Recycling Pricing and Coordination of WEEE Dual-Channel Closed-Loop Supply Chain Considering Consumers’ Bargaining

Abstract

:1. Introduction

2. Description of the Problem and Related Assumptions

2.1. Description of the Problem

2.2. Related Assumptions

3. Model Construction and Analysis

3.1. Decentralized Dual-Channel Recycling Model Analysis

3.2. Centralized Dual-Channel Recycling Model Analysis

4. Revenue-and-Expense Sharing Contract Coordination Mechanism Design

5. Numerical Analysis

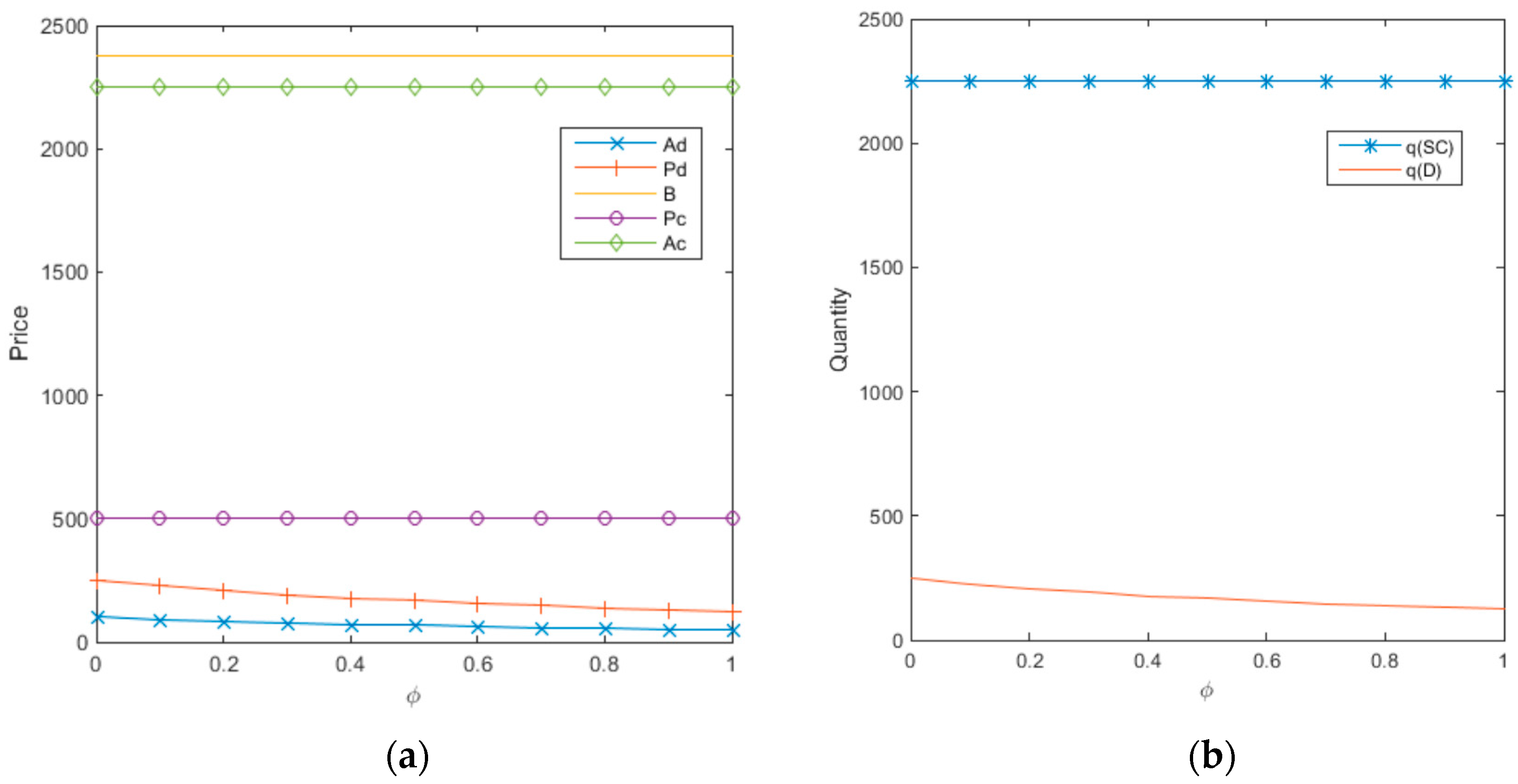

5.1. Sensitivity Analysis of the Consumer Bargaining Power Coefficient

5.2. Sensitivity Analysis of the Channel Competition Coefficient

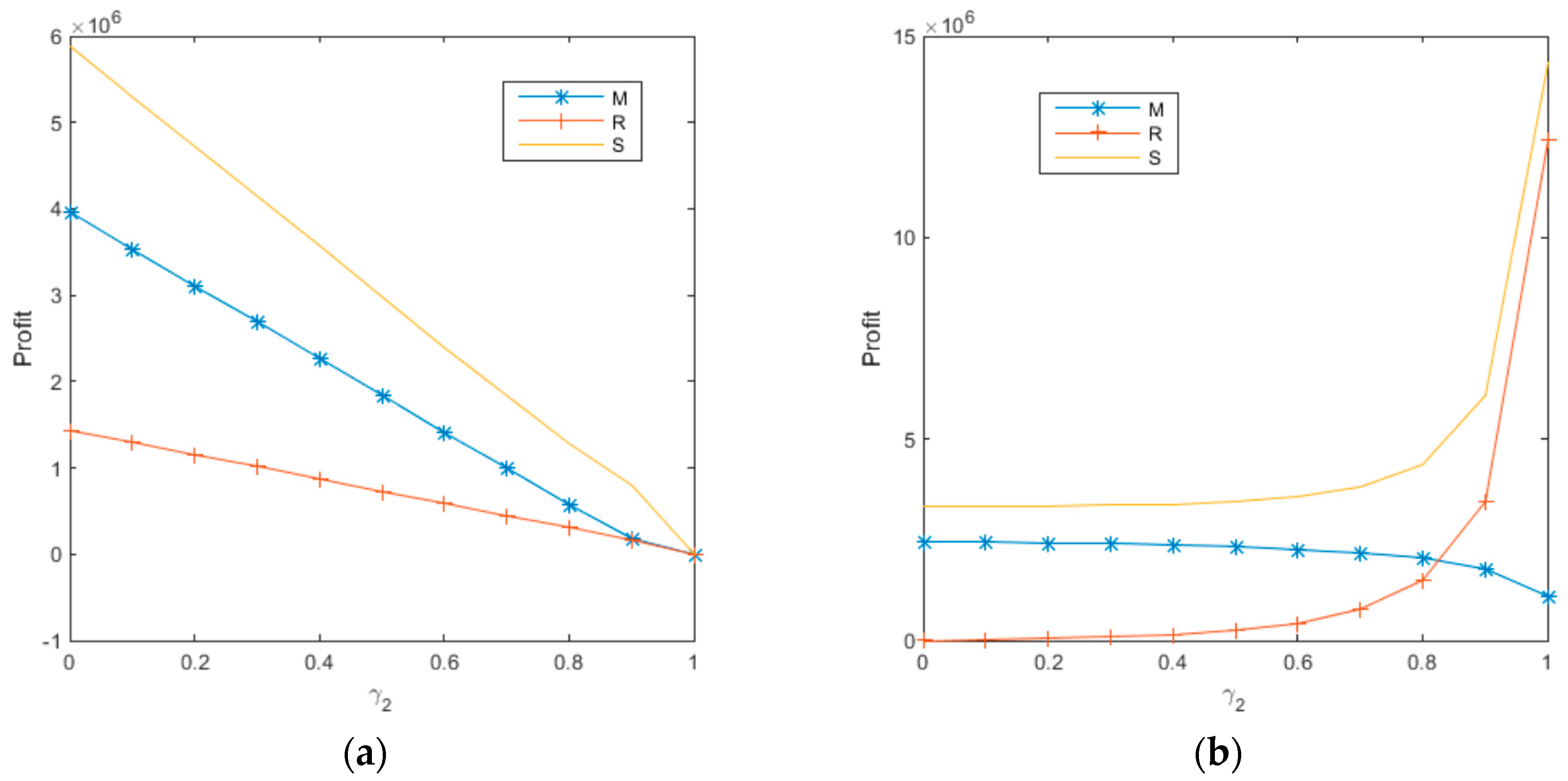

5.3. Sensitivity Analysis of the Revenue-and-Expense Sharing Contract Coefficient

6. Conclusions

Acknowledgments

Author Contributions

Conflicts of Interest

Appendix A

Appendix B. Proof of Proposition 1

Appendix C. Proof of Proposition 2

Appendix D. Proof of Proposition 3

Appendix E. Proof of Proposition 4

References

- Wang, Q.; Yang, Y.; Ma, H.-Y. Research on prediction model of recycling potential of waste electronic products. Chin. Pop. Resour. Environ. 2014, 14, 147–153. [Google Scholar]

- Stock, J.R. Reverse Logistics; Council of Logistics Management: Oak Brook, IL, USA, 1992. [Google Scholar]

- Khetriwal, D.S.; Kraeuchi, P.; Widmer, R. Producer responsibility for e-waste management: Key issues for consideration: Learning from the Swiss experience. J. Environ. Manag. 2007, 19, 1–13. [Google Scholar] [CrossRef] [PubMed]

- Wäger, P.A.; Hischier, R.; Eugster, M. Environmental impacts of the Swiss collection and recovery systems for waste electrical and electronic equipment (WEEE): A follow-up. Sci. Total Environ. 2011, 409, 1746–1756. [Google Scholar] [CrossRef] [PubMed]

- Ongondo, F.O.; Williams, I.D.; Cherrett, T.J. How are WEEE doing? A global review of the management of electrical and electronic wastes. Waste Manag. 2011, 31, 714–730. [Google Scholar] [CrossRef] [PubMed]

- Walther, G.; Spengler, T. Impact of WEEE-directive on reverse logistics in Germany. Int. J. Phys. Distrib. Logist. Manag. 2005, 35, 337–361. [Google Scholar] [CrossRef]

- Fleischmann, M.; Krikke, H.R.; Dekker, R.; Flapper, S.D. A characterization of logistics networks for product recovery. Omega 2000, 28, 653–666. [Google Scholar] [CrossRef]

- Achillas, C.; Vlachokostas, C.; Aidonis, D.; Banias, G. Optimising reverse logistics network to support policy-making in the case of electrical and electronic equipment. Waste Manag. 2010, 30, 2592–2600. [Google Scholar] [CrossRef] [PubMed]

- Feng, L.; Govindan, K.; Li, C. Strategic planning: Design and coordination for dual-recycling channel reverse supply chain considering consumer behavior. Eur. J. Oper. Res. 2017, 260, 601–612. [Google Scholar] [CrossRef]

- Cai, G.G. Channel selection and coordination in dual-channel supply chains. J. Retail. 2010, 86, 22–36. [Google Scholar] [CrossRef]

- Huang, M.; Song, M.; Lee, L.H.; Ching, W.K. Analysis for strategy of closed-loop supply chain with dual recycling channel. Int. J. Prod. Econ. 2013, 144, 510–520. [Google Scholar] [CrossRef]

- Amaro, A.C.S.; Barbosa-Póvoa, A.P.F.D. The effect of uncertainty on the optimal closed-loop supply chain planning under different partnerships structure. Comput. Chem. Eng. 2009, 33, 2144–2158. [Google Scholar] [CrossRef]

- Savaskan, R.C.; Bhattacharya, S.; van Wassenhove, L.N. Closed-loop supply chain models with product remanufacturing. Manag. Sci. 2004, 50, 239–252. [Google Scholar] [CrossRef]

- Wu, C.H. Product-design and pricing strategies with remanufacturing. Eur. J. Oper. Res. 2012, 222, 204–215. [Google Scholar] [CrossRef]

- Wang, X.G. Research on recycling pricing and subsidy policy of electronic waste products in reverse supply chain. Chin. J. Manag. Sci. 2016, 24, 107–115. [Google Scholar]

- Heydari, J.; Govindan, K.; Jafari, A. Reverse and closed loop supply chain coordination by considering government role. Transport. Res. Part D Transport. Environ. 2017, 52, 379–398. [Google Scholar] [CrossRef]

- Bakal, I.S.; Akacali, E. Effect of random yield in remanufacturing with price-sensitive supply and demand. Prod. Oper. Manag. 2006, 15, 407–420. [Google Scholar] [CrossRef]

- Das, D.; Dutta, P. Performance analysis of a closed-loop supply chain with incentive-dependent demand and return. Int. J. Adv. Manuf. Technol. 2016, 86, 621–639. [Google Scholar] [CrossRef]

- Borthakur, A.; Govind, M. Emerging trends in consumers E-waste disposal behavior and awareness: A worldwide overview with special focus on India. Resour. Conserv. Recycl. 2017, 117, 102–113. [Google Scholar] [CrossRef]

- Zhu, X.D.; Wang, Z.; Wang, Y.; Li, B.Y. Incentive policy options for product remanufacturing: Subsidizing donations or resales? Int. J. Environ. Res. Public Health 2017, 14, 1496. [Google Scholar] [CrossRef] [PubMed]

- Liu, Z.; Tang, J.; Li, B.Y.; Wang, Z. Trade-off between remanufacturing and recycling of WEEE and the environmental implication under the Chinese Fund Policy. J. Clean. Prod. 2017, 167, 97–109. [Google Scholar] [CrossRef]

- Hui, L.; Wang, C.X.; Meng, S.; Wei, O. Pricing, carbon emission reduction, low-carbon promotion and returning decision in a closed-loop supply chain under vertical and horizontal cooperation. Int. J. Environ. Res. Public Health 2017, 14, 1332. [Google Scholar] [CrossRef]

- Chen, Z.S.; Su, S.I. Dual competing photovoltaic supply chains: A social welfare maximization perspective. Int. J. Environ. Res. Public Health 2017, 14, 1416. [Google Scholar] [CrossRef] [PubMed]

- Huang, M.; Peng, X.Y.; Shi, T.L. Triple recycling channel strategies for remanufacturing of construction machinery in a retailer-dominated closed-loop supply chain. Sustainability 2017, 9, 2167. [Google Scholar] [CrossRef]

- Ma, Z.J.; Hu, S.; Dai, Y. Closed-loop supply chain decision-making of electrical and electronic products under mixed channel sales/recycling under government regulation. Chin. J. Manag. Sci. 2016, 24, 82–90. [Google Scholar]

- Liu, H.H.; Lei, M.; Deng, H.H.; Leong, G.K.; Huang, T. A dual channel, quality-based price competition model for the WEEE recycling market with government subsidy. Omega 2016, 59, 290–302. [Google Scholar] [CrossRef]

- Zhu, X.D.; Li, B.Y.; Wang, Z. A study on the manufacturing decision-making and optimization of hybrid-channel supply chain for original equipment manufacturer. Adv. Prod. Eng. Manag. 2017, 12, 185–195. [Google Scholar] [CrossRef]

- Xie, J.P.; Ling, L.; Liu, L.H.; Ieromonachou, P. Coordination contracts of dual-channel with cooperation advertising in closed-loop supply chains. Int. J. Prod. Econ. 2017, 183, 528–538. [Google Scholar] [CrossRef]

| Symbol | Definition |

|---|---|

| w | Wholesale price of product |

| Retail price of product | |

| Direct recycling price of waste paid by player i to | |

| Transfer price received by retailer | |

| Transfer price received by third-party online recycling platform | |

| Profits player j receives under dual-channel model, | |

| Unit product cost using new materials | |

| Unit product cost using materials disassembled from product recycling | |

| Voluntary market recycling quantity when recycling price = 0 | |

| Channel competition coefficient | |

| Price sensitivity coefficient | |

| Unit product cost savings from remanufacturing | |

| Player i’s market recycling quantity coefficient | |

| Potential market size | |

| Price impact factor of sale product | |

| Consumer bargaining power coefficient | |

| Coefficient of player i’s revenue-and-expense sharing contracts |

© 2017 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (http://creativecommons.org/licenses/by/4.0/).

Share and Cite

Zhu, X.; Wang, J.; Tang, J. Recycling Pricing and Coordination of WEEE Dual-Channel Closed-Loop Supply Chain Considering Consumers’ Bargaining. Int. J. Environ. Res. Public Health 2017, 14, 1578. https://doi.org/10.3390/ijerph14121578

Zhu X, Wang J, Tang J. Recycling Pricing and Coordination of WEEE Dual-Channel Closed-Loop Supply Chain Considering Consumers’ Bargaining. International Journal of Environmental Research and Public Health. 2017; 14(12):1578. https://doi.org/10.3390/ijerph14121578

Chicago/Turabian StyleZhu, Xiaodong, Jing Wang, and Juan Tang. 2017. "Recycling Pricing and Coordination of WEEE Dual-Channel Closed-Loop Supply Chain Considering Consumers’ Bargaining" International Journal of Environmental Research and Public Health 14, no. 12: 1578. https://doi.org/10.3390/ijerph14121578