), (3c), (3d) take into account the issuer’s counterparty risk. In fact, CLN (3) can also be interpreted as an investment into a synthetic digital CDO tranche with the market portfolio as underlying asset pool. The systematic risk quality of such an investment is already below average regarding coskewness and cokurtosis risk

. However, with the inherent counterparty risk involved in a synthetic CDO, its quality factors are even worse. The “opposite” payoff of CLN 3), i.e., the payoff

is in effect a digital default swap (DDS) under counterparty risk

k. Thus, the synthetic CDO plus DDS issued by the same counterparty

k yields the payoff

, i.e., the digital bond of issuer

k. CLN (4), (5) are structured products with no systematic variance and no systematic skewness risk, respectively. CLN (4), (5) demonstrate the importance of considering non-linear systematic risk, the linear CAPM beta alone is insufficient. The price of CLN (4) entails compensation for non-linear systematic risk and not CAPM alpha. Conversely, CLN (5) is not a negative CAPM alpha investment but offers protection against systematic skewness.

CLN (6) has the lowest rating quality among instruments with no counterparty risk, i.e., it has the highest expected loss. However, CLN (6) only defaults in the best state of the economy when there are no defaults in the market portfolio, i.e., in a state when a marginal payoff is least beneficial. Apart from rating quality, CLN (6) offers the highest possible quality and is in that respect quite the opposite of CLN (3) which has the best rating quality but under quite unfavorable systematic risk. CLN (6a), 6(b), 6(c), 6(d) take into account the counterparty risk of the CLN issuer. That is, those four CLNs unlike CLN (6) can also default in bad states when the CLN issuer is not capable to fulfill its obligation. Remarkably, all four CLNs under counterparty risk still have negative betas yet their coskewness is positive, again a clear demonstration that rating and beta are insufficient for pricing.

5.6. Distress-Contingent Convertible Bond (CoCo)

My model allows the analysis of many other credit instruments such as bank deposit insurance and loan guarantees as an alternative to

Merton (

1977), catastrophe bonds, or credit default swaps (CDSs) under counterparty risk. However, to provide yet a final example, I will discuss distress-contingent convertible bonds or simply CoCos (see

Duffie (

2010)).

Let

denote the dilution factor,

means that the CoCo is a pure write-down bond, existing shareholders experience no dilution at all,

means that existing shareholders are wiped out completely as soon as the conversion level in the form of an attachment point

is triggered. Such a waterfall structure can be thought of as a convolution of first, second, and third loss tranche in a standard CDO structure. The first loss is borne by the equity holder, the second loss tranche is borne by the CoCo bondholder, and claims for the third loss tranche are divided between equity and CoCo bondholder, the fraction

belongs to the CoCo bondholder and

to the equity holder. Consequently, by linearity the prices of equity and CoCo bond are the weighted average of a more standard CDO structure:

where

,

,

are the payoffs of a first, second, and third loss tranche of a standard CDO structure,

,

,

are the attachment points. Due to linearity, the systematic risk contributions as well as the mean payoff of equity and CoCo can be obtained from the corresponding CDO tranches as listed in

Table 6. The higher the dilution

w, the higher is the systematic risk of equity but the lower the systematic exposure of the CoCo. In other words, the lower the dilution

, the less “toxic” is equity. Under

, the rating quality of the CoCo is slightly better than that of a BBB-rated corporate bond in

Table 1, yet its systematic skewness and kurtosis are even higher than that of a BB-rated corporate bond. Similarly, the expected loss of the CoCo is clearly lower than that of an average corporate bond portfolio, yet its systematic risk exposure is considerably worse.

7. Conclusions

I offer an explanation in the spirit of

Akerlof (

1970) for the fall of the structured credit market after the financial market crisis in 2007/08 and why we still see problems resuscitating this market (see, e.g.,

Segoviano et al. (

2015)). The systematic risk of two credit instruments with the same rating can vary substantially, in particular the

non-linear systematic risk, but the systematic risk—unlike the rating—is not readily available to the average investor. That is, structured credit ratings are informationally insufficient for pricing even if ratings provide unbiased, powerful estimates on expected losses. However, a market in which potential buyers cannot correctly assess all pricing-relevant attributes of a product can attract sellers offering inferior goods, in particular, credit products of good rating quality but low systematic risk quality. The presence of market participants who are willing to offer inferior goods tends to drive the market out of existence.

I propose to assess the quality of a credit instrument with end-of-period payoff X by four statistical (co-)moments: mean , covariance , coskewness , cokurtosis , where the three latter metrics are expressed with respect to a well-diversified portfolio M. Currently, rating agencies offer an assessment only about but are silent about , , . In other words, besides the rating information to compute the expected payoff under the issuer’s information , I suggest making also public the systematic risk, i.e., the contribution of X to the variance of M as well as the contributions to the third and fourth central moment of M (always conditional on the seller’s information ). I show that a market in which potential buyers are ignorant about at least one of the four quality attributes has no equilibrium. Making public the seller’s information about , , , , not only , results in a symmetric market with an equilibrium. Such holistic quality assessments for more complex credit instruments can then be benchmarked against simple single-name bonds. As I illustrate, an investment-rated structured finance obligation can have worse systematic risk qualities than a subinvestment-rated corporate bond.

With additional assumptions (i.a., the well-diversified portfolio M is the market portfolio), I offer a simple and straightforward four-moment CAPM that combines the quality attributes of a credit instrument , , , and into an equilibrium price . The variables , , , and are real-world risk metrics independent from any preference assumptions. To arrive at the pricing function , I assume having a representative agent under standard risk aversion, inter alia.

The fact that single-name bonds, structured finance securities and other credit products carry systematic risk contributions , , that can be so different from a pricing standpoint casts significant doubt on whether some credit markets can really smoothly function with only the information provided by rating agencies about the expected payoff . The corporate bond market is possibly homogenous enough but other credit markets—in particular CDOs—certainly not. I illustrate that systematic risk cannot solely be measured by a linear CAPM beta since an asset can be negatively correlated with the market but can still be heavily exposed to non-linear systematic risk. I also demonstrate that counterparty risk of credit derivatives—such as a credit linked note, synthetic CDO, or default swap—has a significant impact on the overall product quality, in particular the product’s systematic risk.

Finally, by considering two empirical cases, namely Morgan Stanley and UBS, I show that even big dealer banks were unaware about inherent non-linear systematic risk of seemingly hedged structured finance portfolios. That is, credit quality was inadequately assessed only based on rating and correlation. The small compensation for non-linear systematic risk was wrongly interpreted as value creation or CAPM alpha and was therefore hardly a fair risk premium for the huge losses that later materialized.