Demand for Long-Term Care Insurance in China

Abstract

:1. Introduction

2. Materials and Methods

2.1. Data and Data Collection

2.2. Household Interview

2.3. Regression Analysis

2.4. Document Analysis

3. Results

3.1. Sample Characteristics

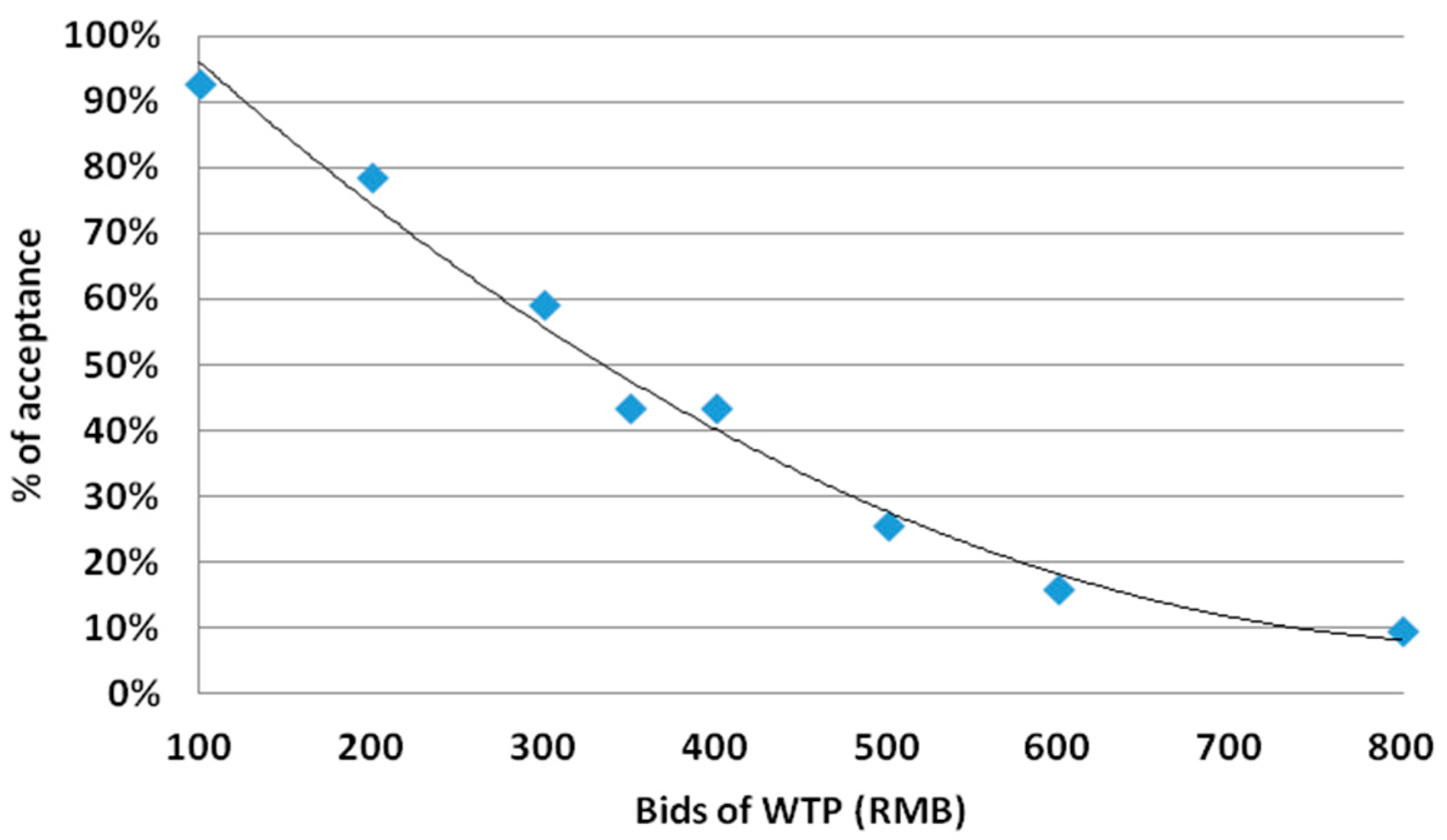

3.2. Mean and Median WTP for LTCI

3.3. Determinants of Demand for LTCI

3.4. Analysis of the Current LTCI Policies in the Pilot Cities

4. Discussion

5. Conclusions

Acknowledgments

Author Contributions

Conflicts of Interest

Appendix A

| UEBMI | URBMI | NCMS | |

|---|---|---|---|

| Participants | employed urban population | unemployed urban population | rural population |

| Financing mechanism | 6% of payroll tax on employers +2% employee contribution | government subsidy + individual contribution (paid in a periodic lump sum) | government subsidy + individual contribution (paid in a periodic lump sum) |

| Benefit package | UEBMI > URBMI > NCMS | ||

| Cities | The Title of Document |

|---|---|

| Chengde | Opinions on Implementing Long-term Care Insurance for UEBMI Enrollees in Chengde |

| Changchun | Opinions on Establishing Long-term Care Insurance for the Disabled in Changchun |

| Implementation Measures of Long-term Care Insurance for the Disabled in Changchun (on trial) | |

| Qiqihaer | Implementation Scheme of Long-term Care Insurance in Qiqihaer (on trial) |

| Shanghai | Pilot Measures of Implementing Long-term Care Insurance in Shanghai |

| Nantong | Opinions on Establishing Long-term Care Insurance in Nantong (on trial) |

| The Rules for Implementing Long-term Care Insurance in Nantong | |

| Suzhou | Opinions on Implementing Long-term Care Insurance in Suzhou |

| Ningbo | Notice on Issuing Pilot Scheme of Implementing Long-term Care Insurance in Ningbo |

| Anqing | Opinions on Implementing Long-term Care Insurance for UEBMI Enrollees in Anqing |

| The Rules for Implementing Long-term Care Insurance for UEBMI Enrollees in Anqing | |

| Shangrao | Implementation Scheme of Long-term Care Insurance in Shangrao |

| Procedures of Administrating Long-term Care Insurance in Shangrao | |

| Qingdao | Administrative Measures of Long-term Care Insurance in Qingdao |

| Jingmen | Measures of Implementing Long-term Care Insurance in Jingmen (on trial) |

| Guangzhou | Pilot Measures of Implementing Long-term Care Insurance in Guangzhou |

| Chengdu | Pilot Scheme of Implementing Long-term Care Insurance in Chengdu |

| The Rules for Implementing Long-term Care Insurance in Chengdu (on trial) | |

| Shihezi | Opinions on Establishing Long-term Care Insurance in Shihezi (on trial) |

| The Rules for Implementing Long-term Care Insurance in Shihezi (on trial) |

| Cities | Province | Participants | Financing Mechanism |

|---|---|---|---|

| Chengde | Hebei | UEBMI enrollees | Pilot stage: individual contribution(transfer from MSA of UEBMI 1, 0.15% of UEBMI premium base 2) + UEBMI pooled funds (0.2% of UEBMI premium base) + government subsidy (0.05% of UEBMI premium base) |

| Changchun | Jilin | UEBMI and URBMI enrollees | UEBMI enrollees: MSA of UEBMI (0.2% of UEBMI premium base) + UEBMI pooled funds (0.3% of UEBMI premium base) + government subsidy (if UEBMI pooled funds are in deficit) URBMI enrollees: URBMI pooled funds (30 RMB/person/year) + government subsidy (if URBMI funds are in deficit) |

| Qiqihaer | Heilongjiang | UEBMI enrollees | Pilot stage: individual contribution (transfer from MSA of UEBMI, 30 RMB/person/year) + UEBMI pooled funds (30 RMB/person/year) |

| Shanghai | Shanghai | UEBMI enrollees and BMIURR enrollees aged 60 or above | UEBMI enrollees: Pilot stage: UEBMI pooled funds. After the pilot: individual contribution (0.1% of UEBMI premium base) + employer contribution (1% of UEBMI premium base) BMIURR enrollees: Pilot stage: BMIURR pooled funds. After the pilot: individual contribution (15% of LTCI fundraising totals) + government contribution |

| Nantong | Jiangsu | UEBMI and BMIURR enrollees | UEBMI enrollees: individual contribution(transfer from MSA of UEBMI, 30 RMB/person/year) + UEBMI pooled funds (30 RMB/person/year) + government subsidy (40 RMB/person/year) BMIURR enrollees: individual contribution (30 RMB/person/year) + BMIURR pooled funds (30 RMB/person/year) + government subsidy (40 RMB/person/year) |

| Suzhou | Jiangsu | UEBMI and BMIURR enrollees | Pilot stage: UEBMI enrollees: UEBMI pooled funds (70 RMB/person/year) + government subsidy (50 RMB/person/year) BMIURR enrollees: BMIURR pooled funds (35 RMB/person/year) + government subsidy (50RMB/person/year) |

| Ningbo | Zhejiang | UEBMI enrollees | UEBMI pooled funds |

| Anqing | Anhui | UEBMI enrollees | Pilot stage: individual contribution (10 RMB/person/year) + UEBMI pooled funds (20 RMB/person/year) |

| Shangrao | Jiangxi | UEBMI enrollees | Pilot stage: individual contribution (transfer from MSA of UEBMI, 40 RMB/person/year) + employer contribution (30 RMB/person/year) + UEBMI pooled funds (30 RMB/person/year) + government subsidy (if individuals work in public institutions or the companies in financial difficulties) |

| Qingdao | Shandong | UEBMI and BMIURR enrollees | UEBMI enrollees: UEBMI pooled funds + MSA of UEBMI (0.5% of UEBMI premium base) BMIURR enrollees: BMIURR pooled funds |

| Jingmen | Hubei | UEBMI and BMIURR enrollees | The LTCI fundraising totals equaled to 0.4% of the annual per capita disposable income in 2015 in Jingmen (about 82 RMB/person/year). Individual contribution (37.5% of LTCI fundraising totals, about 30 RMB/person/year) + UEBMI or BMIURR pooled funds (25% of LTCI fundraising totals) + government subsidy (government provides full subsidy for vulnerable population to pay their individual contribution, accounting for 37.5% of LTCI fundraising totals) |

| Guangzhou | Guangdong | UEBMI Enrollees | Pilot stage: UEBMI pooled funds (130 RMB/person/year) |

| Chengdu | Sichuang | UEBMI enrollees | Pilot stage: individual contribution (transfer from MSA of UEBMI, 0.1%, 0.2%, and 0.3% of UEBMI premium base for those aged 40 years and below, those aged between 40 years and the retirement age, and the retired, respectively) + UEBMI pooled funds (0.2% of UEBMI premium base) + government subsidy(only to retired population) |

| Shihezi | Xinjiang | UEBMI and URBMI enrollees | UEBMI enrollees: UEBMI pooled funds (180 RMB/person/year) + government subsidy (40 RMB/person/year, to those who are aged 60 plus and severely disabled) URBMI enrollees: individual contribution (24 RMB/person/year)+URBMI pooled funds + government subsidy (40 RMB/person/year, to those who are aged 60 plus and severely disabled) |

| Cities | Eligibility | Benefit Package | Effective from |

|---|---|---|---|

| Chengde | the severely disabled | Medical facilities: LTCI pays 70% of the costs, with a payment ceiling of 60 RMB/person/day. Care facilities or nursing homes: LTCI pays 70% of the costs, with a payment ceiling of 50 RMB/person/day. | June 2017 |

| Changchun | the severely disabled | Care facilities or nursing homes: LTCI pays 90% of the costs, with a payment ceiling for UEBMI enrollees, and pays 80% with a payment ceiling for URBMI enrollees. Medical facilities: the payment depends on the level of facilities and the type of health insurance | May 2015 |

| Qiqihaer | the severely disabled | Care facilities: LTCI pays 60% of the costs, with a payment ceiling of 30 RMB/person/day. Nursing homes: LTCI pays 55% of the costs, with a payment ceiling of 25 RMB/person/day. Home care: LTCI pays 50% of the costs, with a payment ceiling of 20 RMB/person/day. | Oct 2017 |

| Shanghai | those rated from secondary to sixth level in disability assessment | Home care: LTCI pays 90% of the costs. The times of home care provided each week depends on the person’s rated level in disability assessment. Nursing homes: LTCI pays 85% of the costs. Medical facilities: according to the requirement of UEBMI and BMIURR. | Jan 2017 |

| Nantong | the severely and partially disabled | Medical facilities: LTCI pays 60% of the costs, with a payment ceiling of 50 RMB/person/day for the severely disabled and 10 RMB/person/day for the partially disabled. Nursing homes: LTCI pays 50% of the costs, with a payment ceiling of 40 RMB/person/day for the severely disabled and 10 RMB/person/day for the partially disabled. Home care: LTCI pays 15 RMB/person/day for the severely disabled and 8 RMB/person/day for the partially disabled. | Jan 2016 |

| Suzhou | the severely and partially disabled | Care facilities or nursing homes: LTCI pays 26 RMB/person/day for the severely disabled, and 20 RMB/person/day for the partially disabled. Home care: LTCI pays 30 RMB/person/day for the severely disabled and 25 RMB/person/day for the partially disabled. Medical facilities: according to the requirement of UEBMI and BMIURR. | Oct 2017 |

| Ningbo | the severely disabled | LTCI pays 40 RMB/person/day for the care provided by nursing homes and specialized care facilities. | Dec 2017 |

| Anqing | the severely disabled | Medical facilities: LTCI pays 60% of the costs, with a payment ceiling of 50 RMB/person/day. Nursing homes: LTCI pays 50% of the costs, with a payment ceiling of 40 RMB/person/day. Home care provided by designated care facilities: The payment ceiling is 750 RMB/person/month. Home care provided by non-designated care facilities: LTCI pays 15 RMB/person/day. | Jan 2017 |

| Shangrao | the severely disabled | Home care provided by relatives or a designated person: LTCI provides a small subsidy for the caregiver. Home care provided by care facilities: LTCI pays by service and by per diem. Institutional care: LTCI pays per diem. | Nov 2016 |

| Qingdao | the severely and partially disabled | LTCI pays 90% of the care costs for UEBMI enrollees, 80% for BMIURR enrollees with the first-type individual contribution, and 40% for BMIURR enrollees with the second-type individual contribution. The payment ceiling is 170 RMB/person/day for specialized institutions, 65 RMB/person/day for nursing homes, 50 RMB/person/day for home care. For care facilities in the community, the payment ceiling is 1600 RMB/person/year for UEBMI enrollees and BMIURR enrollees with the first-type individual contribution and 800 RMB/person/year for BMIURR enrollees with the first-type individual contribution. | Jan 2015 |

| Jingmen | the severely disabled | Fulltime home care: LTCI pays 80% of the costs, with a payment ceiling of 100 RMB/person/day. Part-time home care: LTCI pays 40 RMB/person/day. Nursing homes: LTCI pays 75% of the costs, with a payment ceiling of 100 RMB/person/day. Medical facilities: LTCI pays 70% of the costs, with a payment ceiling of 150 RMB/person/day. | Jan 2017 |

| Guangzhou | the severely disabled | Basic daily care: LTCI pays 75% of the costs, with a payment ceiling of 120 RMB/person/day in nursing homes or care facilities, and 90% of the costs, with a payment ceiling of 115 RMB/person/day for home care. Medical care: LTCI pays by service, with copayment, and with a payment ceiling of 1000 RMB/person/month. | Aug 2017 |

| Chengdu | the severely disabled | Institutional care: LTCI pays 70% of the costs, with a payment ceiling ranging from 1005 RMB/person/month to 1676 RMB/person/month. Home care: LTCI pays 70% of the costs, with a payment ceiling ranging from 1077 RMB/person/month to 1796 RMB/person/month. | July 2017 |

| Shihezi | the severely disabled | Designated institutional care: LTCI pays 70% of the costs, with a payment ceiling of 750 RMB/person/month. Non-designated institutional care and home care: LTCI pays 25 RMB/person/day. | Jan 2017 |

References

- United Nations Department of Economic and Social Affairs (UNDESA). World Population Prospects. The 2012 Revision; United Nations Department of Economic and Social Affairs: New York, NY, USA, 2013. [Google Scholar]

- World Health Organization (WHO). China Country Assessment Report on Ageing and Health; World Health Organization: Geneva, Switzerland, 2015. [Google Scholar]

- Flaherty, J.H.; Liu, M.L.; Ding, L.; Dong, B.; Ding, Q.; Li, X.; Xiao, S. China: The aging giant. J. Am. Geriatr. Soc. 2007, 55, 1295–1300. [Google Scholar] [CrossRef] [PubMed]

- Feng, Z.; Liu, C.; Guan, X.; Mor, V. China’s Rapidly Aging Population Creates Policy Challenges in Shaping a Viable Long-Term Care System. Health Aff. (Millwood) 2012, 31, 2764–2773. [Google Scholar] [CrossRef] [PubMed]

- Li, D.; Zhang, D.J.; Shao, J.J.; Qi, X.D.; Tian, L. A meta-analysis of the prevalence of depressive symptoms in Chinese older adults. Arch. Gerontol. Geriatr. 2014, 58, 1–9. [Google Scholar] [CrossRef] [PubMed]

- Hashimoto, H.; Horiguchi, H.; Matsuda, S. Micro Data Analysis of Medical and Long-Term Care Utilization Among the Elderly in Japan. Int. J. Environ. Res. Public Health 2010, 7, 3022–3037. [Google Scholar] [CrossRef] [PubMed]

- Yang, W.; He, A.J.; Fang, L.; Mossialos, E. Financing institutional long-term care for the elderly in China: A policy evaluation of new models. Health Policy Plan. 2016, 31, 1391–1401. [Google Scholar] [CrossRef] [PubMed]

- Rhee, J.C.; Done, N.; Anderson, G.F. Considering long-term care insurance for middle-income countries: Comparing South Korea with Japan and Germany. Health Policy 2015, 119, 1319–1329. [Google Scholar] [CrossRef] [PubMed]

- Ministry of Human Resources and Social Security Guidance on Pilot Cities to Launch Long-Term Care Insurance. Available online: http://www.mohrss.gov.cn/SYrlzyhshbzb/shehuibaozhang/zcwj/201607/t20160705_242951.html (accessed on 1 December 2016).

- Lu, Y.; Yang, C. A Review of the Construction of Long-term Care Insurance System in China. Soc. Secur. Stud. 2016, 4, 98–105. [Google Scholar]

- Lei, X.; Feng, Y. Financing Channel of Social Long-term Care Insurance: Experience, Difficulties and Future choices. J. Northwest Univ. Philos. Soc. Sci. Ed. 2016, 46, 108–115. [Google Scholar]

- Johannesson, M.; Jönsson, B.; Karlsson, G. Outcome measurement in economic evaluation. Health Econ. 1996, 5, 279–296. [Google Scholar] [CrossRef]

- Louviere, J.J.; Hensher, D.A.; Swait, J.D. Stated Choice Methods. Analyses and Applications; Cambridge University Press: Cambridge, UK, 2000. [Google Scholar]

- Bridges, J.F.P. Stated preference methods in health care evaluation: An emerging methodological paradigm in health economics. Appl. Health Econ. Health Policy 2003, 2, 213–224. [Google Scholar] [PubMed]

- Ahmed, S.; Hoque, M.E.; Sarker, A.R.; Sultana, M.; Islam, Z.; Gazi, R.; Khan, J.A.M. Willingness-to-Pay for Community-Based Health Insurance among Informal Workers in Urban Bangladesh. PLoS ONE 2016, 11, e0148211. [Google Scholar] [CrossRef] [PubMed]

- Basaza, R.; Alier, P.K.; Kirabira, P.; Ogubi, D.; Lako, R.L.L. Willingness to pay for National Health Insurance Fund among public servants in Juba City, South Sudan: A contingent evaluation. Int. J. Equity Health 2017, 16, 158. [Google Scholar] [CrossRef] [PubMed]

- Donfouet, H.P.P.; Makaudze, E.; Mahieu, P.-A.; Malin, E. The determinants of the willingness-to-pay for community-based prepayment scheme in rural Cameroon. Int. J. Health Care Financ. Econ. 2011, 11, 209–220. [Google Scholar] [CrossRef] [PubMed]

- Dong, H.; Kouyate, B.; Cairns, J.; Mugisha, F.; Sauerborn, R. Willingness-to-Pay for Community-Based Insurance in Burkina Faso. Health Econ. 2003, 12, 849–862. [Google Scholar] [CrossRef] [PubMed]

- Nguyen, L.H.; Hoang, A.T.D. Willingness to Pay for Social Health Insurance in Central Vietnam. Front. Public Health 2017, 5, 89. [Google Scholar] [CrossRef] [PubMed]

- Nosratnejad, S.; Rashidian, A.; Mehrara, M.; Akbari Sari, A.; Mahdavi, G.; Moeini, M. Willingness to pay for the social health insurance in Iran. Glob. J. Health Sci. 2014, 6, 154–163. [Google Scholar] [CrossRef] [PubMed]

- Onwujekwe, O.; Okereke, E.; Onoka, C.; Uzochukwu, B.; Kirigia, J.; Petu, A. Willingness to pay for community-based health insurance in Nigeria: Do economic status and place of residence matter? Health Policy Plan. 2010, 25, 155–161. [Google Scholar] [CrossRef] [PubMed]

- Ying, X.-H.; Hu, T.-W.; Ren, J.; Chen, W.; Xu, K.; Huang, J.-H. Demand for private health insurance in Chinese urban areas. Health Econ. 2007, 16, 1041–1050. [Google Scholar] [CrossRef] [PubMed]

- Bärnighausen, T.; Liu, Y.; Zhang, X.; Sauerborn, R. Willingness to pay for social health insurance among informal sector workers in Wuhan, China: A contingent valuation study. BMC Health Serv. Res. 2007, 7, 114. [Google Scholar] [CrossRef] [PubMed] [Green Version]

- Kitajima, T. Willingness to Pay for Long-term Care Insurance System in a Municipality in Tokyo. Asia Pac. J. Public Health 1999, 11, 101–108. [Google Scholar] [CrossRef] [PubMed]

- Costa-Font, J.; Rovira-Forns, J. Who is willing to pay for long-term care insurance in Catalonia? Health Policy 2008, 86, 72–84. [Google Scholar] [CrossRef] [PubMed]

- Brau, R.; Lippi Bruni, M. Eliciting the demand for long-term care coverage: A discrete choice modelling analysis. Health Econ. 2008, 17, 411–433. [Google Scholar] [CrossRef] [PubMed]

- Allaire, B.T.; Brown, D.S.; Wiener, J.M. Who Wants Long-Term Care Insurance? A Stated Preference Survey of Attitudes, Beliefs, and Characteristics. Inq. J. Health Care Organ. Provis. Financ. 2016, 53, 0046958016663728. [Google Scholar] [CrossRef] [PubMed]

- Shen, S.; Li, F.; Tanui, J.K. Long-term care insurance in China: Public or private? Soc. Work Health Care 2014, 53, 679–692. [Google Scholar] [CrossRef] [PubMed]

- Sheng, L.; Yan, J. China Regional Economic Statistics Yearbook 2011; China Statistics Press: Beijing, China, 2011. [Google Scholar]

- Johansson, P.-O. The Economic Theory and Measurement of Environmental Benefits; Cambridge University Press: Cambridge, UK, 1987. [Google Scholar]

- Alberini, A.; Boyle, K.; Welsh, M. Analysis of contingent valuation data with multiple bids and response options allowing respondents to express uncertainty. J. Environ. Econ. Manag. 2003, 45, 40–62. [Google Scholar] [CrossRef]

- Cameron, T.A.; Poe, G.L.; Ethier, R.G.; Schulze, W.D. Alternative Non-market Value-Elicitation Methods: Are the Underlying Preferences the Same? J. Environ. Econ. Manag. 2002, 44, 391–425. [Google Scholar] [CrossRef]

- Cameron, T.A. A new paradigm for valuing non-market goods using referendum data: Maximum likelihood estimation by censored logistic regression. J. Environ. Econ. Manag. 1988, 15, 355–379. [Google Scholar] [CrossRef]

- Barber, S.; Yao, L. Health Insurance Systems in China: A Briefing Note; World Health Organization: Geneva, Switzerland, 2010. [Google Scholar]

- Pan, X.-F.; Xu, J.; Meng, Q. Integrating social health insurance systems in China. Lancet Lond. Engl. 2016, 387, 1274–1275. [Google Scholar] [CrossRef]

- Yong, V.; Saito, Y. National Long-Term Care Insurance Policy in Japan a Decade after Implementation: Some Lessons for Aging Countries. Ageing Int. 2012, 37, 271–284. [Google Scholar] [CrossRef]

- Nosratnejad, S.; Rashidian, A.; Dror, D.M. Systematic Review of Willingness to Pay for Health Insurance in Low and Middle Income Countries. PLoS ONE 2016, 11, e0157470. [Google Scholar] [CrossRef] [PubMed]

- Ministry of Civil Affairs of the People’s Republic of China. Replies to the Representative of the People’s Congress Proposing “Suggestions on Strengthening the Government Support for the Development of Long-Term Care in Western Provinces”. Available online: http://www.mca.gov.cn/article/gk/jytabljggk/rddbjy/201710/20171000006425.shtml (accessed on 14 November 2017).

| Variable | Measurement |

|---|---|

| Price of LTCI (RMB) | Ordinal variable |

| Province | 0 = Zhejiang, 1 = Qinghai |

| Sex | 0 = female, 1 = male |

| Age | |

| ≤35 | 0 = No, 1 = Yes |

| 35–65 | 0 = No, 1 = Yes |

| ≥65 | 65 or above was the default variable |

| Marital status | 0 = Single, divorced, or widowed |

| 1 = Married | |

| Education status | |

| Primary education or below | 0 = No, 1 = Yes |

| Secondary education | 0 = No, 1 = Yes |

| Tertiary education | Tertiary education was the default variable |

| Average annual per capita income (RMB) | |

| Lowest 25% | Lowest 25% average annual per capita income was the default variable |

| Middle 25% | 0 = No, 1 = Yes |

| Higher 25% | 0 = No, 1 = Yes |

| Highest 25% | 0 = No, 1 = Yes |

| The type of public health insurance | 0 = Not covered or did not know the type of public health insurance that the respondent had |

| UEBMI | UEBMI was the default variable |

| URBMI/NCMS | 0 = No, 1 = Yes |

| Not covered or did not know the type | 0 = No, 1 = Yes |

| Having chronic conditions | 0 = No, 1 = Yes |

| Variable | Mean | SD |

|---|---|---|

| WTP (The highest bid which a person was willing to pay) (RMB/year) | 329.94 | 219.34 |

| Annual per capita income (RMB) | ||

| Lowest 25% | 3472.62 | 1519.34 |

| Middle 25% | 7347.68 | 1009.81 |

| Higher 25% | 12,874.09 | 2614.97 |

| Highest 25% | 36,232.52 | 21,732.23 |

| Variable | N | % |

| Province | ||

| Qinghai | 901 | 51.69 |

| Zhejiang | 842 | 48.31 |

| Sex | ||

| Male | 1075 | 61.68 |

| Female | 668 | 38.32 |

| Age (year) | ||

| ≤35 | 370 | 21.23 |

| 35–65 | 972 | 55.77 |

| ≥65 | 401 | 23.01 |

| Marital status | ||

| Married | 1292 | 74.13 |

| Single, divorced, or widowed | 451 | 25.87 |

| Education status | ||

| Primary education or below | 538 | 30.87 |

| Secondary education | 848 | 48.65 |

| Tertiary education | 357 | 20.48 |

| The type of public health insurance | ||

| UEBMI | 508 | 29.15 |

| URBMI/NCMS | 387 | 22.20 |

| Not covered or did not know the type | 848 | 48.65 |

| Having chronic conditions | ||

| Yes | 621 | 35.63 |

| No | 1122 | 64.37 |

| Variable | Coef | S.E. | p-Value |

|---|---|---|---|

| Intercept | 24.786 *** | 4.143 | <0.001 |

| Price of LTC (RMB) | −0.067 *** | 0.003 | <0.001 |

| Qinghai province | −0.528 | 2.660 | 0.843 |

| Male | −0.059 | 0.835 | 0.944 |

| Age of HH | |||

| ≤35 | 3.519 ** | 1.680 | 0.036 |

| 35–65 | −0.268 | 1.240 | 0.829 |

| Married | 0.612 | 1.040 | 0.557 |

| Education status of HH | |||

| Primary education or below | −6.122 *** | 1.364 | <0.001 |

| Secondary education | −4.044 *** | 1.239 | <0.001 |

| Annual per capita income (RMB) | |||

| Middle 25% | 0.036 | 1.146 | 0.975 |

| Higher 25% | 4.448 *** | 1.228 | <0.001 |

| Highest 25% | 9.988 *** | 1.228 | <0.001 |

| The type of public health insurance | |||

| URBMI/NCMS | −1.907 | 1.183 | 0.107 |

| Not covered or did not know the type | −1.139 | 2.651 | 0.667 |

| Having chronic conditions | −0.829 | 0.836 | 0.322 |

| Median WTP (RMB) | 370.14 | ||

| Random effects | |||

| rho coefficient = 0.98; rho S.E. = 0.0012 | |||

| Wald χ2(14); P > χ2 | 779.01 | p < 0.001 | |

| Likelihood ratio test of rho; P > χ2 | 4903.94 | p < 0.001 | |

© 2017 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (http://creativecommons.org/licenses/by/4.0/).

Share and Cite

Wang, Q.; Zhou, Y.; Ding, X.; Ying, X. Demand for Long-Term Care Insurance in China. Int. J. Environ. Res. Public Health 2018, 15, 6. https://doi.org/10.3390/ijerph15010006

Wang Q, Zhou Y, Ding X, Ying X. Demand for Long-Term Care Insurance in China. International Journal of Environmental Research and Public Health. 2018; 15(1):6. https://doi.org/10.3390/ijerph15010006

Chicago/Turabian StyleWang, Qun, Yi Zhou, Xinrui Ding, and Xiaohua Ying. 2018. "Demand for Long-Term Care Insurance in China" International Journal of Environmental Research and Public Health 15, no. 1: 6. https://doi.org/10.3390/ijerph15010006