1. Introduction

In his speech delivered at the Financial Student Association in Amsterdam [

1], in 2009, Andrew G. Haldane, Executive Director of Financial Stability of the Bank of England, called for a rethinking of the financial network, that is the network formed by the connections between banks and other financial institutions. He warned that, in the last decades, this network had become more complex and less diverse, and that these facts may have led to the crisis of 2008.

According to him, it was the belief of theoreticians and practitioners of the financial market that connectivity between financial companies meant risk diversification and dispersion, but further studies showed that networks of certain complexity exhibit a robust but fragile structure, where crises may be dampened by sharing a shock among many institutions, but where they may also spread faster and further due to the connections between companies. Other issue to be considered was the fact that some nodes in the financial network were very connected to others, while some were less connected. The failure of a highly connected node could, thus, spread a small crisis to many other nodes in the network. Another factor was the small-world property of the financial network, where one company was not very far removed from another, through relations between common partners, or common partners of partners.

Such a connected network was also more prone to panic, tightening of credit lines, and distress sales of assets, some of them caused by uncertainties about who was a counterpart to failing companies. Due to some financial innovations, risk was now shared among many parties, some of them not totally aware of all the details of a debt that was sectorized, with risk being decomposed and then reconstituted in packages that were then resold to other parties. This made it difficult to analyze the risk of individual institutions, whose liabilities were not completely known even to them, since they involved the risks of an increasingly large number of partners.

The other important aspect, the loss of diversity, increased when a large number of institutions adopted the same strategies in the pursuit of return and in the management of risk. Financial companies were using the same models and using the same financial instruments, with the same aims.

In the same speech, Haldane pointed at some directions that could improve the stability of the financial network. The first one was to map the network, what implied the collection, sharing and analysis of data. This analysis needed to include techniques that didn’t focus only on the individual firms, like most econometric techniques do, but also on the network itself, using network techniques developed for other fields, like ecology or epidemiology. The second was to use this knowledge to properly regulate this network. The third was to restructure the financial network, eliminating or reinforcing weak points. All these need a better understanding of the connections between financial institutions and how these connections influence the very topology of the financial network.

This article contributes to the first direction pointed by Haldane, that of understanding the international financial network. We do it by calculating a network based on the daily returns of the stocks of the 197 largest financial companies across the world in terms of market capitalization that survive a liquidity filter. These include not just banks, but also diversified financial services, insurance companies, one investment company, a private equity, real estate companies, REITS (Real Estate Investment Trusts), and savings and loans institutions. We use the daily returns in order to build the network because we believe that the price of a stock encodes a large amount of information about the company to which it is associated that goes beyond the information about the assets and liabilities of the company. Also, we believe that it is more interesting to study the effects of stock prices on other stock prices, as in the propagation of a financial crisis, rather than the spreading of defaults, since defaults are events that are usually avoided by injecting external capital into banks.

The network is built using Transfer Entropy, a measure first developed in information science. The network is a directed one, which reveals the transfer of information between the time series of each stock. This network is used in order to determine which are the most central nodes, according to diverse centrality criteria. The identification of these central stocks is important, since in most models of the propagation of shocks, highly central nodes are often the major propagators. We also enlarge the original network obtained by Transfer Entropy to include the most liquid stocks belonging to financial companies in some European countries that have been receiving much attention recently due to the fact that they are facing different degrees of economic crises, and determine who are the major financial companies in the world that are most affected by price movements of those stocks, and which of those stocks belonging to countries in crisis are the most influent ones.

1.1. Propagation of Socks in Financial Networks

The work that is considered the first that deals with the subject is the one of Allen and Gale [

2], where the authors modeled financial contagion as an equilibrium phenomenon, and concluded that equilibrium is fragile, that liquidity shocks may spread through the network, and that cascade events depend on the completeness of the structure of interregional claims between banks. In their model, they used four different regions, which may be seen as groups of banks with some particular specializations. They focused in one channel of contagion, which are the overlapping claims that different regions or sectors of the banking system have on one another. According to them, another possible channel of contagion that was not considered is incomplete information among agents. As an example, the information of a shock in one region may create a self-fulfilling shock in another region if that information is used as a prediction of shocks in other regions. Another possible channel of contagion is the effect of currency markets in the propagation of shocks from one country to another. In their results, the spreading of a financial crisis depends crucially on the topology of the network. A completely connected network is able to absorb shocks more efficiently, and a network with strong connections limited to particular regions which are not themselves well connected is more prone to the dissemination of shocks. In a work previous to theirs, Kirman [

3] built a network of interacting agents and made the network evolve with the probability of each of the links dependent on the experience of the agents involved, obtaining results that were very different from those which might have been predicted by looking at the individuals in isolation.

Later and Allen

et al. [

4] made a review of the progress of the network approach to the propagation of crises in the financial market. They concluded that there is an urgent need for empirical work that maps the financial network, so that the modern financial systems may be better understood, and that a network perspective would not only account for the various connections within the financial sector or between the financial sector and other sectors, but also would consider the quality of such links. Upper [

5] made a survey of a diversity of simulation methods that have been used with a variety of financial data in order to study contagion in financial networks, and made a comparison between the various methods used.

There is an extensive literature on the propagation of shocks in networks of financial institutions, and describing all the published works in this subject is beyond the scope of this article. Most of the works in this field can be divided into theoretical and empirical ones, most of them considering networks of banks where the connections are built on the borrowing and lending between them. In most theoretical works [

6–

23], networks are built according to different topologies (random, small world, or scale-free), and the propagation of defaults is studied on them. The conclusions are that small world or scale-free networks are, in general, more robust to cascades (the propagation of shocks) than random networks, but they are also more prone to propagations of crises if the most central nodes (usually, the ones with more connections) are not themselves backed by sufficient funds. Most empirical works [

24–

38] are also based on the structure derived from the borrowing and lending between banks, and they show that those networks exhibit a core-periphery structure, with few banks occupying central, more connected positions, and others populating a less connected neighborhood. Those articles showed that this structure may also lead to cascades if the core banks are not sufficiently resistant, and that the network structures changed considerably after the crisis of 2008, with a reduction on the number of connected banks and a more robust topology against the propagation of shocks.

1.2. Transfer Entropy

The networks based on the borrowing and lending between banks are useful for determining the probabilities of defaults, but they are not useful in the study of how the stock price of one company relates with the stock price of another company. Such a relation may be obtained using the correlation between each stock price (or better, on its log-return) but, although useful for determining which stocks behave similarly to others, the correlations between them cannot establish a relation of causality or of influence, since the action of a stock on another is not necessarily symmetric. A measure that has been used in a variety of fields, and which is both dynamic and non-symmetric, is Transfer Entropy, developed by Schreiber [

39] and based on the concept of Shannon Entropy, first developed in the theory of information by Shannon [

40]. Transfer entropy has been used in the study of cellular automata in Computer Science [

41–

43], in the study of the neural cortex of the brain [

44–

49], in the study of social networks [

50], in Statistics [

51–

54], and in dynamical systems [

55–

57], and received a thermodynamic interpretation in [

58].

In terms of the applications of Transfer Entropy to finance, Marschinski and Kantz [

59] analyzed the information flow between the S&P500 index of the New York Stock Exchange (USA) and the DAX index of the Frankfurt Stock Exchange (Germany) and detected a nonlinear information transfer between both indices at the one minute scale. They also introduced a measure called Effective Transfer Entropy, which subtracts from Transfer Entropy some of the effects of noise or of a highly volatile time series. This concept is now amply used, particularly in the study of the cerebral cortex, and is also used in the present article.

Baek and Jung

et al. [

60] applied Transfer Entropy to the daily returns of 135 stocks listed on the New York Stock Exchange (NYSE) from 1983 to 2003, and concluded that companies of the energy industries influence the whole market. Kwon and Yang [

61] applied Transfer Entropy to the S&P500 and Dow Jones indices of the New York Stock Exchange and to the stocks of 125 companies negotiated at this stock exchange in order to analyze the flow of information between them, concluding that there is more information flow from the indices to the stocks than from the stocks to the indices. Kwon and Yang [

62] used the stock market indices of 25 countries and discovered that the Transfer Entropy from the American markets is high, followed by that of the European markets, and that the information flows mainly to the Asia Pacific stock markets.

Jizba and Kleinert

et al. [

63] used both Transfer Entropy (based on Shannon’s entropy) and a variant version of Transfer Entropy based on Rényi’s entropy, which is able to examine different regions of the probability density functions of time series by the variation of a parameter, in the study of the Transfer Entropy and of the Rényi Transfer Entropy between 11 stock market indices sampled in a daily basis in the period 1990–2009 and also between the DAX and the S&P 500 indices based on minute tick data gathered in the period from April, 2008 to November, 2009. Their results show that the information flow between world markets is strongly asymmetric with a distinct information surplus flowing from the Asia-Pacific region to both the European and the US markets, with a smaller excess of information also flowing from Europe to the US, what is clearly seen from a careful analysis of the Rényi information flow between the DAX and S& P500 indices. The results obtained by them are very similar for different choices of the parameter that specifies the sector of the probability distribution functions that is highlighted in the calculations.

Peter and Dimpfl

et al. [

64,

65] used Transfer Entropy in order to analyze the information flows between the CDS (Credit Default Swap) market and the corporate bond market using data on 27 iTraxx companies, showing that, although there is information flowing in both directions, the CDS market sends more information to the bond market than vice-versa. Their work also shows that the information flow between both markets has been growing in time, and that the importance of the CDS market as source of information is higher during the crisis of 2008. They also analyzed the dynamic relation between the market risk (proxied by the VIX) and the credit risk (proxied by the iTraxx Europe), showing that information flows mainly from the VIX to the iTraxx Europe, and that, although the transfer of information was mostly bidirectional, the excess information flowing from the VIX to the iTraxx Europe was highest during the crisis of 2008.

Kim and An

et al. [

66] used Transfer Entropy on five monthly macro-economic variables (industrial production index, stock market index, consumer price index, exchange rate, and trade balance) for 18 countries, during the 1990s and the 2000s. They first applied Transfer Entropy in order to study the inter-relations of each of the five variables inside each country, and then the Transfer Entropy between the same variable across countries, for each of the five variables. Besides the relationship between variables inside countries, with some variations of results, they discovered that more influence transfers among the countries in Europe than in Asia or the Americas, most likely reflecting the formation of the European Union, that the stock market indices of Germany and Italy are strong information receivers from other European countries, and that one can expect that signs of the financial crisis originating from some European countries in crisis will be transmitted, with either positive or negative annotation, to the rest of Europe. They also discovered that the Americas, most notably the USA, are sources of information for the stock market indices of Brazil and Mexico, and for the exchange rate in Canada, and receivers of information of trade balance from Mexico and of industrial production index from Argentina. As for Asia, there is a cluster of information transfer formed by China, India and Japan in terms of exchange rate, and another one, in terms of industrial production index, between South Korea, Indonesia and Japan. China and South Korea are large receivers of information of the industrial production index from Indonesia and India, respectively, and Japan influences South Korea in terms of the consumer price index and acts as a receiver of information of the exchange rate from India and Indonesia.

Li and Liang

et al. [

67] used data of the stocks of 16 Chinese banks between 2011 and 2012 and applied Transfer Entropy in order to determine an interbank exposure matrix, using it to evaluate the stability of the Chinese banking system by simulating the risk contagion process using the resulting network. The results show that the Chinese banking system is quite stable with respect to systemic risk, and the study also identifies systemically important banks, what gives regulators information for the development of policies.

Dimpfl and Peter [

68] applied Rényi’s Transfer Entropy to high frequency data (at one minute intervals) from July, 2003 to April, 2010, of the S&P 500 (USA), the DAX (Germany), the CAC 40 (France), and the FTSE (UK) indices at the intervals in time when all stock exchanges were operating, in order to analyze the information flow across the Atlantic Ocean. Their results show that the information transfer between Europe and America increased during the 2008 financial crisis, and has remained higher than before the crisis occurred. The dominant role of the USA as a source of information to the European markets diminished after the crisis, except in the case of France. They also found that the collapse of the Lehman Brothers led to a significant increase in information flow among the countries that were part of the study. The comparison of results using different parameters for the Rényi Transfer Entropy did not show important differences between them.

1.3. How This Article Is Organized

Section 2 explains the data used in the article and some of the methodology. Section 3 explains Transfer Entropy and uses it in order to study the information flows between the stocks of financial institutions. Section 4 highlights which are the most central stocks according to different centralities criteria. Section 5 studies the dynamics of Transfer Entropy for the stock markets in moving windows in time. Section 6 studies the relationships between countries in crisis in Europe with the largest financial institutions, analyzing which stocks are more affected by movements in the stocks belonging to those countries in crisis. Finally, Section 7 shows some conclusions and possible future work.

2. Data and Methodology

In order to choose appropriate time series of the top stocks in terms of market capitalization belonging to the financial sector, we used the S&P 1200 Global Index as in 2012, which is a free-float weighted stock market index of stocks belonging to 31 countries. The stocks belonging to the index are responsible for approximately 70 percent of the total world stock market capitalization and 200 of them belong to the financial sector, as classified by Bloomberg. From those, we extracted 197 stocks that had enough liquidity with respect to the working days of the New York Stock Exchange (NYSE). From the 197 stocks, 79 belong to the USA, 10 to Canada, 1 to Chile, 21 to the UK, 4 to France, 5 to Germany, 7 to Switzerland, 1 to Austria, 2 to the Netherlands, 2 to Belgium, 5 to Sweden, 1 to Denmark, 1 to Finland, 1 to Norway, 6 to Italy, 4 to Spain, 1 to Portugal, 1 to Greece, 12 to Japan, 9 to Hong Kong, 1 to South Korea, 1 to Taiwan, 3 to Singapore, and 18 to Australia. The time series were collected from January, 2003, to December, 2012, thus covering a period of ten years. The stocks and their classification according to industry and sub industry are listed in

Appendix A.

Some of the limitations of our choice of variables are that, first, some companies like Lehman Brothers or Bear-Stearns, which were key players prior to and during the crisis of 2008, are not present, since their stocks do not exist anymore. Second, there are companies that are major players in the financial industry, and particularly some funds, which are not listed in any stock exchange, and so are not in our data set. Such limitations are consequences of our choice of data set, and their effects might be lessened by the number of stocks being considered, but only up to a certain extent.

We took the daily closing prices of each stock, and the resulting time series of all 197 stocks were compared with the time series of the NYSE, which was taken as a benchmark, since it is by far the major stock exchange in the world. If an element of the time series of a stock occurred for a day in which the NYSE wasn’t opened, then this element was deleted from the time series, and if an element of the time series of a stock did not occur in a day in which the NYSE functioned, then we repeated the closing price of the previous day. The idea was not to eliminate too many days of the time series by, as an example, deleting all closing prices in a day one of the stock exchanges did not operate. The methodology which we chose would be particularly bad for stocks belonging to countries where weekends occur on different days than for Western countries, like Muslim countries or Israel, but since no stocks from our set belong to those countries, differences on weekends are not relevant here.

The data are organized so as to place stocks of the same country together, and then to discriminate stocks by industry and sub industry, according to the classification used by Bloomberg. From the 197 stocks, 80 belong to Banks, 27 to Diversified Financial Services, 50 to Insurance Companies, 1 to an Investment Company, 1 to a Private Equity, 8 to Real Estate Companies, 28 are REITS (Real Estate Investment Trusts), and 2 belong to Savings and Loans.

In order to reduce non-stationarity of the time series of the daily closing prices, we use the log-returns of the closing prices, defined as

where Pt is the closing price of the stock at day t and Pt−1 is the closing price of the same stock at day t − 1.

Since the stocks being considered belong to stock markets that do not operate at the same times, we run into the issue of lagging or not some stocks. Sandoval [

69], when dealing with stock market indices belonging to stock markets across the globe, showed that it is not very clear that an index has to be lagged with respect to another, except in cases like Japan and the USA. A solution is to use both original and lagged indices in the same framework, and to do all calculations as if the lagged indices were different ones. The same procedure is going to be followed here with the log-returns of the closing prices of the stocks that have been selected, so we shall deal with 2 × 197 = 394 time series.

3. Transfer Entropy

In this section, we shall describe the concept of Transfer Entropy (TE), using it to analyze the data concerning the 197 stocks of companies of the financial sector and their lagged counterparts. We will start by describing briefly the concept of Shannon entropy.

3.1. Shannon Entropy

The American mathematician, electronic engineer and cryptographer, Claude Elwood Shannon (1916–2001), founded the theory of information in his work “A Mathematical Theory of Communication” [

40], in which he derived what is now known as the Shannon entropy. According to Shannon, the main problem of information theory is how to reproduce at one point a message sent from another point. If one considers a set of possible events whose probabilities of occurrence are

pi,

i = 1, · · ·,

n, then a measure

H(

p1, p2, · · ·,

pn) of the uncertainty of the outcome of an event given such distribution of probabilities should have the following three properties:

H(pi) should be continuous in pi;

if all probabilities are equal, what means that pi = 1/n, then H should be a monotonically increasing function of n (if there are more choices of events, then the uncertainty about one outcome should increase);

if a choice is broken down into other choices, with probabilities cj, j = 1, · · ·, k, then

, where Hk is the value of the function H for each choice.

Shannon proved that the only function that satisfies all three properties is given by

where the sum is over all states for which pi ≠ 0 (Shannon’s definition had a constant k multiplied by it, which has been removed here). The base 2 for the logarithm is chosen so that the measure is given in terms of bits of information. As an example, a device with two positions (like a flip-flop circuit) can store one bit of information. The number of possible states for N such devices would then be 2N, and log2 2N = N, meaning that N such devices can store N bits of information, as should be expected. This definition bears a lot of resemblance to Gibbs’ entropy, but is more general, as it can be applied to any system that carries information.

The Shannon entropy represents the average uncertainty about measures i of a variable X (in bits), and quantifies the average number of bits needed to encode the variable X. In the present work, given the time series of the log-returns of a stock, ranging over a certain interval of values, one may divide such possible values into N different bins and then calculate the probabilities of each state i, what is the number of values of X that fall into bin i divided by the total number of values of X in the time series. The Shannon entropy thus calculated will depend on the number of bins that are selected. After selecting the number of bins, one associates a symbol (generally a number) to each bin.

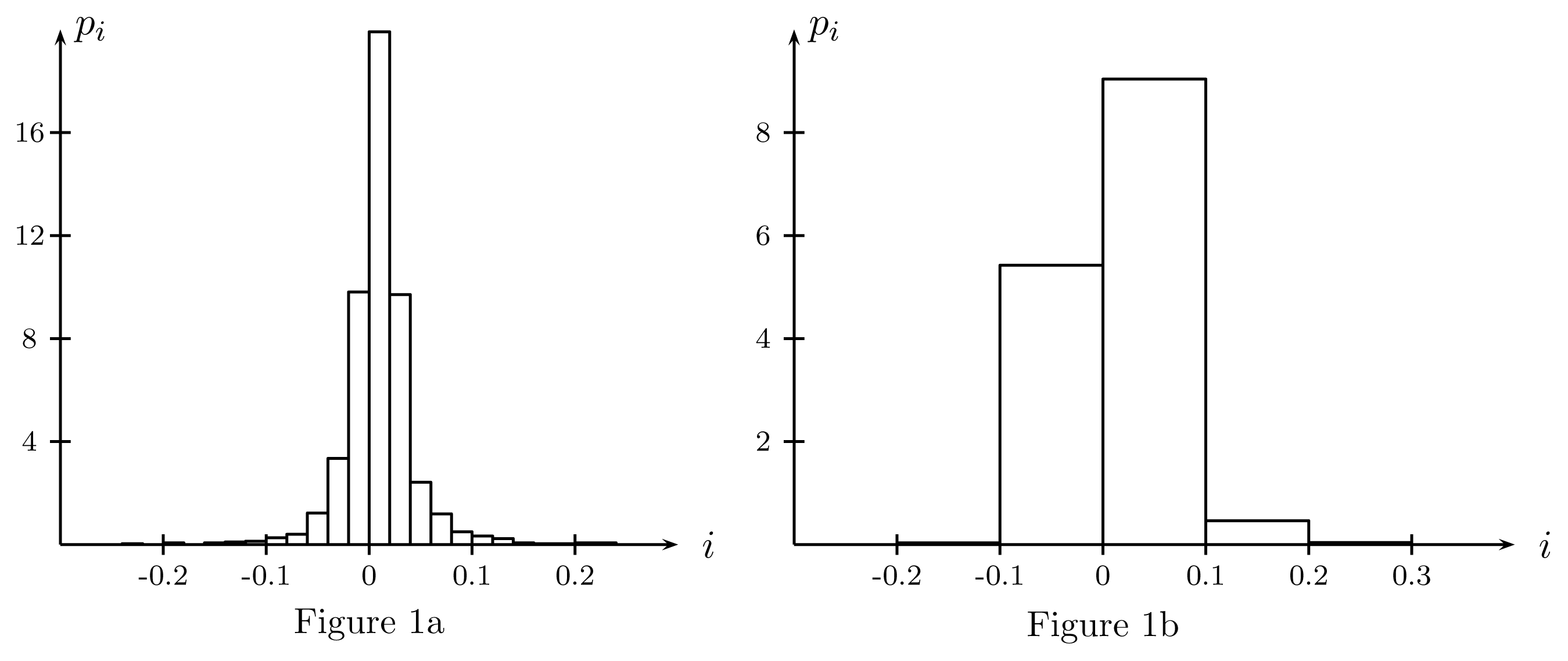

Using the stocks of the J.P. Morgan (code JPM), classified as a Diversified Banking Institution, we shall give an example of the calculation of the Shannon Entropy for two different choices of bins. In

Figure 1, we show the frequency distributions of the log-returns for the stocks of the J.P. Morgan from 2007 to 2012, which varied from −0.2323 to 0.2239 during that period, with two different binning choices. The first choice results in 24 bins of size 0.02, and the second choice results in 6 bins of size 0.1.

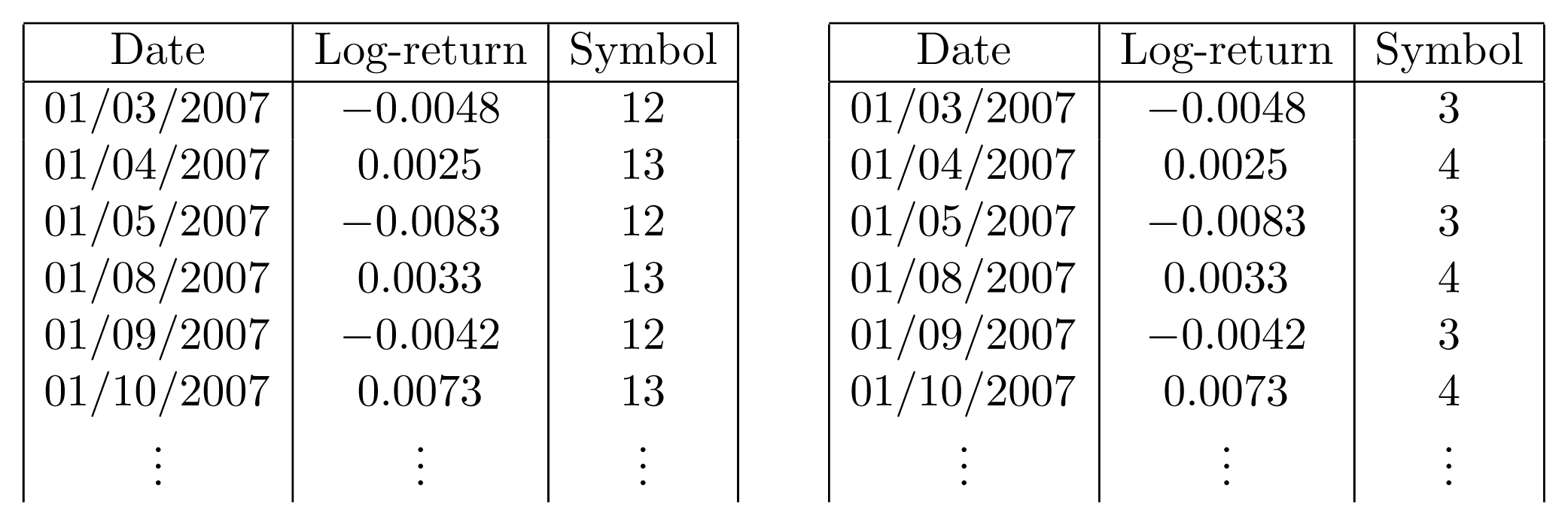

To each bin is assigned a symbol, which, in our case, is a number, from 1 to 24 in the first case and from 1 to 6 in the second case.

Figure 2 shows the assigning of symbols for the two choices of binning for the first log-returns of the stocks of the J.P. Morgan. Then, we calculate the probability that a symbol appears in the time series and then use (

2) in order to calculate the Shannon entropy, which, in our case, is

H = 2

.55 for bins of size 0.02 and

H = 0

.59 for bins of size 0.1. The second result is smaller than the first one because there is less information for the second choice of binning due to the smaller number of possible states of the system. The difference in values, though, is not important, since we shall use the Shannon entropy as a means of comparing the amount of information in different time series.

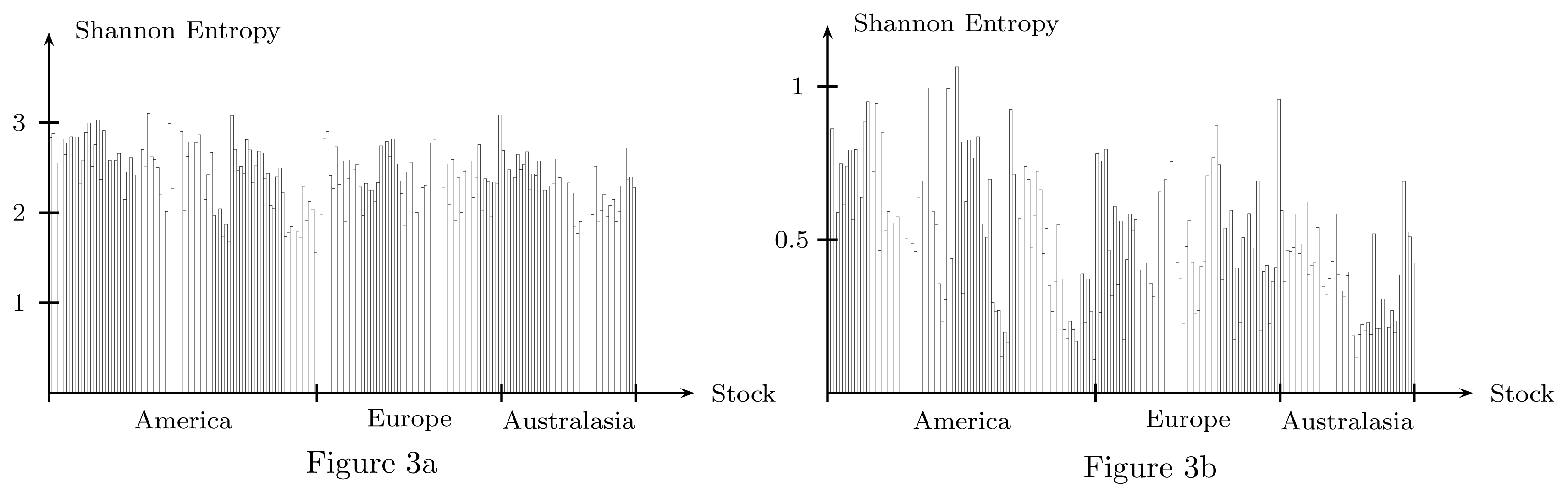

Figure 3 shows the Shannon Entropy calculated for each stock in this study (the lagged stocks are not represented, since their entropies are nearly the same as the entropies of the original stocks). The results for both choices of binning are in fact very similar, and their correlation is 0.97. Stocks with higher Shannon Entropy are the most volatile ones. As one can see, the second choice, with larger bin sizes, shows the differences more sharply, which is one of the reasons why larger binnings are usually favored in the literature.

3.2. Transfer Entropy

When one deals with variables that interact with one another, then the time series of one variable Y may influence the time series of another variable X in a future time. We may assume that the time series of X is a Markov process of degree k, what means that a state in+1 of X depends on the k previous states of the same variable. This may be made more mathematically rigorous by defining that the time series of X is a Markov state of degree k if

where p(A|B) is the conditional probability of A given B, defined as

What expression (

3) means is that the conditional probability of state

in+1 of variable

X on all its previous states is the same as the conditional probability of

in+1 on its

k previous states, meaning that it does not depend on states previous to the

kth previous states of the same variable.

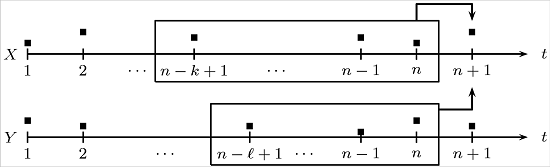

One may also assume that state

in+1 of variable

X depends on the

ℓ previous states of variable

Y. The concept is represented in

Figure 4, where the time series of a variable

X, with states

in, and the time series of a variable

Y, with states

jn, are identified.

The Transfer Entropy from a variable Y to a variable X is the average information contained in the source Y about the next state of the destination X that was not already contained in the destination’s past. We assume that element in+1 of the time series of variable X is influenced by the k previous states of the same variable and by the ℓ previous states of variable Y. The values of k and ℓ may vary, according to the data that is being used, and to the way one wishes to analyze the transfer of entropy of one variable to the other.

The Transfer Entropy from a variable Y to a variable X is defined as

where in is element n of the time series of variable X and jn is element n of the time series of variable Y, p(A,B) is the joint probability of A and B, and

is the joint probability distribution of state

in+1 with its

k + 1 predecessors, and with the

ℓ predecessors of state

jn, as in

Figure 4.

This definition of Transfer Entropy assumes that events on a certain day may be influenced by events of

k and

ℓ previous days. We shall assume, with some backing from empirical data for financial markets [

69], that only the day before is important, since log-returns of the prices of stocks were shown to have low memory (what is not the case for the volatility of the log-returns of prices). By doing so, formula (

5) for the Transfer Entropy of

Y to

X becomes simpler:

where we took k = ℓ = 1, meaning we are using lagged time series of one day, only.

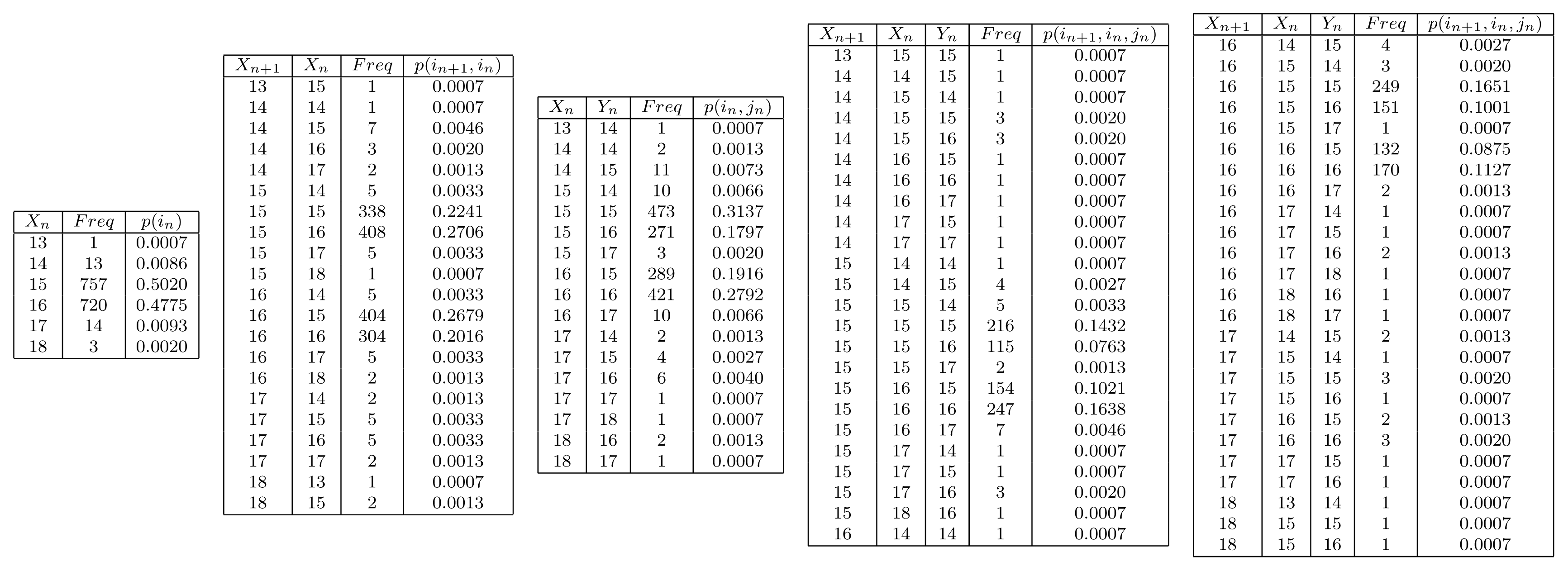

In order to exemplify the calculation of Transfer Entropy, we will now show some steps for the calculation of the Transfer Entropy from the Deutsche Bank to the J.P. Morgan. In

Figure 5, first table, we show the initial part of the time series for the log-returns of the J.P. Morgan, which we call vector

Xn+1 (first column), for its values lagged by one day, vector

Xn (second column), and the log-returns of the Deutsche Bank lagged by one day, vector

Yn (third column). Calculating the minimumand maximum returns of the entire set of time series, we obtain a minimum value

m = −1

.4949 and a maximum value

M = 0

.7049. Considering then an interval [−1

.5

, 0

.8] with increments 0

.1, we obtain 24 bins to which we assign numeric symbols going from 1 to 24. Then, we associate one symbol to each log-return, depending on the bin it belongs to. As seen in

Figure 5, second table, most of the symbols orbit around the intervals closest to zero (corresponding to symbols 15 and 16), since most of the variations of the time series are relatively small.

In order to calculate the simplest probabilities,

p(

in), appearing in (

7), we just need to count how many times each symbol appears in vector

Xn and then divide by the total number of occurrences. As an example, from the first 10 lines of data shown in

Figure 5, symbol 15 appears four times. In order to calculate

p (

in+1, in), we must count how many times a particular combination of symbols, (

a, b), appears in the joint columns

Xn+1 and

Xn. As an example, in the first 10 lines of such columns, the combination (15

, 15) appears zero times, the combination (15

, 16) appears four times, the combination (16

, 15) appears four times, and the combination (16

, 16) appears two times.

For the whole data, we have the following probabilities and joint probabilities shown in

Figure 6. Here, it becomes clearer why, sometimes, it is best to use a binning of larger size in order to calculate Transfer Entropy, since when one has too many binnings, the chance of having particular combinations drop very quickly, making the calculation of probabilities less informing.

We now sum over all combinations of the components of

Xn+1,

Xn, and

Yn using definition (

7), obtaining as a result

TE177→4 = 0

.0155. This result indicates the average amount of information transferred from the Deustche Bank to the J.P. Morgan which was not already contained in the information of the past state of the J.P. Morgan one day before. Doing the same for all possible combinations of stocks, one obtains a Transfer Entropy matrix, which is represented in terms of false colors in

Figure 7a.

Here, like in the calculation of the Shannon Entropy, the size of the bins used in the calculations of the probabilities changes the resulting Transfer Entropy (TE). The calculations we have shown in

Figures 5 and

6 are relative to a choice of binning of size 0.1. In order to compare the resulting TE matrix with that of another choice for binning, we calculated the TE for binning size 0.02, what leads to a much larger number of bins and to a much longer calculation time. The resulting TE matrix for binning 0.02 is plotted in

Figure 7b. The two TE matrices are not very different, with the main dissimilarities being due to scale, and the visualization for binning size 0

.1 is sharper than the one obtained using binning size 0

.02. In what follows, we shall consider binning size 0.1 throughout the calculations, since it demands less computation time and delivers clearer results in comparison with the ones obtained for some smaller sized binnings.

3.3. Effective Transfer Entropy

Transfer Entropy matrices usually contain much noise, due to the finite size of data used in their calculation, non-stationarity of data, and other possible effects, and we must also consider that stocks that have more entropy, what is associated with higher volatility, naturally transfer more entropy to the others. We may eliminate some of these effects [

59] if we calculate the Transfer Entropy of randomized time series, where the elements of each time series are individually randomly shuffled so as to break any causality relation between variables but maintain the individual probability distributions of each time series. The original Transfer Entropy matrix is represented in

Figure 8a. The result of the average of 25 simulations with randomized data appears in

Figure 8b. We only calculated 25 simulations because the calculations are very computationally demanding, and because the results for each simulation are very similar. Then, an Effective Transfer Entropy matrix (ETE) may be calculated by subtracting the Randomized Transfer Entropy matrix (RTE) from the Transfer Entropy matrix (TE):

One effect of calculating Randomized Transfer Entropy matrices is that we may then define a limit where noise is expected to take over. The values calculated for the average of 25 simulations with randomized time series are in between 0 and 0.0523, while the values of the Transfer Entropy matrix calculated with the original time series range from 0 to 1.3407. So, values of TE smaller than around 0.05 are more likely to be the result of noise. The Effective Transfer Entropy matrix has values that range from −0.0202 to 1.3042.

The main feature of the representation of the Effective Transfer Entropy matrix (or of the Transfer Entropy matrix) is that it is clearly not symmetric. The second one is that the highest results are all in the quadrant on the left topmost corner (Quadrant 12). That is the quadrant related with the Effective Transfer Entropy (ETE) from the lagged stocks to the original ones. The main diagonal expresses the ETE from one stock to itself on the next day, which, by the very construction of the measure being used, is expected to be high. But Quadrant 12 also shows that there are larger transfers of entropy from lagged stocks to the other ones than between stocks on the same day. We must remind ourselves that we are dealing here with the daily closing prices of stocks, and that the interactions of prices of stocks, and their reactions to news, usually occur at high frequency. Here, we watch the effects that a whole day of negotiations of a stock has on the others.

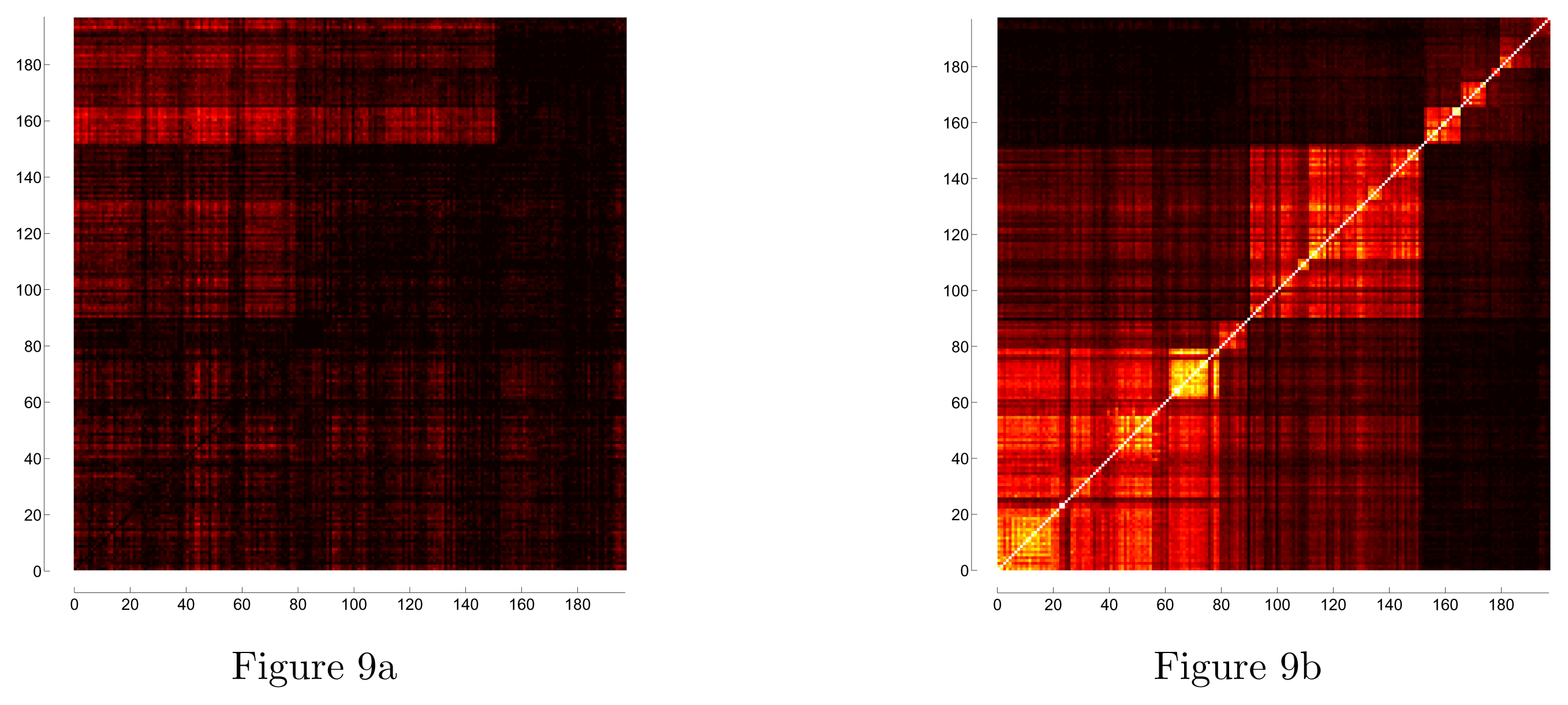

Figure 9a shows a closer look at the ETE of the stocks on stocks on the same day, what corresponds to the quadrant on the bottom left (Quadrant 11), and from lagged to original stocks, in

Figure 9b (Quadrant 12).

Analyzing Quadrant 12 (

Figure 9b), we may see again the structures due to geographical positions, with clusters related with stocks from the USA (1 to 79), Canada (80 to 89), Europe (91 to 152), Japan (153 to 165), Hong Kong (166 to 174), Singapore (177 to 179), and Australia (180 to 197). We also detect some ETE from lagged stocks from the USA to stocks from Canada and Europe, from lagged stocks from Europe to stocks from the USA and Canada and, with a smaller strength, from lagged stocks from Europe to stocks from Australasia, and transfer of entropy within the Australasian stocks.

Quadrant 11 (

Figure 9a) shows much smaller values, but one can see a clear influence of Japan (153–165) on North America (1–89) and Europe (91–152), and also some influence from Europe to the USA. A very light influence may be seen from the USA to itself on the next day, Canada, and Europe, but it is already hard to distinguish this influence from noise. There are negative values of ETE, what means that the Transfer Entropy calculated is smaller than what would be expected from noise. These are the same results found in [

63], who used only same day time series in their calculations.

The Effective Transfer Entropy relations may be used in order to define a network where each stock is represented by a node and each ETE between two stocks is an edge. The network defined by the ETE matrix is one in which each edge has a label attached to it, which is the ETE it represents [

70]. Another type of network may be obtained if one defines a threshold value for the ETE and then represents only the ETEs above this threshold as edges, and only the nodes connected by edges thus defined are represented in the network. The representation of such network is called an asset graph, and by using the concept of asset graph, we may choose values for a threshold and represent only the edges that are above that threshold and the nodes connected by them. By choosing appropriate threshold values for the ETE, above which edges and nodes are removed, we may obtain some filtered representations of the ETE structure between the stocks. This is more clearly visible if one plots only the elements of the ETE matrix that are above a certain threshold. In

Figure 10, we take a closer look at the relationships between the stocks at threshold 0.4.

At the lower right corner, there are three small clusters of stocks from the USA in the same rectangle: the first one is the transfer entropy between stocks of two banks, the second one is a cluster of insurance companies, and the third one is a small cluster of super-regional banks. At the top right rectangle, there are two clusters of stocks from the USA, the first one a large cluster of REITS (Real Estate Investment Trusts), and the second one a pair of two REITS of Health Care. At the center of the graph, we have a rectangle with stocks of two major commercial banks based in Brazil negotiated in the New York Stock Exchange. At the lower left of the graph, there are two pairs: one of diversified banking institutions from France and one of major commercial banks from Spain. At the top left, we have the last clusters; the first one, a pair of stocks from Japan, and the second one is a cluster of Real Estate operations, management and services firms; the third one is a pair of two commercial banks from Hong Kong. It is to be noticed that most relations are reciprocate, although the ETE between stocks is rarely very similar.

We shall not make a deeper analysis of the remaining asset graphs, but one can see from the ETE matrix in

figures 8 and

9 that integration begins inside countries, with the exception of certain countries from Europe, and then goes continental. Only at threshold 0.1 and below do we start having intercontinental integration. This may be due to differences in operation hours of the stock exchanges, to geographical, economic and cultural relations, or to other factors we failed to contemplate (see, for instance, [

71] for a discussion and for further references).

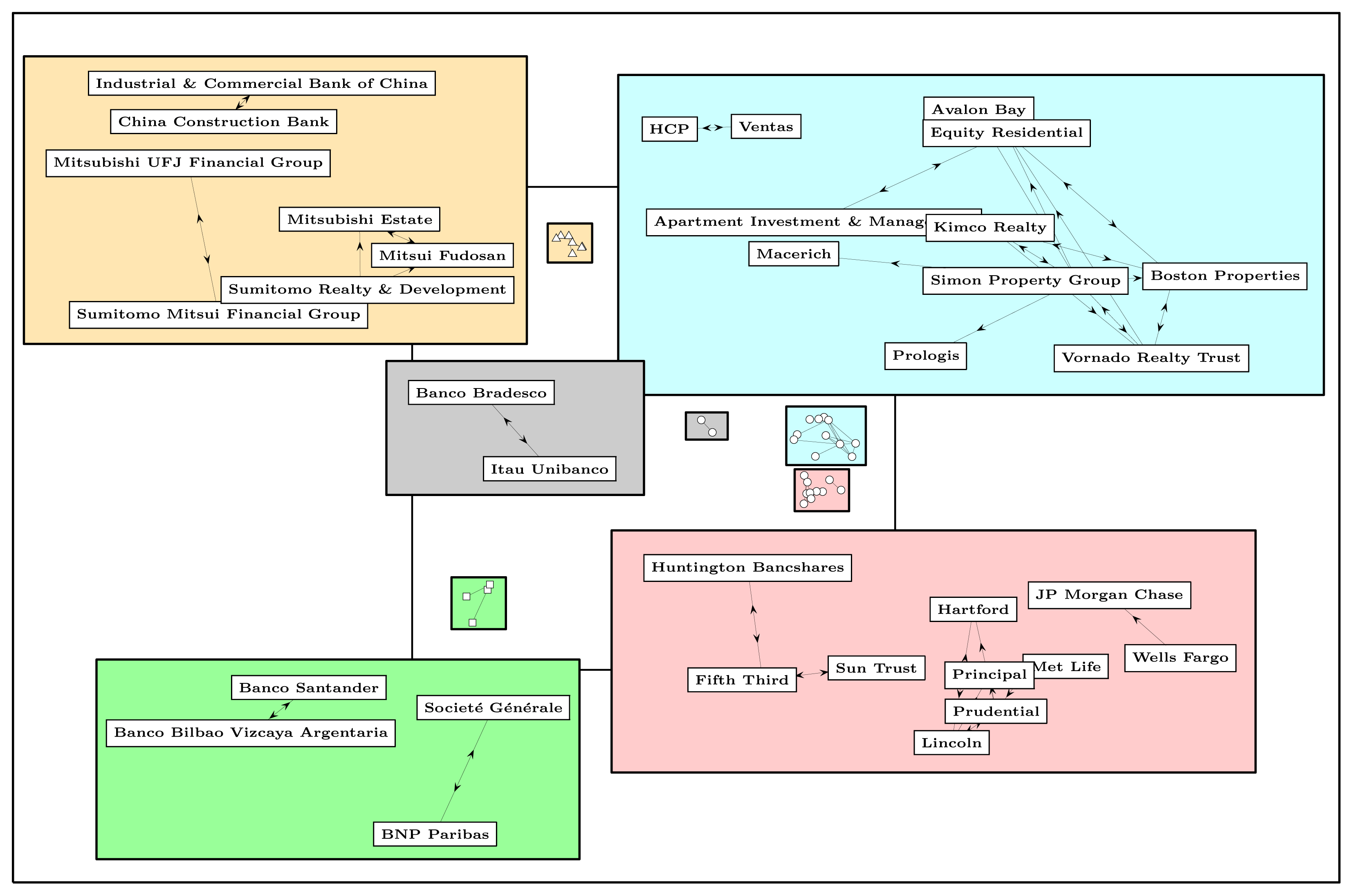

3.4. Aggregate Data

After [

66], we now aggregate data so as to compare first the ETEs among countries and then among continents. We do this by first calculating the correlation matrix of the stocks belonging to each country (we use Pearson’s correlation) and then by calculating its eigenvalues and eigenvectors. As an example, we take the time series of log-returns of the 79 stocks belonging to the USA and calculate their correlations, and the eigenvalues and eigenvectors of the resulting correlation matrix. The largest eigenvalue is usually much larger than the others (it amounts to around 61% of the sum of the eigenvalues for the US data), and its first eigenvector (when normalized so that the sum of its components equals to 1) provides the weights of a vector that, when multiplied by the log-returns, results in an index which is associate with a “market mode” for that particular market. For countries with just one stock represented in the data, the index was the same time series of the single stock. So, by using this procedure, we created one index for each country, based on the stocks of the financial sector, only. Each index has a time series that is then used to calculate an ETE matrix where each line and column corresponds to one country, according to

Table 1, in the same order as in this table.

The ETE matrix for this data is depicted in

Figure 11, together with the matrix corresponding to the ETEs from lagged to original variables. Again, we can notice a flow of information from Pacific Asia and Oceania to Europe and America on the same day (lower left quadrant), and higher values of ETE among European countries (top left quadrant and

Figure 9b). There are particularly high values of ETE from lagged France and lagged Switzerland to the Netherlands and, almost symmetrically, from the lagged Netherlands to France and Switzerland.

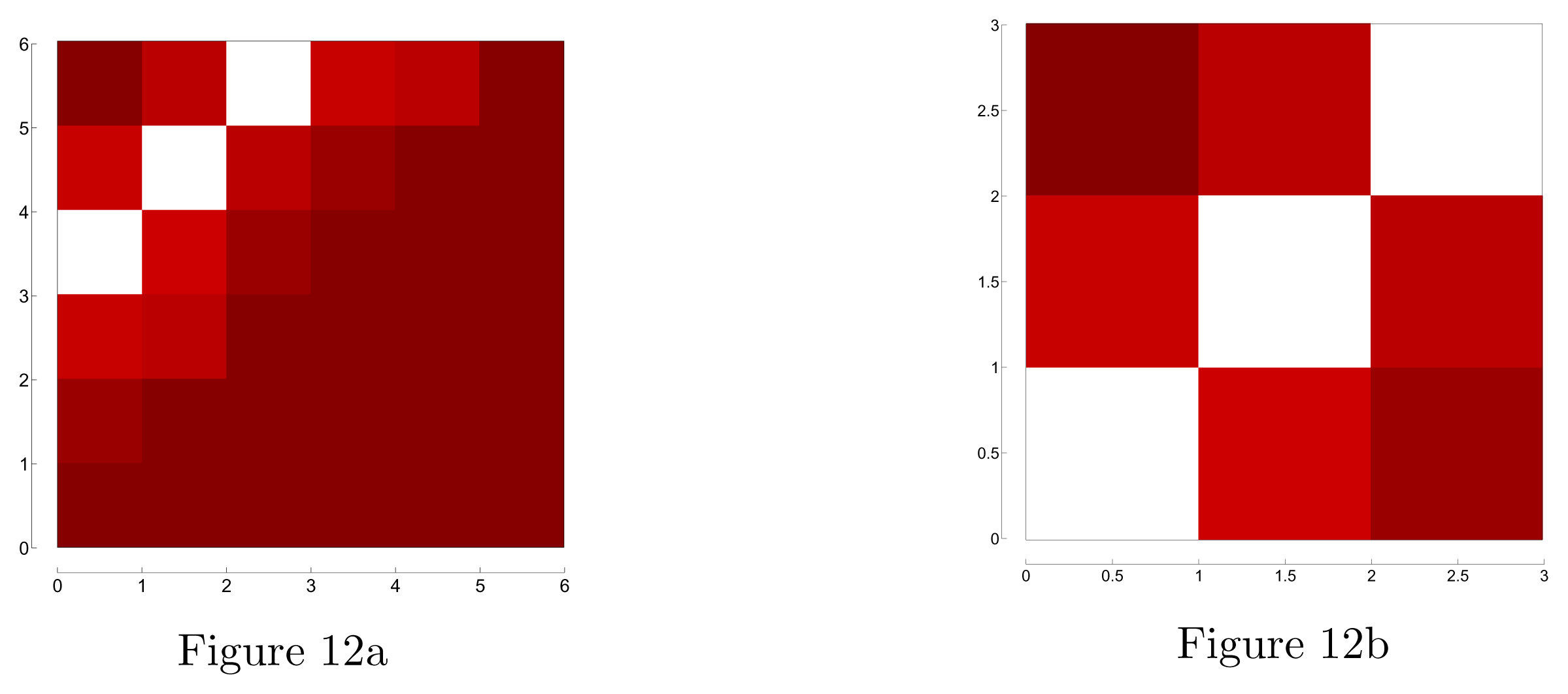

We may do the same for continents, aggregating data now by continent, with three continents, America, Europe, and Asia if we consider Oceania together with Asia. The resulting ETE matrix is plotted in

Figure 12. There is some transfer of entropy from Europe to America on the same day, and also from Asia and Oceania to America and Europe on the same day. We also have higher values of ETE from lagged America to Europe and Asia on the next day, from lagged Europe to America and Asia on the next day, and from lagged Asia to Europe on the next day. These results confirm the ones obtained in [

63] and [

66].

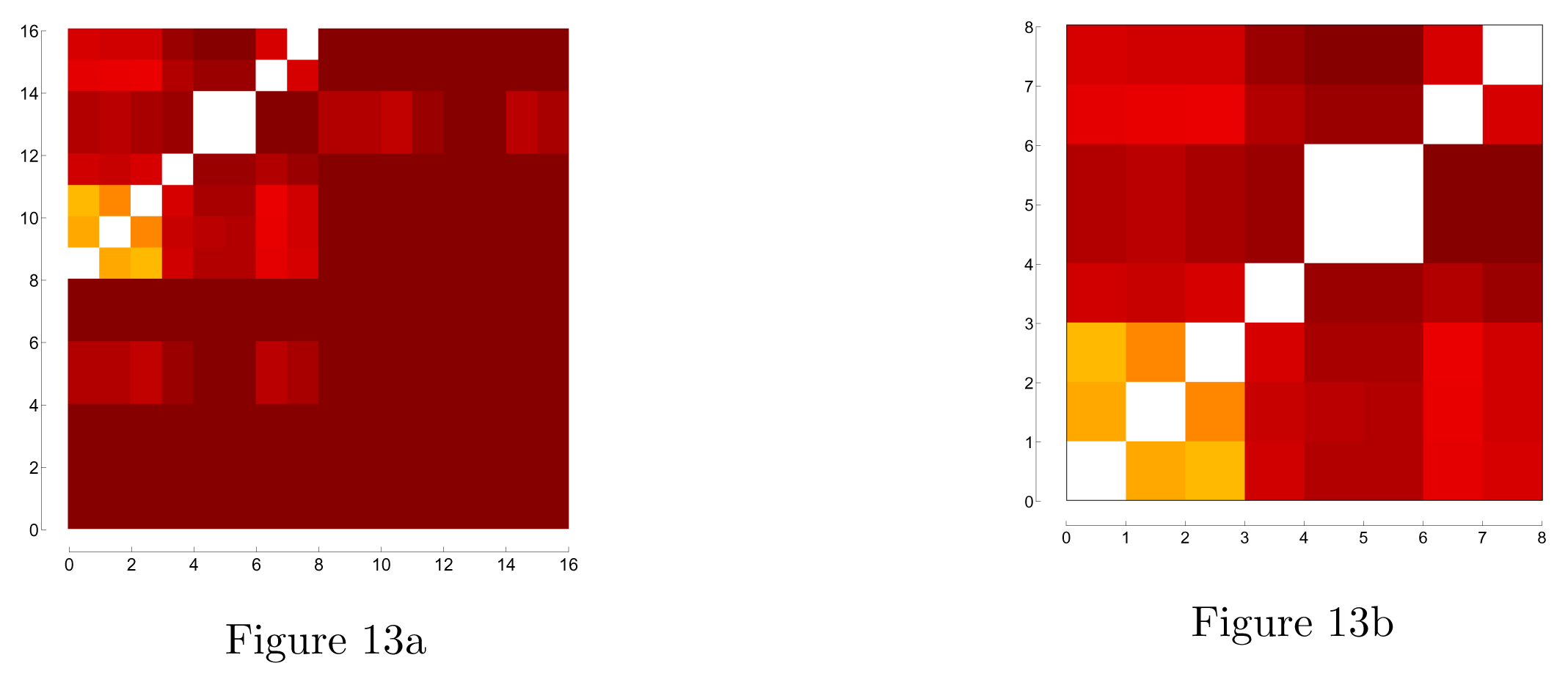

Also based on [

66], we now aggregate data by industry (according to Bloomberg), in the same way that it was done for countries and continents, in order to study more directly the flow of information between the industries of the financial sector. The industries are the same as the ones we used in order to classify stocks within a country, and are displayed in

Table 2.

Figure 13 (left) shows the ETE matrix from industry to industry, and also (right) the sector of ETEs from lagged to original variables. Looking at the lower left quadrant, one may see that there is some transfer of entropy from Private Equity Funds and Real State Investments to Insurance and REITS, and also to Banks, Diversified Financial Services, and to Savings and Loans, all in the same day of negotiation.

Now, looking at the top left quadrant and in

Figure 13b, we have the ETEs from lagged to original variables. There is clearly a cluster of Banks, Diversified Financial Services and Insurance Companies exchanging much information, also exchanging information in a lesser degree with Investment Companies, REITS, and Savings and Loans, which exchange some information with one another; finally, there is a very strong connection between Private Equity Funds and Real State Companies.

3.5. The Rényi Transfer Entropy

By adopting a different definition of entropy, we may define another measure of how entropy is transferred from a variable to another in such a way as to highlight the influence of extreme events in the time series of the variables concerned. Rényi entropy was first defined by the Hungarian mathematician Alfréd Rényi [

72] as

where the logarithm may be of any base, but we adopt base 2 so as to obtain measures in bits, and q is a positive parameter that may be varied in order to emphasize different regions of the probability distribution pi. For q < 1, small values of pi (the tails of the probability distribution) assume greater importance, and for q > 1, the larger values (more central) of the probability distribution assume greater importance. It may be shown that the Shannon entropy is the limiting case of the Rényi entropy when q → 1.

Jizba and Kleinert

et al. [

63] proposed a variant of Transfer Entropy based on the Rényi entropy, and applied it to financial data. This variant may be written like

where

φq is the escort distribution [

73] given by

Rényi Transfer Entropy may be negative, and it may be zero without implying that processes

X and

Y are independent, and it also depends on the parameter

q that enhances different regions of the probability distributions. Dimpfl and Peter [

68] applied Rényi’s Transfer Entropy to high frequency financial data and compared results using different values of the parameter

q. In the particular case of

k =

ℓ = 1, we obtain

which is the version we shall use here, since log-returns of financial data rarely depend on more than one day of data in the past, and because the calculations are also much simpler and faster using this simplification.

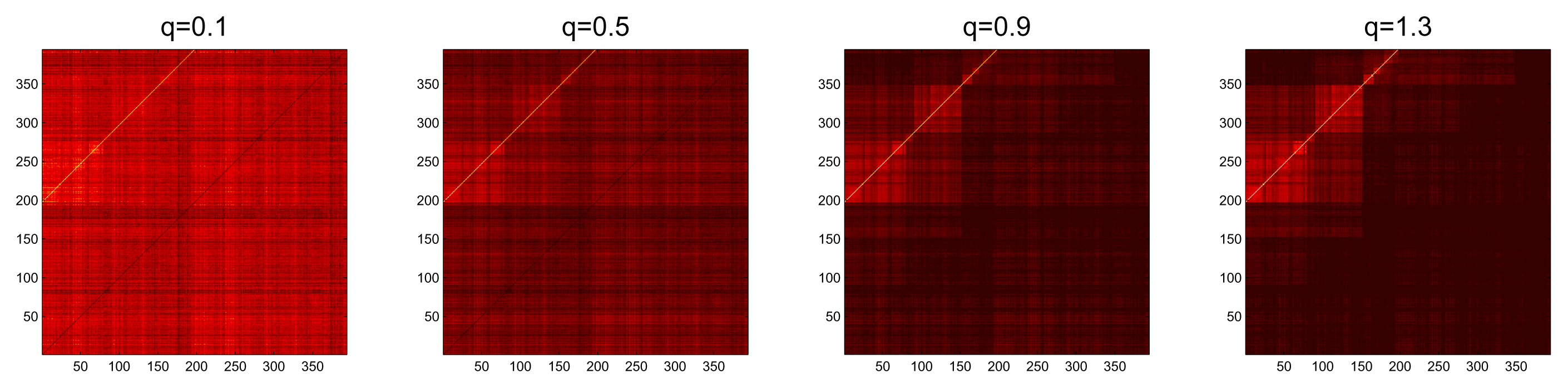

Figure 14 shows the Rényi Transfer Entropy calculated for

q = 0

.1,

q = 0

.5,

q = 0

.9, and

q = 1

.3. One may see that, although the local details are clearer for lower values of

q, which favor the low probabilities of the probability distributions used in the calculations, the overall detail is best for higher values of

q. One may also notice that, for

q = 0

.9, the results are very similar to the ones obtained with Transfer Entropy based on Shannon’s entropy.

4. Centralities

In all studies on the propagation of shocks in financial networks discussed in the introduction [

2–

38], the centrality of a node (generally a bank inmost studies) is one of the single most important factors in the capacity of that node in the propagation a crisis. In network theory, the centrality of a node is important in the study of which nodes are, by some standard, more influential than others. Such measures may be used, for instance, in the study of the propagation of epidemics, or the propagation of news, or, in the case of stocks, in the spreading of high volatility. There are various centrality measures [

70], tending to different aspects of what we may think of “central”. For undirected networks, for instance, we have Node Degree (

ND), which is the total number of edges between a node and all others to which it is connected. This measure is better adapted to asset graphs, where not all nodes are connected between them, and varies according to the choice of threshold [

71]. Another measure that can be used for asset graphs is Eigenvector Centrality (

EC), which takes into account not just how many connections a node has, but also if it is localized in a region of highly connected nodes. There is also a measure called Closeness Centrality (

CC) that measures the average distance (in terms of number of edges necessary to reach another node) of a certain node. This measure is larger for less central nodes, and if one wants a measure that, like the others, is larger for more central nodes, like the others we cited, then one may use Harmonic Closeness (

HC), that is built on the same principles as Closeness Centrality, but is calculated using the inverse of the distances from one node to all others. The Betweenness Centrality (

BC) of a node is another type of measure, that calculates how often a certain node is in the smaller paths between all other nodes. Still another measure of centrality, called Node Strength (

NS), works for fully connected networks, and so is independent of thresholds in asset graphs, and takes into account the strength of the connections, which, in our case, are the correlations between the nodes. It measures the sum of the correlations of a node with all the others.

These measures of centrality are appropriate for an undirected network, like one that could be obtained by using correlation, but the networks built using Effective Transfer Entropy are directed nodes, that have either ingoing edges to a node, outgoing edges from the node, or both. So, centrality measures often break down into ingoing and outgoing ones. As an example, a node may be highly central with respect to pointing at other nodes, like the Google search page; these are called hubs. Other nodes may have many other nodes pointing at it, as in the case of a highly cited article in a network of citations; these are called authorities. Each one is central in a different way, and a node may be central according to both criteria. Node degree, for example, may be broken in two measures: In Node Degree (NDin), which measures the sum of all ingoing edges to a certain node, and Out Node Degree (NDout), which measures the sum of all outgoing edges from a node. In a similar way, one defines In Eigenvector Centrality (ECin) and Out Eigenvector Centrality (ECout), and In Harmonic Closeness (HCin) and Out Harmonic Closeness (HCout). Betweenness Centrality is now calculated along directed paths only, and it is called Directed Betweenness Centrality, (BCdir).

As we said before, when applying centrality measures to asset graphs, those measures vary according to the chosen value for the threshold. As extreme examples, if the threshold is such that the network has very few nodes, Node Centrality, for example, will also be low. If the threshold value is such that every node is connected to every other node, then all Node Degrees will be the same: the number of all connections made between the nodes. It has been shown empirically [

71] that one gets the most information about a set of nodes if one considers asset graphs whose thresholds are close to the minimum or the maximum of the values obtained through simulations with randomized data. We may rephrase it by saying that we obtain more information of a network when we consider its limit to results obtained from noise. From the simulations we have made in order to calculate the Effective Transfer Entropy, we could check that the largest values of Transfer Entropy for randomized data are close to 0.05 for the choice of bins with size 0.1 (

Figure 1a). So, we shall consider here the centrality measures that were mentioned applied to the directed networks obtained from the Effective Transfer Entropy with threshold 0.05. The results are plotted in

Figure 15. As the values of different centralities may vary a lot (from 3 to 153 for

NDin and from 0 to 1317 for

BCdir), we normalize all centrality measures by setting their maxima to one. For all but Directed Betweenness Centrality, stocks belonging to the Americas and to Europe appear more central.

Table 3 presents the most central stocks according to each centrality measure. Only the first five stocks are shown (more, in case of draws). Lagged stocks appear with an * besides the names of the companies. Since we are considering only the strong values of Effective Transfer Entropy, and since asset graphs do not involve the nodes that are not connected, this excludes all connections, except the ones between lagged and original log-returns. So, all in degrees are of original stocks and all out degrees (including Directed Betweenness) are of lagged stocks. For out degrees, insurance companies occupy the top positions, together with some banks, all of them belonging to European or to U.S. companies. For in degrees, we see a predominance of banks, but insurance companies also occupy top positions. This means there is a tendency of entropy being transferred from insurance companies to banks. For Directed Betweeenness, the top positions are occupied by major European banks and also by other types of companies.

By inspection, we may see that the companies with the largest centralities are also the ones with the larger values in terms of market capitalization. This same result has been found in the empirical results relating to the networks found by using the borrowing and lending between banks [

24–

38]. These networks, with a structure in which some few nodes have large centralities and most nodes have low centralities, are the ones that, in theoretical simulations [

6–

23], show more stability than most random networks, but also lead to more propagation of shocks when the most central nodes are not strong enough to act as appropriate buffers for the shocks.

For thresholds 0.1 and 0.2, with results not displayed here, there is a preponderance of insurance companies and banks from the USA, and for thresholds 0.3 and 0.4, also not displayed here, there are mostly banks and REITS occupying the first positions, also due to the fact that they are some of the only nodes that are part of the asset graphs at these threshold values.

The centrality measures we have considered thus far in this section do not take into account the strength of the connections between the nodes. There are centrality measures that take that into account, being the main one called Node Strength (

NS), which, in undirected networks, is the sum of all connections made by a node. For directed networks, we have the In Node Strength (

NSin), which measures the sum of all ingoing connections to a node, and the Out Node Strength (

NSout), which measures the sum of all outgoing connections from a node. These are centrality measures that can be applied to the whole network, including all nodes.

Figure 16 shows the results for both centrality measures, and

Table 4 shows the top five stocks according to each node centrality. We used ETE in the calculations. Had we used TE instead, the results would be the same.

The five top stocks for In Node Strength are those of Insurance Companies, qualified as authorities, which are nodes to which many other nodes point, and with high values of ETE, what means that there is a large amount of information flowing into the log-returns of those stocks. For Out Node Strength, again insurance companies dominate, what means that they send much information into the prices of the other stocks (they are also hubs).

5. Dynamics

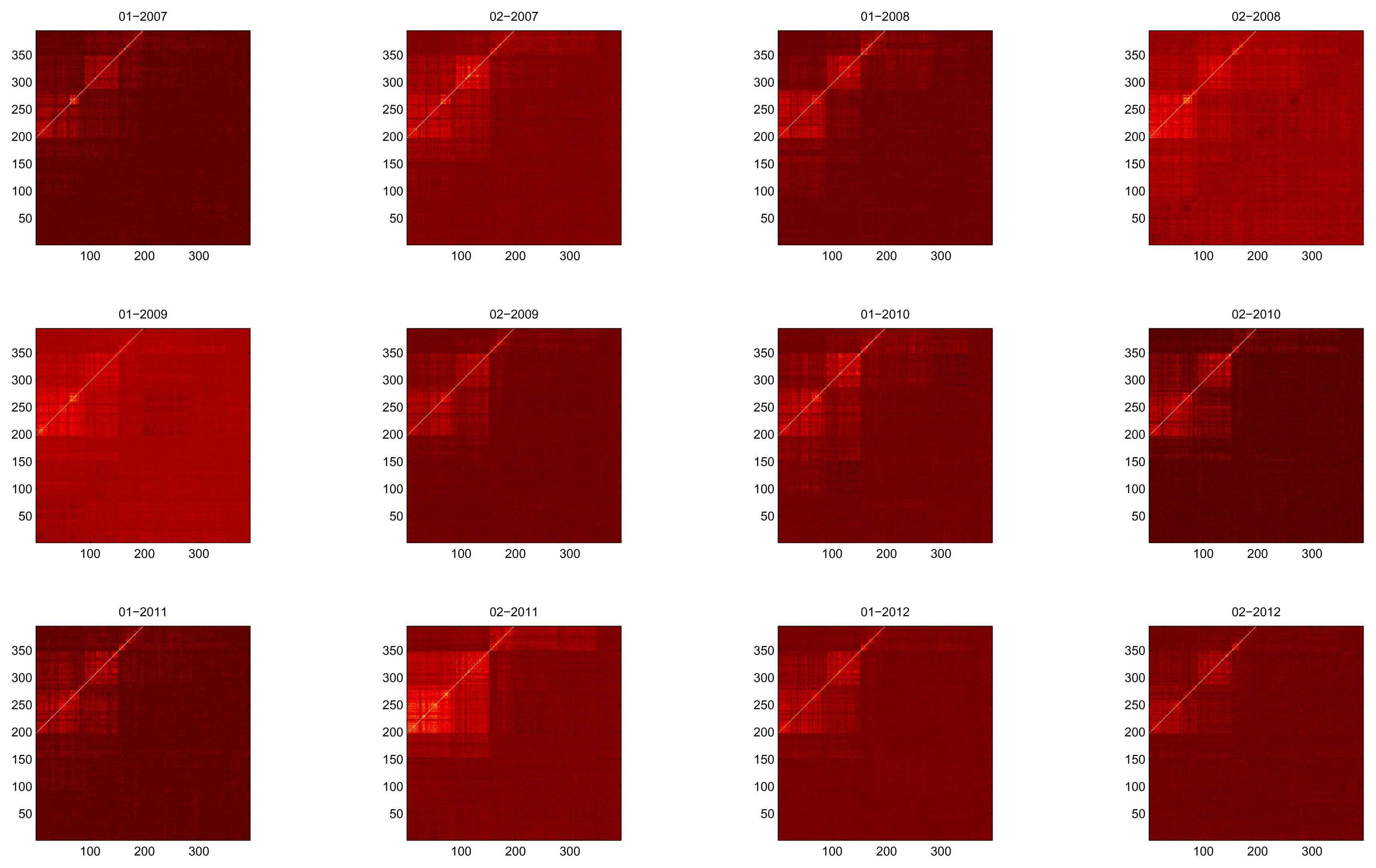

We now look at the network of stocks of financial companies evolving in time. In order to do so, we use moving windows, each comprising data of one semester of a year, moving one semester at a time. The number of days of a semester ranges from 124 to 128, so that there is some small sample effect on the results of ETE, but this choice makes it possible to analyze the evolution of the transfer of information between the stocks at a more localized level in time.

Figure 17 shows the ETEs calculated at each semester, and one can see that there are brighter colors, indicating higher levels of ETE, in times of crisis, like in the second semester of 2008 (Subprime Mortgage Crisis) and in the second semester of 2011 (European Sovereign Debt Crisis). Looking at the ETEs from original to original variables (bottom left sector of each ETE matrix), one can see that the largest ETEs on the same day are from Japanese stocks to American and European ones, as it was the case when we used the whole data, but now one may follow a growth in ETE from Japan to America and Europe on the second semester of 2007, on the first semester of 2010, on the second semester of 2011, and on the first semester of 2012.

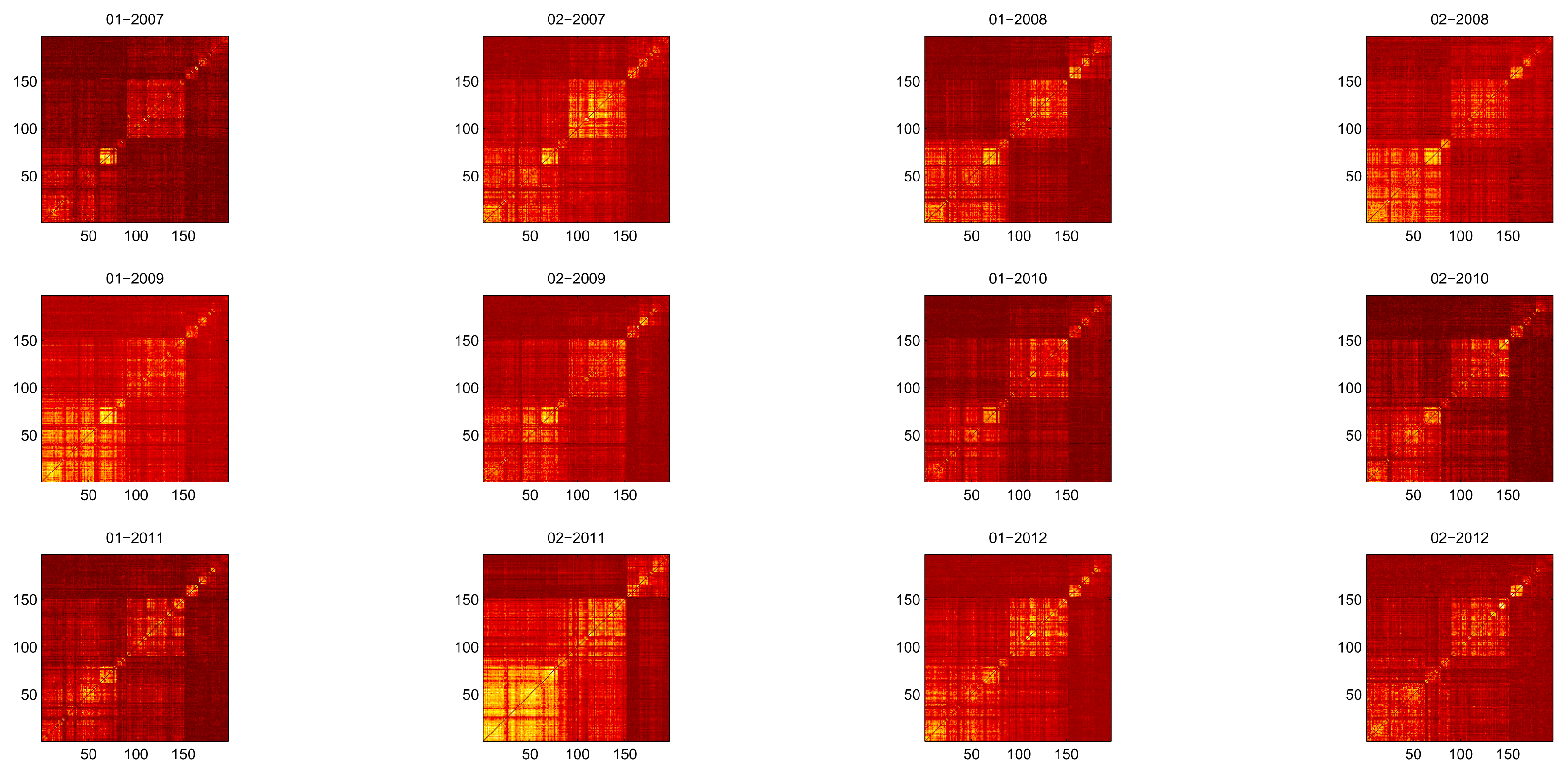

Figure 18 shows the ETEs only from lagged to original variables, corresponding to the top, left sector of each ETE matrix, with the self-interactions removed for better visualization. The exchange of information between the time series of the stocks is low for the first semester of 2007, except for most US REITS. It increases, mostly among US banks and stocks from Europe, in the second semester of the same year. Prior to the crisis of 2008, we have high ETEs among US stocks, among some European stocks, and also between some stocks from Japan and from Hong Kong. During the height of the Subprime crisis (second semester of 2008 and first semester of 2009), the high exchange of information (represented by high ETE) seems to be restricted mostly to US and Canadian stocks. One interesting result is that the ETE is higher for the second semester of 2011, the height of the European Sovereign Debt Crisis, than during the crisis of 2008. The ETE lowers soon afterwards to normal levels. Something else to be noticed is that the exchange of information among REITS decreases in time. Since REITS (Real Estate Investment Trusts) represent the interest of investors in the real state market, a decrease in ETE is associated with lower volatility in this particular market. On a more local level, one can also detect an increase in ETE among mainly Japanese stocks and also among stocks from Hong Kong after the second semester of 2011.

6. Relations with Economies in Crisis

Economic broadcasts of the past few years constantly warned of the dangers of a new global financial crisis that may be triggered by the failure of some European countries to pay their sovereign debts. It is not completely clear how far reaching a default by one of those countries could be, and which institutions are more vulnerable to that. Using networks based on financial loans and debts between banks, researchers can try to evaluate some of the consequences of defaults in banks, but, as said in the introduction, networks built on loans and debts do not account for a myriad of other economical facts that define the relationships between financial institutions. So, in order to attempt to study those relations, we shall build networks based on the ETEs between the 197 major financial institutions considered until now together with all financial institutions listed in Bloomberg of some of those countries in crisis, after a liquidity filter. The aim is to investigate which of the main financial institutions receive more entropy from the financial institutions of those countries, meaning that the prices of stocks from those target institutions are much influenced by the prices of institutions that might be in danger of collapse. Of course, we are not saying here that the institutions being considered that belong to one of the countries in crisis might default; we just analyze what could happen if the prices of their stocks would go substantially down.

The countries we shall consider here are Greece, Cyprus, Spain, Portugal, Italy, and Ireland, although Italy is not considered as a country in crisis, but is usually pointed at as being a fragile economy at the moment. We will do a separate analysis for each country, following the same procedures. First, we remove the stocks belonging to the country in crisis from the original network of financial institutions; then we add to this network all stocks that belong to the country in crisis and that are listed in Bloomberg. The number of stocks from each country is restrained by the data available and by the liquidity of those stocks. The second condition eliminates many of the time series available, particularly in less developed stock markets.

Greece is represented by 17 stocks, including the Bank of Greece, which is removed from the 197 original stocks of financial companies. For Cyprus, we obtain the time series of 20 stocks, after removing the less liquid ones. Spain is one of the main players in the international fears for the world economic market; we remove the stocks belonging to Spanish companies (four of them) from the bulk of main stocks and then add 26 stocks of financial companies from that country, including the ones that had been previously removed. Portugal is also an important country in the monitoring for an economic crisis since its institutions have deep connections with Spanish companies. In order to study the influence of its stocks on other stocks of main financial companies, we first remove the one stock belonging to Portugal in that group, that of the Banco Espírito Santo. Then we add to the data the log-returns of five major Portuguese banks, including the one that had been removed from the main block. The country in this group with the largest number of companies that take part of the original data set, 6 of them, is Italy, for which we start by removing those stocks from the main block, including the 6 original ones. Then we add 61 stocks belonging to the financial sector which are negotiated in Italy and which survive the liquidity filter. For Ireland, we have four stocks that survive the liquidity filter.

Table 5 shows the first five stocks that receive the most ETE from the stocks of each country in crisis. Almost all stocks that receive the most ETE are banks, with the exception of the ING Groep, which is a Dutch corporation that specializes in general banking services and in insurance, and so is not just an insurance company, but also a bank. The stocks that are most affected by Greek stocks are well spread among European banks, with the most affected one being the ING Groepe from the Netherlands. The stock most affected by Cypriot stocks is the one of the National Bank of Greece, what is expected due to the economic and financial relations between Cyprus and Greece. The remaining influence is evenly divided by some other European stocks. The ETE transmitted from Spain to the five most influenced stocks is larger than the ETE transmitted by Greece and Cyprus, and the influence is evenly divided among the European stocks. Portuguese stocks transmit more entropy to two of the largest Spanish banks, and also to some other European stocks. The influence of Italian stocks is much larger than the influence of other stocks belonging to the group of countries in crisis, and it spreads rather evenly among some European stocks. The influence from Irish stocks is low, and evenly distributed among European stocks, including two from the UK.

One must keep in mind that what we are measuring is the sum of ETEs to a particular company, and so the number of companies that send the ETEs is important, but since the number of relevant financial companies a country has is an important factor of its influence, we here consider the sum of ETEs as a determinant of the influence of one country on another.

It is interesting to see that there are some stocks that are consistently more influenced by the stocks of countries in crisis. The Deutsche Bank appears in five lists, and the ING Groep and the KBC Groep appear in four lists. Most of the stocks listed are also some of the more central ones according to different centrality criteria.

Table 6 shows the first five stocks that send the most ETE from the stocks of each country in crisis (four, in the case of Ireland). The most influential stocks are mainly those of banks, but we also have highly influent stocks belonging to insurance companies and to investment companies. The influence of Greece is distributed among some banks, and the influence of Cyprus is also mainly distributed among banks. The Spanish influence also comes from commercial banks, and is concentrated on the top three ones. The same applies to Portugal, with the main ETE being transmitted from a stock that belongs to a Spanish bank but that is also negotiated in Portugal. The most influential stocks from Italy are those of companies that are originally from other European countries, but whose stocks are also negotiated in Italy. The influence of Ireland is mainly distributed among two banks and one insurance company.

So we may conclude that the most influenced stocks by stocks of the countries in crisis according to ETE are those of European companies, and mainly some stocks belonging to some particular banks. The stocks that influence the most, also according to the ETE criterium, are those of banks belonging to the countries in crisis, in particular if the banks are native to other countries, but their stocks are negotiated in the country in crisis.

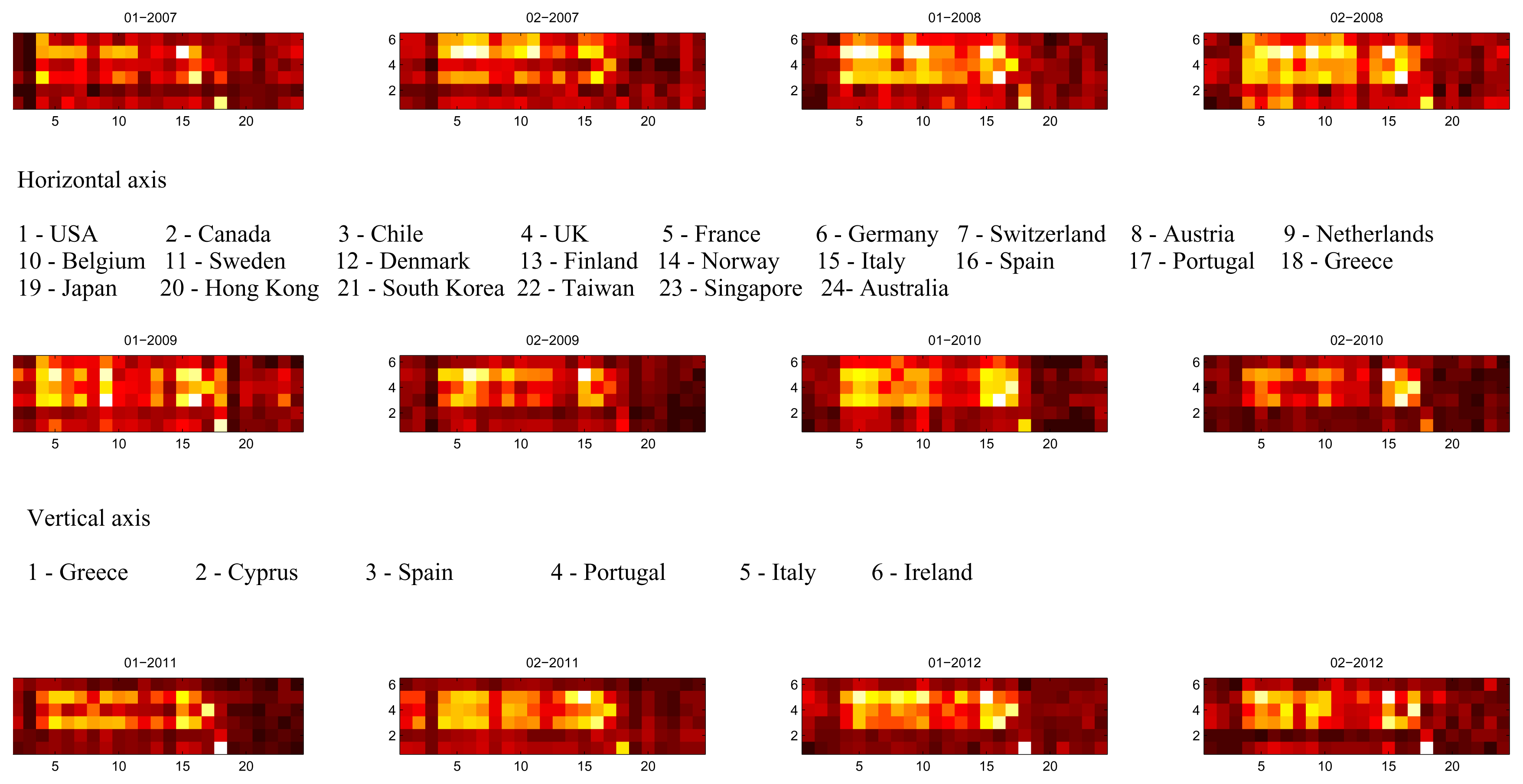

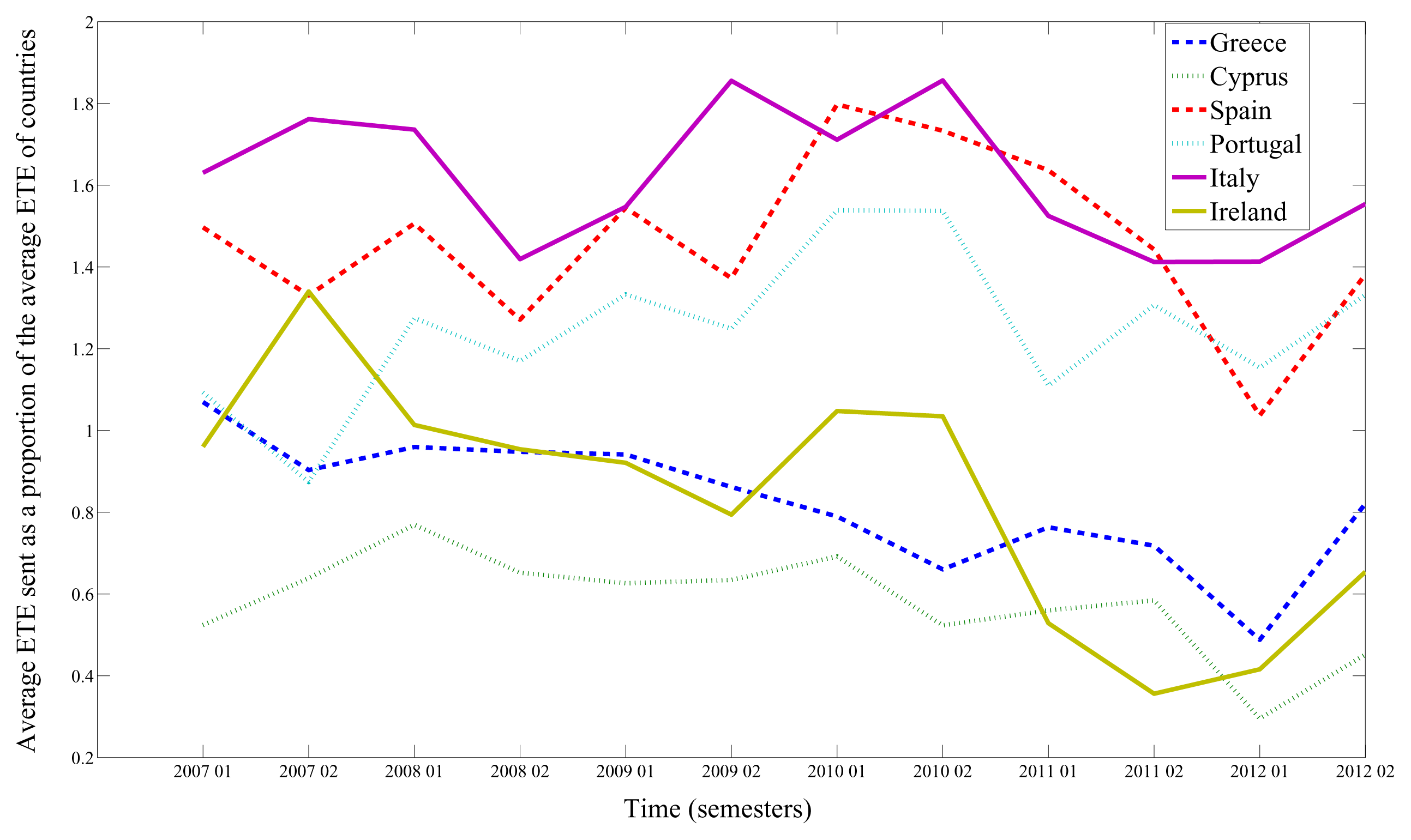

In order to study the dynamics of the influences of the countries in crisis with the countries in the original sample, once more we aggregate data using the eigenvector corresponding to the largest eigenvalue of the correlation matrix of the stocks belonging to each country, as described in Section 3. By doing this, we calculate an ETE matrix such that the first 24 variables are the original countries in the sample, in the same order as in Section 3, and the remaining 6 variables are the aggregate time series for stocks belonging to Greece, Cyprus, Spain, Portugal, Italy, and Ireland, in this same order. This is done for each semester, from 20007 to 2012, and in

Figure 19 we print only the ETEs from the lagged variables corresponding to the countries in crisis (vertical axis) to the original variables corresponding to the affected countries (horizontal axis).

Analyzing the graphs, we may see that, as expected, there is a rise of ETE during the crisis of 2008 and the crisis of 2010. Looking at each country that is sending information, and ignoring the information going from one country to itself, we see that Greece and Cyprus do not send much information to other countries, and that the largest sources of information are Italy, Spain, and Portugal, in this same order. On the first semester of 2010, we see a lot of ETE between Italy, Spain and Portugal. By the first semester of 2011, the transfer of volatility was mainly due to two countries: Spain and Italy. The transfer of volatility rose again on the second semester of 2011, going down ever since, probably due to the efficacy of the austerity measures adopted by some of the countries in crisis and the policy of the European Union, which chose to sustain the strength of the Euro and the unity of the Eurozone.

We may also see that the transfer of entropy is mainly to European countries, as expected. So, according to ETE, the influence of these countries in crisis is mainly on Europe. Any crisis triggered by them would first hit other countries in Europe, most of them with more solid economies, and, only then, could affect other continents.

In

Figure 20, we plot the average ETE that was sent, in each semester from 2007 to 2012, from the six countries in crisis to the 24 original countries in our data set, as a percentage of the average ETE sent from each of these original countries to themselves. So, whenever the percentage is above one, that means that the average information sent from the stocks of these countries was above the average information exchanged between the target countries. From the figure, we see that the average ETE sent from Italy and from Spain is always above the average, and that the average ETE sent from Portugal has also been above the average most of the time. Greece, Cyprus and Ireland have had ETEs sent below the average almost all of the time, and the average ETE sent from those countries has been going down in time, when compared with the average ETE between the target countries. This is evidence that, according to ETE, the stocks of Greece, Cyprus and Ireland have little effect on other stocks of the world, and this is not a result that depends on the number of stock considered for each country, since the result is from aggregate data. So, Italy, Spain and Portugal, in this order, seem to be the most influent countries in crisis.

7. Conclusions

We have seen in this work how the stocks of the top 197 financial companies, in market volume, relate to one another, using the Effective Transfer Entropy between them. We saw that they are related first by country where the stocks are negotiated, and then by industry and sub industry. The network structure for Transfer Entropy is very different from one obtained by correlation, being the network obtained using Transfer Entropy a directed one, with causal influences between the stocks. The use of original and lagged log-returns also revealed some relationships between stocks, with the stocks of a previous day influencing the stocks of the following day. A study of the centralities of the stocks revealed that the most central ones are those of insurance companies of Europe and of the USA, or of banks of the USA and Europe. Since insurance and reinsurance companies are major CDS (Credit Default Securities) sellers, and banks are both major CDS buyers and sellers, some of this centrality of insurance companies, followed by banks, might be explained by the selling and buying of CDS.

A further study of the influence relations between stocks of companies belonging to countries in crisis, namely Greece, Cyprus, Spain, Portugal, Italy, and Ireland, reveal which are the most affected financial companies belonging to the group of largest financial stocks. This calls attention to liabilities of those companies to possible defaults or fall of stocks prices of companies belonging to those countries in crisis.

This work plants the seeds for the study of contagion among financial institutions, but now based on a real network, showing which companies are most central for the propagation of crises and which ones are more dependent on failing economies. This may be used to develop policies for avoiding the spread of financial crises.